Fiscal registrar CCP: simplified system

Now, in 2020, a reform is taking place to develop the project regarding the introduction of fiscal apparatus and cash register systems. By 2020, it is planned to complete the process - all enterprises will switch to online cash registers.

The fiscal data operator has also been modified and improved. It is directly related to the cash register and the structure of reflecting fiscal data. Not only company employees, but also the tax inspectorate can have access to the built-in filler. All information subject to registration in fiscal memory is open and is freely available to all authorized bodies.

If the time for submitting a report is approaching, information about the data can be taken directly from the drive that stores information about financial accounting. It is imperative to reflect all legal data, otherwise the information will be considered distorted.

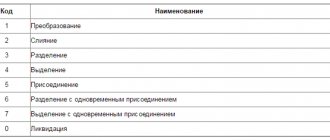

Are there time limits for using the FFD?

Table. Terms of legitimacy of using FDF

| № | FDF version | Period of permitted use |

| 1 | FFD 1.0 | Until 01/01/2019 |

| 2 | FFD 1.05 | Is not limited |

| 3 | FFD 1.1 | Is not limited |

Such restrictions apply only to the 1.0 format. It will be possible to punch checks through it until January 1, 2020. At this point you should have upgraded to either FDF 1.05 or FDF 1.1. We will look at how to do this below. But I note: if you installed a fiscal drive with FFD 1.0 at the cash register, and the period of use of this drive ends after 01/01/2019, you will still have to switch to the new formats by January 1, 2020. Unless, of course, you want to avoid a fine or unilateral deregistration of the cash register by the Federal Tax Service.

Legal legislative norm of law

To understand the peculiarities of working with new devices, you should refer to Federal Law No. 54. Here are the conditions for fixing and implementing online devices. Many will think that this is all complicated, individual entrepreneurs will take a long time to adapt to the legal sphere of accounting, being individuals, and LLCs are only in favor of improving the entire bureaucratic policy of the company.

Cash registers are now equipped with special chips - devices that store information and details of your daily money transactions. Fiscal data is information that is stored in the cash register's memory.

Both registration and registration are carried out at the tax office. A product database is also being implemented there to make product movement easier and more convenient. The device has also become newer and smarter - it will issue receipts only with details: information about goods, prices, discounts, promotions, days of purchase, operator, etc. The cash register, as an operator of fiscal data, connects to the OFD database later, when accounting is already maintained for a specific entrepreneur.

- All received data will be sent to the tax office before the end of the working day.

- The fiscal memory of the cash register is separately built in and changed without losing data.

- The OFD is installed after online registration with the tax office, and the CTO is no longer needed.

It is worth noting that soon a paper check will no longer be needed, and by 2020 its optional issuance will also cease to be relevant. In return, electronic receipts will be sent to customers - conveniently and securely.

What are fiscal document formats?

There are quite a lot of participants in the e-commerce market. This is not only the seller and the buyer, but also the fiscal data operator (FDO), as well as the tax office. So that they could all understand each other, it was necessary to clearly structure information about trading operations, that is, create certain templates for the exchange of information.

This is how the formats of fiscal documents (hereinafter referred to as FDF) appeared. They were finally consolidated by the order of the Federal Tax Service of Russia No. ММВ-7-20 / [email protected] with a complex title: “On approval of additional details of fiscal documents and formats of fiscal documents that are mandatory for use.”

According to this document, the FFD determines the composition, format and mandatory indication of details in a cash receipt (strict reporting form), as well as in reports on the opening/closing of a shift, registration and other fiscal documents. This is true for both a paper and electronic check that is sent to the fiscal data processor and the buyer.