What is a waybill and why is it needed?

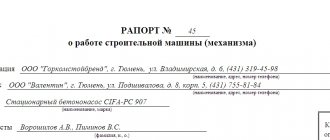

A waybill is a form that confirms the driver’s right to use a vehicle and serves to record and control the operation of the vehicle and the driver. According to paragraph 2 of Art. 6 of the Law “Charter of Motor Transport and Urban Ground Electric Transport” dated November 8, 2007 No. 259-FZ, it is prohibited to use a vehicle without issuing a waybill.

The form of the waybill was approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78, but it is not mandatory (see information from the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012). Starting from 01/01/2013, taxpayers have the right to develop their own form of waybill in accordance with the requirements of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, as well as provided that this document reflects the details established by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152, which include:

- name and number of the waybill;

- validity;

- information about the owner of the vehicle, namely: information about the name, address, telephone number and OGRN;

- information about the vehicle, including the date and time of pre-trip (or pre-shift) technical inspection;

- driver information.

Find out about the latest requirements for mandatory details of waybills from the materials:

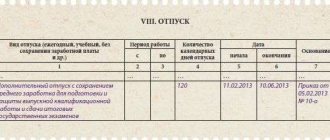

For taxpayers who do not belong to the category of motor transport enterprises, a waybill is issued for every day or for another period not exceeding 1 month (see also letter of the Ministry of Finance of the Russian Federation dated November 30, 2012 No. 03-03-07/51). Motor transport enterprises are required to issue waybills daily, with the exception in this case of a business trip.

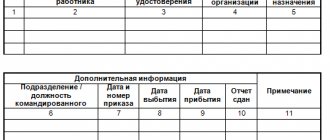

Requirements for filling out the journal

Form No. 8 is a journal whose title page states the name of the company, its status and period of coverage. The journal itself is a table in which information about all waybills issued by the company is entered. Even if any of them is incorrectly filled out and damaged, it is attached to the journal with the mark “Spoiled,” and its number must be entered in general chronological order in the journal.

Like many registration books, the journal has continuous numbering of sheets, is stitched, certified by the signature of the head and the seal of the organization (if there is one). Responsibility for filling out the document and the accuracy of the information in it rests with the employee assigned to perform this work by order of management or in accordance with job responsibilities. Travel log, form 8, can be downloaded below. It looks like this:

All fields of this form are required to be filled out. They reflect in chronological order information about the license plate number, date of issue, full name of the driver to whom it was issued and his confirming signature. When returning a waybill, a note is made on the date of its return and confirmed by the signature of the dispatcher, who accepts the sheet and passes it on to the accountant for processing. The accountant also confirms the transfer of vouchers with a signature on receipt.

Shelf life of the waybill

To date, the storage period for the waybill is established by the following documents:

- by order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152;

- by order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558.

The order of the Ministry of Transport of the Russian Federation clearly states that the waybill must be stored for at least 5 years (clause 18), that is, at the request of the organization, this period can be increased. And if with the first order everything is extremely clear and simple, then with the order of the Ministry of Culture things are different.

Firstly, it stipulates that the storage period for the waybill is 5 years, subject to an inspection or audit by the regulatory authority during this period (Article 842 of the list of documents). Based on this, we can conclude that if no inspection has been carried out within 5 years, then the organization does not have the right to write off waybills. Secondly, the order of the Ministry of Culture stipulates that if the waybill is the only document confirming the harmfulness, danger, and severity of work, then its shelf life increases to 75 years.

For information on the storage periods for other documents given in Order No. 558, read the article “Storage period for accounting documents in an organization .

Due to the fact that the waybill is a primary document, its storage period is also regulated by:

- Tax Code of the Russian Federation, namely sub. 5 paragraph 3 art. 24;

- Law No. 402-FZ, namely Art. 29.

The Tax Code states that the storage period is at least 4 years, and according to the law on accounting, as well as by order of the Ministry of Transport of the Russian Federation, the storage period for a waybill is at least 5 years.

For what storage period is set for an invoice, see the material “What is the storage period for invoices? ”

The minimum shelf life of a waybill in an organization is 5 years, but do not forget that there are some situations when the shelf life of a waybill is significantly extended.

For information on how long it is necessary to store cash documents, see the material “What is the shelf life of cash documents? ”

Results

The minimum shelf life of a waybill in an organization is 5 years, but do not forget that there are some situations when the shelf life of a waybill is significantly extended.

