Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

https://youtu.be/A7VU8Oms8qk

Information for the document

The procedure for transferring debt to a third party is regulated by Articles 391 and 392 of the Civil Code of the Russian Federation. This procedure is possible only with the consent of the creditor and upon concluding an agreement on the transfer of debt (Article 389 of the Civil Code of the Russian Federation).

Features of document preparation

- Completed sample contract

- Contract form

- Contents of the debt transfer agreement

- Nuances of drawing up a debt transfer agreement

Contract form

There are no specific instructions for drawing up a money transfer agreement in legislative documents. However, there are well-established rules that it must meet.

The debt transfer agreement is drawn up in writing and must be in the same form as the main document stipulating the debt obligations. So, if this document was registered with the state registration service, then the agreement is subject to this procedure.

Important! If the contract is free of charge, this must be indicated in its terms. Otherwise, it will be considered remunerative (Article 423 of the Civil Code of the Russian Federation).

The agreement is drawn up in an official style without any emotional overtones. All data provided must be reliable and correspond to the information contained in the primary documents.

Contents of the debt transfer agreement

Like all formal contracts, this document should consist of several separate sections. Their number will be determined directly by its participants and depends on each individual situation.

Contract structure:

- a cap;

- subject of the contract;

- liability of the parties;

- dispute resolution;

- final provisions;

- legal addresses and details of the parties;

- signatures.

The header indicates the name of the agreement, the city and date of its conclusion, as well as the name and details of the parties who concluded it. It must be clearly stated who is the original debtor, who is the new debtor, and who is the creditor. If these are individuals, you must enter their names and passport information; if these are legal entities, you should also enter the positions of their representatives and indicate the documents on the basis of which they act.

Important! The names and titles mentioned in the contract must be written in full without abbreviations.

Basic information regarding the amount of debt and the procedure for transferring it to a third party is entered in the “Subject of the agreement” section. The amount of debt must be stated in both numerical and verbal format. The amount of interest on the debt, which is also payable, must also be included. This also confirms the fact of transfer of the main loan agreement to the new debtor.

Important! The amount of debt in the agreement is indicated as it was at the time of signing this document, and not the original loan amount.

The responsibility of the parties for non-fulfillment or improper fulfillment of the terms of the contract is determined directly by the participants in the procedure. Circumstances beyond the control of the parties, but which may lead to a violation of the terms (force majeure factors), must also be specified. It would be useful to determine the course of action of the parties in the event of the occurrence of this force majeure.

When determining how to resolve disputes, special emphasis should be placed on peaceful negotiations. And only if it is impossible to carry out such actions, the possibility of recourse to court should be provided.

In the final provisions, in accordance with the rules for drawing up official documents, the number of copies of the signed agreement is indicated.

Nuances of drawing up a debt transfer agreement

None of the sections of the agreement can contradict the norms of current legislation or infringe on the legitimate rights and interests of the parties. According to Article 392 of the Civil Code of the Russian Federation, a contract cannot include a condition prohibiting the debtor from raising objections to the creditor’s claims.

Important! An agreement drawn up in violation of the rights of one of the parties is considered initially void.

In addition to these sections, it is possible to include others. Thus, the possibility of changing the payment procedure, debt repayment schedule, etc. can be determined.

Compilation rules

The collection of the following documents will become an obligation when making debt transfer transactions:

Parties to the agreement

- written consent from the lender himself

- the translation agreement itself

The type of transaction under which the agreement is concluded determines the need for notarization.

The subject of this document is the transfer of existing responsibilities to another person. The main thing is to provide the most detailed description of this obligation, because of which the transferred debt arose. The following few points need to be taken into account:

- To prove the very fact of the existence of a debt, you can use not only the main agreement, but also any other documentation.

- Even an agreement in which the parties have determined the obligation, but forgot to indicate the total amount of the debt, will receive the status of a valid agreement from the courts.

- But mentioning only one size of obligations is not enough to recognize the validity of the agreement.

Judicial practice suggests that agreements on the transfer of debt are of a compensated nature. Especially if it is concluded between two organizations. And if they are commercial. Registration of a simple gift becomes a violation of the law in this case. In this case, the contract is not considered gratuitous if it does not indicate the cost of the obligation. The debtor must prove that he is not making a gift.

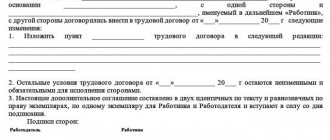

AGREEMENT No. __________ on debt transfer

_____________ "___"___________ 20___

___________________________________, hereinafter referred to as " Organization 1 ", represented by ____________________________________________________________, acting on the basis of ___________, on the one hand, ___________________________________________, hereinafter referred to as " Organization 2 ", represented by _____________________________________, acting on the basis ________, and ______________________________________________, hereinafter referred to as the “ Lender ”, represented by __________________________________________, acting on the basis of ___________________, hereinafter referred to as the Parties, have entered into this agreement as follows:

Subject of the agreement

1.1. “Organization 1” assumes the obligations of “Organization 2” under loan agreement No. ________ dated “___”___________ 20___, concluded between “Organization 2” and the “Lender”. The amount of debt at the time of signing this agreement is ___________.00 rubles. (_______________________________________________ rubles 00 kopecks), of which the amount of the principal debt is _________________.00 rubles. (______________________________ rubles 00 kopecks), the amount of interest due under the specified agreement is _______________.00 (______________________________ rubles 00 kopecks).

1.2. “Organization 2”, at the time of signing this agreement by the parties, transfers to “Organization 1” loan agreement No. ____________ dated “___”___________ 20___.

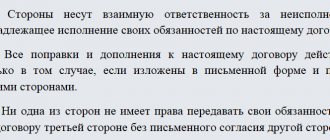

Responsibility of the parties

2.1. Each party is responsible for damage caused to the other party if it arose through its fault, as a result of non-fulfillment or improper fulfillment of contractual obligations.

2.2. The parties are released from liability if the damage is caused regardless of their will, i.e. due to force majeure.

2.3. Force majeure circumstances include such events as: war and hostilities, epidemics, fire, disasters, acts of government and management authorities affecting the fulfillment of obligations under the agreement, issued after the conclusion of this agreement, as well as other events recognized as indefinite force by law and business customs turnover.

Dispute Resolution

3.1. All disputes and disagreements that may arise in connection with the fulfillment by the parties of their obligations under this agreement will, if possible, be resolved through negotiations.

3.2. If the parties cannot reach agreement on a controversial issue, then the disagreements that arise are resolved in court.

Final provisions

4.1. This agreement comes into force from the moment it is signed by the parties.

4.2. This agreement is drawn up in 3 copies, one for each party, and each of them has equal legal force.

Legal addresses and details of the parties

Organization 1:

Organization 2:

Creditor

Signatures of the parties:

Download the document “Debt Transfer Agreement (tripartite)”

About the specifics of agreements

Trilateral agreements are considered before bilateral ones, even if the latter types were concluded earlier. Bilateral transactions do not have any influence on obligations under trilateral transactions.

Agreements between three parties are regulated in such a way that an agreement is only allowed between two parties, bypassing the third. Even if the original conditions undergo a major change.

Under normal conditions, termination of a contract is also only available if all parties have given their consent. In the energy supply sector, such documents are particularly common. The agreement is concluded between those who supply utilities, as well as subscribers and public authorities, to whom a number of functions are transferred.

Then the obligations under the contract are imposed on only one of the parties, which is the subscribers. The city administration has no such obligations. Therefore, utility services cannot involve her in the performance of duties and joint payment of debts incurred by the subscriber. But the other party is not exempt from fulfilling its duty, even if a third party takes part in the agreement. And if this third party agrees to assume part of the monetary obligations, the creditor can make claims against any of the debtors, the sequence is chosen by mutual agreement.

Top

Write your question in the form below

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Debt Transfer Agreement (tripartite)”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

What postings will the debtor need to make?

In the case of changes in debt, the original debtor's obligations, by agreement with the creditor, are completely terminated.

Now the unpaid amount belongs to the new debtor.

When the first debtor ships the goods to a new one, VAT obligations arise.

The following is a list of accounting entries:

- upon receipt of products from the creditor - Debit 41 Credit 60;

- VAT upon receipt of products – Debit 19 Credit 60;

- transfer of debt by a subsequent debtor – Debit 60 Credit 62;

- sending to a subsequent debtor – Debit 62 Credit 90;

- VAT on the day of dispatch of products – Debit 90 Credit 68;

- transfer of cost - Debit 90 Credit 41;

- profit – Debit 90 Credit 99;

- deduction of VAT on goods that were sent by the creditor – Debit 68 Credit 19.

