The profitability of any economic entity depends on the correct reflection and accounting of costs. Their optimization, control, and distribution affect the cost of goods (services) and reduce the risks of sanctions from tax authorities. At the initial stage of activity, each company plans and forms a list of costs necessary to implement production processes. An important aspect reflected in the accounting policy is the methods for distributing general production and general business expenses.

Cost classification

The pricing policy of an enterprise takes into account the market situation regarding a certain type of goods, services or work, while the cost is regulated due to the amount of invested profit or the redistribution of business expenses. Production costs are a constant value that is the sum of actual cost indicators. The selling price (of work, services, goods) includes cost, commercial expenses and the amount of profit.

Each organization creates provisions in its accounting policies that regulate the accounting of expenses, methods of their distribution and write-off. Accounting regulations (Tax Code, PBU) recommend a list and classification of costs included in the cost price. The consumption rate of each item is established by the internal documents of the enterprise. Costs are systematized according to various criteria: by economic content, by time of occurrence, by composition, by the method of inclusion in the cost, etc. To formulate calculations, all costs are divided into indirect and direct. The principle of inclusion in the cost depends on the number of types of products manufactured by the company or services provided. Methods for distributing direct costs (salaries, raw materials, depreciation of capital equipment) and indirect (expertise and maintenance work) are determined in accordance with regulatory documents and internal regulations of the company. It is necessary to dwell in more detail on general and general production expenses, which are included in the cost by the distribution method.

Characteristics of account 26 in accounting

Account 26 in the accounting department is active; there is no negative (credit) balance on it.

Let's consider how to correctly use account 26 in accounting - this is regulated in accordance with the current Chart of Accounts and Instructions for its use (Order of the Ministry of Finance dated October 31, 2000 No. 94n), PBU 10/99 “Organizational Expenses” and other legally approved documents. Accounting standards (methodological instructions, recommendations, guidelines) have been developed for accounting for management expenses and their reflection in reporting in the context of certain economic sectors (clause 10 of PBU 10/99, letter of the Ministry of Finance of Russia dated April 29, 2002 No. 16-00-13/03) .

The chart of accounts does not provide for the opening of subaccounts to account 26.

Analytical accounting on it is carried out using subconto - by cost items (budget items), place of their origin (divisions), etc.

The increase in the debit account occurs from the credit of accounts for property accounting and its depreciation (02, 05, 10), production output (21, 23, 29, 43), settlements with employees for wages (70), for business trips and entertainment expenses (71 ), for the services of other organizations (60, 76), with a budget for insurance premiums (69) and individual taxes and fees (68), etc.

At the end of each month, the account must be closed - there cannot be any balances on it.

ODA: composition, definition

With a branched production structure aimed at producing several units of products (services, works), the enterprise incurs additional costs that are not directly related to the main type of activity. At the same time, accounting for expenses of this type must be kept and included in the cost price. The structure of the ODA is as follows:

— depreciation, repair, operation of equipment, machinery, intangible assets for production purposes;

— maintenance, modernization of workshop premises;

— contributions to funds (FSS, Pension Fund) and wages of personnel serving the production process;

— utility costs (electricity, heat, water, gas);

- other expenses related directly to the production process and its management (write-off of used equipment, equipment, travel expenses, rent of space, services of third-party organizations, provision of safe working conditions, maintenance of auxiliary units: laboratories, services, departments, leasing payments). Production costs are costs associated with the process of managing the main, service and auxiliary departments; they are included in the cost price as general production costs.

Composition of general business expenses

Account 26 in accounting is the company’s costs for management needs for the main activity, not directly related to the production of products, provision of services, or performance of work.

The list of general business expenses for account 26 is open and depends on the type of activity. It includes:

- administrative and management expenses;

- remuneration of administrative and management personnel (hereinafter referred to as AUP) and insurance premiums from it;

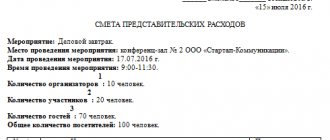

- travel and entertainment expenses;

- repair and depreciation of fixed assets used to maintain the AUP;

- rental of office space;

- budget taxes and payments (transport, land, property, duties and fees);

- security, communications, information, auditing, marketing, consulting, postal services;

- expenses for stationery, materials, office equipment, software used for management needs;

- costs of recruitment and retraining;

- other expenses to ensure uninterrupted operation of AUP services.

Non-manufacturing firms collect all expenses in account 26 and write them off in the future to cost of sales.

NOTE!

- Trading organizations are recommended to charge costs to account 44 “Sales expenses”.

- Construction organizations can include general business expenses in the cost of work under construction contracts only if the customer has provided for their reimbursement (clause 14 of PBU 2/2008).

Accounting

Methods for distributing general production and general business expenses are based on the total value of these indicators accumulated during the reporting period. To summarize information on ODA, the chart of accounts provides for a cumulative register No. 25. Its characteristics: active, collectively distributive, has no balance at the beginning of the month and the end (unless otherwise provided by the accounting policy), analytical accounting is maintained by divisions (shops, departments) or types of products. During a certain period, information on actual expenses incurred is accumulated in the debit of account 25. Typical correspondence includes the following operations.

- Dt 25 Kt 02, 05 – the accrued amount of depreciation of fixed assets and intangible assets is allocated to OPR.

- Dt 25 Kt 21, 10, 41 – goods of own production, materials, inventory are written off as production expenses.

- Dt 25 Kt 70, 69 – salary accrued to the personnel of the operational development department, deductions were made to extra-budgetary funds.

- Dt 25 Kt 76, 84, 60 – invoices issued by contractors for services rendered and work performed are included in general production expenses; the amount of shortfalls identified based on the results of the inventory is written off.

- The debit turnover of account 25 is equal to the amount of actual expenses, which at the end of each reporting period are written off to the calculation accounts (23, 29, 20). In this case, the following accounting entry is made: Dt 29, 23, 20 Kt 25 - accumulated expenses are written off for auxiliary, main or servicing production.

Closing 26 accounts

Closing account 26, that is, writing off all general business expenses, is performed in several ways:

- Included in the cost of production through production accounts if products are produced;

- Referred to as cost of sales when providing services or work;

- Referred to the current expenses of the reporting month using the direct costing method:

Important! The write-off method, as well as the basis for the distribution of general business expenses, must be fixed in the accounting policies of the organization.

Write-off as part of the cost of production

In this case, general business expenses are written off in shares, taking into account the distribution base, into production accounts and may remain on product cost accounts (for example, when producing products under account 43 “Finished Products”) or production accounts (for example, work in progress under account 20 “Main Production” ) at the end of the reporting period.

Main types of cost distribution bases:

- Revenue

- Product output volume

- Planned cost of production

- Material costs

- Direct costs

- Salary and so on

When closing the month, the following transactions are generated, for example:

| Dt | CT | Wiring Description |

| 20 | 26 | General business expenses for main production were written off |

| 23 | 26 | General business expenses for auxiliary production were written off |

General business expenses are distributed to the cost of production (production accounts) according to the specified distribution and analytical accounting base:

Therefore, general business expenses are written off:

- In full - if one product is produced (no analytics);

- Distributed across all types of products in proportion to the selected base - if several types of products are produced and calculated in the context of analytics.

Example

LLC "Horns and Hooves" produces hats and shoes, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off against the cost of production.

- The distribution base is material costs.

In November 2020, direct expenses amounted to RUB 51,040.00:

- For headwear – RUB 28,020.00. of them:

- Material costs – RUB 15,000.00.

- For the production of shoes - RUB 23,020.00. of them:

- Material costs – RUB 10,000.00.

indirect costs – 18,020 rubles.

- 3/p administrative staff – RUB 10,000.00.

- Insurance premiums – RUB 3,020.00.

- Premises rental – RUB 5,000.00.

According to the distribution base for material costs:

Postings when closing account 26

| 30.11.2016 | 20 | 26 | 10 812 | Closing account 26 (headwear) |

| 30.11.2016 | 20 | 26 | 7 208 | Closing account 26 (shoes) |

Important! Also in the accounting policy, you can indicate non-distributable general business expenses, which will be written off immediately to current expenses in Account 90.08.

Write-off to cost of sales

If the accounting policy specifies the write-off method “to cost of sales,” then the following transactions are taken into account when closing the period:

| Dt | CT | Wiring Description |

| 90.02 | 26 | General business expenses are written off as the cost of services and work |

In this case, costs can also be taken into account in terms of analytics.

Write-off using direct costing method

If the accounting policy specifies the “direct costing” write-off method, then general business expenses are taken into account as semi-fixed and when closing the period they are reflected in the following entries:

| Dt | CT | Wiring Description |

| 90.08 | 26 | General business expenses are written off as cost of sales |

In this case, the amount of costs is written off in full in each reporting period.

Distribution

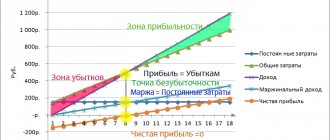

The amount of overhead costs can significantly increase the cost of manufactured products, work performed, and services provided. At large industrial enterprises, pilot projects are planned and the concept of “consumption rate” is introduced; deviations of this indicator are carefully studied by the analytical department. In organizations engaged in the creation of one type of product, methods for distributing general production and general business expenses are not developed; the sum of all costs is fully included in the cost price. The presence of several production processes implies the need to include all types of costs in the calculation of each of them. The distribution of general production costs can occur in several ways:

- Proportional to the selected basic indicator, which optimally corresponds to the combination of ODA and the volume of output (volume of goods produced, wage funds, consumption of raw materials or supplies).

- Maintaining separate accounting of ODA for each type of product (costs are reflected in analytical sub-accounts opened to register No. 25).

In any option, methods for distributing indirect costs must be enshrined in the accounting policies of the enterprise and not contradict regulations (PBU 10/99).

How to close account 26 as semi-fixed expenses

Closing account 26 in accounting means writing it off. Can be done in two ways. Management expenses include:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- as conditionally constant expenses in the current expenses of the reporting month (by direct costing method) - at a reduced cost;

- included in the cost of production through production accounts - at full cost.

The composition of expenses, the choice of write-off method and the basis for the distribution of expenses related to general business expenses are approved in the accounting policy.

As semi-fixed administrative expenses are written off in full on a monthly basis (even if the organization has no revenue!) on the last day of the month in Dt 90.02 “Cost of sales” or 90.08 “Administrative expenses”.

When writing off, costs can be taken into account in the context of analytics.

The method of accounting for general business expenses at reduced cost is recommended for non-production organizations (commission agents, agents, brokers, dealers, etc.), as well as for companies providing services, i.e. organizations that do not have object-by-object accounting of production costs and There is no work in progress at the end of the period.

In accounting, account 26 is an operating account; it does not appear on the balance sheet.

But in the income statement there is line 2220 “Administrative expenses”. It reflects in parentheses the turnover indicator Dt 90 Kt 26 (clauses 5, 7, 21 PBU 10/99), that is, the amount of general business expenses taken into account as conditionally constant according to the first method (at reduced cost) is minus here.

OCR, composition, definition

Administrative and economic costs are a significant factor in the cost of goods, work, products, and services. General business expenses are a total reflection of management costs, they include:

— maintenance and servicing of structures, non-production buildings (offices, administrative areas), rental payments;

— contributions to social funds and remuneration of management personnel;

— communication and Internet services, security, postal, consulting, audit expenses;

— depreciation charges for non-production facilities;

— advertising (if these expenses are not commercial);

— office, utility bills, information services;

— expenses for personnel training and compliance with industrial safety rules;

- other similar costs.

The maintenance of the management apparatus is necessary for the implementation of production processes and further marketing of products, but the high proportion of this type of expense requires constant accounting and control. For large organizations, the use of the standard method of calculating operational and technical expenses is unacceptable, since many types of administrative expenses are variable in nature or, in case of a one-time payment, are transferred to the cost of production in stages, over a certain period.

Accounting

Account No. 26 is intended to collect information about the company’s management expenses. Its characteristics: active, synthetic, collecting and distributing. Closed monthly to accounts 20, 46,23, 29, 90, 97, depending on what methods of distribution of general production and general business expenses are adopted by the internal regulatory documents of the enterprise. Analytical accounting can be carried out in the context of divisions (departments) or types of products (work performed, services provided). Typical account transactions:

- Dt 26 Kt 41, 21, 10 - the cost of materials, goods and semi-finished products is written off for maintenance.

- Dt 26 Kt 69, 70 – reflects the calculation of wages for administrative and economic personnel.

- Dt 26 Kt 60, 76, 71 – general business expenses include services of third-party organizations paid to suppliers or through accountable persons.

- Dt 26 Kt 02, 05 – depreciation of non-production objects, intangible assets and fixed assets was accrued.

Direct cash costs (50, 52.51) are usually not taken into account as part of the OCR. An exception may be the accrual of interest on loans and borrowings, and this accrual method must be specified in the accounting policy of the enterprise.

Postings to account 26

The chart of accounts and instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n) suggest the following entries for account 26:

- Accrual of general business expenses

| Debit | Credit | Contents of operation |

| 26 | 02, 05 | Depreciation of non-productive fixed assets and intangible assets is reflected |

| 26 | 10, 16 | Materials, equipment, special clothing used at the AUP are taken into account |

| 26 | 20, 21, 23, 29, 43 | Products, semi-finished products, products of auxiliary and service production, finished products for management needs were written off |

| 26 | 60, 76 | The work and services of third-party organizations for general business needs have been registered |

| 26 | 68 | Taxes, fees, duties, penalties accrued to the budget |

| 26 | 69 | Social contributions accrued from the salary of the AUP are reflected |

| 26 | 70 | AUP salary calculated |

| 26 | 71 | Travel and entertainment expenses included |

| 26 | 97 | Accrued expenses for future periods for the maintenance of the AUP |

- Closing account 26

| 08 | 26 | Attribution of general business expenses for installation, capital construction of fixed assets |

| 10 | 26 | Capitalization of returnable waste, return of unused materials from management needs |

| 20, 21, 29 | 26 | Write-off of general business expenses for production, production of semi-finished products, service facilities |

| 90.02 | 26 | Write-off of administrative expenses when performing work and services for third parties |

| 90.08 | 26 | Write-off of general business expenses to cost of sales when using the direct costing method |

Write-off

All general business expenses are collected in monetary terms as a debit turnover of account 26. When closing a period, they are written off to the main, servicing or auxiliary production, may be included in the cost of goods to be sold, charged to future expenses, or partially allocated to the enterprise's loss. In accounting, this process is reflected by the following entries:

- Dt 20, 29, 23 Kt 26 – OChR are included in the cost of production of the main, service and auxiliary production.

- Dt 44, 90/2 Kt 26 - general business expenses are written off in trading enterprises, to the financial result.

Why is account 26 not closed?

When automating accounting, accountants quite often complain about problems with closing accounts for general business expenses. How to fix the error?

Depending on the type of specialized accounting program, in the accounting policy settings you should indicate the selected method for determining the cost of products, and also note the method of cost distribution.

If the settings are specified correctly, but closing is carried out with errors, check the analytical accounting for OCR. That is, control the reflection of transactions in terms of distribution by divisions of the enterprise and types of cost items. Apparently, in accounting there was a mis-grading in the analytical detailing of operations.

Accounting account 26 is general business expenses or indirect costs, used in almost every enterprise, with the exception of state budgetary and credit organizations. In this article we will look at the main nuances of this account, its properties, typical transactions and examples of use in accounting.

Determination of general business expenses

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Business trips;

- Salaries of administration, accounting, management personnel, marketing, etc.;

- Entertainment expenses;

- Security, communication services;

- Consultations of third-party specialists (IT, auditors, etc.);

- Postal services and office.

- Repair and depreciation of non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Other:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Main properties of account 26

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

Distribution

General business expenses in most cases are written off similarly to general production expenses, i.e., in proportion to the selected base. If this type of cost is long-term in nature, then it is more appropriate to attribute them to future periods. Write-offs will occur in certain parts attributable to cost. Conditionally variable general business expenses can be attributed to the financial result or included in the price of the goods produced (in trading enterprises or those providing services). The method of distribution is regulated by internal documents.

***

General expenses are the costs associated with running and maintaining a company. They are reflected in the accounting account of the same name 26. These costs do not depend on the volume of sales or production of products, they are related to the structure of the company and the business activity of the administration, therefore they are often considered as semi-fixed expenses that should be controlled for the purpose of optimization.

The composition of management expenses, the method of write-off at the end of the period and the distribution base are necessarily approved in the accounting policy and are unchanged during the tax period.

Account 26 is not reflected in the balance sheet. Non-manufacturing (non-trading) organizations most often reflect general business expenses in the income statement on line 2220, and manufacturing - on line 2120.

1C

Currently, accounting for general production and general economic costs is carried out in accounting databases and programs of the 1C group. Methods for distributing indirect costs are regulated by special settings. When calculating the cost of experimental work and industrial maintenance, it is necessary to check the boxes opposite the approved base in the “production” tab. When writing off as deferred expenses, it is necessary to establish the period and amount. To include costs in the financial result, fill in the appropriate tab. When the “period closing” function is launched, general production and general business expenses accumulated in registers 25 and 26 are automatically written off to the debit of the specified accounts. This process forms the cost of the finished product.

Methodology for distribution of general business (indirect) costs

After choosing an approach to the distribution of costs, taking into account the special characteristics of the organization’s economic activities, as well as accounting policies, it is necessary to formulate a methodology for their distribution.

Let's consider the main stages of the methodology, which is most widely used among domestic organizations.

First, indirect costs are distributed between the service and production departments of the company's responsibility centers.

Indirect costs are then redistributed from service departments to production departments. After this, shop rates are calculated, according to which indirect costs are distributed for all production departments.

The organization independently selects the base for the distribution of indirect costs, based on the specific features of its activities, and reflects the base in the company’s accounting policies. The base is fixed and remains unchanged throughout the year.

Widespread distribution methods are based on accounting: the basic salary, standard hours worked by the main production workers, and the amount of time the machines operate.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |