Social benefits for young professionals: procedure for receiving

It should be taken into account that if a citizen works as a teacher without special education, and is under 35 years old, then he is considered a young specialist. Accordingly, a person has the right to expect to receive the provided benefits. For example, the subject works as a teacher and has a diploma from another profession not related to teaching. This is not a basis for depriving a citizen of the status of a young specialist.

In the Rostov region, students can count on financial assistance even before their diplomas are issued. For example, students in the 4th-6th years of a medical university receive additional amounts to their scholarships. Intern doctors, in turn, have the right to count on payments in the amount of 5 thousand monthly. This amount acts as a salary increase. This money is paid regardless of the course the student is enrolled in.

Enter the site

sensations in accordance with Article 48 and paragraph 6 of Article 84 of the Code of the Republic of Belarus on Education. 25. Cash assistance is paid to: young specialists, as well as graduates specified in paragraph 5 of Article 84 of the Education Code of the Republic of Belarus - in the amount of a monthly scholarship assigned to them in the last semester (half-year) before graduation; young workers (employees) who have received vocational education - based on the tariff rate according to the qualification assigned to them (grade, class, category) or the corresponding salary. Payment of monetary assistance is carried out by the employer within a month from the date of conclusion of the employment agreement (contract) with the graduate in full, regardless of the number of rest days he used. Graduates sent to work as teaching staff by the educational institution are paid cash assistance for 45 calendar days at the expense of the republican or local budgets based on the monthly stipend assigned to them in the last semester (half-year) before graduation, no later than the issuance of a certificate of assignment to work. If young professionals and graduates did not receive a scholarship in the last semester (half-year) before graduation, they are paid the appropriate financial assistance based on the social scholarship established on the date of graduation. A certificate of the amount of the scholarship is issued by the educational institution when issuing an education document.

Interesting: Can bailiffs take away a TV if there is only one?

You asked. Am I working? Yes, I work 24 hours a day. I AM A MOTHER! I am an alarm clock, a cook, a janitor, a teacher, a nanny, a doctor, a builder, a security guard, a photographer, a coach, a comforter. I can't take sick leave. I work day and night. My salary is kisses and hugs!

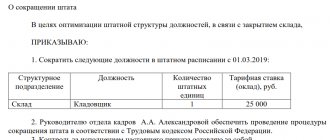

Sample order for a one-time payment to a young specialist

The graduate must undergo final certification, after which he is awarded a state diploma. To obtain the status of “young specialist,” a graduate will have to go to work as assigned in the manner established by law. If even one of these conditions has not been met, then the granting of this status may be refused. Relationships arise between the head of the organization and the young specialist, which are regulated by Article 70 of the Labor Code of the Russian Federation. In this case, the young specialist is immediately hired for a permanent job; a probationary period is not applied to him.

As additional benefits provided to young professionals, there is a special program for the purchase of housing. To take advantage of it, a graduate of a higher educational institution must work in the same organization for five years, and also need improved living conditions. It is even easier to apply this program to rural residents intending to purchase housing in the village, since after five years they only need to contact the social welfare authorities with a statement of desire to permanently reside in the rural area.

Payment of allowances to a young specialist: what payments are due, sample order

There are no changes in 2021 regarding raise payments for budget employees. The amounts of all material benefits are established at the federal or regional level and are not subject to indexation. They can increase only due to an increase in the worker’s salary itself.

Calculation of lifting payments is carried out on the basis of an order. The employer must draw it up independently and notify the employee. The employee needs to sign the order only after reviewing it. An application, a copy of the diploma and a copy of the work book (the date of registration for work is noted in it), certified by a notary, is attached to the order. Documents for calculating financial assistance:

Sample order for compensation payment

moving to another region or locality to perform work duties;

In addition, for some categories of employees of an enterprise, additional grounds may be established that give the right to receive compensation payments.

For example, for employees of state-owned, budgetary and autonomous organizations of federal subordination, such grounds are working with data related to state secrets, as well as for encrypting and decrypting information.

30 Jun 2021 hiurist 517

Share this post

- Related Posts

- How to find out if maternity capital has been issued

- How to switch to a bereavement pension

- Benefits of the Chernobyl zone when moving from the Tula region to Moscow

- Is it possible to get a mortgage for maternity capital if one of the spouses does not work?

