Who is eligible to receive

Payments such as road tolls in Russia are classified as regional types of duties. This means that the tax rate is set differently in each region of the country.

As for preferential groups of taxpayers, they are determined by two directions of legislators:

- Postulates of the Tax Code for the entire country.

- Federal laws for a specific region.

https://www.youtube.com/watch{q}v=Axeb5X6VPO0

As of the legislative provisions for 2019-2018, Article 361.1 of tax law specifies which persons may be exempt from paying mandatory amounts (clause No. 1).

Different categories of citizens and various institutions whose own cars correspond to those that are not subject to taxation can also take advantage of the rights of beneficiaries.

They are discussed in Article 358 of the Tax Code of the Russian Federation, which covers not only automobile means of transportation, but also river and air vehicles.

All persons and types of vehicles to whom the tax office allows not to pay the fee, or gives the right to reduce its amount, are presented in the table below.

| Preferential relief parameters | Legal defaulters | ||

| According to the norms of Art. 361.1 Tax Code of the Russian Federation | According to the norms of Art. 358 Tax Code of the Russian Federation | According to the norms of separate federal laws | |

| Machine designs | Having vehicles weighing more than 12 tons (if you take into account the cargo). | — | — |

| Exclusion from taxation objects | — | Owners: — motor boats, rowing boats (power up to 5 hp); — fishing ships; — passenger aircraft, watercraft; — equipped cars for disabled people; - a vehicle with a power of less than 100 hp, purchased with the help of social services. protection of the population; — agricultural machinery; — government cars; — operational and military vehicles; — searched (stolen) cars; — air medical, sanitary transport; — ships from the international catalogue; — drilling rigs and sea vessels. | — |

| Social privileges and protection | — | — | - social services; — disabled people; — pensioners; — military and labor veterans; - family members with many children; - holders of honorary orders; - widows of fallen soldiers; - having low-power machines; - liquidators of the Chernobyl nuclear power plant, etc. |

| Features of the received collection amount | Persons who, after calculations, received a tax amount greater than that established by the procedure. Only the difference is contributed to the country's budget. | — | — |

Important! In order for the owner of a vehicle with a total weight of more than 12 tons to receive an exemption from paying TN, he must register his vehicle in a special Register.

This should be addressed to any traffic police department before submitting a preferential application to the tax service.

Motorists pay the tax because their cars cause damage to the country's road infrastructure, each to its own extent. Heavy weights cause more damage to the road surface.

But car owners of heavy-duty wheeled vehicles do not pay road tolls to the tax authority for the reason that they are required to pay them according to the “Platon” system (short for “fee per ton”).

The specifics of admitting owners of passenger vessels of water and air transport to beneficiaries are possible only when their main activity is the transportation of passengers.

Such persons are required to confirm their activities not only with a license, but also with regular route schedules and other documents.

Such persons, as a rule, are transport enterprises, companies, firms (legal entities) or individual entrepreneurs.

The social privilege of citizens is always established by place in the country - by region, edge, large urban center, region.

This status provides many guarantees of using discounts or exemptions from obligations to the state.

Such guarantees by local authorities may include transport taxes, which are not required to be paid to privileged persons. Today, veterans, disabled people and pensioners are the most important groups of such persons.

Therefore, you need to clarify these details by calling the local Federal Tax Service, or go to the city official portal of the Federal Tax Service, and not the all-Russian one.

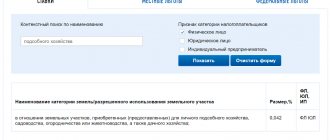

On the all-Russian official website of the Federal Tax Service, it is possible to select a region and city in order to access the local website page.

What documents need to be prepared

In addition to the application for benefits, you must provide the tax service with a standard package of documents:

- PTS (copy of both sides of the document);

- personal passport of a citizen of the Russian Federation (copy of page with photo and registration);

- TIN (copy);

- document on the basis of which the benefit is received (copy). This could be a pension certificate, a MSEC certificate of disability, a combat veteran’s certificate, etc.

According to the latest changes in legislation, since January of this year, the applicant-beneficiary has the right only to indicate the document that provides the basis for the benefit in the application, but not to provide it. An employee of the Federal Tax Service is obliged to independently make a request to those government bodies that issued the documents and make sure that they are available. Only if the request does not produce results, a tax specialist can request them from the applicant himself.

