- Questions about land tax

- Land tax legislation

- Cadastral value of a plot of land in the Moscow region

- Tax rates for household plots and dacha plots in the Moscow region

- How is land tax calculated?

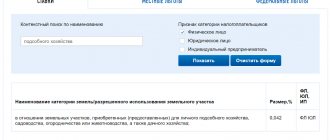

- clarify the cadastral value of land

- check the tax rate for your area

- What tax benefits are there for land owners?

- How to reduce land tax

- How to check tax calculations for your area

- PS About tax increases

Tax notice on land tax to plot owners

A Tax Notice containing calculations (recalculations) for the tax on land near Moscow, coupled with calculations for other property taxes of individuals, is sent by regular letter from the city of Mytishchi (index 141020) or by registered mail (“Mytishchi-DTI”). When looking at the tax amounts, some people have questions, while others begin to get really hysterical. Why such a tax? Why has the tax on my piece of land increased so much? How was the tax on the site calculated? Where did this data come from? Why was the tax significantly different last year? Is it possible to reduce the amount of this tax? Maybe I have at least some benefits? In general, who will pay such a land tax?

Legislative framework for land tax for individuals in the Moscow region

Please note that we are talking about the tax on land ownership in the Moscow region, and not about the income tax arising from purchase and sale transactions of land plots .

Land tax is a local tax regulated by the Tax Code of the Russian Federation (Chapter 31), laws of the Moscow region and regulations of local deputies. Tax payers are organizations and individuals owning land plots. The following applies only to plots of land owned by individuals and located in the Moscow region

.

Every year, the Tax Service assesses land taxes for the previous calendar year and sends tax notices to land owners for payment. The tax base is determined by the cadastral value of the land plot. In 2013, a global revaluation of the cadastral value of lands near Moscow was carried out. The cadastral value of land plots has increased significantly. Sometimes several times. The results of the state cadastral valuation (revaluation of value) of plots were approved by the Orders of the Ministry of Ecology and Natural Resources Management of the Moscow Region dated November 27, 2013: No. 566-RM (land plots as part of the lands of settlements in the region); No. 564-RM (lands of horticultural, gardening and dacha associations); No. 563-RM (agricultural land). The new value of land near Moscow has become the basis for calculating tax since 2014. In addition, since 2014, in some areas of the region, the land tax rate for household plots and summer cottages has increased significantly. Thus, since 2014, due to an increase in the tax rate with a simultaneous increase in the cadastral value, the land tax has increased “out of this world” (that is, astronomically)

. However, if you carefully study the resolutions of local deputies, you can find one very interesting benefit on personal land plots in some areas of the Moscow region.

Who are the tax payers?

Land tax in the Moscow region is paid by legal entities and individuals. The following categories of Russians are required to make contributions:

- citizens who own a land plot (hereinafter referred to as the land plot) by right of ownership;

- individuals who own the land according to established inheritance;

- citizens who have established unlimited use of memory.

If a Russian rents a territory or exploits it for urgent free use, then he does not have to pay land tax in the Moscow region. These responsibilities are assigned by the state to the owners of the site. Citizens who have federal and local benefits must still make payments, taking into account preferences.

- Determining the region by mobile phone number using an online service, directory or USSD request

- 6 ways to combat neck wrinkles

- Who will not be affected by raising the retirement age in Russia - news

Object of taxation

According to the provisions of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the object of taxation when calculating and paying land contributions is considered to be any plot belonging to a municipal entity that has established its own rate for the allotment. The following territories are not subject to contributions:

- withdrawn from official circulation;

- occupied by cultural, archaeological sites, nature reserves, which are a national treasure and are under the protection of Russian and international organizations;

- belonging to the water and forest fund of the Russian Federation;

- located under residential multi-apartment buildings.

How is land tax calculated?

When calculating the tax on a land plot, the following formula is used: N = K * C * M/12

, where

- K

is the cadastral value of the plot at the beginning of the year (as of January 1). Since 2014, updated data from the regional land cadastre have been used in the Moscow region. - C

- tax rate The rate depends on the category of land (purpose of the site) and location. In most districts of the Moscow region, for plots of land intended for personal subsidiary farming (garden plots), summer cottage farming, gardening, vegetable gardening, as well as land for agricultural use, the tax rate has been set at 0.3 percent since 2014. - M

- number of months of land ownership

The final tax amount depends on the share of land rights and the amount of tax benefits for the owner of the land. Payment of land tax is made in full by October 1 of the following year.

An example of calculating the Moscow region land tax

You own a plot of 15 acres, which is located in one of the settlements of the Balashikha district (Balashikha urban district) of the Moscow region. Let's calculate the tax on this land plot for 2014. The cadastral value of the plot is 7,561,950 rubles. The cost can be found on the Rosreestr website. It turns out that the so-called The market value of one hundred square meters of land is 504,130 rubles. All that remains is to wish great luck to these “professionals” who carried out the state assessment in selling the plot at such a price. The purpose of the land is for personal farming. The purpose of the land plot is indicated in the certificate of ownership of the plot. The tax rate is 0.3 percent. We find the rate on the Tax Service website. You owned the entire plot throughout 2014. Share – 100%. Number of months – 12. The amount of tax excluding benefits is equal to 22,685.85 rubles (N = 7,561,950 (K) * 0.3% (C) * 12 (M)/12). If you have a large family or are a pensioner who has lived in residential premises on this site for more than ten years, you have benefits in the amount of 50% of the tax amount. You can find out about the benefits on the Tax Service website. The final amount of land tax, taking into account the benefits, will be two times less - 11,342.93 rubles

.

Land tax for pensioners in 2021, benefits for pensioners on land tax

In 2021, there are federal land tax benefits for all pensioners in Russia - providing a deduction of 5 acres. If a pensioner has only 5 acres of land, then he does not need to pay tax. If it is more, then the tax is calculated taking into account other federal and regional benefits, as well as the coefficient for land in a particular locality. You can find out more on the website nalog.ru.

Hello, Yuri Petrovich. In many regions, Chernobyl liquidators enjoyed the benefit of complete exemption from land tax. From the beginning of 2021, all pensioners enjoy this benefit on land tax: deduction from the tax base - 5 acres. If you have a summer cottage plot of up to 5 acres, then you do not have to pay tax at all.

This is interesting: Seizure of Property Exceeding the Amount of Debt

Cadastral value of a land plot in the Moscow region

The Land Code of the Russian Federation (Article 66) determines that the cadastral value of land plots is established based on the results of the State cadastral valuation of land, carried out in accordance with the law on valuation activities. The cadastral value of a land plot at the time of assessment is equal to its market value

. The average level of cadastral value of land in the regions of the region is approved by the executive authorities of the Moscow region. State cadastral valuation of lands in the Moscow region is carried out no more than once every three years and no less than once every five years. Thus, the next revaluation of lands near Moscow will be in 2021 - 2021.

The cadastral value of a plot is equal to the area of the plot, measured in square meters, multiplied by the specific indicator of the cadastral value (UCV) of the land plot, expressed in rubles per sq.m. UPKS is determined by appraisers during the State assessment of lands in the Moscow region. The area of the plot is taken from cadastral registration data. If your plot is not registered, then its cadastral value is not determined and, accordingly, there is no land tax. Let us remind you that one hundred square meters is equal to one hundred square meters. Accordingly, six acres is 600 sq.m. land, and 15 acres - 1,500 sq.m. For two closely located plots of land, one of which has an area of 6 acres, the other 12 acres, it is logical to assume that the cadastral value of the smaller plot should be exactly half the value of the second. Accordingly, the land tax on a six-hundred-acre plot should be exactly two times less than the tax on a twelve-hundred-acre plot of land. However, the results of the revaluation of lands near Moscow show that this is not always the case.

Where to find the cadastral value of a land plot

The cadastral value of your plot of land, if it is registered, is easy to find using reference information on real estate objects online on the official website of Rosreestr.

How to find out the tax rate for a land plot

Land tax rates are set by local authorities. In contrast to the tax rates on residential buildings, the land rate in most of the Moscow region is the same (0.3 percent). There are areas where lower rates are applied in some places - 0.1%, 0.15%, 0.2%. The Ramensky district is striking in its great diversity, where various rural settlements use many “non-round” tax rates on household plots, for example, 0.07%, 0.12%, 0.13%, 0.14%, 0.15%, 0 .16%, 0.17%, 0.19%, 0.29%. Almost all information about the current land tax rates in the Moscow region can be found on the official website of the Federal Tax Service in the section “Reference information on rates and benefits for property taxes.”

Where to find out about land tax benefits

Current information on local and federal land tax benefits is contained on the official website of the Tax Service (www.nalog.ru) in the section on reference information on property tax benefits.

Land tax in the Moscow region in 2021

The Moscow Region has 36 districts. Local authorities, 20 of them, have set the maximum rate for payment of ZN - 0.3%. In other settlements the payment amount is reduced. Owners of Mytishchi garden plots pay a tax of 0.15%, residents of Kashira, Lyubertsy, Kotelnichesky districts - 0.2%. In other territories, the amount of tax deductions varies from maximum values (0.3%) to minimum (0.13 in the Kolomna district).

