The birth of a child is an important event that is always accompanied by a number of financial expenses. In this regard, the state, through employers, provides working pregnant women with support fixed at the legislative level. Things are more complicated in a situation where a citizen does not have an official place of employment. Receiving benefits in such circumstances will be accompanied by a number of nuances.

Contacting the residential complex

The first financial assistance that an expectant mother can receive is a fixed one-time payment when applying to a medical institution for registration. This could be an antenatal clinic, a private clinic that monitors pregnancy and has the right to issue documents for social security authorities. The amount of assistance is 628 rubles.

Important! You must register before the 12th week of pregnancy.

This payment is calculated:

- female students;

- women workers who were laid off at the enterprise due to its liquidation;

- women who are registered with the Employment Service;

- private entrepreneurs (including those who closed the state of emergency) who made timely contributions to the insurance fund.

The hospital issues a certificate indicating the duration of pregnancy, which is signed and stamped by the doctor. The certificate must have a stamp from the medical institution.

To receive funds, you must provide a certificate and write an application to the Social Insurance Fund (for entrepreneurs and students) or the Social Insurance Fund authorities at your place of residence (for the unemployed).

Categories of pregnant women who are not entitled to maternity payments

The legislation stipulates that not all unemployed citizens have the right to count on financial assistance.

In particular, child benefits will not be provided to such categories of young mothers:

- Unemployed housewives.

- Women who were not formally employed or had never worked.

- Young mothers who were fired by personal choice.

- Female students studying in the correspondence department and who do not have a place of employment. At the same time, women studying on a full-time course are not deprived of this right.

It is also important to note that, in accordance with Art. 6 and Art. 9 Federal Law No. 81, an unemployed young mother is considered a woman who meets the following parameters:

- the subject does not have an employment agreement;

- the person was dismissed 12 months before the birth due to the liquidation of the company, however, is currently registered with the employment center;

- a woman running a private business who has officially ceased this activity;

- student;

- a lawyer or notary practicing private consultations, which were also officially discontinued during pregnancy and childbirth;

- the wife of a soldier who is undergoing military service.

If a woman meets the given characteristics, then she will be assigned benefits. In other circumstances, financial support from the state is unlawful.

How to get maternity benefits for a non-working woman?

Family law > Maternity leave > How to get maternity benefits for a non-working lady?

The birth of a child always requires material costs.

The government has taken care of working women preparing to become mothers. They are protected socially and can receive maternity leave even before the birth.

What about unemployed expectant mothers? Do unemployed people pay maternity leave?

Maternity payments to a non-working mother in 2021

The procedure for paying various maternity benefits is regulated by Federal Law No. 255 of December 29, 2006.

In accordance with Art. 2 The following have the right to maternity benefits:

- persons working under employment contracts;

- municipal and city employees;

- personal entrepreneurs;

- other “self-employed” persons paying contributions to their social insurance.

You see, there is nothing written in the law about non-working mothers. As follows, these categories of persons are not provided with maternity leave.

This is explained by the fact that the so-called maternity payments are characterized as compensation for earnings that the expectant mother does not receive due to maternity leave. But a non-working lady does not have such income.

The exceptions are:

- Expectant mothers who were obliged to resign due to the liquidation of the employer.

- Unemployed female students of inpatient departments of educational institutions. They receive a scholarship amount regardless of whether they pay for their education or not.

Thus, maternity benefits are not provided to non-working mothers. But the government has provided other benefits for non-working mothers.

Social benefits for unemployed mothers

Regardless of employment, any pregnant citizen of the Russian Federation has the right to social benefits. She is entitled to different types of benefits for childbirth and child care.

The legislation provides for several forms of support for families. With all this, if previously child care benefits were not paid to unemployed mothers, now all categories of mothers can count on social payments.

After the birth of a child, parents have the right to receive 2 types of benefits, which are paid based on different criteria:

- child care allowance for up to one and a half years;

- regional child benefit.

Regional benefits are assigned and paid in all regions of the Russian Federation according to different rules and in different amounts.

