How to mark business travel days - designations

The days an employee spends performing an official assignment provided for by a business trip order must be recorded in the time sheet along with the time worked at the permanent workplace, since it is the presented document that allows for the calculation and settlement of payments to the posted employee.

The standard procedure for recording the days of a worker’s stay on a business trip in the time sheet is

recording the code “K” in the appropriate cell of the form.

In addition to the specified symbol, the posted worker may be given other accompanying symbols.

What should I bet on if the trip falls on a weekend?

In order to make correct financial settlements with a posted employee, you should keep records of days off worked on a business trip. To do this, put the letter “K” in the top cell and “B” in the bottom cell.

Regardless of whether the employee was performing part of a work assignment on the day of rest or was on the road (to the place of business trip or back), this time, in accordance with the law, is paid at double the rate of average earnings.

How to record sick leave for a posted worker?

If, during a business trip, a sick leave certificate was issued to the employee and the manager agreed to extend the duration of the trip for recovery and completion of the official task assigned by the order, the days on which the employee was on the trip and was sick are marked with the symbol “K” in the top line and the symbol “ B" at the bottom.

Sick leave for business travelers is paid on a general basis.

How is overtime work defined?

Excessive work time while on a business trip is noted in the time sheet as “K/S” and indicating the exact number of hours worked.

Overtime, as well as night work, are paid to posted workers in the same way as working hours at a permanent place of work.

Sample filling

https://youtu.be/n9Yqe5ttSN8

How is it taken into account?

The employer's obligation to record the time worked by employees is enshrined in Article 91 of the Labor Code of Russia.

The statements that are mandatory included in the working time sheet are presented by Federal Law No. 402 (clause 2, article 9).

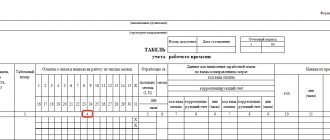

The report card is drawn up at each enterprise (organization) using forms T-13 and T-12 approved by the Regulations of the State Committee of Statistics of Russia dated January 5, 2004. The same document clarifies exactly what information needs to be recorded in the report card.

Important! The choice of the form (form) on which time worked by employees of the enterprise will be recorded depends on the method of recording the activities of employees: if accounting is carried out in an automated way - form T-13, for manual recording, respectively, T-12.

To correctly enter information into the timesheet, each employee is assigned an individual number, which is entered in the document column.

The responsible person authorized to fill out the presented form is appointed from among the accounting department or personnel department , which are directly related to the calculation of wages for workers.

Each of these forms has columns and lines in which the following statements should be entered:

- Employee personnel number;

- The duration of the time period worked or the duration of unworked time;

- Number of working days for each employee;

- Reporting to work, being on business trips, attending advanced training, vacations, etc.

For the convenience of filling out the time sheet, symbols have been developed that are entered using digital and alphabetic methods.

What to do if an employee gets sick before or during a business trip?

It is quite possible to plan working hours, but it is impossible to predict who will go on sick leave and when. In the report card, sick days are marked with the letter “B”. And it depends on which letter is in the column - “K” or “B” - whether the employee’s salary or sick leave will have to be paid.

Let's consider two situations:

- The employee fell ill before the business trip, and the corresponding order had already been issued. You cannot force an employee to go on a business trip if he is on sick leave, but you can ask. And it will be better if he closes his sick leave before leaving - then all the days on the report card will be marked “K”.

- An employee fell ill while on a business trip. In this case, the days after the onset of the illness are marked “B” until the date the sick leave ends, even if it occurs after the end of the planned period of the business trip. In such a situation, it is assumed that the employee interrupted his work assignment due to illness.

It is important to understand that an employee cannot be on sick leave and on a business trip at the same time, just as he cannot receive temporary disability benefits and a salary at the same time.

Business trip in the time sheet - sample filling

Often, for production purposes, workers need to go to another city or country. Such a business trip is called a business trip.

How to correctly take it into account in the report card? How to indicate that an employee fell ill during a trip? You will find answers to these and other questions in our article.

How to reflect a business trip on a time sheet?

The labor time register is an important document in an enterprise. The correctness of filling it out affects the amount of wages. Its accrual and payments are often checked by the tax office. At the same time, they raise and verify all related documents and recalculate the salary.

The essence of filling out the register is to correctly reflect the use of the employee’s working time . The table is filled out by code names, the decoding of which is indicated on the form itself.

The main filling requirements include:

- The need to fill it out in the current time mode, since wages are calculated on the basis of it;

- Appearances and non-appearances are entered using one of the methods: entering deviations or complete registration;

- Two lines are filled in - at the top they put a code designation, for example, I - report to work, K - business trip, etc.; At the bottom they put the number of hours worked. There are both code values.

Reflection in the work time sheet of a business trip is indicated by the letter code - K. It is noted as the day of the trip - the day of departure and the day of arrival home, days of downtime.

How to fill out a business trip in a time sheet?

The basis for sending an employee on a trip is an order from the enterprise. Business travel days can be counted based on: travel tickets; memo; the corresponding certificate.

Days of stay on a trip for production or business purposes are considered to be the following days:

- Departure and arrival;

- Working days;

- Weekends and holidays, if applicable;

- Sick leave.

How to fill out a simple workday is clear to everyone and there are no special questions about this - code K is indicated in the register.

But what if the trip coincided with another event? All details of your stay must be displayed in the time register, as this affects the calculation of daily allowance. Let's look at examples.

The employee with the reporting documents provides sick leave - this is reflected in the register in two lines. In the top - K and in the bottom B - sick leave.

