Journal of vacations actually used by employees

Cover: golden cardboard Removable cover made of transparent PVC Holes for lacing and archiving allows you to always have information about employee vacations at hand.

- Maternity leave

- Leave without pay

- Additional paid leave

- Holiday to care for the child

- Annual basic paid leave

- Study leave

Annual paid leave is 28 calendar days.

Reserve for vacation pay: postings

According to PBU 8/2010, an organization’s obligations to pay vacation pay are formed in accounts that also reflect wages. Accrual is carried out according to Kt 96. The debit of the account can be as follows:

- 20 – accruals to employees involved in the main production activities;

- 25 – total production costs;

- 26 – expenses of an economic, managerial nature;

- 44 – costs associated with the sale of goods;

- 08 – investment of funds in non-current assets, etc.

Accounting for vacations in the organization

Let's try to make a list of what the HR department should do in this direction: The vacation schedule is given in the journal in the “Documents for the topic of the issue” section, the employee notification form is also there, and we will look in detail further at the main document in which all vacation records are kept .

In some cases, labor legislation provides for vacations lasting longer than the specified time. If the employment contract contains a condition that annual leave is granted to the employee for a period of less than 28 days, then this condition is invalid.

Employee personal card. Section VIII “Vacation” Periods of work giving the right to annual leave We must not forget that not all periods of work in the organization give the right to annual leave. In this matter we must rely on Art. 121 Labor Code of the Russian Federation. The length of service that gives the right to annual basic paid leave includes: - time of forced absence in the event of illegal dismissal or suspension from work and subsequent reinstatement to the previous job; — the period of suspension from work of an employee who has not undergone a mandatory medical examination (examination) through no fault of his own; - the time of unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year.

Let's start keeping records of vacations of the organization's employees. Set up a vacation schedule for the organization.

In the previous section, we planned vacations in management accounting.

Below we will look at how a similar task is performed in regulated personnel records. In the “Personnel Accounting” interface, open the “Personnel Accounting” menu item, then “Accounting for Absenteeism” and “Entering Vacation Schedules”.

Figure 3.62 Interface Personnel records of organizations.

Entering a vacation schedule The program will display an empty list of documents. Let’s add a new line, and a new document “Entering the organization’s vacation schedule” will open in front of us.

Let's put the document creation date, January 31, 2008, in the “from” field. Figure 3.63 Filling out the document with management accounting data The tabular part will be filled with information from the management vacation schedule. In this way, we will avoid the need to re-enter data that was already entered into the program earlier.

How to calculate the balance of vacations for the winter period in 1s

The program has specialized documents for entering initial data:

- Initial staffing arrangement of employees

- Using the document, personnel data of employees is entered as of the date of start of operation of the program - Initial wage arrears

- In the same document, but with a minus sign, the debt of employees to the organization is recorded, which must be taken into account when the next payment of wages is made. The amounts paid in the program are taken into account by the month of accrual, so if the salary for the previous month was paid in full, then the document does not need to be entered - Periods paid before the start of operation

- The document is intended to reflect situations where, on the date of start of operation, employees are absent (on vacation).

Vladislav Losev, systems engineer of the intensive growth department. How and what document in the program “1C: Salary and HR Management 8”, ed. 3.1, the formation of estimated liabilities is implemented, with which reports you can track the entered information, as well as how to register balances.

The estimated liability, in simple terms, is how much money our organization needs to pay employees for the unused vacation they have accumulated if we need to fire everyone.

All organizations, except small enterprises, banks and government agencies, are required to reflect estimated liabilities in their accounting records.

Such settings are necessary for issuing personnel orders for additional leave, as well as for correct calculation and accounting of leave time.

In addition to the above settings, as well as the type of annual leave, all other details of the calculation type describing additional leave most often coincide with the details of the calculation type corresponding to the main annual leave.

Calculation types intended for calculating compensation for unused vacation days refer to the plan of calculation types “Additional accruals for the organization.”

The system has introduced six predefined types of calculations, corresponding to compensation for vacation upon dismissal and without dismissal, deductions for unworked vacation days, calculated on calendar days or based on a six-day working week.

