N.V. Kalashnikov

, expert, magazine “Accounting in budgetary institutions” No. 7 July 2008

In a budgetary educational institution (municipal school), the work of teaching staff is paid in accordance with the current rate. Depending on the schedule, the teacher may not have teaching hours every working day. Days when the teacher does not teach classes are considered methodological. On such a day he is not required to be present at his workplace. How should you mark on the report card days with school hours and those when there are no lessons?

LETTER ROSTRUD dated May 22, 2008 No. 1168-6-1

The Legal Department of the Federal Service for Labor and Employment reviewed letter No. 196/04 dated April 17, 2008. Within the limits of our competence, we report the following. Resolution of the State Committee of the Russian Federation on Statistics dated January 5, 2004 No. 1 approved unified forms of primary accounting documentation for labor accounting and remuneration, which are mandatory for use by all employers, regardless of their organizational, legal forms and forms of ownership. To register and record the time actually worked and (or) not worked by each employee of the organization, to monitor compliance by employees with the established working hours and remuneration, the unified form T-12 is used. The above form does not provide such a column as “methodological days”. From our point of view, the time when a teacher does not teach classes, but performs other work provided for by him or her job description (including methodological ones), should be reflected in the time sheet as “working”. For additional clarification on the application of this resolution and the unified forms approved by it, we recommend contacting Rosstat.

Head of Legal Department I.I. Shklovets

Editor's comment

The opinion of Rostrud specialists is based on the rules for filling out form No. T-12 “Working time sheet and calculation of wages” (f. 0301007). However, it should be noted that a budgetary educational institution in the selection of primary documentation should be guided by the provisions of Instruction No. 25n. This means that to reflect the working time of staff, they should use the unified form 0504421 (Ticket for recording the use of working time and payroll). Specialists from the main department also insist on this in a letter dated September 10, 2007 No. 02-14-10a/2261. Please note that when filling out form 0504421 (as well as form No. T-12), it is necessary to register only cases of deviation from the normal use of working time. But methodological work cannot be attributed to such deviations. After all, the working hours of teaching staff include not only teaching hours. It also includes other pedagogical work provided for by job responsibilities (in particular, methodological). So, to summarize, we can conclude that when taking into account the working time of a teacher (educator), there is no difference between the hours when the teacher is teaching classes and when he is teaching methodological work. These hours must be reflected equally on the timesheet. It turns out that if an employee gets injured while at home on a “methodical” day, it will have to be recognized as work-related.

Having considered the issue, we came to the following conclusion:

The time sheet must reflect the fact that the 36-hour weekly norm is worked, and not just the hours of teaching work.

Rationale for the conclusion:

In accordance with part four of Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee. According to Art. 92, as well as Art. 333 of the Labor Code of the Russian Federation for teaching staff, a reduced working time is established, which is no more than 36 hours per week. In addition, depending on the position and (or) specialty of teaching staff, taking into account the characteristics of their work, the duration of working time (standard hours of teaching work per wage rate) is determined by Order of the Ministry of Education and Science of the Russian Federation dated December 22, 2014 N 1601 “On the duration of working time (standard hours pedagogical work for the wage rate) of teaching staff and on the procedure for determining the teaching load of teaching staff, stipulated in the employment contract" (hereinafter referred to as Order No. 1601). Clause 2.8.1 of Appendix No. 1 to Order No. 1601 establishes for additional education teachers the standard hours of teaching work for a salary rate of 18 hours per week. However, this does not mean that the working hours for such a teacher are limited to the specified limit. This only means that in order to receive the full salary, the teacher must complete the specified teaching load. He carries out other pedagogical work not directly related to teaching during working hours, which are not specified in terms of the number of hours (clause 2.1 of the Regulations on the peculiarities of working hours and rest time for teaching and other employees of educational institutions, approved by order of the Ministry of Education and Science of Russia dated March 27. 2006 N 69). In other words, the working time of a teacher of additional education is divided into two parts: normalized in the amount of 18 hours of teaching work and non-standardized, during which other pedagogical work is performed. Moreover, both of these parts in total cannot exceed 36 hours per week - the established working hours for all teaching staff. From Art. 129 and the Labor Code of the Russian Federation it follows that the monthly salary is paid in full to employees when they fulfill the monthly working hours. Therefore, in order to calculate a teacher’s salary, it is necessary to know the total number of hours worked by him. Exactly how many hours during each day were spent on teaching work, and how many on research, teaching, methodological, organizational, methodological, educational and other work, does not matter when filling out a time sheet. Consequently, since the hours spent on teaching work are only part of the total working time of teaching staff, we believe that the time sheet should reflect the fact of working out the entire 36-hour weekly norm.

