This article is devoted to how to reflect a contract, that is, transactions under an assignment agreement in 1C using the example of the 1C: Accounting 8.3 configuration.

An assignment agreement is an assignment of the right to claim receivables, that is, simply put, the sale of such debt to another person. Typically, the debt is sold at a discount, resulting in a loss for the original creditor.

Legislative accounting of the assignment agreement is determined by:

- Civil Code of the Russian Federation - Articles 382-389 (refers to Chapter 24 - Change of persons in an obligation);

- PBU 9/99 – Income of the organization;

- PBU 19/02 – Financial investments – clause 8, clause 9;

- Tax Code of the Russian Federation - Art. 146, 155, 164, 268, 271, 279. When making a transaction between related parties, additional nuances are possible.

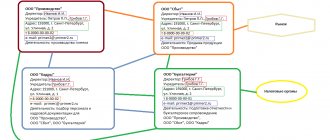

Let's consider an example: Organization A sold goods or provided services to organization B in the amount of 120,000 rubles, incl. VAT 20,000 rub. Not receiving payment when due, A sold this debt to organization C for RUB 110,000.

Terminology within the framework of a transaction under an assignment agreement:

- Organization A (original creditor) – Assignor ;

- Organization B (debtor) – Debtor ;

- Organization C (new creditor) – Assignee.

BU at the assignor

Dt 62 (balance according to B) 120000. Postings under the assignment agreement:

| Dt | CT | Sum | Operation |

| 76(C) | 91.01 | 110000 | Proceeds from the sale of the right to claim a debt |

| 91.02 | 62(B) | 120000 | Expenses for the debt sale operation |

| 51 | 76(C) | 110000 | Received a payment from the assignee on the account |

The loss on the operation will be 10,000 rubles.

If the assignor sold the debt for more than the original amount, then VAT would have to be charged on the excess amount, entry 91.02 - 68.02 VAT.

Note: VAT can only be charged on the sale of debt for VAT-taxable transactions. If the subject of the transaction is a loan agreement, VAT does not need to be charged even if the amount of the agreement exceeds the actual debt.

Civil law basics

The procedure for assigning the right of claim is regulated by Chapter 24 “Change of persons in an obligation” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

According to paragraph 1 of Article 382 of the Civil Code of the Russian Federation, a right (claim) belonging to the creditor on the basis of an obligation may be transferred by him to another person under a transaction (assignment of the claim) or may be transferred to another person on the basis of law. The assignment of a claim based on a transaction made in simple written or notarial form must be made in appropriate writing. In this case, an agreement on the assignment of a claim under a transaction requiring state registration must be registered in the manner established for the registration of this transaction, unless otherwise provided by law (Clause 2 of Article 389 of the Civil Code of the Russian Federation).