Data for each type of leave and the overall result are contained in the corresponding columns of the report:

- Vacation balances report displays more detailed information about vacation balances by type of vacation and working years:

- Certificate of Vacation Remaining report allows you to display the most detailed information, accurate to the registrar document. The advantage of generating a certificate through reports is that the report can display information for any date:

Link How the employee used his vacation

Information about the remaining vacation days for an employee can be quickly requested when entering a vacation order directly from the Vacation . To do this, use the link How an employee used vacation .

Therefore, the acquisition of the right to time off for all categories of employees is registered in the system with a special document “Right to additional days of vacation” (see Fig. 5).

Rice. 5

The balances of employees’ managerial leaves are displayed in the “Employee’s managerial leaves” report, called from the employee’s card. Note that in management accounting, the working year is considered to be the calendar year from January 1 to December 31 or from the moment the employee is hired until the end of the year.

Vacation planning is carried out using the vacation approval tool “Vacation Schedule”.

Double-clicking on the employee's last name allows you to open the employee's vacation card, which records all approved and actually used vacations, as well as the balance of vacation at the current moment.

The program “1C Salary and Personnel Management 8.3 (3.1)” “can” calculate the number of days of annual leave due to an employee, their use and balance.

Vacation amount

By default, the calculation of days of annual paid leave is carried out based on the amount established by the labor legislation of the Russian Federation - 28 days per year worked. The program also allows for the appointment of “additional” annual leave.

This can be done both for all employees of the organization (when setting up the type of leave), and for a position in the staffing table (in a document approving or changing the staffing table) or directly for an employee (in a document of hiring or personnel transfer).

You can also assign “northern” leave for employees of the entire organization or a separate unit (in the form of an organization or a division).

The main forms of directories consist of two parts: a list of employees and a breakdown of the balance of vacations for the employee (see Fig. 9). Depending on the position of the cursor on the left side of the form, the right side displays data on vacation balances for the specified employee.

Using the “Change” button (or double-clicking on any field on the right side of the reference form, or pressing Enter), an element form can be opened containing information on one selected employee. The form will display lines corresponding to all types of leave for all years of the employee’s work.

In each of these lines, in the “Number of days” column, you must indicate the number of vacation days unused by the employee for the year indicated in the line.

Vacation balances can also be recorded automatically using a routine task (see Fig. 10).

Important

For the periods registered in it, the program will not accrue salaries. In the timesheet and other reports, periods will be designated according to the specified type of period (status).

These documents are combined into the journal Data for the start of operation (Main → See also → Data for the start of operation).

This article discusses the process of updating information about vacation balances in the program in the event that employees have used their vacations since the moment they were hired, but these facts are not properly reflected in the program. The first part discusses the mechanism for calculating the vacation balance, starting from the date the employee was hired, if balances were not entered.

The second part discusses the process of entering vacation balances from previous years and calculating balances as of the current date, taking into account the entered balances.

This document also registered the initial balances of vacations.

Information about vacation balances is contained in the Vacation :

By clicking on the link in the Vacations , a form opens in which you can view and edit in detail the employee’s vacation balances:

The tabular part of the Leave Rights must reflect all types of annual leave entitlement to the employee and indicate the number of days per year for each type of leave.

In the tabular section Vacation balances by working years, balances for each type of vacation are entered by working years.

Some of the preset views may or may not be present in the list, depending on the configuration settings*:

- Basic;

- Additional leave for study (paid/unpaid);

- Without compensation (Part 1 of Article 128 of the Labor Code of the Russian Federation);

- No refund (part 2 of the same article);

- For harmfulness;

- For the period of sanatorium-resort treatment (at the expense of the Social Insurance Fund);

- Northern.

*Vacation No. 1 will always be on the list, and all others will depend on the settings.

For example, employees of a company are given additional leave for irregular working hours in the amount of 3 days, so it must be added as a new one to the list of types (Fig. 1):

- Click on “Create”;

- The “Vacation type – creation” window appears;

- Fill in the fields:

- Name – indicate in the form in which it will be displayed in our list.

In accordance with the Labor Code of the Russian Federation (Chapter 19), each employee has the right to annual paid leave of at least 28 days; the maximum duration of leave is not limited.

The employee may also be granted additional leave provided for by the Labor Code of the Russian Federation (in connection with working conditions) or a collective agreement.

The duration of vacation is calculated in calendar days. The length of service that gives the right to leave includes the time of actual work and paid leave, as well as the time when the employee was removed from work through no fault of his own. An employee has the right to leave after six months from the date of hire, however, by agreement of the parties, leave can be granted earlier.

Part of the annual leave exceeding 28 calendar days may be replaced by monetary compensation.

When posting such a document, the system records the fact of compensation and takes it into account when further calculating the vacation balance.

Management Accounting

In management accounting, the main task of the mechanism for calculating vacation balances is to determine the required amount of vacation for vacation planning purposes.

The amount of annual management leave, the same for all employees of the enterprise, is stored in the information register “Personnel Accounting Policy” and is indicated in working days. If there is no entry in the register, the amount of leave is taken to be 20 working days. If there is an entry in the register, but the number of vacation days is not specified, the vacation amount is assumed to be 0.

In addition to the basic annual management leave, employees may have the right to compensatory leave, that is, additional days of vacation.

To do this, you can use a special report by clicking on the hyperlink “How did the employee use vacation?”

This report allows you to see not only the periods of previously used vacations, but also the number of accumulated days.

Where to see vacation balances in 1C ZUP: how many vacation days are left

In the “Personnel” section there is a special subsection “Personnel reports”. In it you can find reports on vacation balances (full and short). Their difference lies only in the interface, sections and the amount of output data.

We will generate a full version of the report on vacation balances for S. V. Bazhova, as an employee of Kron-Ts at the end of October 2020.

After all, most errors lie in periods that have long been closed, and an attempt to correct them leads to the emergence of new problems.

By the way, one of the global advantages of “1C: Salaries and HR Management 3.0” and “1C: Accounting 3.0” is protection against erroneous actions.

The program monitors the documents that the user tries to post and does not allow this to be done if the document is formatted incorrectly. And when to the ZUP 3 database.

0 data with errors is imported, these errors immediately bloom in a lush color in the warning window.

Quite recently in my practice there was a typical case. It was necessary to transfer data for an organization that had been working with the 1C: Salaries and Personnel 7.7 program for more than fifteen years - almost from the moment this configuration appeared. The number of errors identified after the transfer went off scale and caused an obsessive desire to throw the server into the fire.

The same certificate is available from the employee’s form in the reference book using the “Print” command – Certificate on employee leaves.

How and where to view employee vacation balances in 1C ZUP 3.1

You can view the remaining vacation days of all employees (or part of them, depending on the settings) in the reports “Vacation balances (consolidated)” and “Employee vacation balances by type” in the personnel reports section (Personnel/Personnel reports):

The report “Vacation balances (consolidated)” displays periods of the working year and vacation balances for each employee:

The report “Employee leave balances by type” is generated with a breakdown by type of leave.

Unfortunately, we are physically unable to provide free consultations to everyone, but our team will be happy to provide services for the implementation and maintenance of 1C.

The fact that balances are recorded is reflected in the corresponding release report.

Vacation balances must also be filled in when starting to use the program, when entering initial data.

If the company has existed for some time, then most often orders on hiring employees, transfers and dismissals are transferred completely, and data on orders on leave are transferred only for the last year or two.

In this case, to ensure correct calculation of the vacation balance, it is necessary to enter data on vacation balances either as of the start date of accounting in the program, or as of the current date (for the last working year).

You can enter vacation balances manually, after they have been recorded, in the form of the directory element “Vacation balances of organizations from previous years” or “Vacation balances from previous years.”

Why does the error “The last vacation balance period must capture the balance date” occur and how to fix it

Often, when entering vacation balances, users encounter an error:

The last period of vacation balances “Main” should cover the date of balances:

The fact is that the last working year for which vacation balances are entered must be consistent with the date the balances were entered: the date the balances were entered must belong to this particular year.

Source: https://supcore.online/kak-v-1s-poschitat-ostatok-otpuskov-za-period-zkgu

Accounting for vacations in the HR department

“Personnel officer.

We recommend reading: Medical certificate for a driver over 50 years old

Personnel records management”, 2010, N 9 The article describes in detail the actions of a personnel department employee to record employee vacations. How to take into account the overlap of vacations, days taken in advance for vacation, accumulated time off, transfers from last year, and much more. Full range of actions for accounting for vacations Let's try to make a list of what the HR department should do in this direction: - drawing up a vacation schedule; — reminders about employees going on vacation as scheduled; — accounting for vacations of arbitrary types and types; — accounting for periods for which the employee is entitled to leave; — accounting for additional leaves according to the staff schedule (irregular working hours, hazardous working conditions); — control over the overlap of vacations with each other; — tracking the uniformity of employees going on vacation; — control over the overlap of vacations, business trips and sick leave; — possibility of extending vacations; — accounting for vacation compensation.

Registration of vacations: practical recommendations and organization of accounting in the program - 1C: Salary and Personnel Management 8

Registration of vacations: practical recommendations and organization of accounting in the program “1C: Salary and Personnel Management 8.0” Employees engaged in seasonal work are also provided with paid vacations at the rate of two calendar days for each month of work.

Annual leave is the sum of main and additional leave. The differences between them are the duration, grounds and order of provision. Basic leave is guaranteed for all employees. Its minimum duration is 28 calendar days. Certain categories of workers (taking into account the nature, working conditions, health status, etc.)

d.) have the right to extended vacation, in particular: In this case, non-working holidays falling during the vacation period are not included in the number of vacation days.

Vacation balances in 1C ZUP 3.1

The Labor Code of the Russian Federation reserves the right to basic annual paid leave in the amount of 28 calendar days for each employee. Some categories of employees are also entitled to additional annual leave. The balance of annual leave due to employees in the ZUP 3.1 program is calculated automatically.

In this article, we will look at how to view vacation balances in the 1C 8.3 ZUP 3.1 program, how to enter initial vacation balances, and also consider why the error “The last period of vacation balances must capture the date of balances” may appear and how to eliminate it.

Where to see vacation balances in 1C 8.3 ZUP 3.1

The remaining vacation days can be viewed in ZUP 3.1:

- On the employee card.

- In personnel reports on vacation balances.

- In the documents Vacation , Dismissal .

How to view vacation balances from an employee’s card

There are two ways to find out the current vacation balances from an employee’s card.

- From the employee’s card, you can display a printed form of a certificate of vacation balances using the link Print – Certificate of employee vacations:

- You can view the current vacation balance, as well as generate a Certificate of vacation balance from the employee’s card using the Absences :

Reports on vacation balances

In the Personnel - Personnel Reports section there are several reports that allow you to obtain vacation balances for any given date.

- Vacation balances report displays information about vacation balances by type. Data for each type of leave and the overall result are contained in the corresponding columns of the report:

- Vacation balances report displays more detailed information about vacation balances by type of vacation and working years:

- Certificate of Vacation Remaining report allows you to display the most detailed information, accurate to the registrar document. The advantage of generating a certificate through reports is that the report can display information for any date:

How to enter vacation balances in 1C 8.3 ZUP

Vacation balances in 1C 8.3 ZUP can be entered in two documents: Initial staffing and Entering vacation balances .

Entering initial vacation balances using the Initial staffing document

If work in 1C ZUP 3 began after the transition from previous versions and the recommended data transfer option was used for the transition, then during the transition the document Initial staffing arrangement . This document also registered the initial balances of vacations.

Information about vacation balances is contained in the Vacation :

By clicking on the link in the Vacations , a form opens in which you can view and edit in detail the employee’s vacation balances:

The tabular part of the Leave Rights must reflect all types of annual leave entitlement to the employee and indicate the number of days per year for each type of leave.

In the tabular section Vacation balances by working years, balances for each type of vacation are entered by working years. The number of days must be calculated based on the start date of operation.

The rules for calculating and entering initial vacation balances in 1C 8.3 ZUP are discussed further in the article.

Document Entering vacation balances

The document Entering Vacation Balances can be used to enter the initial vacation balance for an arbitrary date.

The document Entering vacation balances “cancels” all previous data on vacation balances, i.e. from the date of entering balances, data previously entered on vacation balances will no longer be taken into account.

List of documents Entering vacation balances opens from the Main section - Vacation balances. In order for the link to be displayed in the interface, you must configure the navigation for this section:

You can also create a new document from an employee’s card using the link Create a document – Absences – Enter vacation balances:

The structure of the document and the rules for filling it out are similar to those described above for the form for entering vacation balances in the document Initial staffing :

- in the tabular section of Leave Rights - all types of annual leave entitled to the employee are indicated, indicating the annual number of days of leave;

- in the tabular section Vacation balances by working years - enter balances for each type of vacation by working years. Balances should be entered as of the Balance Date indicated in the header of the document.