Answer prepared by: Expert of the Legal Consulting Service GARANT Mazukhina Anna

Response quality control: Reviewer of the Legal Consulting Service GARANT Kudryashov Maxim

The material was prepared on the basis of individual written consultation provided as part of the service

Since there is no uniform procedure for maintaining time sheets specifically for budgetary educational institutions, they use different accounting systems depending on the specific conditions of the work performed. Moreover, when recording working time, budgetary institutions can use two forms of timesheets approved by Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 N 173n - a timesheet according to form 0301008 (form T-13) and a timesheet for the use of working time and payroll (form 0504421).

The report card 0504421 records only cases of deviations from the normal use of working time established by the internal labor regulations. In the upper half of the line, for each employee who had deviations from the normal use of working time, hours of deviations are recorded, and in the lower half - symbols of deviations. Hours of operation at night are also recorded at the bottom of the line.

If one employee of an institution has two types of deviations on one day (period), the lower part of the line is written in the form of a fraction, the numerator of which is a symbol of the type of deviation, and the denominator is hours of work. If there are more than two deviations on one day, the employee’s name is repeated in this report card.

At the end of the month, the employee responsible for maintaining time sheet 0504421 determines the total number of days (hours) of absences, as well as hours by type of overtime (substitution, work on holidays, night work, etc.) and recording them in the appropriate columns (35 , 42, 43, 45, 47, 49, 51).

Working time costs in the T-13 sheet can be taken into account by the method of continuous registration of appearances and absences from work or by recording only deviations (absences, tardiness, overtime, etc.). When reflecting absences from work, which are recorded in days (annual leave, leave due to training, temporary disability, business trip, time spent performing state or public duties, etc.), only codes are entered in the top line of the timesheet in the columns symbols, and the columns in the bottom line remain empty.

Difficulties in recording the working time of teachers are primarily due to the fact that their work schedule can be different every day. In addition, there are so-called methodological days, when the teacher is free from conducting scheduled training sessions and other duties regulated by schedules and work plans, but uses this time for advanced training, self-education, preparation for classes, etc. When recording the working time of teachers, the main thing is to ensure that the weekly working time standard is observed. Therefore, in practice, when filling out a time sheet, the actual days worked are often entered, including methodological ones, if the total amount of working time worked per week does not deviate from the norm.

If you comply with the weekly working hours, you can also enter the hours worked for each day in the schedule. But we believe that such accounting is more significant for personnel officers, since it allows them to track employee tardiness, absence from work without good reason, etc. Usually, if employees are not set a six-day working hours (when the start and end times of the working day are determined), but the beginning, end and duration of the working day during the week, month, etc. differ, then a flexible working time regime is established, in which summarized recording of working time is carried out. With this schedule, the timesheet indicates the hours worked for each day of work. The accounting period may be a month, a quarter or another period not exceeding one year. Flexible schedules and cumulative recording of working hours are established by internal labor regulations. The working hours must be reflected in employment contracts with employees.

Thus, if we are guided by the law, when teachers have a six-day working week, it is more convenient to record daily attendance at work on the time sheet. If hours are assigned for each day of work and the duration of work is different each day, a flexible schedule must be established for the employee.

The best option for filling out a working time sheet is to fill it out using the deviation method, when only cases of deviation are recorded (sick leave, weekends, holidays, overtime, etc.).

- Time tracking

- Articles about timesheets

- Current articles

Working time sheet form 0504421 is intended for budget organizations. In the article you can find the document form and read about the special rules for filling it out.

This document is subject to mandatory use in budgetary organizations. However, commercial organizations can also use this form. This may be especially relevant, for example, for private kindergartens or other private educational organizations.

How to fill out a time sheet for a teacher?

Answer to the question: As we understand from your question, the employee is assigned part-time working hours. At the same time, we note that if part-time working hours are established for an employee upon hiring, then this condition must be reflected in the employment contract, as well as in the hiring order. Read more about this link.

We recommend reading: How to prepare yourself for the profession of sales manager

In the employment contract, in the “Working hours” section, indicate part-time working hours, and also specify the working conditions (for example, “The employee is assigned a part-time work week. The working day is Monday. The start and end times of classroom classes are determined by the class schedule.

Salaries are calculated depending on the amount of time actually worked."

Should the teacher take into account the shortened working day in the time sheet when calculating the standard hours?

Answer to the question: According to Part.

Duration of work...hours per week"). In the employment contract, indicate the employee’s salary in full (for a full rate), and it is necessary to indicate that the salary is calculated for the time actually worked (for example, “The employee has a monthly salary of 17,000 rubles.

1 tbsp. 95 of the Labor Code of the Russian Federation, the duration of the working day or shift immediately preceding a non-working holiday is reduced by one hour. For teachers of additional education, it is not the duration of working hours that is established, but the standard hours of educational (teaching) work - 18 hours per week for the wage rate (clause

2.8.1 Appendix 1 to the order of the Ministry of Education and Science of Russia dated December 22, 2014

No. 1601). Since the teacher has a part-time working schedule, his working hours differ from the general rules in force for the employer.

Consequently, the working hours must be determined by the employee’s employment contract (Part 2 of Article 57, Article 100 of the Labor Code of the Russian Federation). Working days and weekends must also be defined.

It is not clear from the question whether, according to the employment contract, Friday is the teacher’s day off or whether the teacher has no classes on that day. If, according to the employment contract, Friday is a day off, then the day off is indicated on the timesheet.

Features of the form 0504421

Tabular form 0504421 is slightly different from the unified accounting form T-12; you can read about filling it out in the article. The header of the document is always filled out first. You must indicate the correct name of the company (legal entity).

Please note that the use of a company's trade name is unacceptable.

For example, a private kindergarten is called “Forest Glade”. At the same time, the legal entity providing child support services is called Avista LLC. The schedule indicates exactly the name of the legal entity.

If the company structure is quite branched, and more than one person keeps the timesheet, then a structural unit is indicated. If there is only one table for the entire company, this is not required. The type of document is also indicated:

- primary;

- corrective.

The numbering of corrective documents is carried out within the accounting month.

The employee’s data is entered directly into the tabular part, as well as. The last column summarizes the time worked for the accounting month.

Afterwards, the signatures of the responsible persons, as well as the institution’s accountant, are affixed confirming the acceptance of filling out the time sheet.

If necessary, institutions have the right to make changes or additions to the form of the report card (paragraph 2 of the Procedure approved by Resolution of the State Statistics Committee of Russia dated March 24, 1999 No. 20).

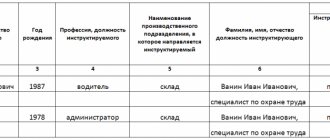

For clarity, let’s look at the procedure for filling out a report card in an educational school using the method of recording deviations.

- Baranov A.A. (Director) worked all days in full. He has a five-day work week;

- Sorokina S.A. (Deputy Director) On October 7 and 8 she was on a business trip, the remaining days she worked full time. She has a five-day work week;

- Smirnova N.V. (social educator) was on sick leave from October 8 to October 14. Works a five-day work week;

- Pimenov L.N. (geography teacher) On October 5 and 6, he replaced an absent teacher in two seventh grades for two hours (lessons) each day. The teacher has a six-day work week;

- Grigorieva T.V. (accountant) was on study leave from October 1 to October 8. She has a five-day work week;

- Zelenkin E.V. (watchman) works in 12-hour shifts: from 8.00 to 20.00 - day shift, from 20.00 to 8.00 the next day - night shift. On October 2 it worked during the day, from October 4 to 5 - at night, on October 8 - per day, from October 10 to 11 - at night, and on October 14 - per day.

Read detailed instructions in the article:

Memo for additional education teachers on keeping a journal.

Recommendations for working hours

. A journal is a state accounting and financial document that requires accurate, competent and timely filling out in one color of ink.1.

The journal is filled out strictly at the end of the working day and is located in the teachers' room or with the deputy director for additional education.2. Keeping a log does not involve marking the presence of students. Those that are missing are marked with the letter -n-. Newly admitted children are included in the list of group members indicating the date of admission.

Training on T/B for new arrivals takes place on the first day of their classes.3.

If the number of absentees in a group exceeds 1/3 of the total composition of students and the names of the absentees are traced throughout 3-4 classes, the question arises about the advisability of continuing the classes of this association (group).

Special cases

Unlike other unified forms, it has specific designations that are unnecessary for ordinary commercial firms. For example, “substitution in an extended day group.”

Several deviations in one period

If one person has 2 deviations from the normal use of working time on one day, they must be recorded in a special way. The lower part of the line is written as a fraction, the numerator of which is the symbol of the type of deviation, and the denominator is the hours of work.

If there are more than 2 deviations on one day, the employee’s name is written in several lines.

Internal part-time worker

When an employee works in two branches of an institution, we fill out the work time sheet 0504421 in each of the divisions.

If a person is in only one department, such work is recorded in one report card, but in two lines. In this case, in the second line it is necessary to again reflect the last name, first name, patronymic of the employee, his profession and personnel number. It must correspond to the data of the second employment contract concluded on an internal part-time basis.

Sick leave during vacation

In a situation where an employee has taken a vacation and during it goes on sick leave, you must proceed as follows. In this situation, the vacation time is already marked with the letter code “From”; you cannot cross out or correct errors in the timesheet. Therefore, it is necessary to draw up a new, corrective document. It is necessary to mark the period of illness with a different code - “B”.

When granting leave, it is important to consider its nature. Different types of vacations have their own individual symbols. So, if an employee went on another vacation, the schedule will show “From”, with additional vacation - “TO”. And long-term maternity leave is designated “OJ”, which means women’s leave.

Absence for unknown reasons

Unexplained causes remain unclear only until they are clarified. Therefore, if the code “NN” was initially entered into the table, then such a document will subsequently require adjustments.

Moreover, the “NN” marking is necessary even if the employee warned the employer that, for example, he was ill or was summoned to court to testify. Until the employee provides documents justifying his absenteeism, changes should not be made to the time sheet.

Moreover, if the employee did not provide documents and in fact there was absenteeism, then it is necessary to request an explanatory note from him. And fill out a corrective document, where instead of unclear reasons it will be indicated - absenteeism.

Civil initiative

New order of the Ministry of Education on the workload of teachers. Lawyer's commentAuthor: On March 10, Order No. 1601 of the Ministry of Education and Science of the Russian Federation came into force

“On the duration of working hours (standard hours of teaching work for the wage rate) of teaching staff and on the procedure for determining the teaching load of teaching staff, specified in the employment contract"

.

(Text is attached to the article). A previously valid similar order (No. 2075 dated December 24, 2010) has lost its force. We are publishing a commentary on the document prepared by the legal service of the independent trade union of education workers of Cherepovets.

The new regulatory act has a number of fundamental differences from the previous order. The difference, which is already in the name, speaks about the procedure for determining the teaching load of teaching staff, stipulated in the employment contract.

How to fill out a teacher’s time sheet if the PVTR specifies a summarized accounting of working time?

In accordance with Part.

This means that the teaching load must be clearly stated in the employee’s employment contract.

3 tbsp. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee. The duration of a teacher’s work depends on the norm of hours established for him for the wage rate (Order of the Ministry of Education and Science of the Russian Federation dated December 24, 2010 N 2075 “On the duration of working hours (standard hours of teaching work for the wage rate) of teaching employees”), working time includes not only the time classroom work of the teacher, but also the time of educational, as well as other pedagogical work, provided for by the qualification characteristics for positions and the features of the working hours and rest time of teaching and other employees of educational institutions, approved in the prescribed manner.

Teachers may not have teaching hours every day in their class schedule.

Days of the week free for the teacher

Time sheet form 0504421: sample filling

The general rules for maintaining timesheets are identical to filling out other forms for commercial organizations. This is the table of hours worked according to form 0504421:

In accordance with the letter of the Ministry of Finance of Russia dated June 2, 2020 N 02-06-10/32007, two fundamentally different filling out procedures are possible:

- Continuous method - all attendances and absences of employees are noted.

- Indication only of deviations from the normal use of working time (for example, weekends and holidays, study leaves, etc.).

Both methods are equivalent. In practice, as a rule, the second method is used. The act of the institution establishes the method of filling out the timesheet.

Standard working hours for additional education teachers

Hello, I work as an additional education teacher at my main place of work. The contract establishes the duration of working hours (standard hours of teaching work per wage) 18.0; A feature of the operating mode is shortened.

The question is: does the head of the educational center have the right to demand the performance of official duties (such as: drawing up educational programs, their coordination and approval; working with students’ personal files) at times other than 18 hours a week. And how should this work be paid?

Thank you. September 21, 2020, 12:50, question No. 1384073 Alexander Kay,

Ekaterinburg Collapse Online legal consultation Reply on the website within 15 minutes Answers from lawyers (1) 5008 answers 1816 reviews Chat Free assessment of your situation Lawyer, Tula Free assessment of your situation The question is:

The main thing about registration and payment of non-working days

Decree of the President of the Russian Federation dated March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation” in practice raised many questions.

Most companies sent employees home with an obligation to pay wages for the period from March 30 to April 30.

But there are those who do not stop work or transfer it to remote mode.

Experts from the Gradient Alpha auditing and consulting group are looking into how everyone together and each category separately can avoid mistakes when registering and paying for non-working days.

Companies that sent employees home

Step-by-step instructions for companies whose employees do not work from March 30 to April 30:

Step 1: By order of the organization, we declare the days non-working. We issue the order in free form and indicate in it that, in pursuance of Decree of the President of the Russian Federation of March 25, 2020 No. 206, the days from March 30 to April 30 are declared non-working paid days. The order is signed by the director and brought to the attention of employees against signature or via email.

Step 2: Fill out the time sheet. If the company is not among the exceptions under the Presidential Decree, then its employees have a rest from March 30 to April 30. Consequently, these days are non-working days for them, while the days are paid. In this case, guided by the Resolution of the State Statistics Committee dated January 5, 2004 No. 1, in the timesheet for these days you can enter a code independently approved by the employer, for example, “OD” (paid day) or “NOD” (non-working paid day). 1C has set the “ON” encoding in its configurations - paid non-working days. Companies working on 1C can use it for convenience. This code must be approved by an internal local regulatory act (organization order) in accordance with the Letter of Rostrud dated February 14, 2013 No. PG/1487-6-1, part 4 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. In the line “Hours” under these days the number of hours is not entered.

Please note that at first glance, the “OB” code that is suitable for this situation implies payment based on average earnings, therefore, in our opinion, it is not used in this case. If an employee is absent on these days due to illness or vacation, enter the appropriate codes for the situation.

consult

Step 3. Pay for non-working days. The fact of payment for non-working days is fixed by the Presidential Decree. The amount of payment will depend on the remuneration system.

Salary.

If an employee has a salary and works the standard working hours for March and April, he should receive payment in full without loss of wages due to the declaration of days as non-working days.

Piecework.

By analogy with the rules for remuneration of piece workers, which are provided for non-working holidays, part 3 of Art. 112 of the Labor Code of the Russian Federation, the employer must pay employees additional remuneration specified in the local regulatory act. This can be a fixed amount, an amount taking into account average earnings, production standards, average prices and minimum wages, a tariff rate, the calculation of which is provided for by local acts to pay for downtime for reasons independent of the will of the parties (based on the full tariff rate, and not 2/3 as during idle time).

In any case, it should be noted that in accordance with Presidential Decree No. 206, from March 30 to April 30, 2020, non-working days are established with retention of wages for employees, that is, payment is made according to the established wage system, including guaranteed compensation and incentive payments provided for by the remuneration system.

The Ministry of Labor in its clarifications dated March 26, 2020 “Recommendations to employees and employers in connection with Decree of the President of the Russian Federation of March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation”, paragraph 1. For these purposes, it recommends that workers paid on a piece-rate basis be paid appropriate remuneration for the specified non-working days, determined by the employer’s local regulations (that is, not based on average earnings).

These recommendations of the Ministry of Labor are not regulated by the norms of the current legislation, including the Labor Code of the Russian Federation. The right to apply them or not remains at the discretion of the employer, since the explanations of the Ministry of Labor of the Russian Federation are not a normative legal act.

One of the suitable calculation options in this case, in our opinion, is the calculation based on the entire payment for the time worked in the current month: if for 19 working days in March the employee received a certain amount of the total payment, taking into account bonuses and compensations, then it is taken on the basis divided by the number of days worked - in our example 19 and multiplied by 2 (March 30 and 31). In any case, the formula for calculating the surcharge is established by the company’s local regulations. This means that the calculation that the company now chooses is necessarily fixed by order.

consult

It was necessary to pay wages for March on the last working day before the weekend, since if the payment day coincides with a weekend, wages are paid on the working day the day before in accordance with Art. 136 Labor Code of the Russian Federation. The President declared a holiday from March 30, therefore, the last working day before the weekend is March 27, and then the payment had to be made.

Companies that don't stop working

The Presidential Decree dated March 25, 2020 and the subsequent clarifications of Rostrud dated March 26, 2020 “Recommendations for employees and employers in connection with Decree of the President of the Russian Federation dated March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation” highlighted the following companies, not stopping work from March 30:

- medical and pharmacy organizations, organizations ensuring the continuity of their production and technological activities, as well as social service organizations;

- continuously operating organizations in which it is impossible to suspend activities due to production and technical conditions. In addition, organizations in the field of energy, heat supply, water treatment, wastewater treatment and wastewater disposal; operating hazardous production facilities and subject to a regime of constant state control (supervision) in the field of industrial safety; organizations operating hydraulic structures; nuclear industry organizations; construction organizations, the suspension of whose activities will pose a threat to the safety, health and lives of people; agricultural industry organizations engaged in spring field work;

- organizations providing the population with food and essential goods; organizations that, in order to provide the population with food and essential goods, provide warehousing, transport and logistics services; trade organizations;

consult

- organizations performing urgent work in emergency circumstances, in other cases threatening the life and normal living conditions of the population, including enterprises producing personal protective equipment, disinfectants, medicines, medical devices, thermal television recorders, non-contact thermometers and installations air disinfection, as well as enterprises producing materials, raw materials and components necessary for their production; organizations whose activities are related to protecting public health and preventing the spread of the new coronavirus infection; organizations in the field of industrial and consumer waste management; organizations providing housing and communal services to the population; organization of a petroleum product supply system; organizations providing financial services in terms of urgent functions; organizations providing transport services to the population; organizations carrying out emergency repair and loading and unloading operations;

- Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund and their territorial bodies

Step-by-step instructions for companies whose employees continue to work from March 30:

Step 1: We issue an order to work on non-working days and obtain the consent of the employees. The Presidential Decree simultaneously defines the days from March 30 to April 30 as non-working days for everyone and at the same time identifies a number of exceptions. Therefore, in order to avoid negative consequences, issue an order to attract workers to work on a day off with reference to the same Presidential Decree No. 206 and familiarize the workers with it against their signature.

Step 2: Fill in the working days in the time sheet. The timesheet shows the same situation: on the one hand, these are working days, marked according to the rules of the timesheet with the code “I”, on the other hand, this is work on a non-working day. For this situation, you can use the combined code “I/NOD”, which will mean working on a non-working paid day.

Step 3: Pay for working days. The Ministry of Labor in its clarification dated March 26, 2020 “Recommendations to employees and employers in connection with Decree of the President of the Russian Federation of March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation” (clause 3 of the Recommendations) indicated: “A non-working day does not apply to weekends or non-working holidays, so payment is made as usual, and not in an increased amount.” The Labor Code does not regulate this issue; there are no official explanations of the above. In the current situation, we consider it advisable to adhere to the Recommendations of the Ministry of Labor and maintain a single salary for employees who will work from March 30 to April 30. If the official position changes and clarifications appear, pay for days of work during a non-working month according to the weekend rules, i.e. double the amount, an additional payment will be required.

consult

Step 4: We issue a special certificate to employees. Companies that have not suspended operations in accordance with the decree of the President, Moscow Mayor and other regional heads must issue employees a special certificate confirming the need to get to work. The employee will present the certificate at the request of government officials, for example, a police officer. We prepare the certificate in any form.

