The terms of power of attorney transactions are often tempting. To compensate for the inconvenience of the buyer from a non-standard sale, sellers reduce the price by 25–40%. Residents of other cities and countries offer good renovation options. They cannot come to the transaction and write out a power of attorney to relatives or realtors.

We had no intention of purchasing real estate, but one day my husband’s aunt offered to buy her apartment. Since the housing is legally clear, we did not refuse. They started to fill out the documents, but the aunt was injured. She left for treatment and, in order not to delay the deal, wrote out a general power of attorney for my mother-in-law.

The apartment is legally and practically clean - 100 sq. m. m of concrete.

We turned to realtors, but they did not want to take responsibility for checking the documents. I had to study the possible outcomes on my own: I went to lawyers, talked to a notary and state registrars. Based on the information received, I will tell you how not to be left without a home when purchasing it from the seller’s representative.

What is a general power of attorney?

A general power of attorney in real estate transactions is a document that equates the representative to the owner of the real estate in terms of rights and obligations in relation to it.

The representative can sell housing, receive money for it, contact state and registration authorities, and also perform other actions related to the assignment for which the power of attorney was issued.

The seller issues such a document so as not to be present at the transaction. He independently decides who will represent his interests: relatives, realtors, lawyers or friends. The reasons for issuing are not regulated by law: sick, lives in another city, works or doesn’t want to bother.

The owner of the property issues a power of attorney with a notary. He reads its provisions out loud and warns about the risks. The buyer needs to know this nuance in order to use it as an argument in a possible legal dispute to declare the transaction void. Reciting the text is necessary so that the principal asks questions about the powers and consequences of the transaction, after which he makes an informed decision. Signature means agreement with the document.

Before the transaction, check the power of attorney and make sure it is executed correctly. Any mistake will lead to suspension of the right registration procedure.

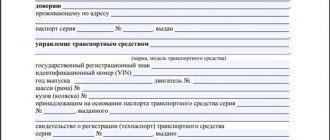

A general power of attorney must contain:

- Full name, passport details, registration address of the owner and representative. If several people are authorized, everyone's data is needed.

- Description of powers. The main thing to pay attention to is the ability of the representative to transfer ownership, receive money and set the value if it is not indicated in the power of attorney. The representative must be authorized to draw up any documents related to the transaction.

- Address, technical characteristics of the property. If it is sold in shares, indicate their ratio. With a power of attorney from the owner of the share, you can only buy his share. For example, a room in an apartment.

- Signature of the principal.

The validity period of a general power of attorney is 1–3 years. After completing the transaction, you need to go to the notary who issued it and write him a simple written application for a review. This means that the power of attorney will cease to be valid and the representative will no longer carry out real estate transactions under it. You can notify the representative about the recall orally or by registered mail with an inventory. The notary calls the authorized person only at the request of the principal.

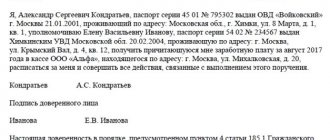

This is what our power of attorney looks like - it spells out all the possible powers for the trustee.

General risks when buying an apartment by proxy

The power of attorney turns out to be fake

This means that the document is not registered in the official register of the Notary Chamber, the seller does not know about its existence and does not sell housing.

This type of fraud is encountered by people who purchase real estate by proxy from single pensioners or orphanage residents. When the real owner realizes that he has been deceived, he goes to court. He recognizes the transaction as void, and the buyer remains on the street. Most often it is not possible to recover the money - the scammer disappears.

For example, in the Irkutsk region, an orphan girl went to court to declare the purchase and sale transaction of her apartment invalid. According to her, she did not sign any documents and does not know how to write or read at all. The examination showed that the power of attorney under which the representative sold the home was fake. The apartment was seized from the new tenant and returned to the previous owner.

