What is the report for?

A material report is a document that allows you to control and track the movement of construction materials, namely their receipt and consumption.

The materials taken into account can include any type of building products: bricks, concrete, paints, cement, nails, tiles, etc. Among other things, the form includes those types of materials with which no actions are taken during the period of compiling the report - this allows you to take into account all inventory items in the warehouse without exception and make the report more complete and informative.

Application of material report

Since the material report reflects the movement of construction materials, it includes all materials, even those for which there were no receipts or expenses. To confirm the receipts and expenses indicated in the report, the financially responsible person submits along with the report all the primary documents - invoices, receipt and expenditure orders, demand invoices, limit receipt statements, etc. The material report allows you to estimate the costs of materials, so it is used for their analysis.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What you need to do to create a correct report

The procedure for generating a document includes a number of specific operations.

- First of all, the organization carries out an inventory and, based on its results, information about the balance of inventory items, or rather their quantity and value, is entered into the report. The date of the report must be identical to the date of the inventory activities.

- Next, the report displays those materials that remained in the warehouse based on previously completed primary documentation, such as: checks, applications, receipts, invoices, receipts, expenditure orders, etc.

- After this, the report includes all inventory items sold to consumers (for each buyer separately) - here their total quantity and amount are calculated. And finally, information is entered about those resources that remained in the warehouse premises of the enterprise at the end of the reporting period in fact.

- After all the necessary information has been entered into the document form, the report is submitted for reconciliation to all interested departments of the organization, and then to the accounting department.

- The accountant also checks the report and fills out its second table, entering data about the materials - their name, product number, unit of measurement, etc.

Sample of filling out material report m 19 – Legal assistance from a lawyer

To prepare a material report you must:

- Carry out an inventory at the enterprise and, based on its results, enter the remaining inventory items into the report form (quantity and cost). The date of the report should be considered the date of the inventory.

- Display the balances of material resources based on primary documents (invoices, checks, applications, etc.)

- Indicate all resources allocated to customers, separately for each consumer. Calculate their total amount and quantity.

- Calculate and fill in data on the actual balances of material resources in the company's warehouses at the end of the reporting period.

The material report is verified with all departments of the enterprise and transferred to the accounting department for further verification.

- Carry out an inventory at the enterprise and, based on its results, enter the remaining inventory items into the report form (quantity and cost).

The date of the report should be considered the date of the inventory.

- Display the balances of material resources based on primary documents (invoices, checks, applications, etc.)

- Indicate all resources allocated to customers, separately for each consumer.

- Name of materials and their brief characteristics;

- Unit of measurement of inventory items;

- Number of inventory items in the organization;

- Registration prices for each type of materials;

- Balance of materials at the beginning of the period;

- Receipt and consumption of inventory items during the specified period.

Attention

Form M-19p ¬ ¦Code¦ Form according to OKUD ¦0315000¦ according to OKYLP¦¦ (name of organization)L APPROVED (position, signature) (full name) » » g.

MATERIAL REPORT for 200 By structural unit Financially responsible person List of appendices to the report T ¬ ¦By receipt¦By expense¦ TTTT ¦ group number ¦Quantity¦ number¦ group number ¦Quantity¦ number¦ of material or ¦documents¦primary ¦material or ¦documents¦ primary ¦ ¦nomenclature¦¦documents¦nomenclature¦¦documents ¦ ¦number¦¦¦number¦¦¦ ¦1¦2¦3¦4¦5¦6¦ ¦¦¦¦¦¦¦ ¦¦¦¦ ¦¦¦ ¦¦¦¦¦¦¦ ¦¦¦¦¦¦¦ L Total documents accepted (in numbers)(in words) Documents handed over (position)(signature)(initials, surname) Documents accepted (position)(signature)(initials) , surname) » » g.

Material report

The material assets report must be reconciled in other divisions of the company, and after that it must be transferred to the accounting department, where it is also checked.

As a rule, the reporting period is one calendar month. Next, you need to enter data on material assets that are contained in the company’s primary documents, such as checks, invoices, applications, and so on. It is necessary to indicate all materials released from the warehouse to customers, each individually and the totality of materials, their quantity and total cost.