There are a number of types of social support:

- One-time payments after childbirth.

- Monthly payments for child care up to 1.5 years.

- Other payments aimed at supporting families with young and minor children.

Payment amounts:

- The one-time payment for the birth of a baby in 2018 is 16,350.33 rubles.

- Monthly support for the first child up to one and a half years old is 3065.69 rubles. At the birth of the second, the benefit is 6131.37 rubles every month.

At the birth of a baby, a previously unemployed mother will be offered a choice of 2 options for receiving cash payments:

- Subsequent transfers of unemployment funds

- Replacing unemployment payments with child care benefits.

Fundamentally! From 01.01. In 2010, a rule was introduced stating that in order to receive monthly child care benefits for children up to 1.5 years old and regional payments, a non-working mother must be registered in the same place as the child.

Other types of state support for unemployed mothers

The law of the Russian Federation allows low-income families, where the woman works informally or does not work at all, to receive food for the baby from the dairy kitchen at the birth of a child until the child reaches 2 years of age.

If there is no dairy kitchen near the family’s place of residence, the social security service must assign the family permanent payments in the form of foreign currency compensation equal to the price of food products. The amount of such compensation is set at the regional level.

The size of these payments depends on the number of children. Similar support is provided in this case if the income received for each family member does not reach the official minimum subsistence level.

In addition, the amount of state support depends on the region of residence of the family and is usually about 300 rubles per month for each child. Thus, a mother with 2 children will additionally receive about 600 rubles per month.

Payments also apply to adult children who study in professional, higher or secondary technical educational institutions. Mothers transfer their payments every month right until the child’s graduation.

If a family has an unemployed mother and an employed father, then only the mother has the right to claim benefits for caring for a newborn.

This benefit is intended only for the family member caring for the child. According to default, these duties are considered to be performed by a non-working family member.

If the mother is not working, the working father is also not entitled to leave to care for the baby.

The answer will be: “In this case, payments are due, but not all and in a smaller amount than for employed citizens.”

According to the law, unemployed women are not entitled to maternity leave (except for those women who were fired during the liquidation of an enterprise and students).

Unemployed expectant mothers are only entitled to receive child benefits, which are accrued after the birth of the child.

To arrange maternity payments, a non-working mother must contact the public welfare authorities at her place of registration. She needs to prepare a package of documents confirming the right to use state aid.

Here's what you need for this:

- Application with a request for the purpose of the monthly payments due (written in random form).

- A certificate purchased from a medical institution confirming pregnancy for more than 30 weeks.

- An extract from the work book indicating the last place of work, certified by a notary.

- A document from the employment center officially confirming your unemployed status.

- Certificate from the University confirming full-time study (for female students).

After 10 days from the date of submission of the application and documents, employees of the social protection department must decide whether to accrue benefits to the pregnant lady.

To design financial support from the country for a newborn, an unemployed lady must also contact the social security service and provide the following set of documents :

- passport;

- baby's birth certificate;

- birth certificates for other babies (if any);

- certificate of family composition;

- account details to which benefit payments will be made;

- certificate of absence of unemployment payments.

Making payments and accruing state support to pregnant women and mothers is strictly regulated by law.

If the lady's request is satisfied, transfers will be made every month no later than the 26th. Funds can be transferred by mail or transferred to a bank account.

How much pay?

Next, we will present the types and amounts of state support that various categories of unemployed women who have given birth to a child can count on in 2021:

- Maternity benefits: only for women dismissed due to the liquidation of the employer, registered with medical institutions within 12 weeks - 613.14 rubles.

- Maternity benefits for those dismissed during pregnancy - 34473.60 rubles, for students - in the amount of a scholarship.

- One-time benefit for the birth of a child: for all categories of ladies in the amount of 16,350.33 rubles.

- Monthly benefits up to 1.5 years: 3065.69 (when caring for the first child); 6131.37 (when caring for the second and subsequent children). For ladies laid off due to the liquidation of an enterprise - 40% of her average earnings.

Naturally, the amount of payments to unemployed pregnant women and mothers with children is very small.

