What is a vacation?

The Labor Code of the Russian Federation contains a number of provisions and basic legal issues relating to the employer and his employees. Knowledge and adherence to all norms ensures comfortable relationships between all members of the labor process. Vacation is the official right of an employee to take a break from his duties for a certain period of time.

While an employee is on vacation, his position and salary are saved. In addition, before the start of the vacation, employees are entitled to certain funds, the amount of which depends on their salary.

How is a bonus calculated if the employee was on vacation?

It all depends on the procedure that is prescribed in the company’s internal documents.

Let’s add to the last example the condition that at the end of the month, employees are given a bonus in the amount of 30% of their salary.

If, according to the company’s documents, the bonus for the month is paid along with the salary for this month, our accountant will receive 30% of the fee for the time actually worked along with the salary: 12,900 x 30% = 3,870 rubles. Total salary for March: 12,900 + 3,870 = 16,770 rubles. In hand minus personal income tax – 14,590 rubles.

But in some organizations the bonus is paid a month later, when the performance indicators for the month are known exactly. Then our accountant will receive a partial salary during the month of vacation, but a full bonus for the last month worked: 43,000 x 30% = 12,900 rubles. – bonus Total 25,800 rubles, in hand minus personal income tax – 22,446 rubles.

But next month everything will be the other way around: the accountant will receive a salary for a full month if he works in full, and a bonus for working incompletely.

https://youtu.be/M8Sni-nG63Y

Types of required vacations

In the Russian Federation there are the following types of vacations:

- permanent annual leave (paid);

- additional paid annual leave;

- leave due to pregnancy and childbirth;

- Holiday to care for the child;

- vacation at your own expense.

The duration of the vacation is 28 days.

The duration of the main vacation is twenty-eight days. Employees can take this leave every year during which they have worked for the organization. An employee can take his very first vacation no earlier than six months after the start of his working life.

However, there may be exceptions in which an employee can take advantage of advance leave. This means that in the future he will not be able to use the annual basic benefit. In order for employees to plan their own vacation time, most enterprises present a vacation schedule at the beginning of each calendar year.

Sometimes the main vacation period can be more than 28 days. This is only possible if the employee belongs to the following categories of persons:

- disabled people;

- minor employees;

- employees of educational organizations;

- rescue workers;

- workers who work in the production of chemical weapons;

- scientific workers who have been awarded the degree of candidate or doctor of science;

- persons working in civilian and city organizations;

- employees of the prosecutor's office and judicial authorities.

Deadlines for calculation and payment of wages

The payment date is set in one of the following documents: internal labor regulations, collective agreement or employment contract. Wages are paid at least every half month (Article 136 of the Labor Code of the Russian Federation). The final payment for the month is made no later than the 15th.

In practice, the payment period is set in the following order:

- advance payment – from the 16th to the 30th (31st) day of the current month;

- The final payment for the month is from the 1st to the 15th of the next month.

If the payment day coincides with a weekend or non-working holiday, the payment is made on the eve of this day (Article 136 of the Labor Code of the Russian Federation).

In practice, the following methods of calculating the advance are used:

- Proportional to time worked.

- As a percentage of salary.

- In a fixed amount.

The organization chooses the most convenient payment methods and terms for itself.

Salary calculation after maternity leave

The calculation of the base month for an employee who returned from maternity leave before her third birthday occurs for a similar position. At the same time, individual features of this position are not taken into account (for example, an increase in salary for length of service).

In this case, the base month is considered to be the month in which the last salary increase was carried out for the position where a woman works.

If the indicators for a similar position have not been subject to changes, then the base month for an employee who has returned from care leave can be accepted immediately after she returns to work.

Normative base

Art. 139 of the Labor Code of the Russian Federation, as well as Decree of the Government of the Russian Federation dated December 24, 2007 N 922, are the basis for the correct calculation of the average salary. This calculation, in turn, determines the amount of the employee’s annual paid leave. The same article establishes the average monthly number of calendar days. In 2014, there were changes in labor legislation. On April 2, 2014, Federal Law No. 55-FZ was adopted, according to which the average number of days in a month changed from 29.4 to 29.3. This was due to the increase in the duration of the January holidays, which, by the way, happened back in 2012.

How to properly pay vacation pay to employees: https://ipshnik.com/rabota-s-kadrami/otpusknyie/kak-pravilno-vyiplachivat-otpusknyie-sotrudnikam-primeryi-raschetov.html

Calculation of salaries for single mothers after a planned vacation

Single mothers can go on additional leave

The law provides for single mothers, in addition to annual leave, an additional one (lasting 14 days). A woman can take advantage of additional leave provided that the mother has children who have not yet reached fourteen years of age.

Also, additional rest is provided if the work of a single mother is associated with increased nervous and emotional stress. It is worth noting that additional leave is not paid by the employer in all cases.

The procedure for granting, priority, replacement of basic leave with cash payments

Not everyone can be granted leave.

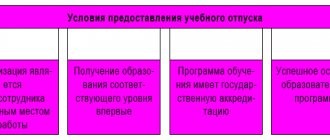

This type of rest is provided to the worker every year. During the first year of work, vacation is granted after six months. The advantage of earlier provision is:

- Pregnant women;

- Under 18 years of age;

- Raising children under 3 years of age;

- Military spouses;

- Other categories.

From the second year, rest time is fixed in the schedule. The employee is notified of this event in advance, 14 days before the start of the rest from work, and signs in the appropriate document. Some individuals have the right to take leave at a time convenient for them, for example, a military personnel with more than 20 years of service or a spouse if his wife is on maternity leave for that period.

Calculation of vacation pay for an incomplete billing period

It does not always happen that an employee managed to work for a full 12 months. Sometimes it was necessary to go on a business trip, there were family circumstances, and due to poor health the person did not go to work. Then the total period of workdays decreases, and accordingly the payments are smaller.

If you do not work a full month, the formula applies:

- Days of the month = coefficient / number of days in the month * actually worked;

- Amount of vacation pay = salary for 12 months/calendar days for a year*vacation days.

Maslova O.A. goes on vacation for 28 days from February 1, 2020. Salary 25 thousand rubles. In October, she did not work for 10 days due to illness and received 15 thousand. Calculated days for the entire year are 312,533. 25000*12/312.533*28=26877. Minus personal income tax and the amount of payments will be 23383.

Ivanova I.E. goes on vacation from March 2, 2020 for 31 days, since he works on a flexible schedule. In December, she did not work for 15 days, taking days off at her own expense. The calculated days for the year will be 375.04. Her salary is 30 thousand rubles monthly. 30000*12/375.04*31=29756. Income tax on this amount is 3868. The amount issued is 25887.

How is vacation pay calculated? Recommendations and examples

In 2020, the coefficient for calculating vacation pay, as well as compensation for unused vacation, will be equal to 29.3.

This is important to know: How long can you be on maternity leave?

In 2014, some amendments were adopted that changed the procedure for calculating vacation pay. It is important to know that by law dated April 2, 2014, number 55-FZ, amendments were made to Article 136 of the Code, and now the coefficient for calculating vacation pay, as well as compensation for unused vacation, became equal to 29.3. Correctly calculated vacation pay will help you make an accurate calculation of your salary after vacation in the future. For this type of calculation, a special formula is used.

Let's consider an example of calculating an employee's vacation pay based on the months he has worked in full. The amount of vacation pay in this case is equal to the total value of monthly salaries during the year, divided by twelve, and then divided by 29.3. The resulting number is multiplied by vacation days. For the calculation, take a period equal to twelve months before the start of the vacation. Below is an example of such a calculation:

How is vacation pay calculated? Recommendations and examples

In 2020, the coefficient for calculating vacation pay, as well as compensation for unused vacation, will be equal to 29.3.

In 2014, some amendments were adopted that changed the procedure for calculating vacation pay. It is important to know that by law dated April 2, 2014, number 55-FZ, amendments were made to Article 136 of the Code, and now the coefficient for calculating vacation pay, as well as compensation for unused vacation, became equal to 29.3. Correctly calculated vacation pay will help you make an accurate calculation of your salary after vacation in the future. For this type of calculation, a special formula is used.

Let's consider an example of calculating an employee's vacation pay based on the months he has worked in full. The amount of vacation pay in this case is equal to the total value of monthly salaries during the year, divided by twelve, and then divided by 29.3. The resulting number is multiplied by vacation days. For the calculation, take a period equal to twelve months before the start of the vacation. Below is an example of such a calculation:

Vacation nuances – 2020

On the eve of summer - the massive vacation season in 2020, you should be guided by updated explanations from the labor department, which clarifies and adjusts the periods, prohibited days and deadlines for the payment of funds intended for vacation. When providing employees with annual paid leave, the accounting and personnel departments must take into account the following nuances:

- Date of transfer or issue from the cash register. The Ministry of Labor, by Letter No. 14-1/OOG-7157 dated September 5, 2018, clarified the timing of payment of funds for vacation. According to the explanations, the minimum period before which money must be paid in accordance with Part 9 of Article 136 of the Labor Code of the Russian Federation is three days before the start. Therefore, if an employee goes on vacation on Monday, then the amount due to the company must be paid no later than Thursday. Previously, Rostrud allowed issuance on Friday, counting the day of issue as one of three calendar days.

- Division into parts. The employer has the right to “split” rest time only with the consent of the employee, taking into account the provisions of Article 125 of the Labor Code of the Russian Federation, which contains the condition that one of the components must be at least 14 calendar days. If the employee objects to the division, the company is obliged to provide the full duration.

- Forbidden days. In order to prevent the receipt of “hidden compensation” for unused vacation rights, the Ministry of Labor in Letter No. 14-2/OOG-9754 dated December 7, 2018 introduced the following regulations:

- permission to grant the right to rest only on working days, regardless of the number, allowing one day (working); approval for the start of the period on a weekend; a ban on vacations exclusively on weekends with penalties of up to 50,000 rubles per company in case of failure to comply with the norm.

Compensation for unused vacation

If a resigning employee has unused vacation, then the employer must pay him upon dismissal compensation for unused vacation (Article 127 of the Labor Code of the Russian Federation).

Our online calculator will also help you calculate the amount of compensation for unused vacation.

Tags: salary, vacation, pay

About the author: admin4ik

« Previous entry

Calculation and accrual of vacation pay for salary increases

It happens that just before or after an employee’s vacation, the organization increased wages (tariff rates). In this case, it is necessary to index the employee’s salary. You can do this in three ways:

How to correctly calculate the average salary: https://ipshnik.com/rabota-s-kadrami/zarplata-i-vyiplatyi/kak-sdelat-raschet-sredney-zarplatyi-primeryi-rascheta-obrazets-spravki.html

- If the salary increased during the calculation period, then all payments from the beginning of the calculation until the month of the increase will be multiplied by the increase factor.

- If the salary increased after the calculation period, but before the start of the vacation, all already calculated earnings are multiplied by the increase factor.

- If the salary increased directly during the vacation, then only part of the vacation pay will increase from the date of the increase.