Regulatory regulation

Any calculations that are carried out within the framework of an employment contract must be carried out in accordance with the requirements of the law. The main regulatory legal act in this area is the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), Chapter VI. The Labor Code norms regulate the following issues:

- Articles 133, 133.1 – establish the rules for determining the minimum wage.

- Art. 135 – the procedure for establishing wages (hereinafter referred to as the salary), determination of remuneration systems, organizational issues.

- According to Art. 136 can determine how, where and when the salary is paid. The documents that should contain such information are also listed here.

- According to Art. 137, 138 deductions are made from the employee’s salary. Legal cases of deductions are listed, as well as the limits of deductions.

- The fundamental norm for carrying out many calculations is Art. 139, since it establishes the rules for calculating average wages.

- Articles 146 – 148 establish the payment procedure for persons employed in jobs hazardous to health or with special working conditions.

- Art. 150 – 151 – settlements with employees who work in several areas.

- Wages for overtime by hour and day are established according to Art. 152 – 154.

- Payment for labor that turned out to be of poor quality due to the fault of the employee is 155 – 156.

- Peculiarities of ZP during idle or new production – 157 – 158.

The legislator also guarantees the preservation of the employee’s earnings on holidays and the employer’s liability for violation of wage legislation (122, 142).

Number of vacation days to calculate

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Most often, vacations are granted in calendar days. Standard paid basic leave is 28 calendar days. Moreover, the employee can take time off not immediately, but in parts. The main thing is that at least 2 weeks of vacation should be taken off continuously.

Some categories of workers are entitled to extended basic leave (Article 115 of the Labor Code of the Russian Federation). For example, workers under 18 years of age must rest 31 calendar days, and disabled people - 30 (Article 267 of the Labor Code of the Russian Federation, Article 23 of the Federal Law of November 24, 1995 No. 181-FZ)

Labor legislation also provides for additional leaves for employees (Article 116 of the Labor Code of the Russian Federation).

Important! Non-working days to which holiday weekends are postponed are included in the calculation. If the day off coincides with a holiday, then the Government of the Russian Federation issues a resolution setting the date to which the day off and holiday is transferred. For example, in 2020, February 23 fell on a Saturday, and the day off from that day was moved to May 10. If an employee is on vacation on May 10, this day must also be paid.

In what cases is partial salary paid?

According to the rules of labor legislation, the total hours of work per week per employee should not exceed 40 hours (Article 91).

At the same time, the employee is not required to work all the established deadlines. A reduction in working hours can occur legally, for example:

- when going on leave (vacation);

- if the employee is temporarily unable to work due to illness;

- when employed not from the beginning of the pay period.

In addition, it is possible to establish an individual shortened schedule. The schedule, which consists of fewer working days and hours, must be agreed upon with the manager. Such conditions are reflected in the employment contract.

Usually this applies to:

- students who are unable to work full time;

- persons working part-time;

- persons who for other reasons cannot work more hours.

The legislator closes the list.

In addition to the employment contract, information about an employee’s part-time work is displayed in a separate local act. When an accountant summarizes the salary amounts, he refers to this document first. The local act serves as justification for the amount of the subordinate’s earnings in case it is contested.

In practice, cases arise when an incomplete period of work brings the employee income that does not reach the minimum subsistence level (hereinafter referred to as the minimum wage) or leaves the employee with nothing. Some workers believe that under Art. 133 they have the right to receive at least the minimum wage, but this is not entirely true. The norm guarantees benefits not less than the minimum wage only if the person works the full term.

This means that initially, when concluding an employment contract, the employer does not have the right to establish a payment to a subordinate that is less than the minimum wage. But if, due to some circumstances, full working time was not worked, transferring an amount less than the minimum to the employee is not considered a violation.

How to prepare documents for vacation pay

1. Vacation schedule. It is drawn up at least two weeks before the start of the calendar year, based on the wishes of employees, legal requirements and the interests of the employer. Both the employer (organization or individual entrepreneur) and employees are required to comply with the schedule (Article 123 of the Labor Code of the Russian Federation). There is a unified form No. T-7. It contains, among other things, columns 8 and 9. They must be filled out if the originally planned vacation was subsequently postponed.

Maintain HR records in the web service for free

2. Employee statement. It is written when you need to go on vacation outside of your schedule. If the schedule is followed, then you can do without an application.

The employee must submit an application in advance so that the accounting department has time to calculate and pay vacation pay no later than three days before the start of the vacation.

General Director of LLC "ChOP "CheKa"

from security guard A.A. Simonov

Please provide me with annual paid leave for a period of 14 calendar days from November 5, 2020 to November 18, 2020.

October 31, 2020

3. Notification of the start of vacation. It is necessary if a person will rest according to a schedule. At least two weeks before the start of the vacation, personnel officers must notify the employee about this against signature. If the basis is not a schedule, but a statement, it is not necessary to notify the employee.

This is important to know: How many vacation days are accrued per month?

4. Order (instruction). It is needed both in case of going on scheduled leave and in case of filing an application. There are unified forms: No. T-6 (for one employee) and No. T-6a (for several employees).

Compose HR documents using ready-made templates for free

5. Note-calculation. Usually use form No. T-60. The first side contains the start, end, and rest dates. On the second side there are payment details.

6. Personal card. In the form No. T-2 there is a section VIII intended for information about leave.

7. Time sheet. The corresponding days should be indicated by a letter or numeric code (for annual basic paid leave these are “FROM” and “09”

Keep timesheets for free in an accounting web service

ATTENTION. Previously, organizations and entrepreneurs were required to use unified forms of personnel documents, in particular, forms No. T-2, T-6, T-6a, T-7, T-12, T-13 and T-60 (approved by resolution of the State Statistics Committee dated 01/05/04 No. 1). But now employers can do this voluntarily, or develop their own forms (information from the Ministry of Finance dated 12/04/12 No. PZ-10/2012).

Calculation formulas

There are several ways to determine the amount of earnings for an incomplete period:

- Divide the monthly salary indicator (hereinafter referred to as the minimum wage) by the number of working days in the month (hereinafter referred to as the RDM). Multiply the resulting figure by the amount of days actually worked (hereinafter - FOD) - minimum wage / RDM x FOD. So, for example, if citizen P. worked for 17 days in July, with 21 RDM, and his salary is 60,000 rubles, then: 60,000 / 21 x 17. For 17 days, citizen P. will be given 48,571 rubles.

- You can also subtract the average salary for a certain period. In this case, the salary (hereinafter - O) is divided by the average number of days per month established by the state, after which the resulting figure is multiplied by the FOD - O / 29.4 x FOD. For example, a driver got a job on June 20 and worked for a total of 8 days. His minimum wage is 45,000 rubles. Thus, 45,000 / 29.4 x 8. The driver will be charged 12,244 rubles.

These are standard formulas used by accountants in organizations.

As already mentioned, the requirement for a salary not less than the subsistence minimum must be strictly observed by all employers. This amount is set as a minimum if the employee has completed the entire amount of work. Accordingly, if a citizen worked 5 days in a month, he will receive an amount corresponding to the hours of work.

For example: a seamstress works in an organization where the minimum wage is 40,000 rubles. Due to employment at the end of the month, she worked 5 days out of the required 22. The salary for the reporting period can be calculated as follows: 40,000 / 22 x 5. The actual salary for 5 days will be 9,090 rubles.

We recommend you study! Follow the link:

How to calculate an advance payment for an individual entrepreneur using the simplified tax system

Although the resulting amount does not reach the subsistence level, the organization does not violate the rights of the employee, since the seamstress worked for an incomplete period.

If the employee was not present for the entire monthly working period, then calculations are carried out according to the first formula. If a person did not show up, but by virtue of the law he is entitled to retain his wages, then its amount is calculated using the second formula, taking into account the average number of working days in a month. As a result, the employee receives the sum of indicators for the payroll and time while maintaining the salary.