The owner revokes the power of attorney, dies before or during the transaction

By law, a power of attorney can be revoked from any notary. Unscrupulous sellers use this right to illegally enrich themselves. The scheme is as follows: they sell housing through a figurehead, agree to receive a deposit or the full amount immediately after signing the contract. While the documents are in Rosreestr, the owner revokes the power of attorney and the buyer is denied registration.

Next, the buyer goes to court, where the owner declares: at the time of the sale he was in a difficult financial situation and sold the property under enslaving conditions. I agree to return the money. The court orders a monthly return from salary or pension, but the seller turns out to be unemployed or his pension is on the verge of the subsistence level.

When the owner dies, the power of attorney also becomes invalid. The seller's heirs have the right to declare the transaction void in court.

There have been no court decisions on this risk in Russia yet, but there are many stories on specialized forums from those who have encountered it. Therefore, consider the likelihood of such events occurring.

It is impossible to verify the adequacy of the owner

By law, a power of attorney on behalf of an incapacitated citizen is issued by his guardian. But often relatives do not bother with bureaucratic procedures and do not formalize guardianship. This plays into the hands of scammers: they ingratiate themselves with the owner and persuade him to issue a power of attorney under any pretext. At the time of signing, the notary may have no complaints about the condition of the homeowner: he is not a doctor and will not discern the hidden course of the disease.

When relatives find out about the scam, they are outraged and want to return the property. They formalize guardianship, prove the owner’s incapacity and file a lawsuit. Thus, the power of attorney becomes invalid. The transaction is considered void.

In the Voronezh region, a woman went to court to have the power of attorney she had issued invalid. She reported that at the time of signing the document she felt unwell, was anxious and embarrassed to ask questions to the notary. The woman was sent for a psychological and psychiatric examination, where experts identified mental characteristics that had a significant impact on the perception and assessment of her actions. The woman simply did not understand what she was doing. The court declared the power of attorney invalid and the transaction void.

The owner is aged and does not account for his actions

Not every older salesperson is incompetent. This makes the situation more complicated: a completely healthy pensioner can issue a power of attorney under the influence of emotions or due to legal illiteracy. He becomes a target for both scammers and young relatives.

When the owner remains on the street, he quickly understands what actions led to the consequences. He makes the situation public, goes to court, and the court takes his side. Since the owner did not receive the money (the scammers received it), he has nothing to return. Then the buyer sues the representative. Theoretically, it is possible to collect what is owed, but the buyer wastes time, nerves and money on litigation without a specific forecast for the result.

There was such a legal dispute in the Krasnodar region. An elderly woman gave her daughter a power of attorney to buy her an apartment. The daughter fulfilled the order, and the happy mother did not even think about revoking the power of attorney. After a while, the daughter independently sold the property to a third party using the same document. The woman went to court with a demand to invalidate it: she did not understand the consequences of issuing a power of attorney and did not know that it needed to be revoked after the transaction. The court upheld the claim, and the buyers remained on the street.

Risks for the seller

Can the person who implements the object be deceived? We should not forget that the transaction amount in the contract and the amount actually handed over often do not coincide. An entity that sells real estate on the market generates income that it is obliged to pay (personal income tax). In order to save on payment, the parties agree that one price will be indicated in the document, but a completely different one will be listed.

This is important to know: Buying an apartment during marriage: who to register for?

The amount corresponding to the agreement between the entities is transferred as payment. In this case there are no violations. It is difficult to prove otherwise.

Advice: Never make concessions or agree to stipulate in the contract an amount different from the actual one. The desire to save on taxes to the budget may have consequences.

Thus, during the transaction of buying and selling an apartment, both parties to the contractual relationship have a chance of falling into the hands of fraudsters. True, the risks of the buyer are several times higher than those of the seller. In order to protect yourself from financial losses and litigation, you need to be sensitive to the issue at the initial stage. You need to assume the worst and check everything you can.

How to minimize common risks

1. Check the power of attorney and notary

Make sure that the seller's notary exists and has issued a power of attorney. You can find out the specialist’s license number, work schedule, phone number and email on the website of the Federal Notary Chamber.

