Why do you need a cash verification report?

Cash in the cash register is checked periodically. Moreover, most often, inspections are sudden. The initiative for such control actions can come from both the management of the enterprise and the supervisory authorities.

Regardless of who organized the inspection, an act is drawn up based on its results. They fit into it

- the amount that should be in the cash register according to accounting documents,

- as well as the amount that actually turned out to be available when the inspectors counted it.

In this way, the financial and cash discipline of the company is monitored, facts of official violations, abuses, shortages, etc. are revealed. illegal phenomena.

When is a cash register audit carried out?

An audit of the cash register is carried out in certain cases, these cases include:

- Change of the financially responsible person who is directly responsible for the cash register;

- If theft of funds or cash documents from the cash register is detected;

- Upon liquidation of an enterprise or its reorganization;

- Before preparing annual financial statements;

- If any emergencies occur;

- And also in other cases provided for by the legislation of the country.

Who checks the cash register?

If the audit is carried out within the company, then a commission consisting of at least three people is created for this event. Usually, directors are included in it by a separate order

- accountant,

- management representative,

- head of one of the structural divisions of the organization.

The financially responsible employee must also be present during these actions, but he is not included in the commission.

In cases where the inspection is carried out as part of on-site tax control, inspectors from the supervisory department are also added to all the above-mentioned persons.

Programs in which the KM-9 report is generated

Modern professional computer programs greatly simplify filling out standard forms:

- The document is printed on the organization's letterhead;

- Constant values are filled in automatically;

- Uploading of ready-made act forms can be done in various formats (PDF, Word, Excel).

Checking the actual state of cash is an important point in determining the level of organization of accounting at the enterprise, therefore, all computer programs initially include the possibility of generating an act of the KM-9 form.

What consequences can an audit have?

If, based on the results of control measures, no violations are revealed, and the cash matches to the last penny what is indicated in the documents, then, of course, there will be no consequences. But if during the inspection it turns out that there is less or more money in the cash register (this also happens) than there should be in accordance with the reporting papers, disciplinary action will most likely be imposed on the financially responsible persons (starting from a remark, a reprimand and up to dismissal). In addition, there will likely be a demand from management to reimburse the missing funds.

Tax inspectors fine the enterprise and its senior officials for surpluses or shortages.

Documents to be verified

Before drawing up an act of sudden check of the cash register in a budgetary institution, the following stages go through:

- The chairman of the commission reads out the management’s order regarding the audit.

- The cashier gives a receipt stating that there are currently no personal funds in the cash register.

- Then, if there are significant grounds for canceling the procedure, they will need to be announced. If there are none, the commission proceeds with the audit.

- During the process, intermediate documents are drawn up, for example, protocols.

- At the end, the final act is filled out.

Drawing up an order to conduct an audit in a store is one of the mandatory stages in organizing control measures aimed at checking the work of a retail establishment.

Tax inspectors fine the enterprise and its senior officials for surpluses or shortages.

First of all, an audit of cash transactions of individual entrepreneurs should make accounting as transparent as possible so that regulatory authorities can always analyze compliance with legislation in the field of cash accounting.

Cash movement is carried out through cash transactions. Among them, the main ones can be identified - the issuance of funds for wages, for payment of administrative and business expenses, to accountable persons, etc.

They represent an analysis and assessment of the information received by the auditor, a study of the most important financial and economic indicators of the audited institution in order to identify unusual and (or) business transactions incorrectly reflected in budget accounting, and identify the causes of such distortions.

It should be noted that the legislation has not approved a special form for the cash audit report.

Who determines the deadline for conducting an inventory of cash in the cash register of an enterprise? Who is included in the circle of people who are notified in advance?

The balance of cash in the cash register as of “__”____________ 20__ is ________________ rubles ___ kopecks.

The actual balance of cash in the cash register as of “__”____________ 20__ is ________________ rubles ___ kopecks.

At the end, the final act is filled out. It is worth noting that the examination of cash registers is carried out in the presence of all members of the commission.

Important! All actions related to the audit are carried out in the presence of the person in charge of the cash register.

Before drawing up an act of sudden check of the cash register in a budgetary institution, the following stages go through:

- The chairman of the commission reads out the management’s order regarding the audit.

- The cashier gives a receipt stating that there are currently no personal funds in the cash register.

- Then, if there are significant grounds for canceling the procedure, they will need to be announced. If there are none, the commission proceeds with the audit.

- During the process, intermediate documents are drawn up, for example, protocols.

- At the end, the final act is filled out.

Supermarkets and retail chains with a large flow of retail customers are faced with the need to constantly monitor the cash register. Thanks to the audit report, you can record funds in writing and compare them with the goods passed through the tape. On this free resource page you can find the document discussed. Let's consider its features and main design criteria.

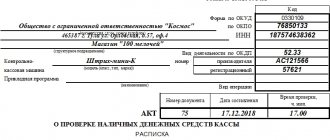

Sample act on checking cash in the cash register

If you need to create a cash check report at the cash register, and you have never done it before, the above tips will help you. Also look at a sample of filling out the document: here a unified form is taken as a basis, which can also be used for internal control measures.

- First enter

- full company name,

- her address,

- as well as the structural unit whose cash register is being checked.

- In the table on the right side of the form, enter

- OKPO and TIN of the enterprise,

- the type of his activity according to OKPD (also in the form of a code).

- Please provide information about cash register equipment below:

- its name,

and two numbers: from the manufacturer and registration.

- Next, indicate the document number, the date of the inspection and its exact time (down to minutes).

- Also make sure that the cashier makes a receipt in the act stating that his personal money is not in the cash register at the time of the check.

- Next is a table where you enter

- results of verification actions, including readings of the cash register counter at the beginning of the working day and at the time of verification,

- the difference (which is in the cash register),

- information about accounting data, identified shortages or surpluses.

- At the end, the document must be signed by all persons present during the inspection, including a tax employee (if the inspection is carried out on the initiative of the supervisory authority), a representative of the company’s management, a cashier, and the head of a structural unit.

- Below is the amount that is in the cash register and which is transferred to the financially responsible employee (i.e., the cashier), and his signature is affixed.

Similarly, fill in all other lines and cells in this part as necessary.

If the inspectors consider it necessary, they can make their comments under the table. If they are not there, this must also be noted accordingly.

How to fill out the act: contents of the document

The cash register inspection report has the established form KM-9. The templates are filled out by a representative of the controlling authority and the employee responsible for funds. The management of the organization is notified of the results of the inspection of material assets.

The document includes the following information:

- counter value at the beginning of the day;

- value at the time of revision;

- amount of revenue.

Important! Data on the amount of revenue is taken either from the cashier’s journal (form KM-4) or from the KMM registration journal (form KM-5).

The number of copies of the document depends on whose initiative the inspection is planned. If it is organized by the company's management, you need two sheets: one for the accounting department, the second for the cashier. When an audit is initiated by a supervisory authority, three copies of the form are needed. The third will be given to her representative.

It is worth noting that each employee who participated in the procedure has the right to request their own sample report.

Registration of audit results

As follows from the literal interpretation of clause 3.39 of the Instructions of the Ministry of Finance of the Russian Federation, audit and inventory of valuables are identical concepts. It follows that in order to properly document the results of the cash register audit, you can use the forms approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88.

The above-mentioned regulatory document approved form No. INV-15. It is important to note that this act is not mandatory. The company has the right to develop its own form. However, using the approved form to formalize the results of the audit of funds in the cash desk will avoid the risks associated with improper registration of the reconciliation results.

You can fill out this document using computer technology or by hand. Regardless of the form design method, the following colors of ink are allowed:

- blue;

- black.

In order to correctly draw up a cash register audit report, the responsible employee must remember the following rules:

- all information must be supported by supporting documents;

- entries are entered accurately;

- Errors, erasures, and blots are not allowed;

- information revealed during the inspection is confirmed by the signatures of all members of the commission.

In conclusion, it should be noted that the procedure for auditing the cash register does not differ significantly from the algorithm for reconciling other divisions, assets or liabilities. As with other types of checks, when analyzing cash, it is not allowed to include in the commission an employee responsible for the safety of valuables.

Ignoring this prohibition may be grounds for invalidating the results of the audit of cash in the cash register.

The procedure for conducting cash transactions is regulated by Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. According to the document, organizations and entrepreneurs working with cash are required to audit the cash register and carry out an inventory of cash in the cash register. In this article we will look at when scheduled and unscheduled cash audits are carried out, how to conduct an audit of the cash register, and what documents need to be drawn up for this.

Audit report, form, sample, example

This is necessary so that the completed audit act has legal force. General requirements for drawing up an audit report Drawing up an audit report begins with indicating the purpose of the audit and the basis for this procedure.

Info

For example, the basis for drawing up an act is the order of the director of Zagadka LLC “On conducting an annual inventory” dated November 10, 2016 No. 245. Each act, regardless of its form, is signed by members of the commission, which is appointed by order of the head of the inspection organization.

It can be assigned either one-time or on an ongoing basis. When signing the audit report, members of the commission indicate their positions, surnames, and initials. The chairman of the commission is usually singled out and listed in 1st place.