Rules for entering vacation balances in 1C ZUP 3.1

1. Balances are entered as of the specified date, and it is sufficient to enter balances only for those past working years for which there are non-zero balances and be sure to enter the balance for the current working year.

Example 1

It is necessary to enter vacation balances for employee Ivanov I.I. as of 01/01/2019.

Source: https://BuhExpert8.ru/1s-zup/otpuska-i-komandirovki/raschet-ostatkov-i-planirovanie-otpuskov/ostatki-otpuskov-v-1c-zup-3-1.html

Vacation accounting and calculation of unused vacation balances

You can indicate the main and several additional leaves at once in one document - “Vacation”.

Calculation of vacation pay. In the “Vacation” document “1C: Salaries and HR Management 8”, along with vacation pay, you can also accrue wages for the days of the month preceding the vacation, as well as financial assistance for the vacation.

The “Vacation” document calculates personal income tax and other permanent deductions established for the employee (for example, professional contributions or alimony), by the amount of which the payment will be reduced. The tax register records the dates of payment of vacation pay and transfer of personal income tax.

How is the vacation reserve formed?

The legislation does not provide for a specific calculation algorithm. The enterprise must independently register it and consolidate it in internal documents. First of all, it is necessary to divide all employees into separate categories according to their wage accounts. For example:

- “main production” - persons performing the main work at the enterprise (accrual occurs according to Dt 20).

- “sales expenses” - employees whose activities are related to the sale of goods (their salaries are calculated according to Dt 44).

After completing this action, you can move on to solving the question of [how to calculate the vacation reserve]. There are several options for determining the desired value.

Average daily income

The first is based on the employee’s average daily earnings. In this case, the accountant must take the following actions:

- calculate the number of unused vacation days provided by law;

- determine the average salary for each category of workers, applying general rules;

- find the amount of vacation pay that must be paid to the employee using the following formula:

Holiday pay accounting

ACCOUNTING WITHOUT CREATING A RESERVE FOR THE UPCOMING PAYMENT OF HOLIDAYS to Andreev O.I.

Payment of vacation pay. You can pay vacation pay in “1C: Salary and Personnel Management 8” together with wages, with an advance payment, or during the interpayment period. During the inter-payment period, payment can be made directly from the “Vacation” document.

annual leave is granted for a duration of 28 calendar days from November 18 to December 15, 2005 inclusive. The billing period (August, September, October) has been fully worked out.

We recommend reading: Where to register in Moscow for school enrollment

Calculation of the average daily wage: (5,000 + 5,000 + 5,000) / 3 / 29.6 = 168.92 rubles.

Total amount of vacation pay / 28 x 168.92 = 4,730 rubles. Calculation of vacation pay to Andreev O.I.

made in November, the money must be paid no later than November 15.

13 calendar days of vacation fall in November, 15 in December. ACCOUNTING FOR RESERVES FOR UPCOMING PAYMENT FOR HOLIDAYS If by the time vacation pay is accrued the reserve has not been fully formed and the amount of accrued vacation pay exceeds the amount of the reserve, then the difference is reflected in account 97 “Deferred expenses” and written off against contributions to the reserve in subsequent months.

Features you need to know about

Creating a reserve is a financial procedure that is performed when approving rest days for employees. According to experts, it is an estimated liability. It is carried out in order to officially confirm the existence of the organization’s responsibilities to its staff as of the reporting period.

create a reserve for upcoming expenses to pay for vacations , with the exception of small businesses - which are allowed not to greatly burden themselves with accounting. Such rules are prescribed in PBU 8/2010 and the Accounting Law. Also see “Accounting on the simplified tax system”.

The legislation of the Russian Federation allows the following frequency (see table).

| When | Costs |

| Last day of every month | A difficult method, but the most accurate |

| Last day of each quarter | Many organizations choose this option because they consider it the most successful |

| Last day of the current year | Application is possible for enterprises that do only annual reporting |

The date for the calculations is determined by the organization itself and established in its accounting policies.

