Why do you need a personal account?

The employee’s personal account is used to monthly reflect all types of employee accruals, deductions from wages and payments during the calendar year. In fact, this is the only primary document that is filled out separately for each employee and contains complete information about wage payments made to him. A personal account is maintained on the basis of primary documents recording production and work performed, time worked and documents for various types of payment.

What are personal payroll accounts?

Specialized documents that are used in accounting to reflect information about monthly accruals, deductions and payments due to a specialist.

IMPORTANT!

The use of standardized forms is not necessary. The company has the right to independently develop the structure of the document, which will fully comply with the features and specifics of the organization’s activities, the current remuneration system, conditionally permanent details for calculating wages and other information.

The independently developed form should be approved in the company’s accounting policy. When developing a document, do not forget to take into account the mandatory details of the primary documentation (Article 9 of Law No. 402-FZ).

If the personal account is maintained on a computer

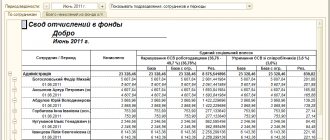

Nowadays, it is rare that an accountant calculates payroll manually. Much more often, he uses specialized accounting programs, which provide for maintaining, among other things, personal accounts of employees. In this case, the employee’s personal account must be printed out monthly, certified by the signature of the responsible person, indicating the date of compilation, and inserted or pasted into the paper personal account.

Any work must be paid, therefore, it is quite logical that working employees are paid regular wages. To avoid confusion with payroll, a number of statements have been developed to facilitate and systematize the process. 04/06/2001 Resolution of the State Statistics Committee of the Russian Federation No. 26 approved a statement encoded form T-54 - a personal account opened for each individual employee to display basic data on accruals made from the moment of employment.

A personal account is necessary to systematize data on an individual employee of an organization. Using a personal account, you can track all accruals or deductions made in relation to a specific employee. Among other things, on the basis of the personal account, a payroll statement is subsequently generated, which in turn will be used in calculating the pension.

That is why the shelf life of the T-54 form is 75 years. In connection with violation of the rules for proper storage of this documentation, fines may be imposed on the organization or enterprise based on the norms of the legislation of the Russian Federation.

Important! In cases where the organization does not have a full-time accountant, and a third-party specialist is hired to prepare reports, the head of the enterprise is responsible for storing the documentation.

The statement consists of three main parts, which contain the following information about the person carrying out labor activities:

- Details, name of the organization in which the citizen works, for whom the T-54 form was issued, dates of admission and dismissal of the person in the specified organization;

- Personal identification data of the employee and specific information, including SNILS numbers, TIN, marital status, number of children, position and qualifications of the employee;

- Information about all accrued, paid and withheld amounts in relation to an individual employee.

https://youtu.be/kZoAHYEYgp8

Residence code in form T-54

It is in this column that the rub for most accountants lies. This line contains the code of the place of residence of the employed citizen for whom the statement is being created, in accordance with the classifier. The thing is that until recently, in this kind of documentation it was necessary to indicate OKATO codes, but since 2020 it has become necessary to enter the OKTMO code, which replaced its predecessor - the OKATO address classifier.

You can find the required code using the official website of the tax office, where there is a corresponding search section. To search for the required residence code for a specific employee, an accountant filling out form T-54 must go to the tax inspectorate website by selecting the OKTMO search section and enter the details of the employee’s place of residence in the following order:

- First indicate the street;

- The next step is to indicate the locality;

- Then the city.

How to fill out and sample

Initially, the accountant fills out the title part of the statement, where information such as the full name of the organization, corresponding to the statutory documents, or full name, if we are talking about working for an individual entrepreneur, is entered. The next step is to fill in the line for the name of the structural unit, after which the basic information about the person carrying out the labor activity is entered into the table. The accountant must indicate the citizen's personnel number from his personal card in the organization, indicate the category of personnel for this employee, and enter the TIN and SNILS numbers in the columns provided for this.

Further, in the same line, in the following columns, the accountant fills in data such as OKTMO code, marital status, number of children, if any. The serial number of the document is entered in the very first column of this line, and the date of hiring and the date of dismissal, if any, are entered in the last column.

How to fill out numbered fields

The main part of the statement contains 50 columns, divided into several main parts. The first part contains basic information about hiring:

- In columns 1-2, enter the number and date of the order to hire a citizen;

- Columns 3-6 contain information about which structural unit of the organization and for which position the citizen was hired, indicating working conditions, employee qualifications and tariff rate or salary;

- Columns 8-9 indicate information on the amounts of additional payments and allowances;

- The second part of the table includes columns 10 to 17. This section of the table contains information about vacations used, including types of vacations, number of days, dates of issuance and numbers of relevant orders;

- The next part of the statement, which includes columns 18 to 22, contains information about contributions and deductions made, and line number 23 contains data on the amounts of standard tax deductions;

- Line 24 indicates the months during which the employee worked;

- The next part, consisting of columns 25-28, contains information about hours worked;

- Columns 29-38 are intended for entering information about accruals made, taking into account periods of temporary disability;

- Columns of the table numbered 39-47 indicate information about funds that were withheld or credited as an advance;

- Lines 48-49 are intended to indicate the amounts of debt attributed either to the organization itself in relation to the employee, or to the employee in relation to the organization;

- Column 50 contains the total amount to be paid.

The completed form T-54 is certified by a signature with a transcript of the person responsible for maintaining the statements, with the current date indicated.

In this article we will look at: Personal account T-54a. Let's find out what the form is used for. Let's figure out who fills out and signs the personal account.

Operations for calculating wages, vacation pay, bonuses, sick leave and other payments are elements of the economic activity of an enterprise. According to the federal law “On Accounting”, all of them must be confirmed by primary accounting documentation. You can view the form.

What is the T-54 form and how to maintain it

Any work must be paid, therefore, it is quite logical that working employees are paid regular wages.

To avoid confusion with payroll, a number of statements have been developed to facilitate and systematize the process. 04/06/2001 Resolution of the State Statistics Committee of the Russian Federation No. 26 approved a statement encoded form T-54 - a personal account opened for each individual employee to display basic data on accruals made from the moment of employment.

What is it for?

A personal account is necessary to systematize data on an individual employee of an organization.

Using a personal account, you can track all accruals or deductions made in relation to a specific employee.

Among other things, on the basis of the personal account, a settlement and pay slip is subsequently generated in the T-49 form, which in turn will be used in calculating the pension.

That is why the shelf life of the T-54 form is 75 years. In connection with violation of the rules for proper storage of this documentation, fines may be imposed on the organization or enterprise based on the norms of the legislation of the Russian Federation.

The statement consists of three main parts, which contain the following information about the person carrying out labor activities:

- Details, name of the organization in which the citizen works, for whom the T-54 form was issued, dates of admission and dismissal of the person in the specified organization;

- Personal identification data of the employee and specific information, including SNILS numbers, TIN, marital status, number of children, position and qualifications of the employee;

- Information about all accrued, paid and withheld amounts in relation to an individual employee.

Form T-54 is not mandatory and is not used in small enterprises and individual entrepreneurs, which, as a rule, are limited to creating a personal card of employed persons in a form with the T-2 encoding or other statements of a payroll nature, such as T-49 or T-51 . Large organizations with a large number of employees most often use employee personal accounts in the T-54 form.

It is in this column that the rub for most accountants lies. This line contains the code of the place of residence of the employed citizen for whom the statement is being created, in accordance with the classifier.

The thing is that until recently, in this kind of documentation it was necessary to indicate OKATO codes, but since 2020 it has become necessary to enter the OKTMO code, which replaced its predecessor - the OKATO address classifier.

To search for the required residence code for a specific employee, an accountant filling out form T-54 must go to the tax inspectorate website by selecting the OKTMO search section and enter the details of the employee’s place of residence in the following order:

- First indicate the street;

- The next step is to indicate the locality;

- Then the city.

Blank form T-54

Initially, the accountant fills out the title part of the statement, where information such as the full name of the organization, corresponding to the statutory documents, or full name, if we are talking about working for an individual entrepreneur, is entered. The next step is to fill in the line for the name of the structural unit, after which the basic information about the person carrying out the labor activity is entered into the table.

Further, in the same line, in the following columns, the accountant fills in data such as OKTMO code, marital status, number of children, if any.

The serial number of the document is entered in the very first column of this line, and the date of hiring and the date of dismissal, if any, are entered in the last column.

The main part of the statement contains 50 columns, divided into several main parts. The first part contains basic information about hiring:

- In columns 1-2, enter the number and date of the order to hire a citizen;

- Columns 3-6 contain information about which structural unit of the organization and for which position the citizen was hired, indicating working conditions, employee qualifications and tariff rate or salary;

- Columns 8-9 indicate information on the amounts of additional payments and allowances;

- The second part of the table includes columns 10 to 17. This section of the table contains information about vacations used, including types of vacations, number of days, dates of issuance and numbers of relevant orders;

- The next part of the statement, which includes columns 18 to 22, contains information about contributions and deductions made, and line number 23 contains data on the amounts of standard tax deductions;

- Line 24 indicates the months during which the employee worked;

- The next part, consisting of columns 25-28, contains information about hours worked;

- Columns 29-38 are intended for entering information about accruals made, taking into account periods of temporary disability;

- Columns of the table numbered 39-47 indicate information about funds that were withheld or credited as an advance;

- Lines 48-49 are intended to indicate the amounts of debt attributed either to the organization itself in relation to the employee, or to the employee in relation to the organization;

- Column 50 contains the total amount to be paid.

The completed form T-54 is certified by a signature with a transcript of the person responsible for maintaining the statements, with the current date indicated.

What is the T-54a form used for?

A personal account drawn up according to the standard form T-54a is used in the case of conducting accounting activities through an automated system. The document contains details required for the correct calculation of an employee’s salary.

The information presented in the form reflects the components of the monthly salary, deductions made, as well as the grounds for their implementation. That is, the form shows the salary amounts accrued every month for payment throughout the calendar year, as well as the initial data for correct calculations:

- Personal information;

- Notes on acceptance into position;

- The amount of salary, tariff rate, allowances and bonus components;

- Vacation periods provided;

- Deductions made.

Instructions for filling out the personal account form

The grounds for entering information are orders on admission, bonuses, disciplinary sanctions, dismissal, transfers, and time sheets. In the case of piecework payment, indicate an order for the work performed, a standardization sheet or waybill. All sources of information must be signed by the head of the organization and have an individual number. The structure of the personal account form includes a mandatory title part and a tabular part. You can see an example of filling out the form.

Filling out the title part of the T-54 form

This is a mandatory component of the personal account and must be filled out on the title page of the form. The accountant needs to fill in the following information:

- Employer details: full legal name, form of ownership, code according to the OKPO classifier, structural unit in which the employee is registered;

- Document details: its number and date, which will coincide with the date of opening the personal account. The category of personnel (worker, specialist, manager) and the billing period for which the document is submitted are also indicated here. If the employee was hired not from the beginning of the year, then the month in which the hiring order was issued;

- Personal information about the employee: last name, first name and patronymic without abbreviations in the nominative case, INN, SNILS, marital status and number of children in the family, date of birth and date of reception. The assigned personnel number and code for the place of residence are entered. The last digit is usually automatically downloaded from the program classifier, but otherwise it can be requested from the regional Federal Tax Service.

Filling out the main part of the T-54 form

This part consists of a table, the columns of which are combined into groups based on the information entered:

| Table columns | Explanations for filling |

| They are filled in with the registration data of the order for hiring the worker (number, date). This includes the department in which the employee works, working conditions, exit schedule, tariff rate and salary, and provided allowances. | |

| These columns contain information about vacations: periods of vacations provided, number of days off, documents on the basis of which vacations were granted, their numbers and dates. | |

| Columns 17-21 | These columns are intended to indicate monthly deductions made. This includes deductions under writs of execution, alimony, penalties, compensation for damage, and financial sanctions associated with disciplinary offenses. If an employee was given an amount of accountable funds for expenses, for example, hotel accommodation or travel on a business trip, and he did not provide reporting documents confirming the intended use of this money (tickets or boarding passes), then the organization also has the right to withhold the missing amount by registering it in your personal account. Each entry must contain a link to the details of the document justifying the withholding. If an organization provides an employee with the opportunity to have meals or accommodation with a postpaid payment system, or issues him a loan against wages, such deductions are not taken into account in the personal account. |

| Enter information about available tax benefits. This may be a benefit for a standard, pension, social, or property tax deduction. Documentary evidence of the right to them should be stored not in a personal card, but in the accounting department of the enterprise. | |

| Columns 23-27 | Information from time sheets about the worker’s presence at the workplace is copied into these columns. These columns contain 12 lines, according to the number of months in the year; accordingly, information is entered for each period individually: hours off and overtime work time. Information for filling out the data in a column is taken from time sheets, which are submitted by responsible persons filling out data on attendance and non-appearance during the billing month. As a rule, at the end of the calendar month, department heads submit completed timesheets to the accounting department, where salaries are calculated and a personal account is filled out. |

| Columns 28-37 | These columns record specific accrual amounts. Each type of payment is coded for easy use. The list of codes is approved by a separate order of the head of the enterprise. For example, in practice the following codes are used:

The same codes will be reflected in the 2-NDFL and 1982 employee certificates. The accruals will look like a “table within a table”, in the header of which the codes are indicated, and below - the payment amounts. Awards, gifts and gift cards provided to employees in connection with corporate and public holidays are also taken into account in the personal account with the code “valuable gift”. |

| Columns 38-46 | Represents the amounts of deductions and withholdings, including advances issued and personal income taxes. |

| Boxes 47 and 48 | In the specified columns of the personal account, data about the employee’s debts to the company is entered. There may be overpaid amounts, advances or, for example, deductions from wages based on documents confirming his guilt. It is important to remember that the amount of monthly deduction should not exceed 20% of his earnings for this period. |

| In this column of the tabular part, the funds issued in person or transferred to the salary card are entered, that is, the employee’s net income - the accrued amount, reduced by the amount of various deductions and taxes. |

Build payment type codes

Table 3 – Filling out payment type codes

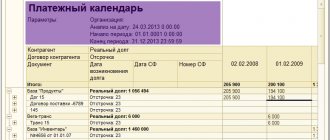

| Data_Fakt | Vall | Summ_Vall | Cost | Summ_Cost | Summ_S_Vall | Summ_S_Cost | D_Cost |

| 02.06.2001 | |||||||

| 28.11.2002 | |||||||

| 07.01.2003 | |||||||

| 12.08.2009 | |||||||

| 01.02.2009 | |||||||

| 02.02.2009 | |||||||

| 01.02.2009 |

2.4 Describe the list of primary documents and the possibility of changing them in the document “Employee’s Personal Card”

All financial and economic operations of the enterprise, including payroll, must be documented and justified.

The list of primary documents for recording the use of working time and settlements with personnel (wages) and the forms of these documents were approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

The primary accounting of the number of personnel of the organization is carried out on the basis of the following documents:

— order (instruction) on hiring (Form No. T-1), which is the basis for hiring. The person responsible for accounting for the personnel of the organization’s employees, in accordance with this order, fills out a personal card for each newly hired employee, makes an entry in the work book, and opens a personal account in the accounting department;

— personal card (form No. T-2), which is filled out for each employee. It contains general information about the employee (last name, first name, patronymic, date and place of birth, education, etc.), information about military registration, appointment and transfer, advanced training, retraining, leave and other additional information;

— order (instruction) on transfer to another job (Form No. T-5), which is used when registering the transfer of an employee from one structural unit to another;

— order (instruction) on granting leave (Form No. T-6), which is used to formalize annual and other types of leave provided to employees in accordance with the Labor Code of the Russian Federation, current legislative acts and regulations, collective agreements and schedules vacations;

— order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (Form No. T-8), which is used when registering the dismissal of employees. Based on it, the accounting department makes settlements with the employee;

— other unified forms To record working hours and pay wages to personnel, the following unified forms of primary documentation are used:

— a timesheet for recording working hours and calculating wages (Form No. T-12) and a timesheet for recording working hours (Form No. T-13), which records the use of the working time of all employees in a given organization. The report card in form No. T-13 is used in conditions of automated data processing. Form No. T-12 is filled out manually by an accounting employee. The symbols of worked and unworked time presented on the title page of form No. T-12 are also used when filling out form No. T-13. These timesheets are compiled in one copy and submitted to the accounting department. They allow not only to take into account the time worked by all categories of employees, but also to monitor compliance by workers and employees with the established work schedule. Based on the timesheets, wages are calculated, statistical reporting on labor is compiled. The use of working time is recorded in timesheets either by the method of continuous (daily) registration of appearances and absences for work, or by registering only deviations (no-shows, tardiness, etc.). d.). Notes on the reasons for absence from work or for part-time work, for working overtime and other deviations from the established work schedule must be entered into the timesheet only on the basis of documents (certificates of incapacity for work, certificates, orders for the performance of state or public duties and etc.).

This is interesting: Work record book for transfer to another position sample

Accounting for time spent on overtime work can also be carried out on the basis of lists of persons who performed this work. The lists are compiled and signed by the head of the structural unit. The overtime manager makes a note of the number of overtime hours actually worked. Based on lists with this mark, the data is entered into the timesheet. Downtime can also be taken into account in the timesheet. The relevant data is entered on the basis of downtime sheets issued by the head of the structural unit. The following forms of statements are used for the calculation and payment of wages.

— payroll statement (Form No. T-49), which is recommended for medium and small organizations. When compiling this form, it is permissible not to fill out other payroll and payroll statements;

— payroll (form No. T-51), which is used to calculate wages for all categories of workers. Recommended for use in large organizations;

— payroll (form No. T-53), which is used to record wage payments;

— personal account (forms No. T-54 and No. T-54a), which is filled out by an accountant for each employee on the basis of primary employment documents and which indicates the necessary information: last name, first name, patronymic; workshop, department of an organization; category of personnel; employee personnel number; number of children (to determine deductions when calculating personal income tax); Enrollment Date.

The personal account is filled out throughout the year, and all types of accruals and deductions made are reflected in it on a monthly basis. The data contained in the personal account is the basis for calculating average earnings when paying for vacations, accruals for sick leave, etc. The following year, a new personal account is opened for each employee.

The most important indicators reflecting labor costs are labor standards, which are established for workers in accordance with the achieved level of equipment, technology, organization of production and labor.

Labor legislation provides for the following types of labor standards:

— production rate — the amount of products that a worker (group of workers) of a certain qualification must produce per unit of working time,

- standard time - the amount of working time (in hours, minutes) that an employee (group of employees) of a certain qualification must spend on the production of a unit of product (work, service);

- service rate - the number of objects (equipment units, production areas, workplaces, etc.) that an employee (group of employees) must service per unit of time (per hour, working day, work shift, working month);

— headcount norm — the number of employees with the appropriate qualifications to perform a certain amount of work (production, management functions). Depending on the nature of production, various primary documents are used to record production output - piece work orders, route sheets, production reports, etc. In conditions of mass production, output is taken into account when accepting finished products. The output of each team member is established on the basis of output reports filled out by the foreman.

In mass production, output is taken into account using route sheets in combination with a report from the foreman or foreman, which records the acceptance of work (their volume) per shift. In individual or small-scale production, output is taken into account, as a rule, using piecework orders work. They are prescribed on the basis of technological maps. Work orders can be issued for one shift or for a longer period (up to one month), depending on the time required to complete the production task. After receiving the products from the workers, the foreman signs the work order and transfers it to the accounting department.

Bibliography

1. Andreeva V.I. Samples of documents in office work/ - M.: CJSC "Business School" Intel-Sintez", 2007.

2. Computer Science: Basic Course/Ed. S.V.Simonovich. - St. Petersburg: Peter, 2002. 400 s.

3. Kozharsky V.V., Sushkevich V.N. Accounting in enterprises and organizations: Proc. manual.- Mn.: PKF “Account”, 2005. p.127

Personal account T-54a: deadlines for filling out

The personal account form is filled out monthly. On paper, the information can be printed and filed in an individual folder for each employee, or at the end of the calendar year, final statements can be collected. You also need to file your payslips for each month here.

The preferred procedure is described and approved in the accounting policies of the organization. Sign the document only in blue ink. There is no need to stamp the document itself, but the form registration log must be stitched and sealed.

The personal account form is stored in the organization’s archives for 75 years

The chief accountant of the company is responsible for maintaining and correctly filling out the form; in the absence of an employee of this position, the head of the enterprise or his deputy is responsible. When resolving controversial issues in the courts and supervisory authorities, their representatives have the right to make a request to provide the employee’s salary sheet. Errors discovered during the audit may become the basis for an audit by the tax service, the Social Insurance Fund and the prosecutor's office. In order to avoid incorrect data, it is important to enter information only of a verified nature, in the presence of supporting documentation.

T-54a (personal account)

is a form used to display the information necessary to calculate salaries and make deductions from it for a specific employee throughout the year, as well as to enter the amounts of accruals and deductions there. You will learn more about where and why this form is used, as well as the procedure for filling it out, in our article.

Data to be filled in

Typically, employee payroll accounts are maintained by the company's accountant.

To streamline their management, a unified form T-54 was developed at the legislative level. Thanks to it, the employee’s personal account shows all possible payments to him throughout his entire career with a particular employer.

Example of filling out form T-54

The data that must be entered into Form T-54 and Form T-54a is entered on the basis of the following primary information, supported by documents:

- time sheet;

- sick leave certificates of the established form;

- well-designed waybills that provide reimbursement of expenses for fuel and lubricants;

- various orders, for example, on additional payment for combining positions during an employee’s vacation, etc.;

- confirmations for piecework payment (mostly orders);

- production reports and other documentation.

Important!

After providing such information, analyzing and processing it, a payroll statement is drawn up so that the employee can receive the payments due to him from his employer. The basis for issuing the T-54 form is the fact that the employee has been admitted to the organization. And the end will be dismissal. Only after this the employee’s personal account at the enterprise is closed.

Thus, the T-54 form and personal account are the most important components of the correct and full functioning of an enterprise in the Russian Federation.

Download for viewing and printing:

When to use the employee account form

Form T-54a is unified (approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1) and is used by an accountant to enter information about monthly accruals and deductions made for a specific employee throughout the year. Such personal accounts are created for each employed employee.

Information to be entered into form T-54a is taken from primary documents relating to the employee, as well as other documentation that takes into account actual output (work performed, amount of working time worked).

The basis for opening a personal account for an employee is an order to hire him. At enterprises with a large staff, T-54a forms are filled out personally for each employee, but if there are not many employees, an alternative is possible - maintaining special statements.

You will learn more about one of these statements from the material

.

Personal file and personal account of an employee of the organization

The employee’s personal account must be filled out at each enterprise. All organizations are required to maintain accounting records correctly and legally.

The rules for calculating employee wages, approved by the state, include a number of documents and forms that accountants must fill out when calculating wages.

A personal account is a document or register used in accounting and personnel work. In Russia, the employee form T-54 has been approved.

Personal documentation is considered to be paper and electronic media of information about an employee. An employee, having got a job, must open a personal account in the accounting department, the basis for this is an order or a copy of the order on taking up the position.

A register must be filled out for each employee, regardless of whether the position is permanent or temporary.

Form T-54 is a cumulative statement and contains information on wages accrued from the beginning of the year to the end.

The work of entering data into personal accounts is performed by a payroll accountant.

Employees' personal accounts reflect accruals and deductions of employee wages. Data entry is carried out on the basis of primary documentation or reporting on the performance of services.

Such documents include time sheets and work schedules, orders or instructions, vacation schedules, time worked books, sick leave protocols, acts of work or services performed, orders for allowances and bonuses.

Personal registers also reflect the deduction of wages with a full breakdown of taxes and contributions. Like the payslip, the shelf life of accounts in the accounting archive is 75 years.

The register form must be filled out for each employee separately and records must be kept throughout the calendar year.

After all, when calculating wages on a monthly basis, the accountant needs to make many additional calculations, for example, calculating vacation, sick leave, average monthly bonus or financial assistance.

For this, the best assistant is a ready-made sample of salaries in personal accounts. The register with a sample provides additional assistance when issuing salary certificates. After all, every month you need to select and make about 20 certificates.

As you know, the form contains a sample of wages from 6 months to a whole year, and it is very difficult for an accountant to select statements and copy the figures from each into the document.

Small-scale enterprises, for example individual firms, do not maintain separate documentation for personal accounts, but insert entries into the payroll. Payroll forms T-49 and T-54 are executed as one.

In accounting practice, the T-54a form is also maintained; it is used to record data using a computer or other computer equipment.

Also, very often, when filling out T-54a, calculations are performed or data is copied using different programs; this arrangement makes the accountant’s work easier.

Payroll calculations in the computer are printed monthly on paper and attached to the employee’s personal account forms, and if the software allows the use of codes or abbreviated symbols during operation, then a printed transcript is attached.

Monthly transfer of information from payslips should be done in blue or black paste without blots. Corrections or the use of corrective agents should not be allowed in the work.

If a mistake is made in filling out, you cannot erase it or try to correct the numbers. To do this, cross out the entire entry with a straight line from the upper right corner to the lower left and write the correct number next to it.

When filling out personal accounts, it is necessary to verify all calculations with the accruals and deductions statements. Reliability of retention data is very important to insurance organizations.

When entering data into an invoice, you should remember that in 10-20 years such a document will contain a lot of important information.

Procedure for maintaining a personal account

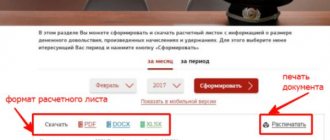

To the printed form T-54a (with filled-in information about the employee) a monthly pay slip containing:

- information about how the salary was formed;

- information about all deductions made;

- the total amount of funds paid.

NOTE!

On the back of the personal account (or on each printout attached to it) are all the codes and codes used when accounting for salaries.

All information related to the employee’s work is entered into the personal account if it can affect the amount of salary. Thus, the document reflects:

- date and number of the employment order;

- information about vacations taken;

- information about accrued income;

- information about tax deductions or other benefits used;

- data on salary deductions.

The shelf life of personal accounts is 75 years. To ensure such long-term storage, documents must be archived. Typically, front sheets are created for a calendar year, but it is also possible to use 1 document form for a longer period of time.

An employee's personal account is an internal document of the employer containing information about all types of payments and deductions from the employee's salary.

A personal account is opened by an accountant after hiring an employee and is maintained by him throughout the employee’s career. The data is entered on the basis of primary documents recording production, work performed, time worked and documents for various types of payments.

Such documents, in particular, include:

- time sheet (form T-13);

- route and waybills;

- orders;

- sick leave;

- production reports;

- orders for piece work;

- other documents.

Based on the personal account data, a payroll slip is subsequently filled out in form T-49.

Sample filling T-54

At the top of the T-54 form, data is entered about the employee for whom the calculation is being made, indicating his TIN, SNILS, presence of children and marital status, date of hire, full name and personnel number, date of birth.

Next, in the upper table, fill in information about:

- hiring (transfer, dismissal) - on the basis of relevant orders;

- granting leave - also, on the basis of the order, its start and end dates are prescribed;

- deductions and contributions (their type, period for which they are withheld, amount);

- standard personal income tax deductions that an employee can count on.

All this information will be useful for calculating employee salaries. Based on a personal account, you can restore all data about an employee, even if orders for his activities are lost.

This is interesting: The procedure for introducing summarized recording of working time sample

In the lower table, based on the working time sheet and other documents relating to all appearances and absences, deviations from the normal working day, data on hours (days) worked and all accruals by type of payment are filled in. The total amount of accruals is displayed.

Next, fill out the part of the table devoted to deductions (personal income tax, alimony, writs of execution, advance payment). Based on the results of filling out this part of the table, the total amount of deductions is displayed, which is subject to deduction from the amount of accruals.

If there is a debt for employees or the employer, this is reflected in columns 47 and 48; the data in these columns is taken into account when calculating the total amount of wages payable.

Data is entered into the personal account for each month of the calendar year.

The personal account is filled out by the accountant.

document

Personal account form T-54 form - download.

Personal account T-54 sample filling - download.

A personal account is opened for an employee of the organization at the time of his hiring; this document includes information about hiring, vacations, dismissal, calculation of wages and other payments.

Employee personal account form

Personal account is maintained in two forms:

- T-54 is a unified form of personal account card. As a rule, this form is used to maintain payroll records in large enterprises and organizations. Small organizations and individual entrepreneurs most often use the unified form T-49, which is both a payroll and a payroll.

- T-54a is a form of personal account card for maintaining records in electronic form.

Note

: if the employer uses a statement in form T-51 to calculate wages, then a personal account in form T-54 is not drawn up.

Existing personal account forms

Currently, the legislator of our state has developed 2 main forms T-54 for personal accounts:

- standard 54 for a personal salary account, which is used mainly by large organizations with a large number of employees;

- 54a for electronic document management.

Advice! Many individual entrepreneurs most often use in their work only the form designated T-49.

It also happens that the employer does not keep personal salary cards. This can happen if the T-51 sheet is to be used.

How to fill out an employee's personal account

General filling requirements

- Data is entered on the card in blue or black ink.

- It is not allowed to make corrections or use corrective agents, including putties.

- The document consists of a title page and a table containing 49 columns.

Instructions for filling out a personal account card

Title part

: The very first lines to be filled in are those containing information about the employer: name of the organization (structural unit), OKPO and OKUD code. Then information about the date of opening the account, the billing period and the employee himself is entered.

Note

: Information about the employee (TIN and SNILS number, marital status, number of children, date of employment) is entered on the basis of a personal card (T-2).

Columns 1-8

. Contains data on hiring, transfers, dismissals, and changes in wages. The indicated columns reflect information about the order for employment (dismissal, transfer), etc., place of work (structural unit), position (specialty, profession), tariff rate, amount of allowances and additional payments.

Columns 9-16

. Contains information about the employee’s vacation: the period for which the vacation was granted, duration, date and number of the order approving the vacation.

Columns 17-21

. The indicated columns reflect information about deductions in relation to the employee (according to writs of execution, order documents, etc.).

Column 22

. The column indicates the amount of tax deduction provided to the employee.

Column 23

. The month for which the invoice is prepared is indicated in the format: 01, 02, 03, etc.

Columns 24-27

. The indicated columns reflect the days (hours) worked by the employee in the reporting month. The data is taken from the working time sheet.

Columns 28-37

. All accruals made to the employee for the reporting month are indicated: wages, bonuses, sick leave, vacation pay and other payments.

Columns 38-46

. Deductions in relation to the employee are reflected: personal income tax, alimony, advances, etc.

Columns 47-48

. These columns reflect the debt of the organization to the employee and vice versa: the employee to the organization.

Column 49

. The total amount of payments to the employee for the reporting month is indicated.

How the card is issued

There are strict rules for issuing cards with personal accounts. There are general requirements that these documents must meet. These include:

- filling out a personal salary account is done using blue or black ink;

- any corrections are not allowed. This also applies to the use of any corrective agents (putties, tapes, etc.);

- The employee's personal account form according to the sample must contain a title page and a standard table of 49 columns.

In addition, the employee’s front card, namely the salary form, has instructions for filling out, which are mandatory for all authorized employees of the enterprise for their maintenance and accounting.

Title page

The title page is filled out at the very beginning. In this section the following information must be entered:

Filling out the column

Next, fill in the table according to the columns:

- Sections 1 to 8 are information about hiring an employer, transfers made within the company, changes in employee earnings, tariff rates, possible additional payments;

- data on all employee leaves is recorded in columns 9 to 16;

- if any deductions are made from a citizen, then this information is entered in columns 17 to 21;

- the tax deduction is registered in column 22 of the form;

- Column 23 indicates the month of drawing up the invoice;

- information from the working time sheet is entered in columns 24 to 27;

- all possible accruals are recorded in columns 28-37 (salaries, vacation pay, etc.);

- Personal income tax, alimony payments are columns 38-46 of the T54 personal card;

- any debt between the employee and the employer is indicated in columns 47 and 48;

- Column 49 contains information about the results of payments for the reporting period (month).

Important! Form T-54 is a very convenient document for an enterprise, which can be used to track an employee’s income for the entire period of employment.

https://youtu.be/0UPDAJPVzaA

Unified form T-54 is a document that combines all the information about an employee working in an organization. Let's look at when it is used and where you can find such a form.