General provisions

The benefit is paid by the employer in cases where the employee is unable to start work due to injuries, illnesses or other cases eligible for insurance.

Funds are not always transferred from the employer. The legislation establishes a number of cases when accruals are the responsibility of the Social Insurance Fund.

For the entire period while the employee was unable to perform work duties, compensation will be determined. To receive funds, you will need proof of disability from a doctor. An employee of an enterprise can submit an application to a private or public medical institution.

What it is

The assignment of payment is allowed only if an employee of the enterprise can provide evidence of the citizen’s incapacity for work. This paper can be a certificate of incapacity for work or a sick leave certificate.

You can obtain documentary evidence in the following cases:

- disease;

- domestic trauma;

- ECO;

- prosthetics;

- caring for a relative;

- accompanying a disabled child to visit a sanatorium or resort;

- quarantine in effect in a child care facility.

The confirmation of incapacity is valid for the full period of rehabilitation, illness or accompaniment of the patient. You must pay for the entire period for which the certificate is valid.

The sick leave must be in an approved form established by the state or institution. If a document is created in free form, the fund will not accept such paper.

The employer pays only the first two days of disability. Funds for the subsequent period of sick leave are allocated from the Social Insurance Fund budget.

Compiled by

Drawing up an application is available to any employed person, individual entrepreneur, lawyer and notary. The main condition is the availability of insurance from the Social Insurance Fund. An application is submitted to the FSS in the following cases:

- the insured event occurred within a month after the termination of the contract with the employer;

- the citizen directly entered into a compulsory insurance agreement with the fund in the event of loss of ability to work for a certain period;

- the employer has insufficient funds to pay sick leave;

- the employer is declared bankrupt;

- it is impossible to determine the exact location of the employer-insured.

Appealing to the fund to pay for sick leave in the absence of funds in the employer’s account is allowed if a bank card file is created. The FSS issues a refusal to pay when a legal entity has no encumbrances, even if there are insufficient funds to pay off the debt on the certificate of incapacity.

Where is it served?

The completed application is submitted to the local FSS office. Such a branch is the place where the insurance contract is concluded or the employer is registered. When the papers are transferred to the Social Insurance Fund, employees check the information received to determine the existence of grounds for payment and its size. Funds will be transferred to the applicant’s account within the period established by law. Money can be received by postal order. The method of receiving funds is indicated when drawing up the application.

What are the deadlines?

The fund has 10 days from the date of registration of the application to make a decision based on the documents and application received. Money for social assistance is sent to a person in accordance with the standard payment terms for the corresponding type of benefits in force in the territorial authority. You can receive funds by mail or through a bank.

The law allows you to receive payment within six months after sick leave. After this period, the Social Insurance Fund does not pay benefits. The exception is situations when the culprit of the delay is the employer or the Social Insurance Fund branch, then the period for filing the application is not taken into account.

Types of statements

The application form will differ depending on the type of paper. The appeal may be aimed at reimbursement of expenses for payment of benefits, reimbursement of sick leave or issuance of sick leave.

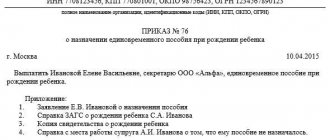

Application for reimbursement of expenses for payment of benefits for VN

Application for sick leave FFS (form and sample)

Form:

Sample:

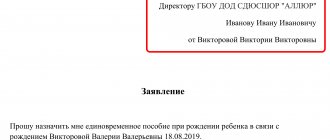

Application for compensation for sick leave to the Social Insurance Fund + sample filling

Application form for a certificate of incapacity for work:

Sample:

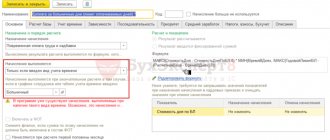

Application for payment (recalculation) of benefits (vacation pay)

Form:

An application for payment of temporary disability benefits is filled out according to the following sample:

Application for reimbursement of expenses for sick leave

In accordance with the order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951n “On approval of the list of documents that must be submitted by the insurer for the territorial body of the Social Insurance Fund of the Russian Federation to make a decision on the allocation of the necessary funds for the payment of insurance coverage” for adoption of the decision by the territorial body of the Social Insurance Fund of the Russian Federation on the allocation of the necessary funds for the payment of insurance coverage, the policyholder must submit the following documents:

| Document | A comment |

| Written statement from the policyholder | · name and address of the insured - a legal entity or surname, first name, patronymic, passport details, address of permanent residence of the insured - an individual; · registration number of the policyholder; · indication of the amount of funds required to pay insurance coverage |

| Calculation of accrued and paid insurance premiums | · for compulsory social insurance in case of temporary disability and in connection with maternity; · on compulsory social insurance against accidents at work and occupational diseases; · on expenses for payment of insurance coverage |

| Help - calculation | · the amount of debt of the policyholder (the Social Insurance Fund of the Russian Federation) for insurance premiums at the beginning and end of the reporting (calculation) period; · the amount of insurance premiums accrued for payment, including for the last three months; · the amount of additional accrued insurance premiums; · the amount of expenses not accepted for offset; · the amount of funds received from the territorial bodies of the Social Insurance Fund of the Russian Federation to reimburse expenses incurred; · the amount of returned (credited) overpaid (collected) insurance premiums; · the amount of funds spent for the purposes of compulsory social insurance, including for the last three months; · the amount of insurance premiums paid, including for the last three months; · the amount of the insured's debt written off. |

| Copies of documents confirming the validity and correctness of compulsory social insurance expenses | · a certificate of incapacity for work, filled out in the prescribed manner, with the benefit calculated; · a certificate from the antenatal clinic or other medical institution that registered the woman in the early stages of pregnancy (up to 12 weeks); · child's birth certificate; · certificate from the other parent’s place of work confirming non-receipt of benefits; · death certificate. |

The application form for reimbursement of expenses for sick leave is recommended by the letter of the Social Insurance Fund of the Russian Federation dated December 7, 2020 No. 02-09-11/04-03-27029 On the submission of documents to the Social Insurance Fund of the Russian Federation for the allocation of the necessary funds for the payment of insurance coverage

Sample:

To the head of Branch No. 1 of the State Institution - regional branch of the FSS, Moscow

Sergeev S.S.

(position of the head (deputy head) of the body monitoring the payment of insurance premiums, full name)

Application for the allocation of necessary funds to pay insurance coverage

Insured __Limited Liability Company "ABV"________________

(full name of the organization (separate division), last name, first name, patronymic (if any) of an individual entrepreneur, individual)

registration number

in the authority for control over the payment of insurance premiums _123456789________________________,

subordination code ___1234______________________,

INN _123456789987________________________,

Checkpoint 0987654321____________________,

address of the location of the organization: 123456 Moscow, st. Moskovskaya, 987,

(separate subdivision)/address of permanent residence of an individual

entrepreneur, individual

in accordance with Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” requests the allocation of funds to pay insurance coverage in the amount of __1,000,000 (one million)_ rubles.

by transferring funds to the policyholder's account

No. _9876543211234567__ in the bank _PJSC “My Gold”______________________________

(full name of the bank)

INN 741258963 KPP 369852147 correspondent/account 9514789368521478963________________

BIC _0123654_OKTMO 987520 Personal account number _741025896301478520369_____________

________________________________________________________________________

(name of financial authority)

| (position of the head of the organization (separate division) | (signature) | (FULL NAME.) | (contact number) | ||

| Chief Accountant | (signature) | (FULL NAME.) | (contact number) | ||

| Place of the policyholder's seal (if any) |

https://youtu.be/-hw7nfQGeeE

How can an employee fill out and submit a form for payment to the Social Insurance Fund?

To directly apply for temporary disability benefits, you must draw up an application in the approved form and attach to it documentary evidence of the existence of grounds for claiming compensation.

To receive funds you need to act in accordance with the algorithm:

- Collect papers.

- Make an appeal.

- Go to the FSS to transfer documents and applications.

- Receive confirmation of registration of the application.

- Choose a method to receive funds.

- Receive money using the chosen method.

Submission of documentation can be carried out without visiting the branch. To do this, you need to go to the State Services portal and select the appropriate service from the proposed list.

Document structure

The current structure of the document was adopted in 2012. Since then, the application forms for the employee and the employer have been separated. The employer must complete the application, including the following sections:

- To whom is it addressed? Information about the territorial body of the FSS is indicated.

- Who is the sender? Provide information about the employer.

- Main text block. The request for payment of funds is indicated here.

- Recipient details. Information about the period of incapacity for work and the amount required to be paid.

- Information from documents confirming the status of a legal entity.

- Method of transferring funds. Indicate post office or bank details.

- Contact information about the applicant. Phone number and signature verifying the document.

The application from the employee includes the following sections:

- To whom is it addressed? Provide information about the local FSS branch.

- Who is the compiler?

- Main part. The need for payment due to the occurrence of an insured event is indicated.

- The method of receiving funds is indicated.

- Transfer details.

- Details of the documents that were attached to the application to prove the existence of grounds for issuing a temporary residence permit.

- Is it the main job or is the work carried out part-time?

- Confirmation of registration of the application with the Social Insurance Fund.

- Signature and date of application.

The payment procedure does not depend on the person who submitted the application. It also does not affect the basis of the claim for costs.

Attached papers

In addition to the application, some additional documents must be attached:

- Certificate of invoice from the employer.

- Sick leave.

- Employment history.

- Help 2-NDFL.

- Employment contract.

- A copy of the payment order for payment (if the applicant is an individual entrepreneur, lawyer or notary).

- Payment order registration number (if the applicant is an individual entrepreneur, lawyer or notary).

The applicant does not have to provide all the papers on the list. To clarify the required package of documents, you must contact the FSS office.

Help for calculating temporary disability benefits

This document will be the most important when applying for payment. Only the last two years of employment with the employer are taken into account. There is an approved document form, deviation from which is grounds for refusal to accept the paper.

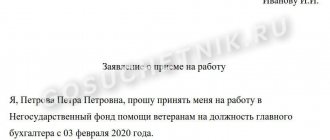

Application form for payment of temporary disability benefits

The form can be filled out manually or printed on a computer. You can download the application for the certificate of incapacity from work using the link:

Is it necessary to file after dismissal?

According to the legislation of the Russian Federation, a citizen can take out sick leave within one month from the date of dismissal. And sick leave can be provided within six months. The entire procedure will take place according to standard algorithms without changes to the package of documents or points of the application. The legal entity is obliged to pay the amount in full.

If the employer refuses to pay, the former employee can file a claim in court.

Where should women go to receive holiday pay under the BiR?

The girl’s status affects the period of sick leave due to pregnancy:

- in case of employment, leave is issued by management;

- in the case of full-time study, leave is issued directly at the educational institution;

- in the case of contract service, registration takes place at the place of duty;

- in case of dismissal, which is associated with the cessation of the organization’s activities or if a woman is officially considered unemployed, she should apply for payments to the social security authorities at her place of residence.

Important! If the methods discussed are not suitable, then the woman should directly contact the Social Insurance Fund.

A pregnant girl can submit a statement to her employer, the dean’s office of the university, her place of employment, or others.

In some cases, difficulties arise when processing payments at the workplace. Eg:

- the company does not have enough funds in its account;

- the company is on the verge of bankruptcy;

- the company's funds are seized;

- While applying for benefits, the organization ceased its activities.

Important! In such moments, it is worth contacting the judicial authorities and providing evidence of the impossibility of accruing payments by management. According to the law, this can be done after the end of the B&R leave - within six months.

Also, a girl in this position has the right to go to her last boss within 30 days after her dismissal to receive the required benefits. This rule also applies in other situations:

- moving to a spouse in another city;

- transfer of the spouse to another job;

- an illness due to which a woman cannot continue to work and live in a certain area;

- you need to care for a sick relative or an incapacitated citizen.

If a woman has already quit, she can still apply to her former employer to receive benefits for 30 days after that.

Design example

Download the application for payment of temporary disability benefits form:

A sick leave certificate is the main document through which an employee can prove the existence of grounds for receiving compensation. In all cases, the employer must prepare an application to the Social Insurance Fund, except in cases where an individual has directly entered into an insurance contract with the Social Insurance Fund and is an individual entrepreneur, lawyer or notary.

Previous

For patients Preliminary medical examination report form

Next

For patients Medical intervention in Russia: a list of certain types