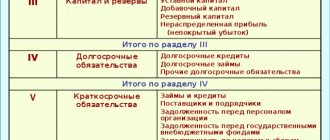

u. It includes authorized, additional, reserve capital, as well as retained earnings and special purpose funds. You will find all these values in Section III of the balance sheet “Capital and Reserves”.

Let's take a closer look at the formation of each article in this section. The authorized capital (line 410 of the balance sheet) represents the amount invested by the founders in the enterprise. It is stipulated in the constituent documents of the organization. The authorized capital can be changed only after making the appropriate entries in the constituent documents. Line 411 “Own shares purchased from shareholders” should also be included in equity capital if the organization purchased securities from shareholders.

Additional capital (line 420) is part of the enterprise’s equity capital, which includes amounts contributed by the founders in excess of the authorized capital. Remember that the amount of share premium of a joint-stock company, the amount of additional valuation of the organization’s non-current assets, as well as part of the retained earnings remaining at its disposal may be reflected as additional capital.

Reserve capital (line 430) is a part of equity capital that is allocated from the profit of the enterprise to cover possible losses and losses. Please note that reserve capital is divided into reserves formed in accordance with legislation (line 431) and reserves formed in accordance with constituent documents (line 432).

Remember that the main source of accumulation of enterprise property is retained earnings (line 470). It is equal between the financial result for the reporting period and the amount of taxes, as well as other payments made from profits. It also includes the balances of special-purpose funds created in the organization, which are not shown as a separate line.

Video on the topic

Sources:

- how to calculate authorized capital

- Return on equity

Sources of formation of enterprise funds are divided into own and borrowed. In the financial statements, they are reflected in the liabilities side of the balance sheet as accounts payable of the organization and equity capital

.

Knowing the amount of borrowed capital

a, you can preliminarily assess the possibility of a company obtaining a bank loan.

Instructions

In the practice of lending to small and medium-sized businesses, many use 2 indicators from the balance sheet liabilities as the main factors influencing the final amount: 1) the amount of equity capital

a company;

2) the ratio of the amount of borrowed capital

a to equity capital and .

Equity value

and the company in most cases cannot be less than the amount of the loan issued. This is the general rule of business lending: the client cannot risk less than the bank risks. However, with increasing competition in the financial services sector and increasing supply, banks and non-banking organizations have begun to use another lending scheme.

It is no secret that commercial companies that provide exclusively services, as a rule, do not have sufficient equity capital

A.

As a result, they cannot qualify for a large loan amount. However, the business profit is quite sufficient to serve the requested service. In this case, banks are much more interested in the ratio of debt capital

to equity and the overall financial condition of the company.

Despite the fact that each uses its own risk assessment methodology, it is still possible to identify certain generally accepted norms of analysis. If the gearing ratio

and the balance sheet ratio is less than 30%, and the financial position is assessed as good - this means that the level of borrowed

capital

is acceptable, and the company can qualify for a loan.

If borrowed capital

is equal to equity, it is worth paying attention to analyzing trends in the company's financial condition.

A possible option is to increase accounts payable due to the deterioration of the enterprise’s position in the market. If borrowed capital

is more than 50% of the balance sheet currency, this means that in fact. In this case, it should include a more detailed business analysis and a more in-depth risk assessment.

Video on the topic

In a commercial organization, the main purpose of activity is to make a profit. Therefore, owners are always interested in the value of the “retained earnings” indicator. This is the money that the company can divide between the founders or leave in the organization’s accounts for the purpose of its further development.

Instructions

Typically, in the early years of a company's existence, retained earnings

, formed at the end of the year, is sent to the reserve fund for further investment, payment of bonuses or acquisition of property.

If the organization is on the general chart of accounts, then you have access to accounting data for the last year. By the way, from January 1, 2013, the responsibility for maintaining accounting records will be assigned to all companies, including those using a simplified taxation system or paying a single tax on imputed income. So, the amount of retained earnings (that is, profit after paying income

), is reflected in account 84. If a company has recorded a loss, its value is reflected in debit, while a positive result is reflected in credit.

