Type of operation “Receipts (acts, invoices)”

Type of operation “Recognition of leasing payments in NU”

When performing the regulatory operation “Recognition of leasing payments in the tax accounting system” (as part of the month-end closing), the difference between the leasing payments reflected in the document “Receipts (acts, invoices)” and the accrued depreciation in tax accounting is determined. If the monthly lease payment exceeds the amount of accrued depreciation, the difference is reflected in tax accounting expenses. If the accrued depreciation exceeds the amount of the lease payment, then the depreciation amount is reversed by this difference.

Accounting for waybills

Input of remaining fuel and lubricants

Before the functionality for accounting for waybills appeared, fuel was accounted for in account 10.03.1 in the warehouse. It turns out that there may be balances on this account. To account for waybills, you need to transfer balances using the “Operation” document. Let's create a new document and enter the postings Dt 10.03.02 and Kt 10.03.01:

That is, we transfer the remains of fuel and lubricants from the warehouse to the tanks of cars.

Purchase and write-off of fuel and lubricants

Let's look at what transactions will be generated when purchasing and writing off fuel and lubricants when accounting for waybills.

You can pay for fuel in cash, by bank card or by fuel card. The payment method determines what documents and postings will be created.

Payment in cash or by bank card

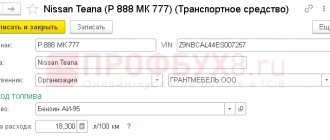

When paying in cash or by bank card, a “Waybill” document is created. Let’s create a new document in the “Purchases” section.

We indicate the organization, document date, vehicle, employee (accountable person), and check the expense account. When choosing a car, the consumption rate is automatically entered:

On the “Fuel” tab enter:

- The document and its number - this could be a cash receipt or a fuel card. In this case, “Cashier's Receipt”.

- Date.

- Quantity and cost of fuels and lubricants.

On the “Route” tab enter:

- Point and time of departure and destination.

- Odometer readings at the beginning and end of the journey.

- Distance and consumption will be automatically calculated.

At the bottom of the document, the initial fuel balance is displayed, how much was filled, how much was spent on the trip, and the final balance in the tank is also calculated.

After saving the document, you can print it:

- Waybill.

- Waybill according to form No. 3.

- Advance report.

Let's go through the document and look at the postings:

- According to Dt 10.03.2, the operation of filling fuel and lubricants into the tank (quantity and amount) is reflected.

- According to Kt 10.03.2, the write-off operation for fuel and lubricants is reflected. Please note that only quantity is written off. The write-off is carried out to the cost account specified in the document.

- The posting according to Kt 10.03.2 to write off the amount of fuel consumed will be made when closing the month using the “Adjustment of item cost” operation:

The amount is calculated based on the average cost per month.

Chart of Accounts

Account 01.03 “Leased property”

Account 01.03 “Leased property” is intended to summarize information on the availability and movement of the organization’s fixed assets that are leased until their disposal.

Account 02.03 “Depreciation of leased property”

Account 02.03 “Depreciation of leased property” is intended to summarize information on depreciation of leased property.

Account 76.07 “Rent payments”

Account 76.07 “Settlements for rent” reflects settlements under lease agreements in the currency of the Russian Federation.

Account 76.07.1 “Rental obligations”

Account 76.07.1 “Rental obligations” is intended to summarize information on long-term financial obligations under lease agreements in the currency of the Russian Federation.

Account 76.07.2 “Debt on leasing payments”

Account 76.07.2 “Debt on leasing payments” is intended to summarize information on current payments under leasing agreements in the currency of the Russian Federation.

Account 76.27 “Rent payments (in foreign currency)”

Account 76.27 “Settlements for lease (in foreign currency)” reflects settlements under lease agreements in foreign currencies.

Account 76.27.1 “Rental obligations (in foreign currency)”

Account 76.27.1 “Lease obligations (in foreign currency)” is intended to summarize information on long-term financial obligations under lease agreements in foreign currencies.

Account 76.27.2 “Debt on leasing payments (in foreign currency)”

Account 76.27.2 “Debt on leasing payments (in foreign currency)” is intended to summarize information on current payments under leasing agreements in foreign currencies.

Account 76.37 “Rent payments (in cu)”

Account 76.37 “Settlements for rent (in cu)” reflects settlements under lease agreements that are actually carried out in rubles, but are accounted for in conventional units.

Account 76.37.1 “Rental obligations (in cu)”

Account 76.37.1 “Rental obligations (in cu)” is intended to summarize information on long-term financial obligations under lease agreements, payments for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are formed simultaneously in conventional units and in rubles. Any currency from the “Currencies” directory can be used as a conventional unit.

