Audit of settlements with personnel for wages: goals

During the audit, the auditor sets the following objectives:

- studying the legality of calculations in the field of wages;

- confirmation of accounting compliance with current standards and regulations that determine the procedure for calculating and paying salaries;

- assessment of the effectiveness of the forms and systems of remuneration established by the employer;

- establishing the completeness of analytical accounting of wages;

- checking the completeness of accrual and transfer of personal income tax to the budget, accrual and settlements under the unified social tax.

Methods for obtaining audit evidence

When conducting an audit of operations to comply with labor laws and payroll calculations, the following methods and techniques are used:

- checking the client’s arithmetic calculations (recalculation);

- checking compliance with accounting rules for individual business transactions, confirmation;

- oral survey of personnel, management of an economic entity and an independent (third) party;

- document verification, tracking, analytical procedures.

Checking the client's arithmetic calculations (recalculation) is used to confirm the reliability of arithmetic calculations of amounts for personnel remuneration and the accuracy of their reflection in accounting records.

Checking compliance with the accounting rules for individual business transactions allows the audit organization to monitor the accounting work performed by the accounting department and the correspondence of wage accounts.

Confirmation is used to obtain information about the reality of balances in accounts for payment of wages from the budget and extra-budgetary funds.

An oral survey is used in the process of obtaining answers to the auditor’s questionnaire during a preliminary assessment of the state of accounting for settlements with personnel regarding wages, as well as in the process of checking them, when clarifying with specialists certain completed business transactions that are in doubt.

Verification of documents allows the auditor to verify the reality of a certain document. It is recommended to select certain entries in accounting and trace the reflection of transactions in accounting down to the primary document that should confirm the reality and feasibility of performing this operation.

Tracking is used when studying credit turnover on analytical accounts, statements, reports, synthetic accounts reflected in the General Ledger, and it is necessary to pay attention to non-standard correspondence of accounts.

Analytical procedures are used when comparing the wage fund of the reporting period with data from previous periods.

Audit Objectives

Salary audit allows you to solve many problems. First of all, timely verification of payroll operations allows the company to receive an audit report indicating errors and omissions in accounting, recommendations for optimizing forms and systems of remuneration.

In the future, such a conclusion allows the employer to bring accounting records into compliance with the law, pass a tax audit without economic losses and penalties, and carry out liquidation, reorganization, and restructuring procedures in a shorter period of time.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Payroll audit

According to Art. 136 of the Labor Code, the deadline for paying wages is established by the internal labor regulations of the organization, a collective agreement, an employment contract, but at least twice a month.

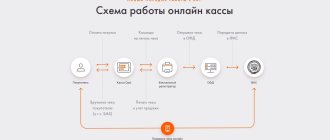

The issuance of cash from the cash registers of enterprises for the payment of wages is carried out according to payment (settlement and payment) statements (without drawing up a cash order for each recipient) with a stamp on these documents with the details of the cash order. Documents for the issuance of money must be signed by the director, chief accountant of the enterprise or persons authorized to do so (clause 14 of the Procedure for conducting cash transactions in the Russian Federation, approved by decision of the board of directors of the Central Bank of the Russian Federation dated September 22, 1993 No. 40 (hereinafter referred to as the Procedure)).

In accordance with clause 7 of the Procedure, enterprises that have constant cash income, in agreement with the banks that serve them, can spend it, in particular, on wages. At the same time, enterprises do not have the right to accumulate cash in their cash registers in excess of established limits for future expenses, including wages.

After the established deadlines for remuneration, the cashier closes the statement in the manner specified in clause 18 of the Procedure. At the end of the payment (settlement and payment) statement, an inscription is made about the amounts actually paid and amounts to be deposited (if any), and they are reconciled with the total for the payment statement.

Expense cash orders, issued on payroll (settlement and payment) statements for wages and other payments equivalent to it, are registered by the accounting department after their issuance in the logbook for registering incoming and outgoing cash documents (form No. KO-3, approved by the Decree of the State Statistics Committee of Russia dated August 18. 1998 No. 88) (clause 21 of the Procedure).

At the end of the last day of payment of wages, on the basis of the Cashier's Report (the second copy of the sheet of the Cash Book (form No. KO-4, approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88)) and the cash expense documents attached to it, the amount paid to employees is reflected in the accounting records wages on the debit of account 70 “Settlements with personnel for wages” and the credit of account 50 “Cash” (Chart of accounts for accounting financial and economic activities of organizations and Instructions for its use.

The amount of deposited wages is reflected in the credit of account 76 “Settlements with various debtors and creditors”, subaccount 76-4 “Settlements on deposited amounts” and the debit of account 70.

What documents does the auditor check?

The basis for conducting a wage audit is the following documents:

- staffing schedule;

- labor agreements, amendments to them, collective agreement, if any;

- orders regulating payroll;

- internal labor regulations;

- provisions regulating the bonus system in the organization.

Also, in order to draw up a full-fledged audit report, the auditor needs to study primary documents, accounting registers for calculating wages and deductions from it, financial statements of a legal entity and tax reporting forms to check the status of calculations for personal income tax and unified social tax.

Introduction

In accordance with Art. 1 of the Federal Law “On Auditing Activities”, auditing activity (audit) is a business activity for independent verification of accounting and reporting of organizations and individual entrepreneurs.

The purpose of the audit is to express an independent opinion on the reliability of the accounting (financial) statements of the audited entities or the organization and compliance of the accounting procedure with the legislation of the Russian Federation.

Accounting, as a system of registration, control and analysis of people's economic activities, originated several thousand years ago. It developed and improved simultaneously with the development of human society. The concepts and principles of “labor and wage accounting” were selected, polished and supplemented by more and more generations. As a result, wages have become the most important element of financial and economic relations in human society, acting in the sphere of operation of the enterprise as a link of management, providing mutual communication between the management of the enterprise and its workforce. Many countries, eras, societies have contributed to this social and practical activity of people.

This course work is devoted to the audit of payroll calculations in retail organizations. The study of this broad topic will be considered using a specific example, namely, an audit of wages in the organization Omega + LLC, which is engaged in the retail sale of non-food products.

Writing a term paper in the discipline “Audit” is of great practical importance, since writing it allows you to specifically understand the whole variety of financial planning, accounting and analytical data, acquire the skills to collect, process and summarize practical material, analyze it, work with documents, accounting registers, reports, plans, draw up tables, graphs, diagrams and on this basis draw appropriate conclusions and proposals.

Thus, when completing coursework, the following tasks are set:

— systematize, expand, deepen and consolidate the knowledge acquired while studying the “Audit” course;

— gain skills in independent work with literary sources;

— learn to collect, check, process and analyze practical material, draw appropriate conclusions and proposals;

— identify shortcomings in the organization of accounting, internal control, and financial analysis.

This course work, in addition to a detailed examination of the process and features of a wage audit in a particular organization, is provided with findings and conclusions, as well as applications, including various documents that confirm the conclusions contained in the presented work.

1. Regulatory and legislative basis for accounting for wages

The following legislative and regulatory acts are used as the main regulatory framework:

— The Constitution of the Russian Federation, adopted by popular vote on December 12, 1993, as amended. dated March 25, 2004, (December 30, 2008 No. 7-FKZ);

— Civil Code of the Russian Federation, parts 1 and 2, adopted by the State Duma and the Federation Council of the Russian Federation on June 29, 1994, approved by Order of the President of the Russian Federation No. 51 - Federal Law dated November 30, 1994, (as amended on December 27, 2009 No. 352-FZ);

— Tax Code of the Russian Federation, parts 1 and 2, adopted by the State Duma and the Federation Council of the Russian Federation on June 29, 1998, approved by Order of the President of the Russian Federation No. 146 - Federal Law dated July 31, 1998, (as amended on December 29, 2009 No. 383-FZ, as amended on January 1 .2010);

— Labor Code of the Russian Federation, parts 1 and 2, adopted by the State Duma and the Federation Council of the Russian Federation on December 21, 2001, approved by Order of the President of the Russian Federation No. 197 - Federal Law dated December 30, 2001, (as amended on November 25, 2009 No. 267-FZ, as amended. from 01/01/2010);

— Federal Law “On Auditing Activities”, approved by Order of the President of the Russian Federation dated 08/07/2001 No. 119-FZ (as amended on 12/30/2008 No. 307-FZ, as amended on 01/01/2010);

— Accounting regulations “Income of the organization” PBU 9/99, approved by order of the Ministry of Finance of the Russian Federation dated 05.06.99 No. 32n, (as amended dated 26.11.2006 No. 156n) and “Expenses of the organization” PBU 10/99 approved by order of the Ministry of Finance of the Russian Federation dated 06.05 .99 No. 33n (as amended on November 27, 2006 No. 156n);

— Chart of accounts and instructions for its use (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), (as amended on September 18, 2006 No. 115n);

— Instruction “On the specifics of the procedure for calculating average wages”, approved by Decree of the Government of the Russian Federation dated April 11, 2003 No. 213, (as amended on November 11, 2009 No. 916).

— Album of unified forms of primary documentation for labor accounting and payment (approved by Decree of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004).

2. Objects, sources of information and tasks of the remuneration audit

The purpose of the audit of settlements with personnel is to check compliance with current labor legislation, the correctness of wage calculation and deductions from it, the correctness of wage registration and the reflection in the accounting of all types of settlements between the entrepreneur and his employees.

The main sets of auditable tasks set before the auditor when achieving the set goal include:

1) compliance with the provisions of labor legislation, the state of internal control over labor relations;

2) accounting and control of the production and calculation of wages for piece workers;

3) accounting and accrual of time and other types of payments;

4) calculations of deductions from wages of individuals;

5) analytical accounting of employees (by types of accruals and deductions);

6) summary calculations of wages;

7) calculation of the tax base from the wage fund, accounting for taxes and payments from the wage fund;

calculations for deposited wages.

calculations for deposited wages.

The presented sets of tasks cover typical accounting tasks, as well as general principles for organizing calculations to comply with labor obligations.

Sources of information obtained during the audit are presented in the figure in Appendix 4.

As primary documents, unified forms of primary documentation developed by NIPI - the statistical form of the State Statistics Committee of the Russian Federation are predominantly used. Maintaining primary accounting according to unified forms applies to legal entities of all forms of ownership operating in sectors of the national economy.

Thus, for personnel records, the following are used: order (instruction) for hiring (form T - 1), personal card (form T - 2), registration card of a researcher (form T - 4), order (instruction) on transfer to another job (form T - 5), order (instruction) on granting leave (form T - 6), order (instruction) on termination of the employment agreement (contract) (form T 8), staffing table.

To record the use of working time and settlements with personnel, the following are used: time sheets and payroll calculations (form No. T - 12), settlement and payroll sheet (form No. T - 49), payroll (form No. T - 53), personal account (form No. T – 54).

In addition, primary documents for accounting production and piecework wages are used: work orders, reports, route sheets and other documents.

