An accountant, when preparing reports for regulatory authorities, tries to reconcile the data to the last point in order to prevent errors. Moreover, in 2020, mistakes are expensive. For example, for false information, SZV-M will issue a fine of 500 rubles for each insured person. We have compiled instructions on how to avoid errors in forms for the Russian Pension Fund and what services to use to check Pension Fund reports online for free.

How to check SZV-STAZH for errors

Even in the new Resolution, the Pension Fund does not provide any control ratios so that companies know how to check the SZV-STAZH for 2020. But there are a few verified rules that will help you avoid mistakes:

- Before checking SZV-STAZH on the PFR website online, look at the number of insured persons in the report. It must match the number of employees indicated in the SZV-M form.

- Sections 4 and 5 are filled out only in cases where a document with the “appointment of pension” type is submitted. However, employees who will retire this year must also be reported in a general form based on the results of the reporting period. The SZV-STAZH verification program for 2020 most likely will not notice such an error, but during the reconciliation, Fund employees will identify it, and then they may be punished for the fact that the company provided incomplete information.

- We recommend that you review the document before submitting the final report. For this purpose, a free verification program SZV-STAZH 2020 has been developed; the latest edition is always up to date on the official website of the Foundation.

What reports are submitted to the Pension Fund?

Currently, organizations are required to submit reports to the Pension Fund in the following forms:

- SZV-M;

- DSV-Z;

- ADV-6-2;

- SPV-1 and others.

In total there are about fifteen different types of reporting. Most entrepreneurs and organizations only need to prepare a few of them. For example, SZV-M and DSV-Z. SZV-M is a monthly form containing information about insured persons working at the enterprise. And for payers of additional contributions, a quarterly form DSV-3 is provided. Depending on the number of employees, reporting can be prepared electronically or in paper form. Since the listed types of documents are submitted most often, errors during preparation usually occur in them.

https://youtu.be/CbcCw0sm7-0

Error codes generated by the verification program for SZV-STAZH for 2020

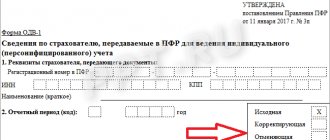

If you are going to check SZV-STAZH online, then you must understand that the system may produce certain errors. As PFR employees explained, there are 5 types of notifications that the policyholder should pay attention to. Let's figure out what they mean.

Codes 10 and 20

If the online SZV-STAZH check on the Pension Fund website produces an error with code 10 or 20, this indicates the presence of minor shortcomings. If you first submitted the document and only then decided to check the SZV-STAZH file online, then you need to correct the inaccuracies by submitting the SZV-KORR form to the Fund. Don't forget that it must also be accompanied by the EDV-1 inventory.

Code 30

Checking SZV-STAZH online without registration may give an error code 30. It signals the presence of more serious shortcomings. In particular, the system may detect an incorrect indication of the employee’s first name, patronymic or last name, or an incorrect SNILS.

It’s great if you first decided to check the SZV-STAZH report online, found errors, corrected them and sent the report in perfect condition. But if the verification took place after you submitted the information, then if there is an error with code 30, you must send another SZV-STAZH with the “Additional” type to the Pension Fund and clarify the incorrect information.

Code 40

Checking SZV-STAZH for 2020 online shows code 40? This means that there are errors in the report, which the Pension Fund of Russia accepts, but the employer will need to clarify some data. For example, after checking SZV-STAZH on the Pension Fund of Russia website, you will have to correct the incorrect position code of an employee entitled to preferential seniority.

To correct inaccuracies, you need to prepare and submit the SZV-KORR for those employees whose data was incorrect. It is possible to avoid submitting a corrective report if you check SZV-STAZH online for free before submitting the original form.

Code 50

The report was prepared incorrectly, and the Pension Fund of Russia will not accept it. In this case, the employer needs to re-form the SZV-STAZH with the “Initial” type. But first you should double-check all the data, since errors can be elementary, for example, an incorrect registration number of the policyholder in the Pension Fund of the Russian Federation.

Before submitting it to the Federal Tax Service, it is necessary to check the DAM report in order to minimize the risks of the document not being accepted by the regulatory authority. The essence of verification actions:

- reconciliation of information in the reporting form with data from accounting records;

- analysis of all existing control ratios that are created for a specific form.

The DAM is submitted quarterly until the 30th day of the month following the expired reporting period. The peculiarity of the document is that the data in its Section 1 is shown cumulatively for the entire year, and in Section 3 information is provided only for the last quarterly period of time with monthly detail. This nuance determined the complete correlation of information from different blocks of the report only in the 1st quarter.

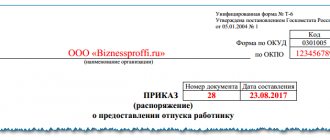

In order for the DAM check to be carried out correctly, it is necessary to use the current form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ When filling out the document using a specialized online service ]]> on the Federal Tax Service website ]]> , verification for compliance with control ratios will be done automatically. If you manually enter data into the form, you must check it yourself. To do this, it is necessary to take into account the norms of such letters from the Federal Tax Service on control ratios:

- No. BS-4-11/ dated March 13, 2017 (the document was canceled after the publication of new control ratios in June 2020);

- No. BS-4-11/ dated 06/30/2017;

- No. GD-4-11/ dated December 13, 2017 – this document updated the entire block of control ratios that must be used for self-testing by policyholders from 2020 (we wrote about this in detail).

CheckXML and CheckPFR 2020 programs - testing PFR files

The developers provide detailed advice by email, phone, or online on the forum. This is one of the best portable programs that exist today. CheckXML Ufa is a professional solution for format and logical control of files that are intended for delivery to business control organizations.

How the Pension Fund checks electronic reporting

Reception and verification of electronic reporting at the Pension Fund of Russia can be divided into five stages. Each stage involves data processing using a separate program. In some Departments, the transfer of information from one program to another occurs automatically. In other Directorates (in particular, in most UPFR of Moscow and the Moscow region), inspectors transfer data manually.

First stage: digital signature verification

Having received reports via telecommunication channels (TCC), inspectors, first of all, check the existence of an agreement concluded between the Fund Management and the policyholder, as well as the relevance of the electronic digital signature certificate (EDS).

If the verification program does not confirm that the certificate is current and the agreement has been concluded, the company will receive an error message: “The digital signature was affixed with a certificate for which there is no concluded agreement.” This usually happens to those who report under the TCS for the first time, as well as to those who have recently changed their certificate due to expiration, replacement of the manager, or for some other reason.

Let's say right away that there is no reason to worry. This error is caused by the peculiarities of the fund’s software, which begins to “recognize” the organization’s digital signature only after it receives the report signed by it for the first time. Within four days, the certificate will be identified and the policyholder will be notified that the report has been received. Even if this happens outside the reporting period, inspectors should not impose a fine. And the next time the Pension Fund “recognizes” the electronic signature without delay.

Second stage: format-logical control

Next, inspectors carry out the so-called format-logical control. Its purpose is to ensure that reports are created without violating established formats.

At this stage, Pension Fund employees carry out verification using the CheckXML and CheckXML-UFA programs. Accountants can also use these programs to ensure that reports are correct before submitting them. You can install verification programs yourself, but then you will have to constantly monitor whether an update has appeared. In some electronic document management systems and reporting programs (for example, in Kontur-Extern, which is an online system where updates are installed without user intervention), they are already included, and the update occurs automatically.

Practice shows that most “format” errors identified at this stage are due to flaws in accounting programs. In this case, the accountant needs to contact the specialist who supports the program and agree on troubleshooting.

Another common cause of error is the incorrectly specified address of the organization or insured person. It can be avoided if you install the latest version of the Russian Address Classifier (KLADR). A number of electronic document management systems (in particular, the above-mentioned online system “Kontur-Extern”) already contain this classifier and maintain its relevance.

Third stage: pre-basic check of reports

The essence of this stage is to conduct an express check of the reports and place them in temporary storage.

Express check is carried out using the Perso PC software package. It is installed in the Pension Fund Offices, and only fund employees have access to it. As for policyholders, they, unfortunately, do not have the opportunity to use this software for self-control.

Perso checks, among other things, the availability and numbers of packs, data on insured persons (full name and SNILS), verifies balances at the beginning of the billing period, payments indicated in the calculations, balances according to information before 2010, etc.

If no errors are found, the policyholder will be sent a receipt of information with the data of the inspector who conducted the inspection. If there are errors, the organization will receive a negative protocol.

Then, reports that have successfully passed the verification will be recorded in a special journal and transferred to temporary storage. There is a peculiarity here: the storage cannot contain two files with the same names. This often leads to consequences that are very unpleasant for the company. The fact is that if the policyholder assigns the same number to two different packs, then the file names of these packs will also be the same. Then the file that was transferred to the storage earlier will be completely erased by the file of the same name transferred later. As a result, incomplete information about the policyholder will remain in the Pension Fund database, and this will greatly complicate reconciliation.

You can prevent such an incident with the help of a little trick: throughout the year, assign batch numbers not in order, but so that the numbering of each reporting period has its own distinctive features. For example, packs for the first quarter should be numbered “101, 102, 103...”, packs for the first half of the year – “202, 203, 204...” and so on until the end of the year.

How to check RSV: updated control ratios using an example

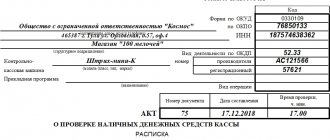

For example, a calculation of insurance premiums for the 1st quarter is submitted for an enterprise that employs 1 person. The data on his salary for drawing up the reporting form is as follows:

| Month | Earnings, rub. | PF 22%, rub. | FSS 2.9%, rub. | FFOMS 5.1%, rub. | Personal income tax 13%, rub. |

| Total |

Let's check the DAM using control ratios:

- The results for each of the months given in the report are verified in relation to accrued contributions to pension insurance - contributions for all employees (columns 2, 3, 4 lines 250 of subsection 3.2.1) when summed up must be equal to the value from gr. 3, 4, 5 p. 061 (subsection 1.1 in Appendix No. 1). In the example, in the columns of line 061 the amount will be indicated as 9900 rubles, 5940 rubles, 7260 rubles, which should coincide with the data from Section 3.

