Personal protective equipment (PPE) is used, as a rule, in manufacturing enterprises and for work requiring specific devices, although the law does not prohibit their use in any other organizations. Let's try to understand some accounting issues:

- Should expenses always be accepted in tax accounting? What conditions must be met for this?

- How to register purchased funds in the accounting department?

- Should the cost of workwear be withheld from an employee upon dismissal?

- Is personal protection required for office workers?

To whom and when

The classification of the funds themselves and their general characteristics can be read in another article on the site. First of all, they are focused on protection from dangerous and harmful factors. It is logical that first these factors must be identified and established. This is done using a special assessment of working conditions (SOUT).

The report on the results of the inspection is the main document that you need to focus on, because it confirms the need to purchase PPE, and therefore is one of the supporting documents for writing off the costs of them.

The provision of special equipment to employees is provided for by the Labor Code (Article 212); ensuring labor safety is the same responsibility of the employer as the timely payment of wages. The company does not necessarily have to have an entire service for this; a specially appointed person who has the appropriate education or has completed courses is sufficient (the latter is relevant for small companies, where such a person is usually the manager).

The work performed in an organization may not be harmful, but it still requires the use of special clothing (safety shoes) because it is carried out in special temperature conditions or is associated with pollution (refer to the same Article 212).

Important! By default, ownership of personal protective equipment remains with the employer, unless otherwise provided by the employment contract or agreement according to the law.

In addition to regulations, it will be necessary to stipulate the issuance of PPE in internal documents, because it is necessary to establish a list of positions, standards, write-offs, persons responsible for the issuance, as well as related situations - for example, deduction of the cost of overalls from the salary upon dismissal.

There is a separate case when the employer is not legally required to provide employees with special protection, but still wants to improve the work process. Even an accountant could be an example - a modern specialist spends most of his time at the computer, formally this is a reason for at least a medical examination, and the factor is considered harmful (clause 3.2.2.4 of Order of the Ministry of Health and Social Development No. 302n).

Typically, employers try not to show that more than 50% of the working time is spent behind a monitor, and a special assessment may recognize that working conditions are optimal, and then even a medical examination will not be required (according to the latest clarifications). If the employees are lucky and the company’s management is ready to take care of its staff, then it is enough to outline the obligations in local acts, labor or collective agreements, even without the need for it by law. In the above example, you can use special “computer” glasses to take the strain off your eyes.

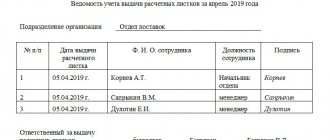

How to register a journal for issuing personal protective equipment

The head of the department is appointed as the person responsible for the storage and distribution of protective equipment and, accordingly, for maintaining accounting logs.

If the journal form is recognized as a primary accounting document (this must be enshrined in a local act), it is necessary to formalize it properly: numbered, stitched, affixed with the seal of the organization, which is placed on a paper strip indicating the number of pages and the certification signature of the manager. In this case, the seal impression partially falls on the strip, which is applied to the ends of the lacing, and partially on the last page.

A ready-made journal for recording the issuance of personal protective equipment can be purchased at a printing house, but it is easier to print and fill out the form yourself using the sample provided.

- serial number of the record;

- product name;

- date of issue;

- product service life;

- Full name of the employee who receives the funds;

- employee signature;

- Full name of the issuing person;

- signature of the issuing person;

- note.

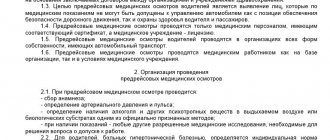

Standard

Of course, it won’t be possible to issue protective clothing and other protective equipment left and right; there are standards. They are determined by several basic documents (model standards) approved:

- Resolution of the Ministry of Labor No. 70 of 13/31/97 (on warm clothing).

- Order of the Ministry of Labor No. 997n dated 12/09/14 (general).

- Order of the Ministry of Health and Social Development No. 297 of April 20, 2006 (signal clothing).

Individual industries also have their own legislation, so first of all you need to check if there are any for your type of activity, and then turn to the general ones. It is allowed to establish your own standards, of course, only if this improves the situation of workers and increases security.

If you open Order No. 997, you will see that the quantity of PPE and protective clothing for an annual period is indicated, but sometimes this is not a specific number, but a mysterious phrase “before wear.” What does it mean: we write off such a product at any time when it becomes unusable? Yes and no. To begin with, you still have to pay attention to the instructions supplied with the product; it should indicate the service life, and you should focus on it (install it in the LNA).

Of course, if, for example, work boots are damaged earlier, they will also need to be replaced. An employee has the right to refuse to start work if he is not provided with protective equipment (and therefore safety precautions are not followed), and the downtime will have to be paid at full rate.

By the way! PPE must be certified and have an appropriate declaration, otherwise their use at the enterprise is unacceptable.

