There are quite a lot of situations in which there is a need to re-register a cash register. Moreover, in one case the fiscal drive will also need to be replaced, but in the other it will not. In this article we will look at when and how a cash register is re-registered with the tax office.

If certain events occur, the entrepreneur will have to re-register his cash register by submitting a corresponding application to the tax office. This need arises in the following cases:

- when changing address;

- in case of change of the owner of the cash register;

- if the owner of the cash register moves to another OFD;

- when changing the name or TIN of the owner of the cash register (full name of the entrepreneur);

- if the operating mode of the cash register changes;

- when the expiration date of the fiscal storage device expires;

- if the serial number of the cash register or fiscal drive changes.

In all of the above cases, the cash register is subject to re-registration with the tax office. Let's look at each of them in more detail.

Re-registration of cash registers upon change of address

Re-registration of a cash register will be required when changing the address if the address of the retail outlet changes, or if the cash register is transferred for use to another retail outlet. That is, re-registration is required when the actual location of the cash register changes. But sometimes stores use a mobile cash register that moves between retail locations.

Important! If an entrepreneur plans to use the same cash register, but in different retail outlets, then re-registration of the cash register will be required constantly.

This is due to the fact that, in accordance with legal requirements, the receipt must indicate the address of the retail outlet where the transaction was made.

But, if the cash register is used in distribution trade, then information about this will be indicated at the stage of registering the device. In this case, the main address is indicated at the point where the CPP will be located for the longest time (not during delivery). The place of payment is indicated by the number of the vehicle where the cash register is directly used (

Re-staging of a cash register and features of its re-registration

https://youtu.be/cBw7yh6gTdI

You can deregister a device for one of the following reasons:

- At the initiative of the user in the event that there was a loss or the device was stolen, as well as its transfer to another entity for use.

- By decision of the Tax Service, if any flaws were discovered in the use of cash register equipment or if the fiscal key has expired.

The user should know that in order to re-register, it is necessary to send an application to the Tax Service to deregister the equipment (but no later than one business day after its decommissioning). Then you need to wait for the decision to re-register the device.

If there is a need to reinstall the online cash register, this can only be done if all the problems that served as the basis for its removal have been eliminated. This can also be done by a new user or after the device has been repaired.

To register the cash register, you need to fill out the appropriate application in paper form or through the user’s Personal Account on the Tax Service website. The Federal Tax Service can also consider this application up to 5 working days.

There are situations when all data from the fiscal apparatus is transferred to the Tax Service in writing. To a greater extent, this applies to situations where equipment is installed in places where there is no uninterrupted access to the Internet. In such a situation, along with the application, you will also need to transfer to the service all the fiscal data of the cash register.

Re-registration of cash registers upon change of owner

Important! Situations when one entrepreneur transfers the right to use the cash register to another entrepreneur, or renting it out, are accompanied by re-registration of the cash register.

For example, if a cash register is sold by a friend to a legal entity, then the new owner will have to replace the old fiscal drive with a new one and return all cash register settings to the original ones. In other words, all data should be returned to the state in which the cash register was when it left the factory.

In order for all data to be reset, the cash register will need to be disassembled. You can do this yourself, but you will need to take into account that the warranty on the cash register will expire, since the integrity of the seals installed by the manufacturer will be broken.

If the entrepreneur is not interested in the warranty period, then you can contact a special service center. Before the fiscal drive is replaced and the cash register settings are reset, it will need to be deregistered with the Federal Tax Service.

Important! You should pay attention to errors in the data of the owner of the cash register (for example, TIN or its name). If such a mistake is made during the initial registration of the cash register, this may entail a mandatory change of the fiscal drive and re-registration of the cash register. Since, despite the fact that the owner remains the same, this fact will be equated to a change in the owner of the cash register. Therefore, when entering information, it must be carefully checked.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Replacement of CCP

Since new, more advanced models of cash register equipment are constantly being developed, the state register is systematically updated, containing a list of cash register models approved for use. The procedure for replacing a cash register cannot be called simple. In addition to the fact that purchasing a device requires considerable financial expenses, all the necessary actions that a pharmacy must carry out before using a cash register also entail both financial and time costs.

