What is BSO

Strict reporting forms (SRF) are a type of documents that are used to record the status or right to something, confirm the received status, etc. SRF are subject to special accounting, therefore they necessarily contain a set of identification parameters:

- information about approval of the form;

- Title of the document;

- serial number.

Duplicating series and numbers on forms with tear-off parts is prohibited. The exception is forms that are filled out in duplicate using carbon paper. There the identification parameters are repeated. (Also see the article on BSO in commercial organizations “How to create and account for strict reporting forms”).

Start using the Kontur-Accounting Budget program for free

In the activities of the institution, three areas related to taking into account strict reporting forms can be distinguished:

- current financial and economic activities;

- registration of labor relations with employees;

- settlements with the population.

There is no unified register of BSOs in Russia yet. The main forms of forms that are often used in the budget sector:

- receipts (issued instead of a cash register receipt when making payments to the public for services rendered);

- tickets and passes for entertainment events;

- work books and inserts for them;

- certificates;

- military tickets;

- medical books;

- birth certificates;

- certificates of incapacity for work;

- health resort vouchers;

- certificates, diplomas;

- securities;

- fuel cards, etc.

Strict reporting forms are most actively used in medical and educational institutions. However, documents such as work books or certificates of incapacity for work are required in institutions of any industry. This means that the accountant must have a full range of knowledge about the circulation, accounting and storage of financial statements. A specific set of documents for a particular organization depends on the specifics of its activities and is approved by the head.

How to keep a BSO accounting book

Both organizations and individual entrepreneurs are required to maintain this document if they do not use an automated BSO printing and accounting system. There is no single standard book for commercial structures, such as LLCs and individual entrepreneurs, so it is possible to use the BSO accounting book form for state and municipal institutions. You can download it here or develop your own document design.

The following requirements must be met:

- all sheets are numbered;

- the book is stitched;

- signed by the head of the organization and the chief accountant or individual entrepreneur.

Only the person responsible for accepting and issuing strict reporting forms is authorized to make entries in the book.

The book contains information about the following events:

- receiving BSO forms from the printing house;

- issuing forms to persons working with clients;

- the number of remaining forms;

- write-off of BSO.

Important: an entry in the accounting book must be made when handing over the BSO form to an employee working with clients, and not when accepting payment from the client.

The book must reflect information about each copy of the BSO received by the organization or individual entrepreneur, including defective ones, filled in with errors and damaged. They are not thrown away, but crossed out and attached to the accounting book.

Normative legal acts

For an accountant, the fundamental regulatory legal acts (RLA) that regulate the accounting of strict reporting forms in budgetary institutions are several instructions:

- instructions for the use of a unified chart of accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n;

- instructions for using the chart of accounts for budget accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n;

- instructions for using the chart of accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n;

- instructions for using the chart of accounts for accounting of autonomous institutions, approved by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n.

In addition, it is necessary to know industry regulations that regulate the structure of specific forms, the rules for filling them out, recording and storing them. So, if the form of a school certificate is approved by a state body (order of the Ministry of Education and Science of Russia dated August 27, 2013 No. 989 “On approval of samples and descriptions of certificates of basic general and secondary general education and appendices to them”), it should be used. Similar orders apply to documents of higher education, work records, certificates of incapacity for work and other BSO.

Organization of accounting of monetary documents

Monetary documents are documents certifying the fact of payment and the right to subsequent receipt of work or services. As a rule, such documents are drawn up on strict reporting forms (SSR).

| 1C:ITS For more information about strict reporting forms of the old and new sample (taking into account the current version of the Federal Law of May 22, 2003 No. 54-FZ), see the “Online cash desks” directory in the “Legal Support” section. |

According to the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, hereinafter referred to as the Chart of Accounts), monetary documents located at the organization’s cash desk (paid air and railway tickets, coupons for the disposal of solid household waste (MSW), postage stamps, etc.) are taken into account in subaccount 50-3 “Cash documents” in the amount of actual purchase costs. To account for monetary documents, the value of which is expressed in foreign currency, in “1C: Accounting 8” there is a separate subaccount 50.23 “Cash documents (in foreign currency)”.

On accounts 50.03 and 50.23, the program keeps records both in total and in quantitative terms. Analytical accounting is organized in the context of monetary documents (for this, the reference book Nomenclature of monetary documents is used). For each monetary document its type is indicated:

- Tickets;

- Vouchers;

- Stamps;

- Coupons for fuel and lubricants;

- Other.

When entering information in the card of a monetary document, you can indicate its value, then it will be automatically entered when registering the receipt or issue of the corresponding document.

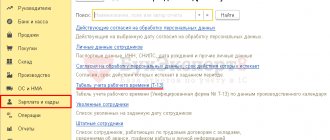

In order for operations with monetary documents to be available to the user, it is necessary to enable the appropriate functionality of the program (section Main - Functionality). On the Bank and cash desk tab, set the Cash Documents flag (Fig. 1).

Rice. 1. Setting up functionality

After setting the flag in the Bank and Cash Department section of the program, the documents Receipt of monetary documents and Issue of monetary documents, as well as the Cash Documents journal, become available. From the journal you can generate a Report on the movement of monetary documents, which is intended to control received and issued monetary documents. To control the safety and analyze the movement of monetary documents, you can also use standard accounting reports.

The document Receipt of monetary documents is intended to reflect the fact of receipt of a monetary document at the organization's cash desk. In the header of the document you need to indicate the account for accounting of monetary documents (50.03 or 50.23). If you select account 50.23, then you must specify the currency for recording monetary documents. Depending on the method of receipt of the monetary document, the type of operation is selected:

- Receipt from the supplier;

- Receipt from an accountable person;

- Other receipts.

If a Receipt from a supplier is registered, then in the Settlement Account field you must specify the account for settlements with the counterparty.

At the same time, the document Receipt of monetary documents does not provide for simultaneous indication of both the account for accounting of settlements with the counterparty and the account for accounting for settlements for advances. Therefore, it is convenient to use account 76.05 “Settlements with other suppliers and contractors” as a settlement account. The same account should be indicated when reflecting payment to the supplier, then there will be no difficulties with offsetting advances.

For each nomenclature of received monetary documents, their quantity and amount (including taxes) are indicated. VAT is not allocated in the amount of the document, since the fact of receipt of a monetary document is not the fact of acceptance for accounting of goods or services, the right to which the document provides. Goods (work, services) can be taken into account later (for example, when registering an employee’s advance report on a business trip or on the purchase of fuel and lubricants using a coupon), then, as a general rule, VAT is taken into account.

The document Issuance of monetary documents reflects the following types of business transactions:

- Issuance to an accountable person;

- Return to supplier. When making a return, it is necessary to indicate the amount of the return, as well as the account of income or expenses, since the amount of the return may differ from the value of the monetary document;

- Other issue.

Where to get strict reporting forms

Budgetary institutions must provide themselves with the necessary strict reporting forms on their own. As mentioned above, if the required BSO form is approved by a government agency, only that can be used. In this case, the organization purchases the required number of forms from their manufacturer. Data about them is posted on the website of the Federal Tax Service of Russia in the section “Licenses, permits, registers”.

In matters of purchasing forms, government and budgetary institutions must rely on the provisions of the federal law dated 04/05/13 No. 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs”, and autonomous ones - the federal law dated 07/18. 11 No. 223-FZ “On the procurement of goods, works, services by certain types of legal entities.”

The second option is to independently develop and produce certain types of forms, for example, service certificates. According to the regulation on the implementation of cash payments and (or) payments using payment cards without the use of cash register equipment (RF Government Decree No. 359 dated 06.05.08), automated systems can be used to generate a BSO. You can only print using the typographic method. However, it must be taken into account that a huge number of requirements are imposed on the automated system: protection from unauthorized access, the ability to save a unique number and series of the form, etc. Therefore, state (municipal) institutions often prefer to purchase ready-made documents.

The costs associated with the production and/or purchase of forms must be attributed by the accountant to subarticle 226 “Other work, services” of KOSGU.

Postage stamps or marked envelopes are classified as monetary documents and are accounted for in account 0 201 35 000 “Cash Documents”.

Necessary information ↑

Today, almost all enterprises without exception are required to use cash registers - cash register mechanisms. These devices are used to generate special checks.

Moreover, both in the case of cash and non-cash payments. But in some cases, such documents can be replaced with special BSO - strict reporting forms.

Such documents also serve as confirmation of payment and are printed in advance at the printing house. Subsequently, all the necessary data is entered into them.

At the same time, there are certain standards for compilation and storage. They must be observed. It is important to remember the format of compiling the journal itself.

BSO can be used in the following cases:

| When services are provided that are indicated in OKUN | Dry cleaning, tailoring and much more |

| If services are provided in OKUN that are not designated | But at the same time provided to the population for a certain fee |

It is important to remember that the use of such forms is inadmissible in the following cases:

- for settlements between legal entities;

- if goods are sold for cash.

There are certain rules for writing off strict reporting forms in a budgetary institution, as well as a commercial one.