Home / Economic law / Material report on balances and movement of materials sample filling

To correctly fill out the MX-20 report form, you must provide the following information in this document:

- Carry out an inventory at the enterprise and, based on its results, enter the remaining inventory items into the report form (quantity and cost).

Attention

INFORMATION ABOUT MOVEMENT TTTTTT ¬ ¦Nomencla-¦Name- ¦ Unit ¦for¦Remaining¦Received¦ Spent ¦ ¦tour ¦vaniæ¦measurement¦unit, ¦on T ¦number¦material¦¦rub.¦beginning ¦quantity- ¦amount, ¦on¦ ¦¦¦¦¦month ¦quality¦rub. ¦ production¦ ¦¦¦¦¦¦¦

T ¦¦¦¦¦¦¦¦quantity, ¦ ¦¦¦¦¦¦¦¦quality ¦ rub.

¦ ¦1¦2¦3¦4¦5¦6¦7¦8¦9¦ ¦¦¦¦¦¦¦¦¦¦ ¦¦¦¦¦¦¦¦¦¦ ¦¦¦¦¦¦¦¦¦¦ ¦¦¦¦¦¦¦¦¦¦ ¦¦¦¦¦¦¦¦¦¦ ¦¦¦¦¦¦¦¦¦¦ 3rd page T ¬ ¦and released¦Balance¦ ¦¦at the end of the month¦ TTT ¦ Including by objects¦ For other purposes¦Total¦ count- ¦amount, ¦ TTTTTTT quality ¦ rub.¦ ¦quantity- ¦amount,¦quantity- ¦amount,¦quantity- ¦amount,¦quantity¦amount,¦quantity ¦amount, ¦¦¦ ¦quality¦ rub.

¦quality¦ rub. ¦quality¦ rub. ¦¦ rub.

Rules for drawing up a material report and its sample

Today, in order to fill out a material report, organizations can choose one of two options: their own document template approved in the accounting policy of the enterprise, or a unified form in the M-19 form, developed at the legislative level and recommended for use. In this case, the second option is preferable, since you do not need to think about the structure and content of the document - all the necessary columns and rows are already included in the standard form.

Filling out the title page

The first step is to enter information into the report on the title page. This includes:

- name of the object (warehouse), the inventory of which is subject to accounting in this document,

- surname of the financially responsible person,

- reporting period,

- date of filling out the form,

- Applications are immediately indicated - the number of incoming and outgoing documents.

At the top of the title page on the left and right there are lines for endorsement by persons authorized to check the report: the accountant and the head of the structural unit.

Filling out the second page of Form M-19

On the second page of form M-19 there is a table in which the following are entered in order:

Completing the third page

Here the table shows:

- balance at the beginning of the period (quantity and amount of materials to be accounted for)

- information on the movement of materials: how much was spent and released for production, including by facility, and for other needs,

- how much was released in total,

- balance at the end of the period.

Rules for preparing a report on form M-19

The preparation of the report begins with the choice of the form in which it will be carried out. At the moment, the organization has the opportunity to independently create forms of primary documentation, which is the material report. Since our article is still tied to a specific form, we will tell you about the rules for preparing a report on form M-19.

Important ! You should fill out Form M-19 by hand (in legible and understandable handwriting) or using office equipment. The material report is generated in a single copy, and then, if necessary, copied.

Filling always begins with the design of the title page. To know what details should be filled in, see the table below.

Important ! On the title page, in the upper right and upper left corners, blank spaces are left for affixing inspectors’ visas. They can be the head of the department and the chief accountant.