Contact the notary in any convenient way and request information about the fact of issue. The specialist may refuse to reveal the “secret”, citing the confidentiality of personal data. But, according to our notary, more often he and his colleagues understand the importance of the situation and tell buyers the required minimum information.

Another nuance: the power of attorney was issued to my husband’s aunt by a person who temporarily acted as a notary. It was not possible to get it on the website. The lawyer explained: it is the notary who needs to be checked - the one for whom the assistant performed the duties.

The search result will be the current license number, work schedule and telephone number of the specialist.

2. Check if the power of attorney is valid

To do this, use the power of attorney verification service. Enter the document number, date of issue and full name of the notary. If nothing is found, the document is valid.

When registering a right, the state registrar checks the authenticity in the same service. It is impossible to determine a fake by the appearance of the form: scammers forge papers with skill.

At the time of verification, the power of attorney has not been revoked.

3. Meet the owner in advance

Explore his social networks to get to know him by sight. When submitting documents, keep a video call with him. During the conversation, record the screen: the owner should hold in his hands an open passport and a sheet of paper with the written date of the conversation. This will confirm that at the time of the transaction the seller is alive, which means the power of attorney is valid. A normal seller will not refuse such a small amount.

If the owner cannot get in touch (for example, he is too old), communicate with his relatives. Contact them a few days and hours before the transaction and inquire about the seller’s well-being. Record your conversations.

4. Request a certificate from the seller from a psychoneurological dispensary

If everything is in order according to the certificate, the owner in a possible trial will not be able to refer to the fact that he did not account for his actions when he issued the power of attorney.

Few people like the request for a certificate because of the additional costs. Take them on yourself. If the seller's representative still does not agree, refuse the transaction.

The nuances of our transaction

Our situation did not carry standard risks. There are close relationships in the family; deception on the part of an aunt or mother-in-law is excluded. The list of concerns has narrowed down to three items:

- Will the transaction go through in Rosreestr if all participants have the same last name?

- Is it possible to formalize such a transaction in simple written form?

- Will the representative be able to submit an application for recognition of a previously arisen right (information about the apartment was not in the Unified State Register) at the time of transfer of ownership.

Transaction between relatives with the same last name

My husband's aunt wrote down the full name of the buyer - my husband - in the power of attorney. It seemed to her that such a move would simplify the registration process.

But instead, the document turned out to be non-standard and limited: only the husband could buy an apartment. It turned out that all participants in the transaction had the same last name, which clearly shows that they are relatives.

Since the state registrar is obliged to verify the rights and capacity of the parties, our situation in his eyes should have fallen into one of the risk categories: a power of attorney for relatives from an older seller (67 years old) without a certificate from the IPA. If in doubt, he is obliged to suspend the transaction and request the necessary documents from the parties.

However, the registrar missed the power of attorney, because it made its way into the register of the Notary Chamber. For us, the lack of hassles is a plus, but for scammers too. Therefore, check the sanity and capacity of the seller yourself, because Rosreestr does not guarantee anything.

Limitation of persons who can buy an apartment

Our power of attorney resulted in a whole problem. We planned that I would buy the apartment: my husband was flying away on a business trip and could not deal with the transaction. In the end he had to stay, we lost time and money. Therefore, if the seller issues a power of attorney for your transaction, you know him or the representative personally, discuss the limitation of the power of attorney in advance. This will save your plans: in case of unforeseen circumstances, any family member will be able to complete the documents.

Restricting who can purchase does not have any positive aspects. If the owner wants to sell the apartment to someone else, he will revoke the power of attorney and issue a new one.

In addition, my aunt entered my husband’s full name without passport data. I made inquiries to the MFC and Rosreestr to find out whether such a power of attorney would be valid. It turned out that there were no problems: the document has legal force regardless of whether the buyer is registered and what data is provided about him.