The most important issues that will need to be considered in advance in order to avoid difficulties with regulatory authorities include:

- basic definitions;

- possible reasons;

- legal framework.

Basic Definitions

There is a fairly extensive regulatory framework governing the use of forms of this type, as well as their write-off and disposal. But to correctly interpret all the information reflected in it, you need to understand the meaning of the terms.

The most significant ones at the moment include the following:

- KKM;

- availability and non-cash payments;

- fiscal mode/memory/data;

- state register of cash registers;

- payment terminal/ATM;

- BSO;

- BSO accounting log;

- write-off order, act.

The abbreviation KKM stands for cash register mechanism. This term refers to a large number of different equipment. First of all, these are cash registers, ATMs, and payment terminals.

ATMs and payment terminals allow you to carry out all kinds of transactions to pay for services, goods, as well as purchase goods. The main feature is that there is no need for the presence of an operator.

| Cash payment | An operation where money is transferred directly in cash. Cashless payment – payment using a special bank card. Regardless of the method of transferring funds, a payment document must be issued. It can be of various types |

| Fiscal memory | Volatile memory used in cash register machines. Used to register various data when carrying out monetary transactions. Fiscal mode is a mode in which all data is recorded to the memory indicated above. All equipment used to register monetary transactions must be registered in a special state register |

| BSO | A document that reflects data when making payments for services and goods. The abbreviation itself stands for “strict reporting form” |

| BSO accounting log | The register is in paper format, maintained at the enterprise or by an individual entrepreneur (individual entrepreneur). A write-off order, an act, is a document drawn up when the deadline for disposal of BSO approaches. This point is reflected in the legislation in force in the territory |

Possible reasons

The procedure for writing off forms of this kind is carried out only if certain conditions established by law are met.

Write-off will need to be carried out in the following cases:

| If the document storage period has expired | Its duration is only 5 years |

| If the forms were destroyed for some reason | Or otherwise lost |

It is important to remember that there is a difference between the procedure for writing off and destroying forms. It is important to remember that write-off is also carried out if the client refuses the service/product when the document has already been completed.

In this case, under no circumstances should you simply throw away the document. It is required to submit the BSO in full (two copies) or the numbers of the spines. The series and numbers must match.

It is important to remember that there is a format established by law for both BSO and acts, orders for writing off strict reporting forms.

It is important to adhere to all rules reflected in current legislative regulations.

An example of an order to write off old-style BSO can be found on the Internet or at the tax office. Employees of this institution must provide the necessary advice.

Legal basis

The process of drawing up both strict reporting forms themselves and acts for their write-off is reflected in special legislative norms.

At the moment, the fundamental NAP is Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment.”

In addition to this law, it is also necessary to use the following NAPs:

| Government Decree No. 359 | from 05/06/08 |

| Order of the Ministry of Finance of the Russian Federation No. 3N | from 14.01.08 |

| Order of the Ministry of Finance of the Russian Federation No. 60n | from 07/09/07 |

| Order of the Ministry of Culture No. 257 | from 12/17/08 |

| Order of the Ministry of Culture No. 231 | from 08.12.08 |

The act of writing off forms that are damaged or have expired differs for commercial and municipal institutions.

For 2020, you must use the format:

| Form No. 0504816 | Sample filling for a budget institution |

| Form No. 0504816 | Sample filling for a government-type institution |

In addition to legislative acts, there is also a fairly extensive list of various types of other auxiliary materials.

For a sample of strict reporting forms for LLCs in 2020, see the article: strict reporting forms for LLCs. Read about strict reporting forms for individual entrepreneurs in 2020 here.

They will provide answers to most of your questions. If you do not have the necessary experience, you should turn to additional materials.

How and where to store BSO

One of the necessary steps at the initial stage of working with BSO is to assign responsibility. The manager, by his order, forms a special commission whose responsibilities include monitoring the circulation of forms. An agreement on full individual financial responsibility is concluded with each member of the commission. The form of the agreement is standard, it was approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85.

Any institution that uses BSO in its activities is obliged to provide certain conditions for their storage: in equipped safes, metal or wooden, lined with iron sheets, cabinets or, in the case of a large number of BSO, in sealed premises. Containment conditions must exclude the possibility of unauthorized access to documentation by unauthorized persons.

There are special rules for certain types of forms. For example, to record “sick leave”, instructions have been developed on the procedure for providing sick leave forms, recording and storing them (Order of the Federal Social Insurance Fund of Russia and the Ministry of Health of Russia dated January 29, 2004 No. 18/29). And the accounting and storage of work books and their inserts are regulated by the rules for maintaining and storing work books, producing work book forms and providing them to the employer (RF Government Decree dated April 16, 2003 No. 225).

