Interdepartmental Inspectorate for Desk Control

A unified database of taxpayers stored in the data center allows you to process information as quickly and accurately as possible. This is especially true during a VAT audit, when the data of counterparties for each transaction is verified. The automated system promptly carries out reconciliations and identifies inconsistencies, while minimizing the risk of errors.

All VAT information received from taxpayers is processed by a special division of the Federal Tax Service - the Interregional Inspectorate of the Federal Tax Service for Desk Control , which was created by Order of the Ministry of Finance of Russia dated July 17, 2014 No. 61n. Its main function is to collect and analyze VAT return data, tracking all stages of the transaction from the manufacturer to the end consumer.

How the new service conducts verification

The tasks of the new division of the Federal Tax Service include:

- processing VAT returns, conducting comparative and cross-analysis of transaction data;

- identification of inconsistencies in information about transactions in the data of counterparties, which may indicate an understatement of the amount of VAT or an overestimation of the amount of tax to be reimbursed;

- identification of VAT payers who abuse the right to tax deduction .

If the amount of VAT paid by one party to the transaction corresponds to the amount accepted for deduction by the other party, no questions arise. But transactions in which, as a result of analysis, a discrepancy between the indicated amounts is revealed, are taken into account. Such transactions are subject to close scrutiny by Federal Tax Service specialists: they must determine whether tax abuse is taking place.

Regardless of whether or not the owner of a “suspicious” VAT return has malicious intent, if errors are detected, he will be sent a request for clarification . In some cases, the result of data discrepancies may be a visit from a representative of the Federal Tax Service and an on-site inspection.

Sources of information for desk audits

It is clear that these declarations are fundamental, but far from the only possible source of information in the “office room” on VAT. In accordance with the recommendations of the Federal Tax Service for conducting desk tax audits, contained in letter dated July 16, 2013 N AS-4-2/12705, inspectors can use many different sources:

- all kinds of state data registers (USRN, Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, CCP register, information on licenses, data on income and tax deductions of individuals, information on bank accounts and others), of which there are about fifty in total;

- data previously received from the taxpayer and third parties - statements and messages, previously filed declarations, documents received during previous tax and other audits;

- information from other departments with which the Federal Tax Service cooperates within the framework of agreements on the provision of information - extra-budgetary funds, law enforcement agencies and others.

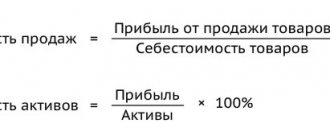

kontrolnye_sootnosheniya_v_deklaracii_po_nds.jpg

When checking the declarations received, tax authorities use special control ratios (CR) according to the relevant reporting forms. Taxpayers should also use CS data for self-monitoring and checking completed reports in order to avoid errors and inconsistencies in them. We will explain in this article what ratios are used when checking a VAT return.

New in legislation: expanding the rights of inspectors

Changes made to the Tax Code at the beginning of the year expanded the list of situations in which Federal Tax Service specialists can request additional documents from the company being inspected for the submitted VAT return. According to the updated paragraph 8.1 of Article 88 of the Tax Code of the Russian Federation, the Federal Tax Service may oblige the taxpayer to provide invoices, other primary and other documents that relate to the transactions specified in the declaration. However, this can only be done if the inconsistencies identified in the declaration may indicate an underestimation of the tax amount or an overestimation of the VAT to be reimbursed.

In this case, inconsistencies can be found both within the company’s own reporting - for example, the data in the declaration and the invoice journal do not match, or when reconciling them with the corresponding forms of the counterparty. Thus, if suspicions of a tax violation arise, the inspector has the right to request almost any documents that will help shed light on the question: which of the parties to the transaction submitted incorrect information to the inspectorate.

Another change, due to the new wording of paragraph 1 of Article 92 of the Tax Code of the Russian Federation, affected the inspection of territories, premises, documents and objects of the taxpayer . Previously, it was allowed to carry out this only during an on-site inspection, but now inspectors have the right to do this during a desk inspection. There is a clear tendency to reduce the number of field inspections and shift their tasks to desk inspections.

There are two cases in which an inspector can visit the taxpayer’s territory for inspection:

- the person has submitted a declaration with the declared amount of tax to be refunded (in other words, simply submitting a declaration with the amount of VAT to be refunded is enough to expect a possible visit from the inspector);

- Errors and inconsistencies were identified in the declaration (including with the data of other taxpayers), which may indicate an understatement of tax or an overestimation of VAT refundable.

Updated VAT return

First rule. Before submitting it, you need to adjust the purchase books, sales books, and journals. It all depends on what kind of operation it is.

There is no need to submit explanations when submitting an updated declaration.

If you make a change after submitting reports for 2020 or 2016, then you must create an additional sheet in both the purchase book and the sales book. You will already be cleaning in it, i.e. cancel entries for invoices that you withdraw and enter those invoices that you will need to enter into the purchase book or sales book. In order for you not to repeat sections 8 and 9, appendices 1 to sections 8 and 9 were provided - this is all the information from the additional sheets.

What is a camera room?

The concept of a desk audit has long gone beyond monitoring the calculation of the amount of tax and the deadline for its payment. Today, almost any “camera room” includes the following procedures:

- comparison of declaration data for the last and previous reporting periods;

- linking the information of the verified form with other declarations, calculations and forms of financial statements;

- analysis of all data available to the tax service to determine the reliability of the tax return indicators.

If the taxpayer is classified as a large taxpayer, as part of the desk audit the following is additionally carried out:

- analysis of revenue indicators, profitability, tax burden of the company, as well as their comparison with the average values of the corresponding indicators in the field of activity and other similar taxpayers;

- identifying the reasons for reducing the tax burden;

- comparison of the company’s tax base in the current and past tax periods;

- analysis of transactions that led to a decrease in the tax base;

- identifying “problem” partners of the company.

When an error is detected

So, VAT reporting has been accepted by the Federal Tax Service. However, this is not yet a reason to relax, because the desk audit process begins after receiving the reporting forms.

First of all, the control relationships between the various sections of the declaration are checked automatically. If an error is identified, the Federal Tax Service sends a request to the company to provide explanations on the control ratios . It is necessary to confirm its receipt within 6 working days (clause 5.1 of Article 23, Article 88 of the Tax Code of the Russian Federation). In the case of a VAT audit, receipt of the requirement and confirmation of this fact is carried out through an electronic reporting system.

Now the company has 5 working days to prepare and send a response to the received request to the tax service. There are two possible options:

- the company admits errors, corrects them and submits an updated declaration ;

- the company still believes that these declarations are correct and provides an appropriate explanation (either electronically or on paper).

The second stage of verification is the comparison of information from counterparties’ reporting forms. If inconsistencies are identified in the data of transaction participants, the company receives an electronic request to provide explanations for the discrepancies . The requirement is generated in two formats - pdf and xml. Each of these files contains a table of invoices that contain discrepancies. Each type of error has its own code: for example, code 1 corresponds to the absence of a counterparty, and code 4 to a detected discrepancy. In this case, an entry of the form 4 (2,3) means that there are inconsistencies in the data in the 2nd and 3rd columns of the form.

As at the previous stage, you must respond to this request within five days . The answer must contain two tables: the first includes data that the taxpayer confirms, and the second - which is corrected. The second table, in turn, consists of two columns, the first of which contains the old information, and the second contains the changed information. There is an important point here: it is permissible to make changes only to those data, the change of which will not affect the amount of VAT. Otherwise, it is necessary to draw up an updated declaration. The answer can be generated either electronically or on paper.

How to write explanations when responding to tax requirements

The taxpayer has the right to provide explanations on VAT to the return in free form. Although officials have prudently developed a sample explanation for VAT, which, if desired, can be used. This document consists of several tables in which you can indicate accounting data and document details, as well as explain the reasons for the discrepancies. Each table is dedicated to a specific topic. For example, there are explanations for the high share of VAT. Before filling out a document, you must write an introductory note to it. It indicates by whom and for what tax period the response to the tax office’s VAT explanations was given, and also provides the number of sheets of the document and the correction number.

If you have a violation of the control ratio, then you will indicate the control ratio number and provide an explanation. Please keep your explanation to 1000 characters.

Explanation of discrepancies regarding the Constitutional Code

The discrepancy between the indicators in column 5 of line 110 of section 3 and line 260 of section 9 is due to rounding error.

If, as a result of checking the requirements for control ratios, errors are identified that lead to changes in the value indicators of the tax return, then it will be necessary to provide an updated tax return.

Those. the absence in section 9 of a registration entry for the invoice, for which the counterparty reflected the corresponding registration entry in section 8 of the tax return.

Case 1. The transaction is confirmed, i.e. There is no invoice in the seller's declaration. No explanations are provided; an updated declaration must be submitted.

Case 2. The transaction is not confirmed, i.e. The seller did not issue this invoice to the buyer.

How to minimize the risk of discrepancies

The best way to reduce the likelihood of data inconsistencies is to first check with each counterparty . This can be done through special services, for example, Kontur.Extern, which contains the VAT+ (Reconciliation) module . Checking the compliance of your forms with your partners’ data, identifying and correcting discrepancies before filing a declaration are the main, but not all, capabilities of the module. With its help, you can assess the trustworthiness of a potential partner, receive expert advice on the preparation of VAT reporting, and if you receive a request from the Federal Tax Service, quickly draw up and send a response.

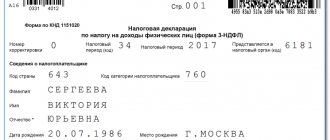

VAT return 2020 and control ratios

The control ratios used to verify the VAT return are contained in the letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 No. GD-4-3/4550 (as amended on April 6, 2017). Taxpayers will have to report VAT for the 1st quarter of 2020 using a new form (changes approved by Order of the Federal Tax Service dated December 28, 2018 No. SA-7-3/853), it is likely that in connection with this the ratios for checking the declaration indicators will also be adjusted, but so far they have not been presented by the tax department.

The ratios allow you to check the correctness of entering indicators into sections 1-7 of the declaration and the relationships between them, as well as with the information included in sections 8-12. Correlations are also checked between indicators within each section.

Procedure 1: Checking VAT accrual

Step-by-step algorithm:

- First of all, check the data from the general ledger. It is necessary to check the correspondence of the numbers and dates of the primary accompanying documentation that you use when filling out accounting records, check the amounts of payments and taxes on them. Correct all discrepancies and contradictions before the declaration falls into the hands of the tax inspector, otherwise you risk paying a penalty after a desk audit.

- Analyze the balance sheet. Now it is important to divide the data from accounts 60 and 62 into subaccounts, where 60.2 and 62.1 are always exclusively in debit, and 60.1 and 62.2 are in credit, respectively. If there is a contradiction, reconcile the balance at the end of the tax period using accounts and amounts from the books of purchases and sales.

- Next, you need to create a statement for account 41 “Goods”. The remaining goods must be in debit and not highlighted in red in accounting. Otherwise, if an error was made, check all issued and received invoices for mis-grading.

- In this order, you need to create a statement of account 19 “VAT on acquired values”, where the debit balance should be zero.

- If there were advances during the reporting period of the declaration, the balance sheet of subaccount 76 “Advances” should be opened. Multiply the credit of subaccount 62.2 by the VAT rate - the value should coincide with the credit at the end of the period.

- In the 1C program, you need to create a subaccount for counterparties, check all invoices, accompanying documents, amounts paid and received - they should not freeze. If you have signed multiple agreements with the same supplier or customer, break them down separately in your accounting. This will help you avoid getting lost in payments and advances, as well as VAT calculations.

- Be sure to check the data on the purchase and sales books for issued and received invoices: their numbers, dates, product names, amounts and costs - do not allow continuous numbering. The manager or chief accountant of the enterprise must approve the signatures and seals in the documentation if corrections have been made to them.

- Check the invoice journal: data on numbers and dates, VAT amounts, total cost, name of the buyer, TIN number and final amounts using the balance sheet. If the transfer of products was free of charge, invoices are not recorded in the journal. The invoice for the advance payment, if there was one, is also not registered.

- Next, it would be advisable to number the sales book, sew it together, certify the information with the seal and signature of the head of the organization, and indicate the number of pages on the last page on the reverse side.

- After checking the details of the purchase book, check the data with the specified statements. Tax documents must be registered in the period when the right to VAT deduction arose.

- If you missed an invoice for the last tax period, or made a mistake in it, cancel it. In this case, you need to fill out an additional sheet, draw up and submit an updated VAT return.

Certain categories of citizens are eligible to lease a plot of land on preferential terms.

How to properly register ownership of a land plot? The step-by-step algorithm is described.

Ownership of land can arise for several reasons. You can read about this in our article.

If you want to find out how to solve your particular problem in 2020, please contact us through the online consultant form or call:

- Moscow.

- Saint Petersburg.