Tax deduction for children's education

Parents of an adult have the right to a social tax deduction for educational expenses for their children. However, there are 2 restrictions:

- the child's age must be no more than 24 years;

- training must be carried out full-time.

At the same time, face-to-face training can also take place remotely. In this case, a deduction will be provided provided that this is not a form, but an educational technology that allows the process of learning and communication between the teacher and the student.

In addition to students, the legislator extends the deduction to: graduate students; interns; residents and cadets.

What the law says

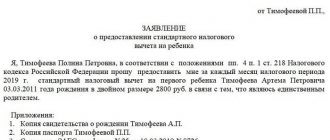

Standard deductions for personal income tax are provided to the taxpayer in the manner and taking into account the features specified in Article 218 of the Tax Code of the Russian Federation.

So, according to para. 11 subp. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, the corresponding standard tax deduction is given to everyone:

- child under 18 years of age;

- full-time student, graduate student, resident, intern, student, cadet under the age of 24 years.

At the same time, the decrease in the tax base occurs from the month (paragraph 18, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation):

- birth of a child (children);

- in which the adoption took place/guardianship (trusteeship) was established;

- entry into force of the agreement on the transfer of the child (children) to be raised in a family and until the end of the year in which the child (children) reached 18/24 years of age;

- expiration or early termination of the agreement on the transfer of the child (children) to be raised in a family;

- death of a child(ren).

What is needed to receive a deduction?

The right to this deduction must be documented, namely, provide your employer with evidence of the provision of educational services to the child by the taxpayer’s parent. Such documents are:

- an agreement with an educational institution indicating the child’s full-time education;

- a certificate from the educational institution on the provision of educational services in a specific tax period on a full-time basis;

- an extract from the organization’s local documents or copies of such documents on the provision of full-time educational services.

You will also need:

- the child’s birth certificate, where the taxpayer is indicated as the parent;

- documents on adoption, guardianship, etc.

If the grounds for the benefit have not changed, the application is submitted once. The certificate is periodically updated as the training period indicated on it ends. More detailed information is presented in the letter of the Ministry of Finance dated 05/08/2018 No. 03-04-05/30997.

Tax deduction amount

The amount of the deduction for children's education is calculated within the calendar year and is determined by the following factors:

- You cannot get back more money in a year than you transferred to the income tax budget (about 13% of the official salary). Accordingly, if you did not have official income and income tax was not withheld from you, then you will not be able to receive a deduction.

- In total, you can return up to 13% of your expenses for educating your children, but not more than 6,500 rubles per year for one child. This is due to the fact that the maximum amount for deduction cannot exceed 50 thousand rubles. for each child (50 thousand rubles x 13% = 6,500 rubles).

Example: In 2020 Portnov A.M. paid for full-time university education for his daughter Daria in the amount of 75 thousand rubles and tuition in a paid school club for his son Sergei in the amount of 36 thousand rubles. In 2020, Portnov earned 300 thousand rubles and paid personal income tax in the amount of 39 thousand rubles. At the end of 2020, in 2020, Portnov A.M. will be able to receive a deduction in the amount of: 50 thousand rubles. (maximum deduction per child) x 13% + 36 thousand rubles. x 13% = 11,180 rub. Since Portnov paid more than 11,570 rubles in tax for the year, he will be able to receive the deduction in full.

How to get a tax deduction for paid education

Your 13%

The tax deduction for an educational loan makes it possible to return up to 13% of the funds spent on your own education or the education of your children for each academic year.

To apply for a deduction, it does not matter which university the student is studying at - public or commercial, the main thing is that the educational institution has a license. Those who paid for education from their own (borrowed) funds, as well as parents, guardians and trustees who pay for the education of children under the age of 24 can claim a tax deduction. Taxes will not be refunded if the studies are paid from maternity capital, winnings, dividends from invested capital, or if the money is some kind of prize.

