We offer a unique algorithm of actions on the topic “Purchasing a secondary apartment with a mortgage: step-by-step instructions.” Interest in secondary market housing has not diminished over the years. And most often, Russians buy residential real estate with a mortgage loan. Finding a suitable lending option, collecting documents for the bank, getting approval and finalizing the deal - the buyer has to solve problems outside his area of interest. So, how to buy an apartment with a mortgage step by step - below.

Selection of a secondary apartment option for a mortgage

Buying an apartment with a mortgage, where to start? The answer is simple - choose an option. You can test your own strength - submit an advertisement with the phrase “I’ll buy an apartment”, announce your plans to relatives and friends. And there will be many offers, but the requested amounts for housing will be different.

At this stage, the help of real estate agencies and professional realtors is most effective. Inspections with a qualified intermediary are carried out in an orderly, hassle-free manner and at a convenient time.

If you plan to buy an apartment with a mortgage without a realtor, it would be useful to recall the criteria that determine the “value” of the apartment:

- consider the future area of residence from the point of view of work - how close it is, how long the journey will take;

- The next factor is transport interchanges. What types of urban transport ensure the vital activity of the area, traffic intervals, location of stops;

- evaluate the infrastructure - the proximity of schools, kindergartens, shops, banks, consumer services. It’s good if there is a supermarket next to the house with everyday goods, not far from the park area;

- they study the surrounding area - how well-maintained it is, is there a children's area, where residents' vehicles are parked and a utility area is located;

- How orderly is the life of an apartment building - concierge, cleanliness of entrances, staircases, serviceability of elevators, availability of storage rooms for household items;

- directly get acquainted with the option - floor, layout, technical condition, engineering support. Pay attention to the sanitary condition of structures - the absence of pockets of dampness and mold.

They evaluate the financial part - the price of the home being purchased, the limited personal budget, the loan amount. It’s worth going to bank websites where they have mortgage calculators. The program assesses the solvency of the future borrower, builds a payment schedule in accordance with the loan terms, and shows the effective lending rate taking into account insurance, participation in the bank’s salary project, and attraction of a co-borrower. By registering on the website, you can submit a preliminary application for a mortgage online.

Recommended article: Buying an apartment with a Gazprombank mortgage

Statistics prove that most resale apartments are purchased with a Sberbank loan. A variety of mortgage programs, participation in state programs to help families with children, and favorable rates are attractive. And assuming that the transaction will be financed by the largest Russian bank, we will outline the stages of purchasing an apartment with a Sberbank mortgage.

Requirements for the property

A Sberbank mortgage for a private house is riskier than a housing loan for the purchase of an apartment. The fact is that land plots and associated buildings are a less attractive collateral. In case of non-payment of the loan, it will be problematic to sell such real estate. Therefore, the requirements for a house with a Sberbank mortgage are quite serious:

- the object must be located in Russia;

- ownership is formalized in accordance with the established procedure;

- no arrest, lien or other encumbrance has been imposed;

- the property is liquid, that is, it is in good condition and can be sold if necessary (not dilapidated, not in emergency, etc.);

- there should be no illegal redevelopment and reconstruction;

- land acquired for subsequent construction must be located in a village or hamlet and allow subsequent registration of residential real estate (category of individual housing construction, private subsidiary plots on the territory of a populated area);

- the house is a residential building;

- the land plot must be demarcated (that is, have officially established boundaries).

How banks check an apartment for legal purity is described in another article.

Until what year are houses eligible for a Sberbank mortgage?

There is no exact date; the lender looks at the general condition of the building and its liquidity. However, it will definitely not be possible to buy an old house with a Sberbank mortgage , because in case of non-payment, the lender will not be able to sell it to pay off the debt. The percentage of wear and tear on the house should not be more than 50%.

Which houses are suitable for a mortgage at Sberbank should be clarified in advance, even before filling out an application for a loan. After approval, select the real estate option that is more likely to be agreed upon. You can turn to a realtor for help, but it is better to opt for bank partner companies.

It is worth noting that buying a house through a Sberbank mortgage is possible if the land plot is under long-term lease. However, in this case there are significant restrictions on the transaction. The specifics of obtaining such a loan should be clarified with the bank, having previously agreed on the documents with its legal department.

Recommended article: What does a mortgage by law mean and when does it arise?

Collection of necessary documents

At the same time as considering options for future housing, it is advisable to start working with a bank. When purchasing an apartment on a Sberbank loan, two packages of documents are collected: the first concerns the potential borrower, the second concerns the loan object.

The borrower provides:

- application form indicating the loan amount applied for;

- personal documents;

- copies of documents confirming length of service and employment;

- certificates of sources of income.

Read more about the borrower’s documents in another article: Requirements for documents for an online mortgage

Depending on the program, the package may be supplemented with similar documents of the spouse, co-borrower, as well as children, if the family lending option is chosen.

If the borrower has decided on an apartment, copies of the following are submitted for preliminary acquaintance with the investment property:

- title document and confirming registration of property rights;

- technical (cadastral) passport.

Sberbank makes a decision on lending within 3-7 days.

As for the apartment you are buying, you should pay attention to the legal “purity” of the documents. Lenders have a negative attitude towards residential real estate where ownership is formalized by a court decision, minors or elderly residents are registered. To avoid wasting time, discuss the issue with the seller or his representative in advance.

Requirements for the borrower

At Sberbank, a mortgage for a house with a plot of land (as well as other housing loan options) is available only to trustworthy clients. The bank carefully checks each applicant, as well as other participants in the mortgage transaction - co-borrowers, guarantors, mortgagors. A good banking history, the presence of a white salary () and the client’s credit load are of great importance. The official requirements look like this:

- Russian citizenship;

- age from 21 to 75 years (and the maximum age limit is taken into account at the time of planned repayment of the mortgage);

- work experience of at least six months at the current job, total - from 12 months.

Please note that the listed requirements apply not only to the main borrower, but also to other participants in the mortgage.

It is easiest for salary clients to get a mortgage for a residential building from Sberbank. At the initial stage of consideration, they will only need a passport; the bank will be able to verify all other data independently. In addition, applications from salary account holders are processed much faster and more loyally. The likelihood of mortgage approval is very high.

Recommended article: Is it possible to change the mortgage payment date?

How to get a mortgage on a house from Sberbank if your salary is not enough? The borrower can involve up to three co-borrowers in the mortgage transaction, and not only relatives. Mortgage with friends - nuances, pros and cons - are described in another article. Then their salary will be taken into account when calculating their creditworthiness. This means that the approved loan amount will be higher. In this case, the borrower’s spouse must become a co-borrower on the mortgage (except for cases of drawing up a marriage contract and foreign citizenship). How to take out a mortgage without the participation of a spouse - read in detail in another article.

Collateral assessment

If the bank has agreed to the loan, it’s time to see an appraiser who will determine the market value of the future collateral. Here it is necessary to take into account that many banks, and Sberbank among them, accredit appraisal companies. You can find out about accredited appraisers on the bank’s website or consult with an employee.

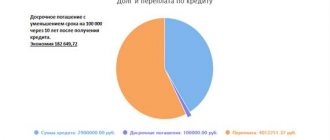

The result of the work of the expert appraiser is a report that substantiates the market value of the apartment. The indicator is important for calculating the amounts of the down payment and mortgage loan, which Sberbank calculates as 15% and 85% of the cost indicated by the expert, respectively. In addition, the property is insured based on its market value.

The bank does not limit the borrower in choosing an appraisal company. But if the appraiser is not accredited, then the review of the appraisal report by the bank may take up to 30 days.

Review of the apartment by the bank

The next step is approval of the purchased apartment by the lender. For this they provide:

- title document;

- confirmation of ownership rights;

- you also need to draw up and sign a purchase and sale agreement for an apartment with a mortgage in one of the forms - preliminary or draft;

- for apartments acquired during marriage - consent to sale from the spouse;

- if the apartment was purchased before marriage, then a statement from the seller about this is required (a sample can be downloaded below)

- a certificate of the composition of those registered in the housing;

- BTI registration certificate for the apartment;

- information center data on utility debts;

- if the sale is carried out by another person on behalf of the owner - a power of attorney;

- assessment report with an album of photographic data of the property.

Contract of purchase and sale of real estate

Sample Consent of the Seller's spouse for the sale of IT

Statement by the Seller that the apartment was not purchased during marriage

The bank verifies that the apartment belongs to the seller and that the title documents comply with the passport details. When selling by power of attorney - the correctness of the document, the validity period, the powers of the authorized person and his passport. Other documents are checked for relevance. After the apartment is approved by the bank, you can proceed to the next step.

Recommended article: Rosselkhozbank mortgage without down payment

Transfer to current account

Transferring mortgage money to the seller's bank account cannot be called a completely safe method of mutual settlements. Usually, immediately after signing the purchase agreement (), the parties to the transaction go to the bank branch, where the first payment is transferred. As confirmation of payment, a payment order is issued, which the borrower must provide to the mortgage manager.

It will be impossible to cancel the transfer, even if the deal subsequently falls through.

The transfer of mortgage money to the seller in the main part, consisting of loan funds, occurs after registration of ownership. Transfer within one financial organization occurs instantly. If the bank transfers the mortgage money to the seller to a third-party account, you will have to wait 3-5 business days for crediting. Please note that transfer fees may apply.

You need to find out in advance whether there will be a commission or not for transferring to the seller’s account in another bank. In practice, we have never taken a commission since it was a transfer of targeted funds. (Transfer of mortgage from VTB to the seller’s account in Sberbank).

If you plan to transfer the down payment separately from the mortgage money, then a commission will definitely be charged. Alternatively, the down payment can be deposited into a checking account and then transferred along with the mortgage.

This option is slightly safer than transferring cash, but there are still risks. If the money is transferred to the mortgage seller's checking account, it becomes the property of the recipient. When the deal falls through, he must return the funds to the buyer in accordance with the terms of the purchase agreement (). If he does not do this or stalls for time, the borrower will have to contact law enforcement agencies or the court.

Recommended article: Apartment exchange via Trade In - how it works

What is the advantage of transferring to a bank account? It is simple and accessible, does not require special knowledge and large expenses. The downside is that there is a risk of being left without money if the deal is cancelled.

Signing a loan agreement and insurance

Next you need:

- make a deposit to the seller (down payment on the mortgage) and take a receipt that the amount has been transferred;

- copies of documents are provided to the creditor.

Receipt for down payment

Experts recommend that documents be notarized, which guarantees the correctness of preparation. The contract must indicate the date of final payment for the apartment.

Next, the buyer signs a loan agreement at the bank and takes out property insurance—from that moment on, he becomes a borrower.

Deal

There are two ways to register a transfer of ownership.

Electronic registration

Sberbank proposed electronic transaction registration to save time. The operation applies to the purchase of finished housing on credit, equity participation agreements, secondary market housing, and undeveloped plots. Comply with the requirements:

- transactions are recorded exclusively between individuals. persons and exclusively direct transactions;

- the number of participants in the transaction is limited - up to 2 people. sellers, 2 people buyers and no more than 5 co-borrowers;

- shared ownership is not registered;

- Transactions where the parties are under the age of majority, incompetent or persons under guardianship are not registered;

- Transactions are not carried out by proxy.

Registration is carried out in the following order:

- a bank employee generates electronic copies of the provided documents;

- sends documents via secure communication channels for registration with Rosreestr;

- after some time, a confirmation is sent to the owner’s email with a note that the transaction has been registered.

Data transmission via communication channels is protected by special reinforced passwords and electronic digital signatures. The service procedure through the Sberbank service is paid, but allows you to save 0.1% of the loan interest.

Submitting documents to the MFC

The same registration can be done at the Service Center. Let's list it step by step:

- An appointment can be made in one of the following ways: through the Center’s website, government services portal, by phone or by visiting the office;

- collect a package of documents for the participants in the transaction and the alienated apartment;

- buyer - pays state duty - 2000 rubles;

- an MFC employee fills out applications, and the buyer and seller will check the information in them;

- then the MFC employee takes a package of all originals and copies of documents along with applications for state registration, and issues an Inventory of Documents to the buyer and seller;

- the buyer - after the expiration of time, receives the documents for the transaction according to the inventory with a registration mark.

According to some estimates, the entire procedure can take up to 30 calendar days, which delays the final settlement between the parties.

Issuance of credit

When the re-registration of ownership of the apartment has been carried out, the loan agreement has been signed, it is time to make the final settlement with the seller. Most often, the bank opens a current account in his name, where the remaining amount under the agreement is credited. Payment via letter of credit or safe deposit box is possible. It is advisable to confirm the final payment with a receipt.

Receipt for credit money

From the moment the loan agreement was signed, the buyer became a borrower who assumed obligations to repay the loan.

Transferring keys

The purchase and sale agreement stipulates two clauses in the seller’s obligations:

- time of vacating the apartment by the previous owner, and deregistration of registered persons. It usually takes 1-2 weeks to remove property;

- date of key transfer. The point is purely symbolic, but it means that the apartment is free and the new owner can move in.

After 7 days, the new owner can register at a new place of residence. After this, personal accounts with utility services are re-registered.

Preliminary purchase and sale agreement

The key document protecting the interests of the parties and, above all, the buyer, is the preliminary purchase and sale agreement. Its text must indicate a prohibition on changing the terms of the transaction on the part of the seller after he receives the first part of the payment. In addition, the agreement must contain comprehensive information about each of the participants, including the bank, as well as the maximum amount of information about the subject of the mortgage.

The best option for document execution is drafting it by specialists from the bank’s legal department. In this case, the buyer can be confident that the contract being signed is correct. An additional tool to reduce the risk of the transaction under consideration is notarization of the document.