In accordance with Article 136 of the Labor Code of the Russian Federation, the employer is obliged to provide the employee in writing with information about wages, its components and about deductions made from accrued income. There is a pay slip for this. The form of the document is not approved by law - a company or entrepreneur-employer has the right to independently develop its form. Many organizations are trying to reduce paper document flow and are switching to electronic exchange. Is it possible to send a payslip by email?

Opinion of the Ministry of Labor

On 02/21/2017, in response to an employer’s request, the Ministry of Labor and Social Protection issued letter No. 14-1/OOG-1560, in which it outlined the department’s position on whether it is possible to send pay slips by email. According to experts, such notification of employees about earnings does not contradict the Labor Code, however, it is necessary that the electronic form be provided for in a collective or individual labor agreement, or other local document of the employer. Later, a similar position was confirmed in the letter of the Ministry of Labor dated May 24, 2018 N 14-1/OOG-4375. Thus, the department has recognized that sending payslips by email is legal.

An example of deciphering salary slips

At the end of the month, each employee must receive a breakdown of the amount of his salary. This is documented in a document called a payslip.

When is the pay slip issued? Article 136 of the Labor Code of the Russian Federation provides for the obligation of the employer, when paying wages, to notify in writing each employee about the components of the salary. Thus, the day of issue is the days of salary payment. Payment of wages cannot be later than the 15th day of the next month - this date can be considered the last date for issuing transcripts.

Special provisions

Give pay slips to all employees without exception. Moreover, regardless of whether your employees work at your main place of work or are employed part-time. Otherwise, the employer will face punishment. We explained which ones at the end of the article.

Designate a responsible person, for example, a payroll accountant, who will process the information, generate and issue the invoice against signature. Introduce this employee to the new responsibilities also against signature.

To keep records of the issuance of pay slips, prepare an accounting journal in which the employee who received the document in hand will put his signature and the date of receipt. Such an algorithm of actions at the enterprise will protect management from penalties.

Let us repeat that issuing invoices is the direct responsibility of the employer. It is impossible to refuse to provide documents, even if the employee has written a written refusal to generate and issue a settlement.

Please note that the method of issuance (payment) of earnings does not matter. Consequently, the employer is obliged to issue a payment slip regardless of the method of payment (cash, card, savings book, etc.).

What is required

There is no approved form for the salary transcript form. There are requirements for information that the employer must explain to its employees and reflect on the pay slip:

- components of wages;

- accrued compensation in separate lines;

- total taxable income on the payslip;

- size and basis of deductions;

- the total amount to be paid.

We offer pay slips so you can use them later in your work.

Wage

The wages reflect accruals that are made as remuneration for labor. This could be a salary, all possible bonuses, payment for work on holidays and weekends.

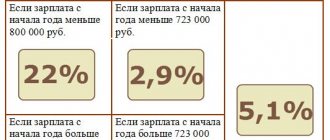

Taxes and deductions

Personal income tax (NDFL) must be included in the deductions. The payer of this tax is the employee.

The employer is obliged to withhold personal income tax on all income of individuals. Some employees are entitled to deductions for this tax. The deductions themselves are not paid, they simply reduce the tax base.

Due to deductions, the withheld personal income tax becomes less.

Let's take a closer look at situations with deductions

On January income of 20,000 rubles, the employee is required to withhold personal income tax at 13%. The amount of deductions will be 20,000 × 13 / 100 = 2,600 rubles.

If an employee is entitled to a deduction for the first child (in 2019, the deduction for the first child is 1,400 rubles), then the calculation of the deduction will be as follows.

First, we reduce the income by deduction:

20 000 – 1400 = 18 600.

We multiply the resulting amount by 13%:

18 600 × 13 / 100 = 2418.

Due to the deduction for deduction, the employee will have an amount of 2,418 rubles (and not 2,600, as was the case in the first example).

