The main points of the accountant's labor protection instructions

The labor safety instructions for an accountant are divided into a number of points and sub-points that control the basic requirements for working conditions in a given situation. Depending on the danger of the activity, as well as the scale of the enterprise, the number of points may be more or less. It should be borne in mind that the finished instructions must be drawn up correctly and conveniently structured for clearer perception.

To get a general idea of labor safety instructions for an accountant, let’s look at the following table:

| Document paragraph | General content |

| General requirements | This paragraph specifies the minimum requirements for professional activities: the required age of the employee; requirements for his personal or physical (if necessary) data; level of education and qualifications, etc. |

| Occupational safety before starting work | The paragraph contains information regarding the basic actions that the accountant needs to complete before performing the work. For example, if an employee works with a PC, then this paragraph should indicate instructions for its safe use. |

| Occupational safety during work | This paragraph should include a maximum of recommendations that will help prevent an accident or other kind of trouble during the working period. They should be based on data about the accountant’s workplace and his expected actions in certain situations. |

| Occupational safety in emergencies | A mandatory clause containing information on how an employee is recommended to act in the event of an accident or emergency. |

It is extremely important to take into account all the nuances when drawing up this document. In situations where an accident occurs at an enterprise, the rules for action for which are not included in the labor safety instructions, the head of the company will bear responsibility for the damage caused.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Registration procedure

Before drawing up labor safety instructions for an accountant, an assessment of the employee’s workplace is carried out. This includes checking:

- microclimate;

- temperature regime;

- levels of illumination, noise and radiation;

- serviceability of wiring and electrical appliances;

- availability of fire extinguishing means.

The assessment provided serves as the basis for drawing up labor safety instructions.

Since 2014, the document in question does not have a unified form. This means that it is designed arbitrarily.

Thus, the enterprise has the right to independently create the necessary template for labor protection instructions for an accountant. You can download this sample for free from our website using the direct link here.

General labor protection requirements

This point is the starting point and main point for the entire document. It contains general information regarding the requirements for the employee, his workplace and other existing nuances of work. As a rule, only general data is written here without any specifics: it is given a secondary place in other paragraphs of the document.

As an example, we refer to the following excerpt from the paragraph “General requirements for labor protection” from the labor protection instructions for an accountant:

- Persons who have reached the age of 18 and have a secondary vocational or higher specialized accounting education are suitable to work as an accountant at an enterprise.

- Before starting professional activities, the employee is recommended to undergo a medical examination and provide a document confirming that health indicators meet the standards.

- The accountant undertakes to report any incidents within the enterprise that may cause harm to his health or the health of other employees.

- The most dangerous tasks within the framework of accounting activities are work on the road, as well as the transportation or saving of cash or other material assets of the enterprise.

- A mandatory security requirement for an accountant is the obligation to appear at the workplace in the form of an enterprise.

- An employee is strictly prohibited from using items in the workplace that could potentially cause harm to himself or employees of the enterprise.

- In order to begin performing job duties, the specialist must listen to a lecture on safety rules.

These requirements may vary, change and be supplemented in accordance with the individual nuances of the enterprise, its focus and other nuances of the accountant’s working conditions.

Purpose of the document

The labor protection instructions list the actions that the relevant specialist should or should not perform. It specifies the requirements for the employee’s health status, the minimum level of education, rules for handling the company’s property, and much more.

This document is being developed to ensure the safety of personnel in the workplace and avoid negative consequences for others.

As a rule, standard instructions on labor protection for an accountant are offered for review during employment, transfer, instruction, as well as making changes to an existing document. After reading the instructions, sign. It means that the accountant:

- successfully completed the briefing;

- may be held accountable for violating the rules established by the instructions.

Occupational safety before starting work

This paragraph requires specific information on the labor protection of an accountant, namely, the basic rules and recommendations for actions necessary to be performed before performing official duties. Separately, it should be noted that these rules are directly related to the conditions in which the employee works. The instructions for preparing for work must include all electronic devices, as well as a desk, chairs and other material equipment of the accountant’s workplace.

As a rule, this paragraph does not contain too much information. Its main subparagraphs include checking the workplace, as well as preparing it for the start of job duties. In addition to specific instructions, you can also indicate more general ones - for example, wet cleaning of individual elements, etc. In addition, a visual check of the employee’s personal space should also be indicated.

Approval procedure

The development and approval of labor protection instructions for accountants is carried out by the management of the organization (Article 212 of the Labor Code of the Russian Federation). When preparing this document, certain conditions must be met:

- the instructions must be drawn up with the participation of a labor protection specialist;

- if there is a trade union in the organization, then the instructions must be agreed upon with it;

- the document must be agreed upon with the employee’s immediate supervisor; in this case - with the chief accountant (it is clear that the organization must also have instructions on labor protection for the chief accountant);

- if the instruction is approved in several copies, then all duplicates are registered by the enterprise’s labor protection service;

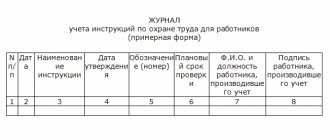

- the fact of the employee’s briefing is recorded in a separate journal.

Occupational safety during work

The immediate period of work of the employee is the most dangerous, therefore, a detailed and clear indication of the rules and recommendations that should be followed to perform the work safely is required. Proper elaboration of the item “Labor safety during work” will help to avoid accidents during the performance of official duties, reduce the number of possible conflicts between the employee and management and stabilize the work schedule.

As an example, let us consider in detail some subparagraphs from the section “Labor safety during work for an accountant”:

- During the working day, an accountant must perform only such work as is indicated in his “Job Description”, paragraph “Job Responsibilities”.

- An employee is prohibited from performing work for which he has not been professionally trained (medical care, etc.).

- If problems or breakdowns occur related to elements of the workplace (personal computer, desktop, etc.), it is strictly forbidden to carry out repairs yourself and it is recommended to contact a senior accountant for help.

- To work comfortably at the computer, it is recommended to take a short break and do physical exercises every 15 minutes.

- It is recommended to store documentation, cash, as well as other valuables of the company in specially designated places (cabinets, safes, etc.).

- When performing traveling work, you must follow traffic rules.

Labor protection after work

At the end of the working day, the accountant must comply with a number of rules that will help keep the work premises and furnishings in it intact, as well as protect his further work and the professional activities of other employees. When drawing up this paragraph, it is also necessary to have precise knowledge of the employee’s office: the content of this paragraph will be based on the equipment of the workplace.

Most often, upon completion of work, the accountant needs to turn off all electronic devices that were used during the day, turn off the lights, and close the windows. If the office has a safe or cabinet equipped with a special lock, it is recommended to close it and hand over the key or take it with you under personal responsibility. All documentation held by the accountant must be collected and either handed over to the chief accountant or taken with him under personal responsibility. Finally, the accountant must check his office (workplace) for fire safety. Only after this the accountant is allowed to leave his post.

Occupational safety in emergencies and emergencies

Despite the fact that such situations occur quite rarely among office workers, the development of this point is an integral part of any instruction on labor protection for an accountant. A specialist must clearly understand what he should do in a given critical situation in order to smooth out all the consequences as much as possible and avoid possible problems.

When drawing up this paragraph, it is extremely important to think through the possible risks to which the company is exposed, and also take into account the location of the accountant’s workplace. Most often, in this case, the following recommended actions and tips are indicated:

- If an emergency or emergency situation is detected, the specialist is obliged to notify employees nearby about it, and then act in accordance with the requirements specified in the emergency response plan.

- If you have any health problems (fever, blood pressure, bruises, abdominal pain), you should immediately contact the organization’s medical professional. In the absence of a medical worker, it is recommended to provide yourself with possible first aid or contact the management of the enterprise to relieve yourself from performing official duties and contact an ambulance.

- If a fire situation occurs, the specialist must notify employees in a loud voice, and also immediately contact the fire department. Further actions are regulated by the fire safety plan.

- If a situation arises at the enterprise that could harm the health and life of the accountant and other employees, it is necessary to leave the premises as soon as possible.

- In the event of any kind of emergency or emergency situation, company employees should remain calm and vigilant and act in accordance with safety instructions.

The seriousness of the consequences of emergency situations at an enterprise depends not only on the first actions of the manager. It also depends on how correctly this paragraph of the labor protection instructions is drawn up, since employees will act based on it.