At the same time, it is obvious that when it comes to replacing the cash register of an existing pharmacy for the period “from purchase to registration” of the cash register, the normal conduct of business becomes problematic, since the temporary use of someone else’s cash register is essentially prohibited by law, and the luxury of having a spare cash register not every company can afford it.

Therefore, information about the exclusion of the cash register being used from the state register becomes quite unpleasant news for a pharmacy organization.

However, such a decision of the State Interdepartmental Expert Commission on Cash Registers does not mean that the organization loses the right to use cash registers immediately. According to paragraph 5 of Art. 3 of Federal Law N 54-FZ, further operation of previously used cash register models is permitted until the expiration of their standard depreciation period. True, from this formulation it is not entirely clear what exactly should be understood by the “standard depreciation period” of cash register equipment. As follows from arbitration practice, the tax authorities interpret this provision this way: an organization loses the right to use an obsolete device after its residual value becomes zero. After this, the pharmacy organization may be subject to sanctions for operating without the use of CCP.

However, the Federal Antimonopoly Service of the North-Western District, in Resolution No. A42-3084/2005-3 dated November 14, 2005, did not support the claims of the tax authorities, recalling that they are obliged to send the owner of a cash register excluded from the state register a notice of the expiration of its possible use. In this case, this notification must be sent in advance (no later than 30 days before the expiration of this period) and it must contain a reminder of the need to deregister the cash register with the tax authority.

Note. This procedure is established by Order of the State Tax Service of Russia dated June 22, 1995 N VG-3-14/36.

By the way, the tax service itself is well aware of the need to apply this notification, as follows from Letter of the Federal Tax Service of Russia dated October 24, 2005 N 06-9-09/ [email protected]

In this document, the tax authorities explained that if the owner of an outdated cash register does not deregister it, then after the notification period has expired, the tax authority has the right to do this independently (unilaterally). Therefore, if the pharmacy did not receive any notifications, but became a “victim” of fines for using cash registers and was excluded from the register, it can safely go to court to challenge the administrative fine. Moreover, this point of view is shared by other arbitration courts (for example, similar Resolutions were adopted by the FAS of the Ural District on June 21, 2005.

N Ф09-2614/05-С7 and dated October 20, 2005 N Ф09-4709/05-С7).

True, if the tax authority can prove that the notification was sent, but for some reason did not reach the pharmacy organization, the process may not end as well for the owner of the outdated cash register as in the situation considered. Therefore, it is better for the pharmacy to find out in advance whether it can use cash registers by referring to the Letters of the Federal Agency for Industry, which is currently entrusted with maintaining the State Register of cash register equipment. For example , the latest information on the List of models approved for use is dated November 28, 2005.

Note. The list is given in the Appendix to Rosprom Letter N BA-857/16.

Re-registration of a cash register when changing the name or TIN of the cash register owner

When an organization decides to change its name, the CCP will require re-registration. The same will apply to entrepreneurs who change their full name.

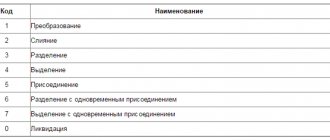

Changing the TIN is possible in one of the cases:

- when changing the company name;

- in case of change of organizational and legal form (CJSC to LLC);

- when carrying out a reorganization in a company (for example, a merger of several companies).

In each of these cases, the cash register will need to be re-registered.

Re-registration of cash registers upon expiration of the fiscal accumulator

The fiscal drive has its own service life. Under the general taxation system, this period is 15 months. If the entrepreneur is on a special regime (USN, UTII), then the service life of the drive will be 36 months. Entrepreneurs and companies on the simplified tax system engaged in the sale of excisable goods must use drives with a service life of 13 months. Upon expiration of the above deadlines, the fiscal drive must be replaced with a new one, and the cash register must be re-registered.