The employee left on Sunday evening - the day of the trip is considered the day of departure, that is, a day off. In the register it is indicated in the top line - K, in the bottom - B.

Payment of daily allowance and salary for a day off is at a double rate, in accordance with the legislation of the Russian Federation, compensation for the cost of a ticket is at its face value.

The employee returned from a trip on a weekend or holiday - the register also reflects - C/W, payment at a double rate.

If an employee on a business trip worked on a weekend or holiday, fill out the timesheet as K/RV - working day off.

All weekends or working holidays are paid at a double rate, or the employee can take one day off, but the B or PB payment will be at the regular rate.

An employee worked at night, for example, when eliminating an accident - designated as K/N. At the same time, there must be written confirmation of activities at night in the form of a memo signed by the manager at the enterprise where the employee was seconded.

Example of a time sheet for a business trip

The time register according to the rules of maintenance is a simple document. When filling it out, it is important to pay attention to detail and reflect all information.

As well as the employees themselves, they must understand the rules for calculating their salaries and maintaining paperwork in order to provide the necessary documentary evidence - memos about working at night, sick leave, submitting a travel certificate and an advance report on time.

Business trip in timesheet sample download

Business trip day – K, is considered as a full working day, including taking into account travel and downtime. Therefore, when summing up the total hours in the timesheet, these days must be counted as full working days.

Download a sample of filling out a timesheet with travel days

When is a business trip not included on the time sheet?

Not every trip is considered a business trip. This definition is prescribed in the Labor Code of the Russian Federation. Day trips or local drives do not qualify.

Not marked in the report card with code K, trips lasting one day, traveling work. They are reflected in the accounting table, like a regular working day, through the letter code Y.

Labor Code of the Russian Federation in the latest edition

If you have questions, consult a lawyer

You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

- +7 Moscow and region;

- +7 St. Petersburg and region;

- +7 all regions of the Russian Federation.

Source:

Rules for filling out the document

When filling out the timesheet, you must take into account the general rules:

- The document must be completely completed within a month after the work trip.

- At the end of the period, all working hours are taken into account.

- All attendances and absences must be recorded on the report card.

- The line at the top contains the following designations: day off, business trip.

The timesheet is necessary for accounting calculations. In this case, the following requirements are put forward for the document:

- It is allowed to keep it on paper and then sign it in the accounting department.

- Can be filled out electronically with the appropriate signature.

- When making corrections in the report card, you must indicate the date when the changes were made and your last name.

- Upon withdrawal, a copy must be made and provided to the accounting document flow.

The table contains the following data:

- What is the name of the document and the date when it was compiled.

- What is the name of the organization?

- Lines – these show whether the employee showed up for work or not.

- What is the unit of measurement (hours and days).

- Who is responsible for maintaining the document?

- Signatures of approvers.

If at least one of the points is missing, the document is considered invalid.

Please note that the days of travel are considered to be:

- departure and arrival;

- labor;

- weekends, holidays if there is a coincidence;

- sick leave.

Not every work trip is recognized as a business trip. Those that are carried out within 1 day and are not displayed by area. They are entered in the accounting table under the code - I.

How to display correctly?

We have already figured out how to indicate the days spent on a work trip. But HR workers often have difficulty filling them out. Looking at the examples, you can understand how to display correctly.

First example:

Ivanov A.V. works at LLC "RiK" as a manager and from 03/01/2017 to 03/15/2017 he was on a work trip. 4 and 5 – days off and no work. Therefore, the days are entered in the timesheet as - B, the rest - K.

Second example:

Mamantov A.G. works at Mir LLC as a welder. From May 1, 2017 to May 11, 2017, he went on a business trip to work in a new branch of the company. 1, 6, 7, 8, 9 are days off, but Mamantov worked. These days are entered in the report card as “RV”, and 2, 3, 4, 5, 10, 11 – K.

Read about travel expenses abroad. Does an employee have the right to refuse a business trip? Information here.

How to pay for a business trip on weekends? Details in this article.

Sample

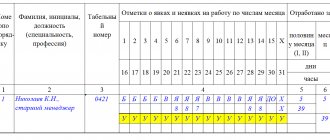

Each personnel employee has a sample business trip in the time sheet. It is presented in the table:

| Number in order | Full name of the employee, position, timesheet number | Attendance/no-appearance marks | |

| 3 | 6 | ||

| 15 | Muslimova Maria Petrovna | short-form | short-form |

| 2 | 2 | ||

As you can see, on the 3rd and 6th of Muslimova M.P. I was on a business trip and worked for about 4 hours.

A sample of the T-12 working time sheet is here,

A sample time sheet, form T-13, is here.

The timesheet must be filled out correctly. If you make a mistake, there may be problems with various services in the future.

How to mark a business trip on your timesheet?

When sending an employee on a business trip, the accounting department of an enterprise has a question: how to correctly mark in the time sheet the days that the employee spent on a business trip?

There are several circumstances in which the markings on a document will differ. Let's consider all the questions and nuances that arise in more detail.

Word of the law

A time sheet is a necessary document that should be in any organization.

It is necessary to document the days on which the employee carried out work in one way or another. In case of disputes, this document is regarded as evidence of the employee’s presence or absence at the workplace.

The report card can be used to control inspection bodies over the work performed at the enterprise.

For the absence of a document, the employer may be held liable.

Normative base

The employer is entrusted with the obligation to keep records of the time worked by employees, enshrined in Part 4 of Article 91 of the Labor Code of the Russian Federation.

