Main deduction

When purchasing an apartment/house using mortgage funds, you can receive two tax deductions: the main deduction (clause 3, clause 1, Article 220 of the Tax Code of the Russian Federation) and a deduction for mortgage interest (clause 4, clause 1, Article 220 of the Tax Code of the Russian Federation).

The main deduction when purchasing an apartment with a mortgage is no different from the deduction for a regular purchase. We will not consider it in detail, but will only recall the main points:

- The maximum deduction amount is 2 million rubles. You can return 13% of this amount - 260 thousand rubles. Read more “Amount of deduction when purchasing a home.”

- The right to deduction arises after receipt of the Acceptance and Transfer Certificate of the apartment (when purchasing under an equity participation agreement) or the date of registration of ownership according to an extract from the Unified State Register (if purchasing under a purchase and sale agreement). You can submit documents for a deduction to the tax authority at the end of the year in which the right to it arose. Read more “Information on property deduction”, “When the right of deduction arises”.

- You can include both your own and borrowed funds in the deduction. From a legal point of view, loan funds are also considered your expenses.

The list of required documents and the process of obtaining a deduction are described in the articles: “List of documents for obtaining a deduction” and “The process of obtaining a deduction.”

Example: In 2021 Dezhnev G.S. took out a mortgage loan from the bank in the amount of 2 million rubles and bought an apartment worth 2.2 million rubles. The certificate of registration of ownership was also issued in 2021.

In 2021 Dezhnev G.S. filed a 3-personal income tax return for 2021 with the tax office and declared the main deduction in the maximum amount of 2 million rubles (towards a return of 260 thousand rubles) despite the fact that Dezhnev spent only 200 thousand rubles of personal funds. He can also claim a deduction for mortgage interest.

Mortgage interest deduction

When purchasing a home with a mortgage, in addition to the main deduction, you can also receive a deduction for the loan interest paid and return 13% of the actual mortgage interest paid.

Note: Your mortgage payments are divided into two parts: principal payments and loan interest payments. You can receive this deduction only for payments on credit interest (payments on the principal debt will not be included in the deduction).

Wherein:

1. The right to deduct mortgage interest arises only at the moment the right of the main deduction arises. If the mortgage was issued earlier than the year in which the extract from the Unified State Register (or the Transfer and Acceptance Certificate) was received, then the deduction can still include all the interest you paid on the first mortgage payments.

Example: In 2021 Belsky G.I. took out a mortgage and entered into a share participation agreement for the construction of an apartment, and in 2021 he received an Apartment Acceptance Certificate. Despite the fact that the mortgage has been paid since 2021, contact the tax office minus Belsky G.I. maybe only in 2021. But he will be able to receive a deduction for all interest actually paid since 2018.

2. The maximum amount of deduction for mortgage interest is 3 million rubles (to be returned 390 thousand rubles).

Note: if the loan agreement was concluded before January 1, 2014, then the old rules apply and the amount of credit interest deduction is not limited.

Example: In 2021 Ulanova N.N. took out a mortgage loan of 10 million rubles from the bank and bought an apartment worth 12 million rubles. For 2010-2020 Ulanova N.N. paid 4 million rubles in mortgage interest.

In 2021 Ulanova N.N. filed a 3-NDFL declaration for 2021 with the tax office and declared the main property deduction in the amount of 2 million rubles. (to be returned 260 thousand rubles), as well as a deduction for credit interest in the maximum amount of 3 million rubles. (to be returned 390 thousand rubles).

Only mortgage interest actually paid for previous calendar years can be claimed as a deduction.

Example: In June 2021 Grechikhin S.D. took out a mortgage and bought an apartment. In 2021, he can submit a 3-NDFL declaration for 2021 to the tax office to receive a basic deduction and a deduction for interest paid from July to December 2020. In 2022 Grechikhin S.D. will be able to submit documents for 2021 (add interest paid in 2021 to the declaration), in 2023 - for 2022, etc.

Maximum amount

To calculate the amount required by law, you need to understand how mortgage taxes are deducted. When you start calculating funds, you need to try to take into account many restrictions that complicate the client’s position. Sometimes, due to ignorance of certain details, the user does not receive the 13 percent he is entitled to on the purchase of a home.

The state sets a maximum tax deduction threshold. It cannot be higher than 2 million rubles for the cost of housing and 3 million rubles for the interest paid by the borrower. 13 percent of these amounts will be 260,000 rubles and 390,000. The maximum refund will be 650,000 rubles. The consumer will not be able to receive more than the specified amount, no matter how expensive his apartment is.

The state will not be able to pay you more than 650,000 rubles, but it can easily pay you less. If the client earned a million and bought an apartment for 500,000 rubles, then the deduction will be the same, and 13% of it will be 65,000 rubles.

Thus, the required 130,000 of half a million over 24 months. If you register shared ownership, the amount will be distributed based on the shares assigned to each participant in the process.

Look at the same topic: Refinancing mortgages from other banks at Tinkoff Bank - review of the service

When spouses purchase an apartment as joint property, they write a corresponding statement indicating their parts. Based on the completed documents, the amount of tax deduction for the husband and wife will be calculated. The share can be up to 10% to 90%. If one participant involved has already received a property return, then the second one will not be paid more than 50%.

For what loans and borrowings can you get an interest deduction?

A deduction for credit interest can be obtained not only under mortgage agreements, but for any targeted loan aimed at the purchase/construction of housing (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation).

For example, if you took out a loan from an employer and the contract states that the loan will be used to purchase a specific apartment, then you will be able to receive a tax deduction on the loan interest paid. If there is no such entry in the agreement, then despite the fact that you spent the loan on the purchase of housing, you will not be able to receive a deduction (Letter of the Ministry of Finance dated 04/08/2016 No. 03-04-05/20053).

Example: In 2021, Shilova K.O. I took out a loan from an organization to buy an apartment. The agreement clearly states that the loan was spent on the purchase of a specific apartment, therefore Shilova K.O. will be able to receive a credit interest deduction.

Example: In 2021 Tamarina E.M. I bought an apartment for 2 million rubles with a loan for consumer purposes in the amount of 1 million rubles. Since the loan is not intended for the purchase of an apartment, Tamarina E.M. will be able to receive a property deduction in the amount of 2 million rubles (for a return of 260 thousand rubles), but will not be able to take advantage of the interest deduction.

Repayment options

The mortgage is issued for a fairly long period. Many borrowers want to get rid of this obligation as quickly as possible and pay off their debt ahead of schedule. This can be done in two ways:

- Increase in the monthly payment amount.

- One-time early repayment.

Read more: How to file a cassation appeal to the arbitration court

In the first option, you must discuss with the bank exactly what changes this will entail. Contracts often provide for 2 options. The first of them is to reduce the loan term, the second is to reduce the monthly payment. The first one turns out to be more profitable, because in this case the interest also decreases. If a predetermined system is not provided for in the agreement, then you should contact the bank and indicate that the additional contribution is used to repay the principal debt. Thus, interest will also decrease, because it is charged only on the actual remaining debt. Another option involves paying off the mortgage in full. This is possible at any time. Some manage to collect the required amount by half the debt, while others simply pay off the last few months. It is in such a situation that it is necessary to recalculate interest. The bulk of them in most programs is included in the initial payments, which is why the overpayment has already been made in advance.

Documents for processing mortgage interest deductions

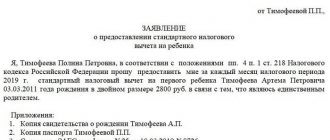

To receive a deduction for mortgage interest, in addition to the main documents for the transaction (see “Documents”), you must submit to the tax office a copy of the loan agreement and a certificate of interest paid.

The certificate can be obtained from the bank where you took out the mortgage. Some banks issue a certificate immediately, and some - a few days after a written request (it is better to check with your bank).

Sometimes the tax authority may also request payment documents for payment of mortgage interest (payment orders, bank statements, receipts, etc.). In this case, you can either provide documents (if available) or refer to the letter of the Federal Tax Service of Russia dated November 22, 2012 N ED-4-3 / [email protected] , which states that a certificate of interest paid from the bank is sufficient and additional payment No documents are required to receive a deduction.

When can a borrower return the money overpaid for the mortgage payment?

More than half of conscientious borrowers pay off their mortgage debt before the end of the contract, while specifically specifying a long term when applying for a loan. There are two options that are the basis for recalculating the payment amount by the bank in which you can count on a refund of interest paid:

- Partial early repayment. That is, the borrower regularly or several times knowingly pays money that exceeds the required monthly mortgage payment. In these cases, the bank, in order not to miss out on its benefits and so that you do not claim a refund of overpaid interest when repaying your mortgage early, offers to either shorten the term of the contract or reduce the amount of the monthly payment. In this case, the borrower also does not lose, since the bank recalculates the amount with the deduction of what has already been paid;

- Full early repayment. This means that at the time the loan agreement is valid, the borrower pays off the entire amount of debt with a lump sum payment. The annuity payment system of all banks at this moment generates an overpayment of interest, since it was based on a longer period and it is precisely this difference that borrowers can return.

Recommended article: How to apply for a mortgage online

It is the second case that serves as the legal basis for the situation in which you can safely contact the bank and demand compensation for the difference in the overpayment, but only for the period of time when full payment has already been made and the agreement was not in effect.

The legal grounds providing for the borrower's rights to interest reimbursement are regulated by the regulatory legal acts of the Russian Federation and the explanatory regulations of the Central Bank of the Russian Federation.

Is it necessary to claim credit interest deduction immediately?

If you have not yet exhausted the main deduction, then you may not immediately claim a deduction for mortgage interest, so as not to submit additional documents to the tax authority. Once the main deduction has been exhausted, you can add information about the credit interest deduction to your return and attach the relevant documents.

Example: In 2021, Khavina M.V. I bought an apartment with a mortgage for 3 million rubles. Income of Khavina M.V. amount to 800 thousand rubles per year (the amount of tax withheld for the year is 104,000 rubles). In this case, in 2021 she will be able to claim the main deduction (since it makes no sense to claim interest).

In 2022, Khavina M.V. will continue to receive the main deduction. In 2023, since the main deduction will be exhausted, she will add to the declaration information about the interest paid from the beginning of payments (from 2020).

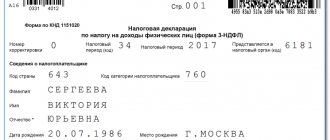

How to apply for a tax deduction - stages

There are three tax refund options in 2021:

- When visiting the inspection at your place of registration.

- When filling out the appropriate form on the Internet, you will need to go to the portal “gosuslugi.ru”.

- When submitting an application at the multifunctional center (MFC).

Tax office addresses can be found on the government services website. The user must first register. There are several stages. With simple authorization, you have limited access to submit applications and register with government agencies.

Look at the same topic: Mortgages for civil servants to purchase housing in [y] year: special conditions and design features

If you pass identification, an expanded range of options will be open:

- Help in finding information;

- Registration at various branches online;

- Ordering certificates via the Internet;

- Review of statistics.

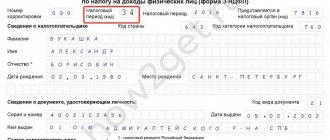

To authorize you need:

- Enter the series and number of the passport;

- If your last name has changed, you must indicate the old one;

- Enter TIN details;

- Fill in the place of residence column.

It is most convenient to submit an application in electronic format. To use this type of service, you must create a personal account. You must enter taxpayer information carefully, checking the accuracy of the data.

After the site administration verifies the accuracy of the information provided, the client will have access to new services. You will be able to fill out a tax return.

When contacting the MFC, it does not matter at all which specific department you decide to contact. They are not tied to areas, so it is not necessary to come to the authority located at your place of residence.

Is it necessary to submit documents for deduction every year?

Often a situation arises when the main deduction has already been exhausted, and the amount of interest paid on the mortgage is small. To save time, you can not submit documents to the tax authority every calendar year, but submit them once every few years, including in the declaration all interest paid for these years.

Example: In 2021 Detnev L.P. I bought an apartment with a mortgage. According to the terms of the mortgage, he annually pays mortgage interest in the amount of 100,000 rubles. Income of Detnev L.P. per year exceed 2 million rubles. In 2021, Detnev filed documents with the tax authority and received a basic deduction and a deduction for interest paid in 2021. In 2021, Detnev may not file a return, but wait a few years and declare all the interest at once: for example, file documents in 2023 and receive a deduction for interest paid in 2021, 2021 and 2022.

Is it profitable to repay a loan early?

Credit organizations, relying on legislation, do not place restrictions on early repayment of mortgages. But many clients are faced with the question of whether it is advisable to partially or fully repay the debt ahead of schedule with an annuity. A simple example of calculations will allow you to answer correctly.

The initial loan parameters are 3,000,000 for 20 years at a rate of 10.5%. The overpayment for the entire period will be 4,188,335.

Let's consider several possible options. If you deposit 100,000 rubles in the first month after the start of the contract, with a decrease in the payment amount, the savings will be 126,792.33. With a decreasing period - 611,021.64.

The situation is different if repayment is made 10 years after the start of lending. With the same amount of early payment of 100,000 rubles, the savings will be 17,669.91 and 182,649.72, respectively.

Such discrepancies are associated with the technology of using annuity payments.

Important! Interest savings will be greater if repayments are made within the first few years of taking out the mortgage. It is more profitable to reduce the duration of the contract, because payment is provided for the time the money is used.

The diagrams illustrate the difference in overpayment depending on when the early repayment is made.

Read more: Deputy Director for Preschool Education

As for full early repayment, it will certainly also be beneficial. Thus, it certainly makes sense to pay off the debt early. But the longer it takes to get a mortgage, the smaller the savings will be.

More useful information about early repayment can be found here.

In order to make calculations based on your parameters, you can use our online calculator below.

| date | Type | Amount/rate | |

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | |

| End of payments | |

| Required Income |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

Interest deduction for refinancing (loan refinancing)

If you refinance a loan with another bank, you can receive a deduction for interest on both the original and the new loan (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation). At the same time, it is important that the new agreement clearly states that it was issued to refinance a previous targeted loan.

Example: Golovanov I.V. I bought an apartment in 2019 worth 3 million rubles (of which 1 million rubles were my own funds, and 2 million rubles were borrowed). In 2021, he refinanced the loan with another bank. Then, upon receipt of the interest deduction, Golovanov I.V. will be able to take into account the interest paid on the first and second loans.