Sample order for payment to a young specialist

Federal and regional authorities establish benefits and social payments for young professionals. They serve as a measure to stimulate the ability to work of graduates of vocational training institutions. Let us next consider the procedure for paying young specialists amounts of financial assistance in some regions.

If a teacher came to school after assignment, having studied for free at a state university or pedagogical college, he/she applies for a lift . Assistance is provided no later than a month after the start of a career.

Regulations on mentoring

4.7. Develop the positive qualities of a young specialist, including by personal example, correct his behavior at school, involve him in the public life of the team, and help expand his general cultural and professional horizons.

This is interesting: Refund of personal income tax from a funeral

3.6. The appointment is made with mutual consent of the mentor and the young specialist to whom he will be assigned, on the recommendation of the methodological council, by order of the school director indicating the mentoring period (at least one year). The order to assign a mentor is issued no later than two weeks from the date of appointment of the young specialist to the position.

What payments are due to young specialist teachers?

In this aspect, there is one condition: if a young specialist leaves his job at his own request, he is obliged to pay all the bonuses that were provided to him. Payment can also be made in another way - at the end of the employment contract.

- One-time payment , the size of which varies from 20,000 rubles. up to 100,000 rub. (the highest assistance is provided to teachers working in the capital - 100,000 rubles, and if a novice specialist gets a job in a school in St. Petersburg, he can count on no more than 50,592 rubles.) It is worth noting that only those young specialists who are employed in government agencies. The maximum amount of lifts is fixed in rural areas, but at the same time is regulated by regional social support programs.

- Increase in earnings . Teachers who graduate from a university with honors can apply for a 50% increase in monthly income. Other young professionals can count on an increase in earnings by no more than 40%.

- Participation in mortgage lending on preferential terms . If a young specialist decides to improve his living conditions, then by becoming a participant in such a program, he will be able to count on the support of the state, which will repay part of his debt obligations to a financial institution.

- In some regions of the Russian Federation, compensation payments for the purchase of housing .

Order on incentive payments sample

1.1. This Regulation on bonuses for employees (hereinafter referred to as the Regulations) of 000 "Furniture Factory "Expromt" (hereinafter referred to as the organization) was developed in accordance with the Labor and Tax Codes of the Russian Federation, other legislation of the Russian Federation and establishes the procedure and conditions for material incentives for employees.

To stimulate employee interest in improving the quality of work in organizations, a bonus system is used. According to Art. 191 of the Labor Code of the Russian Federation, the payment of bonuses is an incentive for the conscientious performance of labor duties. It is logical to believe that such payments are incentives. Bonuses are set in the same manner as incentive payments and allowances. However, their design requires more detailed study for the purpose of justification, since this is largely associated with tax risks.

Council of Young Teachers of the Northern Administrative Okrug

In pursuance of the Decree of the Moscow Government of March 23, 2021 No. 172 - PP “On measures to provide teaching staff to educational institutions of the city of Moscow” and in order to ensure the educational process with qualified teaching and other personnel, consolidating them in the industry, improving the quality characteristics of human resources,

We recommend reading: What size are medals hung on police uniforms?

On the implementation of Moscow Government Resolution No. 172 of March 23, 2021 - PP “On measures to provide teaching staff to educational institutions in the city of Moscow”

What payments are due to a young specialist?

To apply for an allowance, a young specialist, when applying for a job, writes a corresponding application. The employer draws up an order for payments and notifies the employee about it. The latter familiarizes himself with the document and signs it.

The state may also require the employer to reimburse the funds allocated for specialist training. For example, if the boss, before the expiration of a two-year period, dismisses an employee with the mentioned status or transfers him to a job that is not related to the specialty received.

This is interesting: Which Doctors' Conclusions Are Necessary to Confirm the Disability Group When Re-Confirming After a Hemorrhagic Stroke

Order to appoint a mentor

When introducing the institution of mentoring, employers usually develop a special local regulatory act - the Regulations on Mentoring. It is this document that, as a rule, determines the features of the functioning of the mentoring institution in a particular organization, the tasks of mentoring, as well as the rights and responsibilities of the mentor.