Other payments

In addition to salary, an employee can receive various compensations and social benefits:

Deadlines for issuing pay slips

As you know, wages must be paid at least twice a month. That is, every fifteen days. However, employers have the right to make payments more frequently. But not less often. So what about pay slips, how often should they be issued?

If an advance has been paid, then there is no need to issue payslips. Prepare documents on final payments for the reporting month. There is no point in generating a payslip before.

Issue the document no later than the day on which the salary is issued.

There are no exceptions. Even if an employee goes on vacation in the middle of the pay period, it is not necessary to issue a pay slip in advance, but it is possible. For example, if an employee submits a written application for the issuance of a pay slip with vacation pay.

If an employee resigns, then it is necessary to prepare a pay slip. Issue the paper on the resigning employee's last working day. Along with the pay slip, issue a work book and a certificate in form No. 182n. Additionally, the employee may request other documents, for example, an extract from the dismissal order and so on.

Methods for transmitting a payslip

So, we have determined that it is mandatory to issue a payslip. We also determined the structure of the document, mandatory details and components. Now the question of how to issue a pay slip becomes relevant.

There are no problems with full-time employees. On the “significant” day you need to hand out payslips. And the fact of delivery must be endorsed in a special accounting journal. The recipient puts a signature and date of receipt.

What to do if the employee is not available on the day the pay slip is issued? If a hired specialist is on vacation or sick, or, for example, is a freelance (remote) employee, then agree on the procedure for issuing pay slips in advance.

For example, call an absent specialist and determine how to send him a pay slip. The following options are valid:

- By proxy, another person will receive it. For example, an employee broke his leg and is in the hospital. He cannot appear for a payment document, nor can he receive wages in cash from the organization’s cash desk. In this case, you will have to prepare a power of attorney to receive payments and/or wages. This method is used extremely rarely, as it is considered problematic in comparison with others.

- Sending the pay slip by registered mail with a list of attachments. Why order it with an inventory? Yes, because the inventory of the attachment will confirm that it was the pay slip that was sent to the employee. Provided that the document was sent within the established time frame, the inventory of the attachment will be confirmation that the employer has complied with the requirements of the law. For example, if a subordinate goes to court. However, you will have to pay for postal services.

- By email. The easiest, fastest and free way to send a pay slip is by email. Until recently, this method was considered illegal, but the situation has changed. Moreover, sending payslips by email can be provided for all workers, and not just for absent or remote workers. This is a small savings, but still a saving.

Source: https://clubtk.ru/forms/raschety/raschetniy-list

https://youtu.be/6y0gGbDZH2g

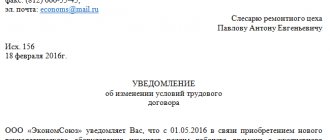

Correct design

The employer is responsible for complying with legal requirements. For violations, fines of up to 50,000 rubles are provided. for companies and up to 5000 rub. for individual entrepreneurs (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Therefore, before sending pay slips by email, you need to complete everything correctly. To do this, the company's management will have to:

● Make changes to an employment or collective agreement, or reflect a change in the form of notice in another local document of the organization.

● Notify employees of the new notification procedures adopted. Introduce the innovations of each of them under signature.

● Collect statements from employees - sending payslips by email must be done with the consent of employees.

To avoid unnecessary conflicts, you will first have to properly complete all personnel documents, and only then can you send electronic information.

Electronic payslip: whim or necessity

Certificates of incapacity for work will soon be issued electronically. And today, you can buy air tickets electronically, file a claim, sign, keep records of the issuance of personal protective equipment, submit declarations of compliance of working conditions with state regulatory labor protection requirements, and even receive an administrative fine (Clause 5.1 of Article 29.10 of the Code of Administrative Offenses of the Russian Federation).

Today, payslips in electronic form are available only to remote workers. For all other categories of workers, Part 6 of Article 136 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) requires that pay slips be issued exclusively in paper form, using the distribution of pay slips by email only as an additional method.

But how can you inform an employee about the payments due to him if he, for example, gets sick or is on the road on the day the salary is paid, is a highly qualified foreign specialist who does not speak Russian, or cannot read it at all because he has limited capabilities due to health conditions? ?

Let's try to figure out why the payslip remains “disadvantaged” in the age of information technology, because the requirements for it are much less than for the same airline ticket or administrative violation resolution.

Personal data - reliable protection

Let's turn to the rule of law. Part 6 art. 136 of the Labor Code of the Russian Federation obliges the employer, when paying wages, to notify in writing each employee about the components of the wages due to him for the corresponding period, about the amounts of other amounts accrued to the employee, about the amounts and grounds for deductions made and about the total amount of money to be paid .

The first advantage of an electronic payslip is that it is not necessary to indicate personal data of employees. Please note: the law does not require the employee’s last name, first name and patronymic to be indicated on the payslip. Therefore, when approving the form of the pay slip, it is enough for the employer to inform the employee, under his personal signature, of what will be indicated on the pay slip instead of his full name. his personnel number, and in case of loss of the sheet this will not entail the disclosure of personal data due to their depersonalization. And taking into account the possible tightening of administrative penalties for violation of laws on personal data, this issue becomes even more relevant.

This technique is especially convenient for civilian personnel of various law enforcement agencies: as a rule, there are quite strict rules regarding even very simple documents. Of course, many experts may object, because all information about wages, including full name. employee, you can easily “sew up”, for example, into a QR code. But many also have telephones that can read such a code in one or two minutes, but the employee’s personnel number is known to him and a limited circle of his colleagues, who are responsible for the disclosure of personal data. And in the event of disputes regarding unlawful actions (inaction) of the employer when processing and protecting the employee’s personal data, such conflicts will be considered by the court, since according to Art. 391 of the Labor Code of the Russian Federation, such disputes are considered directly by the court.

Example 1

The employer issued payslips to employees in sealed envelopes, similar to those in which banks issue PIN codes for bank cards. However, the human factor cannot be avoided: the envelopes were mixed up, as a result of which two employees found out the size of each other’s wages and “caused” a scandal, which could have been avoided if the payslips had contained numbers, not names, and they had been issued electronically to the address employee email.

Saving money

Another advantage of issuing payslips electronically is saving paper. Yes, yes, don't laugh. This is especially true for large organizations. Try to count in your head the number of employees in your company, multiply by twelve - the amount of paper required to print the data. The result will be far from modest. For small companies this is not a problem, but for large ones (especially “green”) this innovation will be a salvation from the routine of paperwork and will provide a good opportunity to save money.

Let us refer to letter No. 02-06-05/21573 dated April 14, 2016, where the Russian Ministry of Finance explains that the formation and storage of second copies of payslips is not provided for by regulations. It also states that payroll sheets for employees’ wages are formed on the basis of the document forms established by Order No. 52n.

Indeed, in Order No. 52n, as well as in the Labor Code of the Russian Federation, there is no indication of the employer’s obligation to store pay slips. However, this obligation is contained in the Instructions for the use and completion of primary documentation forms for recording labor and its payment, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 (hereinafter referred to as Resolution of the State Statistics Committee No. 1). Thus, a copy of the printout of the pay slip with data on the components of wages, the amount and grounds of deductions made, the total amount of money to be paid is invested (pasted) monthly in the employee’s personal account on paper (form No. T-54a, approved by the Resolution of the State Statistics Committee No. 1).

At the same time, the need to invest (paste) printouts of payslips for the entire period of work into employees’ personal accounts has disappeared since January 1, 2013.