To write off unusable protective equipment, an act is drawn up and signed by a special commission. In some cases, it will be necessary to determine the level of wear and tear ahead of schedule, for example, if an employee quits, but did not bother to hand over the workwear (and other things) and kept it for himself. In this case, we make calculations based on the duration of use.

Example: Monter Sidorov was given a special suit - overalls and jacket - with a wear period of 1 year. The employee quit after 4 months without returning the clothes. It is necessary to calculate the degree of wear of the suit. We take a period of 12 months as 100%, then 4 months is 33.33%. It turns out that the wear rate is a little more than thirty-three percent.

Note! If an employer transfers work clothes to a dismissed employee, then this is income in kind, on which personal income tax must be withheld. If this is not possible, you need to send the appropriate certificate of Form 2-NDFL to the Federal Tax Service.

Some products require a special periodic procedure - verification. As a result, special tests are carried out (for example, this applies to dielectric gloves), and suitability for further use is established.

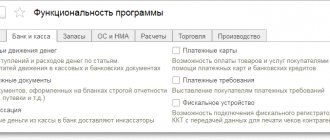

Registration in accounting

As with any other material assets, there is its own documentation for accounting for protective equipment. Let's consider step by step what needs to be formalized when moving such resources in an organization. Remember that these forms are only recommended in 2020; an enterprise has the right to develop its own forms while maintaining their mandatory details, taking into account the specifics of its work.

Receipt and transfer

In most cases, PPE comes to the company as a result of purchase from a supplier, less often in another capacity (gift, participant contribution, exchange, etc.). Accounting for them is carried out almost in the same way as for ordinary materials, taking into account some features:

- A special journal is used for accounting. It reflects basic data on the movement: to whom and when it was issued, on what basis (internal situation, order, etc.).

- A personal card is created for each employee who is supposed to be issued PPE. It indicates the parameters of workwear and shoes (size, height). Reference is also made to a specific legislative provision.

- Accounting is maintained in two separate subaccounts of account 10 “Materials” - 10.10 “Special equipment and special clothing in warehouse” and 10.11 “Special equipment and special clothing in operation.”

Upon receipt at the BU, posting D 10.10 K 60 (76) is carried out, and when transferred into operation, the service life must be taken into account, depending on it, two accounting options are possible:

- The period is less than / more than 12 months, write-off is carried out according to the usual rules (see clause 20 of the Methodological Instructions, approved by Order No. 135n dated December 26, 2002). Wiring - D 10.11 K 10.10.

- The period is less than 12 months, written off in accordance with clause 21 of the Methodological Instructions at a time upon commissioning. Wiring - D 20 (26, 23, 08, 44) By 10.10. Expenses are charged to the same accounts where the wages of workers who received PPE are accrued.

When transferring workwear to an employee, when there is a transfer of ownership, or its loss, several different situations are also possible:

- Giving. It is necessary to conclude an appropriate agreement and sign the transfer deed. The cost of used special equipment must be determined taking into account wear and tear (as we said above, for this you need to carry out a small calculation). Postings: D 73 K 10.10 (10.11) - transfer of clothing to an employee, D 91.2 K 73 - writing off the residual value as other expenses. Moreover, if the cost does not exceed 4,000, then there will be no tax consequences for the employee, provided that he did not receive other gifts during the year. Otherwise, it is necessary to calculate contributions and withhold personal income tax from the next payment (or report the impossibility of withholding tax to the Federal Tax Service).

- The employee lost the product given to him (damaged it), the employee’s guilt has been established. A written admission of guilt by the employee or a court decision is required. Postings: D 94 K 10.11 - write-off of cost, D 73.2 K 94 - write-off of shortages at the expense of the employee, D 50 (51, 70) K 73.2 - compensation for material damage received (withheld). If it was not possible to receive the money, then you will have to include such costs as other expenses - D 91.2 K 73.2 (for example, if the statute of limitations expires).

- The person responsible for the loss has not been identified. A write-off act is drawn up in the absence of the culprit. Posting: D 91.2 K 10.11 – write-off as other expenses.

To track protective equipment that is written off as a one-time expense, but at the same time has a long period of use (but less than a year), we use an off-balance sheet account established by the company itself.

Despite the established standards for use in accounting, write-offs within and above the norms do not differ in any way. Tax accounting also does not establish any special restrictions either for organizations using OSNO or for payers of a single tax using a simplified tax system – paragraphs. 3 clause 1 of article 254 of the Tax Code of the Russian Federation. We write off all expenses in full, the main thing is that the excess expenses are realistically justified.

What if the cost of special equipment exceeds 40,000 rubles for BU and 100 thousand for NU? In this case, PPE already represents fixed assets and is accounted for in account 01. On OSNO, they will be written off using the depreciation method to cost accounts (20, 26, 44, etc.), on the simplified tax system, you must be guided by clause 3 of Art. 346.16 Tax Code of the Russian Federation.