If during the year the organization carried out a revaluation of fixed assets (with the impact of such actions on the amount of additional capital), paid interim dividends or changed the authorized capital, then these changes should affect the final value of retained earnings. They must be added or subtracted depending on whether it was a revenue or expense transaction.

Please note that the value of line 1370 of the balance sheet must match line 2400 of the income statement. This rule works if no distribution of dividends was made during the year, which are reflected in the debit of account 84.

Please note that the distribution of profit based on the results of the year refers to the category of events that occurred after the reporting date. Therefore, in the reporting period for which the company distributes profits

, no accounting entries are made. Thus, the data on account 84 in the reporting year cannot contain information on the distribution of dividends based on the results of this year, but they must reflect transactions based on the decision made on the use of profits received based on the results of the previous year.

Video on the topic

To determine the organization’s ability to self-finance, that is, the ability to do without borrowing funds, it is necessary to assess the composition and structure of equity capital

.

This analysis is carried out on the basis of data from the enterprise's

.

An organization's equity capital refers to the totality of funds available to the company. Or rather, funds belonging to the participants of the organization. How is the amount of an organization’s equity capital determined based on the balance sheet data?

How to determine the amount of equity capital?

According to the balance sheet, the amount of the organization’s equity capital corresponds to the balance of line 1300 “Total for Section III,” i.e., the total amount for Section III “Capital and Reserves” of the balance sheet (Order of the Ministry of Finance dated July 2, 2010 No. 66n, clause 66 of the Order of the Ministry of Finance dated July 29, 1998 No. 34n).

Let us recall that the balance of capital and reserves in the balance sheet is determined as follows:

line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)”

line 1320 “Own shares purchased from shareholders”

line 1340 “Revaluation of non-current assets”

line 1350 “Additional capital (without revaluation)”

line 1360 “Reserve capital”

line 1370 “Retained earnings (uncovered loss)”

It is from the organization's own capital that dividends are paid to participants. And upon termination of the organization’s activities, the size of its equity capital will show the amount of funds that is subject to distribution among participants. However, it is necessary to understand that equity can also be negative. This is possible in the case when the organization operates at a loss and its accumulated value exceeds the sum of other elements of equity capital (authorized, additional, reserve capital).

We talked in more detail about accounting for an organization's equity capital in a separate section.

Please note that if the calculation of equity capital is carried out to determine the maximum amount of interest taken into account in expenses on controlled debt, then the amount of equity capital will be equal to the sum of the balance of line 1300 and debts on taxes and fees (

Shareholders' equity is the total of a company's assets minus its total liabilities.

. It is one of the most common financial ratios used by analysts to determine the financial health of a company.

Equity represents the net cost of a company

or the amount that would be returned to shareholders if all of the company's assets were liquidated and all debts were repaid.

Results

An idea of the amount of equity in the balance sheet is given by the value indicated in its line 1300. However, in its essence, equity corresponds to the concept of “net assets”. To calculate net assets, there is a formula approved by the Russian Ministry of Finance, based on balance sheet data, but taking them into account taking into account some nuances. The amount of equity capital is extremely important for assessing the financial position of the company. Of particular importance is its relationship with the size of the authorized capital.

The organization's balance sheet presents many important financial indicators that characterize the company's business, including the cost of equity capital. At the moment, there are various ways to calculate such an indicator as equity capital - we will consider this below.

One of the main methods for calculating equity capital is based on the balance sheet data and is indicated in line 1300 “Total for section 3”. It consists of authorized capital, additional capital (also arising during the revaluation of fixed assets), reserve fund, as well as retained earnings.

In Russian legislation, the concept of equity capital often refers to net assets, which are formed from the balance sheet data by subtracting from the company’s assets (line 1600) all liabilities (lines 1400 and 1500), debts of participants and adding future income. This method helps participants and investors assess the value of a business.

There is also a method for determining equity for tax purposes when it comes to calculating income tax and there is controlled debt, that is, debt under a loan or credit when the person who issued the loan or security is a foreign company owning more than 20% of the borrower's share capital (directly or indirectly).

We must not forget that debt must exceed more than three times the amount of equity capital. For such borrowings, interest is not taken into account in expenses in full, but within certain limits (the “thin capitalization” rule). When we calculate equity capital for this case, then equity in the balance sheet is line 1300 “Total according to section. Ш" plus the borrower's tax debt.

I note that when it comes to tax arrears, this does not include arrears of contributions to funds (Pension Fund, Social Insurance Fund, Mandatory Health Insurance Fund).

https://youtu.be/O8vpW3xILYc

What it is

Equity may be negative

or

positive

. If the ratio is positive, it means the company has more than enough assets to cover its liabilities. If this indicator is negative, the company has debts that outweigh its assets.

In general, a company with negative equity is not considered a safe investment choice because either its total assets are too low or its total liabilities are too high. In either case, the company has more debt than its current assets can satisfy, putting them at risk of loan default and bankruptcy.

Equity is used in accounting in several ways. Often the word "equity" is used to refer to the ownership interest in a business. Examples include share capital or equity.

Sometimes capital is used to refer to a set of liabilities

:

Assets = Liabilities + Equity becomes assets = Shares

Calculation methods

All information necessary to calculate a company's equity capital is available on its balance sheet

. The calculation is to determine the companies' total assets and total liabilities, including .

Current assets include retained earnings, stockholders' equity, and other cash held in bank and savings accounts, stocks, bonds, and money market accounts.

Long-term assets include equipment, property, illiquid investments and vehicles. Current liabilities include any payments and interest on loans in the current year, accounts payable, wages, and insurance premiums.

Long-term liabilities include any debts that are not due in the current year, such as mortgages, loans and payments to bondholders.

Own capital is reflected in line 1300 of the balance sheet. The traditional calculation is as follows:

Equity = value in line 1300

Shareholders' equity can also be expressed as a company's share capital plus retained earnings, less the value of treasury shares. However, this method is less common. Although both methods should produce the same figure, using total assets and total liabilities provides a clearer indication of a company's financial health.

Equity is important because it represents the real value of the share in the authorized capital

. Investors who own shares in a company are usually interested in their own personal equity in the company represented by their shares.

However, such personal capital is a function of the total capital of the company itself, so a shareholder interested in his own earnings will necessarily have an interest in the company.

Owning shares in a company provides capital gains for the shareholder and potential gains over time. It also often gives the shareholder voting rights at the founders' meeting. All these benefits further increase shareholder interest in the company.

Most often, the average value for the year is used to assess equity capital, which allows you to most accurately determine its variations over time.

The formula for calculation is as follows

:

Sk = (Sk at the beginning of the year + Sk at the end of the year) / 2

The data is taken from the balance sheet for the relevant reporting periods.

Shareholders have voting rights

and other privileges which come only with title, since capital represents a claim to a proportionate share of the assets and earnings of the company. These claims are generally those of creditors, but only shareholders can truly participate in and benefit from the growth in the value of the enterprise.

Some financial instruments have the characteristics of equity, but are not actually equity. For example, convertible debt instruments are loans that convert into equity when the company (the borrower) crosses certain thresholds, thereby turning the lender into an owner in certain cases.

Stock options also act like shares in that their value changes with the value of the underlying shares, but option holders generally do not have voting rights and cannot receive dividends or other financial instruments.

It's important to understand that while equity represents a company's net worth, a company's stock is ultimately only worth what buyers are willing to pay for it.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital. This criterion is important from the point of view of maintaining the investment attractiveness of the business.

A business must pay for itself and ensure an influx of new capital. Sufficient equity capital is one of the most significant indicators of the quality of a company’s business model.

What is own working capital? Details are in this article.

Calculating the amount of equity capital determined using the traditional method is very simple. Under this interpretation, equity on the balance sheet is

figures corresponding to line 1300 of the balance sheet.

The formula for equity in this case is:

Net worth = p. 1300.

However, if we talk about the interpretation of the essence of equity as net assets, in this case, the definition of equity in the balance sheet is

the task is more difficult. Let's study the features of its solution.

Calculation of equity from the balance sheet: the Ministry of Finance method

Having agreed that net assets and equity capital are one and the same thing, we can determine their essence based on the criteria recorded in Russian regulatory legal acts. There are quite a lot of relevant sources of law. Among those with the widest jurisdiction is Order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n.

In accordance with the method of the Ministry of Finance, the structure of assets accepted for calculation must contain absolutely all assets, with the exception of those that reflect the debt of the founders and shareholders for contributions to the authorized capital of the company.

In turn, obligations must also be taken into account, except for some future income, namely those associated with receiving assistance from the state, as well as the gratuitous receipt of this or that property.

Hello, my name is Maya, just sharing my experience

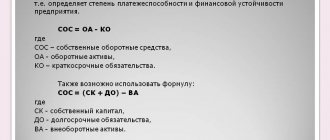

Having your own working capital is the key to successful operation of an enterprise.

The indicator is used to assess the real volume of an organization's resources and indicates whether there is free money. This is an absolute value and is expressed in monetary terms. To calculate it, it is most convenient to refer to the balance sheet data. Managing an enterprise involves making decisions that will lead to profit in the future. The main source of income is the results of conducting core activities, the implementation of which requires resources. One of the key assets of any enterprise is its own working capital. They belong to current assets and are considered the most liquid, i.e. can be quickly converted into hard cash.

We calculate equity according to the balance sheet lines

Calculating net assets, and therefore equity capital, using the Ministry of Finance method involves the use of information:

From line 1400 of the balance sheet;

Lines 1500;

1600 lines.

You will also need information showing the amount of debts of the founders of the business company (let’s agree to call them DOO), if any (they are reflected by posting Dt 75 Kt 80), as well as deferred income, or DBP (account credit 98).

The structure of the formula for determining net assets and at the same time equity capital is as follows. Necessary:

- add the indicators along lines 1400, 1500;

subtract from the number obtained in paragraph 1 those that correspond to the credit of account 98 (for income in the form of assistance from the state and gratuitous receipt of property);

subtract from the number on line 1600 the indicators corresponding to the posting Dt 75 Kt 80;

subtract from the number obtained in step 3 the result from step 2.

Thus, the formula for determining the value of the insurance premium using the Ministry of Finance method will look like this:

Sk = (line 1600 – DUO) – ((line 1400 + line 1500) – DBP).

What is the optimal amount of equity capital

Owner's equity or net assets must be at least positive. If this is not the case, then the business most likely has significant problems - mainly in terms of its credit load, as well as the adequacy of highly liquid assets.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital.

This criterion is important, first of all, from the point of view of maintaining the investment attractiveness of the business. A business must pay for itself and ensure an influx of new capital. Sufficient net assets are one of the most significant indicators of the quality of a company's business model.

There is one more aspect of the importance of equity capital. If we mean net assets by it, then it must be equal to or exceed the size of the authorized capital. Otherwise, the company, if it is an LLC, is subject to liquidation (Clause 4, Article 90 of the Civil Code of the Russian Federation). Or it will be necessary to increase the authorized capital of the LLC to the amount of net assets. A similar scenario is also possible in relation to JSC (subclause 2, clause 6, article 35 of Law No. 208-FZ).

An organization's equity (equity) is the value of its assets, unencumbered by liabilities. Thus, equity is the difference between assets and liabilities. Equity analysis has the following main objectives:

1) identify the main sources of formation of equity capital and determine the consequences of their changes for the financial stability of the enterprise;

2) establish the organization’s ability to preserve capital;

3) assess the possibility of increasing capital;

4) determine legal, contractual and financial restrictions on the disposal of current and accumulated retained earnings. Own capital can be considered in the following aspects: accounting, financial and legal. Analysis of equity capital involves assessing the initial investment of capital and its subsequent changes associated with additional investments, net profit received, and other reasons due to which there is an increase (decrease) of equity capital. This aspect of the problem is reflected in the concept of maintaining (preserving) capital, in order to protect the interests of creditors, as well as for an objective assessment by the owners of the final financial result obtained and the possibilities of its distribution.

To analyze and justify the optimal structure of financing funds, you can use the following classification.

Equity Division

To external (through the issue of shares) sources of funds,

Internal (at the expense of part of the profit) sources of funds, as well as

The allocation of bank loans, loans from other organizations, funds received through the issuance of corporate bonds, budgetary allocations, and others, into a separate separate group of borrowed sources of financing allows analysts to take into account specific goals that stand separately for the owners (proprietors, shareholders) of the organization and its creditors.

The following indicators play an important role in the process of justifying the optimal structure of funding:

Return on equity (/?sk)>

Economic profitability (K e).

Financial leverage (capitalization ratio, 11 x).

This set of indicators is used to assess the impact of capital structure on the level of efficiency of a particular investment option. The above indicators are calculated using the following formulas:

where ZK is the amount of borrowed capital, thousand rubles;

SC - the amount of funds from external and internal sources of the organization's own capital, thousand rubles;

P is the amount of profit before interest on borrowed funds and income tax;

P h - the amount of net profit, thousand rubles;

SK+ZK - amount of financing (total capital) thousand rubles.

equity indicator

calculated using net profit and after interest payments, can be presented in the following form:

where np is the tax rate and other similar deductions from the profit of the enterprise, in fractions of a unit;

r is the average weighted interest rate on borrowed funds, in fractions of one.

To determine the degree of impact of the capital structure on the level of efficiency of financing activities, return on equity capital (a target indicator that takes into account the interests of the owners of the organization) can be used as an optimization criterion.

As a criterion for optimizing a general indicator, which, on the one hand, takes into account the interests of the owners of the organization, on the other hand, combines private indicators of profitability and financial risk, you can use the ratio “profitability - financial risk” (PP). This indicator is calculated using the following formula:

where r br is the risk-free rate of return on the financial market, in fractions of one;

– level of financial risk.

The optimal variant of the capital structure is considered to be the one in which the PP indicator will have the greatest value (PP-> max).

Another evaluation criterion, which can also be used to optimize the capital structure, is the payback period (C

ok ),

which characterizes the rate of return on invested capital.

In this case, C 0 to is calculated using the net profit remaining after paying interest and taxes, according to the formula:

When analyzing equity capital, it is necessary to pay attention to the ratio of inflow and outflow ratios. If the values of the income coefficients exceed the values of the retirement coefficients, it means that the organization is in the process of increasing its own capital, and vice versa.

1.Receipt rate:

2. Attrition rate:

To assess the degree of liquidity of an organization’s assets (except for non-profit ones), the report certificate reflects the “Net Assets” indicator (p. 200), which is used to analyze the financial position of the organization.

The procedure for calculating the net assets of an enterprise was approved by Order of the Ministry of Finance of the Russian Federation No. Yun and Order of the Federal Commission for the Securities Market No. 03-6/pz dated January 29, 2003.

The assets accepted for calculation include:

All non-current assets of the enterprise reflected in section I of the balance sheet;

Current assets reflected in Section II of the balance sheet, except for the cost in the amount of the actual costs of repurchasing its own shares purchased by the joint-stock company from shareholders for their subsequent resale or cancellation, and the debt of the participants (founders) for contributions to the authorized capital.

The liabilities accepted for calculation include:

All items of section IV of the balance sheet - long-term liabilities to banks and other legal entities - line 590;

Items of section V of the balance sheet - short-term borrowed funds, accounts payable, debt to participants in the payment of income, reserves for future expenses and payments and other short-term liabilities - the sum of lines is 610 + 620 +630 + 650 + 660. Article “Income

future periods" (line 640), as well as the articles of Section III are not included in the calculations.

2.