Recommendations for drawing up instructions on labor protection for accountants

Correctly and competently drawn up labor protection instructions will help employees protect their professional activities in the workplace, and the manager in managing the enterprise. Using the following table, we will consider some recommendations for compiling each of the instructions:

| Instruction point | Recommendation |

| General labor protection requirements | When drawing up, you should take into account the legal documents of the Russian Federation, the Labor Code and the job description of a specialist. The paragraph should contain only general information that the specialist will use when applying for a job. |

| Labor safety requirements before starting work | When drawing up, the conditions of the specialist’s workplace and his job description are taken into account. Most often, an item contains no more than 3-5 subitems. |

| Labor protection requirements during work | Subparagraphs should control the safety of life and health of the accountant, as well as the safety of material and other assets of the enterprise. |

| Occupational safety requirements in emergency situations | When drawing up, you should rely on the risk of certain emergency situations, the location of the specialist’s workplace, as well as the emergency response plan. |

Correctly drawn up instructions on occupational safety for an accountant will help preserve the health and life of a specialist, as well as optimize the work of the head of the enterprise.

The accountant is responsible for fulfilling the requirements of regulatory legal acts, orders and directives on labor protection, for maintaining safe working conditions in the workplace.

The accountant is required to:

- Analyze and summarize proposals for spending funds on labor protection, determine areas for their most effective use.

- Provide financing for labor protection costs in the branch.

- Keep records of funds spent on labor protection in repair and maintenance areas, providing the director with the necessary information for drawing up summary statistical reporting.

- Transfer funds in a timely manner:

- under agreements concluded with specialized organizations for the implementation of labor and environmental protection measures, medical care and fire safety, and other labor protection measures;

- under contracts for the purchase of workwear, safety footwear and other personal protective equipment, flushing and neutralizing agents.

- Organize work on timely payment of compensation for harm caused to employees by injury, occupational disease or other health damage related to the performance of work duties.

- Organize the transfer to the Social Insurance Fund of cases of persons who have received work-related injuries and are leaving the enterprise.

- Keep records of funds paid for temporary disability certificates.

- Manage the interaction of the branch with the Social Insurance Fund on established payments related to taxes on compulsory insurance against accidents at work.

- Provide assistance to heads of repair and maintenance areas:

- in the development of lists (lists), in accordance with which, on the basis of current legislation, workers are provided with compensation and benefits for difficult, harmful and dangerous working conditions;

- in organizing and conducting certification and certification of permanent workplaces and equipment for compliance with labor protection requirements.

- Participate in the development of occupational safety measures included in the plan for improving the state of occupational safety and monitoring their implementation.

- Inform employees about the provision of compensation and benefits for difficult, harmful or dangerous working conditions.

- Exercise control:

- for providing workers with compensation and benefits for difficult, harmful or dangerous working conditions;

- taking into account the working time of employees engaged in work with hazardous working conditions;

- for spending funds on labor protection measures.

- Ensure safe maintenance of the assigned workplace in accordance with labor protection, electrical safety, and fire safety requirements.

- Comply with the requirements of labor protection, electrical safety, fire safety during work activities when operating electrical appliances and office equipment.

- Follow the work and rest regime established by the Labor Code of the Russian Federation, Internal Labor Regulations.

- Maintain a personal computer at the workplace in accordance with the requirements of Sanitary Rules and Standards.

- Observe the Safety Rules when working on a personal computer, as well as regulated breaks depending on the time spent working on a personal computer.

- Know the state of working conditions in the accounting department and at the workplace, as well as new legislative and other regulatory legal acts on labor protection being introduced.

- If any violations of security requirements, electrical safety, fire safety, as well as malfunctions of electrical equipment, lighting, sockets, switches, office equipment, etc. are detected. immediately report to the chief accountant (deputy chief accountant).

- In the event of an accident with an accounting employee, organize the provision of first aid to the victim and report the incident to the head of the department.

- Before performing your duties, undergo training and instructions on labor protection, electrical safety, and fire safety in the prescribed manner.

- For violation of labor protection requirements, failure to fulfill labor protection obligations stipulated by a collective agreement (contract), or interfering with the activities of representatives of state supervision bodies and control over compliance with labor protection requirements, as well as public control bodies, he is liable in accordance with the legislation of the Russian Federation (administrative , disciplinary and criminal liability).