In the document, indicate the name of the company, contact details of the employer, as well as the employee’s full name, place of work and position.

To confirm your identity, you will have to carry your passport with you. A certificate must be issued to each employee. The company also needs to approve an order with a list of employees who can work during this period.

Companies working remotely (remotely)

If employees belong to the categories specified in clause 2. Presidential Decree, taking into account the more expanded list established by clause 4. Explanations of the Ministry of Labor dated March 26, 2020 “Recommendations for employees and employers in connection with Decree of the President of the Russian Federation of March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation”, they can work remotely without any restrictions. According to clause 6 of the Explanation of the Ministry of Labor dated March 26, 2020 “Recommendations to employees and employers in connection with Decree of the President of the Russian Federation of March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation”, employees of organizations that continue to carry out labor activities in accordance with the Presidential Decree, by agreement with the employer, they can work remotely (remotely), if job responsibilities and organizational and technical working conditions allow this. On 03/27/2020, the Ministry of Labor issued an addition to its Clarifications, indicating that: “Employees carrying out remote work, in agreement with the employer, have the right to continue it during the period of the Decree with mandatory compliance with the requirements of the Ministry of Health of Russia and Rospotrebnadzor for the prevention of new coronavirus infection. As stated above, the Explanations of the Ministry of Labor are not a normative act and are of an explanatory and recommended nature. But in today’s difficult economic situation, these recommendations establish a more gentle regime for any company, and therefore, in the absence of others, can be taken by employers as a basis, provided that employees work remotely.

Old approaches to tax optimization no longer work. What to replace them with? Find out at a business seminar in Moscow

The possibility of working remotely was also confirmed by the press secretary of the Russian President Dmitry Peskov, telling reporters on March 27, 2020 that those who have worked remotely so far will continue to work the same way. According to the press secretary, non-working days were declared to minimize contacts between people. And that these are not weekends or holidays in the classical sense.

! At the same time, we draw your attention: The government is increasing the punishment for those who violate quarantine. Amendments are being made to Article 6.3 of the Administrative Code “Violation of legislation in the field of ensuring sanitary and epidemiological welfare of the population.” It will spell out liability for quarantine violations “during an emergency or when there is a threat of the spread of the disease.”

The administrative fine for legal entities will be from 200 thousand to 500 thousand rubles or administrative suspension of activities for up to 30 days, for officials - from 50 thousand to 150 thousand rubles, and for citizens - from 15 thousand to 40 thousand rubles.

If violation of quarantine results in harm to human health or death, and if they do not contain a criminal offense, the fine for legal entities will be from 500 thousand to one million rubles or administrative suspension of activities for up to 90 days, for officials - from 300 thousand up to 500 thousand rubles or disqualification for a period of one to three years, and for citizens - from 150 thousand to 300 thousand rubles

Thus, if a company decides to follow the Recommendations of the Ministry of Labor and involve employees in remote work, this can only be done by ensuring that the self-isolation regime for employees is maintained with mandatory compliance with all current requirements of the Ministry of Health regarding the non-spread of coronavirus infection.

Step-by-step instructions for companies whose employees are transferred to remote work from March 30:

Step 1: We issue an internal order with reference to the Recommendations of the Ministry of Labor and justification for the need to continue working remotely:

“Based on the goals of Presidential Decree No. 206 and due to the fact that working remotely meets these goals, namely: compliance with the self-isolation regime and eliminating the threat of the spread of the epidemic, a decision was made to apply the Recommendations of the Ministry of Labor dated March 27, 2020 and for employees to work remotely.”

Step 2: We conclude additional agreements to employment contracts on the transfer of employees to remote work for the period from March 30 to April 30, if the employees’ employment contracts did not previously provide for the opportunity to work remotely.

Still have questions?

Contact us, we will help!