The concept of intangible assets (IMA)

Intangible assets (IMA) are understood as monetary investments in intangible objects for the purpose of their further use and obtaining financial benefits.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

The main criteria for classifying property as intangible assets are:

- the object lacks a material structure;

- difference between the object and other types of property;

- use for production purposes;

- ability to bring economic benefit.

Also included in the category of intangible assets are the exclusive right to use computer programs, as well as the right to an invention and a trademark.

Characteristics of account 04 “Intangible assets”

Intangible assets (IMA), in accordance with clause 4 of PBU 14/2007, include scientific research, literary works, computer software, inventions, brand, know-how. Separately, business reputation is distinguished as part of intangible accounting objects.

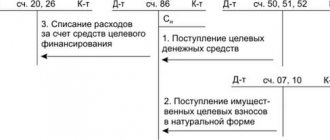

The answer to the question whether account 04 is active or passive is clear – active. Acceptance of objects for accounting is reflected in debit, and disposal is recorded in credit. When an intangible asset arrives at an enterprise, intermediate entries are made in accounting with the participation of account 08, from the credit of which, at the time the object is fully ready for operation, the cost of the intangible asset is written off to debit 04.

The characteristics of account 04 assume that intangible assets are reflected in accounting at their actual cost. It is formed from the costs of acquiring or creating an object, the costs of its delivery, customs duties and commissions of intermediaries of the purchase and sale transaction. VAT amounts are not included in the cost of intangible assets.

There are no sub-accounts for systematizing intangible assets; if necessary, you can introduce your own system of analytical accounting of intangible assets and consolidate it in the working chart of accounts. Account 04 accumulates information about objects with a long period of operation. They may be subject to depreciation, with the exception of assets with an indefinite useful life. No more than once a year, additional valuation or depreciation of intangible assets is allowed.

Account 04. Typical entries

The figure below shows typical entries for account 04 “Intangible assets”. To enlarge the picture, click on it.

Account 04 “Intangible assets”. Typical wiring

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

HIGHLIGHTS OF THE WEEK

05.28.202010:32 Business organization

Mandatory testing in Moscow begins on May 31

25.05.202013:15

Economy and Society

Banks are preparing to block accounts: who's next in line?

29.05.202009:15

Personnel

The rules for calculating average earnings for benefit payments will change

26.05.202015:01

Personnel

Who will receive an increase in monthly child care benefits from June 1

26.05.202012:30

Internet technologies

10 signs of a cool accountant who will never be unemployed

PODCAST 03/20/2020

Electronic work books

All episodes

Comments on documents for an accountant

The RSV does not indicate a tariff code - reporting must be accepted

05/31/2020 The inspectorate unlawfully did not accept the RSV. It did not indicate the tariff code, and this defect is not…

Social security gained access to income information

31.05.2020

Amendments to the law provide social protection authorities with the right of access to information about the income of individuals...

Chamber of Commerce and Industry on force majeure

30.05.2020

Answers of the Russian Chamber of Commerce and Industry to frequently asked questions on force majeure,…

‹Previous›Next All comments

Account 04 in accounting. Accounting for transactions with intangible assets

To reflect generalized information about transactions with intangible assets (receipt, depreciation, liquidation, etc.), accounting account 04 is used.

An intangible asset accounted for on the balance sheet of an organization can be created on its own, or exclusive rights to it can be acquired from another enterprise.