The following are the postings for the second debtor:

- taking on a debt in relation to the creditor – Debit 60 Credit 76;

- debt payment – Debit 76 Credit 51;

- receipt of products from the first debtor – Debit 10 Credit 60;

- VAT on delivery – Debit 19 Credit 60;

- deduction of VAT on cargo delivered by the first debtor – Debit 68 Credit 19.

The agreement is drawn up according to the rules specified in the Civil Code for the transfer of debt between companies.

There is no detailed example of how to draw up a document. But from regulations and judicial practice one can draw conclusions about what points must be contained in the text in order for it to be considered valid.

Current debts in relation to the creditor are transferred to the subsequent debtor.

To properly formalize the agreement, it is necessary to obtain the consent of the lender.

back to menu ↑

Debt transfer agreement

Comments on the document “Debt transfer agreement (tripartite)”

Reply 0

| 5 Valentina | 09/03/2014 at 16:22:23 Thank you very much, it helped a lot |

Reply 0

| 5 HOPE | 10/29/2014 at 10:44:27 am reply to Valentin THANK YOU FOR HELPING... |

Reply 0

| 5 Daulet | 02/23/2015 at 08:19:32 Thank you! concisely and clearly developed |

Reply 0

| 5 Maria | 02/27/2015 at 15:24:18 Very helpful and on time!!! |

Reply 0

| Vera Vasilievna | 06/17/2015 at 09:07:03 Thanks a lot |

Reply 0

| 5 Irina | 07/25/2015 at 21:06:01 thank you very much for the agreement template |

Reply 0

| Lesya | 08/13/2015 at 07:21:22 Thank you, the information was helpful |

Reply 0

| Novel | 08/14/2015 at 10:57:49 Thank you, you helped. I needed just a short one |

Reply 0

| Catherine | 08/20/2015 at 11:47:13 short and to the point)) thank you |

Reply 0

| 5 Oleg | 08/20/2015 at 17:51:47 for the “primitive” man in the street - an excellent example |

Reply 0

| 5 Natalia | 09.25.2015 at 13:13:25 Thanks a lot for your help |

Reply 0

| 5 Maria | 10/02/2015 at 10:21:39 thanks for the help…… |

Reply 0

| Alikhan | 10/12/2015 at 19:48:11 Thank you very much for your help! |

Reply 0

| 5 Kate | 03.11.2015 at 16:01:00 Thank you! The agreement was useful |

Reply 0

| Aigul | 11/11/2015 at 07:14:35 thank you, you helped me a lot |

Reply 0

| Olga | 01/12/2016 at 10:54:28 helped thanks...... |

Reply 0

| Ainur | 01/14/2016 at 09:53:20 Thank you very much! |

Reply 0

| Lily | 01/23/2016 at 10:46:05 very helpful. Thank you! |

Reply 0

| Christina | 01/26/2016 at 15:11:51 Thank you. Suitable template. |

Reply 0

| 4 Denis | 01/28/2016 at 15:20:46 Thank you. The sample was useful. |

Reply 0

| 5 Aliya | 02/16/2016 at 13:56:54 Thank you very much for your help. Everything is clear and understandable |

Reply 0

| valentine | 03/22/2016 at 12:36:26 Thanks for the agreement! |

Reply 0

| Sergey | 03/22/2016 at 16:28:46 thanks for your help, all the best |

Reply 0

| Svyatoslav | 04/03/2016 at 22:36:56 Yes, it's useful. Thank you. |

Reply 0

| Mariana | 04/12/2016 at 06:26:06 the contract is not complete, the template is typical, quite acceptable Thank you |

Reply 0

| Seimon | 04/20/2016 at 19:34:31 a good basis for customization |

Reply 0

| Alexander | 04/29/2016 at 22:32:04 Thank you, it was useful, it’s hard to find such samples. |