Salary upon dismissal

If a person decides to quit without working for a full month, then the balance due to him is calculated according to the system that is used at the enterprise according to the above formulas.

In order to fully pay a subordinate, the accounting department must check the availability of unused vacations. If any are identified, the employee should be offered to use them or compensate them with vacation pay.

Example: a specialist served in the organization for 20 days with a salary of 35,000 rubles. After 20 days he quit, then the total amount will be calculated in several stages:

- Salary for financial support: 35,000 / 22 * 20 = 31,818 rubles.

- To calculate vacation compensation, you first need to establish the average daily salary: 31,818 /20 = 1,590 rubles.

- The resulting value is multiplied by 2.33 days, since according to the law, working more than 15 days is considered to be fulfilling the full monthly plan. This means that the compensation will be 1590 x 2.33 = 3,704 rubles.

This means that on the day of leaving the person will receive 31,818 + 3704 = 35,522 rubles.

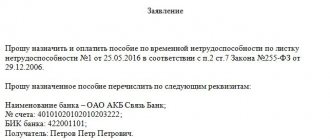

If a person gets sick

Illness, like maternity leave, is not a reason for dismissal or deprivation of a subordinate’s salary. The legislator obliges the employer to preserve for the sick person the place and average earnings for the period during which, according to the certificate of temporary incapacity for work, the citizen was ill.

Sick leave benefits are paid from the following funds:

- enterprises – first 3 days:

- the remaining days of deductions are made by the Social Insurance Fund.

First, the employer makes payments from his budget, and then the Social Insurance Fund returns this amount to him.

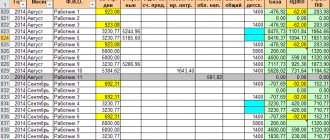

When paying sick leave, different indicators are taken into account than for other reasons for absence from work. What matters here is:

- average salary for the last two years;

- total experience - with 5 years of experience, 60% of the minimum wage is given, with 6 - 8 years - 80%, from 8 years - 100%;

- availability of official employment.

If a citizen is employed unofficially, the employer does not contribute funds to the Fund, which means that the citizen is not entitled to a payment from it. Of course, you will also need a sick leave certificate issued by your attending physician.

Where does the calculation of vacation pay begin?

First of all, it is necessary to determine which period will be the calculation period.

The calculation period is the 12 months preceding the month in which the employee goes on vacation.

For example, an employee plans to go on vacation from June 4th. The billing period will be from 06/01/2017 to 05/31/2018.

However, if an employee’s length of service with a particular employer is less than a year, then the calculation period is the period from the date of hiring to the last calendar day of the month preceding the month of going on vacation. Let’s say an employee was hired on September 11, 2017, and on June 18, 2018, he goes on vacation. The billing period is from 09/11/2017 to 05/31/2018.

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

Payment procedure for different types of payment systems

The indicator and formula for calculating earnings for an incomplete period worked are influenced by the type of payment system under which the citizen works. The following remuneration systems are distinguished:

- Piecework. According to this type, a person receives a salary for the amount of work that was actually performed. The amount of payment for one unit of goods is multiplied by the number of samples actually produced, even if the working period of time is not fully completed. Example: the wizard creates icons. Price for one – 40 rubles. In fact, he produced 1000 badges. Thus, he will receive 40,000 rubles in his hands, despite the number of days worked in the month.

- Time-based. Depends on the time the person worked. So, for the entire month (21 days) you are entitled to 35,000 rubles. In this case, the first formula is used, where daily earnings (minimum wage / 21) are multiplied by the daily income. Example: the seller served 14 days with 21 working days in a month. His minimum wage is 23,000 rubles, then: 21 * 14 = 15,333 rubles

- Commission. According to this system, the employee is most dependent on the amount of time worked, since if he is absent from work for at least a few days, he is deprived of the opportunity to work. The employer is interested in the result of the work, not the hours worked. This procedure for remuneration is used when selling goods or performing services at a percentage.