The registers that are subject to verification include summary statements of wage distribution (by type, cost codes, etc.), calculations on account 76 regarding calculations on writs of execution and deposited wages, journals - warrants f. No. 8 and 10 (with a journal-order form of accounting) and other accounting registers for accounts 68, 69, 70, 71, 73, 76, 88, etc., General Ledger, balance sheet (form No. 1).

3. Main stages of the audit of payroll calculations

When starting to check settlements with personnel for wages and other transactions, the auditor must also find out:

— what forms and systems of remuneration are used at the enterprise;

— whether there is an internal regulation on remuneration and a collective agreement;

— list and average composition of employees;

— How is the accounting of labor costs organized?

At the planning stage, the strategy and tactics of the audit and the timing of its implementation are determined; analyze the general plan and audit program. Planning consists of the audit organization developing a general audit plan indicating the expected volume, schedules and timing of the audit, as well as developing an audit program that includes the volume, types and sequence of audit procedures.

To draw up an audit program and select procedures for collecting audit evidence, it is advisable to draw up an auditor’s questionnaire for all selected sets of tasks. Using this specially designed questionnaire, the auditor determines the state of the internal control system, gives a preliminary assessment of compliance with discipline at enterprises, identifies the most vulnerable areas, plans the composition of the main control procedures, determines the specific features of wage accounting, the description of which is not in the set of standard standards available to him. procedures.

It should be noted that the payroll audit is only one section of the audit.

Let us consider the content of the main stages of conducting an audit of wage calculations.

1st stage. Familiarization with the features of an economic entity, carried out in accordance with the Russian rule (standard) “Understanding the activities of an economic entity”, for which they become familiar with the constituent and licensing documents, main types of activities, organizational and production structure, etc.

2nd stage. Analysis of accounting features carried out in accordance with Russian rule (standard) No. 25 “Study and assessment of the accounting system and internal control during the audit”, dated 04/27/99, for which they consider the accounting policy, working chart of accounts, list of accounting registers, composition business transactions and their reflection in the form of accounting records (entries), the procedure for synthetic and analytical accounting.

3rd stage. Analysis of the internal control system, carried out in accordance with the Russian rule (standard) “Study and assessment of the accounting system and internal control during the audit”, “Risk assessment and internal control”, by assessing the control for processing primary documentation (based on document flow). This also includes the calculation of the level of materiality and audit risk.

4th stage. Planning and development of an audit plan and program, carried out in accordance with Federal Rule (Standard) No. 3 “Audit Planning” (as amended by Decree of the Government of the Russian Federation of October 7, 2004 N 532).

5th stage. Performing audit procedures in accordance with Federal Rule (Standard) No. 5 “Audit Evidence”, (as amended by Decree of the Government of the Russian Federation dated October 7, 2004 N 532.

6th stage. Formation of an audit report in accordance with the requirements of Federal Rule (Standard) No. 6 “Audit Report on Financial (Accounting) Statements” (as amended by Decree of the Government of the Russian Federation dated October 7, 2004 N 532.

4. Payroll audit methodology

4.1. Characteristics of the organization under study

The organization of an audit of payroll calculations will be studied using a specific example, namely, in a conditional organization, for which we will take the object of analysis as the commercial organization Omega + LLC.

In accordance with the Charter, the Omega + organization is a limited liability company, which is a legal entity and operates on the principles of self-financing and self-financing. Created without any limitation on the period of activity. This organization has civil rights and bears the responsibilities necessary to carry out any types of activities not prohibited by federal laws. Also, Omega + LLC is the owner of property belonging to it, including property contributed to the authorized capital of the enterprise.

The retail trade enterprise Omega + LLC was created with the goal of obtaining maximum profits and providing the population with food products.

Revenue for 2009 amounted to 39,198 thousand rubles. The average number of all personnel of Omega + LLC for 2009 was 49 people, of which the share of sales and operational personnel was 71.0%. The company predominantly has personnel with higher education.

The accounting department of Omega + LLC uses a journal-order form of accounting with partial automation. Workers in the accounting and order departments are equipped with personal computers.

The accounting service of the enterprise has a centralized two-level hierarchical management structure and is represented by 5 accounting groups that process incoming financial information and interact with other departments of the enterprise. Currently, Omega + LLC uses, in accordance with the law and the stated accounting policy, a journal-order form of accounting. The accounting of the enterprise is not automated, which means that payroll accounting is carried out manually. This drawback leads to frequent rush jobs when generating reports.

The accounting policy developed by Omega + LLC includes elements of tax accounting, which allows, in particular, depreciation to be calculated in a linear manner, which corresponds to accounting and tax accounting. The cash method of accounting is also used, which allows taxes to be transferred to the state budget in a timely manner.

Now, having defined the organization under study, we describe the practical methodology for conducting an audit.

4.2. Methodology for auditing remuneration of Omega + LLC

We conduct a salary audit of Omega + LLC according to the following scheme in Appendix 3.

For the salary audit, the following sources of information were used (see Appendix 4).

To begin with, we will calculate the level of audit risk by testing and assessing the accounting and internal control systems.

Table 1 – Test of the accounting system and internal control of labor payment transactions of Omega + LLC

| No. | Content | Answers |

Sequence of audit of settlements with personnel for remuneration

The salary audit is performed in a certain sequence. As part of it, you can propose steps such as establishing:

- the correctness of the drafting of internal regulations governing the hiring, dismissal, and transfer of employees;

- the effectiveness of using various remuneration systems;

- compliance with labor laws;

- completeness of deductions from earnings, accruals and payment of unified social tax;

- correct reflection of wage transactions in accounting accounts and reporting.

Pay audit

The audit of settlements with personnel for wages is one of the most labor-intensive objects when auditing organizations. Operations for labor accounting and wages, as a rule, are numerous, carried out systematically, and are varied and specific.

This article discusses practical examples that analyze complex and topical issues of remuneration and incentives for workers, and shows the possibilities of a wage audit carried out to reduce tax risks and eliminate possible conflict situations on the part of workers. Recommendations are presented for resolving complex and controversial issues of remuneration and labor incentives, which are based on the provisions of regulatory and legislative acts, clarifications of official bodies.

Any audit is an independent verification and assessment of an organization’s activities by a professional specialist or an independent organization on a contractual basis. A feature of the audit carried out recently is the following fact: customers who pay for a mandatory or initiative audit want to receive additional or related services to the audit.

As a rule, these are recommendations of professional auditors to reduce the risks of an organization’s business activities. In particular, clients often ask :

- conduct a wage audit;

- check compliance with labor laws;

- analyze the mistakes made;

- draw up a detailed report on violations;

- make recommendations to eliminate violations in the report.

The recommendations given by auditors help to avoid a number of mistakes, especially in complex and ambiguous situations related not only to labor and wage accounting methods, but also to the examination of personnel documents and local regulations of the organization. Competent and professional resolution of issues of remuneration and labor incentives reduces the risks of conflict situations and affects the economic and financial components of the organization’s work as a whole.

assessing the effectiveness of the internal control system for operations related to wages with the presence of local regulations of the organization. This is explained by the fact that it is first necessary to find out whether the organization has internal system documents that directly or indirectly regulate remuneration issues.

These main documents are:

- collective labor agreement;

- staffing schedule;

- wage regulations;

- internal labor regulations;

- bonus position.

Studying the contents of these documents allows us to determine whether the internal provisions comply with the requirements of the Labor Code of the Russian Federation. The absence of these documents or their contradiction to the Labor Code of the Russian Federation indicates systemic errors in matters of payment and labor incentives.

The main stages of the audit of settlements with personnel regarding wages are presented in the table.

| The main stages of auditing settlements with personnel for wages | ||

| Audit stages payroll calculations | Target audit procedures | Methods of obtaining audit evidence |

| Audit of legality and compliance with the legality of labor relations | Verification of compliance with the rights and obligations of employees | Checking the availability and correctness of execution of local regulations, orders for hiring, employment contracts, orders for dismissal of employees |

| Audit of the correctness of wage calculations (checking the correct application of piecework, time-based and other wage systems), tariff rates, piecework rates and compensation and incentive payments | Reasons for occurrence, completeness, measurement accuracy, cost estimate | availability and correctness of execution of primary documents for labor and wage accounting; reconciliation of data against interrelated primary documents for labor and wage accounting; selective arithmetic control of calculations of average earnings, vacation pay, temporary disability benefits |

| Audit of the legality of applied incentive and compensation payments | Reasons for occurrence, completeness, measurement accuracy, cost estimate | Checking the availability and correctness of execution of local regulations, orders on bonuses and other awards |

| Audit of the legality and completeness of deductions from wages in accounting | Reasons for occurrence, completeness, measurement accuracy, cost estimate | control of personal income tax payments; checking the documentary validity of other deductions (availability of court decisions, statements of employees); control over the maximum deduction from wages |

| Audit of the completeness and correctness of disclosure of information on labor costs and wages in financial statements | Presentation, disclosure, analysis | Reconciliation of financial reporting indicators with registers of synthetic and analytical accounting for wages |

From the presented volume of audit work, we will analyze controversial and complex situations related directly to the calculation and payment of wages, as well as incentive payments.

Controversial situations of calculation and payment of wages

Practice shows that often the employer and employee do not fully understand their rights and obligations related to the calculation and payment of wages.

Legal relations regarding wages are regulated by labor legislation (the concept, amounts and procedure for payment of wages are established in Chapter 21 of the Labor Code of the Russian Federation). The employee's salary is determined by the employment contract in accordance with the current employer's remuneration systems (Article 135 of the Labor Code of the Russian Federation).

Wages are paid to the employee, as a rule, at the place where he performs the work or transferred to the bank account specified by the employee under the conditions determined by the collective agreement or labor agreement. Wages are paid at least every half month on the days established by the internal labor regulations, collective agreement, and employment contract (Article 136 of the Labor Code of the Russian Federation).

According to Art. 127 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid monetary compensation for all unused vacations.

NOTE

During inspections, the auditor first of all examines the mandatory personnel records documents, as well as the paperwork for wages: pay slips, personal accounts of employees, pay slips for the payment of wages, cash receipts, registers for pay slips in the case of transferring wages to employee cards, etc. .

In addition to identifying facts of untimely payment of wages, the auditor will definitely check the payment of funds for vacation pay on time (no later than three days before the start of the vacation period), as well as cases of non-payment of estimated amounts on the day of dismissal of the employee.

IT IS IMPORTANT

Amounts of money are considered paid not from the moment the payment documents are sent to the bank, but from the moment they are received by the employee. It is especially important to take this into account in cases where the salary is transferred to the employee’s individual bank card account.

Employers, when establishing days for payment of wages in their internal labor regulations, often consider it their responsibility to pay wages on time for the work performed, if the employer’s accounting department sends settlement documents to the bank on the days specified for the payment of wages. At the same time, the resulting untimely payment of amounts due to the employee for wages threatens not only compensation in full, but also bringing the employer to administrative liability (Article 5.27 of the Code of the Russian Federation on Administrative Offenses).

In practice, the question is often asked: “Is it possible to pay wages once a month if employees have written an application with such a request, and is it possible to include a corresponding clause in a local regulation?”

In this case, the management of the organization should not forget that this clause worsens the situation of workers in comparison with the current labor legislation (Article 8 of the Labor Code of the Russian Federation).

with payment according to the staffing table should not be included in employment contracts instead of indicating a specific salary amount.

Conditions of remuneration (size of the tariff rate (salary), additional payments, allowances, incentive payments) are mandatory conditions of the employment contract (Article 57 of the Labor Code of the Russian Federation).

Auditors draw the attention of financial services employees to the fact that when inspecting an organization by state labor inspectors, it is important that the salary amounts established in employment contracts and in the staffing table coincide and correspond to the amounts included in the payroll statements. It is for this purpose that the organization should adopt a local regulatory act regulating the procedure and grounds for calculating wages according to the existing remuneration systems in the organization.

Particular attention should be paid to the so-called counting errors .

EXAMPLE 1

The organization's accounting department mistakenly (twice) transferred wages to the employee's bank card account. The error was discovered after the employee quit. Will this constitute a counting error and is it possible to recover this amount from the employee? What to do if an employee refuses to voluntarily return the money?

Wages overpaid to an employee (including in the event of incorrect application of labor legislation or other regulations containing labor law norms) cannot be recovered from him, except for the following cases :

1) if the body for consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards (Part 3 of Article 155 of the Labor Code of the Russian Federation) or downtime (Part 3 of Article 157 of the Labor Code of the Russian Federation);

2) if the salary was overpaid to the employee in connection with his unlawful actions established by the court (Part 4 of Article 137 of the Labor Code of the Russian Federation);

3) if a counting error was made.

The concept of “counting error” Art. 137 of the Labor Code of the Russian Federation does not disclose. In practice, this concept is understood as an arithmetic error, that is, an error that was made during arithmetic calculations when mathematical operations (multiplication, addition, subtraction, division) were incorrectly applied (letter of Rostrud dated October 1, 2012 No. 1286-6-1 “ On deduction from wages of amounts overpaid to the employee due to accounting errors").

Thus, wages overpaid to an employee can be recovered from him in the event of an accounting error. In this case, an error made in arithmetic operations related to counting should be considered counting.

In this situation, the accounting department committed erroneous actions of a technical nature, which are not counting errors. Even if an organization goes to court with a request to recover overpaid wages from an employee, the court decision may not be in favor of the organization (Decision of the Supreme Court of the Russian Federation dated January 20, 2012 No. 59-B11-17).

FOR YOUR INFORMATION

A technical glitch in a computer program does not count as a counting error. This means that the return of excessively accrued and paid wages is allowed only with the voluntary consent of the employee.

Let us give another typical example on the topic of “ counting error ”.

EXAMPLE 2

There was an error in payroll calculation: the tariff rate corresponding to a higher position was applied. As a result, the employee received an unearned amount on the payday.

Does the organization have the right to reduce an employee’s salary next month?

According to Part 2 of Art. 137 of the Labor Code of the Russian Federation, deductions from an employee’s salary to pay off his debt to the employer can be made :

- to reimburse an unpaid advance issued to an employee on account of wages;

- to repay an unspent and not returned timely advance payment issued in connection with a business trip or transfer to another job in another area, as well as in other cases;

- to return amounts overpaid to the employee due to accounting errors, as well as amounts overpaid to the employee, if the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards (Part 3 of Article 155 of the Labor Code of the Russian Federation) or downtime (Part 3 Article 157 of the Labor Code of the Russian Federation);

- upon dismissal of an employee before the end of the working year for which he has already received annual paid leave for unworked vacation days.

Thus, the list of cases of wage deduction is closed .

Wages overpaid to an employee cannot be recovered from him, except for a “counting error.”

In the situation under consideration, an error was identified in that when calculating average earnings, a tariff rate that was not subject to use (of a higher position) was applied. Such an overpayment is not recognized as a counting error, since it was due to the fault of the employer due to incorrect application of the payroll provisions. Similar explanations were given in the Determination of the Moscow Regional Court dated October 12, 2010 No. 33-19764.

Thus, the case in question withholding wages does not comply with labor legislation, and therefore the employer does not have the right to withhold wages from an employee due to the application of a tariff rate that was not subject to application.

EXAMPLE 3

The employee did not account for the amounts given to him on account and did not voluntarily repay his debt. Is it possible to issue an order and deduct these amounts from the employee’s salary?

The accountable person is obliged to submit an advance report with attached supporting documents to the accounting department. The expense report is checked by the accounting department, and approved by the head of the organization. In this case, the employee is obliged to report within three working days after the expiration date for which cash was issued for the report.

According to Art. 137 of the Labor Code of the Russian Federation establishes that deductions from an employee’s wages without his voluntary consent are made only in cases directly provided for by the Labor Code of the Russian Federation and other federal laws.

From para. 3 hours 2 tbsp. 137 of the Labor Code of the Russian Federation it follows that deductions from an employee’s salary to repay his debt to the employer can be made to repay an unspent and not timely returned advance issued in connection with a business trip or transfer to another job in another area, as well as in other cases provided for by this article. In turn, this article does not provide for the deduction of unreturned accountable amounts from the employee’s salary.