Reply 0

| Natalia | 05/11/2016 at 14:46:09 Thank you very much for your help)))) |

Reply 0

| 5 Catherine | 06/27/2016 at 13:25:22 Just what was needed! Thank you! |

Reply 0

| Timofey | 07/14/2016 at 15:52:17 thanks for the sample contract |

Reply 0

| 5 Elena | 09/05/2016 at 06:22:24 very helpful!!! Thank you!!! |

Reply 0

| 4 Tatiana | 09/05/2016 at 18:52:06 I think this is what I was looking for |

Reply 0

| 5 Ekaterina Sergeevna | 10/26/2016 at 20:41:40 Thank you for the sample contracts, a very useful site. I will use it. |

Reply 0

| Tatiana | 10/27/2016 at 5:22:24 pm Thank you, simple and clear |

Reply 0

| YU | 02/17/2017 at 18:32:58 Yes thank you. Briefly and clearly |

Reply 0

| Svetlana | 04/11/2017 at 16:25:34 Thanks a lot. We found what we needed. |

Reply 0

| Olga | 07/27/2017 at 13:06:27 hello... can anyone tell me... how to consider a debt transfer agreement in a state institution? |

Reply 0

| Alexander | 09.28.2017 at 20:55:42 Thank you! A well-written document! |

Reply 0

| GALINAKE | 01/17/2018 at 17:53:15 Need urgent money? We can help! Are you having problems or are you in trouble right now? In this way, we give you the opportunity to develop new developments. As a rich man, I feel obligated to help people who are trying to give them a chance. Every person deserves a second chance, and as the government fails, they will have to come from others. No amount is too crazy for us and maturity is determined by mutual agreement. No surprises, no additional costs, but only the agreed amounts and nothing more. Please do not wait or comment on this post. Enter the amount you want to request and we will contact you with all the options. Contact us today at ( [email protected] ) Need urgent money? We can help! |

Reply 0

| Nina | 04/09/2018 at 16:33:19 Great sample! Everything is simple, clear and concise! Thank you very much! |

Reply 0

| Fringe | 05/31/2018 at 14:09:50 Thank you very much. Your sample helped me a lot! God bless you! |

Reply 0

| loan moore | 07/31/2018 at 09:26:51 Are you looking for an instant cash loan? Our company operates in accordance with clear, flexible, transparent and understandable terms. We offer very low interest rates due to the slowdown in economic activity (recession) in most countries around the world. You may have bad credit. Our company now offers affordable loans at interest rates, so do you need funds to grow your business? Or do you need money for personal purposes? Why not get in touch now as we offer personal and business loans with an interest rate of 2% for a maximum period of 30 years. Interested applicant can contact us by email now: [email protected] or WHATSAPP: +19292227999 |

Reply 0

| Larisa | 06/13/2019 at 14:44:41 Thank you very helpful |

Reply 0

| 5 Ruslan | 07/05/2019 at 08:30:11 helped thank you very much |

Reply 0

| Natalia | 05/19/2020 at 10:06:43 Thank you, it helped a lot |

Found documents on the topic “tripartite sample debt assignment agreement”

- Debt transfer agreement (tripartite) Debt, loan agreement → Debt transfer agreement (tripartite)

agreement No. on debt "" 20, hereinafter referred to as "organization 1", represented by ... - Sample. Agreement O assignment rights (addition to agreement about rent or leasing)

Lease agreement for property and equipment → Sample. Agreement on assignment of rights (addition to the rental or leasing agreement)addition no. to rental/leasing agreement dated "" 20, the agreement on the assignment of rights "" 20, hereinafter referred to as (namely...

- Sample. Agreement on assignment of claim debt on credit agreement

Agreement on assignment of right of claim → Sample. Agreement on assignment of debt claims under a loan agreementcontract no. assignment of claims "" 20 commercial bank, hereinafter referred to as (name of the bank) "bank" in the literal sense...

- Sample. Agreement on assignment of claim debt on credit agreement (cessions)

Agreement on assignment of right of claim → Sample. Agreement on the assignment of debt claims under a loan agreement (assignment)contract of assignment of claim (cession) no. "" 20 KB, hereinafter referred to as the assignor, represented by the chairman ...

- Agreement compensated assignments rights to administer the domain name DOMEN.RU

Agreement on the assignment of the right of claim → Agreement on the paid assignment of the right to administer the domain name DOMEN.RUAgreement No. for a paid assignment of the right to administer the domain name domain.ru Russian Federation city “”2…

- Sample. Agreement about translation debt

Debt and loan agreement → Sample. Debt transfer agreement...agreed: "" 20 (name of the creditor organization) (position, full name) (signature, seal) agreement no. on the transfer of debt "" 20, hereinafter referred to as (name of organization) "organization", represented by, ...

