2020-05-28 1260

One of the stable sources of replenishment of the country’s budget is the personal income tax, which is paid by residents and non-residents. Essentially, this fee applies to the entire working population of the state, except for certain persons whose income is exempt from personal income tax in 2020.

In this article we will consider the following questions regarding this tax:

- how to determine the rate for calculating personal income tax;

- when is a child deduction provided?

- what are the deadlines for paying personal income tax;

- the amount of the fine for non-payment of personal income tax.

Innovation No. 1. Income tax on holiday pay

In 2020, the accountant is required to accrue personal income tax on vacation pay simultaneously with the payment of this form of income. The calculated amount must be transferred no later than the last day of the month when the employee took rest days.

Example

Ivanov A.A works at Romashka LLC. He took a vacation on July 18, and on July 15, his vacation pay was transferred to him. Payment of income tax to the treasury will be made on July 30.

The new procedure allows you to accumulate personal income tax over the course of a month and then transfer it in a single payment for all employees going on vacation. This greatly simplifies the work of an accountant.

Transferring taxes on the last day of the month is not an obligation, but a right of the organization. If the company has a small staff and it is more convenient for the accountant to pay personal income tax and vacation pay at the same time, he can continue this practice.

6-NDFL filling out lines

Innovation No. 2. New deadlines for filing income tax reports

Important changes in personal income tax from 2020 are related to the timing of reporting to the Federal Tax Service. The deadline is determined by whether the tax for an individual is fully withheld or not. In the first case, the value “1” is entered in the “Sign” field of the 2-NDFL certificate, in the second - “2”.

Novice accounting professionals often ask how code “2” can appear. Let's look at examples of this situation:

- An employee of the company works in its foreign representative office and spends more than 183 days a year outside the Russian Federation. Initially, his income is taxed at a rate of 13%, but by the end of the year it becomes clear that based on the sum of days of business travel, the specialist must be classified as “non-resident”, which implies the use of a rate of 30%. The law prohibits an accountant from withholding more than half of an employee's income, and therefore part of the income tax may remain unpaid during the year.

- The organization gives a gift, the price tag of which exceeds 4,000 rubles, to a citizen who is not registered in its state. Income tax cannot be withheld; status “2” appears in the certificate.

What is new in fiscal legislation is the deadline for submitting the 2-NDFL certificate. There are two possible options. If the status is “1”, the deadline is 04/03/2017. If the status is “2”, the deadline is 03/01/2017.

6 Personal income tax and civil law agreement

Starting from 2020, personal income tax reporting is submitted in the same order as in 2016. Companies with up to 25 employees can submit it to the Federal Tax Service on paper, others – exclusively electronically.

Fines for failure to present a document remain the same – 200 rubles. for one employee. For an error in each document, the company will have to pay 500 rubles.

2-NDFL for 2020

The 2-NDFL report for 2020 must be submitted using a new form. Accordingly, the procedure for filling it out has also changed.

Certificate in form 2-NDFL approved by Art. 216, paragraph 5 of Art. 226, paragraph 2 of Art. 230 of the Tax Code of the Russian Federation and is intended for reporting to the tax authorities. The certificate contains information about income paid to an individual and the amount of personal income tax calculated, paid and transferred to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation). The 2-NDFL certificate is submitted to the tax authorities by the employer, tax agent based on the results of the past year.

Example 2-NDFL for 2020

There are two deadlines for submitting a certificate to the Federal Tax Service:

1. No later than 03/01/2018, it is necessary to submit 2-NDFL certificates for individuals from whom it is not possible to withhold tax (clause 5 of Article 226 of the Tax Code of the Russian Federation). The certificate must indicate attribute “2”.

2. No later than 04/02/2018, certificates of all income paid by the tax agent to individuals for 2017 are submitted to the Federal Tax Service. The certificate is marked with “1” regardless of whether the tax is withheld or not.

2-NDFL certificates can be submitted to the tax authority according to the TKS or on paper, if the number of individuals who received income is no more than 25 people (clause 2 of Article 230 of the Tax Code of the Russian Federation). The inspection no longer accepts floppy disks and other media.