Next, you should move on to filling out the table. See below for details that need to be filled out. The third page is filled out by the accountant. What data he enters there is shown in the following table.

| Report preparation stage | Information that is included in the report at this stage |

| Title page design | Data of the object whose inventory items are subject to accounting; MOL data; Report period; Date of completion of form M-19; Number of attached documents (receipt and expense certificates). |

| Filling out the tabular part of the second page | Nomenclature number of goods and materials; Name of goods and materials; Cost of one unit of material; Unit of measurement of inventory items; Quantity of inventory items; Total cost. |

| Filling out the third page of Form M-19 by an accountant | Initial balance (quantity and amount of inventory items); Receipt and consumption of goods for the reporting period; The total amount of inventory items issued; Remainder. |

Report formatting rules

The form can be filled out by hand (if it is printed) or on the computer (much faster and more convenient). The report is generated in one copy, and if necessary, copies are made.

The document must contain the signatures of all persons responsible for its preparation, including the financially responsible employee and accountant.

Today there is no strict need to certify a document using the organization’s seal, because from 2020, legal entities have the right to use stamps in their work only when this norm is enshrined in their internal accounting policies.

Using the material report, you will be able to see the turnover of the account(s) you have selected and its analytics separately for each corresponding account and analytics in the context of all subaccounts and analytics of the selected account(s). In addition, it displays the total turnover and balance at the beginning and end of the period.

The material report can be called in two ways:

•Selecting the menu item “Reports | Material report". In this case, the program will prompt you to specify report parameters. There you can also specify the account or account template for which the report will be generated. The program will select all accounts that match the template. When making a selection, you can use the select button. When entering a list of accounts, put ; (semicolon) then the substituted account will be added to the list, otherwise it will simply replace the last account in the list. If the field is left empty, then the material report will be calculated for all accounts (you will get a checkerboard pattern).

•From the turnover sheet and turnover according to analytics. So you can configure these parameters using the Settings button in the report selection dialog.

If the selected account(s) has subaccounts, then they will be displayed up to the level to which the chart of accounts is expanded, specified in the material report settings. You can move on to subaccounts further, depending on the option Group disclosure method: either by clicking on the button or on the button to the left of the account. The difference in these methods of expanding groups is whether the remaining lines of the report will be hidden when expanding subaccounts or not.

If the Expand chart of accounts option is set to No groups, all subaccounts of the selected account(s) will be displayed in a “flat” form.

If the selected account(s) have dimensions, you will be prompted to specify the order in which the dimensions are detailed in the report. Turnovers by analysts will be grouped in the same way as subaccounts in the specified order. To enter the next analytics you will need to click or on the left. But the Expand chart of accounts option will also work for dimensions.

All of the above applies to corresponding accounts and analysts. Depending on the Expand chart of accounts option, offsetting accounts and dimensions may be collapsed. Then, to view their revolutions, you will need to press , or, from the keyboard, +<+> (plus). Accounts and analytics can be expanded to a certain level. The expanded account column will also contain subcolumns with its subaccounts or dimensions. And if the option Totals for correspondent accounts is enabled, then the Total column. The No groups option disables the grouping of corresponding accounts and all of them will be displayed in a “flat” form.

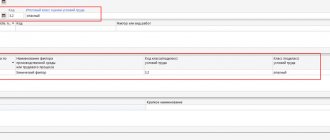

The material report form is a table. The following columns will appear in the table:

•Account code with analysts;

•Depending on the choice of displaying names in the table settings in the menu item “Service | Settings" the program will display the name of the account or analytics;

•Original balance (depends on the section of the balance of the account(s) for which the report is calculated)

•Debit turnover for each of the corresponding accounts or analytics

•Total debit turnover

•Credit turnover for each of the corresponding accounts or analytics

•Total credit turnover

•Final balance (depends on the section of the balance of the account(s) for which the report is calculated)

Depending on the report settings and the presence of revolutions, some columns may be missing.

Example:

To view analytics for 41 accounts, click the <+> icon in the column name of this account. The Select Analytics dialog will appear, in which you can specify, say, a warehouse or product. In accordance with the selected parameter, a material report will be generated either by goods or by warehouse.

For analytics with total accounting and accounts, total turnovers and balances are shown. For analytics with quantitative-cumulative accounting, turnover and balances are shown: in total terms, in units of measurement (for example, in pieces), the average price per unit is displayed. To select the mode for displaying quantitative and total turnover in the report for analysts who have quantitative and total accounting, the Show in report option is provided. It has the following options:

•Amounts and quantity—includes display of quantitative and total turnover by analysts.

