General concepts for business trips

A business trip is a trip by an employee, by order of a manager, for a certain period of time to another location to carry out an official assignment outside the place of his permanent work. Business trips of employees whose permanent work takes place on the road or is of a traveling nature are not recognized .

Duration of business trip – the duration of the employee’s stay on a business trip. The duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

The day of departure on a business trip is the day the vehicle departs from the place of permanent work of the business traveler, and the day of arrival is the day the vehicle arrives at the place of permanent work. When leaving a vehicle before 24 hours inclusive, the day of departure for a business trip is considered the current day, and from 00.00 hours and later - the next day.

Chief Accountant

Sometimes the chief accountant is sent on trips.

It is worth noting that an accountant in any enterprise is a financially responsible person. After all, it is this person who keeps records of finances, money and property matters. Therefore, we can say that the employee is simply attached to his place of work. If he is sent on a business trip, then a part-time employment contract is drawn up. This is especially important to do if the employee leaves for more than one month. The goals for such a working trip of the chief accountant of an enterprise may be the following:

- Checking reporting and accounting in a branch of the enterprise;

- Creation of a new database at an enterprise that opened recently;

- Acceptance of cases. This happens if an accountant is transferred to a new position in another city. At first, he will need to travel to the enterprise to take over all the documents and get to grips with the business;

- Training. Training or a trip to a conference can significantly improve the professionalism of an accountant, which in the future will help him keep records correctly.

Organization of business trips

Let’s look step by step at how to organize sending an employee on a business trip.

So, at the first stage , the initiator prepares a memo or justification for the trip indicating:

- FULL NAME. and positions of employees sent on business trips;

- purpose of the trip;

- start and end dates of the business trip;

- location and name of the legal entity (division) of the receiving party;

- a proposed register of costs indicating the method of payment.

The justification must include a list of the employee's expected expenses - costs of renting living quarters, travel expenses to and from the business trip, additional transportation costs for fuels and lubricants, etc.

At the second stage , taking into account the justification, the head of the company makes a decision on the secondment of the employee, guided by the following principles:

- the purposes of the business trip must be of a production nature;

- secondment of the head and employees of one department, as well as secondment of 2 or more employees of one department should be expedient and economically justified from the point of view of production necessity.

Examples of the purpose of a business trip in case of traveling abroad may be as follows:

- for participation in international conferences, seminars, symposiums, exhibitions;

- to participate in working groups on joint activities with the company’s foreign partners;

- to represent the employer’s interests at significant international events (forums, etc.);

- to familiarize yourself with new types of equipment, organize the supply of goods (equipment) necessary for the operation of the facility ordered by the company from a foreign manufacturer.

Sales Manager

Various companies very often send their sales managers on work trips. Firms in such cases are usually engaged in the sale or manufacture of various products, items or equipment. Sending a manager to another city is always a good idea, because this will help increase sales and demand significantly. The purpose of the manager's trip may be the following:

- The manager will study the needs of the enterprises in order to convey information to the firm. In the future, the company can expand its product range based on this analysis and increase its profits;

- Conducting negotiations with potential buyers. The usual personal presence of a manager is required when large purchases are involved;

- Sometimes managers visit their competitors' outlets to analyze and improve the performance of their enterprise.

Preparation of documents for a business trip

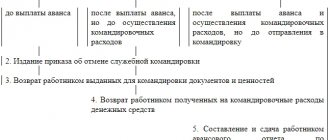

After the approval part comes the documentation of the business trip.

So, at the third step, an order is issued to send the employee on a business trip. It is usually prepared by the personnel department based on a positive decision from the director of the company.

After signing the order and familiarizing the posted worker with it, at the fourth stage they book tickets and a hotel.

Why is it important to issue travel documents only after the order is issued? Because at any moment the plans of the management may change and the business trip will not take place. In this case, your expenses for travel and rental housing will be considered unreasonable .

The employee can independently arrange travel and hotel passes. However, to organize expenses, it is advisable to entrust the booking of tickets and accommodation to a separate employee who will process these expenses in accordance with established standards. In this case, you need to make a preliminary calculation for calculating travel allowances.

You can download an example of a calculation form for the amount of travel allowances for free from our website here:

PRELIMINARY CALCULATION FORM FOR A BUSINESS TRAVEL: SAMPLE

Driver

This point is somewhat more complicated than the others, because the position of a driver often involves traveling work, which means that such trips cannot be called business trips. However, this only works in certain areas. If the driver needs to take his immediate superior to another region, then this is already considered a business trip.

In the event that the driver needs to go to another city for more than one day to check his vehicle, this is also registered as a business trip. After all, maintaining the car in proper quality is his direct responsibility under the employment contract.

Important! It is worth noting that the rules for registering a business trip for truck drivers will not be different. The only thing is that the goal will be the transportation and delivery of various goods.

Business trip payment

And the last step before sending an employee on a business trip is issuing travel allowances for reporting.

Money can be issued in cash from the cash register or transferred to the employee’s bank card, since now many companies have abandoned cash management and pay all expenses by bank transfer.

The approved preliminary calculation for the business trip will be attached to the cash receipt order or to the payment order for the transfer and will be a supporting document.

When agreeing on the preliminary calculation, the accounting department makes a note if the employee has a debt on previously received advances. As a rule, if there is a debt from a past business trip, new advance amounts are not issued . In exceptional cases, the advance is issued minus the debt.

Amounts of unconfirmed (excessively transferred) travel expenses are withheld from the employee’s salary based on the application.

APPLICATION FORM FOR A BUSINESS TRAVEL

If the employee did not have time to receive funds before the business trip on account - in the case of an urgent departure due to production needs - reimbursement of expenses is made after his return from the business trip (subject to the availability of supporting documents).

The transfer of money issued on account for a business trip by one employee to another is prohibited .

Nuances

In order for a person to be sent on a business trip, it is necessary to take into account some nuances:

- The reason for the trip must be clearly stated in the order and then written down on the travel certificate. You can view a sample form on the Internet;

- The company must remember that the trip cannot last more than 40 days. Deadlines are set in advance. A person cannot go on a business trip for an indefinite period of time;

- If the business trip lasts more than one month, then, at the employee’s request, his salary is redirected to him. This is done at the expense of the organization;

- The company reimburses its employee for all expenses related to travel and rental housing. In some cases, expenses related to the fact that the employee is not at his place of residence are paid;

- A business trip is considered to be a trip where an employee leaves for another region relative to his permanent job, and not his place of residence. That is, if you live in St. Petersburg, but work in Moscow, a trip to St. Petersburg will be considered a business trip, despite the fact that in fact you are going home.

Advance report

Upon returning from a business trip, the employee is obliged to submit an advance report to the accounting department with the following supporting documents attached:

- a copy of the order for sending on a business trip;

- a copy of the order to extend (change/cancel) the business trip;

- travel documents: electronic ticket or air ticket with boarding passes attached, railway ticket and others;

- an invoice (act and invoice) of a hotel or a lease agreement when renting a residential premises and a document confirming payment (cash receipt, PKO receipt, card extract and others);

- a document confirming the refueling of the car (in the case of renting a car or sending an employee on a business trip in a company car) - gas station receipt;

- receipts for ticket refunds, fines for cancellation of ticket reservations, rental of accommodation (if there is an order to cancel/change/reduce/extend a business trip);

- a copy of the consignment note, consignment note or movement act - when transporting inventory items;

- other documents confirming expenses during a business trip;

- a copy of a foreign passport with a mark on crossing the border - when traveling outside the Russian Federation (except for cases when, in accordance with the current procedure, crossing the state border of the Russian Federation occurs using an internal passport without putting a mark in the foreign passport).

Who is prohibited from being sent on business trips?

In addition to the human factor, questions about the qualifications and personal abilities of candidates, there is another aspect in choosing an employee for a work trip. There are legal requirements regarding categories of citizens who cannot be sent on business under any circumstances. These include the following groups of people:

- minor employees, interns, interns;

- pregnant women;

- employees of the company working under an apprenticeship contract (except for business trips for the purpose of training);

- participants in election campaigns, candidates for political positions;

- people whose capabilities are limited by illness.

There are also groups of people who can be sent on a business trip only if their written consent is obtained:

- women with small children (up to three years of age);

- a single parent raising a child under five years of age;

- guardians of children under the age of majority;

- an employee whose family has a dependent in need of constant care.

Other business trip expenses

In addition to basic expenses, an employee may have other expenses during a business trip. In order for the accounting department to be able to reimburse them and take them into account, the employee must provide supporting documents:

• for the use of the bed;

• payment of insurance fees (including insurance fees for compulsory and voluntary personal insurance of passengers on transport);

• payment of registration fees;

• payment for services for issuing travel documents;

• return of tickets, fines (if there is an order to cancel/change/reduce/extend a business trip);

• hotel accounts for the provision of additional services (insurance, use of a refrigerator).

The employee may also have expenses for baggage when transporting documents, spare parts and other equipment, if this task is provided for in the business trip order. They are reimbursed to the posted worker in full on the basis of supporting documents.

KEEP IN MIND

The accounting department may refuse to accept for accounting documents that are dirty, worn, torn, have abrasions, holes, punctures, foreign inscriptions, stains, have lost fragments, are glued together from fragments - if, due to their condition, they cannot confirm the fact of expenses incurred or any mandatory document details cannot be identified.

Who to send on a business trip

The choice of an employee to go on a trip depends on the purpose of the trip, examples of work assignments, its duration and the severity of the expected conditions. Different reasons for travel require specific knowledge and skills from the employee.

Thus, the execution of a supply agreement must be entrusted to a person savvy in business negotiations and diplomacy. This may be a specialist whose job responsibilities include procurement, planning and calculating the budget for business relations with suppliers, or a person who can competently explain his position and achieve optimal conditions in the concluded supply agreement.

If the purpose of the trip is to set up equipment or software, knowledge of office work and ordinary human charisma are not enough for the sent employee. An official with a technical background is sent on such a trip. The same situation occurs when conducting on-site inspections and audits. An accountant or economist should be sent on such a trip.