What's happened?

The Krasnoyarsk Regional Court issued an appeal ruling dated January 22, 2020 in case No. 33-873/2018, which confirmed the possibility of bringing to disciplinary liability an employee who spent 3 minutes of working time changing into special clothing.

The employer considered the fact that the employee started work three minutes later than the start of the shift because he was wearing a technological suit to be a violation of labor discipline. For being late for work, which was the name given to this change of clothes, the employee was given a warning and his bonus was reduced. The court, which the employee appealed to because he believed that the time he needed to change clothes was included in work hours, refused to appeal the punishment. https://youtu.be/MlPCKAkmsbE

Dressing time is included in working hours

The main classification of workdays depends on the time a person spends at his workplace. The concept and types of working time must be spelled out in regulatory documents at the enterprise where the person works.

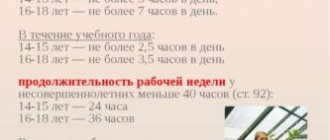

There are normal, part-time and overtime hours, and each type has its own characteristics that are important to take into account. The presented type has no connection with the form of ownership and its organizational and legal orientation.

The normal working hours are at the same time the maximum and cannot be more than 40 hours per week. It is worth considering that part-time work is not considered to be outside normal working hours.

It is important to note that some employers do not count working time as hours actually spent on activities, so this point must be discussed in advance to avoid problems.

Rostrud does not consider changing clothes to be late for work

Rostrud thinks differently. Answering the employee’s question, labor inspectors explained that the use of special clothing, shoes and other personal protective equipment is the employee’s responsibility. The response reads, in part:

In our opinion, the time for changing into special clothing should be included in working hours, since providing workers with special clothing, special shoes and personal protective equipment is an integral part of labor protection in the organization. Thus, the use of the specified clothing, shoes and equipment is the employee’s labor duty and the time for its performance should be included in the working time.

At the same time, changing into non-special clothing, that is, at the request of the employee himself, according to Rostrud specialists, is not included in working hours.

2 owners for one individual entrepreneur how to register

Education LLC

Which is better: LLC or individual entrepreneur?

You can find out what you need to open an individual entrepreneur here.

You can find out what an employee is entitled to when being laid off in this article.

IP means “individual entrepreneur”. According to the legislation of the Russian Federation, an individual entrepreneur is an individual registered in the manner prescribed by law and carrying out entrepreneurial activities without forming a legal entity.

Entrepreneurial activity is considered to be an activity aimed at systematically generating profit.

Everyone will need to independently conduct tax reporting, understanding the intricacies of accounting and bureaucratic affairs, which is very difficult, especially for novice businessmen.

Features of a simple partnership agreement

Unlike an informal partnership, the procedure for concluding a simple partnership agreement is more complicated. Let's consider a number of features of the design of this type of cooperation:

- Before drawing up an agreement, it is recommended that you familiarize yourself with Chapter 55 of the Civil Code, which covers the legislative framework governing simple partnership agreements.

- When writing a contract yourself, you should carefully consider each clause, since in the future the success of doing business will directly depend on this.

This type of activity is not regulated by the government at the official level, so the question of whether it is possible to register an individual entrepreneur for two remains open for many beginning business figures.

If it is intended to create a large business that guarantees high income, it is best for entrepreneurs to create a joint-stock company, the regulations of which imply the division of the total capital into shares in the authorized capital.

The profit of each business participant will directly depend on the total number of individual shares.

The organization of this option of entrepreneurial relations will be most beneficial for two participants at once, since the legalization of many types of activities is quite expanded and the official “share” of each of the parties is stated in the general constituent documents (detailed information is displayed in the official constituent agreement).

2 owners for one individual entrepreneur how to issue a return

That is why most often this type of business is suitable for relatives - most often individual entrepreneurs for two people are registered by people with family ties, as well as good friends.

Each participant in this type of business activity is exposed to the following risks:

- the entrepreneur risks his own property;

- the co-owner of the organized activity does not have legal rights to business, so at any time he may be left without profit;

- an unofficial co-owner, receiving actual profit, may be punished at the state level for non-payment of taxes.

If, nevertheless, a decision is made to register an individual entrepreneur illegally for two people, running a joint business will require preliminary approval of the distribution of profits, as well as detailed collection of initial capital and additional documentation.

2 owners for one individual entrepreneur how to design a title page

Important

How to open an individual entrepreneur for two? This question arises for many beginning entrepreneurs, especially those in friendly relationships. Young people who are faced with organizing a business for the first time often want to join forces to organize a common cause.

In order to reduce the number of questions, we will try to understand the situation and help future businessmen.

- What is an IP?

- Option 1. Register one of the participants as an individual entrepreneur

- Option 2.

Both participants are registered as individual entrepreneurs and enter into a simple partnership agreement between themselves

- Option 3.

For example, if the business turns out to be unprofitable, the individual entrepreneur will pay debts within ALL of his property , which will include real estate, a car, etc.

Such risks will not affect those who participated in the business unofficially.