For information on how long it is necessary to store cash documents, see the material “What is the shelf life of cash documents? ”

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

- Order of the Ministry of Culture of Russia dated August 25, 2010 N 558

- order of Rosarkhiv dated December 20, 2019 N 236

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Nuances of storing waybills

It is recommended to use a separate logbook for waybills, and create a separate directory for storage. Depending on how large the enterprise is and what services it provides, the importance of this document will depend. If an organization directly provides transport services and provides its drivers exclusively with work cars, then waybills from simple local pieces of paper turn into almost the main labor document, according to which it is possible to keep track of spent budget resources.

Don't miss: the main article of the month from a practical expert

All rules and terms for storing personnel documents in a visual cheat sheet.

According to legislative acts, waybills can be located together with other shipping documents or contained in a separate form, but they must be easily accessible to the responsible person if a quick check is implied or a re-accounting of used budget funds is required.

How to issue waybills to document used fuel and lubricants

The laws on joint stock companies and LLCs contain a list of documents that must be kept (,). In particular, these are primary documents, accounting registers and financial statements.

The forms should be recorded in a special registration journal. It must be maintained by all legal entities and private owners who operate cars.

At the end of 2020, only changes from 2020 are taken into account and no new ones have appeared yet. First, it is worth saying that there are a large number of forms that differ depending on the type of car and its owner - LLC or individual entrepreneur.

If the traffic police inspector is not provided with the form, the driver faces a fine of 500 to 3,000 rubles (Article 12.3 of the Code of Administrative Offenses of the Russian Federation).

Storage periods for waybills

Nowadays, the storage periods for waybills are specified in two regulatory and legal government acts: order of the Ministry of Culture of the Russian Federation No. 558 and order of the Ministry of Transport of the Russian Federation No. 152. These documents indicate that waybills at enterprises must be stored for 5 years from the date of preparation and use , but, according to the personal preference of the manager, this period can be extended.

True, no questions arise if you are guided solely by the order of the Ministry of Transport. The resolution of the Ministry of Culture indicates that waybills must be stored for 5 years, provided that during this period the enterprise undergoes an audit. If no inspection was carried out by government agencies, then even after the expiration of the 5-year period, these documents cannot be sent for disposal.

Fine for lack of waybill / Legal Advice

The minimum period for storing a voucher in the archive is 5 years, but pay attention to other moments when these periods are extended. For example, before the commission is held or within 75 years, if at the enterprise this is the only document used as confirmation of harmful and dangerous working conditions for employees. How to properly store and record this type of document in the archive? We will answer these and other questions in this article for accounting.

In accordance with the Code of Administrative Offenses (CAO), punishment cannot be imposed if more than 3 months have passed since the discovery of the administrative offense committed. This does not apply to the so-called “continuing offences”, but they tend to be a significant minority.

Add to favoritesSend by email The storage period for travel documents is established by several regulations. Read our article about how long a waybill should be kept in an organization and what nuances exist for storing this document.

Also, the basis for registering a violation is an incorrect waybill. It is considered to be drawn up in violation if:

- there is no signature or stamp of a medical worker confirming the medical examination. In this case, the physician must have the appropriate permission;

- there is no mark of the person monitoring the technical condition of the vehicle. This person is not just a mechanic at the enterprise, but a specialist with the appropriate qualifications (professional education in the specialty “Maintenance and repair of motor vehicles” or vocational training with the qualification “Inspector of the technical condition of motor vehicles”);

- the basic details of the DP are not filled in;

- there is no signature and stamp of the owner (tenant) of the vehicle and others.

Do I need to store damaged travel documents?

Situations often occur when a driver or any other employee of an enterprise may intentionally or accidentally damage a waybill while performing work duties. But under no circumstances should such documents be thrown away; canceled or deteriorated sheets of accounting for used resources and transport should be stored in a separate folder until the appropriate check is carried out by government agencies.

Early destruction of damaged waybills can only take place with the written permission of the immediate director of the enterprise, who agrees to assume possible responsibility for the disposal of deteriorated documentation. The disposal itself is carried out after drawing up a write-off act, signed by members of the inspection commission.

What waybills have the right to be stored at the enterprise?

In the modern world, there are a huge number of companies, one way or another, in need of their own or hired transport. For such institutions, a certain classification of waybills is provided, which can be used and stored in the archive after use in work:

- waybills for special vehicles (all available vehicles present in the organization’s fleet are taken into account);

- passenger taxi waybills (indicates the number of own cars used by hired taxi drivers);

- waybills for buses (transport for civil and transport transportation);

- waybills for non-public buses (buses for personal use);

- waybills for trucks (piecework and non-piecework).