Vacation accounting

“Personnel officer.

Personnel records management", 2010, No. 9 in the personnel department. The article describes in detail the actions of an employee of the personnel department in accounting for employee leaves.

How to take into account the overlap of vacations, days taken in advance for vacation, accumulated time off, transfers from last year, and much more. Full range of actions for accounting for vacations Let's try to make a list of what the HR department should do in this direction: - drawing up a vacation schedule; Provide leave │Personnel number│ position (specialty, profession) A. annual basic paid leave for │ 28 │ calendar days; annual additional paid leave, educational, without pay and others (specify) from » «__________________ 20.

by "______________ 20 V. Total vacation for │ 28 │ calendar days position personal signature signature transcript Based on the order, notes are made: - in the Certificate Card in form 417 (for budget organizations) or the Personal Card of the employee in form No. T- 2 (for other organizations) - in the Personal Account (Form No. T-54) and the calculation of wages due for leave is made in the Note - calculation of the provision of leave (dismissal) in Form 425 (for budget organizations) or in Form No. T -60

“Note-calculation on granting leave to an employee”

(for other organizations).

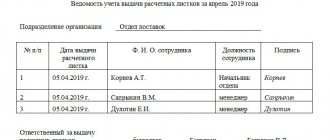

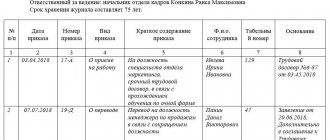

Leave order log form

The execution of orders for the provision of vacation periods is carried out by the employee whose duties include this function. Usually this is an employee of the personnel or other service responsible for relations with personnel.

A HR specialist is also usually responsible for maintaining the accounting log; in different organizations, the position of such an employee may be called differently. The main thing is that the duties of this employee indicate the need to take into account approved personnel orders for the provision of leaves and record information about them in a special logbook.

According to the law, an organization has the right to use for accounting the recommended standard form of registration books and journals or one developed independently. With regard to the journal for registering leave orders, the standard form has not been approved, so the composition of this document remains at the discretion of the organization.

How to reflect the accrual and payment of vacation pay in accounting

Procedure for paying vacation pay Pay for your vacation no later than three days before it starts. At the same time, the Labor Code does not prohibit paying vacation pay earlier (Part.

9 tbsp. 136 of the Labor Code of the Russian Federation). Situation: on which days should the three-day period for payment of vacation pay be counted - calendar or working days? Calculate the deadline for payment of vacation pay based on calendar days. After all, if the Labor Code does not directly indicate which days to count for a particular period, it is necessary to proceed from the calendar.

This procedure is provided for in Article 14 of the Labor Code of the Russian Federation, similar conclusions are expressed in the letter of Rostrud dated July 30, 2014 No. 1693-6-1. Situation: is it possible, at the request of an employee, to pay him vacation pay after he returns from vacation?

How to correctly calculate vacation pay in 2020. Examples and calculation calculator

For 9 years, Kontur.School has answered hundreds of questions about calculating vacation pay. Every year we conduct webinars and courses and know what an accountant needs on this topic. In this article you will find a step-by-step procedure for calculating vacation pay, an online calculator, practical examples and video advice from one of our useful webinars.

All employees of the organization can count on annual basic paid leave. In general, its duration is 28 calendar days.

The procedure for calculating vacation pay

The procedure for calculating vacation pay is regulated by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (hereinafter referred to as Decree 922). To calculate the average salary for vacation pay, you need to perform a number of steps. Let's look at it step by step.

Step 1. Determine the composition of payments made to the employee in the billing period

To calculate average earnings, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments (clause 2 of Resolution 922).

That is, payments that must be included in the calculation of average earnings must be fixed in the company’s local regulations (for example, in the Regulations on Remuneration) and accrued for labor, for work - they must be wages.

The following cannot be included in the calculation of vacation pay:

- guarantees (for example, average earnings during a business trip, during vacation);

- compensation (for example, compensation for the employee’s use of personal transport for business purposes);

- social payments (for example, financial assistance).

Bonuses are included in the calculation of average earnings in a special manner, which is named in paragraph 15 of Resolution 922.