It is important to remember that copies of all documents require a handwritten personal signature of the applicant, its transcript - full name, each sheet must also be dated and certified with the word “Correct”.

Everything is in the same Article 361.1 of the Tax Code of the Russian Federation, in paragraph No. 3 it is written about the procedure for documenting the benefit - a package of necessary papers is provided along with the application.

But the documents serving as the basis for receiving benefits may be different in each individual case.

When, for example, you need to apply for a transport tax benefit for large families, you will need to present, in addition to the marriage certificate, all the certificates of the children.

| Are common | which all pass within the taxpayer category |

| Special | are given only as a basis by which the benefit is granted |

| Taxpayers | Documentation | |

| Are common | Special | |

| Individuals | - statement; — civil identity card; — copy of TIN; — PTS for a vehicle; - SNILS. | Certificates: - from the medical board confirming the assignment of a disability group; - from the guardianship council, if the disabled owner is under the guardianship of the parents, guardian, adoptive parent. Certificates: - disabled; - pensioner; - an honorary citizen with the Order of Glory, etc.; - veteran of the Second World War and other wars; - liquidator of the Chernobyl nuclear power plant, etc. |

| Legal entities or individual entrepreneurs | — certificate of registration in the Unified State Register of Legal Entities (USRIP); — TIN; — documents for a car or a fleet of cars. | - registration certificate; - schedules of regular flights when conducting the main activity - transport of people or specific ones. |

A driver's license is available upon request. All copies must be submitted along with the originals. If you are copying a passport, then you need to use a photocopier to photograph all its pages – even blank ones.

The list of documents may differ from the features of social protection of citizens and enterprises by local authorities.

So, for example, in one city, disabled people are most often exempt from paying TN, in another - pensioners, and in a third - both. It all depends on local conventions.

Are pensioners exempt from paying transport tax? The article explains:

who is exempt from paying transport tax

.

Is it possible to pay transport tax in installments? Read here.

Who has property tax benefits?

In accordance with Art. 407 of the Tax Code of the Russian Federation, in particular, the following categories of taxpayers have the right to tax benefits:

- Heroes of the Soviet Union and Heroes of the Russian Federation, as well as persons awarded the Order of Glory of three degrees;

- disabled people of disability groups I and II;

- disabled since childhood, disabled children;

- participants in the Civil War, World War II, and other military operations to defend the USSR from among military personnel who served in military units, headquarters and institutions that were part of the active army, and former partisans, as well as combat veterans;

- persons entitled to receive social support in accordance with the Law of the Russian Federation of May 15, 1991 No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, in accordance with the Federal Law of November 26, 1998 No. 175-FZ “On social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River” and Federal Law of January 10, 2002 No. 2-FZ “On social guarantees to citizens exposed to radiation due to nuclear tests at the Semipalatinsk test site";

- military personnel, as well as citizens discharged from military service upon reaching the age limit for military service, health conditions or in connection with organizational and staffing events, having a total duration of military service of 20 years or more;

- pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance;

- an individual - in relation to economic buildings or structures, the area of each of which does not exceed 50 sq.m. and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction.

Which vehicles are not subject to transport tax{q}

According to Article 358, paragraph 2 of the Tax Code of the Russian Federation, the following are classified as non-taxable vehicles:

- Cars specially equipped for people with disabilities

- Cars whose power does not exceed 100 hp, purchased with funds allocated by social protection

- Stolen cars

- Vehicles for agriculture (tractors, combines, etc.)

- Rowing boats and more

The full list is presented in the specified article of the Tax Code. Designated vehicles are not subject to taxation, regardless of the region of the country. However, you still need to notify the tax office about the application of the benefit.

Federal benefits for payment of transport tax under Art. 358 Tax Code of the Russian Federation

Important!

Federal benefits are those that are valid in any part of the country, regardless of the registration of the car owner. Unlike regional benefits, which are most often provided to certain categories of citizens, federal benefits apply only to certain vehicles.

The list of vehicles for which auto tax is not charged is regulated by Article 358 of the Tax Code of the Russian Federation. Read more about cars for which you do not need to pay tax in a separate article.

Sample application for transport tax benefits

Among the standard forms of GosRosStat there are no Appendices or Instructions in circulation regarding a unified form for a written application for a tax benefit for transport tax.