Yet, this assistance sometimes turns out to be the only financial protection for non-working mothers.

Social maternity payments for unemployed women

Due to the fact that unemployed pregnant women cannot receive maternity benefits in the same amount as working citizens, the state provides this category of the population with special social benefits.

It is assumed that, regardless of the availability of a job, any young mother in the Russian Federation can apply for state social support.

Don't miss: Will there be an increase in pensions in Moscow and the region?

In the past, maternity benefits were not provided to unemployed women. However, at the moment, the legislation provides for a number of programs to support families with young children.

Upon the birth of a baby, parents have the right to claim the following types of payments::

- child care allowance until he reaches the age of one and a half years;

- regional benefit in connection with the birth of a child.

Similar amounts are assigned in all federal subjects of Russia, however, the rules, as well as the volumes of funds issued, differ.

Social support for pregnant women and young mothers without jobs consists of providing them with the following types of funds::

- lump sums due after the birth of a child;

- child care allowance for up to 1.5 years, accrued every month;

- other payments assigned as state support for families with young children.

The benefits are as follows:

- lump sum payment given to a woman upon childbirth - 16,759.09 rubles.

If twins are born, the benefit is doubled. In the event of a stillbirth, no benefit is paid.

- monthly allowance for caring for an offspring up to one and a half years old - 3142.33 rubles. for the first baby (at the birth of the second, the benefit is 6284.65 rubles).

In conditions where the woman who gave birth lives in a territory for which the use of increasing regional coefficients is valid, all benefit amounts will be increased.

What benefits are available to non-working mothers?

If a pregnant woman does not work, then she has the right to count on any federal payments in connection with the birth of a child only in the event of bankruptcy of the enterprise (previous place of work), when registering with the Employment Center, in the event of dismissal from work already during pregnancy, or maternity leave, as well as in case of study (full-time students).

| Category | Type of social benefit | |||

| For pregnancy and childbirth | Upon early registration at the antenatal clinic | At the birth of a child | Child care allowance up to 1.5 years old | |

| Pregnant women who are not working due to the liquidation of the enterprise (and are registered with the Central Employment Service) | Monthly. In the amount of the average salary for the previous 2 years of work | One-time use. RUB 628.47 | One-time use. RUB 16,873.54 | Monthly. In the amount of 40% of the average salary for the previous 2 years of work |

Important! Payment of maternity benefits to former employees of liquidated enterprises is made from the Social Insurance Fund (at the expense of employer payments for the employee to the Social Insurance Fund and the Pension Fund).

The same payments are also available to women who quit their jobs during pregnancy or maternity leave. The only difference is that a one-time benefit for the birth of a child and a child care benefit under the age of 1.5 years will be paid to them not by the social fund (FSS), but by the territorial social protection authorities.

| Category | Type of social benefit | |||

| For pregnancy and childbirth | Upon early registration at the antenatal clinic | At the birth of a child | Child care allowance up to 1.5 years old | |

| Unemployed pregnant women who are registered with the Employment Center | Monthly. For a maternity leave of 140 days, the amount of payments will be 2861.60 rubles. For maternity leave of 156 days - 3188.64 rubles. For maternity leave of 194 days - 3965.36 rubles. | One-time use. RUB 628.47 | One-time use. RUB 16,873.54 | Monthly. For the first child, RUB 3,163.79 is paid. For the second and subsequent children - 6284.65 rubles. |

If a woman is registered with the central health care center, then payments in connection with pregnancy and childbirth are provided to her by local and territorial social protection authorities.

| Category | Type of social benefit | |||

| For pregnancy and childbirth | Upon early registration at the antenatal clinic | At the birth of a child | Child care allowance up to 1.5 years old | |

| Full-time students of educational institutions (persons without compulsory social insurance) | Monthly. In the amount of the scholarship | One-time use. RUB 628.47 | One-time use. RUB 16,873.54 | Monthly. For the first child, RUB 3,163.79 is paid. For the second and subsequent children - 6284.65 rubles. |

In the case of pregnant women studying full-time at universities and other educational institutions, benefits for the birth and care of a child (up to 1.5 years) are paid by social security, and other benefits are paid by the educational institution.