The current version of Art. 136 of the Labor Code of the Russian Federation directly states that the pay slip is issued in writing, and the legal definition of the concept “written form” is contained in Part 2 of Art. 434 of the Civil Code of the Russian Federation, according to which an agreement in writing can be concluded by drawing up one document signed by the parties, as well as by exchanging letters, telegrams, telexes, telefaxes and other documents, including electronic documents transmitted via communication channels, allowing to reliably establish that the document comes from a party to the contract. In practice, inspectors are adamant: payslips must be issued exclusively on paper (with the exception of remote workers).

At the same time, the Russian Ministry of Finance expressed in its letter the absolutely correct position: the legislation does not provide for either the formation or storage of second copies of pay slips. In fact, during inspections and when employees request the re-issuance of pay slips, they are simply re-printed.

In fact, an interesting thing turns out: the pay slip was issued to the employee, the employer is not required to keep the second copy of the pay slip, however, if it is impossible to confirm the issuance of the pay slip to the employee, he may receive a fine, and on the basis of the inspection report and the decision in the case of an administrative offense, drawn up in electronic form document. The irony of fate, and that's all.

Fortunately, the ice has recently broken. As part of the Russian Investment Forum “Sochi-2017”, a session “Labor relations in the digital economy” was held, at which the head of Rostrud Vsevolod Vukolov noted that the possibility of drawing up employment contracts in electronic form is one of the key tasks for today. This will not only help remote workers and shift workers formalize their employment relationships, but will also reduce the costs of companies that invest heavily in document flow.

On my own behalf, I would add that this initiative is very relevant and timely and will allow, simultaneously with the implementation of the idea of electronic employment contracts, to resolve the issue regarding the “poor relative” of the employment contract - the pay slip, namely the possibility of issuing pay slips in electronic form. I am confident that this will significantly simplify the task of implementing the instructions of the head of state to create a single space for the digital economy.

Pay slip form

There is no recommended (unified) form of pay slip, which negatively affects the employer’s fulfillment of the obligation to approve it. There are often cases when the information included in the payslip is absolutely not needed by the employee, or the components of the salary are presented in the form of abbreviations, which only initiates can decipher.

In my opinion, the registration and subsequent issuance of a payslip in electronic form will allow trade unions (or works councils at the local level) at the level of industry agreements to consolidate its recommended form for all employers in a certain industry and place it in the public domain in order to optimally comply with the requirements of labor legislation, concerning the remuneration of employees, and will significantly reduce the risk of bringing the employer to administrative liability for using an unapproved form of pay slip.

Example 2

Clause 3.2.12 of the Industry Agreement on the Coal Industry of the Russian Federation currently establishes the employer’s obligation to pay employees, with the exception of employees receiving a salary (official salary), for non-working holidays on which they were not involved in work, an additional remuneration in the amount of 1/ 21 from the minimum wage, with the regional coefficient and northern allowances applied to it.

Posting on the websites of trade unions or associations of employers an approved form of pay slip with specific components of the salary (including the most little-known additional remuneration in Russia, provided for in Part 3 of Article 112 of the Labor Code of the Russian Federation), issued in electronic form, will help employers effectively inform employees about payments due to them, and employees - to directly participate in the management of the organization in accordance with the provisions of Art. 53 Labor Code of the Russian Federation.

Let us add that existing software and hardware allow you to create and send payslips to email and mobile devices; draw up graphs showing the growth or decrease of wages over time; link tax withholding data to the taxpayer’s personal account, etc. The possibilities are countless. For example, the concept of synchronous payment to the relevant funds and payment of wages, which will have a positive impact on the level of social protection of workers.

At the same time, it is necessary to understand that electronic and paper methods of informing employees will become equivalent only after appropriate changes in labor legislation, the need for which is long overdue. In fact, you don’t have to do anything drastic. In Art. 9 Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ sets out in great detail the features of the simultaneous use of primary documents in both paper and electronic form.

In the event of a dispute between an employee and an employer, payslips are usually submitted to the court on paper.

When conducting an inspection by the labor inspectorate, payslips can be provided in the form of electronic documents (Part 6, Article 11 of the Federal Law “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” dated December 26, 2008 No. 294- Federal Law). Moreover, starting from January 10, 2016, such electronic documents must be signed by the employer with an enhanced qualified electronic signature (previously it could be submitted in the form of electronic documents).

Note! Prompt provision by the employer of electronic documents during an audit that reveals violations in the field of remuneration will significantly reduce penalties. According to clause 4, part 1, art. 4.2 of the Code of Administrative Offenses of the Russian Federation, this will be regarded as assistance in establishing the circumstances of the offense and will allow (in the absence of a dispute) to fulfill the order before the consideration of the case of an administrative offense, which will significantly mitigate the administrative liability provided for in Parts 1 and 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Example

The employer violated the terms of payment of wages and, during the inspection, provided the labor inspector with payslips of employees in electronic form within 1-2 days after the start of the documentary inspection, which reflected the amount of monetary compensation for delayed wages paid to employees (compliance with the requirements of Part 1 of Art. 136 and 236 of the Labor Code of the Russian Federation), thereby providing assistance and voluntarily eliminating the consequences of the identified violation. In such circumstances, the amount of the fine will be minimal, and some courts (taking into account the nature of the offense and the financial status of the offender) may even impose an administrative penalty in the form of a warning.

Afterword

The possibility of providing pay slips in the form of an electronic document to the inspector most clearly emphasizes the objectively established picture, which makes it possible to inform workers about wages in electronic form without conducting various experiments, public discussions of bills and “run-in” in pilot regions. If the law allows you to send payslips electronically to the labor inspector, then you can not be so scrupulous in relation to workers.

Taking into account changes in legislation, namely the introduction of professional standards, an accountant needs to know the basics of computer science and computer technology. Therefore, the issuance of payslips in electronic form should not be affected by the “last mile” problem, and in the near future it will relieve employers from the problems associated with recording the issuance of payslips on paper and protecting the employee’s personal data.

Summing up, we can confidently say that notifying an employee about wages in electronic form entails more advantages than disadvantages. Modern technologies will make it possible to easily translate the information contained in the pay slip into any language (suitable for both foreign workers and Russian citizens who want to receive a pay slip in the national language of the subject of the Russian Federation), voice it for people with disabilities, and also relieve the headaches of employers whose employees are away from their permanent place of work (rotation workers, business travelers, employees of private employment agencies). And taking into account the recent initiative of the Pension Fund of Russia, expressed in the information letter of the Pension Fund of Russia and the Federation of Independent Trade Unions of the Russian Federation dated December 28, 2020 No. AD-25-26/19130, 101-114/237 “On cooperation of the Pension Fund of the Russian Federation with the Federation of Independent Trade Unions Trade unions of Russia on the issue of preparing documents for assigning pensions to employees,” we can say with a certain degree of confidence that the electronic payslip will receive its rightful “place in the sun.”

Skudutis M. Electronic sick leave. Pros and cons // Calculation. 2016. No. 3. P. 23-25.

Part 5 of Article 312.1 of the Labor Code of the Russian Federation.

Moshkovich M.G. Secrets of the pay slip // Main book. 2014. No. 23. P. 23

Federal Law No. 13-FZ dated 02/07/2017 “On Amendments to the Code of the Russian Federation on Administrative Offences”.

See the section Application and filling out a certificate card (form 0504417) of the Guidelines for the use of forms of primary accounting documents and the formation of accounting registers by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state (municipal) institutions, approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n (hereinafter referred to as order No. 52n).

Letter of Rostrud dated January 23, 2013 No. PG/10659-6-1

https://www.rostrud.ru/press_center/novosti/549002/

Resolution of the Supreme Court of the Russian Federation dated December 23, 2010 No. 75-AD10-3

Agreement to extend the validity of the “Additional Agreement to the Federal Industry Agreement on the Coal Industry of the Russian Federation for the period from 04/01/2013 to 03/31/2016 on measures to stabilize and improve the socio-economic situation in organizations of the coal industry and the implementation of FOS in 2020” (extended until 12/31/2018).

