Tangible exploration assets on the balance sheet are

In the balance sheet, line 1140, called “Tangible Exploration Assets” (MPA), forms information about the fixed assets used in the search for mineral resources (equipment, transport, structures).

MPA is taken into account on account 08, in a separate sub-account 08/MPA. The indicator for line 1140 is calculated as the difference between accounts 08/MPA and 02/MPA, i.e., in the balance sheet, tangible exploration assets are reflected at their residual value. Some types of fixed assets used in the development and extraction of mineral deposits, such as equipment, transport, and structures, are recognized as tangible exploration assets. Among the structures used during exploration operations for mineral deposits, pipelines can be distinguished. Among the equipment used during prospecting activities, there is specialized equipment for these purposes, for example, drilling rigs, storage tanks for extracted minerals, and pumping units.

Depreciation on exploration assets

Since a unit of a search asset is accounted for in the same way as fixed assets, such assets are subject to depreciation in the prescribed manner. You have the right to choose the method by which the exploration asset will be depreciated by recording it in your accounting policy. Determine the useful life of an asset (both tangible and intangible groups) individually and also reflect it in the accounting policy.

If search equipment previously used in one area is currently used for exploration and analysis of a new area, then depreciation charges on this equipment are charged to the creation of a new asset (in a new area). The same rule applies to all search assets that are used to create new assets.

What is included in intangible assets on the balance sheet

Not having a material form, this property brings long-term benefits to the company in economic and production terms, i.e. income. According to PBU 14/2007, intangible assets on the balance sheet are intellectual property, software products, licenses, etc. These may include:

- various kinds of production secrets;

- scientific achievements, works of art and literary works;

- brands, trademarks/trademarks;

- inventions;

- patents and rights to models, inventions, industrial designs;

- copyright and property rights to various objects, etc.

In addition, as part of intangible assets, the balance sheet takes into account positive business reputation, as well as expenses associated with the founding of the company and recognized as a contribution to the authorized capital of the enterprise.

The listed intangible assets in the balance sheet are accumulated in line 1110. It reflects the residual value of intangible assets, calculated in accounting as the difference between the debit balance of the account. 04 “Intangible assets” (not taking into account R&D costs) and the credit balance on the account. 05 “Depreciation of intangible assets.”

Since July 2020, simplified enterprises have been given the right to write off intangible assets as expenses when making expenses, bypassing depreciation charges.

Accounting for intangible assets

When accepting assets for accounting as intangible, the following conditions must be simultaneously met:

- lack of material-material (physical) structure;

- the possibility of identification (separation, separation) by the organization from other property;

- use in the production of products, when performing work or providing services, or for the management needs of the organization;

- long-term use, i.e. useful life exceeding 12 months or normal operating cycle if it exceeds 12 months;

- the organization does not intend to subsequently resell this property;

- the ability to bring economic benefits (income) to the organization in the future;

- the presence of properly executed documents confirming the existence of the asset itself and the organization’s exclusive right to the results of intellectual activity (patents, certificates, other documents of protection, agreement of assignment (acquisition) of a patent, trademark, etc.).

Primary accounting

From the moment the company incurs the costs of searching for minerals, the costs must be taken into account in accounting. balance sheet, in the debit of account No. 08. This account requires you to consolidate expenses for:

- Purchase of a plot of land on which exploration, evaluation and production will be carried out;

- Purchase of necessary special equipment and special transport;

- Cost of services of general contractors for on-site installation and setup of special equipment;

- Cost of intermediary services (if the property was purchased through third parties);

- Information and consulting services related to exploration and assessment of a plot of land;

- Cost of laboratory services for studying found samples;

TOPIC 3. BALANCE SHEET OF THE ENTERPRISE

Balance sheet items show the amount of property and liabilities of the enterprise as of a certain date.

Balance sheet item

– a separate type of funds (property) or source (liabilities), shown in the balance sheet as a separate item and expressed as a separate amount.

ASSETS

SECTION I. NON-CURRENT CAPITAL

includes funds that are heterogeneous in their economic content:

Material resources

Intangible means

Investments, etc.

The combination of these funds in section 1 is due to the long-term nature of their use in the economic activities of the organization and their belonging to the least liquid assets.

Intangible assets (line 1110)

– indicates the amount of the residual value of the intangible assets at the end of the reporting period.

The residual value of intangible assets, depending on the procedure for accounting for depreciation of intangible assets adopted in the accounting policy:

or immediately formed on account 04 “Intangible assets”;

or calculated by subtracting from the balance at the end of the year in account 04 the balance at the end of the year in account 05 “Amortization of intangible assets”.

In accordance with clause 3 of PBU 14/2007 “Accounting for intangible assets”, an object is accepted in accounting as an intangible asset if the following conditions are simultaneously met:

1. the object is capable of bringing economic benefits to the organization in the future, in particular, the object is intended:

For use in production of products;

When performing work or providing services;

For the management needs of the organization.

2. there is a right to receive economic benefits that this object is capable of bringing in the future, including the organization has properly executed documents confirming the existence of the asset itself and the right of this organization to the result of intellectual activity or a means of individualization:

Patents;

Evidence;

Other security documents;

Agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization;

Documents confirming the transfer of exclusive rights without a contract;

There must also be restrictions on the access of other persons to such economic benefits (control over the object).

3. the possibility of separating or separating (identifying) an object from other assets;

4. The object is intended to be used for a long time, i.e. useful life exceeding 12 months;

5. the organization does not intend to sell the property within 12 months;

6. the actual (initial) cost of the object can be reliably determined;

7. the object does not have a material form.

In accordance with Article 1225 of Chapter 69 of the Civil Code, the results of intellectual activity and equivalent means of individualization of legal entities, goods, works, services and enterprises that are granted legal protection (intellectual property) are:

Works of science, literature and art; programs for electronic computers (computer programs); Database; phonograms; communication on the air or via cable of radio or television programs (broadcasting by broadcasting or cable broadcasting organizations); inventions; breeding achievements; brand names; trademarks and service marks.

Also, licenses for the use of software products (such as 1c programs, antiviruses, etc.) do not apply to intangible assets.

In accordance with paragraph 16 of PBU 14/2007, the initial/actual cost of intangible assets at which it is accepted for accounting is not subject to change, except in cases of revaluation and depreciation of intangible assets.

An organization can revaluate intangible assets at the end of the reporting period. The use or waiver of this right must be formalized in the accounting policy for accounting purposes. Revaluation of intangible assets is carried out by recalculating their residual value (clause 19 of PBU 14/2007).

The amount of additional valuation of intangible assets as a result of revaluation is credited to the additional capital of the organization. The subsequent amount of markdown within the revaluation limits reduces the additional capital. The amount of the markdown is included in the financial result as other expenses. Subsequent revaluation within the limits of the previous depreciation amount is included in the financial result as part of other income.

On line 1110

the residual value of intangible assets is reflected: = debit balance in account 04 “Intangible assets” (excluding R&D expenses)

minus

credit balance in account 05 “Amortization of intangible assets”

If depreciation is calculated without using account 05, then this line reflects: Debit balance of account 04 “Intangible assets” (excluding R&D expenses)

Research and development results (line 1120).

This line indicates the amount of expenses for completed research, development and technological work (hereinafter referred to as R&D*), not written off as expenses for ordinary activities and other expenses. *Research work includes work related to the implementation of scientific (research), scientific and technical activities and experimental developments, defined by the Federal Law of August 23, 1996. No. 127-FZ “On science and state scientific and technical policy.”

In accordance with clause 16 of PBU 17/02 “Accounting for expenses on research, development and technological work”, if significant, information on R&D expenses is reflected in the balance sheet for a separate group of asset items (section “Non-current assets”) .

The organization's expenses on R&D, the results of which are used for the production or management needs of the organization, are accounted for on account 04 “Intangible assets” separately in accordance with the Chart of Accounts and the Instructions for its application.

In accordance with clause 2 of PBU 17/02, the following are taken into account as part of R&D:

R&D for which results were obtained that are subject to legal protection, but were not formalized in the manner prescribed by law;

R&D that produced results that are not subject to legal protection in accordance with the norms of current legislation.

As part of R&D, account 04 is not taken into account and is not reflected on line 1120:

Unfinished R&D, as well as R&D, the results of which are taken into account in accounting as intangible assets; expenses of the organization for the development of natural resources (conducting geological studies of subsoil, exploration (additional exploration) of developed deposits;

Preparatory work in extractive industries, etc.;

Costs for preparation and development of production, new organizations, workshops, units (start-up costs);

Costs of preparing and mastering the production of products not intended for serial and mass production;

Costs associated with improving technology and production organization, improving product quality, changing product design and other operational properties carried out during the production (technological) process.

In accordance with clause 9 of PBU 17/02, R&D expenses include all actual expenses associated with the implementation of the specified work.

Expenses for R&D include:

Cost of materials and equipment and services of third-party organizations and persons used in performing the specified work;

Costs of wages and other payments to employees directly involved in performing the specified work under an employment contract;

Contributions for social needs;

Cost of special equipment and special fittings intended for use as test and research objects;

Depreciation of fixed assets and intangible assets used in performing the specified work;

Costs for the maintenance and operation of research equipment, installations and structures, other fixed assets and other property;

General business expenses, if they are directly related to the implementation of these works;

Other expenses directly related to the implementation of research, development and technological work, including testing costs.