Step 2. Determine the billing period

The calculation period for calculating average earnings is 12 calendar months preceding the period during which the employee retains the average salary (clause 4 of Regulation 922).

A calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive). For example, if an employee goes on vacation in February 2020, then the calculation period will be the period from February 1, 2019 to January 31, 2020.

Time, as well as amounts accrued during this time, are excluded from the billing period if:

- the employee retained his average earnings in accordance with the legislation of the Russian Federation, with the exception of breaks for feeding the child provided for by the labor legislation of the Russian Federation;

- the employee received temporary disability benefits or maternity benefits;

- the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

- the employee did not participate in the strike, but due to this strike he was unable to perform his work;

- the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

- in other cases, the employee was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

In the calculation of average earnings for vacation pay, only those days (hours) should be included in which the employee was present at work, according to the schedule established for him, and performed the work provided for in the employment contract concluded with him upon employment.

In practice, cases may arise that differ from the standard ones.

For example, in the 12 months preceding the event, the employee did not have actually worked days or actually accrued wages.

What to do in this case? Average earnings are determined based on the amount of wages actually accrued for the previous period, equal to the calculated one (clause 6 of Resolution 922).

Webinar about vacation pay

Calculation and accrual in 2020. Analysis of complex practical situations

More details

Example

Lozhkina Vera goes on vacation in February 2020. Calculation period: from February 1, 2020 to January 31, 2020. At this time, Lozhkina was on maternity leave. And in the period from February 1, 2020

until January 31, 2020 (preceding the period from February 1, 2020 to January 31, 2020), she worked and received a salary. In this case, the average salary for vacation pay can be calculated based on this period.

Also, the accountant may be faced with a situation where the employee did not actually have accrued wages or actually worked days for the billing period and before the start of the billing period.

In this case, the calculation period must be determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of the occurrence of the event that is associated with maintaining average earnings (clause 7 of Resolution 922).

Step 3. Calculate average earnings for vacation pay

Online training at Kontur.School

Advanced training and professional development courses for accountants

View schedule

The average daily earnings to pay for vacations provided in calendar days are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days (29.3) (clause 10 of Resolution 922).

An example of calculating vacation pay when the billing period is fully worked out

The accountant calculated vacation pay for Anton Kostin, who is going on vacation from January 21 to January 29, 2020. Billing period: from January 1, 2019 to December 31, 2020. Every month during the billing period, Kostin was paid a salary based on his salary in the amount of 30,000 rubles The vacation pay accrued by the accountant will be: (30,000 rubles * 12 months) / 12/29.3 * 9 = 9,215.02 rubles.

If one or more months of the billing period are not fully worked, then the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.3), multiplied by the number of full calendar months, and the number of calendar days in incomplete calendar months (clause 10 of Resolution 922). In this case, the number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.3) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in a given month (clause 10 of Resolution 922).

An example of calculating vacation pay when the entire pay period has not been worked out

Grishin Victor works at Astra LLC. In July 2020, he goes on annual basic paid leave for 14 calendar days. The employee's salary is 20,000 rubles. In August 2020, Grishin was on sick leave for 4 days, and for this month he was paid a salary of 16,190.48 rubles. Let's calculate the average earnings for the vacation period of Victor Grishin:

- We determine the composition of payments that should be included in the calculation of average earnings: 20,000 * 11 + 16,190.48 = 236,190.48 rubles.

- We determine the number of days that should be included in the calculation of average earnings: (29.3 * 11) + (29.3/31 * (31-4)) = 322.3 + 25.52 = 347.82 days.

- We calculate the average daily earnings% 236,190.48/347.82 = 679.06 rubles.

- We calculate the accrued amount of vacation pay: 679.06 * 14 = 9506.83 rubles.

Remember that annual leave can be divided into parts. In this case, when granting each part of the vacation, the billing period will be determined anew each time.

For example, an employee was on vacation twice in 2020: in June - 14 calendar days and in October - 14 calendar days. The calculation period for calculating vacation pay that fell in June will be from June 1, 2020 to May 31, 2020.

, and for a vacation in October the billing period will be different: from October 1, 2020 to September 30, 2020.

Vacation pay can be accrued on any day, starting from the date the vacation order is issued. For example, the manager signed the order on June 17, 2019, but the employee’s vacation will begin only on July 4. You can accrue vacation pay on June 17, or later. The main thing is that vacation pay is paid within strictly established periods.