IMPORTANT IN WORK:

The fields “Residence address in the Russian Federation”, “Country of residence code” and “Address” are excluded from Section 2 “Data about the individual - recipient of income” of the updated certificate.

Main changes in personal income tax

2017 turned out to be rich in changes in tax legislation. The changes also affected personal income tax. Let's look at the main ones:

1. The number of tax agents has expanded. The list was supplemented by organizations that transfer salaries, remuneration, and allowances to military personnel and civilians;

2. The list of payments for which personal income tax does not need to be charged since 2017 includes the cost of employee certification according to professional standards, points and bonuses credited to a bank card under loyalty programs (Clause 8 of Article 2 of the Federal Law “On Amendments to Article 105.15 Part. first and part two of the Tax Code of the Russian Federation and the recognition as invalid of certain provisions of legislative acts of the Russian Federation" dated July 3, 2016 No. 242-FZ), as well as funds that banks return under the cashback program, the norm is enshrined in clause 68 of Art. . 217 of the Tax Code of the Russian Federation and is valid from 01/01/2017.

3. Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated November 22, 2016 approved new codes for bonuses: code 2002 - bonuses for production results and other indicators provided for by labor or collective agreements, which are paid not at the expense of the organization’s net profit , and not at the expense of special purpose funds or earmarked revenues; code 2003 - remuneration from the organization’s net profit, special-purpose funds or targeted income.

4. Letter of the Ministry of Finance dated March 20, 2017 No. 03-04-06/15803 allows you to add standard and increased child deductions for a disabled child when calculating personal income tax.

5. An employee can receive a deduction for the costs of voluntary life insurance from the employer, even if he pays for the insurance himself.

6. From 01/01/2018 (clause 2 of article 2 of the Federal Law of April 3, 2017 No. 58-FZ “On Amendments to Chapter 23 of Part Two of the Tax Code of the Russian Federation”) a personal income tax rate of 35% was approved for interest income on deposits in banks located in Russia and income in the form of interest on circulating bonds of Russian organizations denominated in rubles, the tax base for which is determined according to Art. 214.2 Tax Code of the Russian Federation.

POSITION OF THE FTS:

If an individual’s personal data has changed after the tax agent has submitted a certificate in Form 2-NDFL to the tax authority, the updated certificate will not be submitted.

Letter of the Federal Tax Service of Russia dated December 29, 2017 No. GD-4-11/ [email protected]

What difficulties does this form cause for accountants?

When filling out the 2-NDFL certificate, many questions arise, but it is necessary to understand them, since errors can lead to a fine from the tax authorities.

It is necessary to correctly indicate the “attribute” of the certificate; this is necessary to determine the type of certificate. The field is set to “1” if the 2-NDFL certificate contains information about income and the amount of tax transferred. Put “2” if income is received, but tax is not withheld from it. The certificate always contains a “1” if it is issued for an employee who has received income and tax has been transferred from it.

The introduction of changes by order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/ [email protected] “On amendments to the appendices to the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected] ” simplified filling out the form certificates, since information about the address and place of residence was excluded.

If difficulties arose when indicating income and deduction codes, these data are indicated in the order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11 / [email protected]

Difficulties may arise with filling out the new Appendix No. 2 “Codes of forms of reorganization and liquidation of an organization (separate division).” To fill out this section of the 2-NDFL certificate, the following codes are installed:

- “0” – liquidation;

- “1” – transformation;

- “2” – merger;

- “3” – separation;

- “5” – accession;

- “6” – separation with simultaneous joining.

According to the new rules, approved by order No. ММВ-7-11/ [email protected] , the assignee indicates the OKTMO code at the location of the reorganized structure or its separate division. In the “Tax Agent” line, the legal successor indicates the name of the reorganized company or its separate division.

GOOD TO KNOW:

The list of types of deductions has been supplemented with a code to reflect the deduction in the amount of the positive financial result obtained from transactions accounted for on an individual investment account.

Checking the compliance of forms 2-NDFL and 6-NDFL

Tax authorities check control ratios for forms 6-NDFL and 2-NDFL (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ) only in relation to annual forms and certificates with attribute “1”.

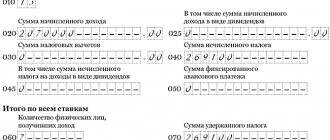

First of all, you need to check line 020 of Section 1 of form 6-NDFL for each rate should be equal to the sum of the lines “Total amount of income” of section 5 of certificate 2-NDFL at the same rate. If these data do not match, it means that one of the reports contains incorrect information. In this case, the inspectors will send the organization a request to provide explanations and make corrections to the reporting. If a tax violation is established, inspectors will draw up an inspection report.

You should carefully consider the data in line 025 of Section 1 of Form 6-NDFL “Income in the form of dividends.” This indicator must be equal to the total amount of such income for all certificates 2-NDFL income code 1010 in Section 3. If these indicators do not correspond, the controllers will also require an explanation.

You should check the calculated tax amounts especially carefully. The indicators in lines 040 of Section 1 of form 6-NDFL for each tax rate must be compared with the lines “Calculated tax amount” of Section 5 of form 2-NDFL. These indicators in the reports must match.

Tax inspectors will definitely check the amounts of tax not withheld by the tax agent. To ensure that inspectors do not have questions, line 080 of Section 1 of form 6-NDFL must be checked with the total amount of the lines “Amount of tax not withheld by the tax agent” of Section 5 of certificate 2-NDFL. These indicators must be equal.

It is necessary to check the indicators of forms 6-NDFL and 2-NDFL according to the number of indicated individuals who received income. The indicator in line 060 of Section 1 of form 6-NDFL must match the number of submitted 2-NDFL certificates submitted to the tax authority.

POSITION OF THE FTS:

The legislation of the Russian Federation does not contain a norm obliging tax authorities to issue taxpayers with certificates of income of individuals and amounts of personal income tax paid. At the same time, an individual has the right to apply in writing to the tax authority at the place of registration of the tax agent (former employer) in order to obtain information about the amount of income received by him and personal income tax withheld from them based on the information available to the tax authority and provided by the tax agent.

Letter of the Federal Tax Service of Russia dated 03/05/2015 No. BS-3-11/ [email protected]

Innovation No. 3. Introduction of new codes for the 2-NDFL certificate

In the coming year, two codes will appear designed to reflect certain types of employee income. This means changes to 2-NDFL from 2020. The new designations are:

- 2002 – bonuses that are related to the employee’s performance and become part of the specialist’s salary.

- 2003 – bonuses paid from the organization’s net profit.

Previously, for the two types of payments given, the code “2000” was used - remuneration received for the performance of official duties.

An issue that will undergo significant adjustments from January 1 is personal income tax deductions in 2020. What changes is the legislator preparing?

Changes affect standard deductions. New codes have been introduced for them:

- 127 – for the first child to parents (adoptive parents);

- 127 – for the second parents (adoptive parents);

- 128 – for the third and other parents (adoptive parents);

- 129 – for a child with a disability of group I or II to parents (adoptive parents).

Additionally, codes 130-133 are used. They are used to reflect tax benefits provided to guardians and adoptive parents. The principle of using values is similar to the one above.

Changes to 2-NDFL 2020 did not affect the rules for providing deductions. As before, before the child reaches adulthood, they are provided in all cases, after - depending on the fact of continuing education. If the child continues his studies at a university, his parents will enjoy the benefit until he turns 24.

The salary “ceiling” for receiving a standard deduction in 2020 is 350,000 rubles. If the parent's income exceeds this amount, he loses the right to the benefit. It disappears when the child dies, turns 18, and graduates from college. In all of the above situations, the deduction ends on January 1 of the following year.

Personal income tax deductions

The latest changes to personal income tax in 2020 were related to the provision of deductions. They are issued in relation to employees of individual entrepreneurs and organizations through managers. An employee can apply for the required monetary compensation if he has dependent minor children and is studying for a child under 24 years of age. The following categories of citizens can count on a standard deduction for withholding tax:

- Parents. This group includes adopted and former (divorced) spouses paying child support.

- Adoptive parents, guardians and trustees.