•Amounts only—disables the display of quantitative turnover for analysts that have quantitative-amount accounting or additional accounting.

•If you select Only quantity, the report will include only accounts with quantitative-cumulative accounting and only quantitative turnovers and balances on these accounts.

The last row of the table shows the total amount of turnover for each of the corresponding accounts and in general, as well as the balance at the end of the period for the account (the sum of account balances).

When viewing a material report, you can get a card of the movement of funds for each amount, account or analytics object of interest. This can be done either using the key (and for accounts with or using the combination +), or by left-clicking on the selected cell.

The material report has the ability to quickly summarize numbers in table cells. To do this, simply select the required cells, and their sum will appear at the bottom left.

See also Accounting and tax reports Setting up a material report

Material report

A material report is a document that is used only in construction organizations in cases where the financially responsible person is the immediate supervisor or the work performer. The material report has a specialized form M-19, adopted by the legislation of the Russian Federation.

The material report displays all calculations of the consumption and receipt of materials at the enterprise. If there were no movements for certain materials during the reporting period, they should still be included in the material report to display complete information regarding the quantity of warehouse materials.

Several stages of filling out a material report:

- Carrying out inventory at the enterprise. The balances obtained as a result of the inventory must be recorded in the report and expressed in both quantitative and monetary terms. In this case, the date of preparation of the material report should be the date of the inventory.

- Next, you need to display the remaining material resources. The basis for entering this information into the report should be primary documents (applications, invoices, checks and other documents that are accepted at this enterprise for carrying out such operations).

- Display all resources that were released to customers in the reporting period for each consumer separately. For this purpose, the M-19 tabular form has special columns that are convenient for filling out. It is also necessary to display their general summary expression (quantitative and cost).

- Next, it is necessary to calculate the actual balances of material resources in all warehouses of the enterprise at the end of the reporting period. To do this, from the total amount of balances of material resources at the beginning of the period, you should subtract the expense for the given period and add the income.

- The report must be verified with all adjacent workshops that are located in the enterprise and only after that it must be transferred to the accounting department for further verification.

The material report is not a mandatory document and is compiled only at the discretion of departments or economic councils. The preparation of a document in form M-19 is carried out by an authorized person who is financially responsible, as well as an accounting employee who is responsible for reconciling the displayed indicators.

Which form to use

Today, organizations have the right to choose the form and procedure for filling out the primary accounting document (clause 4, article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

Order of the Ministry of Finance No. 119n provides a sample product report form. In addition, the State Statistics Committee Resolution No. 132 of December 25, 1998 approved the unified form TORG-29. You can use any of them, or you can independently develop a product report form that meets the specifics of the organization’s activities.

The decision to use one form or another must be approved in a local regulatory act of the company (for example, an order from the manager). It is also advisable to describe the reporting procedure of the financially responsible person.

Material report sample form

The material record is kept in companies focused on the construction industry, if there is a person who is financially responsible for the work carried out by the company, or the direct manager of the company himself.

As an exception, this document is sometimes used in other organizations that are in no way related to the construction industry.

The use or non-use of this type of reporting is established by the internal accounting policies of the organization.

Let's look at some of the features of this document.

Contents of the material report

A special authorized employee of the organization or an accountant of the organization is responsible for the preparation of this reporting documentation. The document has an accepted, unchangeable form that must be followed by the person preparing the report.

The report contains information on the ratio of received and spent material resources. Sometimes in the activities of an organization it turns out that during the reporting period there are no movements of any materials, but according to the rule they must still be recorded in the reporting document in order to fully express information about the volume of materials stored in warehouse premises.

First of all, when drawing up reporting documentation, it is necessary to indicate the name of the organization, its full information data, the date when the document was drawn up, the name of the unit, full name. official who bears financial responsibility.

Algorithm of actions required to compile a material report

- Firstly, it is necessary to conduct an audit and inventory in the organization, and based on its results, record the remaining inventory in a document (volume and price). The time for drawing up the report is usually considered to be the time of implementation of the inventory and audit.