Shape matters

To obtain a refund, the form of training is important. You can receive a tax deduction provided that the student is a full-time student. Parents can receive a tax deduction for their children's education until they are 24 years old. If the education is paid for by a guardian, then he can return the tax only until the 18th birthday of his guardian.

However, if a student works and pays for his studies independently (from salary or loan funds), regardless of age and form of study, he can qualify for a tax deduction. In this case, he must enter into an agreement with the educational institution in his name. By the way, at the time of formalizing financial relations with an educational institution, it is very important to take into account one detail: one person must be registered in the contract and payment receipts - the one for whom the tax deduction will subsequently be issued. For example, if a training agreement was concluded with one parent, and the receipt shows payment was accepted from another, then it will be impossible to obtain a tax deduction.

Who can claim a social tax deduction for education expenses?

According to Article 219 of the Tax Code of the Russian Federation, a deduction is provided for income taxed at a rate of 13%:

- to the student himself (from January 1, 2009, no more than 120 thousand rubles);

- parents of a full-time student of a child under 24 years of age (in a total amount of no more than 50 thousand rubles for each child);

- guardians (trustees) of a child under 18 years of age studying full-time (in a total amount of no more than 50 thousand rubles for each child);

- former guardians (trustees) of a child under 24 years of age studying full-time (in a total amount of no more than 50 thousand rubles for each child);

- to the brother (sister) of a child under 24 years of age studying full-time (in a total amount of no more than 50 thousand rubles for each child).

Reference

What documents do you need to bring to the tax office?

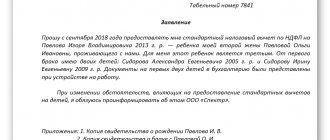

- A written statement of intention to receive a tax deduction for the student’s education (in any form). The document must be submitted at the end of the year in which tuition was paid. Applications are accepted within three years after the end of the year in which payment was made.

- Certificate of income in form 2-NDFL for a full calendar year (issued by the accounting department at work).

- A completed personal income tax return for the past year. The form can be obtained from the tax office at your place of residence or printed from the Federal Tax Service website.

- A copy of the agreement with the educational institution. The contract must specify information about the amount and form of payment. If the amount of payments has changed, documents confirming this are attached to the agreement.

- A certificate from the educational institution stating that the student was studying full-time during the corresponding tax period.

- A copy of the license or other document confirming the status of the educational institution. This can be either a state or a commercial educational institution located in Russia or abroad.

- Copies of payment documents confirming payment for training. They must indicate the personal information of the person for whom the tax deduction is issued.

- A copy of the student's birth certificate.

The documents are verified within 15-20 business days, after which the tax office transfers money as a tax refund to the specified bank account.

Documents for deduction for education of a brother or sister

Your birth certificate . Certified copy.

Your passport or temporary identity card of a citizen of the Russian Federation for those who have lost their passport. A passport is not included in the list of required documents, but NDFLka.ru recommends preparing a copy of the main pages, since a number of tax authorities require them.

Birth certificate of brother, sister . Certified copy.

Documents from the educational institution:

- An agreement between you and the educational institution. It is enough to make a copy.

- License. Copy. It is not necessary to attach a license if its details are specified in the contract. Copies can be certified at the educational institution or in person.

- Certificate from the educational institution stating that the brother/sister is a full-time student . Original.

If the university is located outside of Russia, then a package of documents is required, which is issued by the university upon admission. Among other things, the package must include a document stating that the university has the right to conduct educational activities. Notarized translations are submitted to the Federal Tax Service.

Payment documents : receipts, payment orders, checks. You can restore the lost document where you paid: get a payment certificate from the university’s accounting department or confirmation of payments from your bank. If the tuition fee has changed, do not forget to attach a supporting document.

Help 2-NDFL . This is a certificate of your income from your employer. It must be for the year for which you are filing an income tax refund. If in 2020 you are preparing a deduction for training for 2020, 2-NDFL must be for 2020. If you changed several jobs during the year, request certificates from all employers. Attach the original.

Issued by your company's accounting department. If you changed several jobs during the reporting year, you must provide 2-personal income tax from each employer.