In the case of purchasing intangible assets from a third party, payment transactions can be reflected in the following records:

| Debit | Credit | Description | Document |

| 04 | 50 | Payment for intangible assets was made in cash | Account cash warrant |

| 04 | 51 | Funds were transferred to pay for the intangible asset | Payment order |

| 04 | 52 | Payment of expenses for the acquisition of intangible assets in foreign currency was made | Currency order |

| 04 | 55 | Funds were debited from a special bank account to pay for intangible assets | Bank statement |

If an organization creates an intangible asset object on its own, then such operations are reflected by postings:

| Debit | Credit | Description | Document |

| 08 Creation of intangible assets | 60 (10, 68, 69, 70, 76…) | The costs of creating an intangible asset are included in investments in intangible assets | Salary statements, certificates of work performed, etc. |

| 04 | 08 Creation of intangible assets | The created object is reflected in the intangible assets | NMA-1 registration card |

Depreciation charges, which must be reflected monthly for intangible assets, are accumulated on account 05. The main operations for calculating depreciation on intangible assets are carried out as follows:

| Debit | Credit | Description | Document |

| 08 | 05 | Depreciation charges for intangible assets used to create a new intangible asset are taken into account | Depreciation statement |

| 44 | 05 | Depreciation charges for intangible assets used in retail trade are taken into account | Depreciation statement |

| 91.2 | 05 | Depreciation charges for an intangible asset used in the social sphere are taken into account | Depreciation statement |

| 20 | 05 | The amount of depreciation charges for an intangible asset used in the main production is taken into account | Depreciation statement |

| 23 | 05 | The amount of depreciation charges for an intangible asset used in auxiliary production is taken into account | Depreciation statement |

| 29 | 05 | The amount of depreciation charges for an intangible asset used in service production is taken into account | Depreciation statement |

When recording operations to liquidate intangible assets, the residual value of the object can be written off with the following entries:

| Debit | Credit | Description | Document |

| 58.4 | 04 | The residual value of intangible assets was written off (transferred as a contribution under a simple partnership agreement) | NMA-1 registration card |

| 91.2 | 04 | The residual value of intangible assets is written off (transferred free of charge) | NMA-1 registration card |

| 58.1 | 04 | The residual value of intangible assets is written off (transferred as a contribution to the authorized capital of another organization) | NMA-1 registration card |

Basic operations for accounting for intangible assets

In order for intangible assets to be displayed correctly on the balance sheet, you need to be able to properly organize their accounting. This is done using three basic operations:

- acceptance for registration;

- sale;

- depreciation.

All these transactions must be reflected in the company's accounting policies. Let's look at each operation in more detail.

Acceptance of intangible assets for registration

Intangible assets can be registered through purchase, creation with one’s own hands, receipt as a gift, or during discovery during inventory. As mentioned earlier, an object is accepted for accounting through account 08.

To account for intangible assets, the following entries are made:

- Dt 08, Kt 60 – purchase costs are reflected;

- Dt 02, Kt 10 / 70 / 69 – expenses for materials for creating the object are reflected;

- Dt 19, Kt 60 – VAT is included;

- Dt 04, kt 08 – the actual cost is formed.

Sale of intangible assets

During the sale of intangible assets, its residual value is calculated. As a result, the book price is reduced by the amount of depreciation. The following transactions are made:

- Dt 62, Kt 91 – the sale is reflected;

- Dt 91, Kt 68 – VAT is allocated;

- Dt 05, Kt 04 – depreciation is written off;

- Dt 91, Kt 04 – the residual value is written off.

Property that was acquired for subsequent sale cannot be classified as non-current assets. This also applies to objects that do not have a material form.

Liquidation of intangible assets

The liquidation of intangible assets is documented using the same transactions as for the liquidation of other non-current assets. The only difference is the use of account 04:

- Dt 91 Kt 04 – writing off the residual value of intangible assets for other expenses.

In case of complete liquidation, the residual value is zero.

Thus, in order to correctly reflect intangible assets on the account and in the financial statements, it is important to understand whether the object belongs to intangible assets and how to register it correctly. If you know all the basic nuances, there will be no problems with taking into account intangible assets.

Account 04: examples of reflecting transactions

The main operations with intangible assets include their acquisition, creation and write-off. Let's look at each of these operations using an example.

Account 04. Purchase of intangible assets

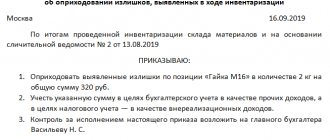

Flagman LLC acquired from Egida LLC the exclusive right to an invention that allows optimizing the production process. According to the patent assignment agreement, the cost of the right to the invention was 67,500 rubles. When registering with Rospatent, Flagman LLC paid a state fee in the amount of 3,800 rubles.

