The program “Respect: Accounting of waybills and fuels and lubricants” is supplied integrated into the following standard configurations of the 1C company:

- 1C: Enterprise Accounting,

- 1C: Trade Management,

- 1C: Integrated automation,

- 1C:UPP.

Integration allows you to generate movements in accounting registers without transferring data. Based on the waybills, a fuel write-off document is generated. Programs and hardware must meet system requirements.

System requirements

To work with the program, computers and software must meet the requirements of the 1C:Enterprise 8 platform.

The license for the program “Respect: Accounting of waybills and fuels and lubricants” provides for the user to have the main delivery of PROF version 1C: Enterprise 8 (Accounting, Trade Management, SCP or Integrated Automation).

To work in multi-user mode, you will need additional client licenses for the 1C:Enterprise 8 platform. Additional licenses for workstations for the configuration “Respect: Accounting of waybills and fuels and lubricants” are not required.

This is an additional printing form with which you can:

- Fill in the information for the truck waybill

- Print a truck waybill

- Calculate distance to specified addresses

- Take into account the fuel of the vehicle - balances at the beginning and end of the trip, refueling, consumption

- Use 1C:Accounting data to fill in information about the driver

- Register the fixed asset in 1C:Accounting and fill out data about the car in the waybill

- Fill truck parking lots

- Take into account the operation of truck trailers

- Enter data about the distance and duration of the truck operation

- Waybill data is saved in “1C: Accounting 3.0”

If you have a passenger vehicle, then you need to fill out a passenger car waybill

You may also be interested in printing a consignment note in 1C: Accounting 3.0

Installation and update procedure

The configuration for “Accounting for waybills and fuels and lubricants” is built into the working database by combining it by subsystem in the 1C:Enterprise 8 configurator. The configuration can also be installed autonomously if the working configuration cannot be changed or data synchronization is not required. In this case, based on the results of the working period, it is enough to transmit summary data on fuel consumption.

Update

The RespectSoft company releases regular program updates, which also contain new versions of standard configurations. This way our users can only be updated with our releases.

In this case, it is possible to update only the standard 1C configuration. Upon request, we can send detailed instructions on how to update and install the configuration.

Accounting for waybills in 1C 8.3 Accounting

On January 28, Druzhnikov Georgy Petrovich provided a check to the cash register for refueling official vehicles with Gasoline AI-95 fuel in the amount of 35 liters in the amount of 2,100 rubles. On the same day, he reported on the waybill and fuel consumption.

On January 30, a waybill was issued for the driver Druzhnikov G.P. and fuel consumption was recorded.

Step 1. Decide on the fuel and lubricants receipt document using the diagram

In the example, the receipt of fuel and lubricants is carried out through an accountable person - for this case, use the document Waybill in the Purchases .

Step 2: Prepare supporting references

To correctly use the Waybill , check the data in the Vehicles .

In the Fuel , select the name of fuel and lubricants from the Nomenclature directory to record its receipt and consumption.

In the Consumption rate , fill in how much fuel the car consumes in winter or summer, depending on when it is used most often or the current time of year.

Also check that the driver has entered current driver’s license information in the Individuals .

Without this data, the waybill will not be processed.

Step 3. Fill out the header of the document Waybill

Indicate the fueled vehicle and driver in the Employee from the Individuals directory.

The consumption rate will be filled in automatically from the vehicle card; change it if necessary. For example, in the summer, fuel consumption according to the standard will be less.

If you select a positive response to the change in the standard and record the document, the Consumption Rate will change in the Vehicles and will be used in the following documents.

the cost account and its analytics using the link of the same name. By default, the Main Cost Account and the default item for waybills are filled in. Change them manually if necessary.

Step 4. Enter data on the purchased fuel and lubricants

On the Fuel , register the data of the driver’s report on refueling the car, selecting exactly how the fuel was purchased: using a fuel card or other funds (cash, bank card). If the documents are issued in the name of the Organization, this tab is not filled in.

Information about the purchased fuel and its balance in the tank will be displayed at the bottom of the document.

Based on these data, click the Print – Advance report (AO-1) to print the accountant’s report, the number of which you need to correct manually. When generating an expense report in this way, there is no continuous numbering. In addition, you will have to control the numbering of the Advance Report documents and, if necessary, correct the serial number in it manually.

For a fuel card, a report in Form AO-1 is not generated from the document.

Step 5. Enter data to calculate fuel consumption

On the Route , register all trips on the vehicle. Fill in either Odometer readings or Distance in km (the blank indicator will be calculated automatically).

Field data Consumption, l is calculated using the formula:

If the actual fuel consumption differs from the calculated one, correct it manually.

After entering the information, fuel consumption will also be automatically calculated and the remaining fuel in the tank will be recorded.

Step 6. Generate transactions for receipt and write-off of fuel and lubricants

Write-off of fuel and lubricants in the waybill is carried out only in quantitative terms. The amount will be calculated at the end of the month.

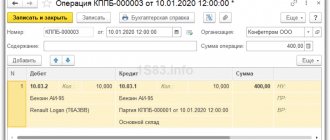

Step 7. Reflect the data of the next trip and generate transactions

If there is fuel in the tank (account balance 10.03.2), regardless of how the receipt is processed, the balance will be reflected at the bottom of the document. Enter route information for the current day.

Create the wiring.

Step 8. Calculation of fuel and lubricant costs in total terms

If waybills were reflected during the month, at the end of the month the credit amount for account 10.03.2 will be determined. The cost of written-off fuel and lubricants according to waybills is always calculated using the average, even if the accounting policy settings provide for the Method of estimating inventories - By FIFO .

Go to the routine operation Adjustment of item cost and check the calculation of the amount.

Cost of 1 unit. = 2,100 / 35 = 60.

The cost of 27.267 liters of decommissioned AI-95 gasoline = 60 * 27.267 = 1,636.02.

Changes in the chart of accounts

The program has made changes to the chart of accounts:

- We added a subaccount 10.03.1 “Fuel in warehouse” - with its help you can keep track of fuel and lubricants without waybills, as before.

- We added a subaccount 10.03.2 “Fuel in the car tank” - with its help you can keep track of fuel and lubricants using waybills for each vehicle.

- Added account 76.15 “Purchase using fuel cards”. Needed to account for the amount of fuel without the amount:

How to make it easier to fill out travel forms

A waybill is an accounting document that is needed by all organizations and individual entrepreneurs if they use official transport. For an organization, a waybill confirms the right to drive, for example, a car; if the owner of the vehicle is a private individual, then the waybill will help calculate costs. The correct filling of waybills is monitored by the Federal Tax Service, the State Traffic Inspectorate, and the labor inspectorate.

Requirements for a waybill in 2020

The waybill is a strictly accountable document, which means it must contain mandatory details (and not only motor transport companies are required to comply with the registration requirements).

In 2020, changes occurred: the details of the waybill required information about the driver passing a medical examination, as well as a note about pre-trip control of the technical condition of the car. But the mandatory round seal on the form has been abolished - it only needs to be placed on those companies that use it in accordance with their Charter.

At the same time, the organization is still not obliged to use a unified waybill form; you can develop your own - most importantly, with all the necessary details:

- name and number of the document itself;

- details of the car owner (OGRIP and OGRN);

- date of issue;

- validity;

- information about the driver of the vehicle;

- data about the vehicle itself;

- information about the owner of the vehicle;

- data on passing technical inspection before the flight.

The use of such a form must be indicated in the accounting policy (according to clause 4 of PBU 1/2008).

Procedure for using the waybill:

- The document is created, printed and certified by the signature of the dispatcher who issued it, as well as the head of the organization.

- The waybill is handed to the driver.

- After the trip, the waybill is returned to the authorized person against signature, and after signing it is considered closed and goes to the accounting department.

But how to fill it out correctly - especially from time to time when a lot of waybills are required?

There are two main options:

- Use Excel.

- Install a special program for filling out waybills.

Maintaining waybills in Excel

Pros:

- Most likely, the program is already on your computer.

Minuses:

- You need to fill out 1-5 tables every day.

- Store each of the created files.

- Based on the numbers in Excel, calculate fuel consumption and enter it into an accounting program (for example, 1C: Accounting 8).

- Change the printed form of the file every time there are changes in legislation.

Special programs for creating and maintaining waybills

These programs allow you to use ready-made forms of waybills, which will themselves be updated depending on legal requirements. In addition, the solutions are integrated with the accounting program; there is no need to manually transfer data.

- “Respect: accounting of waybills and fuels and lubricants”

- "Pobedasoft"

- "1C:Vehicle Management 8" Standard

- "1C:Vehicle Management 8" PROF

Integrates with 1C:Enterprise 8

Price: from 8200 rub.

Integrates with 1C:Accounting 8, also allows standalone use

Price: 14,000 rub.

Boxed solution: RUB 28,500.

Renting the program in the cloud: from 1,290 rubles/month.

Boxed solution: RUB 59,700

Renting the program in the cloud: from 1,620 rubles/month.

For those who work in the field of agriculture: “1C: Accounting for an Agricultural Enterprise 8” already has a built-in function for working with waybills.

Boxed solution: RUB 36,000,

Renting the program in the cloud - 1,440 rubles/month.

These programs differ in functionality, complexity of setup and support conditions. Want to know more? Leave a request and our specialist will advise you free of charge.

Submit your application

Accounting for fuel and lubricants in “1C: Public Institution Accounting 8”

At the moment, we have tested and implemented the following 1C configurations for the possibility of using processing for filling out waybills

- 1C:Accounting 3.0

- 1C: Trade Management

- 1C: Managing a small company

- 1C:Accounting 2.0

- 1C:Construction Contractor

- 1C: Accounting for an agricultural enterprise

If your configuration is not in the list, then tell us the version of your configuration and we will make sure that you can use filling out and saving waybills in your 1C configuration