Submission of documents for recognition of previously arisen rights

There was no information about our apartment in the Unified State Register: the owner purchased it in 1997, when transactions were registered in the BTI and the property was not assigned a cadastral number. If the representative by power of attorney has the right to perform any registration actions, there will be no problems for those who buy housing with old documents (before 1997).

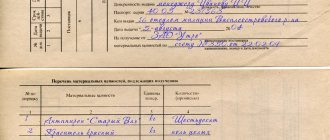

In this case, you must submit two sets of documents for registration at the same time:

- an application for recognition of a previously acquired right to housing, which was acquired before 1997, is submitted by a representative;

- an application for registration of ownership rights is submitted by the buyer.

When the first package is registered, the apartment will be assigned a cadastral number and entered into the Unified State Register. After this, it is possible to continue registering the right as usual.

Risks

...for the buyer

When purchasing an apartment from the seller’s authorized representative, the following risky circumstances arise:

- An issued power of attorney can be revoked at any time, and the law does not even require the need to inform the authorized person about this. To cancel a power of attorney, it is enough to contact any notary. The authorized person may not be aware that his power of attorney has been revoked. An agreement concluded under a power of attorney, which has no legal force, will be declared invalid.

- A power of attorney may be revoked due to the death of the principal, which may also not be known to the authorized person in a timely manner. Such a transaction will also be declared invalid and terminated, and the apartment will be returned to the relatives of the deceased seller.

- The power of attorney may be revoked if the fact of insanity or incapacity of the principal at the time of its preparation is proven. In addition, the trustee may also be declared insane or incompetent at the time of concluding the transaction, which will also lead to its cancellation.

- The transaction may be postponed due to the disappearance of the principal until the transfer of funds for the purchase. This issue may drag on for a long time - until the court declares him missing.

This is important to know: How does the calculation work when buying an apartment in Moscow?

These are the most likely risks arising from the provisions of the law. As practice shows, in reality these risks are less likely than concluding a transaction with a trusted person and principal who are fraudsters. Their only goal is to deceive the buyer, which will ultimately lead to the latter being deprived of both money and real estate.

...for the seller

The risk of losing funds that a trusted person will appropriate for himself and disappear with them. It is impossible to guarantee that the trustee will properly fulfill all of his agreements. Therefore, most often a power of attorney is issued to close relatives, friends, and in some cases it can be issued to realtors to conclude a transaction.

It is possible to recover your money only by knowing the location of the trustee and having convincing evidence of where the funds went after they were received from the buyers. In practice, as we understand, this is not so easy to do. Both the buyer and the seller of real estate may find themselves in a deplorable situation.

Therefore, it is not recommended to issue a general power of attorney to the representative for any actions with the property. The safest option would be for the principal to issue a power of attorney for individual actions step by step, as they are completed. So, at any stage of the transaction, the seller can control the progress of its implementation, make adjustments, and even replace the authorized representative or complete the transaction independently.

Drawing up a contract and paying for an apartment

Transaction form

A power of attorney is not an obstacle to executing a transaction in simple written form. The representative and the buyer can print out the purchase and sale agreement from the Rosreestr website, sign it, and then register ownership.

If you want everything to be official, enter into an agreement through a notary. This does not eliminate risks, but if the deal fails, the notary will act as a witness in court. He will confirm that he has established the identities of the representative and the principal, and read out the rights and obligations of the parties.

To certify the purchase and sale agreement with a notary, you will have to pay from 7,000 to 15,000 rubles (depending on the region) plus 0.2% of the transaction amount exceeding 1,000,000 rubles. There is another expense item - obtaining the consent of the buyer’s spouse to make a purchase. The issue price is up to 2000 ₽. In simple written form, consent is not required.

In Volgograd, the starting rate for a certificate is 10,000 ₽. With a percentage of the transaction amount and registration of my consent, the figure turned out to be large: the notary advised us to draw up the agreement in simple written form, which we did.

Rosreestr’s response to my request (including) about the need for notarized confirmation of a transaction made in simple written form.

Calculations

It is better to transfer money for the apartment to the owner. If not possible, pay the representative. But before you transfer money, check his right to make mutual payments - this is stated in the section of powers of the power of attorney.

Secure the fact of transfer of funds with a receipt: handwritten or certified by a notary. Here it would be more accurate to say that the notary itself is unlikely to be certified by a notary, but the signatures of the parties are ok. The cost of the service varies in regions, on average - 600 ₽. Lawyers believe that the option with a notary is safer than a simple receipt: the buyer acquires an independent witness who confirms that he paid money for the apartment.

An even better insurance option is a notarized receipt and a statement from the owner that he received the money from the representative and has no claims against the buyer. This way the seller acknowledges that all obligations have been fulfilled and he understands the irreversibility of the transaction. To ensure that the representative accurately delivers the documents, include a corresponding clause with a time limit in the contract.

Tax deduction

The buyer has the right to receive a tax deduction from the purchase of real estate in the amount of 13% of its value, but not more than 260 thousand rubles. The taxpayer's right to a tax deduction is confirmed, among other things, by payment documents. For cash payments - a receipt for the transfer of money. If you gave money to a representative, a power of attorney in his name will confirm the legality of the payment. The tax office explained that you need to provide the original. But when submitting documents for registration of rights to the MFC or Rosreestr, it is not necessary and even undesirable to give the original. So our power of attorney was lost, which is why the process of completing the transaction lasted almost two months.

Possible buyer risks

But on the part of the buyer making a transaction through an intermediary, there are much more risks. The most common are the following:

- The author of the power of attorney revoked the power of attorney before its expiration. The transaction will be declared invalid, even if the buyer and the trustee themselves did not know about it.

- The principal has died. In this case, only his heir can sell the property, and he still needs to enter into inheritance. In any case, the power of attorney becomes invalid upon the death of the principal.

- The principal was incompetent at the time of writing the power of attorney or did not give an account of his actions while in a state of intoxication. Fraudsters often take advantage of the client’s deranged state by colluding with doctors at specialized clinics. As a result, the power of attorney is actually signed by the sick person. If his relatives prove this fact, the deal will be annulled.

- If the principal was intimidated or misled. After the trial, such a power of attorney will be revoked, and all transactions carried out under its existence will be cancelled.

- The author of the power of attorney may be listed as missing. If his relatives achieve recognition of him as dead through the court, then transactions made on his behalf will be declared void.

This is important to know: What documents are needed for a tax refund after purchasing an apartment in 2021

Thus, for the buyer, the most important risk is the likelihood that the apartment purchase and sale agreement will be invalid due to the termination of the power of attorney. As a result, the court will oblige the buyer to return the home to the true owner, and the money will have to be “knocked out” from the scammer’s wallet. But this takes time and is not guaranteed to be successful.

conclusions

Buying an apartment by proxy is a risk. But if it is justified by the low cost of the apartment and its legal purity, the deal can be concluded. It’s easier to do it not with a realtor, but with a lawyer. He understands the consequences of transactions with a power of attorney and is responsible for his services.

The main thing you must do before the transaction is to make sure that the owner exists, is alive and sane. Talk to him in any instant messenger with video calling. Request a certificate from the PND. Don't forget to confirm the power of attorney status and check the notary's license. If you are settling with a trustee, include in the contract a clause on the transfer of a notarized receipt stating that the owner has no objections to the transaction and settlements.

We received the title deeds after 3.5 months of waiting. First, Rosreestr lost our power of attorney, then an MFC employee made a mistake in filling out the application. Because of this, the state registrar suspended the transaction and returned the documents. It is noteworthy that the MFC employee filled out the application incorrectly, as she had no experience with transactions by proxy. I went to our registrar, and she showed with her fingers (and a package of documents) that the paperwork should be different. There is no way to influence this; we can only hope for the competence of the staff.

The story in the article is personal experience, not a guide to action. If you still decide to buy an apartment by proxy, consult a lawyer. He will explain the consequences of the transaction and check the documents.