- Spouses of parents, including adoptive ones. Spouses of trustees and guardians are not deducted.

According to the current Tax Code of the Russian Federation, “children’s” tax deductions can be issued for:

- first and second child (1,400 rubles);

- third and subsequent children (3,000 rubles);

- disabled children (6,000 rubles in favor of guardians, adoptive parents and their spouses, trustees);

- minor children with disabilities (12,000 rubles - in favor of parents and their spouses, including adoptive parents).

When determining the number of children an employee has, adult, adopted and non-adopted children are taken into account. Single parents, guardians, trustees, adoptive parents, as well as persons who have received a written refusal from the second spouse to use the standard deduction at their place of work can count on double deduction amounts. The legislator allows summing up the amount of deductions for unpaid time periods (vacation at your own expense, maternity leave).

Employees undergoing training and advanced training receive social deductions when paying for their studies with personal funds. The maximum amount of returned funds is 12,0000 rubles during one billing period.

Innovation No. 4. Changing the deadlines for transferring income tax

New information regarding personal income tax in 2020 is related to the timing of tax payment to the state treasury. The main rule is this: personal income tax is transferred no later than the next day after the final payment for the month is paid (the second half of the salary). The first half (advance) should not be subject to income tax.

How to reflect an advance in 6 personal income taxes

Important: if a company withdraws money to pay salaries from a current account, then personal income tax must be paid no earlier than the day when employees actually receive the funds. Salaries deposited but withheld are not subject to tax.

Example

Employees of Romashka LLC received an advance payment for November on November 20. Income tax for this part of the salary was not transferred to the budget. On December 1, the organization’s accountant calculated the amount of the final payment for the month - 500,000 rubles. and the amount of personal income tax – 65,000 rubles. On December 5, she deposited the amount in the current account, on December 6, she withdrew and gave it to the staff, and on December 7, she transferred income tax to the treasury.

If an employee receives income in kind, personal income tax must be paid to the budget no later than the next day after the transfer of material value.

Example

Romashka LLC settled accounts with its employee N.N. Petrov. for services rendered, giving him a laptop worth 60,000 rubles. The employee received the item on September 1, after which the accountant calculated the amount of income tax (60,000 * 0.13 = 7800 rubles) and transferred it to the budget on September 2.

Changes in the personal income tax rate

Changes in personal income tax from 2020 have also occurred in relation to the tax rate. Government bodies set out to redistribute the tax burden of citizens. Adjustments are planned according to a progressive scale of tax rates, according to which:

- Individuals with earnings of up to 180,000 rubles per year are exempt from paying personal income tax.

- Citizens with an annual income of up to 2.4 million rubles pay taxes at a rate of 13%.

- Individuals with revenues of up to 100 million rubles per year pay tax at a rate of 30%.

- Citizens with an annual income of 100 million rubles or more pay tax at a rate of 70%.

- Income received from bank deposits is taxed at a rate of 35%.

Innovation No. 5. Employees have the right to apply for social deductions to the employer

This is an important answer to the question, income tax in 2020: what changes await employees directly. Previously, citizens who paid the cost of education or treatment this year (for themselves or for their immediate relatives) could receive a social deduction for income tax. To do this, they had to wait until the end of the reporting period (year) and submit documents to the Federal Tax Service. After a set time, the fiscal service transferred the money to the citizen’s specified details.

Negative amounts in 6 personal income taxes

In 2020, citizens have the right to apply for a deduction directly to their employer, and they do not need to wait until the start of the new calendar year. They must submit to the accounting department a notice issued by the tax authority. It indicates the amount of social deductions for each type of service (treatment, personal education, education of children, etc.) and the name of the company for which the form was issued. Additionally, a written statement from the employee is required.

Having received the notification, the accountant must reduce taxable income from the current month by the amount of the deduction (down to 0). The balance of the deduction is carried over to the next month, and so on until the debt is completely paid off.

Important: the notification from the Federal Tax Service is valid only until the end of the calendar year. On January 1, to reduce the tax base for personal income tax, a new basis document will be required.