Analyze the profitability of securities of Parus LLC. Calculate missing indicators, evaluate their values and dynamics. Determine the impact on the “Earnings per share” indicator of changes in factors: the number of ordinary shares and the amount of net profit and dividends on preferred shares, using the chain substitution method. Write the conclusion.

| Indicators | Base year | Reporting year | Deviation (+, -) | Growth rate, % |

| 1. Assets, total | ||||

| 2. Net profit | ||||

| 3. Number of ordinary shares | ||||

| 4. Dividends on ordinary stock | ||||

| 5. Dividends on preferred shares | ||||

| 6. Earnings per share | ||||

| 7.Dividends per share | ||||

| 8.Dividend coverage ratio | ||||

| 9.Amount of assets per share |

Growth rate

This is an indicator that reflects the percentage growth of a statistical value in the current period compared to the previous one.

Let B be the value of the base period, and O be the value of the reporting period.

formula is used to calculate the growth rate

:

Growth rate = (O/B) * 100%.

- 81 334 / 55 730 * 100 = 145,9% (>

2 415 / 3 344 * 100 = 72, 2% (

20,550 / 19,250 * 100 = 106.7% (> 100% - positive dynamics)

450 / 602 * 100 = 74,7% (

420 / 315 * 100 = 133.3% (> 100% - positive dynamics)

Earnings per ordinary share (EPOS)

— shows what share of net profit falls on one ordinary share in circulation. Shares outstanding are defined as the difference between the total number of common shares issued and the treasury shares in the portfolio. If the company's capital structure includes preference shares, the amount of dividends paid on preference shares must first be deducted from the net profit. It should be noted that this indicator is one of the most important indicators affecting the market value of a company's shares.

Calculated using the formula: NI - PD/Nos./ = (Net profit - Dividends on preferred shares)/ Number of ordinary shares in circulation. This indicator is calculated only for an annual period.

Dividend per share (DPS)

-

shows the amount of dividends distributed to each common share. Calculated using the formula:

OD/Nos. = Dividends on common shares/ Number of common shares outstanding.

This indicator is also calculated only for an annual period.

Dividend payout

ratio - demonstrates the company's ability to pay dividends from profits. Shows how many times dividends can be paid from the net profit of the enterprise. Calculated using the formula:

NI - PD/OD. = (Net profit - dividends on preferred shares) / Dividends on ordinary shares.

This indicator is calculated only for an annual period.

Total assets per share (TAOS)

— shows what share of the enterprise’s assets is owned by the holder of one ordinary share. Calculated using the formula:

TA/Nos. = Total assets/number of common shares.

Own capital on the balance sheet is an indicator that can be determined using two methods at once: based on the recommendations of the Russian Ministry of Finance and characterized by the use of a large number of indicators, as well as traditional, which involves the use of a formula with a very simple structure. Let's look at them in our article.

Authorized capital of the organization, sources of formation

When founded, the company does not have the funds necessary to start operations. The authorized capital is the start-up fund formed when opening an enterprise. Sources of formation depend on the organizational form of the company. The size of the charter capital is agreed upon by the founders with a recording of the accepted value in the minutes of the general meeting, the decision of the sole participant, and the constituent agreement.

| Form of organization | Source of income of the management company | Explanations | Payment deadline |

| OOO | Contributions of founders in cash or in kind, assessed at market value | Within the limits of the Criminal Code, an organization in the form of an LLC is liable for debts | No later than 4 months from the date of opening of the organization |

| JSC | The value of issued shares acquired by the founders | The management company determines the minimum amount of liability of the joint-stock company to shareholders | Before the end of 3 months - at least 50%, the remaining amount - until the end of the year |

| Unitary enterprise | The authorized capital is formed by cash, securities and property of the state or municipality | Funds or property transferred to the enterprise do not belong to the rights of ownership, but are transferred for responsible storage or management | Within 3 months from the date of registration of the enterprise |

The size of the minimum capital depends on the specifics of the organization’s activities. Contributions to the management company are allowed in various forms:

- Cash. The investment is made through an account opened with a bank. Deposits are provided in Russian rubles and foreign currencies, which are assessed at the conversion rate.

- Personal property. The decision to contribute property as a contribution is made by the founders at the general meeting. The value of the property is determined by market valuation. The amount is accepted in the amount determined by an independent appraiser.

- Securities owned by the founders.