Therefore, one should take into account the opinion of Rostrud (letter of Rostrud dated 08/09/2007 No. 3044-6-0): “If the employee does not promptly return the balance of unused funds to the cash desk, then his written consent to withhold such amounts should be obtained.”

Since in the case under consideration, consent to withhold accountable amounts from wages was not received from the employee, the employer does not have the right to withhold them from the employee’s wages. In this case, the employer has the right to recover accountable amounts through the court.

Bonuses and rewards: typical mistakes and controversial issues

According to Art. 129 of the Labor Code of the Russian Federation incentive payments are one of the components of wages. At the same time, the organization’s local regulations may approve a list of incentive payments. For example, incentive payments include the following payments:

- for intensity and high results of work;

- for the quality of work performed;

- for continuous work experience, length of service;

- for performing particularly important and urgent work;

- for an academic degree (title);

- for an honorary title;

- bonuses based on the results of the organization’s work.

NOTE

Not all incentive payments can be taken into account as part of labor costs when calculating income tax, even if they are specified in the local regulations of the organization.

According to Art. 255 of the Tax Code of the Russian Federation, labor costs that are taken into account when calculating income tax include incentive charges:

- bonuses for production results;

- premiums to tariff rates and salaries for professional excellence;

- high achievements in work, etc.

At the same time, employee benefits are taken into account for tax purposes if they are provided for in employment contracts or if they contain a reference to a local regulatory act (letter of the Federal Tax Service of the Russian Federation dated April 1, 2011 No. KE-4-3/5165 “On the procedure for accounting for profit tax purposes of payments in the form of bonuses for the results of economic activities”, Department of the Federal Tax Service of the Russian Federation in Moscow dated August 13, 2012 No. 16-15 / [email protected] “On the procedure for accounting for profit tax purposes of expenses for bonuses”).

The official position that expenses in the form of payments not related to the production results of employees cannot be taken into account as expenses for income tax purposes is set out in the letter of the Ministry of Finance of Russia dated September 21, 2010 No. 03-03-06/1/602.

Let's look at the example of specific situations regarding controversial problems with bonus payments.

EXAMPLE 4

The bonus regulations provide for monthly bonuses to employees. Based on the results of the first quarter of 2013, the organization incurred a loss.

Is it possible to pay bonuses in the second quarter and take them into account as expenses when calculating income tax? Will the situation change if a loss is incurred at the end of the year?

As a general rule, expenses for paying bonuses to employees are taken into account when calculating income tax on the basis of local regulations of the organization, including the Regulations on Bonuses, provided that the employment contracts concluded with employees make reference to this provision.

It is necessary to take into account that monthly, quarterly and annual bonuses provided for by the organization’s local regulations can be paid and taken into account when calculating income tax only if they are related to the production results of employees’ labor. This especially applies to year-end bonuses.

In other words, bonuses can be paid and taken into account in expenses when calculating profits if the organization has a provision on bonuses, there is a reference to this document in employment contracts, and the order for the payment of bonuses for the year states that it is paid for production results. At the same time, the fact of whether the organization has made a profit or not has no legal significance in the case of incentive payments to employees for production achievements (letter of the Ministry of Finance of Russia dated September 22, 2010 No. 03-03-06/1/606 “On accounting for expenses when calculating income tax expenses for the payment of bonuses issued on the basis and in the amounts provided for by order of the organization’s management”).

FOR YOUR INFORMATION

A loss as a financial result of an organization’s entrepreneurial activity can be received not from the main activity, but from related activities (for example, from unsuccessful financial investments, loss of property under force majeure circumstances, etc.).

There is no legal basis to deprive workers of incentive payments for performance under such conditions.

Thus, in order to avoid claims from tax authorities or conflicts with employees, it is necessary to pay attention to the execution of documents, from which it should directly follow that bonuses are paid for the production results of employees. The connection between bonus payments and production results should be clearly visible directly in the wording of local regulations and orders for bonuses.

EXAMPLE 5

The organization, in accordance with the Regulations on Bonuses, provides its employees with bonuses and rewards for holidays, anniversaries and professional holidays. Are such costs taken into account as part of labor costs for calculating income tax? And if not, should such payments be subject to insurance premiums?

Expenses in the form of cash payments, gifts dedicated to professional holidays, significant dates, personal anniversaries of employees, as a rule, are not directly related to production results, are not elements of the remuneration system and are not provided for in employment contracts. Therefore, such expenses cannot be taken into account for income tax purposes.

Do not forget that if premiums do not reduce taxable profit, then there is no exemption from insurance premiums for them (Part 1, Article 7 of the Federal Law of July 24, 2009 No. 212-FZ (as amended on June 7, 2013) “On Insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund"; hereinafter referred to as Federal Law No. 212-FZ). In other words, all payments made within the framework of an employment relationship are subject to insurance premiums, with the exception of those that are not subject to insurance premiums and are named in Art. 9 of Federal Law No. 212-FZ. It should be noted that this article of Federal Law No. 212-FZ does not name awards.

A similar approach is developing in arbitration practice. Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 2, 2012 No. A74-2038/2011 contains the conclusion that the disputed payments :

- not related to specific labor results;

- were one-time in nature and were due to such circumstances as reaching the anniversary age, in connection with the anniversary date and retirement, winning a competition, professional and holiday dates.

Resolution of the Federal Antimonopoly Service of the Ural District dated June 20, 2012 No. F09-4873/12 (upheld by the Determination of the Supreme Arbitration Court of the Russian Federation dated September 14, 2012 No. VAS-11641/12) supports the conclusion that premiums on the above grounds are not subject to inclusion in expenses taken into account for the purpose of calculating income tax.

At the same time, the Tax Code of the Russian Federation does not prohibit the inclusion in expenses of insurance premiums accrued for payments that are not taken into account for tax purposes. Therefore, insurance premiums for any employee benefits reduce taxable profit on the basis of sub-clause. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, and the date of incurring such expenses is the date of accrual of contributions (subclause 1, clause 7, Article 272 of the Tax Code of the Russian Federation).

EXAMPLE 6

During the audit, it was revealed that the organization’s order for employee bonuses contained the following wording: “For conscientious work and in connection with the 45th anniversary, award the shop manager I.P. Komarov with a cash bonus in the amount of 100% of the official salary.”

In this case, the bonus is paid not only in connection with the anniversary, but also for high achievements in work, for conscientious successful work, which is directly provided for in paragraph 2 of Art. 255 Tax Code of the Russian Federation.

Let’s say the official salary of employee I.P. Komarov is 40 thousand rubles. The best option in this situation is to differentiate bonus payments on different grounds (for example, for production results or high achievements in work, give an employee a bonus in the amount of 50% of the official salary, and for a personal anniversary, award a cash bonus in the amount of 20 thousand rubles).

In this case, the entire amount of 40 thousand rubles will be subject to insurance premiums, but a bonus in the amount of 50% of the official salary can be taken into account as part of the costs when calculating income tax.

Thus, the official position of the regulatory authorities is that bonuses of a non-productive nature cannot be taken into account when calculating income tax (this approach is supported by arbitration practice).

Conclusion

Recently, the number of orders for wage audits, including proactive audits in this area, has been steadily growing. Auditors, who help identify controversial issues and bring the organization’s remuneration system into full compliance with labor and tax laws, become the main assistants to management. Reducing risks during inspections by regulatory authorities and the ability to avoid conflict situations with employees make personnel audit and wage audit one of the main tools for effective enterprise management.

Audit of personal income tax and insurance charges

Accounting for deductions from employees' salaries should provide the possibility of simple identification of the taxpayer - an individual, the types of income received and the deductions that were provided to him.

An audit of personal income tax accounting involves analysis of synthetic accounting, verification of the correctness of the provision of tax deductions, determination of non-taxable income, completeness and timeliness of transfer of income tax to the budget. Main sources of information: general ledger, statements and order journals for accounts 70 and 68, pay slips, tax reporting forms, tax cards.

Registration of inspection results

Upon completion of the audit, the auditor is obliged to provide the customer with an audit report, the main part of which is the audit report. The inspector also has the opportunity to refuse to provide an opinion if there are compelling reasons.

The conclusion could be:

- positive in the case when labor accounting fully complies with current legislation, and the information specified in the accounting and tax reporting is reliable;

- conditionally positive, when, in general, the accounting of a business entity is organized taking into account the requirements of the law, but during the audit process minor violations or insignificant, easily correctable distortions of reporting indicators are identified;

- negative when the organization’s reporting indicators do not correspond to the actual accounting indicators or payroll accounting is carried out in gross violations of the law.

The auditor has the right to refuse to issue an opinion. The refusal must be justified and is permitted in certain cases. For example, the customer limited the auditor’s access to documentation and did not provide the information necessary and requested by the auditor, as a result of which he is not able to form an objective opinion about the state of salary accounting in the organization. Read also the article: → “Calculations and entries when paying advance wages”

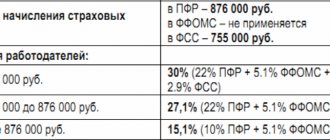

Unified social tax, contributions to the pension fund and insurance fund

In accounting, the amounts of the unified social tax (hereinafter referred to as the Unified Social Tax), calculated in the manner established by Chapter. 24 “Unified social tax” of the Tax Code, are included in expenses for ordinary activities and are reflected in the debit of cost or other accounts (on which the corresponding accruals for wages are made) in correspondence with account 69 “Calculations for social insurance and security” with a breakdown of the amount tax on amounts credited to the federal budget and related funds.

The amount of insurance contributions for compulsory pension insurance, calculated on the basis of the tariffs provided for in Art. 22, 33 of the Federal Law “On Compulsory Pension Insurance in the Russian Federation”, reduces the amount of the single social tax payable to the federal budget (tax deduction) in accordance with clause 2 of Art. 243 NK.

Advance payments under the Unified Social Tax are calculated in the manner established by Art. 243 of the Tax Code, and are reflected in accounting in accordance with the Instructions for the application of the Chart of Accounts in the case under consideration by the debit of account 20 in correspondence with the credit of account 69 “Calculations for social insurance and security” on separate sub-accounts. In accordance with paragraph 2 of Art. 243 of the Tax Code, the amount of the unified social tax (the amount of the advance payment under the Unified Social Tax), subject to payment to the federal budget, is reduced by taxpayers by the amount of insurance contributions accrued by them for the same period (advance payments for the insurance contribution) for compulsory pension insurance (tax deduction), which is reflected in accounting by entries in the subaccounts of account 69 (by the debit of the subaccount “Unified Social Tax in the part credited to the federal budget” and the credit of the subaccounts “Insurance contributions for compulsory pension insurance to finance the insurance part of the labor pension” and “Insurance contributions for compulsory pension insurance to finance the funded part of the labor pension").

In accordance with clause 3 of the Rules for the accrual, accounting and expenditure of funds for the implementation of compulsory social insurance against accidents at work and occupational diseases, insurance premiums are calculated on the accrued wages of employees on all grounds. The amount of accrued insurance premiums relates to other expenses for ordinary activities and is reflected in accordance with the Chart of Accounts on the credit of account 69 in the corresponding subaccount.

For profit tax purposes, accrued amounts of unified social tax and insurance contributions for compulsory social insurance are classified as other expenses associated with production and sales, in accordance with subparagraph. 1 and 45 paragraph 1 art. 264 NK.

The amounts of penalties for UST, insurance contributions for compulsory pension insurance and insurance contributions for compulsory social insurance are reflected in accordance with the Chart of Accounts in the debit of account 99 “Profits and Losses” (sub-account “Payments from profits remaining after taxation”) in correspondence with the loan corresponding subaccounts of account 69.

For the purposes of calculating income tax, the amounts of penalties paid by the organization in connection with the late payment of the unified social tax and the above-mentioned insurance contributions are not taken into account as expenses on the basis of clause 2 of Art. 270 NK. Thus, the amounts of penalties do not participate in the formation of accounting profit indicators and the tax base for corporate income tax.

Common mistakes in accounting

In the course of their activities, the auditor often encounters the same type of errors, which can be grouped as follows:

- violations of the rules for maintaining primary documents;

- untimely withholding of personal income tax and transfer of tax amounts to the budget;

- errors in determining the amount of vacation and sick pay.

In practice, the necessary attention is often not paid to the requirements for filling out primary and supporting documents for recording working hours, production and calculation of wages (sheets, certificates, cards, work orders).

In many cases, the accountant finds it difficult to include additional payments and payments of a compensatory and social nature into the personal income tax and unified social tax base. We recommend that you familiarize yourself with an example of an audit report on verification of settlements with personnel regarding wages, deductions from salaries and the accrual and transfer of unified social tax.

Payment of temporary disability benefits

The auditor, checking calculations for payment of temporary disability benefits, receives confirmation not only of compliance with the law, but also of a certain social protection of the workforce. Thus, the complete absence of this type of payment may indicate an unspoken reluctance of the management of the audited entity to burden itself with additional payments and an actual violation of the law and social protection.

The calculation of the amount of temporary disability benefits in 2004 was carried out in accordance with clause 1 of Art. 8 of the Federal Law of December 8, 2003 No. 166-FZ “On the budget of the Social Insurance Fund of the Russian Federation for 2004” based on average earnings calculated in the manner established by Art. 139 of the Labor Code and the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of April 11, 2003 No. 213 (hereinafter referred to as the Regulations).

Article 8 of Federal Law No. 166-FZ establishes that in 2004, temporary disability benefits are calculated from the average earnings of the employee at the main place of work for the last 12 calendar months preceding the month of the onset of disability.

In accordance with clause 2 of the Regulations, for calculating average earnings, all types of payments provided for by the remuneration system that are used in the organization are taken into account, regardless of the sources of these payments.

According to clause 8 of the Regulations, in all cases, except for the use of summarized recording of working hours, the average daily earnings are used to determine average earnings. Average daily earnings are calculated by dividing the amount of wages actually accrued for the billing period by the number of days actually worked during this period.

The average employee’s earnings are determined by multiplying the average daily earnings by the number of days (working, calendar) in the period subject to payment (clause 8 of the Regulations).

According to the letter of the Social Insurance Fund of the Russian Federation dated April 28, 2004 No. 02–18/06-2706 “On payment of temporary disability benefits,” if there is a cause-and-effect relationship between temporary disability and an industrial accident or occupational disease, payment of temporary disability benefits should be made for account of insurance contributions for compulsory social insurance against accidents at work and occupational diseases.

In accordance with Art. 183 of the Labor Code, in the event of temporary disability, the employer pays the employee temporary disability benefits in accordance with federal law.

The procedure and conditions for providing benefits for temporary disability are established by the Basic conditions for providing benefits for state social insurance, approved by Resolution of the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions of February 23, 1984 No. 191 (hereinafter referred to as the Basic Conditions), as well as the Regulations on the procedure for providing benefits for state social insurance, approved Resolution of the Presidium of the All-Union Central Council of Trade Unions dated November 12, 1984 No. 13-6.

The basis for the assignment of temporary disability benefits is a sick leave certificate (certificate of incapacity for work) issued in accordance with the established procedure (clause 8 of the Basic Conditions).

Benefits for temporary disability due to an occupational disease are issued in the amount of 100% of earnings (clause 24 of the Basic Conditions; clause 29 of the Regulations on the Procedure for Providing Benefits).

Payment of temporary disability benefits to an employee is not recognized as an object of taxation under the Unified Social Tax (Subclause 1, Clause 1, Article 238 of the Tax Code) and, therefore, an object of taxation with insurance contributions for compulsory pension insurance (Clause 2, Article 10 of the Federal Law “On Compulsory Pension Insurance”) In Russian federation").

Temporary disability benefits, paid in accordance with the legislation of the Russian Federation at the expense of the Social Insurance Fund of the Russian Federation, are not subject to insurance contributions for compulsory insurance against industrial accidents and occupational diseases. At the same time, the amount paid to the employee for the period of temporary disability is included in income subject to personal income tax (hereinafter - personal income tax), in accordance with subsection. 7 clause 1 art. 208 and paragraph 1 of Art. 217 NK. Withholding of personal income tax is made upon the actual payment of benefits to the employee (clause 4 of Article 226 of the Tax Code) and is reflected by an entry in the debit of account 70 in correspondence with the credit of account 68 “Calculations for taxes and fees.”