In 2021, experts noticed an explosive increase in the number of requests to notaries for execution of writ of execution. Creditors clearly liked getting their money back without lengthy legal proceedings. So, what is a notary’s writ of execution on a loan agreement, how the inscription is made and the collection process, is it possible to cancel or challenge the notary’s actions.

According to data from the Federal Notary Chamber, if in 2017 notaries made more than 5 thousand writs of execution, then in less than 2021 the number of writs of writ of execution exceeded 19 thousand.

This rapid growth is very easy to explain. The writ of execution allows you to make the debt collection procedure very fast, simple and understandable. After all, the creditor does not need to waste time and money on litigation. It is enough to contact a notary, get an inscription, and then immediately go to the bailiffs, who will begin to work with the debtor, using all their tools, including writing off money from a bank account, seizing property, banning travel abroad, etc. Thus, a notary’s writ of execution is a good opportunity for the creditor to quickly return his money without allowing the debtor to take measures to hide any assets.

Executive inscription on the loan agreement

This tool has its own characteristics. And the notary will not have the right to make an executive inscription without taking into account these features.

Firstly, it is possible to obtain a writ of execution on a loan agreement only if the creditor’s claims are indisputable. That is why, according to the writ of execution, only the amount of the principal debt and accrued interest are usually collected. But if the creditor still wants to collect fines or penalties from the debtor, then he will have to go to court. And all because fines and penalties are no longer undisputed requirements. Here you can easily challenge the amount by reducing it or canceling it altogether.

Secondly, in order to receive a writ of execution on a loan agreement, it is necessary that it be notarized. That is, when concluding an agreement, the parties had to visit a notary and sign the document under his supervision. The absence of a notarization leaves the creditor with only one option - to go to court with a claim.

Thirdly, in order to receive an inscription on the loan agreement, it is necessary that no more than 2 years have passed since the delay.

Fourthly, 2 weeks before contacting a notary, the creditor must send the debtor a notice of the existence of a debt, as well as of his desire to apply for a writ of execution.

What conditions does the notary check before making an inscription?

Without going to court, you can recover the amount of the principal debt and the interest stipulated by the agreement. This procedure does not apply to fines and accrued penalties, since, according to the law, their amount can be challenged and reduced. The notary makes a writ of execution on a copy of the loan agreement, and a special mark is affixed to the original.

The creditor (claimant) must submit the following documents:

- a written application addressed to a notary with a request to make an inscription;

- personally signed calculation of debt on monetary obligations;

- copy of a warning letter about the existence of a debt, sent to the debtor no earlier than 2 weeks before contacting the notary;

- payment details of your bank account where the money should be transferred;

- postal receipt for sending the notification letter.

This is also important to know:

What is damages recovery and how does it happen?

The creditor has the right to apply for a notarial writ of execution within 2 years from the date on which the obligations were to be fulfilled. The loan agreement sometimes specifies a period (for example, to repay the debt after 12 months) or a condition upon the occurrence of which the money (property) must be returned to the lender. In this case, you must provide documents confirming the occurrence of the specified event.

The notary produces a writ of execution provided that the documents presented clearly confirm the validity of the creditor's claims against the debtor. It is also possible to recover pledged property in this manner if the pledge agreement includes an indication of the possibility of using an extrajudicial method of enforcement proceedings.

Which contracts are not covered?

The introduction of amendments to the OZN in July 2021 clearly defined which contractual documents cannot be subject to recovery based on a notary’s writ of execution. These are the agreements:

- with microfinance organizations;

- concluded before July 1, 2021, where there is no mention of the possibility of such collection.

Executive inscription on the loan agreement

Statistics show that at the moment 90% of all inscriptions are made on loan agreements concluded by banks with citizens.

The share of inscriptions on loan agreements concluded between individuals is, of course, growing, but it is still far from being comparable to banking. In general, all the features of making a writ of execution listed in the previous paragraph are also inherent in the credit relations of banks with the population, but they also have their own exclusive feature.

When concluding a loan agreement, banks do not need to contact a notary to certify the transaction. However, they must necessarily stipulate in the contract the possibility, in the event of a debt, of contacting a notary and subsequent collection of the debt by writ of execution.

This condition can be stated both in the contract itself and in an additional agreement. The main thing is that the borrower signs, agreeing with this right of the bank.

Documents for making an inscription

In order for the creditor to receive a notary’s writ of execution, he needs to collect a small package of documents.

If the creditor is a bank:

● Certification ● Document confirming authority ● Application ● Original loan agreement plus additional agreement, if the condition on the bank’s ability to contact a notary is indicated there ● Calculation of debt ● Notification of the defaulter about the presence of an overdue debt ● Document confirming the sending of a notice to the defaulter

If the creditor is an individual:

● Certification ● Application ● Original notarized loan agreement ● Calculation of debt ● Notification of the defaulter about the presence of an overdue debt ● Document confirming the sending of the notice to the defaulter

Basic Concepts

Citizens concluding a loan agreement between individuals are interested in whether this document needs to be certified? Of course, a simple written form and a receipt will be enough, however, if the loan agreement is not certified by a notary, the following difficulties may arise:

- If the debt is not paid, you will have to seek justice in court;

- The debtor may declare that he did not sign the documents - an examination will have to be carried out; a notarial agreement will eliminate this need;

- The collection procedure will take a long time;

- The risk of non-return of funds increases.

Notarization allows you to avoid such problems in a number of cases, however, it does not provide a 100% guarantee; it only protects the parties from dishonest fulfillment of obligations.

It is not difficult to certify a loan agreement at a notary office; just contact a notary and clarify the parameters of the agreement. The contract must specify the subject - a sum of money or property that is transferred to the borrower for temporary use. The return requirement is indicated, if necessary, the interest rate, and the validity period of the document.

This is also important to know:

How compensation for material damage occurs from an employee to an employer: detailed instructions

Although a loan agreement between individuals does not need to be certified, in a transaction completed by a notary’s writ of execution, collection will be facilitated, and the chances of evading payment will be much less.

SAMPLE sample application for execution of a notary's writ of execution.

Notary: _______________________

Claimant:______________________

STATEMENT

A notarized loan agreement No. 710-23 dated February 12, 2018 was concluded between A.A. Ivanov and S.S. Petrov. According to the terms of the agreement, the borrower S.S. Petrov was supposed to fulfill his obligations to repay the loan to A.A. Ivanov no later than May 12, 2018, but to date this has not been done.

The amount of debt in accordance with the agreement is 120,000 rubles, including 100,000 rubles for the principal amount, 20,000 rubles for interest on the use of funds. A calculation of the debt is attached to the application.

On August 20, 2018, the debtor Petrov S.S. was sent by registered mail a written notification of the existence of a debt and the intention to apply for a writ of execution, but by now the creditor Ivanov A.A. I didn't receive any response. Copies of the notice and receipt confirming the sending of the notice are attached to the application.

In accordance with Article 89-94 of the Law “Fundamentals of the Legislation of the Russian Federation on Notaries,” I ask you to make a writ of execution to collect the debt from the debtor in the amount of 120,000 rubles.

Attachments: 1. Original loan agreement 2. Calculation of the amount of debt 3. Notification of the defaulter about the presence of an overdue debt 4. Document confirming the sending of the notification to the defaulter

20.09.2018

Signature

Execution of writ of execution

The lender can contact any notary, regardless of the place of residence/location of the lender or borrower.

Having carefully examined the documents, the notary makes an executive inscription on a copy of the loan agreement. It must contain a number of important information. In particular, the notary must indicate his full name, place of inscription, and date.

Full details of the creditor/creditor must be provided. If we are talking about a legal entity, then accordingly you need to register the OGRN, INN, etc. In the case of an individual, it is enough to indicate the full name and place of residence.

A similar package of information should be available for the debtor. For an individual debtor, the notary, if he has the relevant information, should indicate passport details and place of work.

Next, the notary must indicate the period for which the collection is made, as well as information about the collateral property and the amount to be collected.

At the end, the notary indicates the special registration number of the inscription in the register, signs and seals.

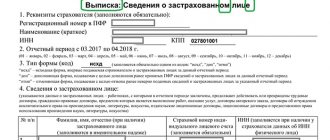

What does a notary's writ of execution contain?

The procedure for making notarial records is established by Law No. 4462-1 (on notaries), a joint letter of the FSSP (No. 00011/16/96020-AP) and the Federal Tax Service (No. 3815/01-01-2) dated 10/14/2016. In accordance with these documents, the writ of execution must contain the following information:

- Place and exact date (year, month, day) of the notarial act.

- Full information about the creditor: for an organization indicating the number in the Unified State Register of Legal Entities, INN; for an individual: full name, residential or location address.

- Information about the debtor. If this is a legal entity or entrepreneur, full details will be required: name, address, number in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, date and place of registration, TIN. For an individual: passport details, place of work and location (if known).

- Information about the property that must be transferred to the creditor, indicating its identification characteristics.

- Indication of the amount subject to indisputable collection plus the amount of expenses for making a notary's writ of execution, highlighting the amount of the notary fee.

- Designation of the period for which the debt is calculated.

- Full name of the notary, indication of the notarial district or office.

- Registration number of the entry in the register, personal signature of the notary, certified by his seal.

This is also important to know:

What are the statute of limitations for debt collection on loans?

If the subject of foreclosure is pledged property, then its initial sale price is additionally indicated. Within 3 days after the action is completed, the notary sends a postal notice to the debtor with acknowledgment of delivery. He is informed after the fact that a writ of execution has been made on the credit agreement (loan, pledge).

Debt collection under writ of execution

Having received the writ of execution, the claimants send it to the bailiffs.

According to Art. 12 of the Law “On Enforcement Proceedings”, a notary’s writ of execution is for bailiffs the same document as a judicial act or writ of execution. Find out here how to check the writ of execution in 3 ways? After this, the bailiffs begin to work with the debtor. Today their capabilities are very extensive. They can seize the debtor's property, write off money from his bank accounts, and send the debtor's employer a request to withhold 50% of his salary.

The bailiffs also have in stock such measures as a ban on foreign travel and restrictions on the right to drive a car.