- Non-monetary intangible assets owned by an individual. The value of an intangible asset accepted as a contribution is determined by the general meeting of founders. If the owner of the organization is one individual, the participant alone makes decisions on the asset.

The amount of the capital is actually funds received from the founders during the activity of the enterprise, returned after its liquidation.

An example of contributing part of a share with property. The founders, consisting of 2 individuals, decided to create a company with a capital of 10,000 rubles. Founder 1 contributed a sum of money in the amount of 5,000 rubles. The general meeting decided that founder 2 contributes 10% of the cost in cash, 90% in property (office equipment). The assessment showed the cost of the operating system in the amount of 12,000 rubles. The founder contributed 500 rubles in cash, and a contribution of property was made in the amount of 4,500 rubles.

Important! After the founder’s share is contributed in kind, the property becomes the property of the organization, unless otherwise specified in the agreement.

What is equity

In economic science and practice, there are two definitions of the essence of equity capital (SC):

- assets of an enterprise recorded without taking into account the obligations of the relevant entity;

- a set of indicators that make up the capital of an enterprise.

The approach based on the first definition is reflected in some legal acts. So, for example, in paragraph 3 of Art. 35 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ states that in banking and insurance organizations, as well as in non-state pension funds, equity capital is calculated instead of net assets. In paragraph 29 of the order of the Ministry of Agriculture of the Russian Federation dated January 20, 2005 No. 6, it is noted that the generally accepted understanding of the capital cost as the difference between the value of property and the company’s liabilities corresponds to the essence of the net value of property or net assets.

Thus, it is quite legitimate to consider the concepts of net assets and equity capital as interchangeable or as the same economic category, corresponding to the volume of a company's assets minus liabilities.

Now about the second definition of equity in the balance sheet - this concept (in accordance with another concept) contains a set of the following indicators:

- authorized, additional, and reserve capital;

- own shares purchased from shareholders;

- the firm's retained earnings;

- the result of the revaluation of the organization’s non-current assets.

It may be noted that these items correspond to lines 1310-1370 of the balance sheet.

Many experts consider this concept traditional. A similar approach is used not only in the Russian Federation, but also in other countries of the world (in this case, foreign economists may use indicators similar to those present in the lines of the Russian balance sheet).

The use of 1 or 2 approaches depends on the specific purpose of calculating equity capital. In particular, the company's management may be given a recommendation to use one or another method by investors, banks making decisions on loans, or the owners of the company. The choice of one approach or another may depend on the subjective preferences of management, the influence of a particular management or scientific school on the development of appropriate decisions by the company’s management.

The approach to defining the concept of equity capital is also predetermined by the traditions that have developed in the legal and expert environment of a particular state. In Russia, in principle, both approaches are common. We outlined possible factors for choosing 1 or 2 above.

Sources of formation of additional capital

Additional capital is created as an asset formed without obligations to third parties. The recreation center arises on the basis of its own funds. The asset increases the financial stability of the enterprise. The sources of additional capital formation are:

- Carrying out additional valuation of non-current assets (reflected as a separate line in the balance sheet).

- Share premium of joint stock companies received in connection with the revaluation of the nominal value of shares.

- Exchange rate difference that arose during the ruble valuation of funds contributed by the founders in foreign currency or during the recalculation of the value of assets. The positive difference is taken into account.

- VAT accrued on property contributed by the founders.

- Amounts received from the founders in excess of payment for the shares of the management company. The DC includes amounts exceeding the value of the founders' shares.

DC funds are allocated only for limited purposes determined by the founders and legislative norms.

What is included in equity capital on the balance sheet: calculation according to the Ministry of Finance

If we take into account that net assets are essentially equivalent to equity capital on the balance sheet, this will allow us to determine their essence based on the criteria given in Russian legal regulations. There are quite a lot of relevant documents. Among those that are most widely used is Order No. 84n of the Ministry of Finance of Russia dated August 28, 2014.

Read more about the provisions of Order No. 84n of the Ministry of Finance

.

