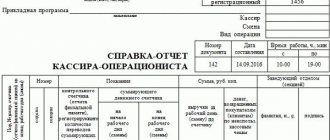

One of the most important documents when accounting for finances is the cashier-operator’s journal of the unified form KM-4 . Initially, registration is carried out with a tax organization, where the sheets are numbered and the journal is stitched. The last page is signed by the manager and accountant.

This journal records the amount of money that passed through the cashier’s machine during the accountant’s work; a record is created at the start and end of the change of cash register counter information.

How to fill out the cashier-operator log?

We advise you to carefully study the example of filling out KM-4. In addition, we advise you to study the forms and examples of filling out reports:

- KM-6 – reporting document of the cashier-operator.

- Form KM-7 - data on the readings of KKM counters.

Do you need to perform operations with cash registers? Study the information on filling out the application - form according to KND 1110021.

Features of the document

Since 2013, unified templates for primary documents have been abolished, so today employees of organizations and enterprises have the opportunity to choose whether to keep a cashier-operator journal in free form, develop their own document form, or use the unified, previously mandatory form KM-4 . The majority, I must say, follow the third path, since the standard form contains all the necessary details and lines, which means there is no need to waste time on creating the structure and content of the journal.

The document should be kept in paper (printed) form. In this case, all its sheets must be numbered and fastened together using a thick thread (but not with a stapler). You can use a ballpoint pen of any dark color to fill out the journal (other writing tools - felt-tip pens, pencils, etc. are unacceptable).

On the last page of the document, you must indicate the number of sheets, put a stamp (unless, of course, the use of stamps is enshrined in the company’s accounting policy), and the signature of the responsible person (accounting department specialist or chief accountant).

Entries in the journal are made strictly chronologically (without gaps), while blots and errors are extremely undesirable.

If such an oversight does occur, the incorrect data should be corrected by carefully crossing out the incorrect information and entering the correct information, making o next to it. All adjustments must be dated and certified by the signature of the cashier-operator and the chief accountant.

The book can be maintained either on a regular basis (if a retail outlet or enterprise operates every day) or as needed.

If there were no transactions involving a cash register during the accounting period, you do not need to fill out the form.

https://youtu.be/szMChAkrf4s

Filling out the cashier-operator's journal (form KM-4)

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

So how do you fill out the KM-4 form?

- Information about the date (shift). Here 1 column is filled in, where the day, month and year of the report are indicated - these data are recorded in the cashier-operator's journal. It also happens that there are many reports for one date, then they are recorded in different lines with a single date.

- Department (division) number. 2 columns where the department number is recorded. Shift checks were issued to this department. If the cashier's device does not have a punching function, then the data is not filled in.

- Last name, first name, patronymic of the cashier. The third column indicates the full name of the person responsible for carrying out transactions at the cash register.

- Number of the main counter at the end of the shift. Column 4 records the Z-report number.

- Counter number that records the volume of data transfers per meter. Column 5 – here the data is taken from column 4.

- Financial counter sum data at the beginning of the shift. Column 6 indicates the accumulating tax at the start of the shift, which takes into account all amounts from the start of the machine’s operation. If another device is registered with a tax organization, then a payment must be made in the amount of 1 ruble 11 kopecks.

- Certified by the signature of the cashier or manager in the journal. The seventh and eighth columns are the affixing of signatures of these people. A person holding two positions simultaneously puts his signatures in both columns.

- Financial counter sum data at the end of the shift. Here in column 9 the same data specified in the previous sentence is indicated. The revenue for this shift is added to this figure from column 6. Accumulations are written off from the Z-report data.

- The amount of money in revenue. The tenth column includes data on profit per shift. The data from columns 11, 12 and 15 are summarized here.

- Cash delivery. Column 11 records cash revenue.

- Payment according to documents. Column 12 records the volume of payments by bank transfer in the KM-4 journal. If the device does not have this function, the column is not filled in. Column 13 records the number of non-cash payments.

- Total change volume. Column 14 records the amount of finance in cash and non-cash payments, minus returns.

- Total number of returns. Column 15 records this characteristic for the shift.

