Who must file a declaration

The following must declare their income, expenses, property and property liabilities:

- civil servants of the highest category of positions;

- heads (their deputies) of territorial bodies of the federal executive power;

- civil servants appointed by the Government of the Russian Federation;

- civil servants involved in the provision of public services, licensing, quotas, etc.;

- civil servants associated with the organization of public procurement, distribution of budget funds, management of state property;

- applicants for the above positions (submit a certificate for the first time along with documents for admission to the position).

A complete list of positions, holding (replacing) which a civil servant is required to declare income and expenses, is given in Decree of the President of the Russian Federation dated May 18, 2009 No. 557 “On approval of the list of civil service positions for which civil servants are required to provide information on income.”

A civil servant must also declare information about income, expenses, property and property obligations of his spouse and his minor children (Part 7, Article 20 of the Law on the State Civil Service).

Information provided in the help

Income certificates are provided separately for the employee, his spouse and each minor child. Those. Separate certificates are drawn up for each specified family member.

If information about income, property and property-related obligations of a spouse and minor children cannot be provided for objective reasons, then the civil servant must submit an appropriate application, which is usually submitted to the employer’s personnel service.

The list of information provided by an applicant for a position and a civil servant is somewhat different.

Information provided by the applicant in the following categories:

- income for the reporting period;

- information on the alienation of movable and immovable property or securities as a result of a gratuitous transaction in the reporting period;

- information about owned property, bank accounts, securities and other property-related obligations as of the 1st day of the month preceding the month of filing documents.

Information is provided to employees in the following categories:

- information on income and expenses in the reporting period;

- information on the alienation of movable and immovable property or securities as a result of a gratuitous transaction in the reporting period;

- information about owned property, bank accounts, securities and other property-related obligations as of the end of the reporting period.

Note: individual questions, according to the information provided, and typical errors when drawing up a certificate are given in letters from the Ministry of Labor of the Russian Federation and the Ministry of Finance of the Russian Federation. Links to these documents are provided at the bottom of the article.

Regulatory documents on the topic:

Civil servants have their own list of privileges and responsibilities. One of the responsibilities is the annual provision of a Certificate of income, expenses, property and property-related obligations . This is a special form in which summary information about all movements of funds in accounts is entered. This certificate is often called a declaration for civil servants. This name is essentially incorrect, so we recommend using the legal wording.

The certificate of income and expenses is carefully checked, and if errors or inconsistencies are found, an internal audit is assigned.

Do you want to report impeccably to your employer? Order a Certificate on the online service NDFLka.ru!

Civil servant declaration form for 2019

Information about income, expenses, property and property-related obligations of civil servants must be included in the certificate in the approved form (this is what is popularly called a declaration). It contains information for the reporting period - from January 1 to December 31 of the reporting year.

If there is no information for declaration, then the certificate must indicate “no”.

Each sheet of the certificate must be signed by the civil servant himself (the applicant for the position). For family members, the certificate is filled out and signed by the civil servant himself (applicant for the position).

Obligation to provide information on income by municipal employees

Obligation to provide information on income by municipal employees.

In order to implement anti-corruption measures, the state controls the income of municipal employees. So, according to Art. 8 of the Federal Law -FZ On Combating Corruption (hereinafter referred to as Law No. 000-FZ), citizens applying for a position in a state or municipal service, as well as employees filling a position in a state or municipal service included in the list established by regulatory legal acts of the Russian Federation, are obliged provide the representative of the employer (employer) with information about your income, property and property-related obligations and about the income, property and property-related obligations of your spouse and minor children.

Meanwhile, not all citizens entering the municipal service and municipal employees must provide information about the income and property rights of their spouses and minor children, but only those whose positions are included in a special list approved by the regulatory legal act of the constituent entity of the Russian Federation or local government.

It should be noted that the Law on Municipal Service provides for the provision of information about the income and property rights of only the citizen himself. Thus, any citizen entering the municipal service (regardless of whether the position for which he is applying is included in the list or not) must provide information about his income, property and property-related obligations. This information is provided for the year preceding the year of entry into the municipal service (clause 10, paragraph 3, article 16 of the Law on Municipal Service). If such information is not provided, the citizen may be denied entry into the municipal service, having previously notified him of this in writing. Well, if the position for which a citizen is applying is included in the corresponding list, then along with information about his income and property rights, the citizen also provides information about the income and property rights of his spouse and minor children. In addition, information about your income, the income of your spouse and minor children received during the reporting period (from January 1 to December 31) from all sources (including wages, pensions, benefits, other payments), as well as information about property belonging to them by right of ownership, and about their obligations of a property nature as of the end of the reporting period are provided annually until April 30 of the year following the current one. The procedure and form for providing this information are the same as for state civil servants of the constituent entities of the Russian Federation (Clause 1, Article 15 of the Law on Municipal Service).

Failure to provide a municipal employee with information about income, if the provision of such information is mandatory, or the provision of knowingly false or incomplete information is an offense that entails the dismissal of this person from the municipal service (Clause 5 of Article 15 of the Law on Municipal Service). Information on income and property rights is provided in the form of a certificate approved by a legal act of local government in accordance with the Decree of the President of the Russian Federation to the personnel service of the local government body. The procedure for provision is established by the head of this body. Let us note that personnel workers do not have the right to demand from a citizen or municipal employee additional documents confirming income received or ownership of property, since this is not provided for by law. If a citizen or municipal employee discovers that the certificates submitted by him to the personnel service do not reflect or do not fully reflect any information or there are errors, he has the right to provide updated information in the manner established by regulatory legal acts. If information about income and property rights is not provided to municipal employees due to objective reasons, then this fact is subject to consideration by the commission for compliance with the requirements for official conduct of municipal employees and the resolution of conflicts of interest. Information about income and property rights is classified as restricted (or confidential) information, unless federal laws classify them as information constituting state or other secrets protected by federal laws. Municipal employees whose job responsibilities include working with information about income and property rights who are guilty of disclosing them or using them for purposes not provided for by the legislation of the Russian Federation are liable in accordance with the legislation of the Russian Federation, namely they can be:

– dismissed according to paragraph 6 of Part 1 of Art. 81 of the Labor Code of the Russian Federation at the initiative of the employer;

– brought to administrative responsibility under Art. 13.11 Code of Administrative Offenses of the Russian Federation;

– brought to criminal liability under Art. 137 of the Criminal Code of the Russian Federation.

Information on income and property rights provided by persons holding municipal service positions included in the lists is posted on the Internet information and telecommunications network on the official websites of local governments and is provided for publication to the media in the manner determined by the regulatory legal acts of local governments . The provisions of these acts are based on the Decree of the President of the Russian Federation, which establishes the procedure for posting and publishing information on the income of federal civil servants. Information on the income of municipal employees is usually posted on the official websites of municipal administrations. This information includes:

– a list of real estate objects owned by the employee, his wife (husband) and minor children by right of ownership or in their use, indicating the type, area and country of location of each of them;

– a list of vehicles, indicating the type and brand, owned by the persons listed above;

– declared annual income of these persons.

And about. district prosecutor

1st class lawyer

Due in 2020

The civil servant must submit information to the personnel service by April 30 of the year following the reporting year. That is, for 2019, information must be submitted by April 30, 2020. Exceptions are employees of the Administration of the President of the Russian Federation, their term is until April 1.

IMPORTANT!

The current procedure for filing a declaration of income and property of a civil servant does not provide for reasons why it may not be submitted or submitted at the wrong time. Neither vacation (including parental leave), nor a business trip, nor sick leave cancels the official’s obligation to report on time.

If a government employee cannot submit the certificate in person on time, he is recommended to send it by mail. Certificates are considered submitted on time if they were submitted to the postal service organization before 24 hours of the last day of the established deadline.

IMPORTANT!

The official’s lack of information to fill out the certificate is also not a reason not to submit anything. If it is impossible to fill out a certificate (for example, for an absent family member), the government employee is required to draw up and submit a corresponding application. This must be done within the same time frame and according to the same rules that apply to regular certificates.

If there is no objective opportunity to provide a Certificate

If there are objective reasons why you cannot provide a Certificate of income, expenses, property and property-related obligations, you should write a statement based on:

- Paragraph 3 of subparagraph “b” of paragraph 1 of the Regulations on the procedure for consideration by the Presidium of the Council under the President of the Russian Federation for Anti-Corruption of issues relating to compliance with the requirements for official (official) conduct of persons holding public positions of the Russian Federation and certain positions of the federal public service, and the resolution of conflicts of interest , as well as some appeals from citizens”, approved by Decree of the President of the Russian Federation of February 25, 2011 No. 233 “On some issues of organizing the activities of the Presidium of the Council under the President of the Russian Federation for Anti-Corruption”,

- Paragraph 3 of subparagraph “b” of paragraph 16 of the Regulations on commissions for compliance with requirements for official conduct of federal civil servants and the resolution of conflicts of interest, approved by Decree of the President of the Russian Federation of July 1, 2010 No. 821.

The application must be written and sent in advance, before the deadline for submitting the Certificate.

Online service NDFLka.ru - your help in filling out Certificates of income, expenses, property and property obligations

Filling rules

When filling out the declaration form, you must create a separate document about your own income, your spouse, and all children under the age of majority. If the marriage relationship with a spouse is dissolved and the decision to dissolve the marriage was made before December of the reporting year, reporting for the spouse may not be submitted.

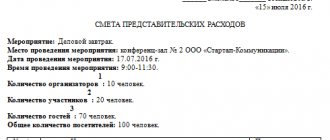

The certificate for each person must include the following information:

- employer's name;

- Full name, date of birth, address, passport details;

- information about family composition;

- the period of time for which information about income and property assets is indicated;

- data on vehicles and real estate owned by a civil servant;

- a list of sources of income indicating the amounts of receipts, the cost of purchased securities and bank account balances;

- credit obligations (both long-term and short-term);

- list of current deposit investments.

Revenue receipts (section 1) are distributed into several categories:

- income from the main place of work - wages accrued for the reporting period;

- in the “Other income” column, wages from previous places of work (if any) are indicated;

- when combining main work with creative activity or teaching, remuneration for them is given separately;

- Income on bank deposits and securities accrued for the reporting period is indicated separately.

Funds received as maternity capital, alimony, pensions, benefits, inherited resources are summed up in other income streams.

If transactions involving the acquisition of shares, bonds, vehicles or real estate were carried out in the reporting year, only assets received by a civil servant (or a member of his family) on a paid basis are entered in the corresponding lines of the form.

Transactions for the acquisition of property are given with an indication of the valuation of the acquired assets and sources of funds for the transaction.

When filling out the declaration, you must strictly follow certain formatting rules. Text and numbers must be readable. Information is entered by hand, but the use of computer technologies to improve the quality of completion and ensure the safety of records for a long time is not prohibited.

It is strictly forbidden to fill in information with any pencils. Corrections are prohibited: letters erased with a scraper, blots and errors covered with a proofreader, crossed out (with a pencil or pen) and the like.

It is prohibited to enter digital names and other fragments, the recognition of which is not possible or difficult. Printing on paper that has been damaged in any way or is not white is not permitted.

Rules for filling out income declarations for civil servants in 2019

The official fills out a certificate for himself, a separate form for his spouse and for each child. The rest of the family members are not considered close relatives according to the Family Code, so their income does not need to be declared. If a civil servant is in a civil marriage, there is no need to submit a certificate for the cohabitant, but if the marriage is officially registered, he must report for the spouse (regardless of whether the spouses live together or not). Data on children must be submitted only for minor dependents.

When filling out a declaration, you need to use special software “BK Help”. It has been applied since 03/01/2017 in accordance with Decree of the President of the Russian Federation dated 02/21/2017 No. 82. The current version of the program is posted on the official ]]>website]]>.

You can download the income statement for civil servants 2020 (sample) at the end of this article.

Corrections and omissions are not allowed in the certificates. The form requires the use of A4 paper. The declaration must be certified by the signature of the civil servant who filled it out. If one or more pages in the declaration are left blank due to lack of grounds for entering data, these sheets are also printed and submitted with the completed sections in one set.

Declaration form

The form of the document was approved by the President of the Russian Federation (decree No. 460 dated June 23, 2014). From 03/01/2017 it is filled out using the SPO “BK Help” software. The document is signed by the employee himself. To fill out you will need:

- 2-NDFL certificates;

- certificates of ownership;

- purchase and sale agreements;

- Bank statements.

The website of the Ministry of Labor and Social Protection of the Russian Federation provides rules for filling out the 2020 income declaration for civil servants and updated methodological recommendations.

Rules for filing declarations

The requirement for officials and members of their families to declare their income, property and property-related liabilities was established by federal law of December 25, 2008. “On combating corruption.” On December 29 of the same year, amendments were made to Article 10 of the federal constitutional law “On the Government of the Russian Federation” obliging members of the Cabinet of Ministers to submit to the tax authorities information about their income, securities and other property owned by them and members of their families.

On May 18, 2009, Russian President Dmitry Medvedev signed a package of anti-corruption decrees, which, in particular, regulate the circle of officials and members of their families who submit declarations. It included not only the president, members of his administration, members of the government, but also parliamentarians, judges, law enforcement officers, as well as military personnel holding command and management positions in the Russian army. Since 2012, the heads of the Central Bank of the Russian Federation, the Pension Fund, the Social Insurance Fund, the Mandatory Medical Insurance Fund, their spouses and minor children began to report.

In accordance with the federal law of December 25, 2008 “On Combating Corruption” and the Presidential Decree of July 8, 2013 “Issues of Combating Corruption,” the list of persons obliged to disclose information about their income and property was expanded. It includes heads of state-owned companies and state corporations. In March 2015, the Russian government exempted the management of a number of companies with state participation from publishing such information (JSC Russian Railways, PJSC Rosneft, etc.). The requirement for a public declaration applies only to employees of non-profit and budgetary organizations, foundations, corporations and companies that are 100% owned by the state and whose managers are appointed by the government of the Russian Federation. Commercial companies (joint stock companies) must provide information about the declarations of their managers to the government, but are not required to publish them.

Since January 1, 2013, Russian officials report not only on income, but also on expenses, including the expenses of wives (husbands) and children. Transactions for the acquisition of land, real estate, vehicles, securities, shares are subject to verification if the transaction amount exceeds the total income for the last three years. The sources of funds at the expense of which transactions were concluded are also required to be declared. On August 19, 2013, a ban on officials having accounts in foreign banks came into force. Failure to comply with the above requirements is subject to administrative punishment, up to and including dismissal with the wording “due to loss of confidence.” Civil servants, according to the law, do not have the right to engage in commercial or entrepreneurial activities.

On November 4, 2020, a law came into force that provides for the possibility of early revocation of the mandates of parliamentarians if they or members of their families do not submit income declarations on time. Previously, there was no liability for failure to submit or late submission of declarations in the legislation.

In May 2020, Russian President Vladimir Putin signed amendments to the current legislation, according to which acting heads of regions and atamans of military Cossack societies are also required to report on their income and expenses.

On August 4, 2020, the President signed a law to monitor the compliance of the expenses of former officials with their income received while working in government positions. The document establishes that such control is carried out within 6 months from the date of dismissal or dismissal of persons “who held (occupied) one of the positions, the exercise of powers for which entails the obligation to provide information about their expenses, as well as about the expenses of their spouses ( spouses) and minor children." We are talking about transactions for the acquisition of a land plot, other real estate, a vehicle, securities, shares, etc.

What data is reflected in the information

For publication in various media, all information about the property, profits and expenses of civil servants and their close relatives is provided (including posted on official pages on the Internet), namely:

- a list of real estate owned by them by right of ownership and those in use;

- a list of vehicles to which they have ownership rights;

- declared annual income.

Considering that information about the circumstances of private life, facts, events that allow the identification of a citizen (his personal data) is confidential, the list of real estate objects only indicates the type, area and location of the object. The address and reasons for using the object are not indicated.

The column “vehicles” contains information about the type of vehicle, its make and place of registration. However, the site only contains information about the type and manufacturer of the vehicle.

Information on income is provided for the reporting year and covers all sources of income, namely: profit received at the main place of work, from scientific, pedagogical, and other creative activities, income from bank deposits (interest accrued on deposits during the reporting period), income from valuable securities, shares in various companies, benefits and pensions.

The official website publishes only the amount of profit received without specifying its sources.