Tax return 3-NDFL . The original is provided to the inspection.

Application for tax deduction . The original application indicates the details of the account to which the money will be transferred to you.

Read more about the deduction in the article “Tax deduction for education.”

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Tax deduction for kindergarten and other educational institutions

The social tax deduction for education is not limited only to secondary specialized or higher education institutions. Payments can also be received for education in preschool educational organizations or additional education institutions. Such educational institutions include:

- Nursery

- Kindergartens

- Schools, lyceums, gymnasiums and other specialized institutions

- Musical, sports, artistic institutions of additional education

- Driving schools

- Courses in foreign languages, programming, photography and similar education

The deduction is provided only for educational services; it cannot be obtained, for example: for food, accommodation, or the child’s presence in kindergarten or an extended day group at school.

You can only receive a deduction for educational services, such as:

- classes with a psychologist, speech therapist, defectologist

- paid classes, sections and clubs

Definition of concepts, full-time and part-time education:

- Full-time – standard form of education

- Correspondence form - self-study with periodic knowledge testing

The division into forms of education in most cases occurs only in higher and secondary specialized institutions. Various courses, clubs, sections and classes at a driving school are in most cases considered full-time education.

Who is eligible to receive the education tax credit? What age should a child be

Article 219 of the Tax Code of the Russian Federation specifies a list of citizens who have the right to apply for this privilege. This includes citizens who have incurred expenses for education in educational institutions with official status.

These include:

- the father or mother of the child, until he reaches the age of 24, as well as adoptive parents.

- citizens who have taken custody of a child until he turns 18 years old.

- persons who were guardians and their obligations towards the ward ended due to the fact that he reached the age of majority, but who wanted to pay for his education until the child reached the age of 24 years.

- citizens who have incurred expenses for the education of their brothers or sisters, regardless of whether they are fully related to them or are related only by one of their parents, until they turn 24 years old.

- taxpayer who incurred expenses for his studies. In this case, the preference is not tied to the age of the applicant.

Important!

Unlike the standard tax deduction for a child under 18 years of age, this education benefit is provided only to one of the parents and it is not conditional on the fact that the one who applied for its accrual paid for the child’s education himself. The Ministry of Finance clarified this provision in the law by saying that if the child’s parents are officially married, then all finances are their jointly acquired property, therefore, if the payment was made by one of them, then with his approval, the second can apply for a preferential return of funds from taxes parent.

Documents for deduction for your education

Passport or temporary identity card of a citizen of the Russian Federation for those who have lost their passport. A passport is not included in the list of required documents, but NDFLka.ru recommends preparing a copy of the main pages, since a number of tax authorities require them.

Documents from the educational institution:

- An agreement between you and the educational institution. It is enough to make a copy.

- License. Copy. It is not necessary to attach a license if its details are specified in the contract. Copies can be certified at the educational institution or in person.

If the university is located outside of Russia, then a package of documents is required, which is issued by the university upon admission. Among other things, the package must include a document stating that the university has the right to conduct educational activities. Notarized translations are submitted to the Federal Tax Service.

Payment documents : receipts, payment orders, checks. You can restore the lost document where you paid: get a payment certificate from the university’s accounting department or confirmation of payments from your bank. If the tuition fee has changed, do not forget to attach a supporting document.

Help 2-NDFL . This is a certificate of your income from your employer. It must be for the year for which you are filing an income tax refund. If in 2020 you are preparing a deduction for training for 2020, 2-NDFL must be for 2020. If you changed several jobs during the year, request certificates from all employers. Attach the original.

Tax return 3-NDFL . The original is provided to the inspection.

Application for tax deduction . The original application indicates the details of the account to which the money will be transferred to you.

Find out what documents need to be submitted in your case!

To get a consultation

For which educational institutions does the tax deduction apply? Status of educational institutions

A deduction for study costs is given in relation to educational organizations that have an appropriate license or other document confirming their status. The list is determined by the Law on Education in the Russian Federation No. 3266-1 dated December 29, 2012.