On line 1120

information on expenses for completed research, development and technological work (R&D) is reflected: = debit balance in account 04 “Intangible assets” (analytical account for accounting for R&D expenses)

Line 1130 “Intangible exploration assets”

On line 1130

the costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area are reflected: =

debit balance on account 08 “Investments in non-current assets” (analytical account for accounting of legal acts) minus

with

credit balance for account 05 “Amortization of intangible assets” (analytical accounts for accounting for depreciation and impairment of legal acts)

When business entities develop natural resources, perform work on the search and development of mineral resources, costs arise, called “exploration” and associated with the use of fixed assets and intangible assets. In this regard, it is necessary to consider what is special and how tangible and intangible exploration assets are reflected in the balance sheet.

Intangible search assets

/ Accounting statements / Line 1130 Attention!

Important news from the site! Expanding the functions of the site. Remember the new address

Line 1130 of financial statements

refers to

the balance sheet

.

Line 1130

reflects the costs of searching, exploration and evaluation of mineral deposits.

Line 1130

| Debit balance on account 08 “Investments in non-current assets” (analytical account for accounting for Intangible Exploration Assets) |

| minus |

| Credit balance on account 05 “Amortization of intangible assets” |

Recognition of search assets

Search assets are material

(MPA) and

intangible

(NPA).

Material prospecting assets

— these are costs related to the acquisition or creation of a material object.

In other cases, search assets are classified as intangible search assets

.

Accounting for search assets is kept in account 08, to which sub-accounts “Intangible search assets” and “Tangible search assets” are opened. In the balance sheet they are shown in lines 1130 and 1140.

Intangible assets include:

— the right to perform search, exploration and evaluation of mineral deposits. These rights must be supported by appropriate licenses;

— information on topographical, geological, geophysical studies of a certain territory;

— results of exploratory drilling;

— results of sampling;

— geological information about the subsoil in a certain territory;

— assessment of the commercial feasibility of mining.

The following are recognized as the costs of acquiring or creating exploration assets:

— amounts paid to the owner under the contract of sale and purchase of legal entities;

- amounts paid for the performance of work under a construction contract and similar agreements;

— commissions to intermediaries when purchasing legal entities;

— payment for information and consulting services;

— customs duties and fees;

— non-refundable taxes, government and patent fees;

— depreciation of other non-current assets used in the creation of legal acts;

— material rewards for employees involved in the creation of legal acts;

— the organization’s obligations in relation to compliance with environmental standards and other costs associated with the acquisition, creation and operation of legal acts;

— costs of obtaining a license to perform work according to legal regulations.

The following are not recognized as costs for the acquisition or creation of legal acts:

- amounts of taxes reimbursed by the state;

— general business and other similar expenses, except for the cases specified in the previous paragraph (in recognized expenses).

— costs until obtaining a license to perform work according to legal regulations.

useful links

►Economic literature◄ ►Methodology of financial analysis◄ ►Manual on financial statements◄ ►Largest joint stock companies in Russia◄

Exploration costs mean the costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area, which are incurred before the commercial feasibility of production is established and documented in relation to this subsoil area (clauses 2, 4, 6 of PBU 24/2011).

1130 “Intangible search assets”

This line of the Balance Sheet indicates the residual value of legal acts (actual costs taking into account the revaluations made, less accumulated depreciation and impairment). This value is determined as the difference between the balances of the corresponding analytical accounts of synthetic accounts 08 and 05 (taking into account revaluation and impairment).

─────────┐ ┌─────────────────┐ ┌────────────────────┐

│Line 1130 │ │Debit balance│ │Credit balance │

│”Intangible │ │by account 08 │ │by account 05 │

│search assets”│ = │(analytical │ — │(analytical accounts│

│Accounting │ │regulatory legal acts account) │ │accounting for depreciation and │

│balance sheet │ │ │ │impairment of legal acts) │

└─────────────────┘ └─────────────────┘ └────────────────────┘

The indicators in line 1130 “Intangible exploration assets” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year.

"Intangible search assets"

In 2012, the organization took into account as part of the legal acts the right to geological study, exploration and production of minerals (coal) in a certain subsoil area, confirmed by the presence of an appropriate license.

The license was obtained in 2011, the cost of obtaining it amounted to 680,000,000 rubles. The specified amount was reflected in the Balance Sheet for 2011 as part of non-current assets on a separate line 1145 “Licenses for the use of subsoil” independently entered by the organization.

PBU 24/2011 “Accounting for costs for the development of natural resources”

Order of the Ministry of Finance of the Russian Federation dated October 6, 2011 No. 125n approved the new Accounting Regulations PBU 24/2011 “Accounting for costs for the development of natural resources.” The new PBU comes into force with the 2012 financial statements.

Who should apply the PBU

PBU 24/2011 is applied by organizations that incur costs for the search, evaluation of mineral deposits and exploration of minerals in a certain subsoil area.