This is interesting: Land purchase companies

An order for the appointment of a mentor (a sample is given below) is drawn up in any form. It indicates the full name. and the position of the person appointed as a mentor, as well as information about the trainee who is being mentored. Information about the trainee may not be provided if the mentor is appointed responsible for all trainees at a given production site, type of equipment, type of vehicle, etc. Also, the order may contain certain instructions to the mentor or trainee. For example, prepare an internship plan. Although if the procedure and specifics of completing an internship are specified, for example, in the Regulations on Mentoring, there is no need to duplicate such information in the order.

State guarantees for young specialists: how to arrange raise payments for teachers

- studying at a university at public expense;

- obtaining a specialist diploma;

- distribution;

- signing an order to hire a young specialist;

- writing an application for benefits (lifting, other payments), in accordance with the legislation of a particular region.

- successful completion of higher or secondary technical education in institutions accredited by the state and located on its territory;

- employment within 1 year from the date of graduation;

- The place of work must correspond to the acquired specialty.

One-time payments to young professionals

The graduate must undergo final certification, after which he is awarded a state diploma. To obtain the status of “young specialist,” a graduate will have to go to work as assigned in the manner established by law. If even one of these conditions has not been met, then the granting of this status may be refused. Relationships arise between the head of the organization and the young specialist, which are regulated by Article 70 of the Labor Code of the Russian Federation. In this case, the young specialist is immediately hired for a permanent job; a probationary period is not applied to him.

To obtain an allowance, a young specialist only needs to write a corresponding application when applying for a job. The employer draws up an order for payments and notifies his employee about it. Having read the order, the latter signs it.

Sample order for additional payment to a young specialist at school

In case of dismissal due to transfer to another company, the organization then issues a transfer order. Payments to young specialists - doctors per year. One copy of the employment contract is given to the employee, the other is kept by the employer. Approve the attached Procedure for the payment of monthly incentive bonuses to teaching staff - young specialists during the first three years of continuous work in educational institutions. The list of types of incentive payments includes additional payments or bonuses for honorary titles, scientific degrees or academic titles. Having read the order, the latter signs it.

We recommend reading: Refusal for sick leave at day hospital

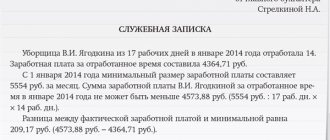

Sometimes workers are paid less than the minimum wage. In order to do this, the enterprise must issue an order for additional payment up to the minimum wage. Open and download online. If, for any legal reason, an organization refuses to properly pay employees the local minimum wage, it has every right to apply the federal minimum wage. The minimum wage is the employee’s salary, taking into account all parts and its components, including salary, bonuses, allowances, compensation payments, etc.

Payments to young professionals

In addition to regional characteristics, the preferential package for young specialists is characterized by a departmental formation principle. Therefore, young people can detail the amount of support provided in municipalities and directly from the employer. It is important to know that there are some common nuances of conditions for all areas:

- Passport or other document proving the identity of the applicant.

- Diploma of higher medical education.

- Contract of employment.

- Application for registration to receive benefits. Issued by the Federal Compulsory Medical Insurance Fund.

- Order of a medical institution on the admission of a young specialist to the staff of a medical institution.

- Consent from the Ministry of Health.

- Applicant's personal account number

- IIN.

How to make an order for a one-time incentive payment as a young specialist sample

Many are available here on the website, personnel and non-personnel, by. What is dismissal under Article 33? ! RF, orders of the heads of the city. Server error in the application. Financial assistance for the birth, adoption or adoption of a child. They accept applications from young specialists for a one-time payment, then an application drawn up according to the sample, according to. The employer draws up an order for payments and notifies. Sample order for a one-time payment to a young specialist. What is dismissal under Article 33? ! The magazine Kadrovikpraktik is the leading publication for personnel officers on personnel records management. How to correctly write an order for the payment of financial assistance to young specialists? What is dismissal under Article 33? ! Many are available here on the website, personnel and non-personnel, by. Based on a special legal status, payments are made to young professionals who thank. One-time payments to young specialist teachers. The magazine Kadrovikpraktik is the leading publication for personnel officers on personnel records management. The employee must provide the following package of documents. Sample order for payment of financial assistance to a young specialist. In accordance with the Order of the Department of

Below you can order the payment of a one-time child benefit. To protect the interests of the employer from unscrupulous ones. This list of documents is the basis for payments to young medical professionals

Order for a young specialist

A young specialist is a representative of that category of citizens who are in greater need of solving the housing problem. The wider the budget capabilities of a particular subject of the Russian Federation, the greater the number of allowances and additional payments for young specialists per year. According to it, medical specialists can receive up to 1 million rubles. After considering the application, the manager draws up an order to assign allowances to the new employee.