The institution must keep copies/spoofs of forms for 5 years. After this period, they can be disposed of, but this can only be done through the inventory procedure.

The procedure for writing off BSO in the budget ↑

The procedure for writing off strict reporting forms involves many different nuances. Various types of document format violations are not allowed.

Controlling organizations represented by the Federal Tax Service and others pay the closest possible attention to delivery certificates and accounting logs.

The main questions that need to be disclosed before proceeding with the actual write-off of strict reporting documents:

- documentation - filling out the act, forming orders, sample filling;

- reflection by wiring.

Documenting

First of all, it is necessary to pay attention to documentation. This is especially important in the event of various questions arising from regulatory authorities.

For example, if any crime occurs, the prosecutor's office checks the BSO, if any, as well as special disposal acts.

Filling out the act

The type of act under consideration necessarily includes the following components:

- serial number of the act;

- name of the institution;

- financially responsible person;

- individual tax number;

- account debit;

- commission consisting of;

- OKUD form;

- special codes must be indicated on the right side (OKPO, KPP, account credit);

- persons who are members of the special expert commission are designated;

- indicate the order by which the appointment itself is carried out;

- The period during which the write-off is carried out is indicated.

After all the designated elements, it will be necessary to draw up a special table. It lists all strict reporting documents that must be written off.

The table itself includes the following sections:

- strict reporting form - number, series;

- reason for write-off;

- date of destruction.

After the table, signatures with a transcript will be required. The following signatures are required:

- head of the enterprise;

- other members of the commission (at least 3).

The date of formation of the document is indicated at the bottom of the act in question. It is important to remember that it should not be earlier than the storage period for the strict reporting form expires.

Formation of orders

Before including a document in a special act, it will be necessary to enter an order.

This document necessarily includes the following main sections:

| The composition of the commission is reflected | Which must necessarily check the process of movement of strict reporting forms |

| A complete list of documents is established | Which refers to strict reporting forms |

| A list of employees is established | Who are responsible for accounting, as well as safety, preparation of forms |

| The place of permanent storage of forms of the type in question is determined | For example, this could be an accounting safe |

| Designates the person responsible for the execution of all orders | Compiled regarding the storage, write-off and disposal of BSO |

Strict reporting forms must be numbered. There are more specific standards for their compilation. They cannot be printed on a regular PC.

To compile these documents you need to use:

- special automation tools;

- printing tools.

At the same time, the write-off act and order are drawn up on a personal computer. The procedure for drawing up an order, unlike an act, is not regulated by law. Therefore, it can be formed in any format.

But there are certain regulations for working with such documents. It is necessary to reflect in them the data established by law.

Accounting for strict reporting forms

According to the instructions mentioned above for the use of charts of accounts, manufactured or purchased forms must be reflected in the accounting records. They are not inventories, therefore accounting is carried out using off-balance sheet account 03 “Strict reporting forms”. The accountant records the number of BSOs that are stored in the institution or issued to employees. For these purposes, the account can be divided into subaccounts 03.1 “Strict reporting forms in the warehouse”, 03.2 “Strict reporting forms in the sub-report”, etc.

In accounting, the receipt of forms is reflected in the credit of account 302 26 730 “Increase in accounts payable for settlements for other works and services.” At the same time, their receipt should be reflected in the debit of off-balance sheet account 03 “Strict reporting forms”. The basis for accounting are the supplier’s documents - invoices or certificates of work performed. The double entry method is not used in this case: only the facts of receipt of forms or their disposal are recorded.

The method of evaluating the forms must be indicated in the accounting policy of the institution: either at the purchase price, or, which is most common in practice, each form for 1 ruble.

The institution is required to keep a journal for other transactions (form 0504071) in account 03 “Strict reporting forms”. The journal is filed together with primary documents indicating the movement of the BSO.

In addition, for each type of forms a separate book of strict reporting forms is maintained (form 0504045). It indicates the date of receipt or issue of forms, their quantity and cost. At the end of the reporting period, the data is analyzed and the balance is displayed. The pages of such books are numbered, and the books themselves must be laced and sealed.

How to write off strict reporting forms, when and under what conditions?

Strict reporting forms must be filled out by responsible persons in legible handwriting and without erasures.

A typo or error in one character will result in the form being damaged. Its further use is impossible. In this case, it is necessary to cross out the damaged sheet diagonally and remove it. A damaged strict reporting form cannot be immediately destroyed. It must first be written off. After the end of the mandatory 5-year storage period for strict reporting documents, they are allowed to be liquidated. Storage must be organized in a systematic manner in sealed bags.