New terminology

Exploration costs are the costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area.

Search assets are search costs recognized as non-current assets.

Tangible search assets are search assets that have a tangible form (structures, equipment, vehicles).

Intangible exploration assets - exploration assets that do not have a tangible form (the right to carry out work on search, evaluation of deposits and (or) exploration of minerals; information obtained as a result of topographic, geological and geophysical research; results of exploration drilling; results of sampling ; other geological information about the subsoil; assessment of the commercial feasibility of production).

Commercial feasibility of mining is an established and documented probability that the economic benefits from mining in a certain subsoil area will exceed the costs incurred, subject to the technical feasibility of mining and the organization having the resources necessary for mining.

The PBU also clarifies that “probability of an event occurring” means: more likely than not.

Procedure for recognizing search costs

Exploration costs are taken into account by the organization until the commercial feasibility of production in relation to a specific subsoil area is established.

The organization independently determines which search costs relate to expenses for ordinary activities (that is, current costs) and which to search assets.

Tangible and intangible exploration assets are accounted for in separate subaccounts to balance sheet account 08 “Accounting for investments in non-current assets”.

The organization establishes the procedure for recognizing and classifying exploration assets in its accounting policies.

In accounting and financial statements, exploration assets are reflected in the amount of actual costs incurred. An open list of these costs is given in paragraph 13 of PBU 24/2011.

Depreciation of exploration assets

Exploration assets recorded on balance sheet account 08 are depreciated according to the rules established for fixed assets and intangible assets.

If a prospecting asset is used to create another prospecting asset, depreciation amounts are charged to the cost of the prospecting asset created.

License

The cost of a license granting the right to perform work on the search and evaluation of mineral deposits includes only actual costs that are directly related to obtaining the license.

If a license gives the right not only to search, evaluate deposits and (or) explore minerals, but also to extract them, then the costs of obtaining it are not subject to amortization until the commercial feasibility of extraction is confirmed.

Testing for impairment of exploration assets

Clause 19 of PBU 24/2011 lists signs indicating possible impairment of exploration assets.

Such signs include, for example, the expiration of the license within 12 months after the reporting date for which the financial statements are prepared, and the organization will not renew the validity of this license.

An organization’s decision to terminate search, evaluation and exploration activities for minerals in a specific subsoil area, since these activities did not lead to the discovery of industrially significant minerals, also indicates the depreciation of exploration assets.

PBU 24/2011 requires organizations to test exploration assets for impairment, and also take into account changes in their value as a result of impairment in the manner prescribed by IFRS 36 “Impairment of Assets” and IFRS 6 “Exploration and Evaluation of Mineral Reserves”.

When the commercial feasibility of mining is confirmed

The organization must:

1) check the exploration assets again for impairment, and if appropriate signs are detected, reflect this impairment in accounting;

2) transfer exploration assets to fixed assets (inventory) or intangible assets at residual value, which is defined as the difference between actual costs minus accumulated depreciation and impairment;

3) write off exploration assets that are not suitable for further use in the same manner as fixed assets or intangible assets are written off.

Production is recognized as unpromising

In this case, search assets are written off, and income and expenses from such write-off are included in the financial results of the organization.

If search assets will be used in the organization’s activities, then they are taken into account at their residual value as part of fixed assets (inventory) or intangible assets.

Disclosure of information in financial statements

The issues and indicators that an organization must reflect in the Explanations to the balance sheet and profit and loss account, as well as in the Explanatory Note, are listed in Section VI of PBU 24/2011. In addition, the PBU contains an appendix that provides an example of disclosing information about search costs in financial statements.

Errors and features of accounting

The procedure for accounting for search assets is quite specific and has a number of features. In this regard, many accountants make mistakes when recording these transactions. Below we will look at the top 3 mistakes made when accounting for search assets.

Mistake #1.

Accounting for asset impairment.

In March 2020, JSC GlavResurs received a license to search for ore in the A-1 area. Within a year from the moment of receiving the license, GlavResurs carried out exploration and analysis of the soil to search for minerals. In March 2020, the amount of costs for searching for deposits was increased many times due to the purchase of expensive equipment necessary to continue work. The cost of the equipment purchased was not included in the original search cost estimate.

The accountant of GlavResurs reflected the cost of purchasing new equipment according to Dt 08. As of 04/01/18, the accounting of GlavResurs reflected the cost of assets taking into account the purchase of new equipment. No additional adjustments were made to accounting for this type of exploration asset.

In this case, the GlavResurs accountant made a fairly common mistake regarding the revaluation of exploration assets. Unlike accounting for fixed assets, which are revalued annually to bring the accounting value into line with the market value, when accounting for exploration assets, there are additional conditions for revaluation. For example, an asset needs to be revalued if the search for deposits is stopped due to the fact that no minerals were discovered at the site.