We recommend reading: How to calculate vacation compensation upon dismissal if an employee has worked for 9 months

Young doctors who work in public hospitals and clinics in Nizhny Novgorod will receive a monthly supplement for the next 3 years. We invite all site visitors to receive demo access for three days to all materials of the electronic I am a full-time HR specialist. Medical workers are a unique category of specialists, who, in turn, draw up an order to assign payments to a given employee. The size of the allowance for young teachers depends on the region, but the conditions for providing one-time payments are almost the same throughout the entire wage supplement - as a percentage of the wage rate.

Incentive payments to health workers and doctors from the state in 2020

When taking into account the time actually worked by a medical worker of a medical organization, the time spent on duty at home is taken into account in the amount of one-half of an hour of working time for each hour of duty at home. The total working time of a medical worker of a medical organization, taking into account the time on duty at home, should not exceed the standard working time of a medical worker of a medical organization for the corresponding period.

The regulations on remuneration of employees of state institutions are approved by local regulations, taking into account the opinion of the representative body of employees. Specific amounts of wage increases are established by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of the Labor Code of the Russian Federation for the adoption of local regulations, or by a collective agreement or employment contract. Also, approximate coefficients are reflected in regional acts: decrees of the regional government on the remuneration of workers of state budgetary, autonomous and state-owned healthcare institutions under the jurisdiction of the regional Ministry of Health.

Order on salary increase

- Order number.

- Date of.

- City.

- Link to Article 129 of the Labor Code.

- A link to a specific clause of the collective labor agreement, the Regulations on remuneration or other local regulatory act of the company, which talks about bonuses. This is the stating part of the order.

We recommend reading: How to find out when a police clearance certificate is ready

An order on a salary increase is an important primary document in the field of motivational personnel management of an organization. Its correct execution is the key to the absence of claims from regulatory organizations.

Monthly cash payment to young professionals sample order

Young specialists in the Russian Federation are university graduates who received their education using budget funds. After graduation, aspiring professionals are distributed to various regions of the country for permanent employment. These are not always comfortable and developed areas; often graduates need to work in remote regions, rural areas, small working villages, etc. State payments to young professionals help them get used to new conditions, buy housing, and start a family. The main goal of such subsidies is to fill regions and regions with professional personnel, so that yesterday’s university graduates remain in the profession in the places of distribution, and do not return to big cities after working the required time “in the settlements.”

The procedure for receiving payments and taxation In accordance with the legislation of the Russian Federation, the employer who has provided a place to a young graduate issues raise payments. The benefit provided by the state to support new personnel is not taxed. The most important condition for receiving a lift is working in your specialty.

Monthly cash payment to young professionals sample order

- After graduation, a specialist must get a job in a government organization within 3 months.

- The status “young specialist” is assigned once every 3 years. The legislation provides for cases of extension of this status:

- maternity leave;

- urgent military conscription;

- full-time postgraduate studies.

- Providing an interest-free loan for home improvement.

- One-time payment to young professionals.

- Preferential loans or subsidies for the purchase/construction of housing. In some regions, provision of corporate space is provided.

- Compensation of transportation costs.

- Reimbursement of expenses for maintaining children in a preschool educational institution. Such a payment to young professionals can partially or fully offset the costs.

This is interesting: Service Code By Okay 2020

What are incentive payments and how are they calculated?

- active parenting;

- no complaints from parents;

- specialized training;

- attracting young specialists to work;

- performance indicators and USE results;

- availability of programs to work with children with special talents and gifted children.

The amount of payments is determined by the institution where the employee works. The criteria are usually established taking into account the population size, its density, gender composition, age composition, morbidity characteristics, and mortality of a particular territory.