Important! If the fiscal drive fails (for example, if it breaks), it must be replaced with a new one. In this case, re-registration of the cash register will also be required.

Reasons for re-registration of an online cash register

CCP is subject to mandatory registration with the Federal Tax Service.

The law does not contain specific deadlines for this procedure - you just need to know that you cannot use the cash register without registration. Therefore, the actual registration completion deadline is the day before the first sale is made at the checkout. With this in mind, you need to register the cash register with the tax office. The methodology for registering a cash register with the Federal Tax Service involves the following main stages:

- Preparatory.

- The stage of sending an application for registering a cash register to the Federal Tax Service.

- Stage of fiscalization (activation of the fiscal drive).

- Registration completion stage.

Let's take a closer look at them.

^Back to top of page

The main provisions of the proposed system are:

- Transfer of information on settlements in electronic form to the tax authorities through a fiscal data operator.

- Electronic registration of cash registers without visiting the tax authority and without physically presenting the cash register.

- Construction of a system for guaranteed detection of violations based on automated analysis of information on calculations, identification of risk areas for committing offenses and conducting targeted effective checks.

- Involving buyers in civil control.

To test the proposed technology, an experiment was conducted in accordance with the Decree of the Government of the Russian Federation dated July 14, 2014 No. 657 “On conducting an experiment in 2014 - 2020...” using the technology of transmitting information about settlements to the tax authorities.

The objectives of the experiment are to determine for organizations and individual entrepreneurs the financial efficiency and ease of use of information transmission technology, as well as the technical capabilities of operating cash register systems and information transmission technology.

The experiment was carried out over six months from August 1, 2014 in four constituent entities of the Russian Federation: Moscow, Moscow region, Republic of Tatarstan and Kaluga region.

The experiment showed both the financial efficiency of the technology for transmitting information on settlements for organizations and individual entrepreneurs when switching to the proposed procedure for using cash register systems, and the ease of use of such technology. At the same time, the technical capabilities of operating the technology for transmitting information about calculations have been proven.

Taxpayers of various types and scales of activity took part in the experiment: both large retail chains and individual entrepreneurs. At the same time, along with taxpayers required to use cash registers, taxpayers who are not required to use cash registers, for example those working in the service sector, took part in the experiment.

The experiment was completed on February 1, 2020, however, at the request of taxpayers who participated in the experiment, by Decree of the Government of the Russian Federation dated June 3, 2015 No. 543, they were given the right to register cash registers and work using new technology until the end of 2015. By Decree of the Government of the Russian Federation dated December 22, 2015 No. 1402, experiment participants were given the right to use CCP using new technology until the end of 2020.

To date, 3.5 thousand units of cash register equipment have been connected to the tested technology, 50 million checks worth 40 billion rubles have been punched.

What advantages does the new technology provide? First of all, it allows a bona fide cash register owner to:

- reduce annual costs for CCP;

- get a tool with which he can monitor his turnover, indicators, and better control his business in real time;

- be able to register a cash register through the website of the Federal Tax Service of Russia without physically submitting it to the tax authority;

- use modern electronic devices – mobile phones and tablets – as part of the cash register;

- get rid of checks, since prompt receipt of information about settlements provides an appropriate environment of trust;

- work in a fair, competitive business environment by preventing unscrupulous taxpayers from illegally minimizing their tax obligations and unfairly gaining a competitive advantage.

The new technology provides citizens with additional protection of their rights as a consumer due to the ability to:

- receive an electronic receipt from the fiscal data operator and (or) in your email;

- You can quickly and conveniently check the legality of a cash receipt yourself using a free mobile application and, if any questions arise, immediately send a complaint to the Federal Tax Service of Russia.

From the point of view of the state, the legalization of retail trade and the service sector is expected and, accordingly, an increase in tax revenues, as well as optimization of labor costs through the transition to electronic registration and focusing the attention of tax authorities on risk areas.

Changing the CCP registration parameters is necessary in the following cases:

- Change of address and location of the cash desk.

