What is overtime work

The Labor Code knows only two forms of legally attracting employees to work in the same position after the end of the working day (Article 97 of the Labor Code of the Russian Federation).

The first is an irregular working day (we have already talked about it earlier, see the article “Arranging an irregular working day”). The second is overtime. Accordingly, the conclusion suggests itself - for those employees who have been introduced to irregular working hours, delays after the end of the work shift will not be considered overtime work. This is also confirmed by Rostrud, which in letter No. 1316-6-1 dated 06/07/08 indicated: the work of employees who have an irregular working day is not overtime, although it is performed outside the working day. So they are not entitled to any additional payments (everything is compensated by additional vacation). Rostrud also regulated another situation that often occurs in practice - when an employee does not have time to complete the assigned work on time, and for this reason he himself decides to stay late (letter of Rostrud dated March 18, 2008 No. 658-6-0). According to officials, in this case it is also impossible to talk about overtime work. Moreover, in this case we cannot talk about work at all - such delays when determining hours worked are not taken into account at all and are not compensated in any way.

But here it is important to understand that we are talking specifically about those cases when the work was assigned to the employee in advance, the time frame for its completion was adequate, and the delay is not related to technological or other unforeseen circumstances. Otherwise, it is possible that dissatisfied employees will appear and, as a result, complaints to regulatory authorities.

In all other cases, engaging an employee at the initiative of the employer to work outside the working day established for this employee is overtime work (Article 99 of the Labor Code of the Russian Federation) and requires proper accounting and registration.

Legal norms

Art.

154 of the Labor Code of the Russian Federation establishes a guaranteed additional payment for performing labor functions at night. According to standard rules, if an employee’s working conditions differ from normal, he is entitled to increased payment. Night work is work in conditions that differ from normal conditions. Along with overtime hours, work on weekends and holidays. Part 1 art. 96 of the Labor Code of the Russian Federation establishes what time is considered night according to the Labor Code - this is the period from 22:00 in the evening to 06:00 in the morning. If an employer engages a subordinate to work at night, he is obliged to pay extra. The minimum amount of additional payment is guaranteed by Government Decree No. 554 of July 22, 2008. This is 20% of the hourly tariff rate for each hour.

The amount of the additional payment is established in the employment contract with the employee and in the collective agreement of the employer. Moreover, the employer has the right to establish an additional payment in an increased amount, but not lower than that established by legislative acts. For example, the company has the right to make an additional payment of 50% for each hour.

Procedure for processing documents

Registration of overtime work begins with obtaining the employee’s consent to such a “labor feat” (situations when consent is not required are listed below). The Labor Code does not regulate the procedure for obtaining consent, requiring only that consent be written. Therefore, formally, the employer can receive it even after issuing an order on overtime work. But we do not recommend doing this. And that's why.

Firstly, there are categories of employees (for example, disabled people, women with children under three years of age, etc.; see the full list below) whom the employer must notify in writing of the right to refuse overtime work. Agree that the order, which states that Ivanova I.I. is involved in overtime work from 18 to 22 hours and at the same time her right to refuse such work is explained, will look ridiculous.

Secondly, not only the specified categories of employees, but also all others have the right to such a refusal (it is simply not necessary to explain this right to them in writing).

Accordingly, any employee can refuse to work overtime without any negative consequences. This means that the order will have to be redone to avoid confusion when filling out the Time Sheet and calculating compensation.

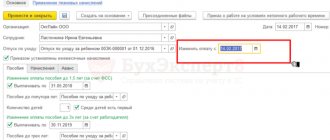

Therefore, we advise that before issuing an order, issue a notification document where the employee would sign that he agrees to work overtime. In such a document you need to indicate the period of overtime (in hours) and the start date of overtime work. In the same document, you can offer the employee to choose the form of receiving compensation - cash or in the form of additional rest (Article 152 of the Labor Code of the Russian Federation).

And only after this an order should be issued to the consenting employees. A unified form for an order to engage in overtime work has not been established, so an organization can issue it in a free form.

Typically, such an order indicates the reason for the need for overtime work. It should be noted here that Article 99 of the Labor Code of the Russian Federation contains only an approximate list of such reasons - part 4 of this article states that it is possible to engage employees overtime “in other cases” (the only difference is that “other cases” require the consent of the trade union, if there is one) .

The order also contains the names, positions and personnel numbers of employees who will work after the end of the working day; the start time of overtime work and its end time are indicated. Please note that the time for completing these documents, if it occurs after the end of the working day, is also included in overtime hours. Additionally, opposite each last name, you can indicate the details of the notification, which contains consent to overtime work. The order drawn up in this way must be handed over to employees for review, which each of them must confirm with a handwritten signature.

