The activities of any organization are associated with costs not only for the manufacture of products, provision of services or sale of goods, but also with costs for organizational, production and general economic needs. Accounting for these costs is necessary, since some of them are included in the pricing of the final product. To accumulate information about the costs of maintaining and operating the main production units, as well as additional structural divisions of the organization, account 25 “General production expenses” is used in accounting.

Using account 25 in accounting

Since account 25 collects information about the organization’s expenses, it is classified as active. The main feature of the account is the absence of balances both at the beginning of the reporting period and at the end. The zero balance is due to the distributive nature of the account. This means that the turnover accumulated during the reporting month is redistributed to other accounts by writing off, and at the beginning of the next period, with a zero balance, the newly spent funds are accounted for.

Costs must be generated for each structural unit of the enterprise.

Due to the lack of information about the initial and final balances, account 25 cannot be displayed in the enterprise’s balance sheet.

Account 25 is a necessary accounting item that helps to calculate and analyze all types of costs included in the production of products. This is especially true in the case when an enterprise produces a large range of product units, and it is not possible to take into account all indirect costs when determining the cost of a released unit.

If the product range is small and is reduced to one dozen product items, it is advisable to classify all indirect costs as main expenses and include them in accounts or.

https://youtu.be/J3l4QDlz3RU

1c accounting - accounting of business transactions in detail!

Traditionally, direct costs include the following:

- material costs aimed at purchasing raw materials for production;

- purchase of components and other semi-finished products;

- remuneration of employees directly involved in the production process, accrued contributions to extra-budgetary funds in favor of the specified personnel;

- depreciation of property related to the production process.

The list of expenses that are classified as direct is not closed. The organization has the right to create a more detailed list of costs independently. In order to avoid subsequent claims from control authorities, it makes sense to prescribe economically sound principles in the current accounting policy of the enterprise.

In this case, inspectors will have no reason to recognize indirect costs as direct, thereby increasing the tax base.

What is general production expenses?

Account 25 serves as a collection and distribution register of costs, so the following ODA must be taken into account here:

- depreciation of capital equipment and property used in production;

- repair and maintenance of fixed assets;

- payment of utilities and expenses for the maintenance, maintenance and repair of real estate;

- transportation costs;

- costs for additional services received from third-party suppliers and contractors;

- payment for insurance of equipment and premises;

- wages of primary production workers, engineering, technical and maintenance personnel (with deductions for insurance and other contributions);

- other general production costs.

What exactly to include in the number of general production expenses is decided by the management of the enterprise. It should be borne in mind that it is quite problematic to take indirect expenses as deductions when accounting for income tax. Therefore, it is advisable to increase the list of costs related to direct costs.

Classification of enterprise costs

All expenses that make up the total costs of the enterprise and form the total cost of production are divided into 2 types:

- Direct are directly related to product output. These include costs for purchased raw materials, materials, employee wages and others related to specific products and work.

- Indirect costs are not directly associated with specific types of products or services. Such costs are distributed among the cost of manufactured products (services provided).

The composition of direct expenses is determined by the taxpayer independently in accordance with the established accounting policy of the organization. Refers to costs in the current period as products are sold or services are provided.

Indirect costs are subsequently distributed between the main, auxiliary and service industries, depending on the specifics of the enterprise's activities.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

How are overhead costs distributed?

When choosing a methodology for distributing ODA, it is necessary to take into account the specifics of production and the norms enshrined in the tax policy of the organization. There is a general formula for the distribution of general and general production expenses:

K (OPR) = OPR/B

K is the required coefficient, OPR is the amount of total expenses, B is the base to which all taken into account expenses are distributed.

Calculation using this formula gives a clear idea of how many rubles of ODA fall on 1 ruble of the distribution base. In this case, the choice of base should take into account the relationship between overhead costs and the final cost of a good, service or product of production.

Subaccounts

For the most structured accounting of general production expenses for account 25, it is advisable to open two auxiliary subaccounts:

- maintenance and operation of production lines and capital equipment;

- general shop expenses.

However, these subaccounts may not be enough. Account 25 includes accounting for general production and general business expenses of various types, and for more convenient management and formation of expenses, it is recommended to open additional sub-accounts for the type of ODA: wages, depreciation of fixed assets, payments to social funds, public services, raw materials, fuels and lubricants, etc.

We should agree with the opinion of a number of scientists that organizations should be given the opportunity to write off fixed expenses collected on account 25 General production expenses, similar to the fixed expenses reflected on account 26 General expenses /3/.

The turnover of account 25-1 at the end of the reporting period is written off to account 20 with distribution among cost objects. The score 25-2 is closed by the score 90. The use of the direct costing system changes the domestic concept of calculation, as well as approaches to accounting for financial results. [p.103] Account 25 General production expenses are maintained by enterprises with a workshop management structure, which need to receive information about general production expenses for the main and auxiliary production workshops (costs for lighting, heating, maintenance and operation of machinery and equipment, wages of production personnel workshops engaged in production maintenance, etc.). If the structure of the enterprise is not built on a workshop basis, but general production expenses are planned for the enterprise as a whole, then accounting on account 25 is also carried out for the enterprise as a whole, without distinguishing between production divisions (shops, sections, redistributions) of the enterprise. Often in such cases, general production expenses are accounted for as part of general business expenses on a separate sub-account of account 26. [p.73] If, in accordance with the accounting policy of the enterprise, the costs collected during the reporting period on account 26 General business expenses, as the costs of the period are not distributed among production orders and are directly charged to the cost of products sold (in the debit of account 90 Sales, subaccount Cost of Sales), then only expected production indirect costs are distributed in the manner described above, i.e. estimated debit turnover of account 25 General production expenses. In accounting, this will be recorded by posting [p.120]

If the enterprise’s accounting policy does not provide for the direct write-off of general business expenses, then not only account 25 General production expenses, but also account 26 General business expenses will be subject to preliminary distribution. [p.120]

Account 25 General production expenses [p.124]

The cost of auxiliary materials as indirect costs is charged to account 25 General production expenses with the following accounting entry (see entry 4 in Fig. 3.5) [p.125]

Let's assume that at the end of the month actual savings in overhead costs have been revealed, i.e. they are written off in excess. If the deviation of the estimate from the actual overhead costs was no more than 5%, then the amount of excessively written off overhead costs is reversed to the debit of account 90 Sales (sub-account Cost of sales) and the credit of account 25 General production expenses. If overhead costs are distributed with a deficiency, then at the end of the reporting period the difference is written off to the debit of account 90. If the deviation from the actual overhead costs incurred is more than 5%, it is distributed between accounts 20 Main production and 90 Sales (sub-account Cost of sales). [p.133]

General production expenses are accounted for on account 25 General production expenses in correspondence with the accounts of inventory, settlements with personnel for wages, calculations for social security and insurance, cash register, current account, etc. [p.143]

Five types of current sources (batteries) are manufactured in the production workshop. Account 25 General production expenses collect expenses for servicing the main production. Analytical accounting is carried out according to expense items. The list of overhead costs approved at the enterprise is given in table. 3.10. [p.147]

Example. The enterprise produces two types of products - A and B. Direct costs for the production of product A are 100 rubles, including direct wages - 50 rubles. Direct costs for the production of product B are 200 rubles, of which wages are 100 rubles. For the reporting period, the debit turnover on account 25 General production expenses is 90 rubles, on account 26 General business expenses - 120 rubles. To simplify the calculation, we assume that overhead costs consist only of the variable part. Let us also assume that a) half of all costs incurred during the reporting period materialized in finished products, and the second part remained in the form of work in progress, and 10 units were produced during the reporting period. finished products A and 15 units. products B b) all manufactured products are sold. Sales revenue amounted to 400 rubles. [p.168]

In the diagram (see Fig. 3.17), two subaccounts 25-A and 25-B are opened for account 25 General production expenses. Constant OPR are accounted for in account 25-B. They are written off to the main production in accounting according to the norms, i.e. accounting entry [p.200]

Due to the fact that both production lines are located in the same workshop, the workers serving them, as well as personnel involved in warehouse and loading and unloading operations, are included in the staff of one department (shop). The accounting policy of the enterprise provides for the wages of all these personnel, along with the costs of heat, electricity and workshop rent, to be taken into account in account 25 General production expenses. [p.472]

ACCOUNTING FOR WEAR AND DEPRECIATION OF FIXED ASSETS. Depreciation charges are determined based on the current norms of depreciation charges, centrally established by the relevant government bodies. Since depreciation of fixed assets is the transfer of part of their cost to the cost of created products (works, services), accounting for depreciation deductions means assigning the corresponding amounts of accrued depreciation of fixed assets to cost accounts (as a rule, these are collection and distribution accounts 25 General production expenses and 26 General business expenses expenses) in correspondence with the credit of account 02. [p.482]

Direct production costs are reflected in account 20 Main production, for the development of which analytical accounts are opened for types of products (works, services). Indirect expenses, depending on their purpose, are reflected in the debit of accounts 25 General production expenses and 26 General business expenses. [p.485]

Account 25 General production expenses Debit Credit 9) 108,800 [p.134]

Synthetic accounting of general production expenses is maintained on the active collection and distribution account -25 General production expenses, and analytical accounting - in special statements for each workshop in the context of budget items. [p.315]

Thus, at the end of the reporting month, after overhead expenses have been distributed and written off, accounts 25 General production expenses and 26 General business expenses are closed and have no balances at the end of the month. [p.318]

Production costs are accounted for according to the general scheme of accounting accounts. To summarize costs, account 20 Main production, account 25 General production expenses, account 26 General business expenses are used. [p.447]

K Account 01 Account 02 Depreciation D Fixed assets K D fixed assets K Accounts 25 General production expenses 26 General business expenses K [p.385]

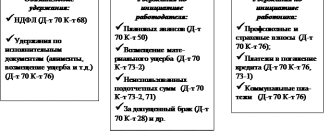

Debit of account 20 Main production, Debit of account 23 Auxiliary production, Debit of account 25 General production expenses, Debit of account 26 General business expenses, Debit of account 29 Servicing production and farms Credit of account 70 Settlements with personnel for wages, Credit of account 69-1 Social insurance calculations , Credit to account 69-2 Calculations for pensions, Credit to account 69-3 Calculations for compulsory health insurance. [p.464]

To reflect the main operations of the production process, knowledge of the accounts used to account for the costs of production and output is required. Such accounts include account 20 Main production, account 25 General production expenses, account 26 General business expenses, account 28 Defects in production, etc. [p.242]

Account 25 General production expenses is intended to reflect and control the amounts of this type of overhead expenses for the purpose of their subsequent inclusion in the cost of production. On the debit of account 25 all amounts are collected [p.242]

Account 26 General business expenses is intended to reflect and control the amounts of overhead expenses associated with the management and maintenance of the enterprise as a whole. The structure of this account is similar to the structure of account 25 General production expenses. [p.243]

The costs of auxiliary production are recorded on the same account 23 Auxiliary production. Direct costs related to one or another main production are recorded on the account for each type of production, and internally - by type of product, work and service. General expenses for servicing auxiliary production are reflected on account 25 General production expenses or on account 23 Auxiliary production, but with their allocation into an independent group of costs. Such expenses are distributed by type of product, work and service in the manner established by industry instructions. After their distribution, expenses for auxiliary production are written off at the end of the month [p.251]

To account for the listed expenses, it is recommended to open a subaccount Expenses for the maintenance and operation of machinery and equipment under account 25 General production expenses. Moreover, industrial organizations with a shop management structure - [p.256]

Expenses for the maintenance and operation of machinery and equipment are taken into account on the debit of the above-mentioned subaccount of account 25 General production expenses. In this case, accounts are credited on which inventory records are kept (10, 12, 07), settlements with personnel (70, 71, 73), etc. [p.257]

Shop management costs, that is, costs not related to the maintenance and operation of machinery and equipment, are accounted for separately, on an independent subaccount of the same name Shop management costs account 25 General production expenses. These include the costs of managing a production unit (workshop, services, processing areas, departments, etc.) of the organization. [p.258]

A decrease in market prices below the valuation of inventories in current accounting makes it necessary to recognize the resulting loss in the balance sheet. The amount of deviations in prices is reflected in the debit of accounts 25 General production expenses, 26 General business expenses and the credit of account 44 Revaluation of assets. It is possible to directly attribute deviations to losses in the debit of account 80 Profit and loss and in the credit of the Revaluation of Assets account. In the reported balance sheet, the value of the organization's inventories is reduced by the amount of the credit balance in the Revaluation account.... [p.501]

Account 25 General production expenses (according to the new Chart of Accounts, the name of the account has not changed) [p.14]

Account 14 Revaluation of material assets Account 15 Procurement and acquisition of materials Account 25 General production expenses Account 26 General business expenses [p.135]

The main difference between the traditional method of accounting for business transactions and the non-traditional one is the procedure for writing off general business expenses. With the traditional method, indirect costs reflected in accounts 25 General production expenses and 26 General business expenses are written off at the end of the reporting period to account 20 Main production. With the non-traditional method, account 26 is closed to account 46 Sales of products (works, services). [p.157]

In addition, in our opinion, organizations should be given the opportunity to write off semi-fixed expenses collected on account 25 General production expenses, similar to semi-fixed expenses collected on account 26 General production expenses. Currently, accounting regulations do not provide for the procedure for writing off semi-fixed expenses. [p.415]

On account 25 General production expenses do not take into account the following costs [p.393]

For a tenant, the accrual of rent is associated with an increase in production (distribution) costs and an increase in debt to the lessor for payments due. This is reflected in the debit of accounts 25 General production expenses., 26 General business expenses, etc. and the credit of account 76 Settlements with various debtors and creditors. Accordingly, repayment of debt is shown in the debit of account 76 Settlements with various debtors and creditors and in the credit of account 51 Current account. When making advances to lessors by paying rent in advance, account 31 Deferred expenses is used, which is debited in correspondence with the credit of account 76 Settlements with various debtors and creditors. When transferring the amount of rent accrued in advance to the lessor, account 76 Settlements with various debtors is debited - [p.185]

When auditing the production cycle, records are checked on the credit of accounts 02 Depreciation of fixed assets, 05 Depreciation of intangible assets, 10 Materials, 12 Low-value and wear-and-tear items, 13 Depreciation of low-value and wear-and-tear items, 70 Payments to personnel for wages, 68 Payments to the budget, 69 Calculations for social insurance and security and other accounts in order to confirm entries in the debit of accounts 20 Main production, 25 General production expenses, 26 General business expenses. The next stage of the audit of operations of this cycle is to check the entries on the credit of accounts 25 General production expenses and 26 General business expenses in order to confirm the correctness of the formation of entries on the debit of accounts 20 Main production and 46 Sales of products (works, services). After this, the correctness of the entries is checked according to [p.262]

Finally, current accounting presents accounts that are not included in the balance sheet because they are closed before the balance sheet is compiled. These include accounts 25 General production expenses, 26 General business expenses, etc. They do not have a balance either at the beginning or at the end of the reporting period. [p.159]

Debit account 25 General production expenses ………….. 9 [p.244]

In synthetic accounting, fixed expenses are collected on account 26 “General operating expenses”, so-called semi-variable expenses (containing both a fixed and variable part) are collected on account 25 “General operating expenses”. At the end of the month, they are written off from the indicated accounts to account 20 “Main production” by distributing them between individual types of products in proportion to the subjectively selected base. Variable costs, varying in proportion to the volume of production, are collected on account 20 “Main production”. [p.92]

General publishing and editorial expenses (indirect expenses). In large publishing houses, general publishing expenses are recorded on account 26 General business expenses, and editorial expenses on account 25 General production expenses. [p.129]

Operational collection and distribution accounts (25 General production expenses, 26 General economic expenses) are intended for accumulating costs to be distributed (account debit) in the places where they arise by type and item and transferring accumulated costs (account credit) for inclusion in the cost of calculation or operational -resulting accounts. Such accounts take into account indicators relating only to the current reporting period. There is no opening or closing balance; the account is opened during the reporting period and closed at the end. In Western accounting they are classified as temporary (variable or transit) accounts. [p.353]