The use and storage of waybills is intended for enterprises of any form of ownership, if they have their own vehicle.

New filling rules

When filling out vouchers, owners or owners of vehicles can use standard approved forms or vouchers of their own form. But any waybill must contain a number of mandatory data :

- name and number of the voucher;

- validity;

- by owner or owner of the vehicle;

- by TS;

- by driver.

There are some differences when issuing vouchers by different business entities.

Individual entrepreneur

An individual entrepreneur, as the owner or possessor of a vehicle, indicates all the required information on the waybill. Last name, first name, patronymic, address, telephone number, OGRIP number are entered in the field about the owner (owner) of the vehicle.

If the entrepreneur himself is the driver of this vehicle, then his full name is also entered in the driver data section. Also, the individual entrepreneur or his authorized persons records and certifies the dates, times and odometer readings when the vehicle leaves the parking lot and returns. If the individual entrepreneur is also a driver, then this information does not need to be certified; he simply enters it into the trip ticket.

For more information about the waybill for individual entrepreneurs, see the video below.

Entity

When filling out a voucher for a vehicle owned or owned by a legal entity, all the required information specified above is also provided. In the section about the owner (possessor) of the vehicle, indicate the name, legal form, location, telephone number, OGRN of the legal entity.

Dates, times and odometer readings when a vehicle leaves the parking lot and enters back are marked and certified by officials appointed by the management of the enterprise.

Individual

If the vehicle belongs to an individual who carries out transportation for his own purposes, then a voucher is not required: regulations regulate the issuance of travel vouchers only for individual entrepreneurs and legal entities .

If an individual transports goods, passengers and luggage accepted in the prescribed manner under contracts of carriage or charter, then a voucher is required. In this case, the legislator sees a clear commercial orientation of such transportation, and the individual must legitimize his activities in one way or another:

- register as an individual entrepreneur and issue vouchers accordingly;

- enter into contractual relations with another individual entrepreneur or legal entity and issue vouchers in the manner established for these organizational and legal forms of economic activity.

Taxi

Waybills are a mandatory document for taxi cars with all the required details listed above filled in. A special feature of a taxi voucher is a field for entering information about the revenue for the transportation performed, indicating the amount charged for landings.

The number of passenger boardings is indicated in a special column. There is also a field for the amount of revenue deposited by the driver at the cash desk. The amount of funds deposited is confirmed by the signature of the cashier and accountant. If during the shift there were premature returns to the parking lot, delays on calls, downtime, then their duration and time of occurrence are included in the ticket with justification of the reasons.

Form No. 4 (passenger taxi) has been developed as a unified form of voucher for use in taxis .

Additional information on taxi waybills is provided below.

Freight car

For trucks, the issuance of a waybill is mandatory in all cases of operation - during commercial transportation, transportation of goods for one’s own needs, hauling, movement for repairs, etc. All mandatory items of the waybill are filled out, and it is also mandatory to undergo pre-trip / pre-shift inspection of the technical condition of the vehicle at any departure from the park, as well as pre-trip and (for transportation of dangerous goods) post-trip medical examination.

Unified options for vouchers are form No. 4-S (for trucks with piecework payment to drivers) and form No. 4-P (for freight vehicles with time-based payment to drivers), as well as form No. 4-PG (for individual entrepreneurs’ trucks).

A car

For passenger cars, issuance of a voucher is mandatory in cases of transporting goods or passengers. Even if a passenger car transports at least one passenger or cargo for the organization’s own needs, it must undergo pre-trip or pre-shift control with data entered into the waybill.

The type of waybill according to form No. 3 (passenger vehicles) is actively used by various organizations, because in the case of operating a passenger car, a waybill is necessary to account for and confirm the expenses of the enterprise, costs for fuel and lubricants and fuel, and payroll calculations.

Buses of public and other (non-public) use

Public buses include vehicles operating on city, suburban and intercity routes. Waybill forms in Form No. 6 are used to record and confirm the company’s expenses, costs of fuel and lubricants, and calculation of wages for drivers.

Form No. 6-special is intended for non-public buses used by owners or owners, for example, for transporting their own employees or for one-time transportation under a contract. This voucher contains a customer coupon - it indicates the tariff, the amount of work performed and the total amount to be paid.

