Production cost accounting

Accounting for the costs of a particular enterprise for the production of goods, the provision of services or the performance of work is considered to be the reflection of costs, their arrangement by elements.

Costs are compiled according to economic content according to the following elements:

- material costs;

- salary expenses;

- accruals to extra-budgetary funds;

- depreciation;

- other expenses.

Other expenses include but are not limited to:

- management salary expenses;

- operation of machines and areas;

- travel expenses of employees;

- expenses for communications, auditing, information services, security services;

- entertainment expenses;

- selling expenses;

- taxes.

Expenses incurred by an enterprise in connection with the production of goods, provision of services or performance of work are reflected in accounting and included in the cost of goods, services or work of the reporting period to which they relate, regardless of the time of their payment.

The following types of costs are distinguished:

1. In relation to cost:

- Direct - costs directly associated with the production of a specific product.

- Indirect - costs for administration salaries, general production and general economic expenses. Costs of this type are associated with the production of several types of goods and must be distributed between product positions in proportion to a certain indicator.

2. In relation to the technological process:

- basic;

- invoices.

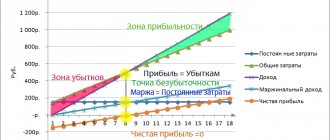

3. In relation to production volume:

- conditional constants;

- conditional variables.

4. According to the economic element:

- elemental expenses;

- complex.

Cost accounting methods:

- custom - used in small-scale production, a specific order is selected as an accounting object;

- cross-cutting - used in large-scale production, costs are accounted for step by step at production stages;

- boiler - used in enterprises that produce one type of product, accounting is made from the expenses incurred by the enterprise as a whole for the reporting period;

- normative - used in enterprises with a large range of manufactured goods, accounting is carried out using standards with the mandatory identification and consideration of the reasons for deviations from them for further analysis and prevention of these reasons during work.

You can get acquainted with detailed information regarding each method of cost accounting in the article “The concept of cost in accounting (nuances)”.

Classification of costs for accounting purposes

The classification of expenses is considered one of the characterizing factors of the rational organization of cost accounting, since it facilitates the adoption of effective administrative decisions and makes it possible to influence economic results. Systematization of costs makes it possible to manage costs: it becomes possible to timely and competently disclose factors and reserves for reducing production costs, forecasting and settling costs is carried out.

Methodological recommendations for cost accounting and cost calculation provide for a certain systematization for the purposes of accounting for production costs.

Grouping costs based on economic elements provides the opportunity to determine and analyze the structure of current costs associated with circulation and production. To conduct such an analysis, it is necessary to determine the share of each element in the total cost, which is reflected in the table below.

| PBU 10/99 | Chapter 25 of the Tax Code of the Russian Federation |

| – costs in terms of material costs; – remuneration of personnel; – social contributions from wages; – wear; – other expense items. | – material expenses; - payment of wages; – wear and amortization; – other cost items. |

As can be seen from the table, the Tax Code of the Russian Federation provides for four cost elements, while accounting has five. In tax accounting, contributions for social needs are not allocated separately, but are included in such items as “Labor expenses” and “Other expenses”, the choice of which depends on the accounting policy adopted by the enterprise.

In order to calculate the cost of any type of product, the costs of an economic entity are grouped and then taken into account in the context of costing items.

Production costs, in addition to the groups indicated above, can also be classified according to a number of other characteristics.

The practice of organizing management accounting provides for various options for classifying costs, the application of which is influenced by the direction of cost accounting and target settings. Users of internal information can determine the direction of accounting that they need to provide information regarding the problem under study.

Initially, the accounting system accumulates information regarding three categories of expenses: material, salary payments and overhead expenses. After this, these expenses are subject to distribution according to certain areas of accounting:

- for estimating the cost of manufactured products and calculating;

- for making management decisions and forecasting;

- to carry out the regulation and control process.

To assess the cost of manufactured products and calculate costs in the management accounting system can be grouped according to various criteria:

- based on the economic role - on invoices and main ones;

- based on the method of inclusion in the cost of production - indirect and direct;

- based on the relationship to the production process - on the costs of the period and costs that are included in the production cost;

- based on the composition of costs - complex and single-element;

- based on the method of attribution to the cost of production and the time of their occurrence - the future period, upcoming and current.

Overhead costs arise in connection with the system and production maintenance. They include general production and general business costs.

Direct costs are associated with the production of a specific type of product and can be directly or directly charged to its cost based on the data of the main documents. These are the costs of raw materials and the main material resources used, wages of workers, etc.

Indirect costs are associated with the production of certain types of products, for example, the costs of management and maintenance of production. They are included in the original cost of certain products using specialized allocation calculations. The selection of a distribution base is determined by the distinctive features of the company and product manufacturing technology. Indirect costs are often called overhead, although these costs are not the same.

Basic expenses are direct expenses, and overhead expenses are indirect expenses, but they are not considered identical.

Production costs are materialized costs; they contain direct costs for material resources; wages, with deductions, production overhead costs. They create the production cost of the product and are used to calculate the cost per unit of the product.

Single-element expenses are those that consist of one component - materials used, wages, wear and tear, etc. These expenses, regardless of their area of origin and target direction, are not divided into different elements.

Complex costs are those that consist of certain components, for example, shop and general plant costs, the structure of which includes wages of the relevant personnel, depreciation of buildings and other single-element costs.

Current costs include the costs of production and sales of the product at this stage. Future expenses include expenses that have not yet been incurred in this reporting period, but in order to correctly reflect the true cost, they are subject to inclusion in production expenses for the given past period in the planned volume.

Cost Accounts in Accounting

To collect the costs of producing goods, providing services or performing work, use Section III “Production Costs” of the chart of accounts.

Grouping of costs within this section is most often done using the following calculation and collection and distribution accounts: 20, 23, 25, 26, 28.

Account 20 “Main production” serves to summarize information about the costs of producing goods, services or works, which, in turn, were the purpose of establishing the company.

This account records both direct costs determined by the production process and included in the cost price, and indirect costs associated with the management and maintenance of production.

Analytical accounting in this account is carried out for specific types of goods, works, and services.

Indirect costs relating to several types of goods are distributed in proportion to the approved indicator. Expenses are written off to cost at standard (planned) or at production actual cost.

You can look at an example of accounting for this account in the article “Account 20 in accounting (nuances).”

Account 23 “Auxiliary production” contains the costs of production that are auxiliary to the main one (OS service, provision of heat, electricity, etc.).

Analytical accounting on this account is carried out by type of production. Expenses are written off to account 20 or to the cost of a specific product as direct expenses or distributed between individual types of goods in proportion to the selected indicator.

You can learn about the features of auxiliary production in the material “Wirings Dt 20 and Kt 23, 10 (nuances)”

On account 25 “General production expenses” the costs of servicing the main and auxiliary production of the enterprise are grouped. Among the costs that are taken into account in this account may be payments for insurance of production machines, costs for service repairs of these machines, operational maintenance costs, costs for renting production space and equipment, and other similar ones.

Analytical accounting on the account is carried out by individual divisions of the enterprise and expense items. At those enterprises where homogeneous goods are produced, expenses, without being distributed, are written off as a debit to account 20. At enterprises producing different goods, expenses are subject to distribution between the types of goods produced and those remaining in work in progress, and are also included in the cost of defects and expenses for fixing the marriage. Expenses are written off to the debit of accounts 20, 23, 29. Account 25 has no balance at the end of the reporting period.

Account 26 “General expenses” groups costs that are not directly related to production processes and relate to management needs. For example, salaries of managers, accounting departments, depreciation of property that the administration uses in its activities, rental payments for premises for the administration, etc.

Analytical accounting is carried out according to budget items and the location of costs. The expenses collected for the month are written off depending on the chosen method of forming the cost of production. When an accountant chooses the accounting method at full production cost, expenses are written off by accounting records Dt 20 Kt 26, Dt 23 Kt 26, Dt 20 Kt 26. If the method of accounting for products at a reduced cost is chosen, the contents from account 26 are written off directly to account 90-2.

It will be useful to familiarize yourself with the main components of general business expenses, consider an example of their accounting and write-off in the article “Account 26 in accounting (nuances)” .

Concept, essence of costs and their classification in the accounting system

In foreign and domestic economic literature, terms such as “expenses”, “costs”, “costs” and “cost” are interpreted differently. These terms are used both in regulatory documents governing financial and tax accounting, and in special scientific and educational literature that examines management accounting issues.

It is worth noting that most Russian specialists interpret the above-mentioned terms at the enterprise level in the same way and consider them synonyms. Thus, at present, in the domestic economic literature, the concept of “expenses” is identified either with production costs, or with the formation of the cost of products, services, works, without taking into account the fact that initially “expenses” were a broader concept.

In particular, the term “expenses” is interpreted as “consumption, expenses for a specific purpose,” while the term “costs” is identified with costs. Costs can be defined as the amount of resources in monetary terms that are used for any purpose in the functioning of the enterprise. In this case, costs can take both the form of production costs and distribution costs, depending on the scope of the entity’s business. Production costs refer to the costs of producing various products, providing services, and performing work.

The concept of “expenses” implies a reduction in the financial benefits of a company over a certain period of time.

Expenses typically include:

- costs of organizing the process of producing products or providing services;

- wages of the personnel of an economic entity;

- depreciation;

- various losses (natural loss, exchange rate differences, etc.).

The table presents approaches to defining the concept of “costs” in modern literature.

| Determination of costs | Author |

| Expenses of an economic entity on production, sales of products, circulation, which are expressed in monetary form | Modern economic dictionary |

| Expenses are expenses that are economically justified and documented, which were carried out (incurred) by the taxpayer | Chapter 25 of the Tax Code of the Russian Federation |

| A decrease in benefits either due to the disposal of assets or due to the occurrence of liabilities, with the exception of a decrease in contributions according to the decision of the owners | PBU 10/99 |

| The total costs of embodied and living labor in financial form, incurred in the process of economic activity for a certain period of time. | Ivashkevich V.B |

| The totality of expenses of an economic entity incurred in connection with the implementation of production and sales activities, expressed in monetary form | Kaverina O.D. |

| Consumed funds that need to be paid, or consumed resources | Horngren C.T., Foster J. |

| Expenses of an economic entity associated with the creation of inventories of goods and materials and services (work) provided by suppliers | Vrublevsky N.D. |

| Funds that are spent on the acquisition of available resources, registered in the balance sheet as assets of an economic entity and capable of generating income in the future | Vakhrushina M.A. |

The terms “costs” and “expenses” are also defined in IFRS. According to IFRS, expenses include all costs in full that arise in the course of the main activity, thus, the term “expenses” is a broader concept compared to the term “costs”.

As for Russian regulatory documents governing accounting (financial) accounting, the concepts of “costs”, “expenses” and “costs” are identical.

Let's summarize the above. We believe that such a concept as costs is a monetary assessment of the cost of labor, material, natural, financial, information and other types of resources consumed in the process of production over a certain period of time.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Guidelines for cost accounting

Since cost accounting in different industries is characterized by its own characteristics due to the conditions and specifics of a particular industry, industry ministries have developed industry-specific guidelines for cost accounting. These recommendations detail and clarify the provisions of federal and industry accounting regulations in relation to the production of products in a particular industry.

In the recommendations for cost accounting in a certain production industry, an economic entity will find a classification of methods and techniques for cost accounting, forms of primary documents for their accounting, cost distribution schemes, a nomenclature of cost items and principles for calculating the cost of various types of products.

Methodological recommendations for cost accounting have been developed, for example, for agricultural organizations, crop production organizations, enterprises engaged in breeding and growing fish, dairy and beef cattle breeding.

Direct and indirect costs

Costs are divided into direct and indirect. They are also sometimes called fixed and overhead costs. Direct costs are directly related to production. Indirect ones go to the management of this production and its maintenance. This division, for example, is reflected in the Instructions for the chart of accounts.

A detailed list of direct and indirect costs by cost item, as well as the procedure for assigning them to cost, must be determined independently based on the characteristics of your production. However, there are general principles that need to be followed.

Thus, direct costs directly related to the production of a certain type of product, work or service include:

- expenses for raw materials, semi-finished products of own production;

- wages of workers directly involved in the production process;

- contributions for compulsory pension, social or health insurance, including insurance against accidents and occupational diseases of workers.

In addition, direct costs include the cost of services of auxiliary production and service facilities. The main thing is that they are directly related to production.

Recognize general production and administrative expenses as indirect costs. For example:

- depreciation;

- salaries of management personnel;

- cost of utilities;

- expenses for renting premises and equipment.

This procedure follows from the Instructions for the chart of accounts (accounts 20, 25 and 26).

In accounting, reflect both direct and indirect costs at the time they occur. Whether such costs were paid or not, whether they were aimed at generating income or not, does not matter. This is stated in paragraphs 16–18 of PBU 10/99.

Recognize expenses based on primary accounting documents. That is, those documents that contain all the required details. Such an instruction is in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

All expenses should be taken into account in rubles. Those expressed in foreign currency or conventional units, recalculate into rubles in the manner prescribed by PBU 3/2006. For more information about this, see How to reflect the receipt and use of currency and foreign currency earnings in accounting.

Not all expenses need to be recognized as expenses, although they need to be taken into account. Thus, the cost of acquiring fixed assets is not an expense in itself. But it is taken into account in the initial cost of the object. And only after the facility is put into operation is it written off as expenses as depreciation. Here are other expenses that are reflected in accounting, but are not classified as expenses:

- contributions to the authorized or share capital of other organizations;

- purchase of shares not for resale;

- advances;

- amounts paid to repay a loan.

Such exceptions are specified in paragraph 3 of PBU 10/99.

Enterprise cost accounting

The methods for compiling production costs chosen by the enterprise must be justified, necessarily determined by regulatory documents, industry instructions and methodological recommendations, and be fixed by the accountant in the accounting policy of the enterprise.

Methods for allocating costs between specific items of goods, services provided or work performed are also required to be reflected in the accounting policies.

Cost accounting by an enterprise accountant must be carried out in strict accordance with regulatory documents, be timely, complete and reliable.

REGISTER FOR CALCULATION OF TAX "UNCOMPLETE".

Due to the fact that account balance 20 shows the value of work in progress at the end of the reporting period in accounting, tax expenses of the main production are inextricably linked with this asset, which has to be tax assessed. It is based on a register that is formed using data obtained not only from the tax register of account 20. Information from registers for writing off direct material costs and depreciation deductions will be useful. We will not collect data from all the above calculations - not only because it is labor-intensive. Calculations may confuse the reader and may not provide a true picture of the tax gap. Let's present numbers from practice.

| Name of expense item | Balance at start | Coming | Total expenses | KNZP | WIP balance in cost estimate | Amount of production costs |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1. Direct costs in the planned cost (estimated data) | 7 143 263 | 10 938 609 | 18 081 872 | 0,9467 | 7 794 113 | 10 287 760 |

| 2. Actual direct costs (accounting data) | 6 782 333 | 10 336 113 | 17 118 446 | 7 378 686 | 9 739 422 |

Let us explain the calculations in the register. The first line provides planned data on direct costs attributable to “work in progress”. The economist calculates them in the auxiliary register, based on documents on the movement and balances (in quantitative terms) of raw materials and materials, as well as information on direct planned expenses of the previous period. For the calculation, ready-made data from the planning department and actual data on expenses from accounting (account 20) are used, and only direct expenses are selected. Indirect costs are excluded from the calculation of “work in progress”. Let’s say that in the example, direct costs include raw materials, depreciation, wages and contributions from them to extra-budgetary funds. Total direct expenses for the reporting period RUB 18,081,872. (according to planned data) and 17,118,446 rubles. (according to actual accounting data). Knzp is a coefficient reflecting the share of actual direct costs in similar planned costs; in the example it is equal to 0.9467 (17,118,446 / 18,081,872). Based on the coefficient, the balance of actual direct expenses remaining in the “work in progress” is calculated - RUB 7,378,686. (RUB 7,794,113 x 0.9467), at the end of the current month it is included in the direct expenses of the next month. The other part of direct costs (RUB 9,739,422 = 10,287,760 x 0.9467) is included in the cost of finished products. This indicator is used in another tax register, which is filled out by an enterprise that has balances of unsold products in its warehouse. But this register has nothing to do with counting 20.