- Molasses - what it is and what to replace it with. How to make sugar molasses at home - recipes with photos

- Removal of a polyp of the cervical canal: operations

- Kombucha: how to grow from scratch

In which regions of the Moscow Region does the reduced rate apply?

In many districts of the Moscow region, local legislators have established a reduced amount of payments for the use of landfills. The value of ZN is given in this table:

| District name | Payments for land intended for the construction of residential buildings, % | Payments for land used for breeding animals, gardening and horticulture, % | Payments for land plots used for personal farming, % |

| Dolgoprudny | 0.2 | 0,25 | — |

| Domodedovo | 0.15 | 0,15 | — |

| Yegoryevsk | 0,3 | 0,15 | — |

| Ivanteevka | 0,25 | 0,2 | 0,25 |

| Istra | 0,2 | 0,2 | — |

| Kashira | 0,2 | 0,2 | — |

| Kolomna | 0,2 | 0,13 | 0,2 |

| Kotelniki | 0,2 | 0,2 | — |

| Lobnya | 0,25 | 0,2 | — |

| Lyubertsy | 0,2 | 0,3 | 0,2 |

| Mytishchi | 0,3 | 0,15 | — |

| Podolsk | 0,2 | 0,2 | 0,2 |

| Pushchino | 0,3 | 0,22 | 0,22 |

| Reutov | 0,1 | — | — |

| Stupino | 0,25 | 0,3 | 0,25 |

| Khimki | 0,2 | 0,2 | 0,2 |

Tax benefits for land plots in the Moscow region

Veterans, disabled people and some other categories of citizens have benefits at the federal level. This benefit reduces the tax base for land tax by 10 thousand rubles. With a tax rate of 0.3 percent - this is!!! as much as 30 rubles. The list of beneficiaries is determined by paragraph 5 of Article 391 of the Tax Code. It includes, in particular: veterans, disabled people, Chernobyl victims, heroes of Russia. However, at the local legislative level, pensioners and other preferential categories of landowners are, as a rule, provided with significant land tax benefits. In addition to beneficiaries from the federal list, local benefits from districts of the Moscow region significantly reduce land taxes for pensioners, large families, honorary citizens and other categories.

Land tax and benefits in St. Petersburg

General federal tax benefits are prescribed in the Tax Code of the Russian Federation, in paragraph 5 of Article 391. Throughout the country, citizens who completed their working career before 2004 due to disability of groups I and II have a benefit in the form of a reduction in the tax base by ten thousand rubles.

To calculate the amount required for payment, the cadastral value of the site, current at the beginning of the year, is taken and multiplied by the local tax rate. The resulting product is also multiplied by a coefficient defined as the ratio of the number of months of use of the site to the number of months in a year (12).

This is interesting: If a Person is Registered in the Chernobyl Zone But Works in a Non-Chernobyl Zone, He is Allotted Additional Leave

How can you reduce land tax on your property?

For already accrued tax

The tax notice with the calculation of land tax contains calculations of other taxes on your property registered in the Moscow region (tax on the ownership of a residential building, road tax on a car). The notification is delivered to the land tax payer somewhat later than the Federal Tax Service plans. For example, the tax office’s Internet service shows that for a given area of the Moscow region, a tax notice should be ready to be sent in May, but a “chain letter” arrives only in August. You must pay the entire tax amount no later than October 1st. Practice shows that in tax calculations there are overstatements of land tax amounts. Let's find out what can be challenged. In order to understand current land tax issues, first of all, compare land tax accruals with calculations of the amounts of this tax in notifications of previous years. Sometimes the identified differences provide the necessary information.

So, the main tips for checking land tax calculations

- Carefully compare the tax calculation data for your land for the last three years.

- Check the cadastral value of your land plot. Since 2014, it could have grown significantly.

- Check the legality of applying the tax rate. The tax rate does not depend on the cadastral value, but is determined by the category of the land plot and the area of its location. The maximum rate for private plots is 0.3 percent. In some areas of the Moscow region, the rate for certain categories of personal land is lower. For example, for certain categories of permitted land use in some parts of Leninsky, Lyubertsy, Odintsovo, Orekhovo-Zuevsky and other districts of the Moscow region. The situation is similar in cities of regional subordination and urban districts of the region, for example, in Khimki, Ivantevka, Kolomna district.

- Research local land incentives. Maybe something applies to you too. There are both federal and additional local property tax benefits. For land tax, federal benefits are insignificant, but local ones, as a rule, range from 50% to 100% of the tax amount.

- Study the texts of decisions of local deputies. Even if the tax rate and benefits indicated on the tax website coincide with the calculations in the notice, but it seems to you that the amount of land tax is quite high and unreasonable, “get to the source.” This in this case is the current resolution of local deputies on land tax. Local authorities are obliged to publish them, including on the public Internet. The name, number and date of decisions can be found on the tax website. It is quite possible that the tax website contains inaccurate information on rates or that not all benefits are indicated. A striking example. Decision of the Council of Deputies “On the establishment of land tax on the territory of the Balashikha urban district.” For plots intended for personal farming and located in rural settlements of the Balashikha District (Balashikha District), a discount of 75% is provided. This reduces your land tax by FOUR TIMES. The benefits are valid in 2014 and 2015.

- Attention! Recalculations of taxes from previous years, which increase the amount of taxes on your land plot, worsen the situation of the taxpayer. Demand that the tax office remove such recalculations as illegal, based on the provisions of Article 5 of the Tax Code.

If you were able to detect an excess of the amount of land tax accrued to you, immediately write a statement to the tax office and demand changes in the calculations . Send your claim to the territorial tax office (at the location of your site)

by certified registered mail with registered notification and preferably with an inventory. Or personally go to the local tax office to review the notification.

Should pensioners pay land tax in 2021?

More recently, in the early nineties, Russian pensioners had a complete exemption from paying all taxes and duties related to land, but in 2005 the situation changed, other laws were adopted - and since then pensioners have been paying land taxes on a general basis. So at the moment, only one thing can be unequivocally noted: formally, there are no legislative provisions establishing the right of persons of retirement age not to pay land tax; that is, to put it in dry language, pensioners as a legal category in the Russian Federation are not exempt from paying land tax. Another thing is that some other categories of citizens are exempt from paying this tax, and if pensioners fall under them, the exemption applies to them too, plus for people of retirement age there are a sufficient number of benefits that minimize the amount of tax that must be paid pensioners. We will consider these two options below.

Among other things, you must constantly keep in mind the fact that laws are constantly changing, and constantly monitor the latest changes in the Land Code of the Russian Federation. So, for example, in 2021, amendments to both the Land and Tax Codes have already been adopted. But you need to understand that there are differences between federal and local laws. During the period 2020-2020, there were no changes in legislation concerning pensioners at the federal level.

09 Jun 2021 uristlaw 463

Share this post

- Related Posts

- Young Family Program Affordable Housing 2021 Conditions Volgograd

- Civil Code of the Russian Federation Paid Debt

- Fund for Assistance to Disabled People

- SFU Social Scholarship

PS On the increase in taxes in Russia on citizens’ property

The whole “horror” of the sharp increase in land tax in 2014 consists of a multiple revaluation of the value of plots (increasingly) with a simultaneous jump in tax rates on private land of citizens. Next year in Moscow and the Moscow region we will see a “new real estate tax”, when taxes on residential buildings and apartments will be calculated based on cadastral value. The tax calculation formulas used will be quite complex. Be careful and carefully check the calculations and source data. Taxes are your money, and no longer small ones.

Land tax rates for household plots and summer cottages in the Moscow region

Below, in tabular form, are tax rates for plots of land intended for running personal subsidiary plots (garden plots), summer cottage farming, gardening and vegetable gardening in urban districts and districts of the Moscow region. These rates have been in effect since 2014.

Table of land tax rates by districts of the Moscow region

| Municipal district of the Moscow region | Land tax rates | |

| 1. | Volokolamsk district | 0,3% |

| 2. | Voskresensky district | 0,3% |

| 3. | Dmitrovsky district | 0,3% |

| 4. | Egoryevsky district | 0,3% |

| 5. | Zaraisky district | 0,3% |

| 6. | Istra district | 0,3% |

| 7. | Kashirsky district | 0,2% — 0,3% |

| 8. | Klinsky district | 0,15% — 0,3% |

| 9. | Kolomna district | 0,3% |

| 10. | Krasnogorsk district | 0,2% — 0,3% |

| 11. | Leninsky district | 0,15% — 0,3% |

| 12. | Lotoshinsky district | 0,3% |

| 13. | Lukhovitsky district | 0,3% |

| 14. | Lyubertsy district | 0,2% — 0,3% |

| 15. | Mozhaisk district | 0,3% |

| 16. | Mytishchi district | 0,15% |

| 17. | Naro-Fominsk district | 0,3% |

| 18. | Noginsky district | 0,2% — 0,3% |

| 19. | Odintsovskii district | 0,1% — 0,3% |

| 20. | Orekhovo-Zuevsky district | 0,15% — 0,3% |

| 21. | Pavlovo-Posadsky district | 0,1% — 0,3% |

| 22. | Podolsky district | 0,2% — 0,3% |

| 23. | Pushkinsky district | 0,1% — 0,3% |

| 24. | Ramensky district | 0,07% — 0,3% |

| 25. | Ruzsky district | 0,2% — 0,3% |

| 26. | Serebryano-Prudsky district | 0,3% |

| 27. | Sergiev Posad district | 0,1% — 0,3% |

| 28. | Serpukhov district | 0,15% — 0,3% |

| 29. | Solnechnogorsk district | 0,15% — 0,3% |

| 30. | Stupinsky district | 0,2% — 0,3% |

| 31. | Taldomsky district | 0,3% |

| 32. | Chekhovsky district | 0,08% — 0,3% |

| 33. | Shatura district | 0,3% |

| 34. | Shakhovskoy district | 0,3% |

| 35. | Schelkovsky district | 0,2% — 0,3% |

Land tax rates in cities of regional subordination and urban districts of the Moscow region

| Urban district (city of regional subordination) of the Moscow region | Land tax rates | |

| 1. | Balashikha | 0,3% |

| 2. | Bronnitsy | 0,3% |

| 3. | Dzerzhinsky | 0,3% |

| 4. | Dolgoprudny | 0,2% — 0,25% |

| 5. | Domodedovo | 0,25% — 0,3% |

| 6. | Dubna | 0,3% |

| 7. | Zhukovsky | 0,3% |

| 8. | Zvenigorod | 0,3% |

| 9. | Ivanteevka | 0,2% — 0,25% |

| 10. | Klimovsk | 0,2% — 0,3% |

| 11. | Kolomna | 0,13% — 0,2% |

| 12. | Korolev | 0,3% |

| 13. | Kotelniki | 0,3% |

| 14. | Krasnoarmeysk | 0,3% |

| 15. | Lobnya | 0,3% |

| 16. | Losino-Petrovsky | 0,3% |

| 17. | Lytkarino | 0,3% |

| 18. | Lakes | 0,3% |

| 19. | Orekhovo-Zuevo | 0,3% |

| 20. | Podolsk | 0,3% |

| 21. | Protvino | 0,2% |

| 22. | Pushchino | 0,3% |

| 23. | Reutov | n/a |

| 24. | Roshal | 0,3% |

| 25. | Serpukhov | 0,3% |

| 26. | Fryazino | 0,3% |

| 27. | Khimki | 0,2% |

| 28. | Chernogolovka | 0,3% |

| 29. | Elektrogorsk | 0,3% |

| 30. | Elektrostal | 0,3% |

Mobile version about land taxes

Property tax rate in the Moscow region

The maximum tax rates depending on the type of land plot provided for by the Tax Code of the Russian Federation can be seen in this table:

| Memory usage option | Contribution rate, % |

| Territory for farming | 0,3 |

| Chargers intended for sports facilities | 0,3 |

| Territories allocated for the construction of residential buildings and related infrastructure facilities | 0,1 |

| Parking lots, garages, and other facilities intended for parking and storing cars | 0,1 |

| Plots related to gardening partnerships, personal subsidiary plots, allocated specifically for development | 0,25 |

| Other uses | 1,5 |

These betting options are maximum. Local authorities can reduce their size, but not increase it. The Moscow Region (hereinafter referred to as MO) has 36 districts. 16 of them apply the maximum rates - 0.3%. The Mytishchi authorities have established a land payment rate of 0.15% for members of gardening associations. In other MO entities, different percentages are applied for the use of the site. For example, in the Ramensky district the minimum amount of payments has been established (0.07%), in the Kashira, Lyubertsy, Noginsky, Ruzsky districts - 0.2%.

- Northern pension for women with two children - calculation procedure

- Nail foil

- 9 foods to avoid if you have diabetes

You can see the payment rates for the city districts of the region in the table:

| District name | Land tax rate, % | Which lands are subject to reduced payments, their size, % |

| Balashikha | 0,3 | — |

| Bronnitsy | 0,3 | — |

| Dolgoprudny | 0,2-0,3 |

|

| Domodedovo | 0,15-0,3 | Loan for housing and personal households – 0.15 |

| Ivanteevka | 0.2-0,4 |

|

| Kolomna | 0,13-0.3 |

|

| Kotelniki | 0,2-0,3 | Territory occupied by residential buildings, dachas, private households, private garages – 0.2 |

| Korolev | 0,3 | — |

| Lobnya | 0,2-0,3 |

|