Any voucher for public and non-public buses must have fields for marking pre-trip/pre-shift control and pre-trip/post-trip medical examination of drivers.

Special equipment, self-propelled vehicles, excavator, fire truck, truck crane

Waybills for special equipment, self-propelled vehicles, excavators, truck cranes, emergency vehicles are issued in accordance with regulations indicating all mandatory details .

Some differences relate only to the pre-trip medical examination of drivers of emergency vehicles (fire trucks, medical vehicles, police, special services) - they undergo a medical examination before the start of the shift, and not immediately before leaving the parking lot.

For special types of vehicles, a unified form, Form No. 3-special, has been developed, which has tear-off sheets - coupons for the customer indicating the operating time of the vehicle and the amount of payment for the work performed.

Form No. 3 for a passenger car

Form No. 3-SPEC for special vehicles

Form No. 4 for passenger taxi

Form No. 4-P for a truck with time-based payment to drivers

Form No. 4-C for a truck with piecework payment to drivers

Form No. 6 for buses of other use

Form No. 6 for public buses

In general, travel vouchers are necessary for calculating wages for an employee, recording work time and downtime when performing a task, fuel consumption, etc. It should also be noted that when filling out a travel voucher for an automobile crane, there is an important feature.

In the universal form No. 3-special or in your own form, the permits must necessarily describe and highlight in a special font the safety rules for crane drivers, for example, “It is prohibited to start work without the permission (signature) of the person responsible for the safe performance of work on moving cargo.” , “Before starting work, check the functionality of the crane in accordance with the instructions” or “Working under a power line is prohibited!”

How long to keep waybills in the organization

A waybill is a strict reporting form that displays basic information about the vehicle and driver, its validity period, and the owner of the vehicle.

If the company has a vehicle in operation on its balance sheet, then filling out the voucher is mandatory. Each document is assigned a serial number and is recorded in the accounting journal.

Vouchers carried out by the accounting department are subject to storage. The question often arises: “How long are waybills kept in an organization?” We find the answer in several legislative acts at once:

- Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 “On approval of mandatory details and the procedure for filling out waybills”;

- Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 “On approval of the “List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods”;

- Tax Code of the Russian Federation;

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

Order of the Ministry of Transport No. 152 defines a period of at least 5 years. Based on the above wording, a company can destroy documentation older than this period if its internal regulations do not establish a longer storage period.

Administrative liability for violation of the work and rest schedule of drivers

The provisions of Order No. 558 of the Ministry of Culture are not so clear. On the one hand, a time period of 5 years is also established. But this is provided that an inspection or audit is carried out at the enterprise during this time. If there was none, then the documents cannot be destroyed. However, if the waybill is the only document confirming difficult, harmful or dangerous working conditions, it will have to be stored for much longer - 75 years.

Subclause 5, clause 3, art. 24 of the Tax Code of the Russian Federation obliges the organization to store waybills for at least 4 years, since this document is used in calculating taxes. Article 29 No. 402-FZ defines this period as 5 years. Moreover, the countdown begins after the end of the reporting period.

Based on the above, the company is obliged to store vouchers for at least 5 years. If we are talking about dangerous, harmful production or work in difficult working conditions, then the period increases significantly - up to 75 years.

Registration in 1C

The waybill is the most important document for monitoring and recording the operation of the vehicle and the driver. For accounting and tax purposes, the voucher confirms the costs of paying the driver and fuel. In 1C programs, waybills are not automatically calculated and issued; with the help of other tools, costs for fuel and lubricants are accounted for :

- According to advance reports (issuance of cash to an accountable person - preparation of an advance report - return of cash to the cash desk - write-off of costs for fuel and lubricants).

- By coupons (purchase of coupons - issuance of coupons - accounting for used coupons - writing off costs for fuel and lubricants).

- For fuel cards (posting a fuel card - posting gasoline received through a fuel card - writing off fuel and lubricant costs).

The final write-off of gasoline and other fuels and lubricants is documented in the same way for all fuel and lubricants accounting options using the “Requirement-waybill” document.

What is a waybill

This is a form of primary documentation confirming the driver’s right to drive a designated vehicle for a specified period of time and travel with it from the territory of the enterprise. The permit is used to record and control the work of the car and the driver.

The form of the document was officially developed by the State Statistics Committee of Russia, but starting from 2013, the enterprise has the right to independently develop its own voucher, reflecting the mandatory and required details required by the Ministry of Transport of the Russian Federation.