The report card must be filled out according to forms No. T-12 and T-13.

Since the time sheet is a primary accounting document, it must contain the information provided for in paragraph 2 of Article 9 of Federal Law No. 402 “On Accounting”.

Labor Code of the Russian Federation

Federal Law No. 402-FZ

Time sheet (unified form T-12)

Form T-13

General rules for filling out the document

There are basic rules by which the timesheet should be filled out.

Let's look at them in more detail:

- Required to be completed within the billing period.

- At the end of the period, you need to indicate the hours the employee worked and the results for the first and second half of the month.

- Attendances and non-appearances must be recorded using the continuous recording method or using the deviation recording method.

- The top line must include a designation (for example, reporting to work, day off, etc.).

- The number of hours is indicated on the bottom line.

Business trip in time sheet

There are certain rules by which the days spent by an employee on a business trip are entered on the timesheet.

Let's consider all the questions and nuances that arise in more detail.

Designation

So, how to mark a business trip on a timesheet and what designation can be used for this?

When entering travel days on the timesheet, do not enter the clock.

According to Article 167 of the Labor Code of the Russian Federation, the employee retains his average earnings for the entire duration of the trip. Thus, there is no need to take into account the hours during which the employee works on a business trip.

The generally accepted designation for the days that an employee spends on a business trip is “K”.

How is it considered - a working day or a no-show?

A business trip is a trip by an employee to fulfill an official assignment away from his place of permanent work.

Thus, during the trip, the employee performs a separate official task, and not the labor function that is enshrined in the contract. Time spent on a business trip is not working time within the meaning of Article 91 of the Labor Code of the Russian Federation.

However, this time cannot be considered a failure to appear either, according to the provisions of Article 166 of the Labor Code of the Russian Federation.

Accordingly, a business trip must be allocated to a separate category of days with appropriate reflection in the primary documentation - the time sheet.

How to display correctly?

There are several circumstances in which the marks on the travel report card will differ.

Let's consider the main situations that employees of an enterprise's accounting department may encounter when entering alphabetic or numerical values in a timesheet.

If the trip falls on a weekend

Quite often there are situations when a business trip falls on a weekend.

A reasonable question arises - how to mark such business trips on the timesheet - as regular days off or as days spent on a business trip?

Let's consider several situations that may arise:

- The employee was on a business trip on his day off, but did not carry out work activities. In this case, you must enter code “B”.

- The employee worked on a day off while on a business trip. This aspect must be reflected in the report card with the letter code “РВ”.

If the employee goes to work on the last day of the business trip

The last day of a business trip is the date of arrival of the vehicle at the place of permanent work.

Let's consider the options that could be:

- If transport arrives at the place of work before 24 hours of the current day, the same day will be considered the day of arrival. The next day will be a regular weekend or workday depending on the employee's schedule. Example: an employee was delivered at 21:25 on May 18, 2020. Thus, May 18 will be the last business trip day.

- If the vehicle arrives after 24 hours, the next day will be considered the day of arrival. Example: an employee was brought in at 6:50 on May 20, 2020. May 20 will be the last business trip day.

It is impossible to oblige an employee to go to work on the last day of a business trip. He can do this only of his own free will.

Let's consider the situations:

- The employee does not go to work on the last day of the business trip. In this case, code “K” is entered in the report card for that day.

- An employee goes to work on such a day. Current regulations do not regulate what values to put on the timesheet and how to pay the employee for such a day. Double payment is not allowed. Consequently, the managers of the organization need to establish in local acts the opportunity to pay the employee both the average earnings and wages for the time worked in these conditions. Otherwise, the employee can only claim to maintain the average salary or only to receive payment for hours worked on the last day of the business trip.

If an employee goes on a trip while on sick leave

Current legislation does not allow the possibility of simultaneous payment of both wages and state disability benefits.

In this situation, an employee can only be allowed to go on a business trip with his written consent.

Thus:

- an employee cannot go on a business trip while on sick leave at the initiative of the employer;

- on personal initiative, the employee loses the compensation payment due to him due to disability, and code “K” is entered on the report card (as for a regular day on a business trip).

If the employee takes sick leave while performing a task

Periods of temporary disability that occur during a business trip are marked with two codes separated by a fraction - “K/B”.

If there was overtime work during her period

If an employee worked overtime, the timesheet during a business trip is marked with the code “K/S” indicating the number of overtime hours.

Sample filling (example)

Let's look at an example of how to fill out a timesheet while working overtime on a business trip:

As can be seen from the example, on the 4th and 5th of the month Aliyeva S.G. I was on a business trip and overworked for a total of 4 hours.

How to close a document?

The timesheet should be closed after the end of the billing period with the employees of the enterprise. In most organizations, this is considered the last day of the month.

According to the general rules, you can close the timesheet on the last day of the billing period.

If you close earlier and mark the time sheet in accordance with the production calendar, it may turn out that some employee will get sick or take unpaid leave.

In such a situation, overpaid wages will have to be withheld from the accruals of the next billing period (in accordance with Part 2 of Article 137 of the Labor Code of the Russian Federation).

Employees of the company's accounting department must correctly fill out time sheets for employees on a business trip. This will allow you to make correct accruals, as well as avoid possible problems from regulatory authorities.

Source:

Word of the law

A time sheet is a necessary document that should be in any organization.

It is necessary to document the days on which the employee carried out work in one way or another. In case of disputes, this document is regarded as evidence of the employee’s presence or absence at the workplace.

The report card can be used to control inspection bodies over the work performed at the enterprise.