Personal income tax

Personal income tax should be withheld from the accrued amount, and then vacation pay should be paid to the employee. The employer is obliged to pay vacation pay no later than three calendar days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation).

The day of payment of vacation pay will be the date of receipt of income for personal income tax purposes. It is necessary to transfer personal income tax to the budget no later than the last day of the month in which vacation pay is listed (clause 6 of Article 226 of the Tax Code of the Russian Federation).

For example, vacation pay was paid to an employee on July 22, 2020. This means that personal income tax should be transferred to the budget from July 22 to July 31, 2019 inclusive.

Insurance contributions from vacation pay

They are accrued for the same month in which they were accrued (Letter of the Ministry of Labor of Russia dated 09/04/2015 No. 17-4/Vn-1316).

For example, vacation pay was accrued to the employee on July 19, 2020, paid on July 22, and the employee goes on vacation on July 25, 2020. In such a situation, insurance premiums should be calculated on July 19, 2019.

Insurance premiums from vacation pay should be transferred no later than the 15th day of the month following the month in which vacation pay was accrued (clause 3 of Article 431 of the Tax Code of the Russian Federation). If vacation pay is accrued in July, then insurance premiums should be transferred no later than August 15, 2020 inclusive.

Vacation in working days

There are such categories of employees who are granted leave in working days:

- employees with whom an employment contract has been concluded for a period of up to two months (Article 291 of the Labor Code of the Russian Federation);

- workers hired to perform seasonal work (Article 295 of the Labor Code of the Russian Federation).

For each month of work, the employee is given two working days of vacation. For example, a fixed-term employment contract is concluded with an employee for a period of two months. In this case, the employee can count on a vacation of 4 working days. In this case, the procedure for including payments in the calculation of vacation pay is similar to the procedure for including payments when vacation is granted in calendar days.

An example of calculating vacation pay provided in working days

Sinitsina Anna was granted annual paid leave in working days followed by dismissal (from October 1 to October 2). A fixed-term employment contract for temporary work was concluded with this employee (from September 1 to September 30). For the month she worked, Anna Sinitsina was credited with 30,000 rubles. Vacation pay in this case will be calculated as follows:

- We determine the number of days based on which vacation pay will be calculated. Weekends according to the 6-day working week calendar are subtracted from the number of calendar days in September. 30 – 4 = 26 days.

- Determine the average daily earnings. To do this, payments accrued for September should be divided by the number of working days in September according to the calendar of a 6-day working week. 30,000 rub. / 26 days = 1153.85 rub.

- We determine the amount of vacation pay. To do this, the average daily earnings are multiplied by the number of vacation days. Since the contract was concluded for only one month, the vacation pay that Anna Sinitsina is entitled to amounted to two working days. 1153.85 * 2 days = 2,307.69 rubles.

Conclusions to the article:

- Payments included in the calculation of vacation pay must be recorded in the company’s local regulations (for example, in the Regulations on Remuneration) and accrued for labor, for work, that is, they must be wages.

- In the calculation of average earnings for vacation pay, only those days (hours) should be included in which the employee was present at work, according to the schedule established for him, and performed the work provided for in the employment contract concluded with him upon employment.

- If an employee is granted leave in parts, then for each part the billing period will be determined anew.

- Employees with whom an employment contract has been concluded for a period of up to two months, and employees hired to perform seasonal work, are granted leave in working days.

- Average earnings for annual additional paid leave are determined by the same rules as for the main one.

Do you want to quickly calculate vacation pay in accordance with all approved rules? Use the free vacation pay calculator from the Kontur.Accounting service.

Tax accounting

Keeping tax records when forming such reserves is not a mandatory requirement of the law, so the decision remains with the heads of organizations. The specifics of creating and accounting for a “piggy bank” are regulated in Art. 324.1 Tax Code of the Russian Federation.

When forming a reserve, the maximum share of deductions (in percentage or monetary terms) is determined using the formula:

R year.from. – the amount of annual vacation costs; R year.ZP – the amount of expected wages.

After completing the necessary calculations, the organization will be able to regularly expense the funds accrued to the reserve. After all, they relate to costs associated with wages and reduce income tax.