Service

Special equipment is not always easy to use; some require regular maintenance. Usually these are protective clothing, gas masks, dielectric PPE and high-altitude insurance. Types of service:

- Wash.

- Disinfection (disinfection).

- Dry cleaning.

- Verification (electrical testing).

- Purchase of consumables.

- Repair.

Service performed by third parties is reflected in the usual transactions for settlements with suppliers and contractors: D20 (25, 26...) K 60 (76). If the organization has its own workshop (laundry, repair shop): D 20 (25, 26...) K 23.

Note! All PPE that has undergone appropriate processing, including clothing, can be reused if time and condition permit. The exception is shoes, their sanitary treatment is too complicated, it is problematic to disinfect them 100%, as well as to clean them. Therefore, the residual unwritten-off cost of shoes, even if they are in good condition, remaining, for example, after an employee left, is charged to other expenses (account 91.2).

What does not apply to personal protective equipment?

Uniforms or uniforms are sometimes confused with workwear. It is a mistake to classify them as PPE, since they perform completely different functions. For example, military uniforms have rank insignia, and sales uniforms typically have specific colors associated with a particular chain of stores.

By the way! A logo (company name) can be applied to workwear; this does not change its original purpose.

There are also some controversial items, such as hats. Some of them (helmets, warm hats) clearly relate to protection. What about the ordinary ones? Does wearing a sun cap when working outdoors during the day count as PPE?

Even regulations in some cases leave room for imagination. Guidelines No. 997n for painters (item 40 in the list) provide for a headgear, but its type is not specified. It is not forbidden to install your own options; try to “adjust” them to industry standards and justify the use of just such special equipment.

True, in this case, problems may arise with writing off expenses in tax accounting, because traditionally, if there is an official base with clearly defined boundaries (as in this case), then the Federal Tax Service focuses primarily on it. Retreat is a reason for the tax service to doubt the justification of expenses and reduce the tax base.

Sample filling

There is no mandatory form for filling out the log book and the contents of personal protective equipment. At the same time, focusing on the requirements of the mentioned application, we can come to the conclusion that it is advisable to enter into this journal information related to the following list:

- inventory number;

- designation;

- dates of inspection of personal protective equipment, both already carried out and planned further;

- time of inspection performed;

- information about the person who is responsible for personal protective equipment;

- dates when PPE was given to employees for the purpose of their use;

- the place where the elements are located;

- note, this column may contain the number of the test report if this report was issued to third-party companies.

Thus, a magazine is a multi-page document that is lined into columns included in the above list. At the same time, since, as mentioned, there is no set form, you can add other columns with information or place those indicated in a different order, as in the example below.

If the company has a significant number of elements of the same type, then their general name can be indicated at the bottom, without allocating an entire column; accordingly, the “designation” column is not required in this case. All products receive an inventory number from the accounting department. They are tested at the enterprise in a laboratory.

Business support in the field of labor protection

In recent years, providing support to small businesses has become fashionable. I admit, it seems to me that this support is not always what it really is, and a plus in one place leads to a minus in another. There are also programs that work, although for small organizations they usually do not provide a special bonus, but they need to be mentioned.

The Social Insurance Fund allows, subject to certain conditions, the purchase of personal protective equipment at the expense of the fund. This is the so-called financing of measures to reduce occupational injuries and prevent occupational diseases. There are a few key points though:

- Only protective equipment manufactured in Russia is subject to compensation.

- Participants in the pilot project (and this is not all regions yet) can reimburse the amount of expenses agreed with the fund, the rest are limited to accrued contributions for injuries.

- It is necessary to collect a supporting package of documents.

Note! The costs of training the manager (other responsible persons listed in clause 3 of the Rules for financial support of preventive measures, approved by Order of the Ministry of Labor No. 580n dated December 10, 2012) are also reimbursed.

Details, including accounting entries for transactions, can be found in the article “How the purchase of personal protective equipment is carried out and accounted for at the expense of the Social Insurance Fund.”

The amount of contributions for injuries is very low, sometimes in rubles for the year it is only a few thousand for companies that do not have a high risk of injury or a large number of employees. Therefore, applying for a refund is not particularly popular among entrepreneurs.

Order a journal of accounting and maintenance of the SZ

You can buy logs for recording and maintaining protective equipment at a good price in the Bitrade online store. We offer a large selection of standardized forms for maintaining reporting documentation for enterprises. Our discount principle will help you make a profitable purchase: the cost of a unit of goods decreases as the batch increases by 10 magazines. You can select the required number of units and click on the “Add to cart” button, leave a message in the online chat or call the contact numbers listed at the top of the page. Delivery is carried out by self-pickup from a warehouse in Moscow, as well as by transport service within the city, Moscow Region and other regions.