Account 76.37.2 “Debt on leasing payments (in cu)”

Account 76.37.2 “Debt on leasing payments (in cu)” is intended to summarize information on current payments under leasing agreements, payments for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are formed simultaneously in conventional units and in rubles. Any currency from the “Currencies” directory can be used as a conventional unit.

Account 76.07.9 “VAT on rental obligations”

Subaccount 76.07.9 “VAT on lease obligations” takes into account the amount of value added tax payable by the organization related to the acquisition of fixed assets under lease agreements in the currency of the Russian Federation.

Account 76.37.9 “VAT on rental obligations (in cu)”

Account 76.37.9 “VAT on lease obligations (in cu)” takes into account the amounts of value added tax due to payment by the organization related to the acquisition of fixed assets under lease agreements, payments for which are actually carried out in rubles, but are taken into account in conventional units. Account balances and turnover are formed simultaneously in conventional units and in rubles. Any currency from the “Currencies” directory can be used as a conventional unit.

Contents of form 1-DA (services)

The 1-DA service questionnaire consists of a title page and 7 sections.

The title page already contains information about the form:

- deadlines;

- who rents;

- information about the Order according to which the form is unified;

- type of reporting (statistical quarterly);

- OKUD 0609708.

Other information on the title page is filled out by the head of the organization:

- name of the enterprise;

- mailing address;

- OKPO company;

- average number of employees.

Section 1 contains information about various types of activities with the corresponding OKVED 2, and the third column of the section indicates the serial number in the table.

Section 2 reflects information about changes in the coefficient in the organization’s work:

- level of demand for services;

- number of transactions concluded during the reporting period;

- the total amount of income from transactions;

- service prices;

- investments;

- various expenses;

- total income;

- personal competitiveness;

- average number of employees in the company.

Section 3 implies a personal opinion guide for assessing work performance for the past, current and future periods: good, normal, bad.

In the fourth column of Section 3, it is proposed to evaluate the trend of changes compared to the last and present quarters, using the assessments: it has become better, has not changed, has become worse.

Section 4 suggests assessing the level of work of competitors. To do this, the table is divided into 3 columns and 6 rows. In the last (third) column, the organization indicates an evaluative opinion about the level of competitiveness.

The Federal Statistics Service is considering options for reducing the indicator:

- inappropriate advertising;

- unfair competition;

- anti-competitive actions of state authorities and local self-government.

The state of the competitive environment and the availability of services from natural monopolies are also assessed.

Section 5 offers various options for obstacles to the advancement of a company, from which the company chooses the most suitable one.

Sections 6 and 7 define narrowly focused employment - tourism and real estate. Therefore, these sections are completed by the relevant organizations.

The questionnaire ends with recommendations for filling out.

Directory "Organizations"

Explanations for the directory details

When creating a new directory element, the basic details of the organization can be filled in by TIN or name by specifying it in the “Automatic completion of details by TIN” field. The details will be filled in in accordance with the information contained in the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. It is recommended to fill in the details that are not filled in automatically manually. To correctly fill in the details, you can use the button prompt with a question mark. The hint contains a brief description of the props, as well as a detailed illustrated one via the “More details” hyperlink.

Name of individual entrepreneur

The full and abbreviated name of an individual entrepreneur, as well as the option for its reflection in the program, can be found via a hyperlink in the “Name” field of the “Organizations” directory element.

Main bank account

The full and abbreviated name of an individual entrepreneur, as well as the option for its reflection in the program, can be found via a hyperlink in the “Name” field of the “Organizations” directory element.

Cash accounting

Budget classification codes

The list of BCCs is brought into compliance with Order of the Ministry of Finance of the Russian Federation dated March 12, 2015 No. 36n “On amendments to the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.”

Document journal "Bank statements"

In the “Bank Statements” journal, using the “Download” button, you can select a file with data from the bank and load it into the program. In this case, documents are created and posted automatically. Uploaded documents and their results are displayed in the journal.

Document "Payment order"

The document “Payment order” is reflected in the list of payment orders, the transaction log, as well as in the lists of documents for the counterparty and the agreement. You can go to the list of documents for a counterparty or for an agreement from the form of the corresponding directory using the “Documents” hyperlink.

When transferring wages to an employee, in the “Recipient” field of the payment order, you may need to indicate the bank, and not the full name. employee (for example, when transferring funds to the employee’s personal account of a salary project). In this case, you should use the “Recipient” toggle switch. If the “Recipient” toggle switch is set to the “Employee” position, then the employee’s bank account is selected in the “Recipient Account” field.

If the “Recipient” toggle switch is set to the “Bank” position, then an additional field “Recipient Bank” appears. In this case, in the “Recipient Account” field, select the bank account intended for further transfer of funds to employee accounts. Information about the employee’s personal account or his card number is entered in the “Payment purpose” field. The information entered in the “Payment Purpose” is saved and subsequently automatically filled in when processing payment orders for this employee.