The above example also represents a case in which a search asset needs to be revalued. The cost of the equipment that was purchased by GlavResurs to continue the work was not taken into account in the initial estimate, therefore, the costs of searching for deposits increased many times over. This fact is the basis for recording the impairment of the asset. The accountant of GlavResurs needs to reflect in the balance sheet the revaluation of the asset taking into account new conditions (increased costs for searching for deposits).

Mistake #2.

Amortization of search license cost.

In September 2020, it received a license to search for gas fields for a period of 3 years. Cardinal's accountant calculated the amount of monthly depreciation taking into account a useful life of 36 months. The amount of depreciation expenses was reflected in the accounts monthly, starting in October 2020. Work on exploration and search for gas fields was started by Cardinal only in December 2020 (from the date of acquisition of the necessary equipment). During the same period, the company issued a document confirming the economic feasibility of production.

Mistake #3.

Accounting for additional exploration costs.

In April 2020, Status Stroy JSC began work on additional exploration of the industrially developed ore deposit. The cost of equipment purchased for the use of the work, as well as the costs of additional assessment and soil analysis, are reflected by the accountant “Status Stroy” in account 08. Expenses for additional exploration of the field were written off in equal parts to depreciation charges.

The procedure for accounting for expenses for additional exploration of areas that have already been put into operation differs from the general procedure for accounting for exploration assets. In this case, “Status Stroy” has the right to recognize the costs of equipment and soil assessment at a time and in full. In this case, uniform distribution of the amount of expenses by calculating depreciation is not required.

Derecognition of exploration assets

You are required to derecognise the search asset and write it off from account 08 if:

- the commercial feasibility of resource extraction in this area has been confirmed;

- Mining of minerals for one reason or another has been recognized as unpromising.

Each of the above decisions must be documented and documented in a corresponding report. If the feasibility of production is recognized as economically justified, make an entry Dt 01 Kt 08 for the amount of costs accumulated for this object. Based on this accounting entry, the amount of search expenses will be allocated to the fixed asset item. If we are talking about intangible assets, then the following entry should be made: Dt 04 Kt 08.

In case of unpromising production and its subsequent cessation, write off the amount of costs accumulated under Dt 08 to other expenses: Dt 91.2 Kt 08.

Example No. 1.

Neft Prom JSC received a license to search for oil deposits in the B-34 area. In September 2020, Neft Prom hired a contractor, Techno Global LLC, to drill a well. Cost of services (7,342,500 rubles, VAT 1,120,042 rubles) to the contractor 09/13/17. Based on the results of prospecting work carried out in September-October 2020, the well was declared unproductive and abandoned on 10/22/17. The cost of work to abandon the well was paid in favor of Techno Global LLC (481,300 rubles, VAT 73,419 rubles).

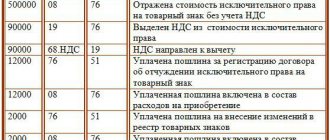

The following entries were made in the Neft Prom accounting:

| date | Debit | Credit | Sum | Description |

| 13.09.17 | 08 | 60 | RUR 6,222,458 | The cost of the work of Techno Global LLC is reflected (RUB 7,342,500 -RUB 1,120,042) |

| 13.09.17 | 19 | 60 | RUB 1,120,042 | The amount of VAT on the cost of drilling a well is taken into account |

| 13.09.17 | 68 VAT | 19 | RUB 1,120,042 | VAT is accepted for deduction |

| 22.10.17 | 91.2 | 08 | RUR 6,222,458 | The exploration asset is written off as expenses in connection with well abandonment |

| 22.10.17 | 91.2 | 60 | RUR 407,881 | The cost of the work of Techno Global LLC to abandon the well is reflected (481,300 rubles - 73,419 rubles). |

| 22.10.17 | 19 | 60 | RUR 73,419 | The amount of VAT on the cost of well abandonment work is taken into account |

| 22.10.17 | 68 VAT | 19 | RUR 73,419 | VAT is accepted for deduction |

| 22.10.17 | 09 | 68 Income tax | RUB 1,326,068 | The tax asset is reflected ((RUB 6,222,458 + RUB 407,881) * 20%) |

| 30.11.17 | 68 VAT | 09 | RUR 22,101 | The tax asset was partially repaid (RUB 1,326,068 / 12 months * 20%) |

What is included in the actual costs of exploration assets?