- The value entered in column 1 of line 250 (subsection 3.2.1) must correspond to the total value of lines with code 210 (in the example this is 105,000 rubles).

- Subsection 3.2.1 verifies the amount of insurance premiums. To do this, compare the values from line 240 for each month of the quarter and the product of the number from line 220 for the same month and the applied insurance rate. In the example on line 240, the amount of January contributions is 9900, the value of the indicator from line 220 is 45,000. If 45,000 is multiplied by the rate of 22%, you get the required number of 9900 rubles. etc.

How to check the DAM - Appendix 1 of letter No. GD-4-11/ contains a complete set of ratios that must be observed within one reporting document. A separate table is devoted to inter-documentary reconciliations - data from the DAM report must correspond to the control values from forms 6-NDFL and information available to the Social Insurance Fund on reimbursements of insurance premiums.

When making an inter-documentary reconciliation with form 6-NDFL, you need to compare the amount from column 1 of line 050 (Appendix 1 subsection 1.1) with the amount that in 6-NDFL is listed as accrued income (line 020) minus income from dividends (line 025 ). In our example, this is 105,000 rubles.

When filling out the report, you also need to carefully double-check:

- whether the personal data of individuals is entered correctly into the lines of Section 3;

- are there any inaccuracies in the numerical indicators from Section 3 - they may cause a deviation in the DAM (for example, when summing up data for three months, the result differs from the quarterly value for this indicator, which is given in the document);

- the total values of indicators for insured persons given in Section 3 - they must correspond to the results from subsections 1.1 and 1.3.

You need to check the numerical values against the calculation bases for contributions and the amounts of contributions.

Test programs

1. Tester

To check information about the income of individuals 2-NDFL and RSV (KND 1151111), you need to use the verification program

Tester

.

The program also checks 6-NDFL, Information on the average number. The Tester

program is the official verification program of the Federal Tax Service.

Get Tester from the website www.gnivc.ru

Russian Pension Fund program CHECKXML

In the new version of the PFR reporting verification program CheckXML dated January 10, 2013, the year 2013 is open.

About the purpose of

the CheckXML verification program

The CheckXML program was developed by URViSIPTO PFR of Russia and the BukhSoft company. It is designed to check reporting files that policyholders provide to the Pension Fund of the Russian Federation in electronic form on computer media (flash drives, floppy disks, etc.) or via the Internet.

In the CheckXML program you can check documents (files): Quarterly reporting in the form RSV-1 (Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of Russia); RSV-2 (Calculation of accrued and paid insurance contributions for compulsory pension insurance in the Pension Fund of Russia by payers who do not make payments and other remunerations for individuals) and RV-3 (Calculation of accrued and paid contributions to the Pension Fund of the Russian Federation, used when monitoring payment contributions at an additional rate for employers employing the labor of flight crew members of civil aviation aircraft); Personalized accounting documents (individual information) SZV-6-1 (Information on accrued and paid insurance contributions for compulsory pension insurance and the insurance experience of the insured person), SZV-6-2 (Register of information on accrued and paid insurance contributions for compulsory pension insurance of the insured persons), SZV-6-3 (Information on the amount of payments and other remuneration accrued by payers - policyholders in favor of individuals), ADV-6-2 (Inventory of information transmitted by the policyholder to the Pension Fund of the Russian Federation), ADV-6-3 (Inventory of documents on accrued and paid insurance premiums and the insurance experience of the insured persons, transferred by the policyholder to the Pension Fund of the Russian Federation), SPV-1 (Information on insurance contributions for compulsory pension insurance of the insured person to establish a labor pension).

In the CheckXML reporting testing program, you can also check other files transferred to the Pension Fund of the Russian Federation with the following document types: Personal data; SZV-4-1, 4-2 (Individual information about experience and earnings); Statements of payment of insurance premiums to the Pension Fund of the Russian Federation; Applications for exchange of insurance certificates; Applications for the issuance of a duplicate insurance certificate; Death certificates; Forms for VHI (voluntary insurance contributions).

CheckXML is constantly updated. Timely updating of versions is an important basis for successful reporting to the Pension Fund. On this site you can check for updates to the CheckXML checker and download them for free.

Other

versions of the CheckXML testing program:

CheckXML from 08/14/2013 CheckXML from 06/18/2013 CheckXML from 04/19/2013 CheckXML from 04/08/2013 CheckXML from 02/01/2013 CheckXML from 08/09/2012

Testing reports for Pension Funds online and free

PFR-POPD New software for checking documents in the Pension Fund - SZV-M, SZV-stazh, SZV-KORR, ADV forms in electronic form - PFR- POPD

Get PFR-POPD from the PFR website (www.pfrf.ru) Get the verification program PFR-POPD is faster than

3. CheckPFR

To check reports to the Pension Fund of Russia - SZV-M, SZV-stazh in electronic form, you need to use the verification program

CheckPFR

.

The program is the official verification program of the Pension Fund of Russia. Get CheckPFR from the PFR website (www.pfrf.ru)

4. Electronic inspector

Go to testing

5. CheckXML

Checking information (ADV-1, ADV-2, ADV-3).

Get CheckXML from the PFR website (www.pfrf.ru)

6. Electronic inspector

Rostrud verification program.

The verification is carried out online. The service will allow you to look at the design and content of documents through the eyes of a real state labor inspector. Go to testing

7. Checkpsn

For reporting to the Pension Fund up to 2006 inclusive,

obtain the CheckPSN verification program.

To use the CheckPSN program, unpack the file you received using any archiver. As a result of unpacking, you will have several files. One of them is the checkpsn.exe file. Now you can configure the Archa program to its location on your computer. To do this, in the Archa program, in the “Settings” menu item, where in the “for Unified Social Tax and Pension Fund” tab there is the attribute “External Relations” there is the attribute “Location of the Pension Fund verification program. Location of Checkpsn.exe". Enter the path to checkpsn.exe here. The second option is to copy the resulting Checkpsn.exe file to the directory where the check program is usually located. Typically this is the directory C:\ARCHA\ARCHA_07\CHECKPSN\.

How to use

Where to start using services designed for PF reports? The first online check begins with registration, that is, you indicate your email address, personal password and type of organization (institution).

After filling out all the fields, a letter is sent to your e-mail. In order to log in, you must first follow the link provided in the letter. After this, the new user account is immediately activated.

In some services, in order to receive a code to remove the restrictions of the “free version”, you must leave your mobile phone number. If the organization has no more than three employees, then a fully functioning service will be available automatically.

If the preparation of the report to the Pension Fund of the Russian Federation was carried out in a program other than that provided by the online service, before sending it is necessary to check the files by selecting the desired verification mode: type “Package” - for checking reports (SZV-6+RSV-1) or “Reports” type – separate check of reports.

Every year, all individual entrepreneurs who have their own business are required to submit a report on time, which includes: a declaration to the tax service, declarations on payment of agricultural tax and land tax, and income tax declaration.

The only quarterly reporting for individual entrepreneurs under the general taxation system is the VAT return. Find out more about quarterly reports for individual entrepreneurs here.

Next, you need to specify the verification files, which are then uploaded to the server. Each report is analyzed by the Pension Fund's verification program.

The test results can be seen in the protocol; it can be downloaded as a separate file. In particular, on the “Kontur-ru” service, when transferring files to “Kontur-Report PF” to correct errors, you do not need to re-enter information, since it will automatically be loaded from verified files.

As can be seen from the instructions given, checking reporting documentation is not so difficult. To do this, special websites provide all the necessary tools.

The main and mandatory condition is only free access to the Internet, and everything else has already been taken care of by specialists and developers of online services for checking and submitting reports to the Pension Fund of the Russian Federation, which have greatly simplified the work of accountants.

CheckPFR

Latest Version of CheckPFR 2020 for Windows

received minor updates to the interface and external design. The program is developed by the Branch of the Pension Fund of the Russian Federation in the Republic of Bashkortostan. It replaced the standard CheckXML-UFA and was officially adopted in the spring of 2014.

Download CheckPFR 2020 for free using the direct link:

Download additional files for CheckPFR:

CheckPFR is software for checking and working with reporting data provided by employers. It is able to check settlement accounts of insurance premiums and display information on individual personalized accounts, which are submitted by policyholders in electronic format 7.0. The transfer of accountable materials to the Pension Fund of the Russian Federation and their entry into the database occurs using media (floppy disks, disks, USB flash drives) or via the Internet electronic channel.

Video review of the CheckPFR program

What data does CheckPFR check?

The SZV-M online verification program checks the correctness of the calculation and payment of mandatory contributions for various types of insurance and the accuracy of information about the insured persons. This reporting is provided once a month.

The CheckPFR program checks a large amount of information. These include all data that has been provided to the Pension Fund since 2010. For any inaccuracy: in the full name, in the SNILS or TIN data, a fine of 500 rubles may be imposed. for each insured person (employee).

Features of working with CheckPFR

The program is capable of checking the following reporting forms:

- quarterly report RSV-1, RSV-2, RSV-3

- documentary personalized accounting S3V-6-1, S3V-6-2, ADV-6-2, S3V-6-4, SPV-1, ADV-11.

Submission of reporting material is implemented through constant updating of the program. You should always check for the latest updates before launching the application. This is especially important when working with the personalized accounting form RSV-1.

Procedure for checking and viewing reporting data

To familiarize yourself in detail and work with a specific report, you need to move the file from the directory to the working window using the mouse or by clicking on .

The screen will display detailed data and information about the currently selected file (name, format, number of documents in the block).

Important: If the file cannot be verified, a text box will appear saying “The selected file is not a valid XML file.”

To check and review information on a specific file, you need to launch the panel labeled “Check selected file.”

If you need to batch test several documents at the same time, then all files should be placed in one folder.

Reporting data reconciliation function

The CheckPFR verification module works on the function of reconciling indicators for two types of reporting forms (Calculation RSV-1 and Inventory of information ADV-6-2). If a difference in values for two parameters of one type of reporting is detected or appears, the reporting documents are rejected by the control authorities and returned for revision.

Important: All comments in the documents being created that are identified as erroneously should be corrected before being transferred to the Pension Fund authorities. Otherwise, you will need to provide a written explanation for the discrepancies and submit detailed reports, in accordance with the decree of the Pension Fund.

Other information to be verified

CheckPFR also now checks other types of reports:

- reporting on forms RSV-1, RSV-2 and RSV-3;

- individual accounting documents SZV-6-1, SZV-6-2, ADV-6-2, SZV-6-4, SPV-1, ADV-11;

- SZV-M described above.

The big advantage of using this program is that there are no costs. You just need to install it and learn how it works. The app is quite easy to use. In addition, for those who do not understand this at all, there is a manual for use. The downside is that updates need to be installed periodically. Therefore, most policyholders prefer to use services on the Internet - it is much faster and easier.

It is worth noting that it does not matter which method of checking SZV-M the organization chooses. In any case, they will help get rid of errors and, as a result, fines.

Official version of CheckPFR from the developer's website

On the website page you can download Bukhsoft for free in one file. Technical support will help users update CheckPFR to the latest version at any time. The archive that should be downloaded includes:

- installer exe

- msxml6_xmsi

- detailed step-by-step installation instructions in .doc format

- user manual in .doc format

To install CheckPFR on your computer, just open the archive and run the .exe file, following the pop-up prompts. Silent installation will automatically unpack the components into the specified directory.

The program is distributed absolutely free of charge and is intended for use only in the Russian Federation.

For the program to work properly, you should regularly check for the latest updates. The official website releases information about the latest updates with a list of changes made to the program.

Entrance to the office for citizens

After registration is completed, a person needs to go to the main page of the site, from where he can enter his personal profile. Next, you should go to the official website of the Pension Fund of Russia www.pfrf.ru, where by clicking the login button, the login and password for State Services are entered, thus the person will be redirected to the Pension Fund of the Russian Federation website.

Logging into your pfrf personal account using SNILS is also not difficult, since you only need to enter its number and then confirm it with the password generated earlier. A person should choose between authorization methods, which depends on the current ability to log in. If there is a SNILS in the immediate vicinity, a citizen can enter a personal pension number into his personal account, otherwise it is better to use a telephone number.

In the case of a mobile phone, you do not need to accept confirmation messages that contain electronic codes; you just need to enter the number and password previously generated during registration. After logging in, a person will have access to personal savings, will be able to see his personal experience and other information that is displayed in the Pension Fund database and transmitted to the citizen’s personal pension account.

Checking reports in the Pension Fund online

CheckXML is an official software solution that was developed by the Pension Fund of the Russian Federation. It is designed to significantly simplify the work of the territorial bodies of the Pension Fund of Russia, policyholders and transfer agents. The fact is that this program can automatically check personalized accounting documentation, which, in accordance with current legislation, all insurance companies are required to provide to government services. The process of preparing a package of documents for a PF is not the easiest task, and if the necessary information is submitted in an incorrect form, it will be returned. In order to avoid possible returns, this program exists. By the way, to compile the forms and calculations themselves, it is recommended to use the Spu orb program, which is also an official development of the Pension Fund of Russia

CheckPFR 1.1.52 from 01/17/2018

This method is not a violation and avoids confusion.

Fourth stage: verification of transferred payments

This stage was introduced in 2010, when the Unified Social Tax was replaced by contributions, and companies and entrepreneurs became obligated to submit calculations for accrued and paid insurance premiums (forms RSV-1, RSV-2 and RV-3).

At this stage, the inspector selects the DAM form from the received package of information and loads it into the software and hardware complex called “Insurance Premium Administration” (abbreviated as PTK DIA). There, the details of the organization and the amount of transferred contributions are checked, after which the information is stored in a separate database (later from this database it will be transferred to the desk audit department).

Here, as at the previous stage, if there are no errors, the policyholder is sent a receipt for receiving information, and if errors are identified, a negative protocol is sent. Most often, an error is found in two cases: either the payment did not go through, or the accountant made a mistake when filling out the calculation.

When eliminating errors indicated in the negative protocol, one important rule must be followed: the corrected version of the DAM calculation must be issued as an adjustment with the corresponding serial number.

This is due to the fact that any calculations, even incorrect ones, are stored in the database. Consequently, the original version of the calculation is already there, and any correction is an adjustment.

Please note: for personalized accounting information (forms SZV-6-1, SZV-6-2, SZV-6-3, ADV-6-2, ADV-6-3, etc.) this rule does not apply. In other words, having eliminated the errors indicated in the negative protocol, the accountant must send to the fund not adjustments, but the source codes of these reports.

Fifth stage: posting individual information to personal accounts

The last, fifth, stage is to distribute the data from the received and verified reports to the personal accounts of the insured persons and store them in a single electronic database. It is called the software and hardware complex of a personalized accounting system (abbreviated PTK SPU).

The process is as follows: first, the inspector downloads calculation data from the DIA software package, then - packs of individual information from the Perso temporary storage. At the same time, there is a comparison of accrued and paid contributions for each insured person and for the organization as a whole. Fund employees call this “information matching.” As a rule, docking takes a day or two.

If no errors are found, the amounts indicated in the individual information are transferred to the personal accounts of the insured persons. At the same time, inspectors do not send any messages or notifications to the organization, that is, the inspection is completed “by default.”

But sometimes docking reveals errors. Let's give an example: a woman got married and changed her last name. At the same time, at the previous stages of verification, the previous name was listed in the database, but at the time of posting to personal accounts, the new name was already listed. Then, at the fifth stage, the system will not be able to identify the insured person and will record an error.

In such a situation, inspectors must send a notice to the company to correct the discrepancies. The policyholder is required to make adjustments within two weeks. Otherwise, the fund has the right to independently eliminate discrepancies and report this to the organization. This is stated in paragraph 41 of the instructions on the procedure for maintaining individual records, approved by order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n.

However, in practice, fund employees very rarely send notifications. Instead, they immediately begin making corrections on their own without the policyholder even realizing it. Naturally, when preparing reports for the next period, the organization does not take into account the adjustments made by the fund. When checking the next period, inspectors perceive this as an error, and the company receives a negative report. Not understanding what happened, accountants often suspect the special communications operator of changing the data in the reports. Unfortunately, it is almost impossible to prevent such a situation.

Advice for those who have transferred registration to another Pension Fund Directorate

In conclusion, we note that a lot of problems when checking electronic reporting arise for policyholders who have changed their address, and with it the Pension Fund of the Russian Federation.

Often difficulties arise due to the fact that accountants mistakenly believe that the agreement on the exchange of electronic documents concluded with the “former” Department will be valid even after the transition to the “new” UPFR. In fact, when changing Management, the organization must enter into a new agreement - otherwise the Foundation will not accept electronic reports.

Another reason for the difficulties is that each Department has its own database for receiving information. And, unlike the SPU PTK, which is a single centralized system and stores information about all persons, the databases for receiving information contain only the data that was received in this particular Department. It turns out that if previously the organization reported to another UPFR, then at the new place of accounting there is no data on previous periods, and they will arrive with a great delay.

In this regard, we advise “newcomers” to submit their first reports not using the TKS, but on paper or a floppy disk. The explanation is simple: “paper” reports will require the personal participation of the inspector, who can be given verbal explanations. Whereas electronic verification systems will record an error without hesitation. Therefore, it is better for newly registered policyholders to get acquainted with the employees of the Department and draw their attention to their situation.

The material is printed from the website "Accounting Online", you can see the full text of the article at the link: https://www.buhonline.ru/pub/tks/2012/7/6185?from=extern

About the functionality

So, CheckXML can check documents both in single and in “batch” modes (that is, several files in one “approach”). She knows how to evaluate the correctness of calculations of combined work experience, as well as the correctness of drawing up forms for pension contributions and accruals. When checking, the program is based on the current version of the Labor Code of the Russian Federation. Upon acceptance of new changes, the developer promptly releases updates that change the verification algorithms. CheckXML can automatically determine the type of document loaded (based on keyword sampling) and determine if there are errors in its structure.

CheckXML

An excellent assistant for checking files that the policyholder has prepared for transfer to the Pension Fund is the latest version of the CheckXML Buhsoft program, which has expanded useful functionality. This solution will quickly test the correctness of information, identify and point out errors. In the Russian Pension Fund, this application has been actively used for more than 10 years. Currently, the product is used to control the loading of files into the pension fund database. It is very easy to update or download the CheckXML 2 personal income tax checking program for free. The Russian version is available on specialized websites.

Free download CheckXML:

How is the verification carried out?

Control ratios

To check RSV-1, tax authorities are developing special control ratios. For 2020, 312 ratios have been adopted, which can be downloaded for review on the Federal Tax Service website. The document describes which calculation lines the data should match, and also indicates the response actions of the tax authorities when discrepancies are detected.

Two types of errors are considered the most serious:

- The total amount of accruals for the first section does not correspond to the total amount of accruals for each employee from the third section.

- The personal data of employees (section No. 3) does not coincide with the data available to the Federal Tax Service. Most often, errors are found in SNILS and TIN numbers.

These errors are the basis for recognizing the calculation as not provided. As a result, the payer will have to resubmit the primary RSV-1 within 5 days.

If there are other shortcomings, it is enough to draw up. It is submitted in the usual manner and must include all the same sections as the primary one, with the exception of personal data of employees for which reliable information was provided.

Common Mistakes

Other common errors in RSV-1 include:

- The employee does not have SNILS or TIN at all. In this case, he must be sent to the Federal Tax Service or the Pension Fund to receive documents, where he can find out his number on the same day. This option is more preferable than completing documents through the employer, since you will have to wait at least 5 days for the result.

- The report does not reflect non-taxable payments. Such an error is a gross violation of the rules for accounting for income and expenses, and is fraught with penalties in accordance with Art. 120 Tax Code of the Russian Federation.

- Sick leave expenses include payments for the first 3 days, which the employer must compensate on his own. This error does not apply to regions participating in the Social Insurance Fund Pilot Project, under which payments to the employee are made directly from the fund.

- RSV-1 reflects only the paid salary, which may differ from the accrued salary. Insurance premiums are calculated exclusively from the accrued amount of payments to employees. The amount of salary paid may differ due to the time gap between the advance payment and the transfer of the main part, which may occur in different months.

- Section No. 3 does not reflect data on the company’s founding director. Even if he is not paid a salary, he must appear on the list of insured persons.

Another important point that inspectors pay attention to is information on the number of insured persons, which is indicated in Appendices No. 1 and No. 2 to the first section. The number of insured persons cannot be less than the total number of officially employed employees of the company (including under GPC agreements).

Registration on the Pension Fund website

The official PFR portal does not have a separate form for creating an account, since access to your personal account is carried out through a person’s account on State Services. Then you can use your account without restrictions by entering only your login and password. All that remains is to select the desired tab and work in the PFRF user profile.

On his page, a citizen can see comprehensive information about the available pension savings deducted from his income. A person’s personal data is kept secret in accordance with the Law “On the Protection of Personal Data”; even Pension Fund employees can only have access to basic data. The full list of information that the account has is available only to the citizen himself, that is, its owner, and to log in after registration it is possible to use a unique user name, his phone number, e-mail, email address or SNILS number.

The entire registration process in the Pension Fund’s personal account can be divided into stages:

- go to the appropriate tab of the payer’s personal account;

- click on the registration button;

- fill in your full name, telephone number and email address;

- You should read the privacy policy and user agreement in advance;

- By clicking on the registration button after entering the data, the citizen confirms agreement with the above documents;

- registration on pfrf.ru is confirmed via a code received in an SMS message or an activation link via email;

- a password is created, which must contain letters and numbers, punctuation symbols are allowed.

Confirmation of identity completes the creation of a personal account and in the future it is this data that is used to authorize the State Service. Recovering your password if you have forgotten it takes a few minutes; the same phone number and email address are used for this procedure. But there are additional requirements, since simply entering your full name and telephone number is not enough. The information indicated on the PFR website is confidential, which means that only a confirmed person who has proven the rights to access hidden data can log into a personal profile and find out information.

Profile confirmation

Despite the fact that registering in the Pension Fund’s personal account is not difficult, it will not be enough. State services will provide access to personal data in the Pension Fund only after the second stage, which involves confirming personal information by entering the SNILS number and passport data, after which the information center employees will check the specified information. This takes about 10-15 minutes, in rare cases you can wait up to a day, but the account cannot be obtained without checking the personal information about the person.

Maximum freedom to use government services can be obtained by confirming the cabinet, which can be done in two ways. In the first one, you can order a letter to your address, which will contain a special personal code; it should be entered on the State Services website. You can also verify your account using mail by going to the nearest branch with your passport and SNILS policy, or you can contact the MFC, where they will issue a code immediately after submitting the documents.

Another method of how you can log in is an electronic digital signature; it transfers the account to confirmed status without waiting, you just have to upload the file in a special section. The signature is issued at the MFC, and then it can confirm the person’s identity when signing electronically. If you choose the option of sending the code by post, you will need to wait about two weeks; when you contact the MFC or post office, the code will be provided immediately. It must be entered into the confirmation line in your account and the services will be unlocked immediately, and logging into your personal account will be done without problems

If a citizen urgently needs to use State Services and an account on this service, he will not be able to do this, since it will take at least a week to receive a confirmed record that will allow him to create a personal profile. The minimum expectation is observed in the case of the insured person having an electronic signature, since it is enough to indicate a personal passport, SNILS and upload a digital file with encodings to your personal account. The maximum amount of time will be required if you order a letter by mail, in which case the waiting period can be about two weeks.

Methods

You can check the report based on the control ratios manually. But the process is labor-intensive and completely unsuitable for accountants running several companies at once. It is much more convenient to use automated services, which are presented both online and in the form of software products for installation on a computer.

Checking RSV-1 online

Checking a report through online services is convenient because it does not require installing programs on a PC. Free services for checking RSV-1 are available on the following sites:

Checking on such services is carried out using a single algorithm. For example, consider the sequence of actions that are necessary to check RSV-1 on the Russian Tax Courier website:

- From the main page of the site, go to the “Services for Accountant” subsection.

- In the list presented, select “Control ratios for a single calculation of contributions.”

- In the window that opens, click “start” and download RSV-1 in xml format (generated in the accounting program).

- Click “check calculation” and the result of the check will be displayed on the screen. The service will inform you whether there are discrepancies or not.

To carry out the verification, you must go through the registration procedure on the site; it is free and does not take much time. For subscribers of the Russian Tax Courier magazine, the service functions have been expanded. At the end of the check, they will see not only discrepancies, but also ways to correct errors. Another advantage of both this service and others like it is the ability not only to check the calculation, but also to generate it online.

Using programs

Programs for accounting and reporting, as a rule, already have built-in functions for checking tax reporting. This function, for example, is present in the popular “1C”. But you can use any third-party software products. The recommendation of the tax authorities is such a tandem - “Taxpayer Legal Entity” and “Tester”. Both programs are freely available on the Federal Tax Service website.

- Using “Taxpayer Legal Entity”

you can generate and check the RSV-1, or check the calculation generated in another program. To check, in the “service” menu you need to select “receive reports from magnetic media” and upload a document in xml format into the program. - The second program, “Tester,”

checks the document solely for compliance with the electronic reporting format. To check RSV-1, you need to load it through the “open” button on the toolbar. After specifying the path to the file and clicking “ok”, the scan will begin automatically. If the format complies with current standards, the message “no errors found” will appear, otherwise it is necessary to update the version of the program that generates RSV-1.

Check SZV-M online

The ability to check SZV-M is also included in programs for accountants, for example, 1C. In order for the report to be reflected correctly, you must first check the SNILS of all employees using the “Personal Data” report and make sure that all information and their changes are entered into the database. This is not a very convenient method, and it also takes a lot of time. Therefore, it is worth turning to Internet services.

Online service "Bukhsoft"

The advantages of this SZV-M verification service are obvious:

- Checking is free;

- Always updated software;

- User-friendly interface.

To start checking, go to the website buhsoft.ru and register. On the first page, select the “Start” - “Reporting Testing” button. Upload the selected files, then click on the “Check” icon. Links will be visible on the right, click on them and see the result.

Checking SZV-M on the Kontur website

This service is partially free, as it is mainly aimed at providing reporting by other means of transmitting information. First, go to the website kontur-pf.ru, select the item called “Go to checking on the site”, then “Reports” and enter the files. Then the results of the test will be visible.

How to check SZV-M on the Pension Fund website using the CheckPFR program

The Pension Fund has created a CheckPFR program for policyholders, with which you can check completed reports. You can install the program from the Pension Fund website.

Stages of work in the program:

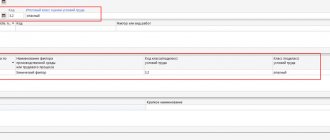

- After installation, run the program - click on the Check.exe icon, the following window opens:

- We load the file that needs to be checked into the program;

- Click on the first button “Check selected file”;

- Then the “File Check Log” opens, which will reflect all inaccuracies and errors:

The CheckPFR protocol shows a detailed report of errors made. Notes may be issued in the form of warnings or errors. If only warnings are shown, the status will display “Good”. The report can be sent to the Pension Fund without any problems. If the text “Bad” appears in the status, then there are errors. They are easy to find in the report - they are highlighted in a different color. They can be corrected immediately.

Setting up automatic check CheckPFR in the Referent program

To set up automatic verification of PFR information using the CheckPFR program, you must:

- launch the “Referent” program;

- go to the program settings (“Options” - “Program settings”);

- open the “Check programs” tab and use the “…” button to specify the path to the CheckPFR program:

- Click “Ok” in the program settings.

Requests for clarification of payments to the Pension Fund of Russia

To create a request for clarification of payments (reconciliation) in the Referent program, you must:

- On the toolbar, click on the “PFR payments clarification” icon.

- In the request window, select an organization from the list (if there are several organizations), in the “RNS / UPFR” field, select the corresponding parameters:

The request will be generated after clicking on the “Generate a file to send to the Pension Fund” button; it will be displayed on the “Output control” tab. To send a request, you need to mark the line with it and click the “By Email” button.

To create a request for reconciliation or clarification of payments in the Online Sprinter system:

- go to “Drafts” and click the “Create” button;

- In the document creation window, select “Reporting to the Pension Fund”;

- Specify the document form “Request to the Pension Fund”;

- click the “Go to editing” button;

- indicate the “Response Code”;

- Click the “Check” and “Submit” buttons.

Further document flow occurs in accordance with the scheme:

The description of this project and the document flow regulations are published on the Pension Fund website.

Example of checking using an online service

Let's look at how to check SZV-M. To do this, we will use the Pension Fund reporting tool through Contour Online.

Step 1. Registering in the system is completely optional. To get started with the system, follow the link located immediately below the “Registration” button.

Step 2. On the page that opens, select the type of reporting form to be checked. For SZV-M you need to select the “Reports” button, for adjustments to insurance premiums - the “RSV-1” button.

Step 3. In the dialog box, select the report file. Validation is only possible for XML formats; any other format cannot be loaded into the system. If the file is downloaded normally, information data will appear on the page that opens: the name of the institution, the delivery period (month and year), as well as the name of the selected file. Click the “Check” button.

Step 4. The system will generate the results of the check (information about errors, the presence of warnings, compliance with the format). The protocol can be opened in a new window, following the link.

Step 5. The protocol generated by the system details all problems.

Correct and recheck the system. Files must be sent to the Pension Fund without errors.

Before submitting reports to the Pension Fund, be it RSV-1 or, it makes sense to check the Pension Fund report for errors. After all, for example, for providing false information in SZV-M, the employer faces a fine of 500 rubles in relation to each insured person ().

And if, for example, incorrect personalized information is indicated in the RSV-1 calculation, then the fine will be 5% of the amount of insurance premiums accrued for payment to the Pension Fund for the last three months of the reporting period in which the error was made (Article 17 of the Federal Law of 01.04 .1996 N 27-FZ).