What do you need to receive

A one-time benefit for the birth of a child is provided to one of the parents.

The payment can be provided to both the mother and the father. If the parents are officially employed, then the application can be written at the place of work of any of them, and you will need to provide a certificate from the work of the other that he did not receive the payment. If one of them does not work, then a lump sum benefit is paid at the place of employment of the working parent. If both father and mother are not officially employed, the payment is made through the Social Insurance Fund. To apply for assistance from the state, you will need to prepare an application for a lump sum payment at the birth of a child and you will need to provide additional documents with it:

- ID card of father and mother;

- child's birth certificate;

- a certificate of birth of a child from the registry office, which is issued at the time of registration;

- marriage certificate;

- divorce certificate if parents are divorced;

- certificate from the second parent’s place of work. If he is not officially employed, he needs to contact the social protection authorities and request such a certificate there.

Temporary disability certificate: what is it?

A sick leave certificate or bulletin is a special type of certificate that confirms that a given employee is temporarily unable to perform his job duties. It is issued by an institution licensed to carry out medical activities and is issued on the day of completion of treatment or when going on maternity leave under the BiR.

Attention! The procedure for registration and issuance is regulated by the Order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011. According to the general provisions, the bulletin is intended for insured persons who are or are not residents of the Russian Federation, reside temporarily or permanently on its territory, as well as people with or without foreign citizenship.

A sick leave certificate is an official document, without which it is impossible to issue insurance benefits to a worker. The data on the front side is entered by the attending physician, the back part is filled out by a representative of the administration of the institution or enterprise. The current form is approved in 2011, which can be issued in paper format, and from 2020 in electronic form. In order to make payments on time, the form must be filled out correctly.

How to fill

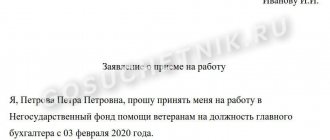

The paper is drawn up in writing, or in any form. A sample application for a lump sum benefit for the birth of a child can be downloaded below.

Step 1. In the “header” you must indicate the name of the organization if applying from an employer. If in the FSS, then the territorial office to which you are applying.

Step 2. Enter the full name of the manager in the genitive case and your details.

Step 3. State your request for one-time cash assistance. In this case, it is necessary to indicate the full name and date when the baby was born.

Step 4. Be sure to include in the sample application for payment of a lump sum birth benefit a list of all attached documents.

Step 5. Be sure to date and sign the lump sum payment application.

How can an employee fill out and submit a form for payment to the Social Insurance Fund?

The application for direct payment to the Social Insurance Fund is filled out by the employee independently and submitted along with the sick leave to the employer. The employer is obliged to submit it to the Social Insurance Fund authorities within five days of receiving such a form.

The form is approved by Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 N 578. It can be downloaded from the official website of the Social Insurance Fund.

There are certain rules for filling out an application for sick leave payment through the Social Insurance Fund:

- All entries must be black and written using a gel or capillary pen, or typewritten.

- Blots, corrections, crossing out, covering up, etching are not allowed.

- Only those sections for which the applicant has information should be completed.

The procedure for filling out the form to receive direct payment of sick leave benefits for temporary disability:

- In the header, in the appropriate columns, the full name of the territorial body of the Social Insurance Fund is written.

- The header indicates who the application is coming from.

- After the words “In connection with the occurrence of an insured event, I request you to assign and pay (pay)” the type of insured event is indicated with a tick. If the applicant is in doubt as to what type of insured event he is in, this can be clarified on the certificate of temporary incapacity for work.

- In the “payment method” column, put a tick next to either “by postal transfer” or “by transfer to a credit institution.

- If the method of receiving the amount of sick leave benefits “through a credit institution” is selected, then the bank details and passport details field is filled in.

- If the applicant wishes to receive disability benefits by postal order, only personal information and address should be filled out in the application. The transfer will be sent to the post office to which this address belongs. You will need to appear in person to receive the transfer after receiving the relevant notice.

After the form is filled out, it must be taken to the employer along with the original temporary disability certificate.

and sample 2019

Below you can download the current application form for submission to the Social Insurance Fund in order to receive insurance coverage for temporary disability directly through the fund.