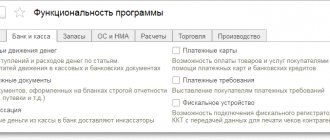

Key features of the 1C:Accounting 8.3 system

There are many different opportunities for comfortable work as an accountant. The 1C program has everything you need to automate routine tasks when maintaining tax and accounting records and minimize errors.

Today, the most current version of the program is “1C: Accounting 8.3”. It has combined all the best from previous editions and expanded with new features taking into account the wishes of users. In our article we will look at the key features of this configuration.

Features of the program "1C: Enterprise Accounting 8.3":

All accounting areas.

"1C: Accounting 8.3" automates all types of accounting: VAT, inventories, warehouse and trade accounting, production accounting, transactions with counterparties, income tax accounting, fixed assets and intangible assets, indirect expenses, banking and cash transactions, wages fees and personnel records. Also in the system you can keep records of activities subject to UTII, records of income and expenses of individual entrepreneurs - personal income tax payers, records under the simplified taxation system, and others.

At the same time, the program can be customized to suit the specifics of the business and the accounting principles adopted by the company. Accounting "1C" is also convenient for maintaining records for several organizations

. All data is collected in one database. In a matter of seconds you can obtain information on any institution (Fig. 3).

Fig.3. Analysis of the state of tax accounting for VAT in “1C: Accounting 8.3”

Accounting for banking and cash transactions.

The program conveniently records the movement of cash and non-cash funds. The system supports the functions of entering and printing payment orders (Fig. 4), incoming and outgoing cash orders. The functionality of settlements with suppliers, clients, as well as depositing cash into the current account is automated.

Fig.4. Printing payment orders in “1C: Accounting 8.3”

Automation of complex operations and calculations.

To reduce the percentage of errors in 1C: Accounting 8.3, most of the data is filled in automatically. For example, books of purchases and sales when accounting for VAT, as well as tax returns. To control the quality of complex calculations, a VAT accounting assistant and other useful functions have been developed.

Final operations of the month.

Accounting "1C" 8.3 automates operations that should be performed at the end of the month: currency revaluation, write-off of deferred expenses, determination of financial results, etc. The functionality of the system includes a set of reports for operations to close the month (Fig. 5)

Fig.5. Final operations of the month in the 1C: Accounting 8 program

Accounting for settlements with counterparties. In the “1C: Accounting 8.3” configuration, you can keep records of settlements with suppliers and customers in rubles, conventional units or foreign currency (Fig. 6). The program will automatically calculate the amount taking into account the current exchange rate. Mutual settlements with counterparties can be carried out both under the agreement as a whole and for each document.

Fig.6. Settlements with counterparties in the 1C accounting program

Individual settings.

"1C: Accounting 8.3" has a modern interface, simple and clear menu. The program saves the user's individual settings. You can customize the appearance of any list, the format and position of the columns, their size and other parameters. All this makes working in the program convenient and efficient.

Reports to the manager.

Reports for the manager (section “Manager”) in the program allow you to conduct financial analysis, identify debtors, analyze sales dynamics, determine the most profitable products or areas of activity, etc. (Fig. 7)

Fig.7. Reports to the manager in 1C 8.3 accounting

Payroll and personnel records.

The system is convenient for maintaining personnel records, calculating employee salaries, taxes and contributions, generating reports, including preparing reports for the PFR personalized accounting system. The program includes a “Payroll Assistant”, it shows the sequence of actions that must be performed in this section: from hiring an employee to accounting for wages (Fig. 8)

Fig.8. Section “Salaries and Personnel” in Accounting “1C” 8.3

Remote access.

Thanks to the functionality of the web client, you can work in the program from any convenient place, being in the office, at home or on a business trip. You can also access it via a cloud service. To operate, you only need the Internet; you do not need to install the system on your computer. This function allows you to connect several remote divisions of the company to the information base, as well as make the work of accountants more comfortable.

Accounting for trade operations.

The program automates the accounting of transactions of receipt and sale of goods and services, as well as returns to suppliers and returns from customers. When selling goods, invoices are issued for payment, invoices and invoices are drawn up (Fig. 9.10).

Fig.9. Accounting for trading operations in the 1C program 8.3

Fig. 10. Creating an invoice for a buyer in 1C accounting 8.3

Inventory control.

“1C: Accounting 8.3” includes operations for the movement of goods through the company’s warehouses, their inventory, acceptance and write-off. For warehouses, you can maintain quantitative or quantitative-total accounting. The program can record inventory data, which is automatically verified with accounting data. Based on these data, it is possible to identify surpluses and write off shortages (Fig. 11)

Fig. 11. Warehouse accounting in the program "1C: Accounting 8.3"

Integration with 1C.