The following entries were made in the accounting of Flagman LLC:

| Debit | Credit | Description | Sum | Document |

| 60 | 51 | Flagman LLC transferred funds to Egida LLC in payment for the patent | 67,500 rub. | Payment order |

| 08 | 60 | The cost of the patent is reflected as part of investments in intangible assets | 67,500 rub. | Agreement |

| 08 | 60 | The cost of the state duty is reflected as part of investments in intangible assets | RUB 3,800 | Receipt for payment of state duty |

| 04 | 08 | Intangible assets accepted for accounting (RUB 67,500 + RUB 3,800) | 71,300 rub. | NMA-1 registration card |

Read about the accounting accounts used in accounting in the articles: account 60 (accounting for settlements with suppliers and contractors), account 08 (investments in non-current assets).

Account 04. Creation of intangible assets on your own

Monolit LLC created its own trademark, recognized as an intangible asset. The process of developing the sign took 1 month, during which the employees of Monolit LLC were paid salaries and accrued insurance contributions:

- salary – 67,000 rubles;

- mandatory insurance premiums – 20,100 rubles. (RUB 67,000 * (22% + 2.9% + 5.1%));

- insurance against accidents and occupational diseases – 134 rubles. (RUB 67,000 * 0.2%).

Upon completion of the development process, Monolit LLC received a certificate of exclusive right to the mark, having paid a state fee of 28,800 rubles.

The following entries were reflected in the accounting of Monolit LLC:

| Debit | Credit | Description | Sum | Document |

| 08 Creation of intangible assets | 70, 69 | The expenses for paying salaries (and insurance premiums) to development employees are reflected (RUB 67,000 + RUB 20,100 + RUB 134) | RUB 87,234 | Payroll sheet |

| 76 | 51 | Payment of the state duty amount | RUB 28,800 | Payment order |

| 08 Creation of intangible assets | 76 | The cost of the state duty is reflected as part of investments in intangible assets | RUB 28,800 | Certificate for a trademark |

| 04 | 08 Creation of intangible assets | The trademark is included in the intangible assets (RUB 87,243 + RUB 28,800) | RUB 116,043 | NMA-1 registration card |

Read about the accounting accounts used in accounting in the articles: account 70 (payroll accounting), account 69 (social insurance calculations), account 76, account 51 (current account).

Account 04. Write-off of intangible assets

Globus LLC owns the exclusive right to a technical invention. This invention is registered as an intangible asset. As of 02/01/2016:

- initial cost of intangible assets – 132,000 rubles;

- the amount of accrued depreciation (account 05) is 43,500 rubles.

According to the agreement, Globus LLC will exercise the exclusive right to the invention of Breeze LLC at a price of 118,300 rubles.

Operations to write off intangible assets in connection with the sale were reflected in the accounting of Globus LLC with the following entries:

| Debit | Credit | Description | Sum | Document |

| 76 | 91.1 | The amount of income from the sale of intangible assets is taken into account | RUB 118,300 | Patent assignment agreement |

| 05 | 04 | The amount of depreciation accrued on the sold intangible asset was written off | RUB 43,500 | Patent assignment agreement, registration card NMA-1 |

| 91.2 | 04 | The residual value of the sold intangible assets is written off | RUB 88,500 | Patent assignment agreement, registration card NMA-1 |

| 51 | 76 | Funds have been credited from Breeze LLC as payment for the right to the invention | RUB 118,300 | Bank statement |

| 91.9 | 99 | The amount of the financial result is taken into account (RUB 118,300 – RUB 88,500) | RUB 29,800 | Turnover balance sheet |

Read about the accounting accounts used in accounting in the articles: account 91.1 and 91.2 (exchange differences), account 99 (accounting for financial results).