A completed example of a document current for 2019 is also provided.

for sick leave payment – excel.

filling out an application for disability benefits - excel.

Is it necessary to file after dismissal?

There is an opinion that after dismissal the employer is not obliged to bear any social responsibility to the employee. This is wrong.

For example, an employee quits, he is not listed on the staff, the employee has a work book in his hands.

In this case, when opening sick leave within 30 days from the date of dismissal, the employee has the right to present a certificate of incapacity for payment.

The period within which sick leave can be filed is limited to 6 months from the date of termination of illness.

If the deadlines are not violated, the employer is obliged to pay temporary disability benefits.

There is no need to write any special statements. The basis for calculating benefits will be a certificate of incapacity for work.

If the policyholder refuses to accept the document for payment, it makes sense to write a statement in any form demanding payment of benefits. This must be done within the period established by law.

As a sample, you can take a form for direct payment to the Social Insurance Fund or use the example below. The last point is to indicate the requirement to issue a written reasoned refusal in case of an unsatisfactory decision.

In order to reduce waiting times, you can specify in the document that the employer issues a document related to the work process. For example, payslips for the last two years.

Such a statement in accordance with Art. 62 Labor Codes are reviewed within three working days.

If you receive a refusal or do not receive a response at all, there is the possibility of challenging it in court or appealing to other authorities.

Design example

applications for payment of benefits from a former employer after dismissal - word.

Who is entitled to payment

Almost all categories of citizens can count on financial assistance:

- officially employed persons subject to compulsory social insurance in case of temporary disability and in connection with maternity clause 27 Pr. Ministry of Health and Social Development No. 1012N;

- persons without a permanent place of work, or students, on the basis of clause 29 of Pr. Ministry of Health and Social Development No. 1012N;

- foreign citizens who live on the territory of the Russian Federation and are subject to compulsory social insurance on the basis of Article 2 of Federal Law No. 255;

- pizza, who adopted the baby in accordance with paragraph 25 of Pr. Ministry of Health and Social Development No. 1012N.

Application for recalculation and its sample

Recalculation of sick leave is a change by the employer in the amount of cash accruals that the employee received in connection with temporary disability. It can be initiated by both the employee and the employer. A statement is written when an employee needs recalculation. As a rule, this happens in cases where the amount of the benefit does not correspond to the length of service and the average salary.

This is important to know: Is it possible to take sick leave for 1 day?

The procedure for drawing up such an application remains unchanged, with the following exceptions:

- The body of the text indicates on what basis recalculation is required. For example, if the length of service is incorrectly calculated or the calculation period needs to be changed when calculating sick leave benefits.

- There is no need to indicate the method of receiving benefits and details, because the employer must initially agree on the recalculation.

- The applications must indicate the availability of a certificate and the amount of wages for a period of no more than 3 years. Without this certificate in the package of submitted documents, recalculation is impossible.

A sample application for recalculation of sick leave benefits can be viewed below:

Who does the law apply to?

Any woman, regardless of her status, can receive a lump sum payment after the birth of a child.

The law applies equally to students, working and unemployed women.

Also, by agreement between the parents, benefits can be paid to the spouse (father of the child) - but only to one of the parents. If a father who is a military man wants to receive funds, he must fill out a special application form indicating the place of service or military unit to which he belongs.

If the child is under guardianship, the guardian receives financial assistance (upon confirmation of the fact of cohabitation with the newborn).

When and where to apply?

The period for filing an application for any of the types of benefits prescribed under this Law is contained in Article 17.2. In particular, one-time assistance from the state at the birth of a child can be paid if the application is submitted no later than 6 months from the date of his birth.

The application is filled out by the parent or legal representative (guardian) of the child and submitted to:

- to the accounting department of the employing organization, if at least one of the parents (guardian) is officially employed;

- to the body authorized to assign and pay benefits at the place of residence of parents or guardians if they are unemployed.

How to supplement the form

The application must be accompanied by a number of additional documents:

- document certifying the birth of the child;

- a certificate from the spouse’s employer stating that he/she was not given benefits through the accounting department of his/her enterprise (if the mother is unmarried or the child does not have an officially identified father, such a certificate does not need to be brought);

- Divorced women must provide a copy of the divorce certificate;

- in the case when the application is submitted to government agencies, you may need a certificate from the labor exchange stating that the person is not officially listed as an employee anywhere, or an extract (copy) from the employment record certified by the last employer.

Contents of the document

The text of the document can be arbitrary.

In the header please indicate:

- addressee (i.e. the name of the organization - the employer, the territorial branch of the Social Insurance Fund or the social service - depending on where exactly you are sending the application);

- your last name, first name, patronymic (sometimes you need to include information from your passport on the form).

Next, in the middle of the line, write the word “application” and then express your actual request for payment of financial assistance. Here, in the main part, enter the following information:

- Full name of the newborn, date of birth;

- a document certifying the birth of the baby;

- a certificate from the employer of the second parent stating that he did not request and this benefit was not transferred to him (created according to the established rules);

- an extract from the work book about your last place of work (if the application is submitted to the social security service);

- if the application is accompanied by a copy of the certificate of separation of marital relations (it is needed if the baby’s parents are divorced) and some other documents (and it is better to check the full list where you plan to submit the application), all this must also be included in form.

Finally, sign the application and submit it to your destination.

Who applies and when

According to the mentioned article 11, receiving money is possible only if a living child is born. If the pregnancy was multiple, the family can apply for payment for each newborn.

Its size from 01.02.2018 is 16,759.09 rubles (in accordance with Decree of the Government of the Russian Federation No. 74 of 01.26.2018) and is indexed annually. That is, upon the birth of twins, parents will receive 33,518.18 rubles, triplets - 50,277.27 rubles, and so on.

As a rule, it is the mother or father who applies for payment. It does not matter what salary the parent received before adding to the family, or whether he worked at all. The only caveat: you will need to provide a certificate from your spouse’s (partner’s) employer (if you have one) stating that he did not apply for money.

What documents are needed

A sample application for a lump sum benefit for the birth of a child can be found on the official website of the Social Insurance Fund. It must be accompanied by a set of documents confirming the arisen right:

- Certificate in form No. 24. It is issued by the registry office in exchange for a certificate from the maternity hospital. For the first time, the baby’s personal data is recorded in it (full name, date and place of birth, full name of parents).

- Birth certificate. It is also issued at the registry office.

- Passport of the parent or other applicant.

- The mentioned certificate confirming that no one else applied for the money owed to this baby.

Keep in mind: Certificate No. 24 is valid for six months from the date of birth. As soon as it ceases to be valid, the right to payment is also canceled.

If the application is submitted, for example, by a grandmother, then she must provide either confirmation that the child does not have parents (death certificate, deprivation of parental rights), or a certificate that none of them have received money yet.

Application for replacing years when calculating sick leave

By law, all these benefits are calculated taking into account the employee’s average earnings for the two years (according to the calendar) preceding the year in which the event covered by insurance occurred. Thus, if a person did not work for the reasons stated above, his insurance payment is significantly reduced, and recalculation with the replacement of years leads to a reasonable increase in the amount of benefits.

Who is eligible for a replacement?

Russian legislation firmly guards the interests of employees. The transfer of years is one of the measures that follows this principle, since it is needed for the correct calculation of benefits for temporary disability, pregnancy and childbirth, and for caring for a child up to one and a half years of age.

A certificate of incapacity for work is a document issued by a medical institution, containing the necessary information and details and confirming that within the specified period the person could not perform labor duties due to objective reasons.

Since the deadlines for transfers from the Social Insurance Fund, and even more so the deadlines for filing applications, can be quite long, payments to employees must be made regardless of the transfer of compensation, otherwise labor laws will be violated.

Application form for sick leave 2020

There are situations when a special application for sick pay is sent directly to the Social Insurance Fund. Thus, employees of a liquidated enterprise, or independent workers (individual entrepreneurs, notaries) submit an application exclusively to the social insurance authority.

As for HR workers, they have only five days during which they send documents to the social security fund. In this case, the employee must bring a sheet and a completed application. If the application is not completed, you can fill it out using the sample in the HR department, or print it and then simply sign it.