Thus, the described method of doing business for two can be risky and unprofitable for both parties, both the registered participant and the unofficial one.

Both participants are registered as individual entrepreneurs and enter into a simple partnership agreement between themselves

This option is described in detail in the Civil Code of the Russian Federation (Article 1041).

The document spells out in detail the rights and responsibilities of both parties and additionally highlights the general parameters for the distribution of all existing income.

Conducting a joint business involves serious responsibility for each participant, since the rights of both parties are affected. The form of entrepreneurial activity in this case can be organized using other options.

Other options for doing joint business

If neither party wants to expose themselves to risk, and registering a joint individual entrepreneurship is not possible, there are other optimal options for starting a business in which two persons will participate. It is possible to create a limited liability company, a special joint-stock company, as well as a separate business partnership.

According to the law, the second participant does not have any rights to a share in the business and it will not be possible to prove his participation in it.

How to protect yourself in this case? The only option may be a loan agreement between partners, as individuals. That is, the contribution of an unregistered participant is documented as a loan to a registered participant.

Receipts must be kept. This will help you get your money back if the relationship goes bad.

But even such loan agreements and receipts will not be able to fully compensate for the costs of organizing business activities incurred by an unregistered participant.

In this case, the second person can unofficially invest money and participate in business management.

Many entrepreneurs do this, believing that in this case they will be able to save significantly on taxes, accounting, using cash register equipment, having a bank account, etc. Whether such savings will really be profitable depends on many indicators - the activity of entrepreneurial activity, its types and other factors.

The more important issues, from the point of view of two people participating in a business, are not small savings and ease of registration, but guarantees of safety and financial responsibility of the participants. In the case of registration of one individual entrepreneur, the participant who is officially registered has all the rights to the business and in the event of a quarrel or the need for division, problems may arise.

This number can be reduced if you are not an employer.

Open an individual entrepreneur for only one participant

It’s worth mentioning right away that this path is fraught with many risks, and not only for the person whose name is not included in the documents. If you want to minimize the amount of tax and enjoy the privileges of individual entrepreneurship together, then you can open an individual entrepreneur for only one person.

At the same time, the second participant in the business will only be an unofficial co-owner of your institution. This path is usually chosen by close relatives or best friends who have no reason to doubt each other.

However, no matter how prosaic it may sound, when it comes to profits or finding out who has invested more effort, time and money in a business, “friendship may turn out to be friendship, but money may be apart.”

Source: https://praktica46.ru/2vladeltsa-na-odno-ip-kak-oformit

Question: Is changing into work clothes and safety shoes included during working hours if the employee’s employment contract obliges him to comply with labor safety rules and the use of personal protective equipment? (Rostrud information portal “Onlineinspection.RF”, March 2020)

Is changing into overalls and safety shoes included during working hours if the employee’s employment contract obliges him to comply with labor safety rules and the use of personal protective equipment? Working time is the time during which an employee, in accordance with internal labor regulations and the terms of the employment contract, must perform labor duties, as well as other periods of time that, in accordance with the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation, relate to working hours time. Accordingly, the internal labor regulations must determine the start and end times of working hours and whether the time for changing into work clothes is included in working hours.

https://youtu.be/J_bSv6ocxIw

In our opinion, the time for changing into special clothing should be included in working hours, since providing workers with special clothing

Calculation of working hours

The chairman of the primary trade union organization of the Northern Production Association “Arktika” N.V. turned to Solidarity for legal advice on the issue of calculating working hours.

BORODULIN. “The worker must begin his work duties at 8.00 in accordance with the Rules of the daily work schedule adopted at the conference of the labor collective on March 6, 2003, which have not been revised even once since then. Working hours do not include the time spent changing clothes, traveling from the locker room to the workplace, and obtaining tools and materials.

91 Labor Code of the Russian Federation. This is the time during which the employee, in accordance with the internal labor regulations and the terms of the employment contract

Question: The internal labor regulations were adopted in 1996 and have not changed even once since that time.

They contain a clause stating that “working hours start at 8.00. This time does not include the time spent on the road from the entrance to the workshops and changing into overalls.” Does this provision comply with the Labor Code of the Russian Federation?

(Expert consultation, 2007)

Question: The internal labor regulations were adopted in 1996 and have not changed even once since that time.

They contain a clause stating that “working hours start at 8.00. This time does not include the time spent on the road from the entrance to the workshops and changing into overalls.”

Does this provision comply with the Labor Code of the Russian Federation? Answer: Due to the requirements of Part.

3 tbsp. 68 of the Labor Code of the Russian Federation, the employer is obliged, when hiring (before signing an employment contract), to familiarize the employee with the internal labor regulations in force in the organization.

Thus, even during employment, the employee is given the opportunity to decide whether he is satisfied with the internal regulations established in the organization and, in particular, the regime of working hours and rest time.

Source: https://advokat-credit.ru/vkljuchaetsja-li-v-rabochee-vremja-prinjatie-dusha—nadevanie-specodezhdy-30235/

What should employers do?

