What's happened?

The Federal Tax Service of Russia published on a single portal for posting draft regulatory legal acts a draft of its departmental order approving a new form of income tax return. In accordance with the requirements of Articles 23, 80 and 289 of the Tax Code of the Russian Federation, all taxpayers of corporate income tax are required to provide such a report at the end of each reporting and tax period. The declaration is sent to the tax authorities at the location of the taxpayer and the location of each of its separate divisions.

What is a zero declaration and how to fill it out

Situations where the company did not carry out its activities during the reporting period or did not make a profit and did not incur expenses require filing a zero declaration. That is, the profit tax will be zero, because there was no profit.

In this case, the form will look much simpler. You need to fill in:

- title page, as usual, according to all requirements;

- in the first section (1.1 or 1.2) TIN, KPP, OKATO and KBK codes are filled in. Instead of amounts there are dashes;

- sheet 02 with attachments No. 1 and No. 2. Sheet 02 is also dashes.

In general, they do not submit a declaration on NP:

- exempt from such tax;

- located on the simplified tax system.

Income tax return form.

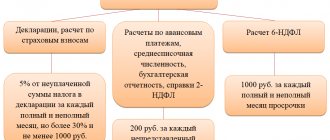

Everyone else is required to submit a declaration, even if it is zero. Penalties for evasion or late submission of a declaration amount to 5% of the amount of tax that must be paid on the basis of failure to submit or late mandatory reporting.

Delay or absence of an annual zero declaration is fined with a minimum amount of 1000 rubles. For a quarter and for 9 months – 200 rubles.

Income tax return form.

Electronic version of the document

The electronic version, by order of the Federal Tax Service, must meet the requirements for XML files. Accountants have the opportunity to draw up a declaration before October 28 of the current year in the 1C accounting program, version 8.3. In this program, you can make changes in accordance with the accounting policies of the organization.

Despite the fact that this reporting document is the most difficult to fill out, the “Regulated income tax return report” in the program will allow you to create a declaration as quickly as possible.

The most important thing here is to enter all the data for the enterprise into 1C, close all accounts that should not have a balance at the end of the reporting period. And, most importantly, fully understand the structure. 1C accounting offers invaluable assistance to the accountant.

https://youtu.be/uMBCTDB07b8

Why was it necessary to update the declaration?

Tax authorities believe that the reporting form needs to be changed due to changes in legislation. In particular, since the approval of the current declaration form, the following changes have been made to the Tax Code of the Russian Federation:

- The procedure for transferring losses from previous years has been changed, in particular, in reporting (tax) periods from January 1, 2017 to December 31, 2020, a restriction has been introduced on the transfer of losses received by taxpayers in previous tax periods in the amount of no more than 50% of the tax base of the current reporting (tax) period. period.

- The approach to the formation of the consolidated tax base of consolidated groups of people has been changed. In particular, the amount of reduction in the tax base of the consolidated group of investors, formed by profitable participants of the consolidated group, is limited to the amount of loss received by the unprofitable participants of the consolidated group, in an amount not exceeding 50% of the profit of the profitable participants of the consolidated group.

- Introduction of an investment tax deduction for corporate income tax. With the help of such a deduction, taxpayers are given the opportunity to reduce income tax by the amount of investments in the construction, purchase and modernization of equipment, as well as by the amount of donations transferred to state and municipal cultural institutions and non-profit organizations (foundations) in order to support these institutions.

- New tax rules for international holding companies have been introduced. In particular, dividends of international holding companies (IHC) and their income from the sale or other disposal (including redemption) of shares (stakes) of Russian or foreign organizations are taxed at a rate of 0% if the conditions provided for by law are met.

- MHC income in the form of profits of controlled foreign companies, which are subject to accounting in the MHC tax base until 01/01/2029, is exempt from income tax.

- The income tax rate at which dividends paid until 01/01/2029 to foreign persons on shares (stakes) of public MHCs has been reduced to 5%.

- Zero tax rates have been established for organizations engaged in tourism and recreational activities in the Far Eastern Federal District.

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

Filling out a declaration for a separate division

At the location of the separate division, it is necessary to submit an income tax return for the separate division (group of separate divisions) in the following composition:

- Title page (Sheet 01);

- subsection 1.1 of Section 1;

- subsection 1.2 of Section 1 (if monthly advance payments are made during the year);

- Appendix No. 5 to Sheet 02.

Here are some features of filling out a profit declaration in the OP.

On the Title Page, in the “Checkpoint” field, the checkpoint of the separate unit at the location of which the declaration is being submitted is indicated.

Accordingly, in the field “Submitted to the tax authority (code)” the code of the Federal Tax Service where the declaration is submitted is indicated.

In the field “At location (accounting) (code)” code 220 is indicated. This means that the declaration is submitted at the location of a separate division of the Russian organization.

In the “Organization/separate division” field, the full name of the separate division is indicated.

In subsection 1.1 of Section 1, lines 040 and 050 are not filled in (dashes are placed), because the tax to the federal budget is paid at the location of the parent organization.

If income tax to the budget of a constituent entity of the Russian Federation is due for additional payment, line 070 is filled in. The amount reflected in it corresponds to the value shown on line 100 of Appendix No. 5 to Sheet 02.

If the tax is to be reduced, line 080 is filled in (from line 110 of Appendix No. 5 to Sheet 02).

If the organization pays monthly advance payments, then in subsection 1.2 of Section 1 you need to fill out lines 220-240.

In these lines you need to show 1/3 of the amount reflected in line 120 of Appendix No. 5 to Sheet 02.

Please note that subsection 1.2 is not included in the tax return for the year.

In Appendix No. 5 to sheet 02, data on this division should be transferred from the corresponding Appendix No. 5 to sheet 02 of the main declaration (in particular, the share of profit of a separate division).

What will change in the income tax return?

In the new income tax return form, Federal Tax Service specialists took into account all of the above changes in tax legislation. The procedure for filling out the declaration and the format for submitting reports in electronic form will also change. You can see what the new form will look like by following the link.

This is important to know: Car tax: benefits for pensioners

It is expected that the order of the Federal Tax Service will be approved and come into force two months from the date of its official publication, that is, the new reporting form will begin to be applied on January 1, 2020.

Income tax return for 2010. KND-1151006

A declaration on the income tax of organizations in the form KND 1151006 is submitted by taxpayers, regardless of whether they have an obligation to pay tax and (or) advance payments for tax, the specifics of calculation and payment of tax after each reporting (tax) period, and submit it to the local tax authorities its location and at the location of each separate division, the corresponding tax returns. Taxpayers classified as the largest taxpayers submit tax returns (calculations) to the tax authority at the place of registration as the largest taxpayer.

The declaration on corporate income tax was approved by order of the Federal Tax Service of the Russian Federation dated December 15, 2010 N MMV-7-3/ [email protected] “On approval of the form and format of the tax return on corporate income tax, the procedure for filling it out.” The order was registered with the Ministry of Justice of the Russian Federation on 02/02/2011 N 19680. Published in the Russian newspaper, N 35, 02/18/2011.

Taxpayers submit income tax returns for the reporting period no later than 28 days from the end of the corresponding reporting period in accordance with paragraph 3 of Article 289 of the Tax Code of the Russian Federation. Valid upon submission of the 2010 tax return .

Declarations based on the results of the tax period are submitted by taxpayers, including those paying advance payments monthly based on the actual profit received, no later than March 28 of the year following the expired tax period in accordance with paragraph 4 of Article 289 of the Tax Code of the Russian Federation.

The deadline for submitting the Declaration, as well as the deadline for paying income tax that falls on a weekend (non-working day) or holiday, is postponed to the first working day after the weekend or holiday.

The declaration can be submitted by the taxpayer to the tax authority in person or through his representative, sent by mail with an inventory of the contents, or transmitted via telecommunication channels. When sending the Declaration by mail, the day of its submission is considered to be the date of sending the postal item with a description of the attachment. When transmitting an income tax return via telecommunication channels, the day of its submission is considered the date of its dispatch. Upon receipt of the Declaration via telecommunication channels, the tax authority is obliged to provide the taxpayer with a receipt in electronic form.

Composition of the Tax return for corporate income tax for reporting and tax periods

1.1. The Tax Return for corporate income tax must include: Title page (Sheet 01), subsection 1.1 of Section 1, Sheet 02, Appendices No. 1 and No. 2 to Sheet 02. Organizations specified in paragraphs 1.2, 1.6 and 1.7 of this Procedure, subsection 1.1 of Section 1 is not represented.

Subsections 1.2 and 1.3 of Section 1, Appendices No. 3, No. 4 and No. 5 to Sheet 02, as well as Sheets 03, 04, 05, 06, 07, Appendix to the tax return are included in the Declaration and are submitted to the tax authority only if the taxpayer has income, expenses, losses or funds subject to reflection in the specified subsections, sheets and appendices, carries out transactions with securities, is a tax agent or includes separate divisions.

Subsection 1.2 of Section 1 is not included in the Declaration for the tax period.

Appendix No. 4 to Sheet 02 is included in the Declaration only for the first quarter and tax period.

Sheet 06 is filled out only by non-state pension funds.

Sheet 07 is filled out by organizations when receiving targeted financing, targeted revenues and other funds specified in paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), when drawing up a Declaration only for the tax period.

1.2. Non-profit organizations that do not have an obligation to pay corporate income tax (hereinafter referred to as income tax) submit a Declaration at the end of the tax period in the form included in the Title Page (Sheet 01), Sheet 02, as well as the Appendix to the tax return, if available. income and expenses, the types of which are given in Appendix No. 4 to this Procedure, and Sheet 07 upon receipt of targeted financing, targeted revenues and other funds specified in paragraphs 1 and 2 of Article 251 of the Code.

1.3. Organizations that pay advance payments monthly based on the actual profit received on an accrual basis from the beginning of the year submit Declarations in the amount specified in paragraph 1.1 of this Procedure for the reporting period (Q1, half-year, 9 months) and tax period (year).

Based on the results of other reporting periods (for January, 2, 4, 5, 7, 8, 10, 11 months), such organizations submit a Declaration in the amount of the Title Page (Sheet 01), subsection 1.1 of Section 1 and Sheet 02. When carrying out relevant operations and (or) the presence of separate divisions, the Declarations also include subsection 1.3 of Section 1, Appendix No. 5 to Sheet 02 and Sheets 03, 04, 05.

1.4. An organization that includes separate divisions, at the end of each reporting and tax period, submits to the tax authority at its location a Declaration drawn up as a whole for the organization with the distribution of profits among separate divisions (Article 289 of the Code) or among separate divisions located in the territory one subject of the Russian Federation, when paying income tax in accordance with the second paragraph of paragraph 2 of Article 288 of the Code (hereinafter referred to as a group of separate divisions).

To the tax authority at the location of the separate division, organizations submit a Declaration, including the Title Page (Sheet 01), subsection 1.1 of Section 1 and subsection 1.2 of Section 1 (if monthly advance payments are made during the reporting (tax) periods), as well as calculation of the amount tax (Appendix No. 5 to Sheet 02), payable at the location of this separate division. When calculating income tax for a group of separate divisions located on the territory of one subject of the Russian Federation, the Declaration in the specified volume is submitted to the tax authority at the location of the separate division through which the payment of profit tax to the budget of this subject of the Russian Federation is carried out (hereinafter referred to as the responsible separate subdivision).

Taxpayers who, in accordance with Article 83 of the Code, are classified as the largest, submit a declaration drawn up for the organization as a whole, as well as declarations for each separate division (group of separate divisions), to the tax authority at the place of registration as the largest taxpayer in electronic form (for telecommunications communication channels) according to established formats, unless a different procedure for presenting information classified as state secret is provided for by the legislation of the Russian Federation.

The title pages of Declarations for separate divisions of the largest taxpayer, submitted by him to the tax authority at the place of registration as the largest taxpayer, indicate the reason codes for registration (hereinafter referred to as KPP), assigned to the organization by the tax authorities at the location of the separate divisions, and the codes of these tax authorities . For the details “at the location (accounting)” the code “220” is indicated.

1.5. Agricultural producers who have not switched to paying the unified agricultural tax in accordance with Chapter 26.1 “Taxation system for agricultural producers (unified agricultural tax)” of part two of the Code for activities related to the sale of agricultural products produced by them, as well as the sale of products produced and processed by these organizations own agricultural products, the taxation of which is carried out in accordance with Article 2.1 of the Federal Law of August 6, 2001 N 110-FZ “On introducing amendments and additions to part two of the Tax Code of the Russian Federation and some other acts of legislation of the Russian Federation on taxes and fees, and also on the recognition as invalid of certain acts (provisions of acts) of the legislation of the Russian Federation on taxes and fees” (hereinafter referred to as agricultural producers paying income tax) (Collected Legislation of the Russian Federation, 2001, No. 33 (Part. , art. 3413; 2003, N 46 (part I), art. 4443; 2006, N 12, art. 1233; 2007, N 49, art. 6041; 2008, N 30 (part I), art. 3614) (hereinafter referred to as Federal Law N 110-FZ), based on the results of the reporting (tax) periods, they are presented as part of the Declaration Title page (Sheet 01), subsections 1.1 and 1.2 of Section 1, Sheet 02, Appendices No. 1, No. 2, No. 3 , N 4, N 5 to Sheet 02 with code “2” - agricultural goods. Subsection 1.2 of Section 1, Appendices No. 3, No. 4, No. 5 to Sheet 02 are presented only when calculating monthly advance payments, in the presence, respectively, of expenses, losses and separate divisions.

Indicators for other types of activities of agricultural producers paying income tax are reflected in the Declaration in the generally established manner, indicating in subsections 1.1 and 1.2 of Section 1, in Sheet 02 and in the appendices thereto the code “1” for the attribute “Taxpayer Attribute”.

1.6. Taxpayers who are residents of special economic zones in accordance with the legislation of the Russian Federation, in order to calculate income tax at a rate different from the rate provided for in paragraph 1 of Article 284 of the Code, based on the results of reporting (tax) periods, submit a Title Page (Sheet 01) as part of the Declaration. , Sheet 02, Appendices No. 1, No. 2, No. 3, No. 4, No. 5 to Sheet 02 with code “3” for the “Taxpayer Attribute” detail. Appendices No. 3, No. 4, No. 5 to Sheet 02 are presented only if there are, respectively, expenses, losses and separate divisions.

Residents of special economic zones reflect the indicators for calculating income tax at the rate provided for in paragraph 1 of Article 284 of the Code in the Declaration in the generally established manner, indicating in Sheet 02 and in the appendices thereto the code “1” for the attribute “Taxpayer Attribute”.

1.7. Organizations performing the duties of tax agents for calculating the tax base and the amount of income tax, withholding from the taxpayer - a Russian organization and transferring the specified tax to the federal budget (hereinafter referred to as tax agents), submit a tax calculation (hereinafter referred to as the Calculation) in the form approved by this By order.

Russian organizations - taxpayers of income tax, acting as tax agents, submit the Calculation as part of subsection 1.3 of Section 1, as well as Sheet 03 “Calculation of income tax withheld by the tax agent (source of income payment)”. In this case, in the Title Page (Sheet 01), according to the details “at the location (accounting)”, the code “213” or “214” is indicated. Codes for submitting a tax return for corporate income tax to the tax authority are given in Appendix No. 1 to this Procedure.

Organizations that have completely switched to paying a single tax on imputed income for certain types of activities, to a simplified taxation system, applying a taxation system for agricultural producers (single agricultural tax), taxpayers whose income and expenses are entirely related to the gambling business, subject to taxation in accordance with Chapter 29 of the Code, perform the duties of tax agents and submit to the tax authorities based on the results of the reporting (tax) periods the Calculation as part of the Title Sheet (Sheet 01), subsection 1.3 of Section 1 and Sheet 03. and this in the Title Sheet (Sheet 01) according to the details " at the location (registration)" code "231" is indicated.

Section II. General requirements for filling out

and submission of the Declaration

2.1. The declaration is drawn up on a cumulative basis from the beginning of the year. All values of the Declaration’s cost indicators are indicated in full rubles. Indicator values less than 50 kopecks are discarded, and 50 kopecks or more are rounded to the full ruble.

2.2. The pages of the declaration have continuous numbering, starting with the Title Page (Sheet 01), regardless of the presence (absence) and number of sections, sheets and appendices to be filled out. The serial number of the page is written in the field specified for numbering from left to right, starting from the first (left) familiarity.

Errors may not be corrected by correction or other similar means.

Double-sided printing of the declaration on paper and fastening of declaration sheets, which leads to damage to the paper, is not allowed.

When filling out the declaration, black, purple or blue ink is used.

2.3. Each declaration indicator corresponds to one field, consisting of a certain number of acquaintances. Each field contains only one indicator.

The exception is for indicators whose value is a date or a decimal fraction. To indicate the date, three fields are used in order: day (field of two characters), month (field of two characters) and year (field of four characters), separated by the sign “.” ("dot"). For decimal fractions, two fields are used, separated by a period. The first field corresponds to the integer part of the decimal fraction, the second - to the fractional part of the decimal fraction.

Filling out the declaration fields with the values of text, numeric, and code indicators is carried out from left to right, starting from the first (left) familiarity.

For negative numbers, the “-” (“minus”) sign is indicated in the first familiarity on the left.

When filling out declaration fields using software, the values of numerical indicators are aligned to the right (last) space. In this case, in negative numbers the “-” (“minus”) sign is indicated in the familiar place before the numerical value of the indicator.

Filling out the text fields of the declaration form is carried out in capital printed characters.

If any indicator is missing, a dash is placed in all familiar places in the corresponding field. The dash is a straight line drawn in the middle of the familiarity along the entire length of the field.

If to indicate any indicator it is not necessary to fill out all the spaces in the corresponding field, a dash is placed in the unfilled spaces on the right side of the field. For example: at the top of each page of the Declaration, the taxpayer identification number (hereinafter referred to as the TIN) and the organization’s checkpoint are indicated in the manner specified in Section III “Procedure for filling out the Title Page (Sheet 01) of the Declaration.” When specifying a ten-digit TIN of an organization in a field of twelve acquaintances, the indicator is filled in from left to right, starting from the first acquaintance; a dash is placed in the last two acquaintances: TIN 5024002119—.

Fractional numeric indicators are filled in similarly to the rules for filling in integer numeric indicators. If there are more acquaintances for indicating the fractional part than numbers, then a dash is placed in the empty acquaintances of the corresponding field. For example: the share of the tax base attributable to a separate division is 56.234 percent. The specified indicator must be filled in according to the format: 3 spaces for the integer part and 11 spaces for the fractional part. Therefore, in the Declaration it should look like this: 56-.234———. The income tax rate in the Declaration is filled in according to the format: 2 places for the whole part and 2 places for the fractional part and, accordingly, at rates of 2% and 13.5% they are indicated as: 2-.- and 13.5-.

When preparing a declaration using software when printing on a printer, it is allowed that there is no framing of the acquaintances and dashes for empty acquaintances. The location and size of the attribute values should not change. Signs are printed in Courier New font with a height of 16 - 18 points.

2.4. Taxpayers submit Declarations for the reporting period no later than 28 calendar days from the end of the relevant reporting period (clause 3 of Article 289 of the Code).

Declarations based on the results of the tax period are submitted by taxpayers, including those paying advance payments monthly based on the actual profit received, no later than March 28 of the year following the expired tax period (clause 4 of Article 289 of the Code).

The deadline for submitting the Declaration, as well as the deadline for paying income tax that falls on a weekend (non-working day) or holiday, is postponed to the first working day after the weekend or holiday.

2.5. The declaration may be submitted by the taxpayer to the tax authority in person or through his representative, sent by mail with a list of attachments, or transmitted electronically via telecommunication channels in accordance with Article 80 of the Code.

The declaration is submitted via telecommunication channels in electronic form in established formats with an electronic digital signature in accordance with the Procedure for submitting a tax return in electronic form via telecommunication channels, approved by Order of the Ministry of the Russian Federation on Taxes and Duties dated April 2, 2002 N BG- 3-32/169 “On approval of the Procedure for submitting a tax return in electronic form via telecommunication channels” (registered by the Ministry of Justice of the Russian Federation on May 16, 2002, registration number 3437; Rossiyskaya Gazeta, 2002, N 89).

When sending the Declaration by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. When transmitting the Declaration via telecommunication channels, the day of its submission is considered the date of its dispatch. Upon receipt of the Declaration via telecommunication channels, the tax authority is obliged to provide the taxpayer with a receipt of its receipt in electronic form.

2.6. Tax agents fill out and submit Calculations in the manner prescribed by this Section.

2.7. When submitting to the tax authority at the place of registration by the successor organization the Declaration for the last tax period and updated Declarations for the reorganized organization (in the form of merger with another legal entity, merger of several legal entities, division of a legal entity, transformation of one legal entity into another) in the Title Page (Sheet 01) according to the details “at the location (registration)”, the code “215” or “216” is indicated, and in the upper part of it the TIN and KPP of the successor organization are indicated. The “organization/separate division” detail indicates the name of the reorganized organization or a separate division of the reorganized organization.

The details “TIN/KPP of the reorganized organization (separate division)” indicate, respectively, the TIN and KPP that were assigned to the organization before the reorganization by the tax authority at its location (for taxpayers classified as the largest - by the tax authority at the place of registration as largest taxpayer) or at the location of separate divisions of the reorganized organization.

Section 1 of the above Declarations indicates the OKATO code of the municipality in whose territory the reorganized organization or its separate divisions were located.

Codes of reorganization forms and liquidation code are given in Appendix No. 1 to this Procedure.

2.8. If an organization makes a decision to terminate the activities (closing) of its separate division (hereinafter referred to as a closed separate division), updated Declarations for the specified separate division, as well as Declarations for subsequent (after closure) reporting periods and the current tax period, are submitted to the tax authority at the location organization, and for an organization classified as the largest taxpayer - to the tax authority at the place of its registration as the largest taxpayer.

In this case, in the Title Sheet (Sheet 01), according to the details “at the location (accounting)”, the code “223” is indicated, and in the upper part of it the checkpoint is indicated, which was assigned to the organization by the tax authority at the location of the closed separate division.

In Section 1 of the above Declarations, the OKATO code of the municipality on whose territory the closed separate subdivision was located is indicated taking into account the provisions of paragraph 4.1 of this Procedure.