Social Security Fund: Applying Directly

When getting a job, every employee thinks that there will be cases when he will not be able to go to work. At such moments, employees should ask questions to their superiors regarding sick leave. After all, every person gets sick, and no one is immune from this, so a sick leave certificate will be needed.

To receive such benefits, the employee must provide his employer with a sick leave certificate and an application. How is an application for benefits made? When should it be submitted to the employer, and when to the Social Insurance Fund? Where to submit? In the vast majority of cases, the application is submitted to your employer's HR department, accounting department, or manager.

How is sick leave paid in 2020?

Completed sample Download for free The pilot project is that the Fund directly, without the participation of employer companies, pays social benefits to insured persons. These are sick leave, maternity benefits, childbirth benefits, child care benefits up to 1.5 years old, etc. The Fund also pays for the costs of preventing injuries and occupational diseases. Currently, 39 regions are already involved in the FSS pilot project. Consider sick leave in the BukhSoft program. You can easily determine the employee’s insurance length, all the amounts included in the calculation, and find the amount of benefits online.

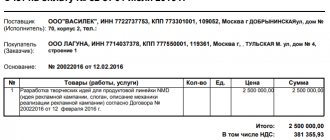

It is recommended to issue a statement of payment on the company’s letterhead, which already indicates its name, legal form, registration number in the Social Insurance Fund, and code of subordination. You should fill in the number and date of the calculation, as well as the details of the sick leave certificate to which this application is drawn up. Next, all the necessary information is indicated and the calculation of the amount of benefits during illness is carried out.

Where to submit documents

It depends on the status of the person asking for the benefit:

- The employee should write a statement to his organization.

- The student has the right to send a request to the university administration.

- An unemployed person or an individual entrepreneur interacts directly with the Social Insurance Fund.

In the first case, you can count on faster transfer of funds. Usually 10 days are allotted for this. If you submit an application directly to the Fund, the process will take 25 days due to the large number of applications being processed.

Application form for payment of sick leave sample 2020

Benefits, guarantees and compensation Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media. networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > May 06, 2020 Application for payment of sick leave - a sample is given in the article - can be addressed to both the employer and directly to social security. The statements will be different. You will find forms and samples of these applications in our article.

Providing sick leave to the employer in itself expresses the individual’s desire to receive payment of benefits. A separate application for payment of sick leave issued in connection with an illness is not provided for by law. But there are cases when it may be required.

How to write an application

A sample application for a one-time benefit for the birth of a child is contained in Appendix 1 to Order No. 578 of the Social Insurance Fund of the Russian Federation dated November 24, 2017.

This is what the title page looks like.

An application on seven pages is filled out:

- The first contains the name of the body that should assign the benefit and full name. applicant. You also need to note the action (pay or recalculate), the type of benefit and the method of payment.

- The second sheet is intended for payment details and personal data of the applicant (full name, date of birth, passport).

- The third should indicate the place of registration or temporary stay.

- The next sheet contains a contact phone number and the number of the document giving the right to funds. In our case, this is a certificate in form No. 2.

- On the fifth sheet it is necessary to record the number of the certificate from the other parent about non-receipt of payment and the name of the applicant’s employer.

- The sixth sheet contains information for assigning benefits. But in our case it does not depend on average earnings. Therefore, we enter only SNILS and INN.

The last sheet is filled out by the employer (signs and indicates a contact number), if there is one, or the rector of the university (if the applicant is a student). When submitting an application to the territorial body of the Social Insurance Fund, filling it out is not required.

Do I need to write?

Legislative acts at the federal level oblige workers to hand over certificates of temporary incapacity for work to the employer in order to pay for the days on which they were absent.

Based on the provided sick leave, the organization guarantees social insurance to the subordinate in the form of payment of benefits.

According to the law, the presence of a certificate of incapacity for work is sufficient for the employer to make the necessary calculations and assign the amount to be paid.

Also, in case of changing years for calculating sick leave benefits, an additional application of this type must be submitted.