Sick leave

To receive maternity benefits for non-working women, you must also belong to a certain category of the unemployed population:

- full-time students;

- dismissed as a result of liquidation of an enterprise (private entrepreneur).

A sick leave certificate for pregnancy and childbirth is issued at a residential complex or other medical institution where pregnancy monitoring is carried out. It is issued at 30 weeks (or 28 if there is more than one fetus). For non-working citizens, it will provide a fixed amount of money, which is tied to the minimum wage. In 2019, the payment is 20.81 rubles per day. Thus, with a standard sick leave of 140 days (singleton pregnancy, childbirth without complications), the amount will be 2913.4 rubles.

Don't miss: Electricity Tariffs

To receive a financial payment, you must provide a sick leave certificate at the place of study (for full-time students), to the Social Insurance Fund (for former entrepreneurs), to the USZN (for unemployed citizens). It is also necessary to write an application of the appropriate sample, provide a copy of the work record book and a certificate from the Employment Service.

Birth benefit

Regardless of a citizen’s employment status, each child born is entitled to financial assistance in the amount of a fixed amount. It can be issued to any of the parents or a person who will officially perform their functions (for example, a guardian). In 2019, the fixed benefit amount is 16,759.09 rubles. This amount is also due to adoptive parents when adopting a child.

The benefit is paid to the employed mother or father, but if both are unemployed, then the accrual is made to the one who will actually care for the child. To provide financial assistance, you must contact the social security authority at the place of registration no later than six months from the date of birth of the baby.

A one-time allowance is provided to the wives of military personnel who are undergoing military service. In this case, it is 26,539.76 rubles. Registration also takes place at the USZN.

Monthly payments

After the birth of a baby, each mother or person who will care for him has the right to monthly compensation payments until the child reaches 1.5 years of age. If sick leave was previously issued, then these payments come into effect after its expiration.

For the non-working population, the amount of payments will be fixed and amount to:

- for the first child – 3142.33 rubles/month;

- for the second, third, etc. – 6284.65 rubles/month.

Important! If a woman decides to go to work before the child is one and a half years old, payments stop from her first working day.

Regardless of employment, the wife of a serviceman has the right to monthly financial assistance in the amount of 11,451.86 rubles until the child reaches 3 years of age or the end of the father’s service. Benefits are paid from the social protection fund.

How are child benefits calculated in 2021?

The basis of this benefit is 300 rubles. This amount is increased by the indexation coefficient and the regional coefficient. The amount of payments depends on the date of sick leave and childbirth, since they are the insured event. If the certificate of incapacity for work was issued before January 31, 2021, the amount of the benefit without taking into account the regional coefficient is 675 rubles. From February 1, the minimum benefit will be 708 rubles.

New maternity benefit in 2021

- for the first child born or adopted from January 2020 – 483,881 rubles;

- for the second born or adopted child in a family where the eldest child was born before 2021 - 639,431 rubles;

- for the third child born or adopted from 2021 in a family where they could not take advantage of the right to maternity capital - 639,431 rubles.

To receive benefits, an unemployed mother must collect the required package of documents and contact the place where the cash payment is issued. All documents must be current as of the date of application, copies submitted in proper form (clear, without erasures or corrections).

All mothers in Russia, including the unemployed, receive one-time financial assistance to provide the baby with proper care immediately after birth. For these purposes, the regions are allocated money from the federal treasury, and they then make payments from local budgets.

Payment of sick leave

Taking into account annual indexation from February 1, 2021, the basic amount of benefits for unemployed pregnant women was 675 rubles. The total amount will be different in the regions of the country, as there is a system of regional coefficients. For example, the coefficient may take into account living in areas with a harsh climate (in the north), in rural areas.

- the child's mother or a relative caring for him, if there is no mother. Officially appointed guardians are also entitled to this benefit. If there are actually several carers, the benefit is due to one person;

- from the day of the child’s birth, but not earlier than the day the child’s father begins military service;

- until the earlier of the dates - the day the child reaches the age of 3 years or the day the child’s father completes military service under conscription.