- Secondly, it is necessary to record the balance of the material base in accordance with the primary documents (invoices, checks, applications, etc.)

- Thirdly, display the available resources transferred to consumers separately for each person and organization. Calculate their total amount and volume.

- Fourthly, find out and write information about the actual balances of material resources in the organization’s warehouses at the end of the reporting period.

As a result, the compiled material report is correlated with the existing divisions in the organization and sent to the accounting department for the next reconciliation.

The organization's accountant generates table number two of the report and records data on materials (names, numbers, quantity, cost, balance at the beginning of the month, movement, balance at the end of the month).

Any material report of the organization is created every month in a single copy.

Below is a standard sample and a material report form, a version of which can be downloaded for free.

Material report. Form N M-19p

Form M-19p ———¬ ¦ Code ¦ +——-+ Form according to OKUD ¦0315000¦ +——-+ ________________________________________________ according to OKULP ¦ ¦ (name of organization) L——— I APPROVED _____________________ ___________________ (position, signature) (F. I.O.) “___”__________ _____ MATERIAL REPORT for _______________ 200__

By structural unit _________________________________ Financially responsible person_________________________________ List of appendices to the report___________________________————————————-T————————————¦ By income ¦ By expense ¦+——— ——T———-T———-+—————T———-T————+¦ group number ¦Quantity¦ numbers ¦ group number ¦Quantity¦ numbers ¦of material or ¦documents¦ primary "material" or "documents" primary "nomenclature" —+———-+————+¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦+—————+———-+———-+—————+—— —-+————+¦ ¦ ¦ ¦ ¦ ¦ ¦+—————+———-+———-+—————+———-+————+¦ ¦ ¦ ¦ ¦ ¦ ¦+—————+———-+———-+—————+———-+————+¦ ¦ ¦ ¦ ¦ ¦ ¦+———— —+———-+———-+—————+———-+————+¦ ¦ ¦ ¦ ¦ ¦ ¦L—————+———-+——— -+—————+———-+———— Total documents accepted _____________________ ________________________ (in numbers) (in words) Documents submitted __________________ __________________ __________________ (position) (signature) (initials, surname) Documents accepted ________________ __________________ __________________ ( position) (signature) (initials, surname) “___”__________ _____ g.

2nd page TRAFFIC INFORMATION

———-T———T———T———T——-T—————T—————¦Nomencla-¦Name- ¦ Unit ¦ for ¦Remaining¦ Received ¦ Spent ¦ ¦ tour ¦ measurement unit, ¦ by +——T——-+—————+¦ number ¦material¦ ¦ rub. ¦beginning ¦of ¦amount, ¦for ¦¦ ¦ ¦ ¦ ¦month ¦quality¦ rub. ¦ production ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ +——-T——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦quantity ¦amount, ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ quality ¦ rub. ¦+———+———+———+———+——-+——+——-+——-+——-+¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦+———+———+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+— ——+———+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+— ——+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+— ——+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+———+— ——+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+———+———+— —-+——+——-+——-+———

3rd page

—————————————————————————T—————¦and released ¦ Balance ¦¦ ¦at the end of the month¦+————— —————————T——————T—————+——-T——-+¦ Including by objects ¦ For other purposes ¦ Total ¦ amount, ¦ +——T——T——T——T——T——+———-T——+——T——-+quality ¦ rub. RUB. ¦quality¦ rub. ¦quality¦ rub. ¦ ¦ rub. ¦quality¦ rub. ¦ ¦ ¦+——+——+——+——+——+——+———-+——+——+——-+——-+——-+¦ 10 ¦ 11 ¦ 12¦ 13¦ 14¦ 15¦ 16¦ 17¦ 18¦ 19¦ 20¦ 21¦+——+——+——+——+——+——+———-+——+——+ ——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+——+——+——+———-+— —+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+——+——+——+— ——-+——+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+——+—— +——+———-+——+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+ ——+——+——+———-+——+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦L——+— —+——+——+——+——+———-+——+——+——-+——-+———