For the absence of a document, the employer may be held liable.

Normative base

The employer is entrusted with the obligation to keep records of the time worked by employees, enshrined in Part 4 of Article 91 of the Labor Code of the Russian Federation.

The report card must be filled out according to forms No. T-12 and T-13.

Since the time sheet is a primary accounting document, it must contain the information provided for in paragraph 2 of Article 9 of Federal Law No. 402 “On Accounting”.

Labor Code of the Russian Federation

Federal Law of December 6, 2011 N 402-FZ

Time sheet (unified form T-12)

Form T-13

General rules for filling out the document

There are basic rules by which the timesheet should be filled out.

Let's look at them in more detail:

- Required to be completed within the billing period.

- At the end of the period, you need to indicate the hours the employee worked and the results for the first and second half of the month.

- Attendances and non-appearances must be recorded using the continuous recording method or using the deviation recording method.

- The top line must include a designation (for example, reporting to work, day off, etc.).

- The number of hours is indicated on the bottom line.

Normative base

The timesheet is a mandatory document that is available in any company. It is needed to confirm that the work trip actually took place.

If a dispute arises, the document will serve as proof of the veracity of the employee’s words. The absence of a document is punishable in accordance with the legislation of the Russian Federation. In general, the regulatory framework in 2020 did not change compared to 2020.

According to Part 4 of Art. 91 of the Labor Code of the Russian Federation, the employer must keep records of the time worked by the employee. There are special forms N - T-12, T-13.

A time sheet is an accounting document, and a primary one. It must contain information in accordance with paragraph 2 of Art. 9 FZ-402.

What symbols are used to indicate a business trip on a timesheet?

When filling out the timesheet, the days or hours that the employee worked are marked by entering “I” in the columns intended for this, and the number of hours is entered at the bottom of the column (check out the sample timesheet posted on our website - there you can see what these columns are ).

The days spent on a business trip are assumed to be o, and the number of hours is not entered. This is due to the fact that, according to Art. 167 of the Labor Code of the Russian Federation, the employee retains his average earnings for the duration of his business trip, for the calculation of which the length of the working day spent on a business trip performing an official assignment is not important.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week. Subscribe I agree with the terms of personal data processing

Separately, it is worth mentioning the issue of weekends that fall during a business trip. Related issues are partially regulated in Decree of the Government of the Russian Federation No. 749 of October 13, 2008. On the one hand, the employee spends these weekends away from home, on the other hand, he does not always use them to complete work assignments.

That is why it is important to record when an employee was involved in work on a day off, if there is confirmation of this (a corresponding order), supplemented by the employee’s consent to go to work on a day off. In this case, many personnel employees believe that they need to put “K” on weekends, although sometimes they put “RW” (work on days off). If the employee rested on a day off, “B” is entered on the report card.

At the same time, there is another point of view, according to which the letter “K” is marked on the timesheet for all the days listed in the order for sending on a business trip. The accounting department calculates wages on the basis of documents confirming the employee’s going to work on a day off, or taking into account their absence.

In fact, the time sheet is used to simplify salary calculations, while the calculation itself regarding days of absence due to illness, business trip or absenteeism is done on the basis of other documents: orders, instructions, sick leave, certificates, etc.

Features of filling out the timesheet

According to Art. 9 Federal Law No. 402 “On Accounting”, the time sheet is a primary accounting document and contains relevant information reflecting cases of employee attendance or non-appearance at the workplace, indicating the reasons. To be completed by an authorized employee every day, in accordance with the relevant instructions.

report card can be found here.

Samples of filling out timesheets

Rules

Rules for drawing up a timesheet:

- The timesheet is designed for entering information during the billing period. Typically this period is a month.

- After the end of the period, you need to enter the number of hours worked by the employee, as well as the results separately for the first and second parts of the month.

- When registering attendances and absences, it is necessary to use the complete registration method or the deviation registration method.

- In the top line above each column their designations are indicated, for example, attendance at work, day off, and so on.

- The number of hours is entered in the bottom line.

Marking time sheets for business trips has some peculiarities caused by the possibility of ambiguous interpretation of labor law norms. Consequently, the time sheet during a business trip is filled out according to special rules.

- Firstly, in this case there is no need to note the number of hours. This is due to the condition stated in Article 167 of the Labor Code of the Russian Federation that the employee retains the right to receive average daily earnings for the entire duration of the official trip, and for this, counting hours is not required.

- On the other hand, during a business trip, the employee is away from his main place of work; he performs a separate work assignment, and does not fulfill obligations under the employment agreement. Therefore, from this point of view, business trip time is not working time (Article 91 of the Labor Code of the Russian Federation). However, this cannot be called absenteeism.

Weekends and overtime on a business trip

The day the employee spent on a business trip, Fr. Difficulties may arise when filling weekends, sick days or overtime hours. In this case, an administration or accounting employee may encounter the following situations:

- The day off falls on one of the business trip days, but the employee does not work on that day. The report card is marked with code “B”.

- The business traveler worked at his host company on his day off. The report card is written “R/V” or “K/V”.

The specifics of how holidays are reflected in timesheets are regulated by Resolution No. 749 of October 13, 2008. To confirm the fact of working on a day off, an appropriate order and the employee’s written consent to work on a day off are required. Work on weekends is paid twice as much.

At some enterprises, the entire period of a business trip is based on an order to be sent on a business trip, and the fact of working on a day off when calculating wages is confirmed by other documents.