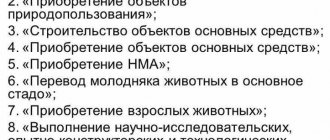

The following sub-accounts are open to the account:

- 04.01 “Intangible assets of the organization”

- 04.02 “Expenditures on research, development and technological work”

“Additional valuation of intangible assets during the first revaluation: Change in initial value”

ENTRY: Debit 04 “Intangible assets” Credit 83.01.2 “Increase in the value of intangible assets”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Depreciation of intangible assets during the first revaluation: Change in initial value”

ENTRY: Debit 91.02 “Other expenses” Credit 04 “Intangible assets”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Additional valuation of previously discounted intangible assets: Change in the original value by the amount of the previous discount”

ENTRY: Debit 04 “Intangible assets” Credit 91.01 “Other income”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Revaluation of previously discounted intangible assets: Change in initial cost “

ENTRY: Debit 04 “Intangible assets” Credit 83.01.2 “Increase in the value of intangible assets”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Depreciation of previously overvalued intangible assets: Change in the original value by the amount of the previous revaluation”

ENTRY: Debit 83.01.2 “Increase in the value of intangible assets” Credit 04 “Intangible assets”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Markdown of previously overvalued intangible assets: Change in initial value “

Documents confirming the creation/purchase of intangible assets

The basis for recording entries for transactions with intangible assets are primary documents. Account entries in the Intangible MA-1 card and postings to account 04 are carried out only if there are correctly executed supporting documents. Documents that confirm the acquisition of intangible assets can be presented in the table below.

Read more: Intangible assets. Formula. Calculation

| Type of intangible asset | Confirmation document |

| Industrial invention | Patent (issued by the Federal Service for Intellectual Property) |

| Computer or database (database), audio and video recordings | Certificate of registration of the right to create this asset in the organization, documents confirming the purchase of intangible assets |

| Topology of integrated circuits | Certificate of registration of the right to create this asset in the organization, documents confirming the purchase of intangible assets |

| Trademark, name | Certificate of registration of rights issued by Rospatent |

| Business reputation | Purchase and sale agreement for the organization as a whole with registration in Rosreestr |

In what account are intangible assets reflected?

The answer to the question on which account intangible assets are accounted for is set out in instruction 94n (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000): information on the presence and change, disposal of intellectual rights is reflected in the account. 04, which is active. By debit we take into account the receipt, and by credit we take into account the disposal of the asset. In the balance sheet, account balances are reflected minus depreciation if the period of their use has been established for intellectual objects. Analytical accounting is organized for each acquired or created intellectual right.

This page is an appendix to the Chart of Accounts for accounting of financial and economic activities of organizations.

Account 04 “Intangible assets” is intended to summarize information on the presence and movement of the organization’s intangible assets, as well as on the organization’s expenses for research, development and technological work.

Intangible assets are accepted for accounting in account 04 “Intangible assets” at their original cost.

For intangible assets for which depreciation is accounted for without using account 05 “Depreciation of intangible assets”, the accrued amounts of depreciation charges are written off directly to the credit of account 04 “Intangible assets”.

Acceptance of intangible assets for accounting is reflected in the debit of account 04 “Intangible assets” in correspondence with account 08 “Investments in non-current assets”.

When intangible assets are disposed of (sold, written off, transferred free of charge, etc.), their value recorded in account 04 “Intangible assets” is reduced by the amount of depreciation accrued during use (from the debit of account 05 “Depreciation of intangible assets”). The residual value of disposed objects is written off from account 04 “Intangible assets” to account 91 “Other income and expenses”.

The organization's expenses for research, development and technological work, the results of which are used for the production or management needs of the organization, are accounted for separately on account 04 “Intangible assets”.

Expenses for research, development and technological work are accepted for accounting on account 04 “Intangible assets” in the amount of actual costs, while account 04 “Intangible assets” is debited in correspondence with the credit of account 08 “Investments in non-current assets”.