In accordance with the method of the Ministry of Finance, the structure of assets accepted for calculating equity capital must contain absolutely all assets, with the exception of those that reflect the debt of the founders and shareholders for contributions to the authorized capital of the company.

In turn, obligations must also be taken into account, except for some future income, namely those associated with receiving assistance from the state, as well as the gratuitous receipt of this or that property.

Definition

The funds belonging to the organization constitute its own capital (SC). In other words, this is the value of all the company's assets paid for through its own efforts. The insurance company ensures the financial interests of the founders. Conventionally, it can be divided into 2 categories:

- initial capital in the form of contributions from participants;

- accumulated, which was formed as a result of conducting economic activities.

Initially, equity capital is formed from the authorized capital. Then the source of replenishment becomes the accumulated profit and gratuitously received funds. Dividends are paid to the founders at the expense of the insurance company. It is also distributed when the company’s activities cease, the participants receive their share as a percentage.

Which line of the balance sheet contains the equity indicator

Calculating equity capital in the balance sheet using the Ministry of Finance method is a procedure that involves using data from the following sections of the balance sheet:

- lines 1400 (long-term liabilities);

- lines 1500 (current liabilities);

- lines 1600 (assets).

Also, to calculate equity capital, you will need information showing the amount of debts of the founders of a business company (let’s agree to call them DOO), if any (they correspond to the debit balance of account 75 as of the reporting date), as well as deferred income, or DBP (account credit 98 ).

The structure of the formula by which net assets and at the same time equity capital in the balance sheet are determined is as follows. Necessary:

- Add the indicators along lines 1400, 1500.

- Subtract from the number obtained in paragraph 1 those that correspond to the credit of account 98 (for income in the form of assistance from the state and gratuitous receipt of property).

- Subtract the debit balance of account 75 from the number on line 1600.

- Subtract the result obtained in step 2 from the number obtained in step 3.

Thus, the formula for equity capital according to the Ministry of Finance will look like this:

Sk = (line 1600 - DUO) - ((line 1400 + line 1500) - DBP).

Formation of the organization's reserve capital

Reserve capital is a form of insurance that increases the guarantee of liability to third parties. The source of formation of reserve capital is the retained earnings of the enterprise. Less often, the source of creation of the Republic of Kazakhstan is the property of the founders. Contributions from founders in the form of property are not taxed, while the monetary form of replenishment of net assets is recognized as income. Reserve capital in an LLC may not be formed. There is no obligation to create an RK in the LLC Law. Contributions to the fund are made voluntarily, the amount is fixed in the Charter.

Unlike LLCs, joint stock companies are required to contribute to the fund an amount of at least 5% of net profit. The fund's funds accumulate over several periods. Organizations forced to use funds to cover losses or repurchase their own shares must cover the amount spent in the next period.

What is the optimal average equity capital

Net asset figures must be at least positive. The presence of negative equity values in the balance sheet of an enterprise is most likely a sign of significant problems in the business - mainly in terms of the credit burden, as well as the sufficiency of highly liquid assets.

Most often, the average value of equity capital for the year is used for assessment, which makes it possible to most accurately determine its fluctuations over time. The formula for calculating the indicator is:

Sk = (Sk at the beginning of the year + Sk at the end of the year) / 2.

The data is taken from the balance sheet for the relevant reporting periods.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital. This criterion is important primarily from the point of view of maintaining the investment attractiveness of the business. A business must pay for itself and ensure an influx of new capital. Sufficient equity capital is one of the most significant indicators of the quality of a company’s business model.

You can familiarize yourself with other approaches to assessing the quality indicators of a company’s business model in the article

“How to read a balance sheet (a practical example)?”

There is one more aspect to the importance of equity in the balance sheet. If we mean net assets by it, then it must be equal to or exceed the size of the authorized capital. Otherwise, the company, if it is an LLC, is subject to liquidation (Clause 4, Article 90 of the Civil Code of the Russian Federation). Or it will be necessary to increase the authorized capital of the LLC to the amount of net assets. A similar scenario is also possible in relation to JSC (subclause 2, clause 6, article 35 of Law No. 208-FZ).