In general, the time sheet allows you to simplify the calculation of wages, and absences due to illness, business trips and absenteeism are taken into account when calculating wages with the help of relevant orders, instructions, sick leave, and certificates.

Overtime activities require mandatory indication of overtime hours. In this case, only overtime hours are indicated in the bottom line. To confirm processing, you need a certificate from the place of travel.

An example of filling out a timesheet for overtime work

| Serial number | Full name of the employee, position personnel number | Notes on attendance and non-appearance | |

| 4 | 5 | ||

| 15 | Alieva Svetlana Gennadievna, commercial director, 154 | C/S | C/S |

| 2 | 2 | ||

Reflection of the last day

Filling out the last day of a business trip on the timesheet also has its own characteristics. According to the law, the last day is the day of return by transport to the place of main work. Wherein:

- If you arrive before 24:00 of the current day, this day is considered the last day. If a worker is next, then the business traveler should go to work as usual. If tomorrow is a day off, then you need to go to work after it.

- If transport arrives after midnight, then the day of arrival will be the next day.

Note:

- Example 1 . The employee arrived at his permanent work address at 21-30 on May 14. Accordingly, May 14 becomes the last day of the business trip. I have to go to work on May 15th.

- Example 2. An employee was brought in at 6.15 on May 12. May 12 is the last business trip day. Going to work on the morning of May 15th.

An employee can go to work on the same day if he so desires, but the employer has no right to force him.

Notes on the time sheet regarding the last day of the trip:

- The employee does not come to work. The report card is marked with code “K”.

- He goes to work.

You should be guided by local legal acts, since the current labor legislation does not provide any guidance on such a case.

If the management of the enterprise has secured the opportunity to pay the employee both the last day of business trip and the average salary at the workplace, then the employee will receive double payment. In other cases, the employee will receive either his one-day salary or pay for a day on a business trip.

While on sick leave

A difficult situation arises when an employee goes on a business trip while on sick leave. This is done only with his consent. That is:

- The manager does not have the right to send an employee on a business trip with sick leave.

- If the employee himself agreed to the trip, then he loses the right to compensation under the certificate of incapacity for work. This is noted on the report card as a regular business trip day: “K”.

- If sick leave is issued while on a business trip, the report says: “K/B”.

At the end of the billing period, you need to close the timesheet.

It is not recommended to close before the end of the last day, since situations are possible when one of the employees suddenly gets sick or goes on unpaid leave. There will be an excess payment of funds in the form of wages, which will have to be withheld from accruals for the subsequent period (Part 2 of Article 137 of the Labor Code of the Russian Federation).

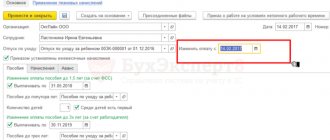

The formation of a time sheet in “1C: Accounting 8” is shown in the video below:

Payment for working hours of business travelers

Payment for working hours of business travelers

Payment for business trips is made according to the employee’s average earnings during the period spent on a business trip, so there is no need to indicate the number of hours worked by the employee. However, if overtime hours were worked on a business trip, they must be paid additionally and are indicated in the timesheet by the abbreviation “KS” . In this case, it is necessary to indicate the number of hours worked in excess of the norm and pay them in accordance with the employee’s average hourly wage. At the same time, just like during normal working hours, overtime hours must be paid in excess of the norm in accordance with the employment contract with employees and the Labor Code.

An example of a business trip designation on a time sheet can be viewed below.

Basic moments

It is important that the employee’s business trip is reflected correctly, because if the wrong code is indicated, the employee will not be able to receive the due payment. During a business trip, all information is indicated on the working time sheet. If the company does not record this, it will be difficult to confirm that the person was on a business trip for a certain period.

The Labor Code has a number of guarantees for employees who are away. First of all, the person retains his position. It does not matter how long the employee will be doing business in another city or country (several days, months or more). In any case, your place in the company will remain, so upon return you can immediately begin your duties.

Important! For each working day, a person will be paid an average salary. Therefore, even if he is away on company business, he will still receive income.

If the activity falls on a weekend, double salary is due. This rule also applies to holidays recognized by the state.

For business trips, an advance is allocated, which must be spent on services related to business and the trip itself. Its size depends on the specific situation, since the destination, number of days, etc. are taken into account. But sometimes a person did not have enough advance payment issued by the sending company. In this case, you will have to pay money from your own pocket.

Upon return, the employee will draw up an advance report. If it turns out that he paid his money, then it will be reimbursed to him. But you will need to confirm all data on embezzlement with checks, receipts and other documents. If there is any amount left over from the advance payment, it will have to be returned to the company. In any case, a time sheet must be kept, and next we will look at what information is indicated in it.

registration of a business trip in a time sheet

An employee’s stay on a business trip must be recorded in the work time sheet, without which it will be difficult to prove the work trip and calculate wages. The designation of a business trip in the time sheet must be done by the employer or an employee of the enterprise’s accounting department in accordance with Part 4 of Article 91 of the Labor Code of the Russian Federation.

You can find out how to mark a business trip on your report card by studying Article 91 of the Labor Code of the Russian Federation.

The time spent by an employee on a business trip cannot be designated either as working hours or as missed work days, so a business trip is usually designated with the special designation “K” .

In fact, a business trip can be defined as a work assignment not at the place of main work activity. In the timesheet, business trips must be separated into a separate category with a special designation.

Payment for working hours of business travelers

Payment for the duration of a business trip is made according to the employee’s average earnings during the period spent on a business trip, so the number of hours worked by the employee does not need to be indicated.

However, if overtime hours were worked on a business trip, they must be paid additionally and are indicated in the timesheet by the abbreviation “KS” . In this case, it is necessary to indicate the number of hours worked in excess of the norm and pay them in accordance with the employee’s average hourly wage.

At the same time, just like during normal working hours, overtime hours must be paid in excess of the norm in accordance with the employment contract with employees and the Labor Code.

An example of a business trip designation on a time sheet can be viewed below.

Sick leave on a business trip

An employee may get sick even during a business trip and then he will have to take sick leave.

The time spent on a business trip that a person spent on sick leave is not noted as regular business trip days, but has a special designation “K/B” .

Payment for time spent on sick leave on a business trip is made based on the same principles as payment for regular sick leave.

If an employee is on sick leave during a business trip, the employer cannot oblige him to travel, but must assign the work to another employee.

However, on his own initiative, an employee can go on a business trip even while on sick leave if he writes a special statement.

If an employee voluntarily goes on a business trip while on sick leave, the days of sick leave during which he performed work duties are not paid, but only the days spent on a business trip are paid. An employer has no right to pay for the same working day twice.

Weekends on a business trip

Even while on a business trip, an employee has the right to use legal days off. However, if a business trip involves urgent work, the employee can also work on a day off.

Weekends on which the employee went to work are indicated in the work time sheet as a special o and are paid at an increased rate in accordance with the terms of the employment contract.

Read more about how a business trip on a day off is paid on our website.

Weekends on which the employee did not carry out work activities while on a business trip are indicated in the work report card with a special abbreviation “B” .

How a business trip is noted in the time and attendance system - see the video:

Last day of the trip

The last day of a business trip is the day the employee arrives back. Depending on the time of arrival on the last day of the business trip, the employee can also go to work on his own initiative.

note

The daily allowance for a business trip is determined by the employer. The maximum amount for a business trip in Russia, which is not subject to personal income tax, is 700 rubles, abroad - 2500 rubles. Read more in this article

If the employee arrived in the city before 24 o'clock in the afternoon, this day will be considered the last day of the business trip; if the arrival takes place in the morning of the next day, the business trip should be closed tomorrow.

Even if an employee arrived in the city early in the morning, the employer cannot force him to go to work on the last day of the business trip. According to the law, one working day cannot be paid twice.

Hours of work will be indicated on the time sheet as travel hours marked “K” .

Thus, the time worked at the place of main work on the last day of the business trip will not be taken into account when calculating wages.

Source:

Accounting and payment of time on a business trip

In accordance with Art. 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

When an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as reimbursement of expenses associated with the business trip (Article 167 of the Labor Code of the Russian Federation).

Within the meaning of these norms, during a business trip, the employee ceases to perform his labor function at the place of permanent work and performs an official assignment outside the place of such work. In other words, while on a business trip, the employee performs a separate official assignment, and not the labor function enshrined in the employment contract. Accordingly, business trip time is not working time in the sense in which it is defined in Art. 91 Labor Code of the Russian Federation.

Fulfilling the requirement of Part 4 of Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee. For this purpose, unified forms No. T-12 and T-13 are used, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

According to the Instructions for the use and completion of primary accounting documentation forms, columns 4 and 6 of the top line are used to mark symbols (codes) of working time costs, and the bottom line is used to record the duration of worked or unworked time (in hours, minutes) according to the corresponding codes of working time costs for every date.

When reflecting absences from work, which are recorded in days (vacation, days of temporary disability, business trips, leave in connection with training, time spent performing state or public duties, etc.), only symbol codes, and the columns of the bottom line remain empty.

To indicate the time of a business trip, the letter code K and the numeric code are set to 06. Marks in the report card on the reasons for absence from work are made on the basis of documents drawn up properly.

Based on the order to send the employee on a business trip, which records the period of the employee’s business trip in calendar days, as well as travel documents and work assignments in the work time sheet, all calendar days of the business trip, including weekends and non-working holidays, are marked with code K or 06. Otherwise, it will not be clear from the timesheet that this is a single period of business trip. Columns 4 and 6 of the bottom line remain blank. After all, absences from work due to a business trip are recorded in days. Accordingly, the duration of performance of an official assignment on working days is not recorded in the time sheet, even if the employer, according to the employee or according to information from other sources, has such information.

According to clause 9 of the Regulations on the peculiarities of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations), the average earnings are maintained for all days of work according to the schedule established in the sending organization, which fall both during the period of stay an employee on a business trip, as well as for days on the road, including during a forced stop along the way. At the same time, for the purposes of the Regulations, the sending organization is the organization in which work is stipulated by an employment contract (clause 3 of the Regulations).

Thus, the average salary is paid to the employee only for working days missed due to a business trip.

During a business trip, it is necessary to pay the average earnings, and not wages. This is confirmed by Rostrud in letter dated 02/05/2007 No. 275-6-0. It follows from it that paying an employee sent on a business trip wages for the days he is on a business trip will contradict the provisions of the Labor Code of the Russian Federation.

There is another position: employees with a time-based wage system (based on an hourly, daily rate or salary) during a business trip, instead of average earnings, can be paid a regular salary, subject to the requirements of Art. 167 of the Labor Code of the Russian Federation, that is, no less than the guaranteed average earnings, since this does not worsen the employee’s situation.

In our opinion, the employer, in any case, is obliged to pay employees the average salary for all working days on a business trip, as required by Art. 167 of the Labor Code of the Russian Federation and clause 9 of the Regulations. At the same time, he has the right to decide that posted workers will not only retain their average earnings, but will receive an additional payment in the amount of the difference between the current (actual) salary and the amount of average earnings saved for the period of the trip. A similar approach was proposed by specialists from the Russian Ministry of Health and Social Development on the official website.