(approved by the All-Russian Industry Association of Coal Industry Employers, the Russian Independent Trade Union of Coal Industry Workers on October 26, 2015).

https://onlineinspektsiya.rf/news/show/1115.

Appeal ruling of the Supreme Court of the Republic of Bashkortostan dated May 29, 2014 No. 33-5719/2014.

Decisions of the magistrate of judicial district No. 9 of the Oktyabrsky district of Ulan-Ude No. 5-333/2016, 5-334/2016 dated 06/15/2016.

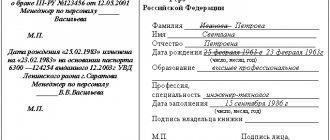

Application for receiving an electronic certificate

The employer must receive a written request from each employee to receive payslips by email. The application is also required in order to find out the email address to which earnings data should be sent. An employee can independently determine to which email the employer should send the form, or the company itself chooses how to organize the mailing (for example, this could be the employee’s personal account on the corporate website).

Consent to the processing of personal data will also be required. Only the employee and an authorized representative of the employer should have access to confidential information contained in the payslip.

Sample application for receiving a payslip in electronic form:

How to give an employee a pay slip?

The Labor Code states that it is necessary to notify subordinate colleagues in writing. Often this requirement is carried out by notifying employees on paper.

The pay slip is drawn up and printed, after which it is given to each employee.

At the same time, Article 136 of the Labor Code of the Russian Federation says that the form of the settlement notice sheet for issuance to employees must be approved by the employer himself in a local regulatory act.

That is, an order must be created to approve the form of the pay slip, which is carried out taking into account the opinion of the bodies representing the interests of the labor collective.

The absence of local acts and an order to approve the form of the salary notice sheet is considered a violation of labor legislation and provides for criminal liability for the employer.

Providing sheets in electronic form does not contradict current legislation. It can be sent to the employee’s email or entered into the database of a special program that contains the organization’s salary sheets.

Such a procedure for issuing will be a legal action if such a form of notification is approved by an act and order of the company.

Thus, according to the law, wage slips can be issued in the following ways:

- on paper for signature in person;

- electronically by mail;

- in electronic form using special software.

The chosen method of issuing information to personnel should be enshrined in the local regulations of the employer’s organization.

Deadline for provision by law

According to the Labor Code, payment for the period worked in the form of wages must occur on time at least twice a month. Notification of accruals is made once a month upon the final payment of wages for that period.

In most cases, employers issue salary notices to employees upon payment of full monthly earnings.

It is not recommended to issue it for the advance period, since all the components of the monthly earnings are not fully known.

There is no need to notify about the transfer of vacation funds. But at the time of dismissal, a full calculation must be made and the employee must be notified of all accruals and deductions due to him.

Transfer order for signature

To protect itself from prosecution, fines and proceedings with employees, the employer can approve the documentary form of salary slips with their issuance against signature.

To do this, management draws up a normative act approving the form of the pay slip, while taking into account the opinions of bodies representing the interests of employees, a trade union, for example.

An order is also created to familiarize colleagues with the form in which they will receive such sheets - in paper for signature, in electronic or other form.

It is not necessary to print the sheets to obtain the employee's signature on receipt of information about his wages.

The issuance of salary slips against signature can be done in several ways:

- approve the form of the document with a detachable part on which the employee’s signature will be placed confirming its receipt;

- keep a journal or record of issuing written slips, where employees will sign upon receipt;

- enter employee signatures into the payroll.

However, the law does not oblige the employer to take signatures from employees regarding receipt of salary notices.

Is it possible by law to refuse the paper version?

The law does not prohibit, if necessary, the transition from a paper version of pay slips to an electronic one.

Such actions will be considered lawful if another form, not in paper form, is approved in the company’s local regulations and provided for familiarization to employees against signature.