- Trilateral agreement supplies (leasing)

Agreement for the supply of goods, products → Tripartite supply agreement (leasing)supply contract of the contract ) (date of conclusion of the contract ), hereinafter referred to as ...

- Agreement construction contract (trilateral)

Construction contract, construction contract → Construction contract (tripartite)contract date and place of signing, hereinafter referred to as “customer”, represented by , acting on the basis of...

- Agreement equipment leasing (trilateral)

Leasing agreement, agreement → Equipment leasing agreement (tripartite)agreement No. date and place of signing (name or full name), hereinafter referred to as “lessor”, represented by (position, name...

- Trilateral agreement contract for the construction of real estate (with the participation of two customers and one contractor)

Construction contract, construction contract → Tripartite contract contract for the construction of real estate (with the participation of two customers and one contractor)a tripartite agreement for the construction of a real estate project (with the participation of two customers and one contractor)…

- Trilateral agreement contract for the construction of real estate (with the participation of two customers and one contractor)

Construction contract, construction contract → Tripartite contract contract for the construction of real estate (with the participation of two customers and one contractor)contract agreement for the construction of a real estate property in the city of ""20. ...

- Sample. Statement of claim for recovery of amount debt, penalties and interest for the use of other people's funds in connection with non-fulfillment agreement (contract) for the supply of products

Statements of claim, complaints, petitions, claims → Sample. Statement of claim for recovery of the amount of debt, penalties and interest for the use of someone else's funds in connection with non-fulfillment of the agreement (contract) for the supply of products... an application for collection of the amount of debt , penalties and interest for the use of someone else's funds in connection with the failure to fulfill an agreement (contract) for the supply of products "" 20 year by an arbitration court in a claim against (name of plaintiff) (name of response...

- Agreement about translation debt By agreement delivery of goods

Agreement on the assignment of the right of claim → Agreement on the transfer of debt under a contract for the supply of goodsagreement No. on the transfer of debt under agreement No. dated "" 20, "" 20 ...

- Agreement about translation debt By agreement delivery of goods

Agreement on the assignment of the right of claim → Agreement on the transfer of debt under a contract for the supply of goodsAgreement No. on the transfer of debt under agreement No. dated "" 20, "" 20...

- Debt and loan

agreement Debt and loan agreement

Information about the parties to the agreement

The agreement specifies detailed information about the parties: full names of organizations, actual and legal addresses, OGRN, INN, KPP, as well as bank details in the case of non-cash debt repayment.

The parties must attach the necessary documents about the enterprise, incl. licenses and certificates.

Article 389 of the Civil Code of the Russian Federation states that it is necessary to adhere to the same form of agreement as in the initial transaction. If, when signing the initial agreement, the agreement was notarized, then the agreement on the transfer of debt must also be concluded with the involvement of a notary.

https://youtu.be/PknRxV7nlwU

Related documents

- Agreement of assignment (assignment of the right of claim)

- Debt forgiveness agreement

- Loan agreement (microloan)

- Loan agreement (interest-free) with an employee

- Interest-free loan agreement

- Sample. Commercial loan agreement

- Sample. Trade credit agreement

- Letter of guarantee

- Letter of guarantee (form)

- Agreement on the temporary use of foreign currency (annex to the Moscow government decree No. 962 dated October 19, 1993)

- Targeted loan agreement. Agreement on a targeted loan to a customer of scientific and technical products

- Targeted loan agreement. Agreement with the contractor on a targeted loan for scientific and technical products

- Additional agreement to the loan agreement between a legal entity and the institution of a savings bank of the Russian Federation

- Agreement on the bank's participation in the authorized funds

- Foreign currency loan agreement (with collateral in rubles)

- Agreement on credit financing of leasing

- Inter-farm loan agreement

- Agreement on a targeted loan to a customer of scientific and technical products

- Agreement with the contractor on a targeted loan for the supply of scientific and technical products

- Financing (investment) agreement

- Application from an individual borrower for a loan

- Executive inscription

- Loan agreement

- Loan agreement (without collateral)

- Loan agreement (with collateral in foreign currency)