Let us note that the Ministry of Finance of Russia confirms the possibility of accounting for tax purposes costs in the form of additional benefits to employees in addition to the average earnings for business trips, if such payments are provided for in the employment contract with the employee, the local regulatory act of the employer or in the collective agreement (see letters dated September 26, 2008 No. 03-03-06/1/548, dated 01/27/2009 No. 03-03-06/1/34, dated 04/02/2009 No. 03-03-06/1/208 and dated 04/03/2009 No. 03-03- 06/2/77).

An employee’s work if he is involved in work on weekends or non-working holidays is paid in accordance with the labor legislation of the Russian Federation (clause 5 of the Regulations). This means that during a business trip, employees are subject to guarantees of increased pay for work on weekends and holidays established by Art. 153 Labor Code of the Russian Federation.

According to this article, work on weekends or non-working holidays is paid at least double the amount:

- for piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- for employees receiving a salary - in the amount of no less than a single daily or hourly rate (part of the salary for a day or hour of work) in addition to the salary, if work on a weekend or non-working holiday was performed within the monthly standard working time, and in an amount of at least double the daily rate or an hourly rate (part of the salary for a day or hour of work) in addition to the salary, if the work was performed in excess of the monthly working hours.

Thus, a posted worker for carrying out an official assignment on weekends and non-working holidays is paid not double the average salary, but a double wage rate. Instead of increased pay, the employee can take another day of rest. Then the day off (holiday) is paid in a single amount (Part 3 of Article 153 of the Labor Code of the Russian Federation).

The time sheet must reflect the fact that a work assignment was completed on a day off (holiday). For this purpose, the number of columns is increased for the corresponding number. In the first column, as usual, the business trip code is entered without indicating the number of hours, and in the second column - the code of work on weekends and holidays (РВ or 03) and its duration in hours.

As noted above, according to Art. 91, 166 and 167 of the Labor Code of the Russian Federation, an employee, fulfilling an official assignment, for the duration of a business trip ceases to perform labor duties in his position, and the days of the business trip are not working time for him. Consequently, during a business trip there cannot be hours of work outside the established working hours, that is, overtime hours (Article 99 of the Labor Code of the Russian Federation).

For all days of a business trip, which are considered working days according to the schedule established by the sending organization, the employer is obliged to pay the employee only the average salary, since the legislation does not provide for any other mechanism for paying for business trip days.

Determining the duration of a business trip, taking into account the volume, complexity and other features of the official assignment, is within the exclusive competence of the employer (clause 4 of the Regulations).

However, in our opinion, the employer abuses the right if, when assigning a job assignment, he knows that the duration of its completion will exceed the normal one. We believe that the employer, when sending an employee on a business trip and setting its terms depending on the volume of the official assignment, should, by analogy, apply the requirements of labor legislation on normal working hours for certain periods.

In any case, the employer has the right to compensate the employee for the actual loss of rest time that occurred during the business trip, securing the decision on additional payment in a local regulatory act defining the system of remuneration and bonuses for employees, a collective or employment agreement.

Symbols in the time sheet

Since 2013, many enterprises have been recording staff working hours using their own forms. To develop them, you should rely on a unified form.

Conventional symbols are used to compile timesheets. Mandatory designations are not provided for by law. The existing encoding is only a recommendation and can be changed by users.

Since the rules for filling out time sheets in some situations are not clearly regulated, HR officers and accountants have to resolve issues of their reflection in the register on their own.

Purpose of the document

The Labor Code of the Russian Federation requires all employers to keep records of the time worked by their staff.

Timesheets are mandatory for both enterprises and individual entrepreneurs.

For its absence, administrative liability is provided for the enterprise itself and the responsible persons.

A time sheet is a document containing information about days worked by each employee, absences from work for valid and unexcused reasons.

It can be done in different ways. Information about the presence or absence of workers is recorded daily.

All facts of absence, no-shows, and tardiness must be included in the report card.

The data from the Time Sheet serves as the basis for calculating and calculating wages for all employees of the company.

It controls:

- labor discipline;

- standard length of the working week;

- duration of overtime work;

- work on weekends.

The Labor Code establishes a five-day working week with a duration of 40 hours and a six-day working week with a duration of 36 hours.

During operation, these standards may be violated.

The main rule is that the total amount of hours for the reporting period, for example, a quarter, must correspond to the required size.

The report card is the main document used by the labor inspectorate for inspection. In addition, on its basis, statistical reporting on labor and personnel for government agencies is generated.

Form T-12

Who is responsible for filling it out?

Each company appoints a specialist responsible for timesheets of employees.

The organization of accounting depends on the specifics and scale of the company’s activities and the number of personnel.

In small enterprises, where all work is carried out within the office, the staff is reported by a personnel inspector, accountant or other authorized specialist.

In large companies with several structural divisions, it is more convenient to keep personnel records directly at their workplaces. A separate order assigns the responsibility for timesheets to the head of the unit. It can also be specified in the employment contract.

The difference between the T-12 and T-13 forms

Especially for the convenience of recording time worked by personnel, Goskomstat developed and approved unified document forms: T-12 and T-13. They differ in purpose.

The first is used for normal manual accounting. The second is necessary for enterprises with an automatic system.

As a rule, special turnstiles are installed that independently control the attendance of workers.

Form No. T-12 is universal. It includes an additional section to reflect information about the calculations made for the payment of wages. If calculations are carried out separately, it is not filled out.

Time sheet (form T-12)

Sample of filling out a time sheet (form T-12)

Sample of filling out form T-12:

Decoding the symbols in the time sheet in 2020

In practice, mistakes are often made when drawing up a document. Usually they are caused by incorrect placement of conditional codes.

Designations in the timesheet can be used both alphabetic and digital. There are no instructions for choosing them.

Therefore, each company independently chooses the type of encryption depending on its convenience.

Time sheet (form T-13)

Sample of filling out a time sheet (form T-13)

To avoid such mistakes, you should use brief recommendations for filling out the document in 2020:

As you can see, the designations in the time sheet are important.

There are no legal requirements for encryption, so it can vary depending on the needs of the organization and the convenience of timesheets.

You can come up with your own conditional codes. The main thing is that the accounting and its final indicators are correct.

Form T-13

Weekends on business trips

There are different points of view regarding the coding of days off during employee travel. Some personnel officers argue that it is necessary to designate them with the general code “K” (business trip) for such work. Others lean toward the "B" (out) cipher.

Both points of view have reasonable justification and legislative argumentation. Since there is no uniform approach, when marking days off on a business trip, you should proceed from your own practice and preferences.

Sick leave

If an employee is on sick leave, he is considered temporarily disabled. Therefore, the missing time in the report card is o. There is no difference between working days and weekends.

Leave in connection with pregnancy and childbirth, care for an infant, and unpaid leave are recorded in the same way.

Vacation

To designate weekend holidays during the annual main and additional paid leave (OT and OD), the letter symbol “B” is used, meaning a day off and a non-working holiday. The basis for this rule is the norms of the Labor Code of the Russian Federation. According to Article 120, non-working holidays during paid holidays are not included in the number of calendar days of rest.

Sample of filling out form T-13

Procedure for filling out the form

The new form of the report card (0504421) is a table consisting of a heading, content and design parts. The first part indicates the type of document, correction number and date of preparation.

The work of filling out the content of the report card is painstaking. It must be performed with special attention. For convenience, you can use the method of continuous registration of attendance and non-appearance time.

Each column is filled in with the appropriate code. Some symbols are used to indicate the presence of specialists at work, and others to indicate their absence. For all absences, it is necessary to indicate what the reasons were. It is important to indicate the number of hours spent at work.

The information in the timesheet is as follows: day off, under which is indicated “O”, worker - “I” with the number of hours, for example, “6”.

The reasons for absence from work are noted similarly to days off. Moreover, this can be either business trips or absenteeism for unknown reasons. If an employee was dismissed in the middle of the month, then all subsequent columns for him until the end of the period are filled in with dashes.

Such registration greatly simplifies the calculation procedure, since all the numbers needed for it are systematized and clearly shown. This allows you to avoid confusion and mistakes, which is especially important for specialists with little experience.

It is possible to use the method of recording deviations. It is convenient to use if the working hours are the same throughout the reporting period.

In such a situation, only non-standard phenomena are reflected, i.e. business trips, overtime work, absences, etc.

This method takes significantly less time to fill out the form.

The information in the timesheet looks like this: the top line reflects data on the specialist’s absence from work - B, PR, NN, OT, K, V, etc. There is nothing on the bottom line. Next, when calculating, all that remains is to count the number of filled cells and multiply them by the number of hours of the working day.

This method is most convenient for experienced accountants and personnel officers. It is also effective in small companies with a small staff.

New fields have been added to the formal part of the form for the accountant to mark the acceptance of the document, as well as the signature of the responsible executor and its transcript.

In addition to the traditional paper form of timesheets, electronic versions are now used. It is desirable that the registers be duplicated, i.e. both options were used. This way, the risk of loss will be minimal, and the reliability of the information will be maximized.

The easiest way to keep timesheets electronically is through office programs. Exce is best suited for this, allowing you to create tables of any type and size. The ability to set formulas simplifies the process of calculating both intermediate and final indicators.

If you don’t have enough experience working with spreadsheets, you can use special software. In this case, do not forget about the need to pay for using the licensed program.

Source:

What form is used to record working time?

All facts of the economic life of the organization must be recorded in the primary documentation. This obligation follows from the provisions of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Simultaneously with the adoption of this law, there was no longer a need to use unified forms for a number of primary documents.

In particular, Goskomstat Resolution No. 1 of January 5, 2004 provides unified forms of working time sheets T-12 and T-13. It is in these forms that data is displayed both on the worker’s attendance/absence at his workplace, and on the reasons for the absence. Now these forms are optional for use by organizations, i.e. it is allowed that the personnel department can develop its own form of report card.

In practice, most companies continue to use a time sheet in the T-12 form (if it is filled out by hand) or T-13 (if individual columns are automatically filled out). If necessary, these forms are adjusted taking into account the specifics of the company's activities.

In this case, in any case, the form of the primary document used must contain the details specified as mandatory in Art. 9 of the Law “On Accounting”:

- name of the document (in this case - “Working Time Sheet”);

- date of preparation of the report card;

- the name of the company where the timesheet is used to record employee working hours;

- columns for displaying attendance/no-appearance (indicating the reasons for non-appearance);

- indication of units of measurement (days and/or hours);

- name of the position and full name of the employee responsible for maintaining the schedule;

- signatures of persons authorized to approve the report card.

Only if all these details are present in the form of a report card can it be considered valid.

https://youtu.be/Gs-gnYjgQTY