Is it legal to send by email?

According to the resolution of the Ministry of Labor No. 14-1/OOG-1560 of 2017, sending electronic salary notifications to employees does not contradict the law.

Such actions of the employer will be considered lawful if the electronic form of the sheets is approved by a regulatory act or specified in an employment or collective agreement with familiarization in the team under signature.

The main thing is that the procedure for issuing pay slips is brought to the attention of employees and is officially approved by local acts and orders.

Confirmation of receipt of an electronic document

When conducting an inspection of a company or individual entrepreneur, you will have to prove to the GIT inspector that the payslip by email was poisoned. Otherwise, there is a violation of labor laws. If an employer sends a payslip to an employee by email, how can I confirm receipt? To do this, you need to configure your email to receive notifications when a message is read. Most programs have this option. The employer will have to arrange for the storage of this evidence. If there is no confirmation of receipt of the pay slip by email, then it is safer to issue a paper version of the document to the employee.

How to issue pay slips electronically?

The Labor Code of the Russian Federation contains the following wording: employees must be informed about the components of their wages in writing. No other requirements are specified. Thus, after sending the calculation by e-mail, employees have the opportunity to familiarize themselves with its contents and print it out for personal storage. Legal requirements for written format will be followed.

Many companies have been successfully using electronic document management for a long time. In addition to e-mail, there are other options, for example, sending payslips in personal messages to employees’ computers through the organization’s corporate website or developing and implementing software with access to personal documents for each employee. It is worth noting that the courts agree with such methods of informing (appeal ruling of the Novosibirsk Regional Court dated 06/05/14 No. 33–4700/2014).

Of course, not every employee of an institution has a personal computer, personal email and Internet access.

Therefore, there is no need to exclude the paper version at all; it will not contradict labor laws if you leave both notification options.

To ensure confirmation of the issuance of invoices to employees by email, the program used to send emails must be configured to send back messages with read confirmation. In addition, instruct the payroll accountant to be sure to save all sent emails; if there is a sufficient accumulation, they can be archived and stored on a server.

The program allows you to generate individual payslips for employees and send them to email addresses.

Sheets are generated using the standard “Calculation sheets” report. For each employee, the sheet is saved in a separate Excel file.

The user can specify the period, organization and, if necessary, limit the list of employees to one division.

The employee's email address is stored in the individual's card. Before using the program, you must fill in the email addresses of individuals, either manually or through automatic loading from an external Excel file.

All program settings are saved and are valid for all database users.

The employee will receive this email:

How to use the program:

- Open processing from disk

- Configure mail server settings. Specify the username, password, server address, port and authorization method.

- Indicate the period for which payslips will be generated, as well as the organization. If it is necessary to generate sheets for only one division, then the division is indicated.

- Specify the directory on the disk in which the archive of payslip files and the letter distribution protocol will be saved.

- Fill out the list of employees either manually or automatically by clicking the “Fill” button

- Employee email addresses will be downloaded from individuals' contact details. If the address is missing, you can enter it manually.

- After the list of employees is completed, you must click the “Generate payslip files” button. After some time, a set of files for distribution will be generated.

- Click the “Send mailing” button and fill out the letter template.

- Click the “Send mailing” button and wait until the program sends the letters.

- After the mailing is completed, the mailing protocol will be recorded in the folder with the archived files.

The program provides free technical support for 1 month.

The processing code is closed for changes.

Is it possible to use paper and electronic versions at the same time?

A situation may arise that there is nowhere to send the payslip - the employee does not have access to the Internet, and therefore does not have an email address. Then the company should provide in its internal document containing the procedure for issuing pay slips that it is possible to use a paper form and an electronic one at the same time.

Thus, the law does not prohibit the use of electronic document management when notifying personnel about wages. The company has the right to use an electronic form, but first it will need to bring all personnel documents into compliance with the accepted procedure.

Source: Modern Entrepreneur