The text and content of the document can be compiled arbitrarily, but most importantly, in writing according to the general rules of document production.

There are two options for such statements:

- Free form.

- Federal Tax Service form.

The last option is approved not at the general legislative level, but at the level of the tax authorities. A version of the form was developed and approved by official Letter No. BS-4-11 / [email protected] dated November 16, 2020.

Sample application for transport tax benefit

Where _________________

From whom _______________

Taxpayer Identification Number__________________

Passport_______________

Address_________________

Telephone_______________

Statement

Based

| Document basis for the benefit |

please provide me with how

| Reason for granting the benefit |

| car make | car registration number | VIN |

Copies of documents indicating the right to benefits are attached.

| " " 20 year | / / | |

| date | signature | transcript |

The document can be submitted to the Federal Tax Service in person or sent by mail. In the first case, you need to fill out two forms, one of which is given to the tax authorities. On the second, the inspector will put a stamp indicating acceptance of the paper.

Documents should be sent by mail in a valuable letter with an inventory and notification.

The department employee will mark the inventory and issue a receipt.

These supporting documents must be kept, and later an acknowledgment of delivery of the letter must be attached to them.

The application is allowed to be submitted to the Federal Tax Service in electronic form. The format of the form recommended for this is approved by Order of the tax authorities No. ММВ-7-6 / [email protected] dated 11/10/16. The document is transferred through the Federal Tax Service website, attaching scans of documents confirming the right to the benefit.

If an application for a benefit is submitted in the current year, but the right to it arose earlier, the document indicates the month and year from which the person had the right to use the privilege.

We recommend that you claim your rights to reduce tax fees before April-May. That is, before the start of the formation and mass distribution of notifications about the amount of transport tax for the previous period. In this case, the application will be taken into account when drawing up the notification, which will save you from the need for recalculation.

You do not need to renew your benefit application annually. If you have already claimed your rights to the benefit and did not indicate time restrictions, it will be automatically extended.

If an application for a benefit was submitted after the fact, the Tax Code allows for recalculation. But only for the last three years (clause 3 of Article 363 of the Tax Code of the Russian Federation).

Application for property tax benefits

When calculating property tax for individuals, the Tax Code of the Russian Federation provides for the provision of tax benefits (Article 407 of the Tax Code of the Russian Federation). And since the property tax for individuals is a local tax, additional benefits may also be provided for by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) (clause 2 of Article 399 of the Tax Code of the Russian Federation).

To confirm his right to a benefit, an individual generally submits an application. We will tell you how to draw up such a statement in our consultation.

Submitting an application for benefits

The transport tax is regulated by federal law, but is under the jurisdiction of regional authorities. Federal and local government bodies have the right to provide some advantage to certain categories of transport tax payers, putting them in a financially advantageous position compared to other vehicle owners. This advantage is a tax benefit.

It can be expressed as:

- complete exemption from payment of tax on movable property;

- discounts from the tax base.

Once a year, self-government bodies of each region have the right to legislatively review the size of the tax base and the composition of transport tax beneficiaries. The decision to reduce or increase tax rates is reflected in the level of local budget occupancy. Therefore, even in neighboring regions located close to each other, the amount of transport tax for the same car with similar technical characteristics can vary significantly.

You can become a beneficiary based on 2 criteria:

- As the owner of a taxable object that is not subject to transport tax.

An individual taxpayer is completely exempt from paying car tax if he owns:

- low-power passenger car up to 70 horsepower in the engine;

- a low-power motor boat with up to 5 horsepower in the engine or a non-motorized rowing boat;

- a vehicle equipped for driving by persons with disabilities;

- passenger vehicles with up to 100 horsepower in the engine, acquired into ownership with the help of social protection authorities;

- vehicles that are officially on the wanted list;

- specialized fishing vessels (river, sea);

- specialized offshore platforms (floating, stationary);

- specialized offshore mobile drilling rigs and drilling ships.

A legal entity - a taxpayer is completely exempt from paying car tax if it owns:

- special equipment that is necessary for the production of agricultural products;

- special equipment that is necessary to service production enterprises;

- special equipment that is necessary for servicing federal highways, city roads, and highways;

- passenger and cargo ships, with the help of which cargo and passenger transportation is carried out (sea, river, air).