When creating or acquiring exploration assets (both tangible and intangible), the following are included in the actual costs (PBU 24/2011):

- amounts paid by the business entity to the supplier upon purchase according to the contract;

- amounts paid by an economic entity to organizations for work performed during the construction or other creation of a prospecting asset;

- amounts paid by the business entity to intermediaries who participated in the acquisition of the exploration asset;

- when creating a search asset, amounts are paid to employees who create it;

- amounts paid by a business entity for services in the field of information or consultation provided;

- the amount of fees and duties paid at customs;

- the amounts of patent duties, state duties, and taxes paid by an economic entity that are non-refundable;

- the amount of depreciation charges for non-current assets used in the process of creating an asset classified as a search asset;

- costs incurred by an economic entity during the development and extraction of mineral deposits and associated with environmental protection, liquidation of fixed assets, land reclamation, etc.

What costs can be attributed to intangible exploration assets? Only the costs of obtaining a license were collected as part of the costs of intangible exploration assets. A license was obtained for geological study, exploration and extraction of rock salt. Afterwards, work was carried out to study the subsoil and collect information on this site. At what point should the costs of intangible exploration assets be transferred to another group of assets and to which one (intangible assets, deferred expenses or other)?

Costs that may relate to intangible exploration assets are listed in Article 8 of PBU 24/2011. The costs you mentioned form the cost of the intangible search asset. Costs are transferred to another group at the moment the commercial feasibility of production or liquidation of the asset is determined. Read more about accounting, depreciation, and transfer of assets in the recommendations below.

The rationale for this position is given below in the materials of the Glavbukh System

Intangible exploration assets are: – the right to perform work on the search, evaluation of mineral deposits and (or) exploration of minerals, confirmed by the appropriate license; – information obtained as a result of topographical, geological and geophysical studies; – results of exploratory drilling; – results of sampling; – other geological information about the subsoil; – assessment of the commercial feasibility of production.

Determine the accounting unit for exploration assets as follows: – for tangible exploration assets – according to the rules of accounting for fixed assets; – for intangible exploration assets – according to the rules of accounting for intangible assets.

This procedure is provided for in paragraph 10 of PBU 24/2011.*

Intangible exploration assets can be amortized in one of the ways listed in paragraph 28 of PBU 14/2007, namely:

Accrue depreciation, include it in costs and reflect these operations in accounting according to the general rules for fixed assets and intangible assets, taking into account the following two features.

Do not amortize the costs of obtaining a license until the commercial feasibility of mining is confirmed (clause 18 of PBU 24/2011).

If a prospecting asset is used to create another prospecting asset, include depreciation charges on it as part of the costs of the asset being created (clause 17 of PBU 24/2011).

Derecognition in accounting

Terminate recognition of exploration assets in relation to a licensed subsoil area if there is documentary evidence of:

Reflection on accounting accounts

In accounting, reflect search costs with the following entries: Debit 08 Credit 02 (10, 70, 69...) – expenses are reflected in the form of formation of the cost of a search asset.

Make such entries until the commercial feasibility of production or liquidation of the asset is recognized.

Once the commercial feasibility of production has been recognized, assign these costs to the cost of the fixed asset (intangible asset):

Debit 01 (04) Credit 08 – search costs are allocated to the cost of a fixed asset (intangible asset).

If mining is recognized as unpromising, then write off exploration assets as other expenses:

Debit 91-2 Credit 08 – the cost of exploration assets for unpromising production has been written off.*

Elena Popova

, State Advisor to the Tax Service of the Russian Federation, 1st rank

A selection of the most important documents on request Material search assets

(regulatory legal acts, forms, articles, expert consultations and much more).

Regulations: Tangible Exploration Assets

6. Exploration costs related primarily to the acquisition (creation) of an object that has a tangible form are recognized as tangible exploration assets. Other search assets are recognized as intangible search assets.

Order of Rosstat dated November 22, 2017 N 772 (as amended on December 29, 2018) “On approval of the Instructions for filling out federal statistical observation forms N P-1 “Information on the production and shipment of goods and services”, N P-2 “Information on investments in non-financial assets", N P-3 "Information on the financial condition of the organization", N P-4 "Information on the number and wages of employees", N P-5 (m) "Basic information on the activities of the organization" Line 39 reflects fixed assets , both in operation and those under reconstruction, modernization, restoration, conservation or reserve, in lease, in trust management, at residual value (with the exception of fixed assets for which, in accordance with the established procedure, depreciation is not accrued). On this line, organizations making profitable investments in material assets provided for a fee for temporary possession and use (including under a financial lease agreement, under a rental agreement), in order to generate income, reflect the residual value of the specified property. Line 39 reflects tangible exploration assets that are recognized as non-current assets. To fill in line 39, account data 01, 02, 03, 08 is used.

Reflection of information in reporting and accounting errors

In the balance sheet as of the reporting date, all expenses associated with the development of the field are grouped in accounts 1130 (material) and 1140 (intangible). In addition, mining companies provide information:

- Costs associated with revaluation of PA.

- The amount of accumulated depreciation.

- The amount of asset impairment.