- Certification by cashier. In column 16, the person responsible for the cash register leaves his signature.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Receiving cash proceeds: what the cashier needs to know

Both large and small taxpayers have to work with cash. In some cases permitted by law, when accepting cash, the cashier does not punch the cash register receipt, and the taxpayer may not have a cash register. But a significant portion of tax payers are still forced to work with cash register equipment.

IMPORTANT! The requirement for the mandatory use of cash register systems when working with cash is contained in paragraph 1 of Art. 2 of the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ.

Working with cash register means obeying all the rules established by regulatory documents and drawing up all the necessary cash documents and reports. Violation of these rules results in penalties.

For more information about what a taxpayer should prepare for if he does not comply with the rules for working with cash registers and violates cash discipline, see the material “Cash discipline and responsibility for its violation .

One of the forms used when working on cash registers equipped with EKLZ is KM-4 “Journal of the cashier-operator”, approved by Resolution of the State Statistics Committee dated December 25, 1998 No. 132.

Since mid-2020, with amendments to Law No. 54-FZ, this form has ceased to be considered mandatory and can be replaced with a similar free-form document. And with the withdrawal of cash registers equipped with EKLZ from use due to their replacement with online cash registers (from 07/01/2017), the KM-4 form becomes unnecessary, since all the necessary information will be accumulated and stored in a fiscal storage device, allowing the generation of a report of a similar nature for every shift (see letter of the Ministry of Finance dated June 16, 2017 No. 03-01-15/37692). Although, if desired, such a document can additionally be created manually, including using the unified KM-4 form, in which data that does not arise when working with it will not be filled in regarding the online cash register.

For technical requirements for online cash registers, read the article “Procedure for switching to online cash registers from 2016.”

What goals and objectives does the document solve?

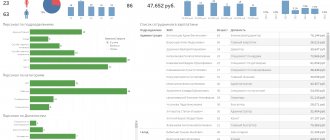

The journal is a means of recording all transactions performed using a cash register. It contains information about both the receipt and expenditure of funds.

In cases where an organization has several cash registers, a journal is kept for each of them separately.

Generally speaking, having a magazine allows you to solve several different problems at once. For example, with the help of a journal, the head of an enterprise can quickly determine at any time how much money passed through the cash register for a specific period, and tax service employees, during inspections, have the opportunity to quickly compare cash register readings and figures from reporting documents with information from the journal.

Shelf life

The cashier-operator's log should be stored near the location where the cash register is installed throughout the entire life of the device. The document must be presented to the inspectors upon their request.

The storage of logs for past periods is carried out by an organization or an individual entrepreneur. Shelf life is at least 5 years.

After the end of the specified period, the document must be destroyed. In accordance with the requirements of the law, a special commission must be constituted for these purposes, which will attest to the fact of destruction. Then, the head of the organization or entrepreneur must draw up an act, which the commission members will certify with their signatures.

Is a document needed?

The journal must record any funds passing through the organization's cash register. This approach will ensure correct accounting of revenue, as well as financial and tax reporting.

When the tax office conducts an audit, cash documentation is first confiscated; for this reason, keeping a journal is a responsible task for the enterprise and requires special care and thoroughness.

An individual entrepreneur may have a question: does he need such a document and who should maintain it if there is no cashier position.

Legislatively, accounting for cash transactions and cash is not separated for different forms of ownership, so it is necessary to keep a journal in any case. If the individual entrepreneur does not provide for the presence of a cashier, then the document must be filled out by the manager.

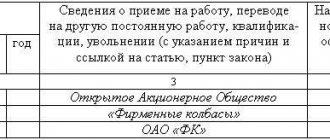

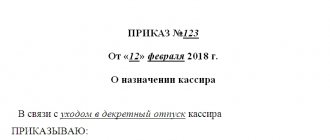

Sample cover of a cashier-operator magazine

What paperwork still needs to be filled out?