- As a separate category of citizens who are entitled to tax benefits:

https://www.youtube.com/watch{q}v=jx0pFi37Z0Y

Also, the entire government vehicle fleet, military equipment, and aviation equipment of sanitary and medical importance are 100% exempt from transport tax. A complete list of special equipment that is not taxed is in the general classifier of fixed assets in Russia.

A paper application can be submitted to the Federal Tax Service in two ways:

- carry it personally;

- send by mail (by registered, valuable letter with acknowledgment of receipt and a list of attachments) to the tax office address at the location of the apartment, house or garage.

If the pensioner has access to his personal account on the Federal Tax Service website, he can draw up and submit an application using this function in his account.

Attention! The document must be submitted before November 1 of the current year.

If a pensioner has overpaid tax, he has the right to return the overpaid amount, but only for the three previous years. For example, a pensioner learned about the benefit (that he does not have to pay tax) in April 2020, while the benefit itself arose in 2012. This means that he can return taxes paid to the budget since April 2015. That is, he has the right to request a refund only for 2014 (paid in 2015), 2020 (paid in 2016) and 2020 (paid in 2017).

To receive a refund, in addition to the above application for benefits, you must also provide an application for a refund of overpaid tax. A separate application must be submitted for each year.

If an individual has the right to a transport tax benefit, he submits an application to any tax office. In this case, the citizen has the right to attach documents confirming the right to the benefit to the application.

The application form, as well as the procedure for filling it out, were approved by Order of the Federal Tax Service dated November 14, 2017 No. ММВ-7-21/ [email protected]

The application can be filled out by hand or on a computer, and submitted on paper or sent electronically through the taxpayer’s personal account.

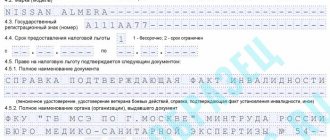

Please note that the form is intended simultaneously for applying for benefits for transport tax (section 4), land tax (section 5) and property tax (section 6). Accordingly, you only need to fill out those sections in which benefits are claimed. That is, when submitting an application for a transport benefit, section 4 is filled out. If there are no benefits for land or property, then these sections of the application are not filled out and are not submitted to the inspection.

The application must indicate whether the benefit is requested for a specific year or indefinitely. In the latter case, you will not have to submit an application every year.

Here is a sample of filling out an application for a transport tax benefit.

A special place among the beneficiaries is occupied by owners of heavy vehicles with a maximum weight of more than 12 tons, registered in the register of vehicles of the toll collection system (the so-called “Plato”).

Let us recall that one of the main goals of the transport tax is to replenish the budget in order to restore roads. The Platon system does the same thing: it collects funds for the damage that heavy trucks inevitably cause to highways. To avoid the situation of double payments, it was allowed to deduct payments for “Plato” from the amount of transport tax (Federal Law No. 249-FZ of 07/03/2016). As a result:

- The tax is not transferred at all if payments to compensate for damage to roads exceeded (or were equal to) the amount of tax for the same period;

- The tax is reduced by the amount of the payment if the latter was less than the amount of the calculated transport tax.

The deduction is valid for both individuals and companies.

Even if a citizen fits into a category that is not required to pay transport tax, it will not be canceled without filing an application. There are 3 ways to notify the tax office.

- Submit in person. After filling out all the necessary sections, come to the tax office to which you are assigned at your place of registration. Take with you 2 copies of the application, a copy of supporting documents, and a passport. After the inspector has looked at your documents and accepted them, it is necessary that he put a stamp and date of acceptance on 2 copies. Save this document. It serves as confirmation of your application in the event of loss of your submitted copy or other unforeseen circumstances.

- Send by mail. If it is difficult to find time for a personal visit, you can send your application by mail. Lawyers advise choosing a letter with a list of attachments and a notification of receipt. In this case, you will insure yourself against the loss of a letter by post office workers. In the attachment description you need to indicate what documents you are sending. It is enough to indicate the value of the documents in the amount of 1 ruble. The postal worker will put a date on the inventory, which will be considered the date of filing the application. It will also be possible to track when the tax authorities receive the letter.

- Submit online. Technology is moving forward. The convenience of working via the Internet is appreciated in many areas, including government agencies. The State Services service provides the opportunity to submit an application online, attaching copies of the necessary documents. The only downside to this system is the need to confirm your account at one of the city’s MFCs. For privileged categories of citizens, including disabled people and pensioners, this may be difficult to achieve.

