For various reasons, individual entrepreneurs and organizations may not operate during the tax period. In such cases, reporting for most taxes will be zero, which means you can not fill out reporting forms for each of them, but submit a single simplified declaration to the Federal Tax Service.

How a single declaration is filled out, who submits it, where and within what time frame, what taxes will have to be reported in the usual manner - all this is covered in our article. Here you will find an example of filling out a simplified declaration.

How to fill out a single simplified tax return: conditions

A simplified declaration is submitted if the individual entrepreneur or organization must fulfill two conditions simultaneously:

- in the reporting period they have no movement of money in their current accounts and cash register,

- there is no object of taxation for the taxes they must pay.

For such taxpayers, a single simplified tax return is zero reporting, which they submit instead of a set of zero reports for several taxes. As a rule, this situation occurs if a company or individual entrepreneur has just been created, or in case of suspension of activities.

The single declaration, as well as the procedure for filling it out, were approved by order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n (form according to KND 1151085). It consists of only two sheets, one of which is intended to be filled out only by individuals who are not individual entrepreneurs.

The first sheet contains information about the taxpayer and tax indicators. The declaration can only reflect data on taxes whose tax period is equal to a quarter or a year, so it cannot include, for example, excise taxes or mineral extraction tax, where the period is a month.

It is important to take into account that insurance premiums from the Pension Fund of the Russian Federation, compulsory medical insurance and the Social Insurance Fund are not taxes; they cannot be shown in a single simplified declaration, but you will have to submit zero calculations.

The unified reporting can only include those taxes for which there is no taxable object. It is a mistake to assume that if during the tax period an organization has no cash flows or profits on OSNO, then it is possible to submit a single declaration for all taxes. This is not always the case. For example, an actually non-operating company has fixed assets on its balance sheet, which means it has a taxable property tax item and will have to submit a property tax return, then the accrued tax must be shown in the income tax return as expenses.

Please note: if, without complying with the required conditions, you submit a single simplified tax return, zero or other reporting for these taxes will be considered unsubmitted, which threatens the taxpayer with a fine.

Submission of a single declaration does not cancel the obligation of individual entrepreneurs to submit an annual 3-NDFL declaration to OSNO, which does not need to be reflected in a single simplified form.

In what cases is this declaration submitted?

A single simplified tax return in 2020 is submitted subject to certain conditions. Namely:

1. The taxpayer did not carry out cash transactions, or there were no cash flows in the current account. 2. The document can be submitted only for taxes for which there are no objects of taxation (for example, property, sale of services or goods).

Thus, the fulfillment of these conditions indicates that the taxpayer did not conduct business activities or is a newly registered individual entrepreneur who has just started working.

Due to the fact that fulfillment of such conditions is extremely rare, a single simplified declaration is not popular among entrepreneurs. The fact is that some entrepreneurs incorrectly believe that they have the right to file a single simplified tax return if they have no profit or did not provide services, but this is incorrect. Indeed, in this case, cash flow includes not only income, but also expenses of the organization.

Unified simplified tax return - sample filling

When filling out the declaration, you need to consider the following nuances:

- Organizations and individual entrepreneurs fill out only the first page; Individuals (not individual entrepreneurs) fill out both pages.

- Please provide your details: INN, KPP, OKTMO and OKVED codes, full name of the organization or last name, first name and patronymic of the individual entrepreneur.

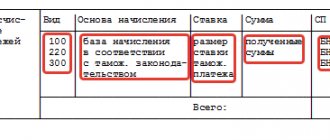

- The names of taxes in column 1 are indicated in the sequence in which they are listed in the second part of the Tax Code of the Russian Federation.

- Column 2 contains the number of the head of the Tax Code corresponding to the tax.

- The tax (reporting) period in a single simplified declaration is indicated in column 3: for a tax period equal to a quarter, put the number “3” (in this case, in column 4 the quarter number is written - from “01” to “04”); for a tax period equal to a year - “0”, and for reporting periods equal to a quarter, half a year, 9 months - “3”, “6” and “9”, respectively, column 4 will remain empty.

- The declaration is signed by an individual, and from an organization - by its head or representative.

Sample filling for individual entrepreneurs:

Unified tax return (KND 1151085): form

Unified tax return: sample completion

Even if an organization (IP) does not conduct business, it must submit zero declarations to its Federal Tax Service at the place of registration for the taxes for which it is a taxpayer. Or submit a single (simplified) tax return, abbreviated as EUD (Appendix No. 1 to Order of the Ministry of Finance dated July 10, 2007 No. 62n). It can be replaced with:

- when an organization applies OSN - income tax and VAT returns. Individual entrepreneurs in the general regime can submit a EUD instead of a VAT return. But it is dangerous to replace a declaration in form 3-NDFL with a EUD. The regulatory authorities take the position that even in the absence of income, an individual entrepreneur in the general regime must submit 3-NDFL to the tax office (clause 1.5 of Article 227, 229 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated November 9, 2015 N BS-4-11/19548 , dated March 21, 2008 N 04-2-02/ [email protected] ). Note that the opportunity to submit a EUD instead of a VAT return is still a positive thing for the taxpayer. After all, the EUD can be submitted to the Federal Tax Service on paper, which cannot be said about the VAT declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation);

- when applying a simplified tax system - a declaration according to the simplified tax system;

- when applying the Unified Agricultural Tax – a declaration under the Unified Agricultural Tax.

The UUD is submitted by the taxpayer instead of zero declarations, provided that (clause 2 of Article 80 of the Tax Code of the Russian Federation):

- he does not conduct business, that is, there are no transactions on his bank accounts (as well as in the organization’s cash desk), which means there is no cash flow;

- he does not have a taxable object for the tax for which he would have to submit a zero declaration (no income and expenses).

Deadline for submitting a single simplified declaration

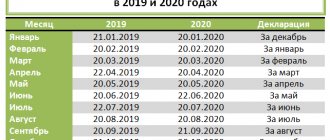

A single declaration must be submitted to the tax office at the location of the company or the place of residence of the individual. The last day for submitting reports is the 20th day of the month following the expired reporting period: quarter, half-year, 9 months, year. Thus, the annual unified simplified declaration 2020 must be submitted no later than January 20, 2020.

Payers using the simplified tax system can submit a single simplified declaration with a zero indicator according to the simplified tax system once a year, as the Ministry of Finance of the Russian Federation explained in its letter No. AS-4-3/12847 dated 08.08.2011. Although this is not always advisable: “simplified” people already do not pay taxes on profits, property, VAT and personal income tax, which means they only need to submit one zero declaration under the simplified tax system and there is no point in replacing it with a single report.

The declaration can be submitted on paper by visiting the inspection in person, or sent by mail, or via electronic communication channels (if the number of employees exceeds 100 people). Having received the paper report, it is marked with the date of acceptance, and the payer receives an electronic receipt to confirm the acceptance of the electronic declaration. By the way, when submitting a single simplified VAT return, the taxpayer can report zero tax on paper, and not in the electronic form required for VAT.

As a result, we note that a single declaration is reporting that, in practice, very few taxpayers can submit. After all, it is not so often that there is an absolute absence of monetary transactions - bank services are written off, the salary of at least the head of the organization is paid, etc. But at the same time, this is a convenient form of zero reporting for newly created payers who have not yet had time to work, but are already required to report taxes.

Penalties for late submission of declarations

If a single simplified tax return was not submitted in 2020, but the tax was paid, the fine is 1,000 rubles.

If the tax has not been paid, then the penalty is 5% of the amount of tax that must be paid (based on the declaration) for each full (incomplete) month from the day that was established for its submission. In this case, the amount of the fine cannot exceed 30% of the specified tax amount and cannot be less than 1,000 rubles.

It is worth noting that if a taxpayer was not entitled to file a return, but filed one, then he faces a penalty for failure to file returns for all taxes for which he was required to report.

Filling out Page 2. Information about an individual who is not an individual entrepreneur

As noted above, individuals who are not individual entrepreneurs and do not want to indicate their TIN fill out the second page of the declaration, where they reflect their personal data.