Tax refunds can be obtained not only for studying at a university, but also in other organizations:

- Preschool structures;

- Schools;

- Organizations of additional training for adults (driving courses, training centers, qualification courses, etc.);

- Children's additional education organizations (dance, music, sports schools, etc.).

Reimbursement can be obtained for education purchased in government institutions, as well as in municipal and private organizations. The legislation of the Russian Federation allows you to receive compensation for a child’s education in foreign institutions. The deduction cannot be used if maternity capital money is spent on a child’s education!

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Period for receiving a tax refund

The time limit for receiving social benefits is 3 years. Refunds are possible for the previous academic year, but not more than the last 3 years.

An application for deductions can be submitted no earlier than the new year following the previous academic year. Many educational institutions use the practice of sending payment orders to students to pay for educational services. They can also be requested in person.

It is possible to obtain a tax deduction for several years, but it is a complicated procedure. Remember the statute of limitations is 3 years and the maximum deduction amount. All situations are considered individually, so you will receive a benefit under any circumstances. Paperwork can delay the process.

Two ways to get a deduction

Through the tax office

By contacting the tax service directly, you can be sure that the entire amount of the required tax deduction will be returned in full. Typically, funds are transferred to the taxpayer's bank account.

The disadvantage of this method is due to the fact that it is difficult to fill out all the fields of the 3NDFL tax return yourself.

You can personally visit the tax office and ask the staff for help, or use the online service through the taxpayer’s personal account on the website of the Federal Tax Service. Citizens of the Russian Federation are also given the right to send documents by Russian Post. There is also the opportunity to use paid services of tax consultants who will do all the work for you.

Through the employer directly

This method is chosen by the majority of citizens. The easiest way is to contact the accounting department at your place of work: colleagues will help with the preparation of all documents. The tax deduction will be transferred gradually, along with wages. You will not need to pay income tax until the deduction amount is reached.

Initially, it is still necessary to contact the tax inspectors for m/f for written confirmation of the tax benefit.

The list of documents required to obtain a tax deduction for education is publicly available on the information resources of tax authorities and in the accounting department of any enterprise. Upon your request, you will be provided with an application form and other background information.

Social security allows you to cover a certain part of the expenses that you incurred for your education or the education of your children and relatives. Millions of Russians use this opportunity every year, but not all, believing that the amounts that are returned are insignificant and are not worth the costs associated with the time to prepare documents. But that's not true. Know how to count your income and expenses!

Step-by-step instructions for filing a deduction

The procedure for receiving a study deduction has several main stages. Their sequence is reflected in the table for registration by the employer and independently.

| Stages | Employer | On one's own |

| Step 1. | Prepare a package of documents, except for 2-NDFL and 3-NDFL | Take an income certificate 2-NDFL from work |

| Step 2. | Submit documents to the Federal Tax Service, write a corresponding application | Draw up a 3-NDFL declaration yourself |

| Step 3. | Pick up the finished notice after 30 days | Provide a package of documents to the tax office at your registration address and fill out an application for reimbursement of part of the personal income tax. (see → how to write an application for a personal income tax refund for education) |

| Step 4. | Bring a notification to the accountant, write an application for deduction | The Federal Tax Service will transfer the compensation to the account within 30 days from the date of filing the application |

| Step 5. | The accountant will provide a deduction from the month the application was written |

When contacting the Federal Tax Service, the taxpayer can write an application for a deduction simultaneously with submitting documents. A 3-month period is allotted for checking the tax return. The deadline during which the inspectorate will reimburse personal income tax is four months from the date of submission of documents.

Important! The right to reimbursement of deductions has a statute of limitations of 3 years. After its expiration, funds cannot be received.

For example, in 2020 you can submit documents for a personal income tax refund for 2013-2015. If study expenses were incurred in 2016, then you can receive a deduction for them from 2020 to 2020.

Unlike property, the deduction can be used repeatedly: as the relevant costs arise.