When talking about the size of the B&R benefit in 2021, you should remember its maximum and minimum values. Both depend on the minimum wage, therefore changed from 01/01/2021:

- the maximum that can be received per day for sick leave according to BiR in 2021 is 2,434.25 rubles (accordingly, standard sick leave for 140 days cannot be paid in an amount greater than 340,795 rubles);

- minimum per day (those for whom benefits are calculated according to the minimum wage will receive) in 2021 - 420.56 rubles (for non-extended sick leave they will pay 58,878 rubles).

Additional regional benefits for pregnancy 2021

In addition, the size of the payment in St. Petersburg is also affected by whether the pregnancy is multiple. If, for example, twins are born, then the children will be counted “in order”: first and second, and payment will be made for each (Social Code of St. Petersburg as amended from 10/07/2020).

15 Apr 2021 semeiadvo 538

Share this post

- Related Posts

- Pay veterans in Chuvashia if I have completed experience in the Nizhny Novgorod region

- How long does it take for social security to transfer benefits to veterans of labor after accrual?

- What does the title of labor veteran in the Primorsky Territory give?

- 50 percent discount on train tickets for disabled people of group 3

Maternal capital

This payment is not related to the employment of citizens and is paid after the birth of the second child. It has a fixed amount of 453,000.26 rubles. It can be used as follows:

- for training;

- to improve living conditions;

- as additional funds to support a child up to 1.5 years old (no more than one subsistence minimum per month);

- to pay for kindergarten or nursery.

Answers to the most common questions about payments to stay-at-home mothers: video

Who is paid maternity benefits?

However, there are such women, and during their work they faithfully paid taxes. Therefore, due to the presence of a “ceiling” of payments, expectant mothers want to know how to calculate the amount of the required benefit themselves. The process is not very complicated, you just need to understand its basis and main principles.

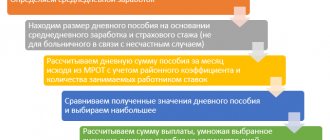

Procedure for calculating maternity pay

However, there are women who voluntarily make such sacrifices, because... their daily income at work significantly exceeds the amount entitled to sick leave. Also, many continue to work because of a “gray” salary - the real income is high, but the woman is officially paid in the amount of the subsistence level (SL).

Depending on the situation due to which the woman lost her job, the amount of benefits provided may vary. For example, if we are talking about a girl who has never worked and is a student at the time of maternity leave, the amount of payment for her will be calculated based on the amount of the scholarship provided.

When applying to a government agency to receive a payment, you should take into account the fact that the documents will be reviewed within ten working days. Accordingly, the answer will be given precisely after this time.

Where to apply to receive

If a family is in need and is below the poverty line, it is entitled to additional cash payments to support the child until he reaches adulthood. The final amount of such state support depends on how many children are being raised in the family.

You might be interested ==> What is due for a third child in 2021 in Samara

In case of adoption of a disabled child, a child over seven years of age, as well as children who are brothers and (or) sisters, the benefit is paid in the amount of 137,566 rubles 14 kopecks for each such child. From February 1, 2021, the amount is RUB 144,306.88.

The amount of the maximum child care benefit for a child up to 1.5 years old in 2021 depends on the mother’s earnings for two calendar years, but not more than 27,984 rubles 66 kopecks . In 2021, the amount was 29,648 rubles 48 kopecks.

Maternity payments in 2021

The minimum care allowance until February 1, 2021 for unemployed (housewives), full-time students and individual entrepreneurs for the first child, second and subsequent children is 6,752 rubles .

The amount of payments is now calculated taking into account the new billing period (2019 and 2021) and the size of the insurance base - for two years its size amounted to 1,777 million rubles. When calculating the amount of benefits, the minimum wage this year is also taken into account - 12,792 rubles. Since January, all regions that used the offset mechanism to calculate benefits now receive benefits from the Social Insurance Fund. This means that all regions now use the same algorithm for calculating benefits.