The “Identity document code” field is presented in the table. Document codes are listed in Appendix 2.

Appendix 1. Table of taxes and corresponding chapters of the Tax Code

| Type of tax | Number of the chapter of the Tax Code of the Russian Federation |

| Value added tax | 21 |

| Corporate income tax | 25 |

Appendix 2. Table of document codes confirming the taxpayer’s identity

| Document code | Title of the document |

| 10 | Foreign citizen's passport |

| 12 | Residence permit in the Russian Federation |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 21 | Passport of a citizen of the Russian Federation |

| 03 | Birth certificate (for persons under 14 years of age) |

| 23 | Birth certificate of a foreign citizen |

Income tax cannot be reflected in a single simplified tax return! They report for it with a declaration in form 3-NDFL.

General procedure

A single simplified tax return consists of 2 sheets. The first indicates the types of deductions for which reporting is actually provided. The second sheet contains information about the payer - an individual who is not an entrepreneur. The quarter serves as a reporting period for which a single simplified tax return is submitted. The deadline for provision is no later than the 20th day of the month that occurs after the end of the period. The document is presented to the Federal Tax Service at the location of the organization or the residential address of the individual. Reports are submitted electronically or in paper form.

The payer can come to the Federal Tax Service in person or send his representative to the service. The law also allows the document to be sent by mail. If the payer misses the deadline for submitting a single simplified tax return, he will be subject to a fine under Article 119 of the Tax Code. When sending a document by registered mail, an additional inventory of the attachment should be made. 2 copies of reporting are provided in paper form. The declaration is submitted in electronic form directly through the Federal Tax Service website or under an agreement through EDI. If a document is presented by a representative, he must have a power of attorney confirming the relevant authority.

Peculiarities

A single simplified tax return for individual entrepreneurs, in essence, replaces reporting on three mandatory payments:

- VAT.

- Deductions from income.

- Property tax.

But there are situations when a payer who does not carry out activities and does not receive income cannot use the UNUD. For example, fixed assets are leased, the payment for which affects the amount of profit and must be reflected in the corresponding declaration. In this case, the enterprise that does not carry out activities suffers losses. Rent can be paid from the account and be indicated with VAT. In this case, the organization submits additional tax reports. price. If a company has an employee on its payroll, he is paid a salary. This, accordingly, entails expenses for the organization. In such cases, a single simplified tax return cannot be used.

Comments

MarinaPooh 12/01/2015 at 11:39 pm # Reply

Marina

Forgot to fill out OKVED. There are six cells, I only filled four. It turned out 52=11=? what are the last two digits to write?

Natalia 12/02/2015 at 09:33 # Reply

Marina, good morning. Code 52.11, includes: 52.11.1 Retail sale in non-specialized stores of frozen products 52.11.2 Retail sale in non-specialized stores of non-frozen products, including drinks, and tobacco products What type of activity you were engaged in, indicate this, see what code you registered when when submitting an application for registration of an individual entrepreneur, they must comply. Don’t worry that there are six cells, OKVED codes have 4 and 5 digits.

Marusya 01/17/2016 at 00:18 # Reply

Hello! and if it is not an individual entrepreneur who fills out a simplified declaration, but an LLC, should income tax be included there?

Natalia 01/17/2016 at 09:26 # Reply

Marusya, hello. Personal income tax is not included in the simplified declaration; a personal income tax report must be submitted for it. Pay attention once again to the conditions when you can submit a simplified declaration: 1. No transactions that result in the movement of funds in bank accounts (at the cash desk). 2. The declaration can be submitted only for those taxes for which there are no objects of taxation (income, sales of goods and services, property, etc.). If you have any doubts, it is better to submit zero reports.

Marusya 01/18/2016 at 17:50 # Reply

Natalia, thank you for your answer. I just had doubts - previously 2-NDFL was simply not submitted in the zero version, but now electronic services are offered in the list of taxes and personal income tax, so I doubted it.

Irina 02/02/2016 at 01:10 pm # Reply

Hello! I opened an individual entrepreneur on January 22, 2020, and a patent only from March 1, 2020. How should I report for the period from January 22 to February 28? Is it possible using a simplified declaration? (rental services), there will be no activity until March 1. If yes, then nothing else is needed other than this declaration?

Natalia 02/02/2016 at 14:11 # Reply

Irina, good afternoon. If you have submitted an application for the use of the simplified tax system, then before the patent begins and until its expiration you will be registered on the simplified tax system and you will submit the simplified tax system declaration for 2020 by 04/30/2017. Apart from this, when working without employees on the simplified tax system + PSN, you do not need to submit anything to the tax office. If you have not submitted an application to apply the simplified tax system, then you still have until February 22, 2016. If you don’t submit, then by default you will end up on OSNO, and you will have to submit a VAT and personal income tax return 3.

Viktor Petrovich Lazarevich 05/16/2016 at 12:03 # Reply

I pay 5% quarterly...how is the amount distributed and where do the funds go?

Tatyana 06/29/2016 at 15:48 # Reply

Trade union organization at OSNO, can I submit a simplified VAT return for the quarter? (no database)

Natalia 07/02/2016 at 17:00 # Reply

Tatyana, Vv you can submit a simplified VAT return. In St. 6 402-FZ, you can read the list of organizations to which simplified reporting forms cannot be submitted.

Nikita 10/16/2016 at 11:30 am # Reply

Good afternoon, I am closing an inactive individual entrepreneur on the basis from the very opening, 3 quarters have passed, what reports do I need to submit? I know that for each quarter you need to submit simplified VAT forms, I don’t know anything else, please tell me

Natalia 10/16/2016 at 12:58 # Reply

Nikita, good afternoon, an individual entrepreneur on OSNO, without employees, is required to submit: - A VAT return, in your case zero, once a quarter, no later than the 25th of the month following the reporting quarter. Moreover, VAT declarations are accepted only in electronic form. — The declaration in form 3-NDFL, in general it is submitted once a year, based on the results of the past year until April 30. When closing an individual entrepreneur, the declaration is submitted no later than 5 days after the closure of the individual entrepreneur. You can submit it at the same time as submitting documents for closing an individual entrepreneur. It is also necessary to keep in mind that despite the fact that you did not have any activity, you are required to pay fixed insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. Their size in 2020 is: Pension Fund: 1613-04 for each month before the closure of the individual entrepreneur. FFOMS: 316-40 for each month before the closure of the individual entrepreneur.

Rules for filling out the declaration in 2020

The form of a single simplified declaration (USD) was approved by Order of the Ministry of Finance of the Russian Federation No. 62 on July 10, 2007. To date, the EUD form has not changed and remains relevant in 2020.

When filling out a single simplified declaration, it is important to follow a number of rules. The basic rules for filling out this document are as follows:

- The declaration can be filled out either by hand or using a computer.

- Individual entrepreneurs (organizations) fill out only the first page of the document.

- When filling out the declaration, you can use blue or black ink.

- Two pages of the document are filled out by individuals (who are not individual entrepreneurs) and do not want to indicate their TIN.

- It is unacceptable to correct errors in the declaration.

Filling out Page 1

Field "TIN":

Individual entrepreneurs and organizations indicate their TIN (in accordance with the received certificate of registration with the tax office).

Field "Checkpoint":

Individual entrepreneurs do not fill out this field, but organizations indicate the checkpoint received from the Federal Tax Service (at the location of the organization).

Field "Document type":

- if the declaration is submitted for the first time during the tax period - put “1 / - “;

- if the first correction is “3/1”;

- if the second correction is "3/2".

Field "Reporting year":

The year for which the declaration is submitted is entered.

Field "Represented in":

The name of the tax office to which the declaration is submitted is indicated. If a document is submitted by an individual. by a person - his last name, first name, patronymic (in accordance with passport data) is indicated without abbreviations; for organizations - full name.

Field "OKATO Code":

From January 1, 2014, the OKATO code is indicated in the field instead of the OKATO code:

This field indicates the activity code in accordance with the OKVED classifier. OKVED codes are contained in the extract from the Unified State Register of Legal Entities (USRLE).