All collected documents are submitted to the only possible state organization in such cases - the Inspectorate of the Federal Tax Service (abbreviated as IFTS or FTS).

Most often, a unit is selected that is located within the territorial boundaries of the area where the citizen is registered or the enterprise is registered. But you can apply to any department you choose.

The place of registration of a car or other equipment, in this case, does not matter. When submitting an application online, you need to fill in the details of the car owner and the object (car) for which the tax benefit will be issued, or the absence thereof.

It is also possible to apply for benefits through the Federal Tax Service portal, having previously registered there and received passwords to access your personal account.

Sample applications for tax benefits

Just like all citizens, pensioners are required to make timely payments of land taxes. Failure to pay may entail not only administrative penalties (penalties, fines, confiscation of property), but also criminal penalties. Advertising Legislative framework

- 1 Legislative framework

- 2 How to use the right to tax benefits

- 3 Procedure for applying for land tax benefits for pensioners

- 4 Where to apply 4.1 How to independently calculate the land tax benefit

Land tax refers to local fees (Article 15 of the Tax Code of the Russian Federation), which are paid to the state by ordinary citizens and legal entities owning a plot of land.

Sample application to the tax office for benefits for pensioners

- to provide benefits from the date when you became entitled to it (month of retirement, month of receipt of disability, etc.);

- for a tax refund for periods when you could have taken advantage of property tax benefits, but did not (see the link for a sample).

Send both applications in one letter.

Example: A pensioner had the right not to pay property tax on the cost of an apartment, but paid it regularly. The pensioner learned that he had been paying taxes in vain in March 2020.

He has the right to demand a refund of taxes paid starting from March 2020. He no longer has the right to claim a refund of the tax that was transferred even earlier.

How to write an application for a transport tax benefit?

There is no annual notification requirement;

- submission of an updated notification with a change in the object of taxation after November 1 of the year is not allowed.

To receive (register) a benefit, a person entitled to benefits must contact the tax office in person or through the taxpayer’s Personal Account and provide:

- application for tax benefits;

- identification document;

- pensioner's ID;

- TIN (if available);

- documents confirming the pensioner’s ownership of land, housing, other real estate, and a vehicle.

All documents (except for the application) must be provided in the form of an original and a copy, which (upon presentation of the original) the Federal Tax Service inspector can certify himself.

Online magazine for accountants

CONTENTS ♦ Application for property tax benefits: form and submission♦ Application for property tax benefits: composition and completion → general rules for filling out → title page → sheet with data on property tax benefits Applications for property tax benefits: form and sending On our website you will find:

- The procedure for filling out an application for property tax relief and a sample of the completed application form.

- An application form for property tax relief in Excel and PDF format, which you can download and fill out with your own data (see attached file).

The application can be submitted to the inspection in person or sent by mail. When sent by mail, the day of submission of the application is considered the date of its transfer to the post office for dispatch.

- Tax audits

- What should a complaint to the tax inspectorate contain?

- Tax return

- Complete list (list) of persons who are required to file a tax return

- Sample of filling out the 3-NDFL tax return for 2014 - 2017:

- title page

- income from sources in the Russian Federation, taxed at a rate of 13% (sheet A)

- calculation of property tax deduction (sheet D 1)

- calculation of property tax deductions for income from the sale of property (sheet D2)

- calculation of standard tax deductions (sheet E1)

- calculation of social tax deductions (sheet E2)

☎ Telephone ⌚ Opening hours daily, around the clock ✉ AddressMoscow region, Noginsk district, Elektrostal, st.

Sovetskaya, 8/1☎ Phone+7+7 (495) 580-59-50+7+7 ⌚ Opening hours Mon-Thu 09:00-18:00; Fri 09:00-16:45 All | only with websites Based on the Law of the Russian Federation No. 118-FZ “On judicial...

All sheets in both books must be numbered, laced, certified by the signature of the head of the organization, and also sealed with a wax seal or sealed. This procedure is established in paragraph 41 of the Rules, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225. Responsibility for lack of accounting For...