Loose-leaf

TRAFFIC INFORMATION

———-T———T———T———T——-T—————T—————¦Nomencla-¦Name- ¦ Unit ¦ for ¦Remaining¦ Received ¦ Spent ¦ ¦ tour ¦ measurement ¦ unit, ¦ by +——T——-+—————+¦ number ¦material¦ ¦ rub. ¦beginning ¦of ¦amount, ¦for ¦¦ ¦ ¦ ¦ ¦month ¦quality¦ rub. ¦ production ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ +——-T——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ quantity, ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ quality ¦ rub. ¦+———+———+———+———+——-+——+——-+——-+——-+¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦+———+———+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+— ——+———+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+— ——+———+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+— ——+———+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+———+— ——+——-+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+———+———+———+———+— —-+——+——-+——-+———

2-page loose leaf

—————————————————————————T—————¦and released ¦ Balance ¦¦ ¦at the end of the month¦+————— —————————T——————T—————+——-T——-+¦ Including by objects ¦ For other purposes ¦ Total ¦ amount, ¦ +——T——T——T——T——T——+———-T——+——T——-+quality ¦ rub. RUB. ¦quality¦ rub. ¦quality¦ rub. ¦ ¦ rub. ¦quality¦ rub. ¦ ¦ ¦+——+——+——+——+——+——+———-+——+——+——-+——-+——-+¦ 10 ¦ 11 ¦ 12¦ 13¦ 14¦ 15¦ 16¦ 17¦ 18¦ 19¦ 20¦ 21¦+——+——+——+——+——+——+———-+——+——+ ——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+——+——+——+———-+— —+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+——+——+——+— ——-+——+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+——+—— +——+———-+——+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦+——+——+——+ ——+——+——+———-+——+——+——-+——-+——-+¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦L——+— —+——+——+——+——+———-+——+——+——-+——-+——— The report was drawn up __________________ ___________________ _________________ (position) (signature) (F. I.O.) The report was checked by __________________ ___________________ _________________ (position) (signature) (Full name)

Source: https://readydoc.ru/obrazec/Otchet/Materialnyj_otchet_Forma_N_M-19p

Report on the movement of inventory items in storage areas MX-20

Accounting for inventory items (inventory assets) in the places where they are stored or located is carried out by filling out special documentation - a report on the movement of inventory items. Filling out the act is drawn up according to form MX-20. The report is compiled for a certain period. The finished document is sent to the accounting department. The act reflects information regarding the expenditure of inventory items, their receipt and storage. The document is maintained according to the OKUD 033520 classifier and has a unified format. Such forms should be available at any enterprise, organization or institution. They fill out the acts with data about inventory items, their movement, and receipt. To compile the report, invoices are used - receipts and expenses, as well as acts of acceptance and delivery, invoices, etc. How to fill out a report on the movement of inventory items When filling out forms on the movement of inventory items, it is important to indicate data on capital items received, consumption of inventory items, and indicate balances in stock. The act must include the following information: • name of inventory items for each type with a description of their characteristics; • quantity in the corresponding inventory units – meters, liters, kilograms, units; • price; • balances for the specified period of time; • total balance and cost of inventory for the specified reporting period; • volume of consumed inventory and materials for the period specified in the act; • volume of accepted goods and materials for the reporting period. Forms for reporting the movement of inventory items are traditionally filled out by an accountant or a trusted representative.

| Downloads | Size |

| 5.94 kb |

What is a receipt?

When conducting an audit, a special commission is created. The members of which can be accounting employees and other specialists of the organization.

https://www.youtube.com/watch?v=ytadvertiseru

The composition of the audit commission is approved by the Order to conduct an audit or inventory. Before the start of the audit, MOL provides the audit commission with a special receipt.

The MOL receipt shows that before the inventory, the documents received for the MC were submitted to the accounting department.

The received assets have been capitalized, and the unusable ones have been written off as expenses. The receipt is signed by MOL and his position is indicated in it. It is attached to the inventory documents.

You can additionally read about how the inventory is carried out and what the role of the MOL is in this, how the receipt is drawn up, here.