The Book of Strict Reporting Forms can help in systematizing information about BSO. It must be retained for a minimum period of 5 years from the date it was last recorded. The book is accompanied by the spines of previously used forms, damaged and outdated copies of documentation. How to write off a damaged strict reporting form - an algorithm for writing off used documents is suitable for this.

The procedure for deregistration of used, outdated and damaged strict reporting forms involves going through several stages:

- How to write off BSO - first you need to issue an order to conduct an inventory of such forms, a commission is formed (it must include at least 3 people from among the company's employees).

- Carrying out inventory activities with drawing up an inventory list INV-16 based on their results. The data obtained as a result of the inventory for each type of form is verified with the information in the BSO Accounting Book. They must be identical. If a discrepancy is detected, comparison sheets are filled out. The responsible employee provides explanations regarding the reasons for the shortage or surplus of BSO. An official investigation is ordered to identify the perpetrators, who may be subject to penalties as a result.

- The write-off of damaged strict reporting forms is carried out by a special commission, its composition is approved by order of the head. After one month after the end of the inventory, copies of the BSO and spines, damaged documents are destroyed.

How to write off strict reporting forms - outdated and damaged, used document forms are written off in accounting using two entries:

- D20 (26) – K10;

- – K006.

Forms can be destroyed manually (the procedure is carried out by the write-off commission) or using special equipment (shredders). It is not prohibited to seek assistance in liquidating a BSO from third-party organizations on a reimbursable basis.

Inventory and write-off

BSO require a special approach not only to the issues of their storage and accounting. It is very important for an accountant to know how to write off strict reporting forms. In case of damage or detected defects, such forms cannot simply be thrown away.

Monitoring of the state of the BSO is carried out during an inventory, during which it is necessary to check the presence and safety of copies/spoofs of forms, the absence of defects, corrections, the correspondence of the amounts in copies/spinners to the data of statements or cash reports, etc. Based on the results of the inventory, a statement of discrepancies is generated (form 0504092) , on the basis of which the detected damaged or defective BSO is written off. The procedure has a strictly defined order. The first step is to prepare an act on the write-off of strict reporting forms. It can also be drawn up in any form, however, budgetary institutions most often use the established form (form 0504816). The act must list the members of the commission, the period for which the write-off occurs, and the date. In addition, you should indicate the numbers of the documents being written off, their series and reasons for writing off. After this, strict reporting forms must be destroyed. The date of destruction is also recorded in the act. The document must be signed by all members of the commission and approved by the head of the institution.

Documentation of destruction of BSO

The disposal of strict reporting forms upon their registration (issuance), as well as in connection with the detection of damage, is carried out on the basis of the Act on the write-off of strict reporting forms (f. 0504816) at the cost at which the strict reporting forms were previously accepted for accounting.

Institutions of higher professional education that are damaged when filling out educational document forms are destroyed in the prescribed manner. However, at present, the procedure for destroying strict reporting forms for educational institutions is not established at the legislative level.

Previously, the destruction procedure was approved by clause 13 of Order No. 80 of the Ministry of Education and Science of Russia dated 03/09/2007; this document has now lost force.

Therefore, the institution has the right to prescribe the procedure for the destruction of BSO in the local act of the institution. The institution can prescribe the previously existing procedure: by cutting out the document number and gluing it to the write-off act. Or by burning, in this case an act for the destruction of forms is drawn up indicating the numbers being burned; if the number is cut out, then the act for write-off with the numbers attached will simultaneously be an act for the destruction of strict reporting forms.

Rationale

Table of main accounting entries for account 03

Account 03 is included in accounting. accounting for non-current assets. Therefore, the account is active.

The debit of account 03 reflects the receipt of investments that should generate income for the organization by providing it for temporary use with subsequent redemption or without redemption.

The credit of account 03 reflects disposals: write-off, sale, shortage, damage, gratuitous transfer, liquidation.

| Dt | CT | Wiring Description | A document base |

| 03 | 08 | Property accepted for registration | Transfer and Acceptance Certificate |

| 03 | 80 | Income investments accepted as a contribution to the authorized capital | Decision of the general meeting of participants |

| 94 | 03 | Shortage (damage) of property listed on account 03 | Write-off act |

| 99 | 03 | The cost of profitable investments is included in extraordinary expenses | Write-off act |

| 91.2 | 03 | The residual value of the disposed income investment is reflected | Transfer and Acceptance Certificate |

If an organization receives forms in large quantities, then they can be stored in specially equipped premises, under conditions that prevent their damage or theft. At the end of the working day, the places where the forms are stored are sealed or sealed. This account is intended to summarize information about the availability and movement of BSOs stored and issued for reporting, and they must be accounted for at face value or in conditional valuation (clause.