You can buy “1C: Accounting 8.3” and easily integrate it with the programs of the “1C” line. For example, “1C: Trade Management”, “1C: Salaries and Personnel Management” and other solutions.

Constant development.

continuously improves the system to offer users an increasingly modern and functional solution. In version 1C: Accounting 8.3, server load distribution indicators have been improved, fault tolerance has been increased, security profiles have been implemented, navigation between sections has been simplified, and much more.

To easily and quickly master the functionality, users of the 1C: Accounting 8.3 solution have access to various types of support: ITS, methodological literature, and a specialized Internet resource for accountants. Also, if you have any questions about working with the system, you can always contact our company.

Methodological changes

In accordance with the letter of the Federal Tax Service of Russia dated 04/22/2015 No. GD-4-3/ [email protected] , the list of selection of transaction codes issued when filling out section 7 of the value added tax declaration as amended by the order of the Federal Tax Service of Russia dated 10/29/2014 No. MMV -7-3/ [email protected] , added code: 1010823 - transactions for the sale of property and (or) property rights of debtors recognized as insolvent (bankrupt) in accordance with the legislation of the Russian Federation.

The forms of accounting statements of small enterprises are brought into accordance with the order of the Ministry of Finance of Russia dated 04/06/2015 No. 57n, including a new form of report on the intended use of funds has been added.

Registration of a separate division

Neither branches nor representative offices of the company, like other divisions, are independent legal entities. They cannot be located at the same address as the parent company; they must have stationary workplaces for work for at least one month. The “head” endows them with property, appoints managers, issues powers of attorney to them, and also develops regulations on the basis of which they act (Article 11 of the Tax Code of the Russian Federation, Article 55 of the Civil Code of the Russian Federation).

Registration of separate divisions of a company is carried out by the Federal Tax Service at their location. After the decision to create is made, no more than a month is allotted for this (clause 1 of Article 83 of the Tax Code of the Russian Federation):

- If a company opens a representative office or branch (Article 55 of the Civil Code of the Russian Federation), the Federal Tax Service, along with a package of necessary documents, submits an application for registration of a separate division - Application for state registration of changes in the constituent documents of a legal entity (form No. P13001) and Notification of amendments (Form P13002), for entering divisions into the Unified State Register of Legal Entities;

- When creating other separate divisions, the “head” sends only one document to its Federal Tax Service - Message in form No. S-09-3-1 (approved by Order of the Federal Tax Service of the Russian Federation dated 06/09/2011 No. ММВ-7-6/362);

- Notification in form No. 1-6-Accounting (Order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6/488) is submitted along with the notification of establishment if the organization opens several divisions on the same territory - in one city or municipality, but at the same time they fall under the jurisdiction of different Federal Tax Service Inspectors. There is an exception for such cases: when a new branch, representative office, etc. opens in an area where the company has already registered a previously created division, it can be registered with the same inspection; also, when opening several divisions in one city at once, all of them can be registered at the location of one of them (clause 4 of Article 83 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated September 28, 2011 No. PA-4-6/15886).

Having received the documents, the inspectorate within five days sends the legal entity a notice of registration of a separate division indicating the checkpoint assigned to it. Not being separate legal entities, the divisions use the TIN of the parent organization, so it is not assigned to them.

Changes in electronic submission of regulated reporting forms

The electronic presentation of statistics forms is brought into compliance with XML templates: - Form No. 1-MO “Information on municipal infrastructure facilities” (approved by Rosstat order No. 685 dated December 2, 2014) XML template dated March 31, 2015; — form No. ZP-zdrav “Information on the number and remuneration of healthcare workers by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015; — forms No. ZP-culture “Information on the number and remuneration of cultural workers by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015;

— forms No. 3P-science “Information on the number and remuneration of employees of organizations carrying out scientific research and development, by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015; — forms No. ZP-education “Information on the number and remuneration of employees in the education sector by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015. — Form No. 3P-social “Information on the number and remuneration of social service workers by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015; — Form No. P-2 “Information on investments in non-financial assets” (approved by Rosstat order No. 548 dated 09/04/2014) XML template dated 04/06/2015.

— Form No. 11-NA “Information on the availability, movement and composition of contracts, leases, licenses, marketing assets and goodwill (business reputation of the organization)” (approved by Rosstat order No. 543 dated August 29, 2014) XML template dated April 21, 2015; — Form 1-MO “Information on municipal infrastructure facilities” (approved by Rosstat order No. 685 dated December 2, 2014) XML template dated April 23, 2015; — Form 11 (transaction) “Information on transactions with fixed assets on the secondary market and their rental” (approved by Rosstat order No. 543 on August 29, 2014) XML template dated April 29, 2015.