One of the main tasks of every manufacturing enterprise is to increase labor productivity and optimize time spent on the work process. This is why every employee in the accounting department should know how to calculate man-hours. In order to obtain these economic indicators, special formulas are used, which will be discussed below.

Productive use of time intended for a specific production process allows you to optimize the work activity of each employee in the enterprise. Using special formulas, you can derive the time costs that an employee will need to cope with the task.

By making such calculations, you can not only identify the efficiency of your employees, but also significantly increase the efficiency of the labor process.

This means that such an approach will increase the productivity of the enterprise. It is for this purpose that the formulas “man-hours” and “man-days” were developed in economic science.

To optimize the production process and obtain greater benefits, it is necessary to calculate the number of man-hours spent on the production of one unit

How are calculations made?

Adding up man-hours makes it possible to assess the required financial investments to pay for the labor activities of company employees. Often, man-hours are used to set deadlines for completing obligations during the design of certain tasks that place management under strict time constraints.

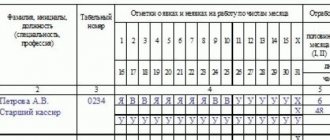

These figures are used in the preparation of reporting documentation for the tax inspectorate, the Pension Fund and institutions providing social and legal protection of the population. In addition, each enterprise provides detailed information about the man-hours spent to Rosstat. When compiling such documentation, the “P-4” form is used, which clearly displays the calculations being carried out.

Labor potential assessment

Possession of information about man-hours for working and non-working hours allows you to determine the labor potential of an individual employee or business entity in general, as well as assess the dynamics of the company’s work and the prospects for its further development.

Assessing the labor potential of employees is superficial, so it does not allow developing individual programs for each of them in order to ensure work efficiency. Behavioral factors cannot be unified, so drawing up an individual schedule is always more effective than a general plan.

Calculation of man-hour cost

For this reason, labor assessment is carried out from different angles. The price does not reflect all the capabilities of employees, so for objectivity it is better to use the integral evaluation method. To implement it, it is necessary to evaluate the characteristics of each subject using a five-point scale, and then make the actual determination of all indicators. Labor potential includes such elements of the importance of employees as personal level of development, qualification knowledge and skills, and also psychophysical abilities.

https://youtu.be/UqJ3u8nCIok

Share with friends on social networks

Telegram

Nuances of making calculations

Let's look at examples of calculating man-hours. In order to obtain the required indicator, you should add up the working time of a certain employee. It should be noted that not only the hours spent on the work process both on the territory of the organization and outside it are summed up. Thus, when compiling calculations of labor activity indicators, business trips, work in a combined position (in the same enterprise), as well as overtime are taken into account.

Such calculations should not include:

- Days missed by an employee due to illness.

- Production downtime (days or hours when an employee was not engaged in his direct job responsibilities due to circumstances that he had no control over).

- Time spent on vacation (vacation time initiated by the management of the enterprise is not taken into account).

- Time off provided to nursing mothers.

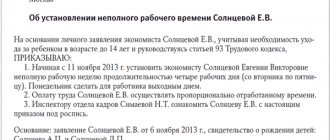

Also, those hours by which the working day of employees of certain organizations are reduced in accordance with the decrees prescribed in the legislation of the Russian Federation are not taken into account. The calculations do not take into account absenteeism and other various factors of staff absence from work.

This indicator is used by the accounting department and the statistics department of the enterprise and indicates the duration of one person’s stay at work.

Non-standard conditions

The calculation algorithm given above is not suitable for an enterprise in which employees work in shifts, provided that the duration of the shift is set individually. In this case, it is more convenient to use a different formula for calculating man-hours:

Chh = Ch1 + Ch2 + Ch3 ... + Chn,

Where:

- Chn is the actual hours worked per month, calculated for a specific employee individually.

In simple words, for the calculation, the number of hours that all workers worked, but separately, is calculated. And then the results obtained are summarized. Please note that all calculations must be made on the basis of data from time sheets.

Formulas used in calculations

When calculating the man-hours spent, special economic formulas are used. The simplest formula for calculating labor costs in man-hours: H = K * T. Let's look at what this formula means. The letter “H” denotes man-hours. Instead of the letter “K” the number of employees in the organization is substituted. "T" is the unit of time used in calculations. To simplify the calculation of labor costs, it is best to use hours as a unit of time.

Calculation example

Man-days are days worked by company personnel. A person-day is considered worked regardless of the actual length of the working day. That is, if the employee showed up on time and began performing his job duties on time, the man-day should be counted.

Let's look at an example of how to calculate man-hours for a month of work. An organization with thirty employees will be used as an illustrative example. The duration of one working day is eight hours. All necessary calculations will be made for September of this year. In order to get man-hours for a month, it is necessary to multiply the number of employees, the duration of one working day and the number of working days in a particular month: “30*8*21=5040”.

However, when filling out the documentation sent to Rosstat, the chief accountant of the enterprise carries out much more complex calculations. To obtain accurate data, it is necessary to take into account the time spent on business trips and extracurricular work activities. In addition, the time period that is not intended for accounting is subtracted.

Let's look at the same manufacturing example, but in this case, two out of thirty employees spend only four hours at their desk. Moreover, in the example under consideration, we will take into account that one of the employees went on vacation in the middle of the working month and worked only eighteen days:

First, you need to calculate man-hours, for workers who are at their workplace full time - 27*8*21=4536. After this, it is necessary to make separate calculations of the labor costs of employees who spend four hours at their workplace every day - 2 * 4 * 21 = 168. Then you should make a calculation for an employee who went on vacation in the middle of the working month - 144. The resulting products should be summed up to get the result - 4536 + 168 + 144 = 4848.

The result obtained is the sum of the labor costs of all employees of the organization for the above month.

Calculating man-hours can become more complicated if employees do not work full time.

Calculation of the cost of a standard hour

In order to determine the cost of a standard hour, it is necessary to calculate how much time the employee spent performing the work.

The actual number of working days in a year with a five-day week corresponds to 247 days. The days of vacation and the first days of sick leave are calculated from them. The total number can be reduced to 224 days.

To determine the number of hours paid by the client, data is taken from the timesheet. Usually, not 8 regulated hours are taken into account, but 6, assuming that the remaining time is spent on breaks, meetings, calls and solving internal problems of the company. Based on this, the number of paid hours per year is 224x6x70%=941. The 70 percent adjustment was taken into account because the customer most often pays only for this part of the work, not wanting to spend money on the customer solving organizational problems.

To calculate using the cost formula, data on the wage fund is required. When determining the value of the parameter, one should take into account mandatory contributions to authorized bodies, such as personal income tax, unified social tax, as well as fund contributions.

To determine the cost of a standard hour, the pre-calculated amount of the wage fund is divided by the number of paid days.

Man-day

This term is a designation of a similar value with man-hours. In a specific example, the unit of work time is one standard working day. When used in man-day calculations, the average length of a working day is not taken into account, even when the figures significantly exceed the eight hours established by law. It should be noted that in the economic sphere, man-hours are a more accurate unit compared to man-day.

How to make calculations

When calculating using the man-day formula, unexcused reasons for absence from work are not taken into account. This means that absenteeism, no-shows and absence from work for more than three hours are considered a full-fledged absence. Let's look at how man days are calculated. The formulas used in calculations that are used in accounting imply following a clear order of actions:

- In order to obtain the result of the reporting month, it is necessary to multiply the number of man-hours worked by each employee by the sum of working days in the month in question.

- The obtained figures are summed up in order to obtain the result of man-hours for the reporting month.

- After this, the amount received is divided by eight, since according to the Labor Code this time is a full-time working day.

- The resulting figure is the “man-day” indicator.

This unit is used when calculating the temporary funds indicator. This indicator is used to determine the number of days worked, attendance, absences and all-day downtime. Using such values, statistics are compiled, on the basis of which economic analysis is carried out. Not only certain enterprises, but also various industries are subject to such analysis.

Procedure for calculating labor intensity

During the calculations, the following formula is used: Tr = Kch / Sp.

Within the formula these values appear:

- Tr – labor intensity.

- Kch – total time fund in man-hours.

- Cn is the total cost of manufactured products.

https://youtu.be/cpNOquHkDMM

There is also the following formula: T = Pv / Kp.

The formula uses these values:

- T – labor intensity.

- Рв – working time.

- Кп – number of manufactured products.

Let's take a closer look at the calculation algorithm. First you need to determine the total amount of time worked by employees during the reporting period (usually a month). The calculations include the time actually worked. It can be determined based on the information contained in the primary documents. For example, this could be a time sheet for specific workshops.

Then the cost of the goods that were manufactured by the company is calculated. You also need to take into account the receipt of finished products. The calculations will include the planned accounting prices of the goods. They are determined based on the information contained in the accounting records. It is necessary to divide the real time fund in man-hours by the cost of the manufactured product. The value obtained from the calculations is considered the labor intensity coefficient.

The obtained values are analyzed. The procedure includes the following steps:

- The lower the labor intensity, the greater will be the productivity of employees.

- Checking the execution of the production plan.

- Establishment of deviations from planned values.

- Determine the impact of various factors on increasing or decreasing productivity.

- Summarizing.

Productivity can be affected by the quality of raw materials and employee training.

IMPORTANT! Reducing the labor intensity of work helps save resources. This reduces the cost of goods and has a beneficial effect on making a profit.

Calculation using the labor intensity formula is performed in a certain order:

- Determination of the actual costs (amount) of time worked by the workers of the enterprise for the corresponding period. The source of this information is primary accounting documents, including time sheets for each section (shop). Based on this information, the total amount of man-hours for a certain calendar period of all areas of the enterprise is calculated.

- Calculation of the value of goods produced in the reporting period using primary accounting documents, the type of which depends on the specifics of the company itself. Next, they calculate the ratio of the amount of time spent, which is expressed in man-hours, to the cost of goods produced by the enterprise. As a result, the labor intensity formula will give the desired result in the form of product labor intensity.

- After calculating the coefficient, it is necessary to analyze the data obtained by comparing the actual labor intensity with its planned value. Then the factors contributing to the occurrence of deviations are identified, analyzed and the required conclusions determined.

Among the factors that may cause deviations of actual indicators from planned indicators may be qualitative changes in semi-finished products or raw materials, employee qualifications, etc.

- Determination of the actual costs (amount) of time worked by the workers of the enterprise for the corresponding period. The source of this information is primary accounting documents, including time sheets for each section (shop). Based on this information, the total amount of man-hours for a certain calendar period of all areas of the enterprise is calculated.

- Calculation of the value of goods produced in the reporting period using primary accounting documents, the type of which depends on the specifics of the company itself. Next, they calculate the ratio of the amount of time spent, which is expressed in man-hours, to the cost of goods produced by the enterprise. As a result, the labor intensity formula will give the desired result in the form of product labor intensity.

- After calculating the coefficient, it is necessary to analyze the data obtained by comparing the actual labor intensity with its planned value. Then the factors contributing to the occurrence of deviations are identified, analyzed and the required conclusions determined.

Brief overview of basic terms

Below we suggest familiarizing yourself with the terms that were used in the calculations given above.

Days worked

A day worked is the time spent by each employee performing their job duties . Regardless of the actual length of the production day, the day is considered worked if the employee arrives at his workplace on time.

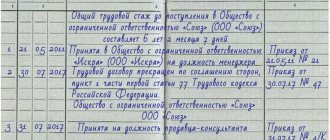

In addition to the above, the time that the employee spent on a business trip, was on duty, or combined several positions on the territory of the enterprise is added to this value.

To calculate man-hours accurately, it is necessary to maintain a time sheet.

Turnouts

The term “attendance” means the total result of adding up days worked and all-day downtime. The term is quite easy to understand.

No-shows

The term “absenteeism” should be understood as the period of time during which a certain employee was absent from his workplace . There are many different reasons for not showing up to your workplace, both respectful and disrespectful. The only exception to this rule is cases related to production downtime.

Valid reasons include vacation, maternity leave, educational leave, illness and other absences permitted by law. This includes performing military or civilian duties. In addition, some personal reasons are valid reasons for not showing up to your workplace. However, in this case, preliminary coordination with the administration of the enterprise is necessary.

Sometimes this list expands significantly. Often, valid reasons include labor strikes or mass absences from work.

Absence from the workplace without a valid reason includes absenteeism, failure to appear on the territory of the organization for more than three hours from the start of the work shift. In addition, unexcused reasons for absences include exclusion from the work process for existing objective reasons.

Production downtime

An all-day downtime is a working day during which the employee does not perform his direct job duties due to the influence of various factors that he cannot influence. Such downtime includes various malfunctions of production equipment or power outages on the territory of the enterprise. At the moment, the employee can either be at his workplace or absent, having notified the administration in advance.

Assessing the effectiveness of working time is a fundamentally important task

Labor hours

Labor hour is the time spent by an employee who does not have the necessary qualifications at a certain workplace. The number of labor hours in one week is at least forty hours (taking into account that the enterprise in question has a standard eight-hour working day). The calculation of payment for labor hours is carried out in accordance with the current law specified in the Labor Code. Using labor hours, wages are calculated for personnel who do not have the necessary qualifications.

https://youtu.be/RWKKDkodtS8

Calendar fund of time

All statistical analysis of working time is based on taking into account this indicator.

The calendar fund of time is divided into two large significant groups:

- time sheet (accounted for in the working time sheet);

- non-working days (weekends and holidays).

We are interested in the time fund, which consists of:

- the maximum possible working time fund;

- vacations.

In turn, the maximum possible time fund consists of the employee’s attendance and absence from work. The actual working time includes appearances, that is, man-days, from which only downtime lasting a whole day is excluded, both for valid reasons (sick leave, personal leave, etc.) and disrespectful reasons (absenteeism or those permitted by the administration). omissions).

We invite you to familiarize yourself with Filling out forms 3, 4 and 6 of the balance sheet

The following temporary funds are measured in man-days:

- days actually worked by the employee;

- turnout time;

- days when the employee did not show up for work;

- downtime that includes a full day or more.

In addition to temporary funds, man-days are taken into account when calculating the average number of employees.

Calculation of time for statistical earnings report

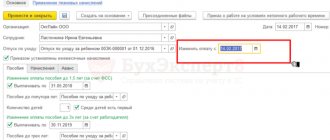

All organizations must have a statistical department that monitors the average wage of workers in the enterprise. The P-4 report provides all data on working persons, regardless of activity. This does not apply to private businesses and small organizations. The report is carried out with a frequency depending on the number of employees in the company: with more than 15 employees, the report is submitted monthly, and with a smaller workforce - quarterly.

The calculation of man-hours is entered in lines 5 and 6 of the P-4 report, which contains information about hours worked since the beginning of the year. Line 5 contains data on the employee’s total working hours worked, and line 6 contains information about the ordered external hours. This document includes absolutely all working hours: even overtime and unplanned ones. As in other methods of calculating hours, downtime in the form of sick leave, absenteeism and vacations are not taken into account.

Determining the value

This is one of the units for calculating working hours. It shows the amount of work completed in one hour of a certain working time. magnitude allows you to optimize any work (production, office, etc.). This unit of measurement also allows you to evaluate:

- The required amount of labor expended to complete a specific task.

- Labor costs of employees.

- Deadlines for completing a specific task.

The “man-hour” value is approximate. It is closely related to the unit of measurement “money-hour”. This value is more specific and allows us to determine an equal ratio of work-salary-deadlines.

Example. Maria Ivanovna works as an operator at the post office. She is a labor unit - one man-hour. The operator's working day lasts 8 hours. But on one day Maria Ivanovna receives 50 clients, and on another - 5. At the same time, man-hours do not change. And the money clock determines how much labor the employee actually put in and what monetary reward he received for it.

Cost of man-hour in construction

Standard indicators are given in the tables of state elemental estimate standards: labor costs of construction workers (man-hour), average level of workers, labor costs of machinists (man-hour), composition and duration of operation of construction machines, etc. To calculate the cost of a man-hour in construction it is easier to use special software. If you don’t have one, you can use ENiR (Unified standards and prices for construction, installation and repair work).