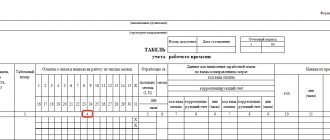

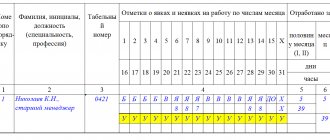

The time worked overtime by employees is necessarily recorded in the Working Time Sheet (forms No. T-12 or T-13, approved by Resolution of the State Statistics Committee of Russia dated 01/05/04 No. 1). For this, a special code “C” or 04 is provided, which must be combined with an indication of the number of hours worked overtime. In this case, the data in the Timesheet must coincide with the data in the order (and the order, in turn, with the documents on consent to overtime work signed by the employee). Remember also that the Labor Code prohibits working overtime for more than four hours for two days in a row and more than 120 hours per year (Article 99 of the Labor Code of the Russian Federation).

Overtime work: we process and pay correctly

E. N. Galichevskaya , independent consultant

Accountants often confuse two concepts: overtime and irregular working hours. This is not surprising, since both of them refer to work outside the working hours established for the employee. In the article, we will consider what is meant by overtime work, what guarantees and compensations are provided to employees, how to formalize their involvement in it and, most importantly, how to correctly calculate and pay for such work.

What kind of work can be considered overtime?

Overtime work is recognized as work that meets the following conditions (Part 1 of Article 99 of the Labor Code of the Russian Federation):

- carried out at the initiative of the employer;

- goes beyond the established working hours for the employee - daily work (shift).

Please note that if an employee is late at work on his own initiative (the reasons for this can be any: low productivity, the need to complete personal matters, etc.), such work is not considered and is not paid as overtime. This was voiced in the letter of Rostrud dated March 18, 2008 No. 658-6-0. Also, the performance of work duties within the framework of irregular working hours is not recognized as overtime work.

If the organization has adopted a summarized accounting of working hours, then overtime is considered to be work performed in excess of the normal number of working hours for the accounting period. The employer must determine the accounting period (month, quarter or other period up to a year) in the internal labor regulations. This is necessary for the correct calculation of hours worked overtime by an employee (Article 104 of the Labor Code of the Russian Federation).

Involvement in overtime work should not be systematic; it can occur sporadically in certain cases (Rostrud letter No. 1316-6-1 dated 06/07/2008).

Overtime duration

Normal working hours are 40 hours per week (Article 91 of the Labor Code of the Russian Federation). To attract employees to work overtime, you need to act like this.

1. Notify the employee about this in writing. In the notification, the employee can express his consent to be involved in overtime work (when necessary) or refuse it.

The employee’s consent to perform overtime work can be formalized in one of the following ways. The first method: the employee writes a statement in free form with the following content: “I, F.

I. O., I agree to be involved in overtime work due to production needs.”

The second method: the employee makes a note on the order about being involved in overtime work with the following content: “I agree (agreed) to be involved in overtime work.”

2. Issue an order to involve the employee in overtime work, indicating the following data:

- the reason for engaging in overtime work;

- its start date;

- details of the document with which the employee expressed his consent to work overtime.

The unified form of such an order has not been approved, so the employer has the right to develop it independently. The employee must be familiarized with the order and signed.

3. In the work time sheet (for example, in form No. T-12 or No. T-13, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1), hours worked overtime are indicated by the letter code “C” or the digital code “04”.

Remember that the duration of overtime work should not exceed four hours for each employee for two consecutive days and 120 hours per year (Article 99 of the Labor Code of the Russian Federation).

True, for some categories of workers a reduced working time is established, which is normal for them (Article 92 of the Labor Code of the Russian Federation). These include, in particular:

- minor workers - from 24 to 35 hours per week depending on age;

- disabled people of group I or II – no more than 35 hours per week;

- employees whose working conditions at their workplaces, based on the results of a special assessment of working conditions, are classified as hazardous working conditions of the 3rd or 4th degree or hazardous working conditions - no more than 36 hours per week;

- women working in the Far North (Article 320 of the Labor Code of the Russian Federation);

- teachers (Article 333 of the Labor Code of the Russian Federation);

- health workers (Article 350 of the Labor Code of the Russian Federation).

That is, for these categories of workers, overtime will be considered work that exceeds the reduced working hours established for them (daily work, shift).

The rules regarding overtime work apply to both employees at the main place of work and part-time workers.

