Book value of assets: where to look in the balance sheet (line) and how to calculate

The book value of assets is the sum of all assets of the enterprise in monetary terms, reflected in the balance sheet (BB). The company's assets include:

- non-current assets - line 1100 BB;

- current assets - line 1200 BB.

The book value of assets is the sum of non-current and current assets reflected in line 1600 BB.

Fixed assets and intangible assets are classified as non-current and are indicated in the BB at their residual value, that is, at the purchase price minus accumulated depreciation and taking into account revaluation, if it was carried out at the enterprise.

Working capital is the assets that participate in the activities of the enterprise and are consumed within 1 year or 1 full cycle. Current assets include such assets as:

- materials/supplies;

- accounts receivable;

- cash;

- VAT on acquired values, which indirectly, but also, is the property of the enterprise;

- short-term financial investments.

Based on its goals, an enterprise can calculate the book value of assets as the value of all property of the enterprise or its constituent elements (fixed assets, intangible assets, etc.). How to calculate the book value of an enterprise's assets will be discussed below.

So, as already noted, the book value of assets is reflected on line 1600 BB and represents the sum of the non-current and current assets of the enterprise. That is, the book value of assets is the value of all property of the enterprise according to the balance sheet as of the last reporting date. It is calculated like this:

Line 1100 BB + Line 1200 BB.

Note! Book value of assets and book value of net assets are different concepts. Book value of assets is the total of all the assets of a business, while net assets are the assets minus the liabilities of a business.

An enterprise can, upon request, provide information about the state of its assets to credit and insurance organizations and some counterparties when making transactions. To do this, the company draws up a certificate of the book value of assets, which includes the calculation given above.

A sample of such a certificate and the procedure for filling it out can be found in the article “Certificate on the book value of assets - sample” .

Calculation of fixed assets

Fixed assets of a company are defined as part of the company's property that is used to meet production needs for more than one year. They are not goods and are used for commercial purposes. Their acquisition occurs in large transactions. For an objective assessment, three types of cost are used:

- balance sheet;

- residual;

- restorative.

The total book value is determined by the purchase price plus expenses. Residual value is calculated as the difference between the original price and depreciation. Replacement cost is determined based on the current market price. In the balance sheet, the cost of fixed assets is reflected in line 1130.

Why is the book value of assets calculated?

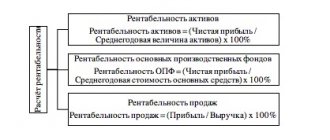

First of all, for the purpose of financial analysis, which is the most important tool for assessing the financial condition of an enterprise. In particular, the book value of assets is used when calculating:

- return on assets, which shows how much profit the company receives from each ruble invested in property;

- asset turnover ratio, which determines the efficiency of their use.

How the asset turnover ratio is calculated can be read in the article “Asset turnover ratio - calculation formula” .

If an enterprise calculates the profitability and asset turnover ratios for self-analysis, then the indicator of the book value of assets in some cases must be calculated by law.

The book value of assets is the most important indicator that determines the size of a transaction performed by an enterprise.

Thus, some transactions of an organization for the sale of assets are recognized as large ones in accordance with paragraph 1 of Art. 46 Federal Law No. 14-FZ dated 02/08/1998 (for LLC) and clause 1 of Art. 78 Federal Law No. 208-FZ dated December 26, 1995 (for joint-stock companies). To determine the size of the transaction, it is necessary to calculate the book value of assets and the value of the property being sold. If the cost of the property being sold is more than 25% of the book value of the organization’s assets, the transaction is considered a major transaction. In this case, a decision of the meeting of shareholders or founders is required to carry out the transaction. If the book value of assets is determined incorrectly or not calculated at all, the transaction may be considered invalid.

Why do the calculations?

Calculation of the book value of assets is done primarily for the financial analysis of the enterprise. These data are used (see table):

| What is the book value of assets used for? | |

| Action | What gives |

| Calculation of return on assets | It will become clear how much profit the company receives from each ruble that was invested |

| Calculation of asset turnover ratio | Shows how efficiently an enterprise works with its assets |

Also see Return on Assets: What the Formulas Show.

The book value of assets also helps businesses determine how large a transaction is. This follows from Article 46 of the Law “On LLC” No. 14-FZ. To find out the scale of the transaction, compare the value of the assets on the balance sheet and the price of the property that the company can part with under this transaction.

If this amount is 25% of the value of all assets or more, then the transaction will be considered large. In this case, to confirm it, it is necessary to hold a meeting of participants (shareholders).

If it turns out that the calculation of the book value of assets was made incorrectly, the validity of the transaction that has already taken place is jeopardized.

https://youtu.be/HbN9shlPIo4

What is it used for?

To approve a major transaction for an LLC and/or JSC, it is necessary to obtain the approval of the founders or shareholders. For example, when selling property whose price exceeds the BSA by 25%. The importance of correct calculation lies in the fact that if it is calculated incorrectly, the transaction is considered invalid.

It is also important to calculate the BSA to understand whether a company can fall under tax monitoring and get rid of desk and on-site tax audits: this figure as of December 31 of the year preceding the year of filing the application for monitoring must be at least 3 billion rubles.

To merge organizations into a consolidated group of companies, all merged enterprises together, as one of the conditions, must have a BSA of at least 300 billion rubles as of December 31.

Net assets in 2019

The concept of net assets cannot be considered without reference to the Civil Code. It is the Civil Code that establishes net assets as indicators of liquidity for companies of various organizational and legal forms (LLC, JSC, unitary enterprises, partnerships, etc.).

So for an LLC, net assets are the real equity capital of the organization, that is, what will remain at the disposal of the company after the organization sells all its property and pays off all creditors.

Find out also:

Definition

What is the value of assets on the balance sheet ? The answer is contained in the same letter dated October 16, 2001 No. IK-07/703. The book value of assets is a balance sheet line containing the inscription “BALANCE”, that is, this is a figure that is the sum of the currency of this report.

In fact, the BSA of an organization is the sum of its balance sheet assets: this is the sum of its non-current and current assets or the sum of the results of sections I and II of this report. It should be remembered that fixed assets and intangible assets are shown in the report at their residual value, that is, minus accumulated depreciation.

Calculation by intangible assets

Intangible assets have no tangible form. They have value and create conditions for generating income. The initial cost of intangible assets is equal to the acquisition price (read more about accounting for the initial cost of intangible assets). As production resources are used, balances are determined taking into account wear and tear based on average values. In the balance sheet, intangible assets are reflected in line 1110.

How to make a payment

The legal form for the calculation is not established. Typically, in such cases, a certificate of BSA is drawn up in a form developed by the organization independently in accordance with the requirements of Law 402-FZ with the mandatory presence of the following information:

- name of the certificate;

- Date of preparation;

- name of the compiling organization;

- a description of why the certificate was prepared;

- the calculation procedure and the amount of the calculated indicator;

- unit of measurement of the indicator;

- positions and signatures (with transcript) of responsible persons.

Depending on the purposes, the certificate may be drawn up not for all, but for certain property of the enterprise. For example, to sell a fixed asset, its price is determined according to the balance sheet.

Functions of non-current assets

Non-current assets are necessary to ensure the activities and development of the company. The following functions can be distinguished:

- Providing financial benefits in the long term.

- Guarantee of uninterrupted production of goods or performance of services.

- Supporting management needs.

- Possibility of settlements with creditors.

- Ensuring the transportation and production of goods.

- Improving product quality.

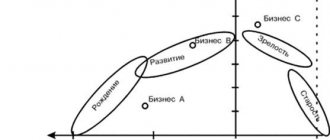

Based on the dynamics of the indicator, the manager can draw a conclusion about the development of the enterprise and its prospects.

What is the book value of assets?

The book value of assets is a set of values and objects of an organization, expressed in numbers. In simple words, this is the result of property valuation. The information received is displayed in the accountant’s financial statements.

Important: the value of assets on the balance sheet differs from the valuation of net assets; the latter value is the sum of the enterprise’s assets excluding its liabilities.

This indicator is important for making decisive management decisions to optimize the activities of the enterprise, lending, and attracting third-party investments.

The process of applying book value, the procedure for its calculation and the definition of the concept as a whole are regulated by the following standards:

- Federal Law-208 on JSC from 1995;

- Federal Law-14 of 1998 on LLC;

- Supreme Arbitration Court of the Russian Federation No. 62 of 2001;

- Letter of the Federal Commission for the Securities Market of the Russian Federation No. IK-07/7003 of 2001.

The BSA includes the price value of assets, regardless of the difference to which group they belong.

Composition of non-current assets

Non-current assets are company property that is used many times. This includes objects that have been in use for more than a year. Their cost is more than 15 times the minimum wage, excluding taxes.

Non-current assets may include:

- funds received from the main activities of the enterprise;

- intangible assets;

- unfinished objects;

- equipment and machinery;

- long-term investments.

This list is not exhaustive. Let's look at each of the component categories. Material VA include :

- building;

- Earth;

- equipment, vehicles;

- furniture that has been in use for more than a year;

- resources in the form of animals and plants;

- trade equipment;

- equipment stored in enterprise warehouses;

- property leased to another person.

Among financial VAs we can highlight:

- bonds with a long-term maturity period;

- shares purchased for the purpose of receiving dividends;

- providing loans;

- various investments.

Intangible non- current assets are:

- Database;

- software developed by the company;

- rights to own land and subsoil;

- licenses to carry out work;

- various patents.

Regardless of which object is being considered, its period of use must exceed a year. If the operating time is shorter, the property will be classified as current assets.

Where is the asset value on the balance sheet?

The sum of all assets in the balance sheet is displayed on line 1600

Information on the amount of all assets is displayed in line 1,600 BB. In this case, data on non-current objects is indicated in line 1,100 BB, and negotiable in line 1,200 BB.

Non-current assets include fixed assets and intangible assets. Data on them is indicated at the remaining cost or at the purchase price minus expenses for depreciation. Revaluation of equipment is also taken into account if the company practices it.

Current assets are objects that are systematically used in the work process of an organization throughout the year or one working period. They include:

- material values;

- stocks;

- accounts receivable;

- finance;

- investments for a short period;

- accrued VAT on the acquisition of valuables, which is indirectly related to financing.

Based on the accounting policies adopted by the enterprise, you can calculate the total volume of all components or summarize the figures for individual blocks (intangible assets, fixed assets, etc.)

So, the book value of assets is a balance sheet line of 1,600 BB, designed to display the total amount of data entered in all lines for objects. It is completed as of the last reporting date.

The value of the enterprise's property on the balance sheet

The value of a company's property consists of current and non-current assets. The first group includes:

- the organization's reserves in some form, for example, finished products;

- money;

- accounts receivable;

- financial investments;

- VAT on purchased assets.

Current assets are recorded in the second section of the balance sheet (PBU 4/99 “Accounting statements of an organization”).

The cost of non-current assets can usually be written off gradually as an expense. This is one of the characteristic features.

Calculation of book value of assets

The basis for the calculation is a compiled balance sheet, which reveals information about the total price of the company’s property, including assets and intangible objects. The result of the calculation is the sum of lines 1,100 and 1,200 entered into line 1,600.

The calculation should be carried out in accordance with the regulations, regulatory documents minus the regulatory values, the list of which is included in clause 35 of PBU 4/99.

How the assets in the line balance are correctly summed up can be seen in the following example:

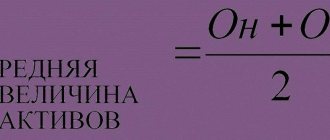

You can also calculate the average balance sheet. To do this, you need to use a formula in which the total amount is obtained by adding the balance sheet indicators at the beginning of the year and the price of objects at the end of the year, divided by 2. The amount displayed on the last day of the calendar year is used.

The average annual cost is calculated as the arithmetic mean at the beginning and end of the year

Therefore, for the first indicator, data is taken from line 1,600 of the penultimate reporting, that is, for the year before the previous one. For the second indicator, the figure from the financial statements for December of the previous year is used.

For example, to find out the average for 2020, you need to take data as of December 31, 2018 and as of December 31, 2019. For example, 1,200 + 1,200 / 2 = 1,200 rubles. Such an indicator may, as a result, turn out to be a more objective determinant of the profitability of an activity, omitting one-time fluctuations that arise from one or more statements.

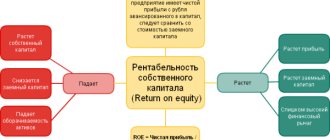

Types of return on assets

Return on current assets of the enterprise:

- Rob.act = 100% × Pch/OAsr;

Where:

- Rob.akt – profitability of current assets;

- Pch – profit taking into account taxation (net);

- ОАср – average annual value of current assets;

The concept of return on current assets reflects the effectiveness of the production process. With its help, you can safely judge the nature of the implementation of economic and financial plans. Increasing the volume of production and sales of goods, conquering new markets, must constantly be guaranteed by working capital.

It is this task that aims to ensure profitability, because fixed assets must always be used rationally.

This indicator indicates how capable the company is of achieving positive financial results. It is current assets that guarantee the enterprise the continuity of economic activity and financial transactions.

The profitability of non-current assets is determined similarly:

- Rn.act=100% × IF/NAsr

Where:

- Rn.act – profitability of non-current assets;

- Pch – net profit;

- NAsr – average annual value of non-current assets;

Another important indicator of an organization’s performance is the profitability of non-current assets. This criterion shows the return that is generated by funds intended for economic activities. It is thanks to him that a clear relationship can be traced between the assets and liabilities of the balance sheet and profit and loss account.

The return on sales indicator will help you find out the amount of profit that an enterprise receives from each ruble of revenue:

- Rр=100% × (Pch.pr)/V;

Where:

- Rр – profitability of sales;

- Pch. pr – the amount of net profit received from sales;

- B – sales revenue;

Of course, the higher this indicator, the better the company is. But when analyzing companies in different industries, this indicator can be very different. That is why comparisons of profitability of sales should be carried out only between competitive companies.

You can achieve increased implementation efficiency in the following ways:

- Increase the amount of profit.

- Reduce sales volume.

But the best option, of course, would be to simultaneously influence both the numerator and the denominator of the formula.

Thanks to all these indicators, we can safely talk about discrepancies between planned profitability indicators and actual data, and we can also understand what caused the discrepancy.

With the help of profitability indicators, the management of an enterprise has the opportunity to assess its profitability from various angles, depending on the interests of participants in the business process. Until recently, profitability was an exclusively relative indicator of financial results and operational efficiency.

In any case, this is one of the most important areas of the factor environment for generating income (profit) of an enterprise.

That is why profitability indicators always occupy a leading place in the processes of analyzing the operational and investment state of an enterprise. By analyzing production indicators, profitability can be used as a pricing and investment policy tool.

A significant position in a market economy is occupied by the comparison of net profit with its revenue parts and, accordingly, with the sources of its formation.

https://youtu.be/v3aVaUY9MUo

What is the book value of assets used for?

The resulting calculation is used to solve a large number of issues, but first it is a financial analysis of the profitability of the enterprise. By studying it, you can find out how much each ruble spent will bring.

Also, the book value is the basis for calculating the asset turnover ratio, an indicator of their effective use by the enterprise.

In addition, you can calculate the significance of a transaction by determining the amount of property that the company risks losing during its implementation. According to the norms, a transaction as a result of which a company may lose 25% of its property is considered large and a meeting of shareholders is required to confirm participation in it.

Important: if the calculation of the balance sheet indicator was carried out incorrectly, then a transaction that has already taken place may be considered invalid.

A correctly calculated BSA makes it possible to join companies that are subject to tax monitoring, applied since 2016 in the Russian Federation. Such companies are not subject to tax and desk audits. Federal Tax Service specialists monitor the company’s reporting through remote access, paying special attention to transactions with risks.

To be included in the number of such enterprises, the conditions established by clause 3, art. 105.26 Tax Code of the Russian Federation.

Important: the correct calculation of BSA is an assessment of the enterprise’s property, the efficiency of its use and confirmation of the legitimacy of transactions.

Increase in net assets

There are several ways to increase net assets:

- carry out a revaluation of property (fixed assets and intangible assets) in accounting (clause 15 of PBU 6/01);

- check accounts payable (perhaps some debts have expired);

- receive help from company participants (contribution to LLC property).

Articles on the topic

We have prepared detailed instructions on how to calculate net assets - the calculation formula for the 2020 balance sheet will clearly show how to make the calculation. See where net assets appear on the balance sheet? What line is this on the balance sheet? And also, what is the formula for calculating their values.

Activate trial access to RNA magazine or subscribe with a discount

How to determine the average price of assets

Any balance sheet is designed in such a way that it allows you to calculate not only the book value of assets, but also its average. It gives a clearer understanding of the value and size of assets. It seems to neutralize the circumstances that distort the real amount.

A c – average cost for the year; A n – assets on the balance sheet at the beginning of the year; A k – value of assets at the end of the year.

Note that the amount of assets in the balance sheet is shown as of the last day of the calendar year. That's why:

- the indicator at the beginning of the year is the balance of line 1600 at the end of December of the year before the previous one;

- book value at the end of the year - the balance at the end of December of the previous year.

As a result, the book value of assets is the price of property owned by the enterprise according to accounting data. Key information about it can be found in line 1600 of the balance sheet. This indicator is very important for analyzing the company's performance.

If you find an error, please highlight a piece of text and press Ctrl Enter.

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions{q} And is it taken into account for tax purposes{q}

We talked about them in separate consultations, brought them up, and also considered the issue. In this material we will dwell in more detail on the book value of assets.

The form of the balance sheet allows you not only to answer the question of how to determine the book value of assets on the balance sheet, but also to calculate their average value.

The average net asset value indicator can give a more realistic idea of the value of assets, smoothing out possible sharp fluctuations that arose on one of the reporting dates.

A SG = (A NG A KG) / 2,

where A NG is the value of assets on the balance sheet at the beginning of the year;

And KG is the value of assets on the balance sheet at the end of the year.

Considering that assets are shown in the balance sheet as of December 31, the value of assets at the beginning of the year corresponds to the balance of line 1600 as of December 31 of the year preceding the previous one, and the value of assets at the end of the year corresponds to the balance of line 1600 as of December 31 of the previous year.

Let's show this with an example.

Thus, the average annual value of the organization’s assets for 2016 will be calculated in the amount of 115,455 thousand rubles. ((127,234,103,676) / 2).

Company assets are resources expressed in value that support the production process. These include non-current assets (buildings, structures, work equipment, machines, vehicles, as well as business reputation, software products that are intangible assets) and current assets, i.e.

money in cash and in bank accounts, inventories, accounts receivable, short-term investments and others. Our publication is devoted to such a concept as the book value of assets. Where to look in the balance sheet, as well as find out how the book value and average annual value of assets are calculated is the topic of this article.

▪ in the first section of the balance sheet (total line 1100) non-current – fixed assets and intangible assets, accounted for at residual value, i.e. minus depreciation;

▪ in the second (total line 1200) – current inventories, finances, liabilities, investments participating in the production process.

Accounting amount of assets The balance sheet is only an absolute indicator that determines the total value of the company's property assets.

- Ang – book price of funds at the beginning of the reporting period;

- Akg is the book price of funds at the end of the reporting period.

Classification of balance sheets

There are many types of balance sheets. Their diversity is determined by a variety of reasons: the nature of the data on the basis of which the balance is formed, the time of its compilation, purpose, method of reflecting the data and a number of other factors.

According to the way the data is reflected, the balance sheet can be:

- static (balance) - compiled for a specific date;

- dynamic (revolving) - compiled by turnover for a certain period.

In relation to the moment of compilation, balances are distinguished:

- introductory - at the beginning of activity;

- current - compiled as of the reporting date;

- liquidation - upon liquidation of an organization;

- sanitized - when rehabilitating an organization approaching bankruptcy;

- dividing - when dividing an organization into several companies;

- unifying - when organizations merge into one.

Based on the volume of data on organizations reflected in the balance sheet, balance sheets are distinguished:

- single - one organization at a time;

- consolidated - based on the sum of data from several organizations;

- consolidated - for several interrelated organizations, internal turnover between which is excluded when preparing reports.

According to its purpose, the balance sheet can be:

- trial (preliminary);

- final;

- predictive;

- reporting.

Depending on the nature of the source data, there is a balance:

- inventory (compiled based on the results of the inventory);

- book (compiled only according to registration data);

- general (compiled according to accounting data taking into account the results of the inventory).

By way of data reflection:

- gross - including data from regulatory items (depreciation, reserves, markup);

- net - with the exception of these regulatory articles.

Balance sheets may vary depending on the legal form of the company (balance sheets of state, public, joint, private organizations) and the type of its activity (main, auxiliary).

Based on frequency, balances are divided into monthly, quarterly, and annual. They can have either full or abbreviated form.

The balance sheet table can be of 2 types:

- horizontal - when the balance sheet currency is defined as the sum of its assets, and the sum of assets is equal to the sum of capital and liabilities;

- vertical - when the balance sheet currency is equal to the value of the organization's net assets (i.e., the amount of capital), and the net assets, in turn, are equal to the assets of the enterprise minus its liabilities.

For internal purposes, the organization itself has the right to choose the frequency, methods and methods of preparing the balance sheet. Reports submitted to the Federal Tax Service must have a certain form with comparable data as of the dates indicated in the balance sheet.

To learn how to prepare a balance sheet for a small business, read the article “Balance Sheet for Small Businesses (Features).”

The concept and meaning of balance sheet items

Sections of the balance sheet are detailed by breaking them down into items. The itemized details recommended for submission to the Federal Tax Service Inspectorate are contained in balance sheet forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n in 2 versions:

- complete (Appendix 1);

- abbreviated (Appendix 5).

The abbreviated (simplified) form of the balance sheet allows for the combination of its articles in order to obtain aggregated indicators and simplify reporting. However, its use is available only to persons entitled to conduct simplified accounting (SMEs, NPOs, participants in the Skolkovo project).

The breakdown of sections into articles is due to the need to highlight the main types of property and liabilities that form the corresponding sections of the balance sheet.

The form of a complete balance sheet recommended by the Ministry of Finance of Russia assumes the following breakdown of sections by item:

- fixed assets:

- intangible assets;

- research and development results;

- Intangible search assets;

- tangible prospecting assets;

- fixed assets;

- profitable investments in material assets;

- financial investments;

- Deferred tax assets;

- Other noncurrent assets;

- stocks;

- VAT on purchased assets;

- accounts receivable;

- financial investments (except for cash equivalents);

- cash and cash equivalents;

- Other current assets;

- authorized capital (share capital, authorized capital, contributions of partners);

- own shares purchased from shareholders;

- revaluation of non-current assets;

- additional capital (without revaluation);

- Reserve capital;

- retained earnings (uncovered loss);

Find out which line shows gross profit in the balance sheet here.

- long term duties:

- borrowed funds;

- deferred tax liabilities;

- estimated liabilities;

- other obligations;

- borrowed funds;

- accounts payable;

- revenue of the future periods;

- estimated liabilities;

- other obligations.

When drawing up a balance sheet, an organization can use the item-by-item detailing recommended by the Russian Ministry of Finance. However, it has the right to use its own development of this breakdown if it believes that this will lead to greater reliability of reporting. In addition, if there is no data to fill out the relevant items, the company has the right to exclude such items from the balance sheet it compiles.

Balance sheet items are filled out based on data on balances in accounting accounts as of the reporting date. When filling out a report for submission to the Federal Tax Service, you must be guided by a number of rules established for the preparation of such reports (PBU 4/99, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n):

- The initial accounting data must be reliable, complete, neutral and formed in accordance with the rules of the current PBU. When reflecting them, it is necessary to comply with the principles of materiality and comparability with the results of previous periods.

- In the current report, data from previous periods must be consistent with the figures in the final accounts for those periods.

- For the annual balance sheet, the presence of property and liabilities must be confirmed by the results of their inventory.

- Debit and credit balances in the balance sheet are not collapsed.

- Fixed assets and intangible assets are shown at residual value.

- Assets are reflected at their book value (less created reserves and mark-ups).

The accounting balance from 06/01/2019 is filled only in thousands of rubles (without decimal places).

Below is information on the basis of which account balances the above balance sheet items are filled in in relation to the current version of the chart of accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n:

- Under the article “Intangible assets”, the residual value of intangible assets is indicated, corresponding to the difference in the balances of accounting accounts 04 and 05. At the same time, for account 04, data falling in the line “Results of research and development” is not taken into account, and for account 05 - figures related to intangible search assets.

- The article “Results of research and development” is filled in if there is data on R&D costs in account 04.

- Data on the items “Intangible exploration assets” and “Tangible exploration assets” are important only for those organizations that develop natural resources if they have information on account 08 to fill out lines for these items. Tangible exploration assets include tangible objects, and intangible assets include all others. Both types of assets are subject to depreciation, recorded in accounts 02 and 05, respectively.

- For the item “Fixed Assets”, data on the residual value of fixed assets (the difference in the balances of accounting accounts 01 and 02, while account 02 does not take into account data related to material exploration assets and profitable investments in assets) and capital investment costs (account 08, excluding the figures included in the lines of the articles “Intangible search assets” and “Tangible search assets”).

- Data for the article “Profitable investments in assets” is taken as the difference between the balances of accounts 03 and 02 in relation to the same objects.

- The item “Financial investments” in non-current assets is filled in if there are amounts with a repayment period of more than 12 months in accounts 55 (deposits), 58 (financial investments), 73 (loans to employees). The balance of account 58 is reduced by the amount of the created reserve (account 59) related to long-term investments.

- Under the article “Deferred tax assets”, organizations applying PBU 18/02 indicate the balance of account 09.

- When the line item “Other non-current assets” is used, the balance sheet reflects assets that are either not included in the above lines, or those that the organization considers necessary to highlight.

- The figure for the item “Inventories” is formed as the sum of the balances on accounts 10, 11 (minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting for goods carried out with a markup), 43, 44, 45, 46, 97.

- The item “VAT on purchased valuables” reflects the balance of account 19.

- To obtain the data indicated under the “Accounts receivable” item, debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus data , recorded under the article “Financial investments”), 75, 76.

- The article “Financial investments (except for cash equivalents)” in current assets shows data on accounts 55 (deposits), 58 (financial investments), 73 (loans to employees) with repayment periods of less than 12 months. In this case, the figures in account 58 are reduced by the amount of the created reserve (account 59) for short-term investments.

- The data for the item “Cash and cash equivalents” is obtained by adding the balances of accounts 50, 51, 52, 55 (excluding deposits), 57.

- The line of the article “Other current assets” includes assets that are either for some reason not reflected in the above lines, or those that the organization considers necessary to highlight. For example, this could be a bad debt from a counterparty or the value of stolen property for which investigative actions have not yet been completed. Reflection of such data on this line with a corresponding reduction in figures for those items in which they could have been reflected if there had not been a decision by the organization to allocate them, will require notes both to the article “Other current assets” and to the second article, which will be affected such an operation.

- The data for the article “Authorized capital (share capital, authorized capital, contributions of partners)” is taken as the balance of account 80.

- The figures in the article “Own shares purchased from shareholders” correspond to the balances of account 81.

- For the article “Revaluation of non-current assets”, data on balances on account 83 related to fixed assets and intangible assets is used.

- Data for the item “Additional capital (without revaluation)” is formed as balances on account 83 minus data on the revaluation of fixed assets and intangible assets.

- The item “Reserve capital” shows the balance of account 82.

- The value reflected under the item “Retained earnings (uncovered loss)” in the annual balance sheet is the balance of account 84. For interim reporting (before the balance sheet reformation carried out at the end of the year), this figure is the sum of two balances: for account 84 (financial the result of previous years) and 99 (financial result of the current period of the reporting year). The item “Retained earnings (uncovered loss)” is the only balance sheet item that can have a negative value. At the same time, it is important that for an organization that has a loss, the total of the “Capital and Reserves” section (net assets) does not turn out to be less than the amount of the authorized capital. If this circumstance occurs for two financial years in a row, then the organization must either reduce its authorized capital to the appropriate figure (and this is not always possible, since the authorized capital cannot be less than the minimum value established by current legislation), or it is subject to liquidation.

We invite you to familiarize yourself with Opening a business for 100 thousand rubles

Read more about the reformation of the balance sheet in the article “How and when to reform the balance sheet?”

- The article “Borrowed funds” in the “Long-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which exceeds 12 months (account balance 67). In this case, interest on long-term borrowed funds must be taken into account as part of short-term accounts payable.

- Under the article “Deferred tax liabilities”, organizations applying PBU 18/02 indicate the balance of account 77.

- The value under the item “Estimated liabilities” in the section “Long-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in relation to those reserves whose useful life exceeds 12 months.

- The item “Other liabilities” in the section “Long-term liabilities” shows liabilities with a maturity of more than 12 months that are not included in other lines of long-term liabilities.

- The article “Borrowed funds” in the “Short-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which is less than 12 months (account balance 66). At the same time, this includes interest on long-term borrowed funds, recorded in account 67, and debt on long-term loans and borrowings, recorded in account 67, if there are less than 12 months left until its repayment.

- The data for the “Accounts payable” item is formed as the sum of credit balances for accounts 60, 62, 68, 69, 70, 71, 73, 75, 76.

- For the item “Deferred income” the value is taken as the sum of balances on accounts 86 (target financing) and 98 (deferred income).

- The value under the item “Estimated liabilities” in the section “Short-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in terms of those reserves whose useful life is less than 12 months.

- Under the item “Other liabilities” in the section “Short-term liabilities”, liabilities with a maturity of less than 12 months are shown that are not included in other lines of short-term liabilities.

https://youtu.be/xuUufh03iks

Composition of assets and where to look

Any specialist who has ever dealt with accounting knows the words “balance sheet” and “organizational assets.” If we explain their meaning in accessible language, it turns out that the book value of assets is a certain number of funds and benefits that can be expressed in monetary terms.

If we speak in the language of accountants about what the book value of an enterprise's assets is, then this is the amount of all the company's assets in cash, which is clearly shown in the accounting. balance.

https://www.youtube.com/watch{q}v=OfHuns4bqcM

Assets can be:

- non-current - they are summarized in line 1100 of the balance sheet;

- negotiable – written in line 1200.

All main types of property and intangible assets are classified as non-current. They appear on the balance sheet at their residual value (at which they were received/purchased, taking into account subsequent aging, wear and tear and revaluation carried out by the company).

Working capital includes assets, the use of which in the activities of an enterprise to achieve financial success is quite frequent. They are involved for 12 months or another established cycle. These include:

- materials needed for production;

- debts of debtors to the company;

- monetary assets and the like;

- VAT on property acquired by the enterprise;

- financial investments, etc.

It is not at all difficult to find the book value of assets: this is line 1600 in the balance sheet. It shows the amount of both current and non-current assets.

Thus, there is only one option where to look at the book value of assets in the balance sheet: it is written in line 1600 of the balance sheet.

Accounting

Since all, in fact, the company’s property has a heterogeneous composition, it is taken into account in different accounts of the chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n (as amended on November 8, 2010). In particular, the following accounts are used for this:

- 50 "Cashier";

- 51 “Current account” (and 52 “Currency account”);

- 58 “Financial investments”;

- 10 "Materials";

- 41 "Products";

- 62 “Settlements with buyers and customers”;

- and others similar, which are located in the sections “Inventory”, “Cash”, “Finished products and goods”, “Calculations”.

Liabilities also relate to negotiable assets, since in essence they are already invested money that belongs to the company. All these accounts are grouped into several lines on the balance sheet, and a special formula is used to determine what to enter in each of them.