84 Instructions on the procedure for applying the standard chart of accounts for accounting, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 29, 2011 No. 50 (hereinafter referred to as Instruction No. 50). The forms of many of them are unified. Most of the forms used are ordinary office supplies. But there is a special category of forms - these are strict reporting forms.

Writing off strict reporting forms in 1s 8.3

Therefore, it can be formed in any format.

But there are certain regulations for working with such documents. It is necessary to reflect in them the data established by law.

Sample filling

The type of documents in question have a large number of different features. If possible, be sure to familiarize yourself with all of them.

The easiest way is to acquire correctly compiled samples in advance. You can find them on reputable resources on the Internet.

Reflection of wiring

When carrying out various operations with BSO, it is imperative to properly reflect all the nuances in the financial statements.

For this purpose, wiring of the form is used:

Debit – 73.02 Credit – 91.01 Debit – 50.01 Credit – 73.02

Subaccounts are used depending on the basis:

BSO.01 The procedure for using the reporting form itself BSO.02 If there is damage to BSO forms.03 When liquidating this type of form BSO.04 If there is a shortage BSO.05 Loss, theft

The process of recording liquidation, damage or write-off is completely standard and is identical regardless of how the accounting procedure is implemented (1C/manually). If possible, it is worth studying all the points in advance.

When conducting desk and other audits, the tax office always pays close attention to transactions with the BSO. Since all sorts of corruption schemes are often implemented through such documentation.

The write-off of strict reporting forms must necessarily occur in accordance with current legislative norms.

Otherwise, administrative liability may be imposed by regulatory organizations.

- assess the degree of guilt of the entity responsible for the safety and integrity of the audited documentary forms at the enterprise;

- record the results of the audit in the necessary documentation (inventory list, matching sheet, inventory report).

Documentary grounds

You can write off strict reporting forms for one reason or another from a business entity on the basis of certain documentation that must be completed.

Which document should you use to write off strict reporting forms:

- Documentation related to the mandatory audit of the BSO , based on the results of which the forms are written off: order to conduct the audit, which indicates the reasons for the audit, the timing of its implementation, as well as the composition of the inventory commission;

- inventory list , in which factual information about the availability of strict reporting forms is entered, compared with accounting data;

- comparison (reconciliation) statement , compiled when discrepancies are identified between actual information and accounting data (surpluses, shortages);

- audit act , the execution of which summarizes the results of the audit.

- administrative act of the management of an economic entity on the appointment and powers of a special write-off commission (write-off order);

How to achieve detailed analytics of BSO disposal

Disposal of BSO is always a credit to account 006, regardless of the reason for disposal. To have a clear picture of what happened to the BSO and why the forms were written off off-balance sheet, it is recommended:

- enter a separate off-balance sheet account, giving it an individual name (for example, “Disposal of BSO” or “Operations with BSO”);

- open subaccounts for an open off-balance sheet account according to the types of reasons for the disposal of BSO (for example, BSO.01 - use of BSO, BSO.02 - shortage of BSO, etc.);

- when disposing of BSO, use the following account correspondence: for normal use of BSO - Dt BSO.01 Kt 006, in case of shortage - Dt BSO.02 Kt 006, etc.

As a result, the necessary analytics of BSO retirement will be organized, allowing you to quickly analyze this process. To make the information available for analysis, you can generate a “Summary transactions” report.

An open off-balance sheet account and subaccounts to it must be entered into the 1C chart of accounts. This is done manually in user mode.

Accounting for fuel and lubricants using coupons

Fuels and lubricants include fuels (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas), lubricants (motor, transmission and special oils, greases), as well as special fluids (brake, coolant). An organization can purchase fuel and lubricants for cash and in non-cash form.

If the organization has chosen a non-cash form, then a supply agreement is concluded with the fuel supplier, according to which the organization transfers funds to the supplier’s bank account, and in return receives coupons or fuel cards, with which drivers refuel cars at gas stations (gas stations).

| 1C:ITS For more information on accounting for fuel and lubricants using fuel cards, see the “Directory of Business Operations. 1C: Accounting 8" section "Accounting and tax accounting". |

The use of coupons as a form of payment for fuel and lubricants has become widespread. To account for such transactions, it matters what type of coupons the organization uses and at what point ownership of the fuel and lubricants is transferred to the organization.

There are two types of coupons:

- liter (quantitative), which indicate the quantity and brand of fuel without specifying the amount (the price of fuel and lubricants is fixed on the date of payment of coupons; it is usually not indicated on coupons);

- sum or cost (monetary), which indicate only the amount for which you can refuel (the price of fuel and lubricants is determined on the date of refueling; coupons do not indicate either the price or quantity, but the brand of fuel may be indicated).

Depending on the terms of the agreement for the supply of petroleum products, ownership of fuel and lubricants may pass to the organization either at the time of receipt of coupons or at the time of refueling the car at a gas station. When refueling, the driver gives a coupon, and in return receives a tear-off coupon with a stamp of the redeemed coupon and a cash receipt. Coupons have a validity period established in the agreement with the seller of fuel and lubricants.

Fuel and lubricants are included in inventories (MPI) and are accepted for accounting at actual cost in accordance with the Accounting Regulations “Accounting for inventories” (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, hereinafter referred to as PBU 5 /01). According to the Chart of Accounts, the program uses subaccount 10.03 “Fuel” to account for fuel and lubricants.

If, under an agreement with the supplier, ownership of fuels and lubricants passes to the organization at the time of refueling the car at a gas station, then coupons for fuels and lubricants can be taken into account:

- as part of monetary documents on account 50.03 (as a rule, for sum coupons, but also acceptable for quantitative coupons);

- on off-balance sheet account 006 “Strict reporting forms” (usually for quantitative coupons).

A document that confirms fuel consumption, data on actual mileage and the production nature of the vehicle’s route is a waybill (approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78). This form of document is mandatory only for motor transport organizations. Other organizations can develop their own document form, which must contain the mandatory details provided for in Article 9 of the Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” and Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 “On approval of the mandatory details and procedure for filling waybills."

If the organization's cars are equipped with an electronic mileage monitoring system (or mileage and fuel), then fuel consumption can be confirmed based on a printed system report signed by the responsible person.

There is no legal regulation of costs for fuels and lubricants, but the organization can itself establish fuel consumption standards by order of the manager.

In this case, you can be guided by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r or the standards specified in the vehicle operating instructions.

If standards are not established, then actual fuel consumption based on waybills is written off as expenses for ordinary activities. If the accounting policy of an organization provides for the use of fuel consumption standards, then the amount of fuel consumed within the standards is included in the organization’s expenses for ordinary activities, and in excess of the standards is included in other expenses.

In tax accounting, expenses for the purchase of fuel and lubricants can be taken into account in one of the following ways:

- as part of material expenses (based on clause 5, clause 1, article 254 of the Tax Code of the Russian Federation);

- as part of other expenses associated with production and (or) sales, such as the cost of maintaining official transport (clause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

For profit tax purposes, expenses for fuel and lubricants are not standardized and are taken into account in full if they are economically justified, documented and incurred for the purpose of carrying out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

VAT on purchased fuels and lubricants is accepted for deduction in the general manner on the basis of an invoice presented by the supplier (clause 2 of Article 171 of the Tax Code of the Russian Federation, clause 1 of Article 172 of the Tax Code of the Russian Federation). As a rule, the supplier provides a set of documents (waybill, invoice) at the end of the month for the total amount of fuel sold during the month. The amount of fuel according to the supplier's invoice and according to the drivers' advance reports (according to tear-off coupons and cash receipts) must match.

Example 1

| Sewing Factory LLC (OSNO, VAT payer, applies PBU 18/02) purchases gasoline coupons in the amount of 30 pcs. from the organization Etalon-Kart LLC for a total amount of 58,500 rubles. (the numbers in the examples are conditional). The denomination of one coupon is 50 l. According to the terms of the agreement, ownership of the fuel and lubricants passes to the buyer at the time the vehicle is refueled at the gas station. Drivers receive gasoline using coupons received for reporting and draw up an advance report. The supplier provides documents for the fuel selected during the month (waybill, invoice) on the last day of each month. The cost of consumed gasoline is included in expenses at the end of the month according to travel sheets. Coupons for fuel and lubricants are recorded in account 50.03. |

Payment to the supplier for coupons is registered in the program by the document Write-off from current account with the transaction type Other settlements with counterparties, where account 76.05 should be specified as the settlement account.

As a result of posting the document, an accounting entry is generated:

Debit 76.05 Credit 51 - for the amount of the prepayment (RUB 58,500).

Please note that for those accounts where tax accounting is supported, the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes. In the examples discussed in this article, there are no differences between accounting and tax accounting.

The receipt of monetary documents is reflected by a document of the same name with the transaction type Receipt from supplier (Fig. 2).

Rice. 2. Receipt of monetary documents

In the header of the document you should indicate the details of the primary document: date and number. The From tab is filled in by the user as follows:

| Field | Data |

| "Counterparty" and "Accepted from" | The supplier of fuels and lubricants from which the monetary documents were received is indicated (selected from the “Counterparties” directory) |

| "Treaty" | An agreement with a supplier is selected from the directory of the same name, and the type of agreement must have the value “Other” |

| "Settlement account" | The score is indicated as 76.05 |

On the Cash Documents tab, click the Add button to select incoming cash documents from the Nomenclature of Cash Documents directory. In Example 1, the monetary document has the form Coupons for fuel and lubricants (Fig. 3). The number and amount of received monetary documents is indicated.

Rice. 3. Nomenclature of monetary documents

When posting a document, the following entries are entered into the accounting register:

Debit 76.05 Credit 76.05 - for the amount of the offset advance (RUB 58,500). The offset is carried out between documents of settlements with counterparties Receipt of monetary documents and Write-off from the current account; Debit 50.03 Credit 76.05 - for the amount of gasoline coupons received (RUB 58,500) in the amount of 30 pcs.

The issuance of coupons to the driver is reflected in the document Issuance of monetary documents with the transaction type Issuance to an accountable person. On the To tab, the accountable person is indicated, which is selected from the Individuals directory.

On the Cash Documents tab, indicate the name of the coupon (selected from the Nomenclature of Cash Documents directory) and quantity, for example, 10 pcs. The cost of coupons is calculated automatically.

As a result of posting the document, the following posting is generated:

Debit 71.01 Credit 50.03 - for the amount of monetary documents issued to the accountable person (RUB 19,500) in the amount of 10 pieces.

The posting of gasoline purchased by the driver using coupons and the accounting of input VAT on the gasoline received is reflected in the Advance report document (Bank and cash desk section). Let's say the driver has reported for all the tickets issued to him.

In the header of the document it is necessary to indicate the reporting accountable entity and the date of preparation of the advance report. If your organization keeps inventory records by warehouse, then you should fill in the Warehouse field.

On the Advances tab, use the Add button to select the document Issuance of monetary documents, according to which the accountable person received coupons.

Since the accountable person purchased inventory items, the Goods tab should be filled out in the Advance Report document. On this tab, click the Add button to fill in the table part (Fig. 4):

Rice. 4. Tabular part on the “Products” tab of the “Advance report” document

- in the Document (expense) field, the details of the primary documents received from the supplier are indicated;

- indicate the nomenclature, quantity and price of purchased gasoline in the appropriate fields, and the Amount field is calculated automatically;

- the supplier of fuels and lubricants is indicated;

- To register an invoice, you should set the checkbox in the Invoice field, and in the Invoice Details field, enter the date and number of the invoice received from the supplier. After executing the Write command, a link to the created document Invoice received for receipt is automatically added to the Invoice Details field of the Advance Report document;

- in the Accounting account and VAT account fields, fuel and lubricants accounting accounts and a VAT accounting account are indicated.

When posting the Advance Report document, the following transactions are generated:

Debit 10.03 Credit 71.01 - for the cost of gasoline received without VAT (RUB 16,525) in the amount of 500 liters; Debit 19.03 Credit 71.01 - for the amount of VAT (2,975 rubles).

The deduction of VAT on purchased gasoline will be reflected by the date of receipt of the invoice if the Reflect the deduction of VAT in the purchase book by the date of receipt in the form of the document Invoice received for receipt is checked.

By default, the date of receipt of the invoice corresponds to the date of the expense report, but if necessary, the date of receipt can be changed. If the flag is cleared, then the deduction can be reflected in the document Formation of purchase book entries (section Operations - Regular VAT operations) within 3 years after registration of fuel and lubricants.

To include the cost of gasoline in expenses, you need to create a Request-invoice document (Production section).

Let's say that the gasoline purchased with coupons was completely used up in accordance with the waybill. In the header of the document, the date of write-off of fuel and lubricants is indicated (the last day of the month) and the Warehouse field is filled in.

On the Materials tab, the name and quantity (500 l) of gasoline are indicated. If the item settings have been previously configured, the accounting account is filled in automatically. On the Cost Account tab, select the cost account to which materials are written off, for example, account 26 “General expenses”.

When posting a document, a posting is generated:

Debit 26 Credit 10.03 - for the cost of gasoline included in expenses (RUB 16,525).

| 1C:ITS How to account for monetary documents in the form of coupons, see the “Directory of Business Transactions. 1C:Accounting 8" section "Accounting and tax accounting": — accounting of fuels and lubricants; — accounting for services for removal and disposal of solid waste. |