This situation is possible when the location of the store changes due to a change of landlord, the cash register is transferred to another branch, etc.

- Change of owner of cash register equipment.

The reason may be selling the cash register to another person or renting it out.

- Transition to another fiscal data operator.

Changing the fiscal data operator, as well as the details of the current operator, also require re-registration.

- Changing the name of an organization or individual entrepreneur.

If the organization has changed its name or the individual entrepreneur has changed his full name, you need to make changes to the CCP registration data.

- Changing the operating mode of the cash register.

The online cash register provides several modes of operation: encryption, normal, autonomous, automatic, for the service sector, BSO printing, use by payment or banking agents (subagents).

If the user decides to change the mode in which the cash register operates, for example, switch from offline mode to regular mode or cancel encryption, you must go through the re-registration procedure.

We invite you to familiarize yourself with: Deadline for conducting an on-site tax audit

The features of this procedure depend on which mode is changed on the CCT.

- Expiration of the FN.

The fiscal drive has a limited validity period. The accumulator for the general taxation system has a validity period of 13 months, the Federal Tax Service for special regimes (STS, PSN, Unified Agricultural Tax, UTII) - 36 months. After the specified period, the fiscal drive must be replaced and the cash register must be re-registered.

- Changing the serial number of the cash register.

Changing the registration data may be necessary, for example, if you incorrectly entered the serial number of the cash register during initial registration. This may also be necessary when the specified number is changed by a service center specialist.

If the cash register fails due to malfunctions or breakdown of the fiscal drive, it is also necessary to re-register the cash register.

- Changing the number of the fiscal drive.

Entering the fiscal drive number by mistake will also require changes to the registration parameters.

If the organization's TIN was changed during the reorganization process, this also requires re-registration.

https://youtu.be/pSJPpuIE5NI

The process of making changes to the accounting journal and cash register registration card occurs in two stages:

- Drawing up and submitting an application to the tax authority.

The application must be completed no later than 1 day following the day on which these changes were made.

You can obtain an application for registration (re-registration) of an online cash register at any tax authority, or by downloading it from the Federal Tax Service website.

- Through your Personal Account on the Federal Tax Service website.

The fastest and easiest way to draw up and send an application without a personal visit to the tax office is to create it in your personal account.

Note: the process of re-registration through LKN will be discussed below.

Re-registration of cash registers with the tax office with replacement of the fiscal drive

Re-registration will be quite simple if the fiscal drive cannot be replaced. However, in certain cases, replacing a drive is necessary, for example: breakdown, change of TIN or name, correction of the drive or cash register number, expiration of the drive, overload of the drive’s memory, change in operating mode, etc. reasons.

Drive replacement is carried out both for a fee and free of charge. If the replacement is carried out on a paid basis, then this occurs on the initiative of the owner of the cash register in which the drive was built. Free replacement takes place at the service center under warranty.

A fiscal drive costs from 4,000 to 6,000 rubles. It is worth considering that once the storage device expires, you cannot work with the cash register. Therefore, an entrepreneur should make sure that he has additional storage in stock.

Important! The fiscal drive does not suddenly fail; warnings about this begin 1-2 months in advance.

Reasons for replacing FN

In addition to expiration, the fiscal drive may require replacement in a number of other cases:

- Memory full. Regardless of the specified service time, the chip is designed for a certain amount of information, the so-called capacity. It amounts to up to 250,000 documents. Therefore, a trading enterprise with a high turnover or customer flow will change its fiscal device more often. The online cash register itself notifies about this directly, displaying a message to the user. To continue operations, it is necessary to immediately replace the FN with a new one and re-register the equipment.

- Breakage or defect. As with any equipment, breakdowns or manufacturing defects occur here, which can result in a refusal to transfer data to the operator. In this case, you need to contact the manufacturer, who will conduct an examination, preserving the existing information for the tax authorities.

- Cash register registration errors.