- The residual price of the asset taking into account depreciation.

When accounting for exploration assets, accountants quite often make the following mistakes:

- Accounting for asset impairment. Let's consider this example: in 2020, we acquired a license to develop a deposit. Early next year, additional equipment was purchased to conduct soil analysis. The company's accountant as of the quarterly date (04/01/2018) displayed the cost of equipment in account Dt 08 without revaluation of the exploration asset. But the price of new equipment was not included in the original estimate, which means development costs have increased, which is grounds for depreciation of the asset.

- Amortization of the cost of licenses or permits. in August 2016, it purchased a license to develop an oil field for a period of 5 years. The company's accountant calculated the monthly depreciation amount based on this period, that is, 60 months, and began taking into account depreciation expenses from September 2020. The decision on the economic feasibility of production was made only in January 2017. In this case, the accountant made a mistake; he began to amortize the cost of the license before the decision to produce was made. Therefore, he needs to reverse all accrued depreciation for previous periods.

- Displaying the costs of additional exploration of the field. ordered work for additional exploration of the ore mining site. All additional expenses, which included the purchase of new equipment, additional soil analysis, etc. The company's accountant displayed 08 on the account and then wrote it off evenly as depreciation. It should be noted that all expenses for additional exploration of areas that have been put into operation can be recognized at a time in full, and therefore they are not written off on a straight-line basis.

Reflection of assets in reporting

When drawing up a balance sheet, group the cost of exploration assets in lines 1130 and 1140:

- indicate the amount of costs for the search assets of the material group accumulated on the 1st of the reporting date in period 1130;

- in line 1140, reflect general information about the costs associated with obtaining information on analysis and exploration of deposits (intangible group of assets).

Also, current legislation obliges mining companies to provide detailed information regarding:

- costs for revaluation of exploration assets;

- accumulated depreciation amounts;

- asset impairment;

- residual value of assets taking into account depreciation.

Concept of tangible assets

Tangible assets are the company's resources, expressed in material and property form, used in production or non-production activities. They can be fully or partially consumed in the manufacture of goods for final consumption or transfer their value to finished products in the form of depreciation during wear and tear.

Examples include stocks of raw materials, materials, equipment, finished products, buildings and premises. The level of MA security determines the stability of the enterprise, the continuity of the production process and, ultimately, a positive financial result

Also important is the structure of material resources and the share of each type in the total value of assets

More found about intangible search assets

- Study of non-current assets of an enterprise for the purpose of financial analysis The difference between the debit balance of account 08 analytical account for accounting for intangible search assets and the credit balance of account 05 analytical accounts for accounting for depreciation and impairment of intangibles

- Analysis of the balance sheet of a commercial organization using financial ratios Share of intangible exploration assets in non-current assets Intangible exploration assets Non-current assets Share of tangible exploration assets in non-current assets Material exploration

- Tangible assetsFurther tangible exploration assets intangible assets intangible exploration assets financial assets non-current assets depreciable assets operating assets

- Assessing the fundamental value of a business in the financial management system: methodological approaches and practical recommendationsAssets accepted for calculation Intangible assets and research and development results 631854 741 310 Search assets 5 390 681

- Balance sheet - exampleResults of research and development 1120 Intangible exploration assets 1130 Tangible exploration assets 1140 Fixed assets 1150 284433 314415 324515 Income

- Calculation of the level of materiality in an auditResults of research and development 1120 Intangible exploration assets 1130 Tangible exploration assets 1140 Fixed assets 1150 314415 284433 11.42 113570

- Balance sheetResults of research and development 1120 Intangible exploration assets 1130 Tangible exploration assets 1140 Fixed assets 1150 Income investments in tangible assets

- Forecasting by average growth rate Research and development results 1120 Intangible search assets 1130 Tangible search assets 1140 style font-size 90% text-align right background

- Balance sheet assetResults of research and development 1120 Intangible exploration assets 1130 Tangible exploration assets 1140 Fixed assets 1150 Income investments in tangible assets

- Analysis of the arbitration managerResults of research and development 1120 0 0 0 0 0 Intangible search assets 1130 0 0 0 0 0 Tangible search assets 1140 0 0

- Analysis of financial and economic activities for administrations of subjects of the Russian FederationResults of research and development 1120 0 0 0 0 0 Intangible exploration assets 1130 0 0 0 0 0 Tangible exploration assets 1140 0 0

- Intangible assetsFurther intangible assets intangible exploration assets tangible assets tangible exploration assets monetary assets non-monetary assets non-current financial assets

- Analysis of the creditworthiness of small enterprises by a bank credit expertResults of research - - and development Intangible search - - assets Tangible search assets - - Fixed assets 321 96 Income

- Forecasting by average absolute growthResults of research and development 1120 Intangible search assets 1130 style font-size 90% text-align right background #FFFFC0 color #AAA >

- Evaluation of research and development results PBU 14 2007 and intangible exploration assets p 6 PBU 24 2011 18 18 On approval of the Accounting Regulations

- Non-financial assetsNext financial assets monetary assets non-monetary assets tangible assets intangible assets intangible exploration assets investment assets non-current assets depreciable assets The page was helpful

- GoodwillNext intangible assets intangible exploration assets amortization of intangible assets The page was helpful

- Monetary assetsFurther non-monetary assets non-financial assets intangible exploration assets investment assets other non-current assets operating assets current assets current assets Page

- Audit of intangible assetsResults of research and development line code 1120 Intangible exploration assets line code 1130. Explanations to the balance sheet and income statement

- Current issues and modern experience in analyzing the financial condition of organizations - part 2I Non-current assets reflected intangible assets results of research and development tangible search assets fixed assets income-generating investments in tangible assets

Valuation of intangible assets on the balance sheet

Intangible assets have value without having material content. Therefore, the valuation of these assets is a very complex process. The cost of intangible assets, especially in high-tech companies, significantly increases the overall value of the company, and knowledge of their true value and its competent use help strengthen the company’s market position.

Intangible assets (balance sheet line 1110/1130) are assessed depending on their membership in one of four groups:

- industrial property - patents for inventions, industrial designs, achievements, certificates for trademarks;

- items of copyright and related rights to works of science and art, programs for electronic devices, databases;

- objects constituting a trade secret - know-how, R&D results, design and other technological documentation;

- property rights to use natural resources.

Valuation of intangible assets confirms ownership rights and allows this property to be included in assets, making it possible to charge depreciation and form depreciation funds.

In accordance with current legislative norms, it is necessary to reflect all transactions of a commercial and economic nature in special accounting.

This also applies to various types of assets – including intangible search assets. This issue is addressed in the legislation in force in the Russian Federation. If possible, you should familiarize yourself with the most significant points in advance.

This way it will be possible to reduce the likelihood of a large number of difficulties and other difficulties associated with the process of conducting audits by tax authorities.

Inappropriately registered intangible assets will lead to fines and other difficulties.

Specifics of accounting for search assets

How to recognize a search asset

Expenses for searching for mineral resources are recognized as exploration assets in accordance with PBU 24/2011. Specific types of costs that will subsequently be classified as exploration assets are determined individually by the organization and reflected in its accounting policies. As a rule, the list of costs related to exploration assets depends on the specifics of the mining company’s activities. However, when allocating costs to assets and other expenses, general rules should be taken into account:

- land plots on which exploration is carried out, as well as equipment and transport used in the process of extracting samples, are recognized as an exploration asset of the material group;

- the results of assessment, exploration, soil analysis, as well as the commercial feasibility of resource extraction in a specific area are recognized as an exploration asset of an intangible group. These provisions should be recorded in the accounting policies.

Initial accounting of a prospecting asset

- purchase of a land plot on which assessment and exploration will be carried out;

- acquisition of equipment and machinery;

- services of contractors for installation of equipment, its adjustment, installation, technical support, etc.;

- intermediary services (if the asset is acquired through a third party);

- wage fund (if full-time employees are involved in the search for resources);

- information and consulting services regarding exploration and assessment of the site (if such services are received from involved companies);

- laboratory services for analyzing extracted samples, etc.

To optimize accounting, it is recommended to open a sub-account for account 08 for each of the study areas. This will allow for a more complete and detailed analysis of costs if the company searches for and extracts resources simultaneously in several areas.

Search assets: concept and types

One of the initial stages of the production cycle of mining companies is the search for deposits and assessment of the economic feasibility of extracting resources in a particular location. In the process of searching for deposits, companies use exploration assets. This concept refers to the costs incurred in searching for land and assessing deposits.

This type of asset can include both tangible and intangible components. Equipment, communications systems, transportation and other fixed assets are classified as tangible exploration assets. Search assets of an intangible group are considered to be information relating to:

- field exploration (for example, report on drilling results);

- analysis and evaluation of mined mineral samples;

- report of geodetic and topographical research.

In addition, the group of intangible exploration assets includes licenses and other permits that allow the company to conduct exploration and evaluation of deposits.

Based on the results of the research, an assessment of the commercial feasibility of mining in a particular area should be carried out, the result of the assessment must be documented in writing. When preparing your report, answer the following questions:

- does the company have the resources to carry out production (equipment, labor and financial resources, etc.);

- what is the probability that the profit from the sale of minerals will exceed the costs incurred for their extraction.

If production is technically possible, the company has all the necessary means for this, and in addition, it is planned to receive high income from the sale of resources, then their production is considered economically justified. Note that the commercial feasibility of production also falls into the category of intangible exploration assets.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |