What penalties for non-payment of VAT are provided by law?

Every taxpayer - enterprise or private entrepreneur - is obliged to pay accrued taxes on time. If funds are not deposited or payment is incomplete, a debt arises, in connection with which a corresponding check is carried out by government agencies.

During this audit, the reasons for tax evasion and the presence of illegal actions on the part of the entrepreneur are identified.

To avoid paying taxes, businessmen can resort to various illegal manipulations. For example, entering into contracts with shell companies, falsifying financial statements, understating the tax base, etc.

Control authorities are familiar with these methods, so they can easily detect them during inspection. In addition, the use of illegal fraud is equivalent to committing an intentional act.

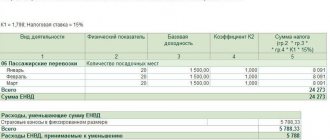

The amount of fines for non-payment of VAT is established by Article 122 of the Tax Code of the Russian Federation:

- 20% of the unpaid amount of the fee (in the absence of signs of intentional action and tax violation);

- 40% of the unpaid fee (in case of an intentional violation).

The fine is imposed on the outstanding amount of the debt. It does not matter whether the fee was not paid in full or in part.

Premiums received by the buyer from the seller

Often, the supply agreement stipulates that upon reaching a certain sales volume, the supplier undertakes to transfer a cash bonus to the buyer. There is currently no consensus on how to reflect this bonus in accounting.

Some believe that the premium reduces the original cost of the product. As a result, the supplier must reduce the previously accrued VAT, and the buyer must reduce the previously accepted deduction. In this case, the buyer is not required to include the bonus in the base subject to value added tax. This approach was supported by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 11637/1 dated 02/07/12 (see “The amount of the monetary bonus for achieving a certain volume of purchases of goods is not included in the VAT tax base from the buyer”).

MORE DETAILS: Federal Law of July 27, 2004 No. 79-FZ “On State Civil Service” -

Others believe that the bonus is an independent payment and is not reflected in the delivery price. The premium should be regarded as the amount associated with payment for goods sold, and subclause 2 of clause 1 of Article 162 of the Tax Code of the Russian Federation should be applied. There is an example in arbitration practice when judges supported this point of view (resolution of the FAS Moscow District dated May 26, 2011 No. KA-A40/4206-11-2).

From July 2013 the situation will change. In Article 154 of the Tax Code of the Russian Federation, paragraph 2.1 will appear, which states that the accounting method depends on the terms of the contract. If it stipulates that the initial cost is reduced by the amount of the premium provided, then the supplier and buyer must adjust the VAT base.

But the question remains open whether VAT should be charged on the bonus amount in the case where, according to the terms of the contract, the bonus does not affect the original supply price. In other words, should subparagraph 2 of paragraph 1 of Article 162 of the Tax Code of the Russian Federation be applied in this situation? We believe that there is no such need, since the bonus is not related to sales.

The opposite situation occurs when the premium is paid not by the supplier, but by the buyer. Such conditions are usually typical for transactions for the provision of services (for example, marketing or advertising). The parties agree that if the services are beneficial, the customer undertakes to transfer to the contractor, in addition to the basic payment, a monetary reward.

Experts from the Russian Ministry of Finance believe that such a bonus increases the tax base for VAT for the performer (letter dated December 6, 2011 No. 03-07-11/336). However, we do not agree with this, because there is no fundamental difference between the premiums received from the supplier and the premiums received from the buyer. And if officials allowed not to charge tax on the premium from the supplier (we talked about this above), then logically the same conclusion can be drawn regarding the premium from the buyer.

Assignment of penalties for late payment of VAT

Any delay in paying the tax fee, even one day, is accompanied by the accrual of appropriate penalties, in accordance with Article 75 of the Tax Code of the Russian Federation. Penalties are accrued for each day the debt is not paid. Their appointment is carried out the next day after the end of the period for depositing funds into the VAT account.

The following factors influence the final amount of penalties:

- period of delay;

- amount of debt not transferred to the budget;

- the refinancing rate applicable during the period of delay.

The amount of penalties is established by Part 4 of Article 75 of the same code and amounts to 1/300 of the refinancing rate of the Central Bank of the Russian Federation of the amount of arrears (in 2020 - 10%).

In addition, tax evasion deprives entrepreneurs of the opportunity to refund VAT.

We recommend material : Fine for illegal trading in the wrong place.

New point of view of officials: fines are not subject to VAT

Officials recommend that the amounts of penalties (fines and penalties) received from the buyer be regarded as a measure of responsibility for late payment for goods and services and that the provisions of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of 02/05/2008 No. 11144/07 be applied to them. In accordance with this resolution, the amount of the penalty received by the seller from the buyer is considered a measure of liability for failure to comply with the terms of contractual obligations and therefore is not related to payment for goods sold under Art. 162 of the Tax Code of the Russian Federation. Therefore, such a penalty is not subject to VAT. The position of the Ministry of Finance of the Russian Federation on the non-inclusion of the amount of fines in the VAT tax base is given in letters dated July 27, 2016 No. 03-07-11/43854, dated October 7, 2015 No. 03-07-07/57255.

At the same time, the Ministry of Finance of Russia emphasizes that if the amounts of penalties and fines determined by the contractual terms are not such in essence and are in fact an element of pricing that provides for payment for goods (work, services) sold, then these amounts are subject to VAT (letters from the Ministry of Finance Russia dated 05.10.2016 No. 03-07-11/57924, dated 09.11.2015 No. 03-07-11/64436, dated 04.03.2013 No. 03-07-15/6333, as well as the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 05.02.2008 No. 11144/07 in case No. A55-3867/2006-22, FAS Moscow District dated March 11, 2009 No. KA-A40/1255-09 in case No. A40-32554/08-129-101 and FAS North Caucasus District dated 07.07 .2011 in case No. A32-40880/2009).

There are also numerous court decisions that share the opinion that received fines are not subject to VAT. For example, the Arbitration Court of the North Caucasus District, in resolution dated January 20, 2016 No. F08-9883/2015 in case No. A01-25/2015, came to the conclusion that the amounts of penalties received from buyers are not subject to VAT, since the payment of the penalty is related to violation of the terms of the contract, and the amount of the penalty is paid in excess of the price of goods (work, services) and does not increase their value.

FAS Moscow District dated February 24, 2014 No. F05-17712/13 in case No. A40-82044/2013 indicated that the amounts of the penalty received by the taxpayer from the counterparty under the contract are not related to payment for goods sold (works and services), and therefore are not subject to VAT taxation according to sub. 2 p. 1 art. 162 of the Tax Code of the Russian Federation. Similar conclusions are given in the decision of the Arbitration Court of the Volga District dated December 12, 2014 No. F06-18029/13 in case No. A72-278/2014.

FAS Moscow District confirmed that, in accordance with paragraph 2 of Art. 395 of the Civil Code of the Russian Federation, paragraph 6 of the resolution of the Plenum of the Supreme Court of the Russian Federation No. 13, the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 8, 1998 No. 14, payment of interest for the use of other people's funds is considered a measure of liability for non-compliance with contractual terms, which means it does not apply to payment for goods under within the meaning of paragraph 2 of Art. 153, sub. 2 p. 1 art. 162 of the Tax Code of the Russian Federation and is not subject to VAT (resolution of the Federal Antimonopoly Service of the Moscow District dated November 13, 2008 No. KA-A40/10586-08 in case No. A41-3502/08).

Similar conclusions are set out in the decisions of the FAS of the Volga-Vyatka District dated May 10, 2007 in case No. A29-7483/2006a (by the decision of the Supreme Arbitration Court of the Russian Federation dated September 10, 2007 No. 10714/07, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused), the FAS of the North-Western District dated December 11, 2006 in case No. A05-7544/2006-34 (by decision of the Supreme Arbitration Court of the Russian Federation dated March 29, 2007 No. 3432/07, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused) and the Federal Antimonopoly Service of the Central District dated September 16, 2008 in case No. A54-3386 /2006-С21.

FAS Moscow District also noted that the penalty has its own legal nature, not related to the object of VAT taxation. Therefore, funds received as a penalty for untimely fulfillment of contractual obligations are not subject to VAT (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 28, 2009 No. KG-A40/6668-09 in case No. A40-84761/08-7-816). The same conclusion is contained in the ruling of the Supreme Court of the Russian Federation dated 09/02/2015 No. 305-ES15-7719 in case No. A40-20035/2014, the resolution of the Arbitration Court of the Volga District dated 12/03/2015 No. F06-3084/2015 in case No. A12-2805/2015 , FAS Moscow District dated April 25, 2012 in case No. A40-71490/11-107-305.

In the resolution of the Federal Antimonopoly Service of the Ural District dated February 16, 2009 No. Ф09-464/09-С3 in case No. А76-5994/2008-46-131, the arbitrators indicated that a penalty is considered one of the ways to ensure the fulfillment of contractual obligations and is associated with non-fulfillment of the terms of the payment agreement , compensates for probable or incurred losses of the parties to the contract and is paid in excess of the cost of the goods. Consequently, receiving a penalty (penalty, fine) does not apply to transactions subject to VAT and does not fall under subclause. 2 p. 1 art. 162 of the Tax Code of the Russian Federation. The same conclusion is contained in the resolution of the Federal Antimonopoly Service of the Moscow District dated February 24, 2014 No. F05-17712/2013 in case No. A40-82044/13-45-133.

The Federal Antimonopoly Service of the Central District determined that penalties paid by the buyer to the supplier for non-compliance with the terms of the contract for payment for goods are not subject to VAT, since at the time of receiving the penalty the transfer of ownership of the goods does not take place. In Art. 146 of the Tax Code of the Russian Federation does not indicate that sanctions are subject to VAT. Amounts included in the base and specified in Art. 154–158 of the Tax Code of the Russian Federation also do not have in their list the amounts of sanctions for compliance with the terms of contractual obligations. Only amounts that increase the cost of the goods sold are subject to VAT (resolution of the Federal Antimonopoly Service of the Central District dated April 23, 2008 in case No. A08-4124/07-22).

For additional information, see the material “Are business fines subject to VAT?”

Circumstances mitigating liability

If there are circumstances mitigating the taxpayer's liability, it is possible to achieve a reduction in the amount of the fine for failure to pay VAT within the period established by Russian legislation.

Article 112 of the Tax Code of the Russian Federation contains a list of circumstances, the presence of which is considered by the court as mitigating the guilt of the offender to a certain extent, namely:

- the difficult financial situation of the offender;

- presence of personal or family reasons;

- being under the influence of coercion or threat.

This list is not final, so the judge has the right to independently decide whether the circumstances that forced the violator to fail to pay VAT within the time limits specified in the law are considered mitigating.

In addition, if a citizen has previously committed a similar offense, this circumstance is classified as aggravating.

Overpayment of tax dues

Whether overpayment of VAT is a mitigating circumstance when arrears are discovered is a controversial issue. In practice, most courts take the side of the taxpayer and reduce the amount of the fine, but the legislation does not contain a precise explanation.

Thus, an entrepreneur may insist that an overpayment of the fee proves that he has no deliberate desire to evade paying VAT.

The final decision on this issue remains with the judge presiding over the particular case.

Committing a tax violation for the first time

In this case, the answer is also ambiguous, because the person who committed the offense for the first time could not pay the VAT in full by mistake.

In practice, courts prefer to take this circumstance into account as a mitigating factor for the defaulter. However, the final decision still rests with the judge presiding over a particular case.

Voluntary debt repayment

Administrative fine for violating silence - read here. Fine for smoking in a public place or entrance.

The fine for driving without a child seat is .

If the VAT debt was paid by the entrepreneur before the inspection of the regulatory authorities was ordered and the presence of arrears was discovered, in practice the courts recognize this circumstance as a mitigating factor.

A reduction in the degree of guilt of a citizen also occurs when arrears are eliminated in a timely manner on the basis of clarifying declarations.

However, it is impossible to say unambiguously whether voluntary repayment of tax debt will be considered by the court as a mitigating circumstance. The legislation does not contain clear instructions in this regard, so the final decision on the case is made by the judge.

Penalty - with or without VAT

Many accountants are wondering whether the penalty is calculated with or without VAT, how to correctly determine its size and which regulatory document to refer to in order to avoid further penalties from regulatory authorities.

Two answers can be given to this question, based on completely opposite points of view of specialists and officials:

- Value added tax is charged on collection, since the tax base for it is made up of all amounts that are associated with payment for sold products (clause 2, clause 1, article 162 of the Tax Code of the Russian Federation).

- VAT is not charged due to the fact that, according to Art. 331 of the Civil Code of the Russian Federation, the agreement on collection is an independent document of title, separate from the main contract, and collection is not directly related to the sale of goods (Letter of the Ministry of Finance of Russia dated 06/08/2015 No. 03-07-11/33051).

Let's look at each position in more detail.

The first point of view of officials is that the penalties that the seller receives from the buyer for late payment are directly related to payment for the goods, and therefore they must be included in the tax base for value added tax. This position is confirmed by Letters of the Ministry of Finance of Russia No. 03-07-11/311 dated 08.17.2012, No. 03-07-11/1 dated 05.18.2012 and No. 03-07-11/222 dated 09.11.2009, but at the moment no There is not a single judicial precedent to support this point of view of experts. According to the Ministry of Finance, penalty obligations are determined in the terms of the contract and, in fact, act as one of the pricing tools for goods sold, therefore they must be included in the tax base (Letters of the Ministry of Finance of Russia No. 03-07-11/64436 dated 09.11.2015, No. 03 -07-15/6333 from 03/04/2013).

As for the second position, officials, in response to the question whether the penalty is subject to VAT or not, argue that the penalties received by the seller are sanctions imposed on the buyer for violating his obligations, that is, payment terms. That is why fines and penalties have nothing to do with the sale of products and should not be included in the tax base (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/05/2008 No. 11144/07). It is this position that answers the question of whether a penalty based on a court decision is subject to VAT. There are many official court decisions confirming that value added tax should not be taken into account when calculating penalties.

To date, disputes continue, and experts cannot give an unambiguous and legally enshrined answer to this problem.

Income tax

Include penalties, interest on late payments, compensation for losses and legal interest in non-operating income (clauses 3 and 6 of Article 250 of the Tax Code).

Situation: for the purposes of tax accounting of income using the accrual method, is it considered that by paying the penalty and interest for late payment, the counterparty thereby recognized them

Situation: how to take into account when calculating income tax (accrual method) interest received from the counterparty for late payments under the contract. Interest is calculated for the period from the day the court decision came into force until the date of payment

Situation: when calculating income tax, is it necessary to include in non-operating income the penalty and interest for late payments provided for in the agreement. The organization does not require the debtor to pay them

Situation: is it necessary to accrue interest in accounting and taxation for the use of funds in excess of those specified in the court decision. According to the court decision, interest is subject to accrual until the date of repayment of the obligation