FN is tied to a specific cash register model. If it was registered incorrectly and errors were made, but the drive was still included in the registry, after correcting all registration data, a new one will be needed. Therefore, you should carefully and responsibly approach the issue of re-registration of the cash register itself. Inaccuracies and errors will result in financial costs and loss of time.

Most models of online cash registers notify you that the drive is not working by displaying a message on the screen. If this is due to the expiration of the validity period, it is better to start re-registration at the very beginning of the last month so as not to interrupt the operation of the outlet.

We remind you that after replacing with a new device, a used copy must be stored for five years after the archive is closed.

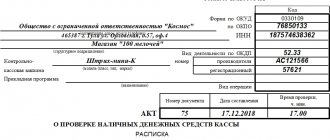

Application for re-registration of cash register

You can submit an application for re-registration of the cash register with the tax office via the Internet by going to the tax office website in the taxpayer’s personal account. The sequence of actions will be as follows:

- Fill out an application for re-registration and log into your personal account on the tax authority’s website.

- Go to the “Accounting for cash register equipment” tab.

- Click on “RN KKT”, then select the serial number of the cash register that requires re-registration.

- Click “Re-register” and indicate the reason for submitting the application.

- Sign the application for re-registration using an electronic signature and send it for verification. Additionally, you can check all the information specified in the application.

- After signing the application and sending it, the notification “Request added” will be displayed in the taxpayer’s personal account.

An entrepreneur can check the status of his application at any time in his personal account.

Next, the data will need to be entered into the CCP and also transferred to the OFD. If the re-registration of the cash register is carried out with the replacement of the storage device, then the following two reports should be attached to the application:

- with changed registration data parameters;

- confirming the closure of the drive.

As with the initial registration of a cash register with the tax office, a new registration card will be ready within 5 days from the date of contacting the tax office. The date the card is generated will be the date of re-registration of the cash register.

Re-registration without replacing the FN

In some cases, the cash register may require re-registration without installing a new fiscal drive. The reason may be:

- change of the company's legal address. For example, if the owner moved the store and all the products to a new premises and the cash register will work in a different place;

- re-conclusion of the contract with OFD. Many reasons can influence the change of operator - you are not satisfied with the service, the cost, and so on;

- change in VAT rate. After the VAT increase to 20%, all entrepreneurs had to re-register all working cash desks;

- transition to another format of fiscal data. Thus, in 2020, new requirements for the use of FFD were issued, obliging cash register owners to use the new version 1.05, abandoning the previous modification.

The registration procedure is similar to that carried out when replacing a personal name, with the possibility of personal and remote submission of an application. For online actions you will need UKEP, but for the paper version the sequence of actions is as follows:

- 1. Prepare an application approved by the order of the Federal Tax Service dated May 29, 2017, a passport and a copy of the technical documentation.

- 2. Update the form and cards for registration and deregistration.

- 3. The rules for filing an application are established by order; the tax inspector will notify you of the decision within 10 days. If all the information provided is confirmed, the owner will be issued a paper or electronic document, depending on the chosen method.

Refusal to re-register may be due to lack of information about the equipment used or mistakes made when filling out documents. Therefore, you should carefully choose a cash register, checking the register of approved equipment.

Keep in mind that cash register equipment resets all settings after re-registration. The procedure for entering new parameters depends on the specifics of the equipment itself. If you are not sure about the correct reconfiguration, it is better to contact the manufacturer’s technical support.

Is it possible to use a cash register with an expired FN or work without it?

Federal Law-54 clearly answers this question - after replacing the Federal Tax Code, mandatory re-registration of cash register equipment is required. The application must be submitted no later than 24 hours after the details of the entrepreneur or company have changed. If temporary norms are violated, the owner will face penalties in the amount of 1,500 to 3,000 rubles for an official, and 5-10 thousand for an enterprise. By complying with all requirements and standards, the business will remain within the legal framework and will not suffer losses due to fines and suspension of work.

Need help re-registering your cash register?

Don’t waste time, we will provide a free consultation and re-register the cash register when replacing the FN.