However, many enterprises have established a procedure according to which the employee is also required to receive an application requesting payment for the attached sick leave. If such a rule is established in the company and enshrined in internal documents, then the employee should comply with it.

Thus, it is necessary to write an application for paid sick leave if such a procedure has been established in the organization. In this case, the form is submitted to the HR department within six months from the moment the sick leave is closed, along with the temporary disability certificate itself. If deadlines are ignored, the employee will have to prove the reason why time was missed. The employer has only 5 days to transfer the document to the Insurance Fund.

The law does not stipulate a template for filling out an application, so it can be drawn up in free form. Traditionally, HR specialists at each enterprise develop a unified form in which you only need to enter personal information. It doesn’t matter who fills out the form, the main thing is that it is signed personally by the employee.

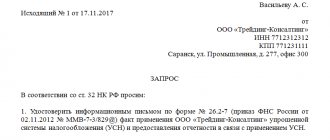

How can an employee register when receiving a payment on the sheet directly through the Social Insurance Fund?

In some cases, payment for sick leave benefits is made directly from the Social Insurance Fund.

The production process may be disrupted if the employer's company goes into liquidation.

In such situations, documents are submitted directly to the Social Insurance Fund to receive compensation for temporary disability.

The same method is used by self-employed citizens, for example, individual entrepreneurs, notaries, lawyers and other persons who regularly transfer insurance premiums.

Until a certain time, there was no unified application template. Since 2020, Order No. 585 of the Ministry of Labor and Social Policy has established a specific list of documents required to accompany the application, and by letter No. 02-09-11/04-03-27029, applications with forms have been developed and sent.

Pilot project

An employee can directly receive payment of benefits from the Social Insurance Fund if the region participates in a pilot project providing for direct payments. In this case, the fund pays its part of the benefit, and the employer gives money for the first 3 days of temporary disability.

To receive payment through the Social Insurance Fund, you need to fill out a standard application form and submit it to the employer along with a sick leave certificate. Next, the documents are sent to the fund - this function is assigned to the employer, who must transfer the documents to their destination within five days.

The application form that an employee must fill out to receive sick pay is approved by Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 N 578.

Government agencies also have requirements for filling out an application, which must be completed:

- block letters;

- black (helium/ballpoint) fountain pen;

- without making spelling errors, blots, or corrections;

- strictly within the established columns and fields.

You are allowed to fill out the form on a computer. This is usually done in enterprises. The structure of the form is similar to the one that the employee submits to the personnel department.

There are two options for receiving benefits:

- by transferring funds to a bank account;

- via postal transfer.

The contents of the document should indicate in detail the details for transferring payment, otherwise the money may not reach the addressee.

and sample filling

Download a standard application form for payment of temporary disability benefits through the Social Insurance Fund - excel.

filling out an application for sick leave payment directly to the Social Insurance Fund - excel.

If temporary disability occurs after dismissal

If an employee falls ill within 30 days after dismissal, he has the right to present the slip to the employer to receive payment for it.

The procedure for applying for sick leave after dismissal is no different from that provided if the employment contract remains in force. The certificate of incapacity for work should be handed over to the employer and accompanied by a statement.

The application is written to the head of the company and registered in the human resources department. It is possible to submit documents by registered mail.

To avoid troubles, it is better to personally bring the completed form in 2 copies and register it at the reception.

Keep one after indicating the incoming number and date of acceptance. Sometimes you have to defend your rights through court.

In this case, a second copy must be attached to the statement of claim.

Approximate structure of an application for sick leave payment:

- In the upper right corner the details of the organization to which the appeal is addressed are indicated: name, position and full name. responsible official. Next, it is written from whom the application for payment of benefits was received.

- In the central part, the main requirement is drawn up: “I ask you to assign and pay temporary disability benefits according to sheet No..... dated…..in accordance with paragraph 2 of Article 7 of Law No. 255 - Federal Law of December 29, 2006.” Here you should indicate the current account for transferring the cash payment and make an inventory of the documents provided.

- The application is endorsed with the signature of the employee and the date of application.

According to the standards, two copies are drawn up, one with the incoming number remains with the addressee.

Approximate form

applications from an employee for payment of disability benefits after dismissal - word.