Example 1

An accountant has a five-day working week and an eight-hour working day from 9.00 to 18.00 (with a lunch break from 13.00 to 14.00). The manager asked the accountant to stay until 20.00 to prepare a report for him. The period of time from 18.00 to 20.00 in this case is overtime work.

Example 2

The locksmith works 5 days a week - from Monday to Friday from 9.00 to 18.00. To eliminate the accident, he was called to work on Saturday from 10.00 to 20.00. Is this considered overtime?

No, this is considered work on a day off and is regulated by Article 153 of the Labor Code of the Russian Federation. Thus, if a mechanic receives a salary and has worked a monthly standard of working time, then his work on a day off must be paid in the amount of at least double the hourly rate above the salary (Part 1 of Article 153 of the Labor Code of the Russian Federation). Also, work performed on non-working holidays is not considered overtime.

Example 3

An employee works in an organization with summarized working hours. The accounting period is a quarter. Normal working hours are 40 hours per week. To calculate the number of hours worked overtime, it is necessary to compare the normal working hours established for a given employee and the number of hours actually worked by him in the accounting period, that is, indicated in the time sheet.

In the first quarter of 2020, according to the production calendar for a 40-hour work week, the standard working hours is 447 hours: in January - 120 hours, in February - 159, in March - 168. According to the schedule, the employee worked 125 hours in January, 160 in February , in March 164. Total - 449 hours. That is, he worked 2 hours overtime.

Who should not be required to work overtime?

The following categories of workers are not allowed to work overtime:

1) pregnant women (Part 5 of Article 99 of the Labor Code of the Russian Federation);

2) persons under the age of 18, with the exception of:

- certain categories of creative workers (Article 268 of the Labor Code of the Russian Federation). Their list was approved by Decree of the Government of the Russian Federation dated April 28, 2007 No. 252;

- athletes, if a collective or labor agreement, agreements, or local regulations establish cases and procedures for engaging in overtime work (Part 3 of Article 348.8 of the Labor Code of the Russian Federation);

3) employees during the period of validity of the student agreement (Part 3 of Article 203 of the Labor Code of the Russian Federation);

4) other employees (as a rule, restrictions are established in connection with medical contraindications, for example, persons with an active form of tuberculosis (Resolution of the Council of People's Commissars of the USSR No. 15 dated January 5, 1943), drivers allowed to drive a vehicle as an exception due to a special condition health (Sanitary rules for occupational hygiene of car drivers, approved by the Ministry of Health of the USSR on 05.05.1988 No. 4616–88)).

In addition, for some categories of employees there is a special procedure for attracting overtime work. The employer is obliged:

- obtain the employee’s written consent;

- make sure there are no medical contraindications;

- inform employees, upon signature, of the right to refuse to perform overtime work.

Such employees include (Part 5 of Article 99, Article 259, Article 264 of the Labor Code of the Russian Federation):

- disabled people can be involved in overtime work only if this is not prohibited for them due to health reasons (Part 5 of Article 99 of the Labor Code of the Russian Federation). For example, if a medical report states that working hours should not exceed 30 hours per week, the employer does not have the right to involve the employee in work beyond the specified time. By the way, documents confirming disability are not contained in the list of documents established by Part 1 of Article 65 of the Labor Code of the Russian Federation, which the employee is obliged to present to the employer when concluding an employment contract. Submission of such documents is the right of the employee. An employer who enters into an employment contract with an employee on a general basis (not counting the quota) is not only not obliged, but also does not have the right to demand from the employee documents confirming disability (Part 3 of Article 65 of the Labor Code of the Russian Federation). Therefore, the employer’s obligation to create recommended working conditions for a disabled employee will arise only after the presentation of documents confirming disability;

- women with children under three years of age;

- mothers and fathers raising children under the age of five without a spouse;

- workers with disabled children;

- workers caring for sick members of their families in accordance with a medical report;

- guardians (trustees) of minors.

Experts offer several options for notifying an employee of his right to refuse overtime work.

The first option: on the order to engage in overtime work, the employee writes by hand: “I am familiar with the right to refuse overtime work.”

Second option: the notification is issued in the form of a separate document, and the employee gets acquainted with it and signs it.

Involvement in overtime work with the consent of the employee and without his consent

With the written consent of the employee, you can be required to work overtime in the following cases (Part 2 of Article 99 of the Labor Code of the Russian Federation):

- if necessary, perform (finish) work that has begun, which, due to an unforeseen delay due to technical production conditions, could not be performed (finished) during the working hours established for the employee, if failure to complete this work may result in damage or destruction of the employer’s property or create a threat to life and people's health;

- during temporary work on the repair and restoration of mechanisms or structures in cases where their malfunction may cause the cessation of work for many workers;

- to continue work if the replacement employee fails to appear, if the work does not allow a break.

By order of the employer, an employee without his consent can be involved in overtime work (Part 3 of Article 99 of the Labor Code of the Russian Federation):

- to prevent a catastrophe, industrial accident, to eliminate their consequences, as well as the consequences of a natural disaster;

- to eliminate the circumstances due to which centralized systems of water, heat and gas supply, transport and communications do not function;

- in the event of a state of emergency or martial law and in other emergency situations that threaten the population (fires, floods, etc.).

To engage in work on these grounds, the consent of the trade union organization is not required, since these circumstances are extraordinary. If you refuse to perform such work, a corresponding act is drawn up, and the employee is subject to disciplinary action.

In all other cases, at the initiative of the employer, work outside the working hours established for the employee is carried out with the written consent of the employee and taking into account the opinion of the elected body of the primary trade union organization (Part 4 of Article 99 of the Labor Code of the Russian Federation). That is, the employer has the obligation, in other necessary cases, to take into account the opinion of the elected body of the primary trade union organization when inviting an employee to work overtime, even if he is not a member of the trade union.

Overtime pay

Overtime work is compensated to the employee with increased pay:

- the first two hours of overtime are paid at least one and a half times the rate;

- subsequent hours - no less than double (Article 152 of the Labor Code of the Russian Federation).

Specific payment amounts can be established:

- local regulations;

- collective or labor agreement.

If a collective agreement or other local regulation establishes the amount of additional pay, then this amount can be indicated in the order to involve the employee in overtime work. The amount may also be determined by agreement of the parties.

Overtime work can be compensated by increased wages or additional rest time at the request of the employee (Article 152 of the Labor Code of the Russian Federation). If the employee has decided on the form of compensation, this item is also included in the order.

Despite the fact that the Labor Code of the Russian Federation specifies how to pay for overtime work, questions and disputes still arise. This is because the procedure for determining one and a half and double overtime pay is not clearly established in the legislation. The employer naturally has a question about what amount to calculate.

The Supreme Court, in its Decision dated June 21, 2007 No. GKPI07–516, tried to clarify this point and determined that payment should be made in the same way as work on weekends and non-working holidays is paid (Article 153 of the Labor Code of the Russian Federation). That is:

- for piece workers - for the first two hours at no less than one and a half piece rates, and for subsequent hours - at no less than double;

- employees whose work is paid at daily or hourly tariff rates - in the amount of one and a half daily or hourly tariff rate for the first two hours, and for the following hours - in the amount of double daily or hourly tariff rate;

- employees receiving a salary - in the amount of one and a half hourly rate (part of the salary for a day or hour of work) in addition to the salary for the first two hours of work, and for subsequent hours - in the amount of double the hourly rate (part of the salary for a day or hour of work) in addition to the salary.

The Ministry of Health of Russia, in a letter dated July 2, 2014 No. 16-4/2059436, expressed its position on how to determine the hourly tariff rate, because such a calculation procedure is not regulated by law. The procedure for calculating it for overtime pay can be determined by a collective agreement, an additional agreement to the employment contract, or an internal local act. Accordingly, this fact will not entail a violation of the labor legislation of the Russian Federation.

Taking into account the annual standard of working hours according to the production calendar for 2020, the average monthly number of working hours will be:

- with a 40-hour work week – 164.5 hours (1974 hours / 12 months);

- with a 36-hour work week – 148.03 hours (1776.4 hours / 12 months);

- with a 24-hour work week – 98.63 hours (1183.6 hours / 12 months).

The Russian Ministry of Health itself recommends calculating this rate by dividing the employee’s salary by the average monthly number of working hours, depending on the established length of the working week in hours. In this case, the average monthly number of working hours is calculated by dividing the annual norm of working time in hours by 12.

This calculation benefits both the employee and the employer because it allows the employee to receive the same pay for overtime work performed in different months. True, this is just a private opinion of an official, and not a normative act (in addition, there are court decisions where the courts expressed a different point of view, for example, the decision of the Ust-Ilimsk City Court of the Irkutsk Region dated June 24, 2014 No. 2-1275/2014).

Thus, when using this approach, all responsibility will fall on the shoulders of the employer. It would be advisable to enshrine this calculation procedure in a collective agreement, agreement or local regulation.

Let us show with an example how the hourly tariff rate is calculated.

Example 4

The employee's salary is 60,000 rubles. In 2020, with a 36-hour work week, the average monthly number of working hours will be 148.03 hours (1776.4 hours / 12 months). Hourly wage rate for this employee: 60,000 rubles: 148.03 hours = 405.32 rubles.

Example 5

Workers V.N. Klyushkin and D.N. Plyushkin have a 12-hour shift. The accounting period is the month during which each of them worked 12 hours overtime. The employment contract sets the hourly wage rate from which their labor is paid at 234 rubles/hour. For overtime work, Klyushkin had one shift off, but Plyushkin did not.

For 12 hours worked overtime:

– V.N. Klyushkin earned 2,808 rubles (234 rubles/hour x 12 hours);

– D.N. Plyushkin – 5,382 rubles. (234 RUR/hour x 2 hours x 1.5) + (234 RUR/hour x 10 hours x 2).

How to pay overtime when working hours are summarized

When recording working hours in aggregate, overtime can occur for two reasons.

1. Due to the occurrence of emergency and non-routine (which cannot be foreseen in advance) situations.

In this case, regardless of the procedure for recording working time, the involvement of an employee in work beyond the established duration of the working day (shift) is formalized by order (instruction) of the employer. Hours worked overtime are reflected in the timesheet using code “C” and are paid at the end of the month in which they occurred.

2. Due to the impossibility of creating a work schedule for the accounting period in strict accordance with the standard working hours for this period.

The specificity of the hours of overtime work determined in this case is that they are worked in accordance with the schedule and are indicated in the timesheet by the code “I”, “N”, “RV”. Code "C" is not used.

In this matter, one should adhere to the norms of paragraph 5.5 of the Recommendations on the use of flexible working time regimes in enterprises, institutions and organizations of sectors of the national economy (approved by Resolution of the USSR State Committee for Labor No. 162, All-Union Central Council of Trade Unions No. 12–55 of May 30, 1985). These Recommendations are valid to the extent that they do not contradict the Labor Code of the Russian Federation (Article 423 of the Labor Code of the Russian Federation, decision of the Supreme Court of the Russian Federation of October 15, 2012 No. AKPI12–1068).

In accordance with this document, it is necessary to determine the number of working days in the accounting period and pay for the first two hours of overtime work, falling on average for each working day of the accounting period, in no less than one and a half times, and for the following hours - no less than double size.

The presence and number of hours recognized as overtime can be determined only at the end of the accounting period and only by calculation:

Ksu = Kotr – (Nup – Kosv),

where Ksu is the number of overtime hours;

Kotr – the number of hours actually worked in accordance with the schedule;

Nуп – standard working time in the accounting period, calculated on the basis of the working time established for the employee (normal or reduced) in accordance with the production calendar;

Kosv - the number of working hours falling during periods when the employee was released from work in accordance with current legislation.

So, for the same hour, two additional payments that are similar in economic essence cannot be made - for work on a day off and for overtime work (the same hour cannot be reflected in the time sheet using both the code "РВ" and code "C")

In accordance with the general rules, work hours designated by the code “РВ” are always paid at least twice the amount and in the month in which they are worked. In other words, payment in an increased amount for time worked on weekends and holidays is made at the end of the month, regardless of the reasons for which the work was performed (for emergency reasons or in accordance with the schedule), and other conditions.

If the work was done on a day off, that is, outside the schedule, it is similar to overtime work. No one doubts this.

If the work was carried out in accordance with the schedule on a non-working holiday, then the order of reasoning is different.

Ideally, no one should work on non-working holidays (work on these days is prohibited by Article 113 of the Labor Code of the Russian Federation). However, everyone knows that there are industries, public service organizations, etc., whose work is not suspended on holidays.

Then work on the indicated days should be provided for by schedules and be part of the standard working hours (observance of which is “ideally” mandatory). If, despite all the efforts of the employer, the schedule is drawn up in excess of the standard working hours, then, according to the author, first of all, overtime (“extra”) hours are those worked on holidays, and then the rest. That is why, at the end of the accounting period, additional payment is made only for those overtime (exceeding the norm) hours that are clearly not paid among those worked on holidays.

Example 6

According to the production calendar compiled for a 40-hour work week, there are 176 working hours (22 working days) in September 2020.

Employee Ivanov works according to a schedule: a five-day working week with an 8-hour working day. During the month, Ivanov was twice released from work due to temporary disability:

a) for 5 calendar days (from Monday to Friday), of which 5 days were working days;

b) for 5 calendar days (from Monday to Tuesday), of which 3 days were working days.

The working time sheet reflects:

— by code “I” – 13 days (112 hours);

- according to code “B” - 10 days, including: 8 days, which, in accordance with the production calendar, are working days, and 2 days, which are weekends.

Thus, 8 days of temporary disability were not included in the number of hours worked. Normal working hours per month are reduced by 8 working days missed due to illness and amount to:

22 days – 5 days – 3 days = 13 days,

or

176 hours – (8 hours x 5 days) – (8 hours x 3 days) = 112 hours.

Employee Petrov works on a shift schedule (shift duration is 10 hours). Working time recording – summarized; accounting period – 1 month.

In accordance with the schedule, Petrov must work 180 hours in a given month (4 hours will be considered overtime). During the month, Petrov was twice released from work due to temporary disability:

a) for 5 calendar days, of which 4 days were working according to the schedule (4 shifts were missed - 40 hours);

b) for 5 calendar days, of which 2 days were working according to the schedule (2 shifts were missed - 20 hours).

The working time sheet reflects:

— by code “I” – 120 hours;

- according to code “B” - 10 days, including: 6 days (60 hours) and 4 days, which, according to the schedule, are days off.

Thus, 6 shifts (60 hours) were included in the number of hours worked. Normal working hours per month are reduced by 60 working hours missed due to illness and amount to:

176 hours – (10 hours x 4 days) – (10 hours x 2 days) = 116 hours.

The number of overtime hours determined at the end of the accounting period was:

120 hours – 116 hours = 4 hours.

The “extra” 4 hours initially included in the schedule remained “extra” – overtime.

Example 7

Normal working hours are 40 hours per week. The employee has a work schedule: 2 working days, 12 hours each, 2 days off. A summary record of working time is kept, the accounting period is one year.

During 2020 (standard working hours - 1974 hours with a 40-hour work week), the employee:

- worked 152 days (1824 hours), including in the timesheet indicated: code “I” - 1776 hours; code “RV” - 48 hours worked in accordance with the schedule on non-working holidays (January 2, 4 and 7, June 12);

- was on annual paid leave (the code “OT” indicates 28 calendar days) - 160 hours;

— was temporarily disabled for 11 calendar days. The 11 calendar days indicated in the timesheet by code “B” accounted for 6 working days – 72 hours.

Calculation of the number of overtime hours:

Ksu = (1776 hours + 48 hours) – (1974 hours – 160 hours – 72 hours) = 82 hours.

Calculation of the number of overtime hours for which additional payment is made:

Xu additional = 82 hours – 48 hours = 34 hours.

Practical situation

In the time sheet, the same code “РВ” indicates hours worked outside the schedule and hours worked in accordance with the employee’s schedule, but falling on a non-working holiday. Is it possible to “delimit” such hours, and is it necessary to do so?

Since work on holidays is paid double, it should not be taken into account when calculating overtime hours (clause 4 of the explanation dated 08/08/1966 No. 13/P-21 “On compensation for work on holidays”, approved by the resolution of the USSR State Committee for Labor and the Presidium All-Union Central Council of Trade Unions dated 08.08.1966 No. 465/P-21, remains in effect - decision of the Supreme Court of the Russian Federation dated 30.11.2005 No. GKPI05–1341).

Thus, when determining overtime hours that are subject to increased payment at the end of the accounting period, the hours indicated in the timesheet with the code “РВ” are not taken into account. However, they cannot be completely excluded from the calculation, since some of them (hours falling on non-working holidays) can be worked in accordance with the schedule, that is, included in the standard working time for the accounting period.

First, the number of “overtime” hours worked in the accounting period is determined. In this case, the Kotr indicator in the above formula includes all hours actually worked, indicated in the report card with the codes “I”, “N”, “RV”.

Obviously, in the total number of “overtime” hours, some hours may be worked on weekends and non-working holidays.

Then, from the total number of “overtime” hours, the hours indicated in the time sheet with the code “РВ” are subtracted. Additional payment will be made for remaining hours.

Thus, based on the results of the accounting period, an additional payment is made for the hours worked by the employee in excess of the standard working time established for the specified period and which are not hours worked on a day off:

Ksu additional = Kotr – (Nup – Kosv) – Krv,

where Ksu additional is the number of overtime hours for which additional payment is made at the end of the accounting period;

Крв – the number of hours worked in the accounting period on weekends and non-working holidays, both in accordance with the schedule and outside the schedule.

Additional rest time

At the request of the employee, payment for involvement in overtime work can be replaced by the provision of additional rest time. Rest time cannot be shorter in duration than time worked overtime (152 Labor Code of the Russian Federation).

Thus, if an employee has worked four hours overtime, then the additional rest time provided to him as compensation must be at least four hours. Overtime work in this case is paid at a single rate.

It is better to immediately indicate the compensation option chosen by the employee (rest or additional payment) in the order for involvement in overtime work. The law does not oblige the employer to provide additional rest at a time convenient for the employee. However, the parties can always agree.

Additional rest time is not paid in any way and is provided on the basis of an order (instruction) of the employer, with which the employee must be familiarized with a signature.

By the way, this doesn’t have to be a day or a shift. As practice shows, depending on the volume of processing, this can be an hour or several hours. If an employee is given a whole day of rest, then it should be reflected in the working time sheet with the letter code “NV” or the digital code “28” - as an additional day off without pay (Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

But the situation when the provided rest time is measured not in days, but in hours or minutes, is not provided for by the resolution, and there is no corresponding code. You can indicate on the timesheet only the time actually worked per day, or you can independently develop a designation for such a case and enshrine it in a local regulatory act.

Example 8

The employee worked 160 hours during the month in accordance with the schedule, including 8 hours on a non-working holiday. The standard working time for a given month is 159 hours. Doesn’t a “shortfall” to the norm occur in this case if 160 hours – 159 hours – 8 hours = –7 hours?

Obviously, in the situation under consideration, we cannot talk about the employee’s failure to comply with working hours. On the contrary, the employee worked one hour (160 hours - 159 hours) overtime.

However, at the end of the accounting period, additional payment for this hour is not required, since it has already been paid in double amount as worked on a non-working holiday. For the case under consideration:

Ksu = 160 hours – 159 hours = 1 hour;

Ksu additional = 1 hour – 8 hours = –7 hours – no additional payment is made.

Example 9

Workers R.D. Ptichkin and G.V. Sushkin worked 3 hours overtime on March 7. Their salary is 36,000 rubles.

For the overtime worked, R.D. Ptichkin came to work 3 hours later on March 11. G.V. Sushkin did not take additional rest time for overtime work.

The standard working hours in 2020 according to the production calendar is 1974 hours. The hourly rate is calculated by dividing the salary by the average monthly number of working hours.

The hourly part of the employees' salary is 275.86 rubles. (36,000 rubles / (1974 hours / 12 months)).

For 3 hours worked overtime on March 7, R. D. Ptichkin earned 827.58 rubles. (275.86 rubles/hour x 3 hours), and G.V. Sushkin – 1,379.30 rubles. (275.86 rub/hour x 2 hours x 1.5 + 275.86 rub/hour x 1 hour x 2).

Example 10

How to calculate additional payment for overtime work for a piecework worker?

Workers involved in installing windows, D.R. Nozhkin, G.D. Ruchkin, V.N. Pyatkin, worked 3 hours overtime on June 10. Each employee is paid a salary based on piece rates.

The piece rate for one window is 900 rubles. Overtime, each of them installed 3 windows. Overtime work in the organization is paid: for the first 2 hours at one and a half times, for subsequent hours - at double. Instead of increased pay, Ruchkin took advantage of additional rest time.

We will calculate the additional payment for overtime work for each employee.

Nozhkin – 4950 rub. (900 RUR/piece x 1 piece x 1.5 + 900 RUB/piece x 2 pieces x 2).

Ruchkin – 2,700 rub. (900 RUR/piece x 3 pieces).

Pyatkin – 4500 rub. (900 RUR/piece x 2 pieces x 1.5 + 900 RUB/piece x 1 piece x 2).

Please note that employee Ruchkin received a single additional payment, since he took additional rest time.

Briefly on the topic

In conclusion, let us pay attention to the main points related to overtime work:

— request the written consent of employees and the opinion of the elected body of the primary trade union organization;

— check whether, according to a medical report, the recruited employees are not contraindicated from working overtime;

- compensate for work beyond normal working hours.

Reflect in the collective agreement or other local regulations the procedure for attracting employees to overtime work, providing additional days of rest and the mechanism for calculating monetary compensation for overtime (for example, will increased overtime pay include bonus payments);

- Keep an overtime log and use it to track that employees do not overwork more than 120 hours per year.

If the procedure for involving an employee in overtime work is violated, the employer is liable in accordance with Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation - this is a fine of 30,000 to 50,000 rubles, and the official who committed the violation is in the amount of 1,000 to 5,000 rubles. If a similar violation is committed again (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation), the amount of penalties will increase: for officials the fine will range from 10,000 to 20,000 rubles. or disqualification for a period of one to three years, for legal entities - from 50,000 to 70,000 rubles.

Overtime compensation

As mentioned above, the Labor Code provides for two options for compensation for overtime work - money or additional rest (Article 152 of the Labor Code of the Russian Federation). At the same time, it is the “monetary” option that is fixed as the main one. Additional rest is provided at the employee’s request.

This means the following. If there is no statement from the employee that he wishes to receive additional rest instead of money, the employer is obliged to pay him overtime at an increased rate. This amount depends on the duration of the overtime: the first two hours are paid at one and a half times the rate, the rest - at double. The duration of overtime is calculated for each case of overtime work based on the Working Time Sheet.

Note that the Labor Code does not specify in what form and when an employee may express a desire to replace monetary compensation with additional rest. It turns out that he can make his choice at any time, including after receiving payment. Therefore, in order to avoid conflicts and unnecessary work for the accounting department in recalculating payments, we recommend agreeing on this issue in advance, in the document with which the employee agrees to the processing. The wording here may be as follows: “In addition, we notify you that, according to Article 152 of the Labor Code of the Russian Federation, at the request of the employee, overtime work is compensated by providing additional rest time, but not less than the time worked overtime. In this regard, we ask you to indicate whether you would like to receive additional rest time. In this case, overtime work will be paid to you at the normal rate."

Please note that the Labor Code does not contain a rule obliging the employer to provide additional rest time exactly when the employee requires it. Accordingly, this issue should be resolved by agreement of the parties. The agreement reached can be recorded in the shift schedule for the next period, if one is drawn up in the organization. And if a schedule is not drawn up, then an order is issued to provide additional rest time. The order should indicate the name and position of the employee who is entitled to additional rest, and the reason why it is provided. The employee must be familiarized with this order and signed. In the Timesheet, this vacation is about or 28 “Additional days off (without pay).”

Remuneration for night overtime work

Employees work more than normal at the request of the administration. Therefore, increased tariffs are introduced when calculating. The first two hours of overtime work are paid at time and a half, and all remaining hours at double.

If an employee wishes to take time off for hours worked in excess of the norm, then they are paid at the usual single rate. Time off is given for the same number of hours that the employee worked in excess of the norm.

For work at night (from 10 pm to 6 am) at least 20% is added to the regular daily tariff rate. If night work is not the norm for a given employee’s work schedule, then it is paid both as night work and as overtime. That is, 20% is added to one and a half and double tariffs.

Let's look at an example of how overtime work at night is paid. The employee worked 4 hours overtime in a month, 2 of which were night hours. His hourly rate is 100 rubles. The first two overtime hours are calculated at time and a half: 100 x 1.5 x 2 = 300 rubles. The next two hours at a double rate of 100 x 2 x 2 = 400 rubles. Supplement for night hours 20%: 100 x 2 x 20% = 40 rubles. It turns out that the total amount for overtime is: 300 + 400 + 40 = 740 rubles.

In a collective agreement or internal local acts of an organization, an additional payment for night work may be set at more than 20% of the rate.

Calculation of overtime hours during a shift schedule: features

The continuous production cycle dictates the introduction of a shift schedule, i.e., work in several shifts. Such a schedule has some features that affect the calculation of processing. When an employee goes on someone else's shift (by order of management), payment must be made double or (by agreement with the administration) in a single amount, with a day off for his own shift.

If a shift coincides with a holiday, it is also paid double. If an employee works after a shift at the initiative of the employer, then overtime hours must be paid according to the above formulas. Let's find out how to calculate overtime when working in shifts.

Example: calculation of overtime hours on a shift schedule

The steelmaking process requires a 24-hour operation. Steelmaker Vetrova R.P. works in three shifts of 8 hours each (04:00 – 12:00, 12:00 – 20:00, 20:00 – 04:00). Salary – 40,000 rubles. The norm is 40 hours/week. Night hours (and additionally paid hours) are considered to be 22:00 – 06:00.

Vetrov was involved in work beyond the norm:

- March 3, 2020 for 2 hours after the shift per day from 20:00 to 22:00;

- March 8 for 2 hours after the shift on the night from 04:00 to 06:00.

The industry agreement has adopted an additional payment for night hours in the amount of 40% of the salary. The March work/time standard is 175 hours. Let's look at how to calculate overtime during a shift schedule.

1 hour of salary = 40,000 / 175 hours = 228.57 rubles.

Calculation:

— for March 3 = 2 hours x 228.57 x 1.5 = 685.71 rubles.

— for March 8 = 2 hours x 228.57 x 1.5 = 685.71 rubles. + 2 night hours 2h x 228.57 x 0.4 = 182.85 rub.

Payment for overtime hours – 1554.27 rubles. (685.71 + 685.71 + 182.85).