Example: a bank specialist must attract clients and provide services for 500,000 according to a given plan. For completing the task he will receive 10%. If he fulfilled the plan for less than the full period, then he will receive an amount calculated from what he actually fulfilled.

Accordingly, if a specialist is not sure whether he will be able to complete the work on time, he should not relax and skip hours, since failure to fulfill the plan is directly proportional to the decrease in his income. Recycling, on the contrary, contributes to an increase in salary.

Often several payment systems are used simultaneously, for example, time-based and commission. Then the person is given a salary that he will definitely receive for the month, while the rest of the income will depend on the volume of tasks and plans completed. This means that the omission will be displayed on the salary amount, and the percentage is calculated using the classical method.

We recommend you study! Follow the link:

Is 1 percent deducted from income over 300,000 rubles for individual entrepreneurs?

Example: a salesperson works at a salary of 20,000 rubles, with ten percent of sales. The number of RDM is 23, and FOD is 13, sold for 100,000 rubles.

The calculation is as follows:

- salary amount: 20,000 / 23 x 13 = 11,304 rubles.

- commission: 100,000 x 10% = 10,000 rub.

- in 13 days the seller receives 21,304 rubles.

With a shift schedule, funds are accrued for the amount of shifts worked during the reporting period.

Other grounds

A person may not be present for the full period:

- If there are holidays in the paid period. If a person works for a salary, then the presence of any number of holidays is not reflected in the amount of payments. When an employee was absent for some time during the “holiday month,” the calculations are made according to the first scheme, as usual. In this case, state rest days are not taken into account as non-work.

- When the contract stipulates a partial day. In this case, actual hours and days worked are paid. Often these are people who work part-time and want to earn extra money. For example, if a specialist has agreed with the manager to establish a schedule according to which he undertakes to work 5 hours a day for 30 days, and his minimum wage for a normal day is 45,000 rubles. So, in a month he would have to work 175 hours, but according to the new agreement it turned out to be 60. Then it turns out: 45,000 / 175 x 60 = 15,428 rubles.

- When going to work on a day off. According to labor legislation, it is allowed to go to work on a day of rest as directed by your superiors. If there are not enough hours in the paid period, then to increase earnings, workers also perform work on weekends.

According to the Labor Code of the Russian Federation, salary for a day off is calculated at double the average daily earnings rate.

The formula looks like this:

- salary is calculated for an incomplete period;

- after which the size for the weekend is calculated;

- the final payment will correspond to the sum of the above indicators.

Salary after vacation is calculated according to the usual scheme according to the first formula. Indexation of accrued wages is also carried out according to the general rules of Art. 134 Labor Code of the Russian Federation.

What are rental holidays and how to include them in the contract

9815 Page contents Rental holidays can be called a point of contact between the interests of the tenant and the landlord, allowing both parties to benefit on a monetary basis.

How can I reflect less than a month's rent in the same agreement? Is it possible to separately indicate different rental prices by period by month or date? And what if the utilities are still taken into account in the fixed payment if the month is different? June 08, 2020, 09:12, question No. 2019811 novel,

For the first, this is a way to save your own resources by adapting rented premises to your business.

https://youtu.be/aIrMkc-I5Sk

For the second, it is an opportunity to retain a tenant and get at least some money in the face of serious competition in the rental market for residential and non-residential premises. This term can be understood as a certain period of time during which the tenant does not pay rent or pays some part of it.

There is no such thing in legislation as “rental holidays,” but the rules do not prohibit their establishment. This practice is equally applicable in terms of rental of both residential and non-residential premises.

But with the only caveat that in the first case, the agreement is most often concluded verbally, while in the second, the main conditions are reflected in the lease agreement or an additional agreement to it. During the vacation period, the tenant has the right to use the premises.