The court does not agree with either the employee or the position of Rostrud in the controversial situation. The main argument is that the Labor Code or other law does not provide that changing clothes is included in working hours. According to the norms of Article 91 of the Labor Code of the Russian Federation, working time is the time during which an employee, in accordance with the internal labor regulations and the terms of the employment contract, must perform his duties, as well as other periods of time that are in accordance with this Labor Code of the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation relate to working time. The inclusion of time for changing into overalls in the employment contract with the employee was not regulated. Therefore, the court agreed with the employer that this was late for work, and therefore a disciplinary offense. In accordance with the position of the court, workers must have time to put on overalls and safety shoes before starting work.

Although the court sided with the employer in this case, the employer had to expend time and resources to litigate. Therefore, in order to avoid such controversial situations, it is better to resolve the issue of changing clothes in local acts of the organization. However, whether this is classified as working time remains at the discretion of management. The main thing is that such a position is explicitly stated in the employment or collective agreement.

Because of the three minutes it took to change clothes, I was reprimanded and deprived of my bonus.

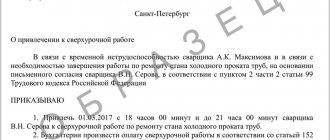

The judges of the Krasnoyarsk Regional Court issued an appeal ruling dated January 22, 2018 in case No. 33-873/2018, in which they confirmed the legality of the disciplinary punishment imposed on the employee in the form of a reprimand, as well as the partial deprivation of a bonus for being 3 minutes late.

Interestingly, this time was used by the employee to change into a special suit, which is supposed to be worn before a shift. Since the wardrobe is located outside the workplace, the employee was late. But his immediate superior considered that the delay was without good reason, so he wrote a report addressed to the supervisor. At the same time, the employee himself believed that the time for changing clothes should be attributed to the worker.

When making their decision, the judges stated that the employee misinterpreted the law. So, based on Art. 91 of the Labor Code of the Russian Federation, working time is the time during which an employee must perform labor duties in accordance with the internal labor regulations and the terms of the employment contract. The employer's internal labor regulations state that the employee is required to work in special clothing. In addition, it is clarified that the shift begins at 7:15 a.m., and work should begin taking into account all requirements and instructions. Based on this, the court concluded:

The plaintiff, taking into account the provisions of the job description, is obliged to begin performing his job duties no later than 7 hours 15 minutes, already dressed in a technological suit and special shoes. The plaintiff arrived at the workplace at 7:18 a.m., i.e., after the start of his shift.

The judges also took into account the defendant’s arguments. The employer's representative in court, in particular, reminded that the plaintiff is an employee of a special enterprise with dangerous working conditions in certain areas. He is provided with personal protective equipment, including special technological suits. According to the organization’s standards (STO 06606330-0115-2010, 06606330-0074-2009), all workers in assembly areas and workshops must wear technical clothing and shoes while at the assembly area. Before starting the shift, the performer must put on a set of technical clothing, check and remove all foreign objects found at the workplace (clause 13.1.2 of the STO). Taking into account these requirements specified in the employer’s regulations, the plaintiff’s opinion that the time of changing into a technological suit should be included in working hours is subjective and is not supported by specific documents.

Do changing clothes and showering count as work time?

Answer to the question: Labor legislation operates with two categories of time - working time and rest time (section , Labor Code of the Russian Federation). Since during preparation for work the employee is not free from performing work duties and does not use it at his own discretion, this time does not apply to rest time (). The time required to prepare for work has all the characteristics of working time (). Moreover, without this training, in appropriate cases, it is impossible to either fulfill official (production) duties or ensure labor safety, which is an equal responsibility of both the employee and the employer (Labor Code of the Russian Federation).

For example, without spending time on changing into special clothes, it is impossible to perform a job function for work where it is necessary to use protective equipment, since the use of these means is one of the employee’s duties (). From the foregoing it follows that by fulfilling the duties established by labor legislation, a local act or an employment contract, the employee performs a labor function, at this time he is bound by labor relations with the employer, and the time spent on this to prepare for work (in particular, the time to change into special clothing) ), since it is objectively necessary, is the employee’s working time (Art.

, Labor Code of the Russian Federation). A similar conclusion follows with regard to other necessary activities related to production, including the time required to take a shower.

This is confirmed by judicial practice (Supreme Court of the Komi Republic dated April 20, 2020

in case No. 33-1795/2015, ruling of the Kemerovo Regional Court dated March 2, 2012

in case No. 33-1872 (see paragraph 1 of the appendix to the answer below)). It should be noted that there are court decisions that are of the opinion that if the company’s internal documents indicate that changing clothes and time for personal hygiene are not included in working hours, then this rule will be lawful (Orenburg Regional Court dated July 17, 2014 on case No. 33-3811/2014, Determination of the Leningrad Regional Court dated July 31, 2013 No. 33-3441/2013 (see.

clause 2 of the appendix to the answer below)