The amount of bonuses and incentives will be calculated correctly if it ensures a corresponding increase in revenue and profit of the enterprise. The analysis also reveals specific factors that positively and negatively affect labor intensity. For example, interruptions in the supply of spare parts, raw materials, frequent breakdowns of equipment,...

The format of the agreement is not strictly defined, but there are some sections that must be present. All the subtleties of this type are covered in article No. 550. Accordingly, property rights must be properly registered. Process…

Source: https://2440453.ru/obraztsy-zayavlenij-po-nalogovym-lgotam/

How to fill out an application for benefits{q}

General information:

- The form of the document was approved by Order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ [email protected]

- You must fill out the form carefully, entering each letter or number in a separate cell.

- You can enter information by hand or on a computer. With the second option, it is important to remember that the taxpayer’s signature must be “living”.

- The form contains 4 sheets, but to receive the benefit for the tax we need, only the title page and the page on which the specified benefit is declared are filled out. Blank sheets do not need to be attached to the document.

Sheet 1 (title)

Documents for an application for a transport tax benefit

In order not to waste time, the pensioner is recommended to contact the tax office to clarify the exact list of necessary documents that must be attached to the application. This is due to the fact that each region can have its own list of documents:

- Copies of documents that confirm the legal right of a pensioner to receive transport tax benefits - in accordance with current title documents.

- A copy of the pension certificate.

- A copy of the vehicle passport, which confirms the right of a citizen of retirement age to own a car. This paper is required by the tax authorities of certain regions of the Russian Federation.

When the documents listed above are submitted to the tax office, the pensioner has the right to take advantage of the benefits.

So, citizens who have reached retirement age are recommended to visit the tax service in advance in order to familiarize themselves with the procedure for applying for the benefits they are entitled to by law when paying transport tax in 2020. The pensioner needs to come to the tax authority with the appropriate application in person or use e-mail to send a message and the necessary papers.

Registration of benefits for land and property

An application for a land tax benefit and an application for a property tax benefit are completed in the same way.

The title page for these applications is identical, as are the fields for indicating the document giving the right to tax preferences. The only difference is in the designation of taxable property in respect of which the benefit will be applied.

Thus, an application for a pensioner’s land tax benefit will contain the cadastral number of the land plot and be confirmed by the number of the taxpayer’s pension certificate.

An application for a property tax benefit will differ only in specifying the type of real estate and its inventory, conditional or cadastral number.

It is optimal to submit an application for a benefit in a timely manner, while the current tax period is still in effect, submit the application with an already collected package of documents, etc.

What is the most common procedure for considering such cases:

- Collect and prepare the necessary documentation.

- Drawing up an application for the possibility of providing benefits for the existing type of vehicle.

- Submitting documents to the tax authority.

- Getting a solution.

The most important rule for granting transport tax benefits will be the validity of all documents provided; they must be dated in actual numbers and certified with a seal and signatures.

You should carefully monitor the correctness of filling out and writing the application. The slightest corrections and you will have to rewrite the application, since tax inspectorates usually pay great attention to the cleanliness of writing and may simply not accept an application with blots.

There are two options for submitting such a document as an application for granting transport tax benefits to pensioners, other citizens, or legal entities.

These are the following methods:

- Arriving independently at the tax office at the taxpayer’s residence or registration address.

- By filling out an application and sending it along with scanned documents via the Internet, on the Federal Tax Service website through your personal account.

In the first case, this is convenient when you need to immediately pick up the second copy of the application, which will already have a mark from the office of the government agency indicating that the paper has been accepted for consideration.

When the provision of benefits is unreasonably denied, then such a mark will play a big role in the process of pre-trial or trial proceedings.

Thanks to the Order of the Federal Tax Service No. ММВ-7-6/ [email protected] dated November 10, 2020, you can now submit such applications on any official website of the tax service belonging to a city.

This mechanism is very convenient for people who cannot go to the tax office for various reasons - they have a disability with physical limitations, they do not have time to take time off from work, and other factors.

Submission methods

An application for transport tax relief in 2020 can be submitted in several ways:

- Go to the inspectorate in person . In this case, it is recommended to write the application in two copies, the second remains with the taxpayer. The employee must put the date of hire on the applicant’s copy. If the right to benefits is denied, then such a decision will be easy to challenge in court. In accordance with the law, the applicant can submit a package of documents to any department of the Federal Tax Service; the place of permanent registration does not affect this.