Innovation No. 6. Changes in certificate 2-NDFL 2020

A new field has appeared in the tax document - “Adjustment number”. If the document is submitted to the Federal Tax Service for the first time, you need to enter the value “00” there. For subsequent versions that correct errors of previous ones, you need to indicate “01”, “02” and further down the list.

When specifying the employee’s address, you must use new subject codes from the Federal Tax Service list. Please note: Sevastopol and Crimea have their own codes.

Changes in certificate 2-NDFL 2020 are associated with a new list of codes for types of income and deductions. When filling out the document, use the current values.

In the new sample tax document, special lines have appeared in which you need to enter the notification number from the Federal Tax Service. It is affixed in three cases: if an employee receives a property or social deduction, if a foreigner works in the company on the basis of a patent.

Innovation No. 7. The emergence of a new reporting form - annual 6-NDFL

This is an important answer to the question, personal income tax reporting in 2020: what changes have occurred. In 2020, companies submitted annual form 6-NDFL to the fiscal authorities for the first time. The deadline for submitting the form is 04/03/17 (April 1 is a non-working day, so the deadline is postponed to April 3).

All organizations and individual entrepreneurs that paid wages (or other forms of income) to individuals at least once during 2016 must submit the form. Even if the transfer was made once in January, after which there was no activity, an annual report is prepared.

The procedure for compiling the annual 6-personal income tax is similar to the formation of the quarterly one. The form states:

- all types of employee income;

- the deductions they receive;

- the amount of personal income tax accrued and paid to the budget throughout the state.

Tax officials will verify data from reporting forms submitted at the end of the year. Therefore, check whether the 2-NDFL report in 2017 is correct (changes must be taken into account) and whether its data matches the information in 6-NDFL.

If a company has not paid wages to anyone during the calendar year, it is not considered a tax agent and is not required to file 6-NDFL. This conclusion is contained in the explanations of the Federal Tax Service. In her opinion, there is no need to inform regulatory authorities about the reasons for failure to submit the document.

6 Personal income tax zero: to hand over or not?

Experts still advise you to play it safe and write to “your” Federal Tax Service a letter in any form (indicating the name of the organization, Taxpayer Identification Number, legal address), which will state the reason for failure to submit the form - the lack of payments to individuals in the reporting period. This will help avoid unnecessary questions and proceedings.

An accountant who wants to organize his work correctly and in accordance with the law must know everything about personal income tax in 2017: what changes (rate, deadlines, reporting) have occurred, how to take them into account in current activities. Keep your finger on the pulse of innovations, and you can avoid problems and disputes with regulatory authorities.

Similar articles

- How to reflect carryover vacation pay in 6 personal income taxes

- Personal income tax changes in 2020

- KBK for personal income tax for employees

- Deadline for submitting 2-NDFL (with sign 2) for 2020

- Reporting period for personal income tax - dates from 2020

Personal income tax reporting in 2020: what changes

It is necessary to generate and submit personal income tax reports next year according to the old rules. The composition of the reports depends on the status of the business. Legal entities are required to submit Form 2-NDFL certificates and Form 6-NDFL reports. Entrepreneurs on the OSNO (general taxation system) report income by submitting 3-NDFL and 4-NDFL.

How long is a 2-NDFL certificate valid?

Important reporting points:

- 2-NDFL - compiled annually based on information about the amounts of remuneration paid in terms of taxable income, as well as the amounts of due deductions and withheld/paid tax.

- 6-NDFL – compiled quarterly based on the total amounts of accrued/paid income by the employer. The obligation to submit this form also applies to individual entrepreneurs with hired employees. The deadline for submission is the last day of the month following the reporting period.

- 3-NDFL – compiled based on the results of the reporting year in terms of the amounts of income received. The deadline for submission is April 30. the year following the accounting year.

- 4-NDFL - compiled on the first income in terms of the expected amounts of revenue of individual entrepreneurs and private practitioners. The annual delivery was canceled by the Ministry of Finance in Letter No. 03-04-07-01/47 dated April 1. 2008

Note! Declaration 3-NDFL is also submitted when registering social and property deductions or when receiving income of a various nature not related to the main business activity.