If an enterprise does not carry out passenger and cargo transportation, it has the right to issue a document for a period of no less than one day and no more than 30 calendar days.

Need a magazine

In order to control the movement of waybills at the enterprise, you need to make entries in the appropriate journal. It, in particular, reflects the fact of issuing sectional waybills to drivers (clause 17 of section III of Order of the Ministry of Transport dated September 18, 2008 No. 152).

Typically, organizations and entrepreneurs use a unified form - Form No. 8, approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. However, if the company has such a need, then you can develop your own form. This is not prohibited by law.

Organizations of all forms of ownership, as well as individual entrepreneurs, must issue waybills. These entities must use transport to transport people and goods (luggage) for business purposes and for their own needs.

It happens that errors creep into the accounting log. The mistake made must be corrected according to the general rules (clause 7, article 9 of the Federal Law of December 6, 2011 No. 402-FZ):

- cross out an incorrect entry with one line so that it remains readable;

- make an o and indicate the correct entry;

- indicate the date the corrections were made;

- sign and full name of the employee responsible for maintaining the travel log book

Logbook for the movement of waybills: how to use them

The law obliges firms and entrepreneurs using vehicles of various categories in their activities to issue drivers waybills (PL) - documents giving the right to operate them. It records information about the route, fuel remaining and movement, speedometer readings, features of the work process (for example, the number of load lifts), time of departure to work and arrival at the garage. Large and motor transport enterprises practice daily issuance of waybills. Small organizations whose activities are not related to motor transport can issue a waybill for drivers for up to 1 month. But, no matter what the frequency of issuing vouchers, they must be recorded in the submarine’s logbook.

How long to store

Now let's talk about storing waybills. The period during which the company must ensure their safety is 5 years (clause 18 of section III of Order of the Ministry of Transport dated September 18, 2008 No. 152).

The retention period for the waybill is 5 years, subject to inspection or revision by the regulatory authority during this period. Based on this, we can conclude that if no inspection has been carried out within 5 years, then the organization does not have the right to write off waybills. You also need to understand that if the waybill is the only document confirming the harmfulness, danger, and severity of work, then its shelf life increases to 75 years.

However, the legislation does not establish a special procedure for storing these documents.

Waybills need to be stitched. This can be done using a stapler, thread or special equipment. The main thing is that after stitching it is possible to easily familiarize yourself with the documents and, if necessary, make copies. The company can take as a basis the instructions from the order of the Federal Archive of December 23, 2009 No. 76 and GOST R 7.0.8-2013 and arrange the storage of waybills according to the recommended rules.

Basic design rules

A waybill should be issued for each vehicle that the organization uses in its activities. This applies equally to both the company’s own transport and rented cars.

In addition, a waybill is also issued if the employee uses his own car for business purposes. To receive compensation for the use of their own vehicles, an employee, among other documents, must submit waybills to the accounting department. This is stated in the letter of the Ministry of Taxes and Taxes of Russia dated July 2, 2004 No. 04-2-06/419.

Usually a waybill is issued for only one day or shift. After the end of the working day, a properly executed waybill is submitted to the organization’s accounting department. The accountant must file it in a special folder and store it for at least five years.

It is not recommended to issue a waybill for a week or a month. An exception is the case when the driver goes on a business trip, the duration of which exceeds one day (shift). However, there are precedents when judges sided with organizations that drew up waybills once a month. As an example, we can cite the resolution of the Federal Antimonopoly Service of the North-Western District dated 04/05/04 in case No. A56–22408/03. True, in this decision the judges noted that drawing up a waybill not per day or per shift, but for a longer period of time is possible if the waybill is not the basis for calculating wages for drivers, but is intended primarily to record operations related to transportation, and registration of transactions with third parties.

The Main Financial Department now also adheres to the point of view that the waybill “can be issued with such regularity that on its basis it is possible to judge the validity of the expenditure made.” In other words, officials believe that it will not be considered a violation if the organization can organize the recording of time worked by the driver and fuel consumed using waybills issued not for every day, but for a longer period (letter of the Ministry of Finance of Russia dated March 16, 2006 No. 03-03 -04/2/77).

For those who prepare travel documents using a unified form, we would like to remind you that there should be no blank details in it. Responsibility for correctly filling out the waybill lies with the head of the organization, as well as those persons who are responsible for operating the vehicle and who participate in filling out this document. If the waybill is drawn up with violations, then it is impossible to include the costs of purchasing fuel as expenses for profit tax purposes.