- The application can be sent by mail . In this case, the day of filing will be considered the date of its transfer to the post office for dispatch. Copies of all documents confirming your right to benefits must be attached to your application. The application should be sent by certified mail with a list of attachments and acknowledgment of receipt. In this case, you need to save the inventory certified by the postal worker, the shipping receipt and the notification received. Thus, the fact of sending documents to the tax office is confirmed.

- In recent years, people have often asked how to apply for vehicle tax relief online . This can be done through your personal account on the Federal Tax Service website https://www.nalog.ru/rn27/. Now tax officials are actively promoting the way of working with the inspectorate through the personal accounts of vehicle owners. Since 2020, a departmental order of the Federal Tax Service has approved a sample electronic application for benefits for several types of property taxes https://www.nalog.ru/rn77/taxation/taxes/nnifz/5686398/. This greatly simplifies the task of active Internet users. The format is used for transport payments, which makes it possible to reduce the number of errors and significantly speeds up the process.

To submit an application online, you must follow these instructions:

- visit any branch of the Federal Tax Service to receive a login and password for your personal account;

- activate data on the Federal Tax Service website and register a personal account;

- obtain an enhanced qualified electronic signature in specialized centers.

After registration, the user will be able to control absolutely all payments and make them, submit applications in the form that is recommended, and monitor current changes in laws.

What to remember

When a transport tax benefit is issued, some nuances and important points may emerge during the process.

So, when contacting the Federal Tax Service with a completed special application, the following 10 recommendations and important details may be useful:

- Participants of the Platon system can obtain an application form on the system’s website. Each of its representatives has his own personal account there, through the service of which you can find all the necessary documents and download them.

- Late taxpayers who are entitled to a benefit, but did not know about it before, can exercise the right to recalculate the tax on TN. To do this, you will need to submit a separate application for recalculation (a free form document indicating the applicant’s bank account).

- It is possible to submit an application by regular mail. You need to fill out a form at the Russian Post organization for preparing a valuable, registered letter, which must include an inventory of all documents attached to the application.

- Refund of overpaid amounts is possible only after 3 years, which is the statute of limitations for transport tax claims by the state.

- If there are errors in the form or in the text that the applicant wrote, the tax office has the right to refuse to consider the package of papers even at the stage of submitting it to the office.

- Retroactive appeals to the tax authorities are not processed.

- Receiving a tax benefit is also called obtaining a zero transport tax.

- The amount of benefits for retired drivers must be clarified for each city separately.

- Documents serving as the basis for granting benefits must be valid and not expired.

- If the application is not submitted at all, the transport fee will be charged to the taxpayer according to standard conditions - “on a general basis”.

For several years now, various bills have been submitted to the State Duma of the Russian Federation for consideration, which propose to abolish the payment of transport tax and transfer this collection to the amount of excise taxes on fuel products.

This mainly concerned road transport, but such proposals are constantly rejected and are not yet taken into account. Therefore, the procedure for filing applications for transport tax benefits has not yet been cancelled.

Those wishing to receive the benefit should monitor innovations in legislation in order to be able to take advantage of the abolition of the tax obligation for themselves.

The article describes the calculation of the advance payment for transport tax in 2019:

advance payments for transport tax

.

For information on filling out a transport tax return, see the page.

Find out how to calculate transport tax for an incomplete year from this information.

How to apply for transport tax benefits

According to Russian legislation, this application to reduce the amount of transport tax can be submitted in two versions:

- In the form of a paper document

- As an email

If the applicant chose the second option, the pensioner can send a corresponding message to the tax office’s email address. It should be accompanied by scanned documents and an application. This method can be implemented using the service of the Federal Tax Service in 2020, which provides similar government services to citizens. To have access to this service, a citizen of retirement age will need to register on the website and log in to his personal account using his login and password. To gain access to your personal account, the taxpayer should contact the tax office at their place of residence. There he will be issued a special plan registration card.

If a citizen sends an application and a package of documents via e-mail to the address of the tax service, then he needs to do the proper paperwork in accordance with the requirements of the law, and they are signed using a personal electronic signature. Detailed information on the procedure for using an electronic signature can be found in the norms of the order of the Federal Tax Service of the Russian Federation dated 04/08/2013 No. ММВ-7-4/142.