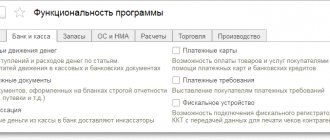

With the introduction of online cash registers, it is no longer necessary to maintain a whole range of accounting documents. These include forms:

- KM-1: “Act on transferring the readings of summing money counters to zeros and registering control counters of cash registers”;

- KM-2: “Act on taking readings of control and summing cash meters when handing over (sending) the cash register for repairs and when returning it to the organization”;

- KM-3: “Act on the return of funds to buyers (clients) for unused cash receipts”;

- KM-4: “Journal of the cashier-operator”;

- KM-5: “Logbook of recording readings, summing cash and control counters of cash registers, operating without a cashier-operator”;

- KM-6: “Certificate-report of the cashier-operator”;

- KM-7: “Information on KKM meter readings and the organization’s revenue”;

- KM-8: “Logbook of calls to technical specialists and registration of work performed”;

- KM-9: “Act on checking cash in the cash register.”

All information previously entered into the above documents is now taken into account in the system automatically.

The changes did not affect two important documents:

- Cash book. It is a unified registration document filled out in writing or electronically.

- BSO. Strict reporting forms remain in force, but can now be issued electronically. At the client's request, the BSO can be sent to a phone number or email address.

With the entry into force of Law No. 54-FZ “On the use of cash register equipment,” two new documents appeared. This is a correction check and a form with the “receipt return” sign.

The first is issued if unaccounted revenue appears. It reflects the excess amount. It is also necessary in cases where there is a power outage in the store and the cashier is conducting business by accepting cash.

The second is issued when a refund is made for a product or service. It is issued both when paying in cash and by credit card.

Reports also appeared on the opening and closing of shifts, closing of the fiscal accumulator and confirmation of the CRF on the reliability of the received data. They are not included in the list of accounting documents, so we will not consider them in detail.

On August 18, Resolution of the State Statistics Committee of the Russian Federation No. 88 of 1998 approved unified forms of primary documents required for conducting cash transactions. Government Decree No. 470 canceled the completion of some papers.

Important! The authorities' decision is advisory. Individuals carrying out entrepreneurial activities and enterprises have the right to maintain the same document flow when transitioning to a new system.

When maintaining a cash book online, you do not have to fill out the following forms:

- Act on resetting cash register counters (form KM-1).

- An act for taking readings from a cash register during repairs and connection to work (KM-2).

- Cash return act (KM-3).

- Journal of the cashier-operator (KM-4).

- A journal for recording data when using cash registers operating without an operator (KM-5).

- Certificates and reports from the cashier operator (KM-6).

- Documentation containing readings of cash registers (KM-7).

- Logbook for recording calls from technical specialists and recording work performed (KM-8).

- Act on checking cash at the cash desk (KM-9).

Important! According to legislative changes, business entities have the right to fill out optional papers in any form.

After compiling the journal

Since the journal is an accounting document, the procedure for its content and storage is determined either by law or by internal regulations of the organization. Regarding the storage of a document during the period of its validity, one thing can be said - it should be located either in the accounting department or next to the cash register in a place inaccessible to strangers.

After the journal expires, it must be transferred to the enterprise archive, where it must remain for at least three years, then it can be disposed of in compliance with the procedure prescribed in the legislation of the Russian Federation.

Corrections in the cashier-operator's journal - a sample of this document is required by most people working with cash in case of unexpected errors - can be easily found using the link on the website. The main difference between such adjustments is that in addition to the cashier’s signature, they require the signatures of the chief accountant and director.

What can result from an incorrect correction in the cashier-operator’s journal?

The procedure for adding edits to the cash journal

Where can I see an example of the fixes?

Filling out the cash register: sample

On the title cover, regardless of whether a self-developed or recommended journal form for registering receipts and expenditures is used, there must be the name of the organization, its structural unit where the cash desk is located, and the name of the form itself. In addition, you need to write the date when maintaining the form began, and the details of the person responsible for it (position and full name). It will look like this:

Inside the form, it is necessary to provide columns to indicate the following information for each cash order:

- order number and date of its preparation;

- amount of expense or income;

- a note indicating a brief purpose of the amount of money issued or received.

Numbers for incoming and outgoing orders must be assigned separately for each of these types of cash papers. Continuous numbering of income and expenses is not allowed.