Results

One of the most significant tasks of accounting is accounting for production costs, since information about production costs is needed directly by the director of the enterprise to formulate the financial policy of the enterprise, aimed at increasing profitability and reducing costs.

Therefore, it is so important for an accountant to determine the methods for arranging production costs and methods for distributing them between products that are suitable for his enterprise. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

TAX REGISTER OF COSTS OF MAIN PRODUCTION.

Any accountant has a good idea of what a balance sheet looks like for a particular accounting account. One of its main advantages is that the details of the account are visible. In particular, for cost accounts, analytics are provided in the context of cost elements (items).

| Naming of expenditures | Number of correspondent account | Account turnover | Amount accepted for calculation | Amount not accepted | Note (included in other registers) |

| Raw materials | 10 (15, 16) | 5 000 000 | – | 5 000 000 | From register "RN-MPZ" |

| Staff salaries* | 70, 96 | 1 000 000 | 1 000 000 | 200 000 | To register "Rn-NZP" |

| 200 000 | |||||

| Insurance premiums for employees | 69, 96 | 300 000 | 300 000 | 60 000 | To register "Rn-NZP" |

| 60 000 | |||||

| Depreciation of fixed assets | 02 | 50 000 | – | 50 000 | From register "Rn-Amort" |

* The reader may be surprised that for wages (and insurance premiums) of the main production personnel, not only accounts 70, 69, but also account 96 are corresponding. These are estimated obligations for the vacations due to them. Chapter 25 of the Tax Code of the Russian Federation allows you to reserve expenses for vacation pay - but according to rules that differ from the accounting rules, in which the main thing is not to evenly distribute vacation expenses, but to show the obligation to pay them as of the reporting date. Accordingly, the accounting “vacation” reserve is not accepted for tax purposes.

Let us explain the filling out of individual fields of the tax register, which contain links to other tax registers of “profitable” tax accounting. Moreover, some information is included, and some, on the contrary, is excluded from further tax accounting. In addition to the fact that estimated vacation liabilities are not taken into account, material costs and depreciation are calculated in a separate tax register, after which the information is transferred to another register characterizing account 20.

“Rn-WIP” is a tax register that reflects the tax calculation of work in progress, present in many industrial enterprises.

“Rn-Amort” is a tax register for calculating depreciation for all fixed assets, including the calculation of the depreciation bonus and the division of depreciation for fixed assets taken into account and not taken into account when calculating income tax.

“Rn-MPZ” is a tax register for calculating material costs related to the main production.

Subaccounts and analytics

The main production - count 20 - is active. Synthetic and analytical accounting is carried out on it. Sub-accounts are opened depending on the specifics of the activity and industry of the organization. Analytical accounting is carried out by type of costs of products that the enterprise produces, or by structural divisions of the enterprise.

The credit of account 20 reflects the write-off of the full cost of finished products, the debit serves to take into account the total amount of all costs for the production of industrial products.

Accounting on account 20 “Main production” can also be carried out using subaccounts:

- 20.1 - crop production. It is intended to reflect costs and output of crop products, including accounting for horticultural products and growing seedlings.

- 20.2 - livestock farming. Data on costs and output of livestock products are reflected here. Analytics of livestock products is carried out by types and groups of animals and poultry, as well as by established types of costs.

- 20.3 - industrial production. This takes into account accounting information about the production and release of the results of the main production, preparation and development of production, etc. The actual cost is carried out under credit 20.3, and the balance at the end of the period for this sub-account (in accordance with analytical accounting data) indicates the cost indicator for work in progress industrial production.

- 20.4 - other main production and activities. Designed to accumulate accounting data for certain types of activities and for agricultural chemical organizations, machine-technological stations, and off-farm enterprises. This subaccount includes expenses for harvesting, transporting fertilizers, working with soils, protecting plants, improving land, operating costs for vehicles of MTS organizations and agricultural chemicals, etc. Accounting for the costs of maintaining cars, trucks and other special vehicles is carried out for each type separately.