In addition, the law gives citizens of retirement age the opportunity to send an application using the post office. If the pensioner has chosen this method of sending papers, then when collecting the necessary package of documents, you should take not original copies, but appropriately certified copies. Moreover, you do not need to contact a notary to undergo this procedure.

Which pensioners will be denied transport tax benefits in 2020:

If you refer to the letter of the Ministry of Finance dated 08/07/2014 under number No. 03-02-RZ/39142, it says that the pensioner has the right to certify this document independently. For this purpose, below the “Signature” detail, you should put the certification inscription “True”, your signature, its transcript and the date when the paper is certified.

How to submit and when?

The Tax Code of the Russian Federation does not establish a specific period within which an application for a benefit must be submitted to the tax office. However, the Federal Tax Service recommends submitting such an application before the tax notice for the year is generated. By the way, based on the results of 2017, the Federal Tax Service recommended submitting an application for benefits before May 1, 2018.

The benefit begins to apply from the moment an individual becomes entitled to it. For example, from the date of retirement or from the date of receipt of disability. However, there are situations when the taxpayer did not know about the possibility of applying the benefit or could not apply. What to do in this case{q}

In this case, he needs to submit 2 applications.

- One thing about the application of the benefit, only indicate the start date of application from the date of entitlement, but not earlier than 3 years.

- The second application for a refund of the amount of tax paid.

After reviewing the submitted documents, the tax office must transfer the overpaid transport tax to the taxpayer’s bank account within three months. In the future, the beneficiary may not pay tax.

When submitting two applications, it is better to send or bring them to the tax office at the same time. This will speed up the refund process.

What transport tax benefits are there for pensioners?

There is a legislative framework in accordance with which transport tax is established for pensioners - this is the Tax Code of the Russian Federation. But it does not contain specific rules exempting retired people from paying transport tax. But municipal authorities can adopt legislative acts, according to which pensioners have a number of social benefits. Therefore, each Russian subject, whose competence includes taxation of individuals, establishes a scheme for the use of benefits. That is why the main points of applying for benefits should be clarified with local tax authorities.

Pensioners should not forget that tax benefits for their vehicle are of a notification nature. What does it mean? The point is that a citizen can take advantage of the benefit only if he submits an appropriate application about his rights to the authorized state bodies. Until this happens, transport tax will be calculated without taking into account benefits in full.

Tax deduction according to the Platon system

Heavy vehicles weighing more than 12 tons are required to make payments for travel on federal roads in the Platon system. This innovation appeared at the end of 2020. For the owners, this meant double taxation, since no one had canceled the transport tax. In 2020, a relaxation was introduced for such taxpayers.

Now the transport tax for heavy trucks can be reduced by the amount of payments in the Platon system. To do this, you also need to submit an application to the tax authority and confirm it with documents on payment of payments, the owner of the vehicle and the car itself.

For the tax authorities, it does not matter whether a legal entity or an individual owns a vehicle. In any case, the taxpayer will notify the inspectorate of the possibility of applying the benefit. The company must attach the application to the declaration, and the individual must send it to the tax office within the established time frame.

https://www.youtube.com/watch{q}v=7KzFBFGuKhc

The right to use the benefit is completely voluntary. That is why the tax authorities will not cancel it automatically when a reason arises. The taxpayer independently notifies the inspector about the termination of the accrual of transport tax. If a citizen does not submit an application and stops making payments, he will begin to be charged penalties on his existing debt.

Procedure for applying for benefits

Benefits relating to property and tax legislation in general are issued through the Federal Tax Service. A citizen entitled to a benefit must contact a government agency with an application and the established package of documents.

How to apply for and where to get a property tax benefit

If the apartment is located in Moscow, then the citizen must submit an application specifically to the Moscow tax office.

List of documents

When submitting an application, a citizen must provide the following package of documentation:

Submitting an application

There are three ways to submit an application to the tax authority:

General rules for filling out an application

An application for benefits is drawn up according to the established template. The citizen must indicate:

- Last name, first name and patronymic.

- Date and place of birth.

- Information about the identity document.

- Contact phone number.

- The method of informing about the results of consideration of the application is indicated (through the body where the application was submitted or by mail).

- The accuracy of the information provided must be confirmed.

- The type of property for which the benefit should be provided is selected. Information about it is described (according to documents).