When writing off in accordance with the established procedure expenses for research, development and technological work, the results of which are used for the production or management needs of the organization, account 04 “Intangible assets” is credited to expenses for ordinary activities in correspondence with the debit of cost accounting accounts (20 “Main production”, 26 “General expenses”, etc.).

Upon termination of the use of the results of research, development and technological work in the production of products (performance of work, provision of services) or for management needs, amounts of expenses not included in expenses for ordinary activities are written off to the debit of account 91 “Other income and expenses” » in correspondence with the credit of account 04 “Intangible assets”.

Analytical accounting for account 04 “Intangible assets” is carried out for individual objects of intangible assets, as well as for types of expenses for research, development and technological work.

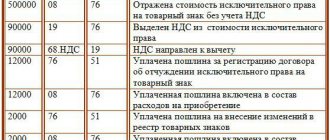

At the same time, maintaining analytical accounting should provide the ability to obtain data on the presence and movement of intangible assets, as well as the amounts of expenses for research, development and technological work. Account 04 “Intangible assets” corresponds with the accounts:

| by debit | on loan |

| 08 Investments in non-current assets 51 Current accounts 52 Currency accounts 55 Special accounts in banks 76 Settlements with various debtors and creditors 79 On-company settlements 80 Authorized capital | 05 Amortization of intangible assets 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 44 Selling expenses 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 91 Other income and expenses 97 Deferred expenses |

Accounting for depreciation of intangible assets

Depreciation of intangible assets is a gradual transfer of the cost of intangible assets to costs.

In accordance with PBU, the following methods of calculating depreciation are provided:

- Linear method.

- Proportional to the products produced.

- Method for reducing balance

We will look at these methods in detail in the following lessons. To account for accrued depreciation, the chart of accounts provides account 05.

Postings:

- Debit 26 Credit 05-Accrued depreciation on intangible assets used in management, for example, by trademark

- Debit 20 Credit 05-Accrued depreciation on intangible assets when using production.

My other lectures on accounting for account 04:

Implementation of intangible assets: postings (example)

Let us use an example of accounting records for the sale of an intangible asset.

Let's assume that an organization sells the exclusive right to an industrial design worth 367,000 rubles (VAT is not assessed on the basis of clause 26, clause 2, article 149 of the Tax Code of the Russian Federation). The object was previously accounted for by the organization at its original cost of 208,000 rubles. The depreciation accrued at the time of disposal is 31,200 rubles. Payment for the sold industrial design was made in money to the seller's bank account. For simplicity, we assume that there were no other transactions in the reporting month. We also do not consider the calculation and payment of state duties when exercising an exclusive right in the example.

| Operation | Account debit | Account credit | Amount, rub. |

| Income from the sale of the exclusive right to an industrial design is reflected | 62 | 91, subaccount “Other income” | 367 000 |

| The depreciation accumulated on the exclusive right being sold at the time of its sale is written off | 05 | 04 | 31 200 |

| The residual value of the exclusive right to an industrial design has been written off (208,000 – 31,200) | 91, subaccount “Other expenses” | 04 | 176 800 |

| Payment received from buyer | 51 “Current accounts” | 62 | 367 000 |

| Profit from the sale of an intangible asset is reflected (367,000 – 176,800) | 91, subaccount “Balance of other income and expenses” | 99 "Profits and losses" | 190 200 |

If the sale of intangible assets is subject to VAT (for example, in the case of the sale of a trademark), then the VAT accrued at the time of sale is reflected as follows:

Debit of account 91, sub-account “VAT” - Credit of account 68 “Calculations for taxes and fees”

In this lecture we will cover the following topics:

- Introduction

- Account characteristics 04.

- Accounting for receipt of intangible assets (Accounting for the purchase of intangible assets, Creation of intangible assets, Receipt of intangible assets free of charge).

- Accounting for the disposal of intangible assets (Sale of an intangible asset, Write-off of obsolete intangible assets, Gratuitous transfer of intangible assets)

- Depreciation of intangible assets